This topic lists the important GST FAQ, especially related to GSTR-1, unregistered dealers, HSN/SAC, tax calculations, invoicing and printing, cash discount or trade discount, GST features, GST calculation, licensing and migration, and others.

Release 6.1 – Related

You need to upgrade to TallyPrime Release 6.1 and later to be able to export GSTR-1 with revised HSN/SAC in Excel format.

To know more, refer to Export GSTR-1 in MS Excel/CSV Formats & Update Rate-wise HSN/SAC Summary and How to Enable Breakup of HSN Summary into B2B and B2C Supplies in TallyPrime video.

This happens due to the current validations related to Table 12 in GSTR-1. These validations verify whether the values reported in various tables (for both B2B and B2C Supplies) match the totals shown in Table 12 of the HSN Summary. Since export sales (like in Table 9A) are considered B2C for validation purposes, their HSN details may appear in the HSN Summary for B2C Supplies.

B2B supplies shown in different tables such as 4A, 4B, 6B, 6C, 8 (recipient registered), 9A, 9B (registered), 9C (registered), 15 (recipient registered), and 15A (recipient registered) will be captured under HSN (B2B) supplies in Table-12.

B2C supplies shown in different tables such as 5A, 6A, 7A, 7B, 8 (recipient unregistered), 9A (export), 9A (B2CL), 9B (unregistered), 9C (unregistered), 10, 15 (recipient unregistered), and 15A (recipient unregistered) will form part of B2C supplies shown in Table-12.

Right now, these validations show a warning if there’s a mismatch, and you can still file your return. But if B2B transactions are reported elsewhere in GSTR-1, you must fill in the B2B part of Table 12 of HSN Summary.

To know more, refer to Advisory on HSN Validation.

The Department hasn’t provided a specific format for Payment Vouchers. They’ve only mentioned the minimum required fields like invoice number, GSTIN, invoice date, and amount. In TallyPrime, if you record an unregistered RCM purchase, the voucher can be printed, and it will be included in Table 13 of the GSTR-1 report.

Connected GST – Upload, Download Returns, Filing

You can export in Excel and JSON formats. While exporting the GSTR-3B report, enable the option Export a single file for the set Period in the configuration screen.

Though, the preview shows the transactions for a month, the exported data will include all the transactions for the period. For example, when you are exporting from 1st April, 2025 to 17th May, 2025, the preview report shows the data for April but the exported report shows all the transactions.

This happens on AWS, as the macros are disabled in LibreOffice. You need to download the GSTR-3B Excel to your local system and calculate the totals manually.

Yes, in Release 7.0 or later, you can export GSTR-3B report for multiple months in Excel format as a single file.

I am text block. Click edit button to change this text. Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

To resolve this issue, where multiple invoices are getting rejected by GST due to an inactive GSTIN,

- Go to the Rejection by GST Portal section.

- Find the categories Inactive GSTIN/UIN and Other Reasons.

- In the Inactive GSTIN/UIN category, select multiple transactions.

- Press Alt+V (Convert to B2C). This will change the transactions from B2B to B2C.

Only transactions under the Inactive GSTIN category will be converted to B2C.

The categories Inactive GSTIN/UIN and Other Reasons will appear only when there are transactions available under Inactive GSTIN/UIN.

Yes, you can convert vouchers of a party having an inactive GSTIN/UIN from B2B to B2C, before exchanging transactions.

No, it is not possible to filter. You need to manually select the relevant transactions for multiple/bulk voucher conversion from B2B to B2C.

Even if you select all the vouchers, only those under the Inactive GSTIN/UIN section will be converted, while vouchers in the Other Reasons section will remain unchanged.

When your transactions are in the ‘Upload in Progress’ status, you need to refresh the GST status using one of the following methods:

- Press (Alt+Z) Exchange > Refresh GST Status, select the transaction, and press Refresh.

- Select the Notification bell icon. In the Notifications report, select the relevant row for GST and press Enter.

After the upload is successful, the transactions will move to the Uploaded category.

To upload all the transactions, you can do one of the following:

- In the Upload GSTR-1 report, press F8 (Include Uploaded)

- In the Upload GSTR-1 report, press Ctrl+B (Basis of Value), and set Include transaction where no action is required to Yes.

Once all the transactions appear on the report, you can press S (Send) to upload the transactions to the portal.

Currently, TallyPrime does not support quarterly GSTR-3B. However, while downloading, you can specify the applicable From and To dates (for example, Apr-24 to Jun-24). Then you can open GSTR-3B for the full quarter (for example, Apr-24 to Jun-24).

To register your DSC on the GST Portal, refer to https://www.gst.gov.in/help/loginanddsc

No. Once you have generated the e-Invoices using TallyPrime Release 5.0, the invoices are directly uploaded on the portal.

However, for any reason if you want to upload them again

- In the Upload GST Return report > press Ctrl+B (Basis of Value), and set the option Include e-Invoices to Yes.

- Based on the reason for rejection of the voucher, alter the voucher and update it with the correct details.

- In the Upload GST Return report, press Ctrl+B (Basis of Value) and set the option Include transactions Rejected by GST Portal to Yes.

- Press S (Send) to upload the invoices.

No worries! TallyPrime will upload the updated data, whether any modification or deletion, to the portal in your next upload process.

Ensure that you have enabled the required configurations while uploading the Return. For example, if you had deleted a voucher in Books, in the Upload GST Return screen:

- Press Ctrl+B (Basis of Values) > set Include Delete Requests to Yes.

The delete request for the voucher is sent to the portal on uploading the Return.

Using TallyPrime Release 5.0, you can upload GSTR-1, GSTR-3B, and CMP-08.

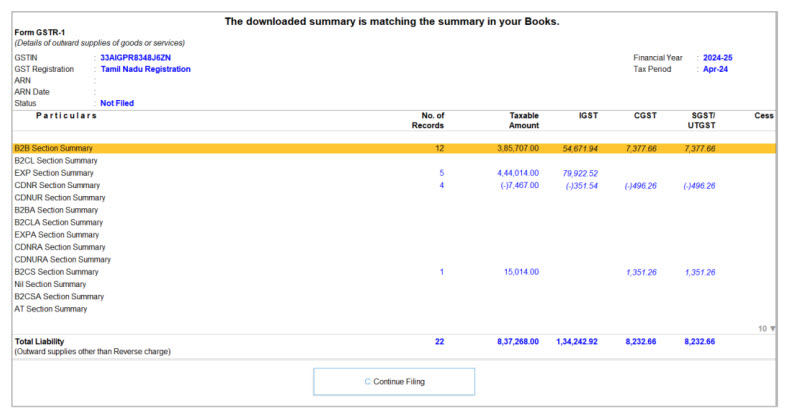

While filing your Returns, if there is a mismatch between your Books and portal values, TallyPrime will pause the filing process.

You can do one of the following:

- Continue filing with the mismatch – You can resolve the mismatches before filing the Returns in the subsequent period.

- Resolve the mismatches in the Books or Portal value and file again.

Yes. In TallyPrime, you can file a Nil Return that has no entries for a given return period.

Yes, now directly upload your returns on the GST portal right here from TallyPrime Release 5.0 using IFF, without the need for any manual activity.

In the Upload GSTR-1 report, press F12 (Configure), and set Consider Report Period instead of Return Filing Period for Online Upload (for QRMP/IFF) to Yes.

This option will help you upload your vouchers for each month of the quarter (as per the IFF scheme) and the summary at the end of the quarter.

However, if you have opted for the Quarterly Return Monthly Payment (QRMP) scheme, then you will have to manually upload the details of your B2B invoices and credit notes every month using the Invoice Furnishing Facility (IFF) provision on the GST portal.

If the GSTIN/UIN format is not complaint with the GST portal guidelines, importing such GSTIN/UINs might fail.

Yes, you can now upload GSTR-1 and GSTR-3B for multiple registrations in TallyPrime Release 5.0.

Yes, you can easily download GST returns for one or more GST Registrations at the same time.

You can select the required GST registration while downloading the GST Returns such as GSTR-1, GSTR-2A, GSTR-2B, and GSTR-3B.

- Press Alt+Z (Exchange) > Download GST Returns.

The Download GST Returns screen appears, in which you can see that all the GST Registrations are selected, by default./li> - Press C (Configure) to set the required GST Registrations.

- In the Download GST Returns screen, press D (Download).

You also have the option to set one or more default GST Registrations, based on your business preferences. Subsequently, these return types will be automatically considered as your default GST Registrations for download.

- Press Alt+Z (Exchange) > Configuration > GST.

- Under Download Settings > GST Registration, select one or multiple GST Registrations for which you want to download the Returns.

- Press Ctrl+A to save the changes.

The From and To dates will appear blank in the Download GSTR-1 report if you have already completed the download activity.

Once you download any GST Return for a specific period, TallyPrime stores the period information internally.

On selecting another Return Type next time, TallyPrime intuitively displays the next applicable period by default – similar to the way the Voucher Data changes when you press F2 on a voucher.

Since the B2B and B2BA vouchers refer to a common voucher in the data, excluding any of these will exclude the voucher from the next GST activity.

When you exclude transaction Appearing Only on the Portal, the status of the Return will be Reconciled.

Once your Internet connection is active, you will need to upload the GST Return again.

Yes. you can upload GSTR-1 and GSTR-3B for multiple periods together.

Once you have downloaded the GSTR-3B report

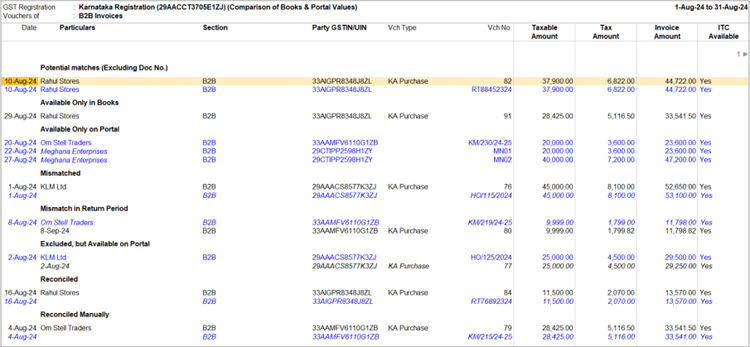

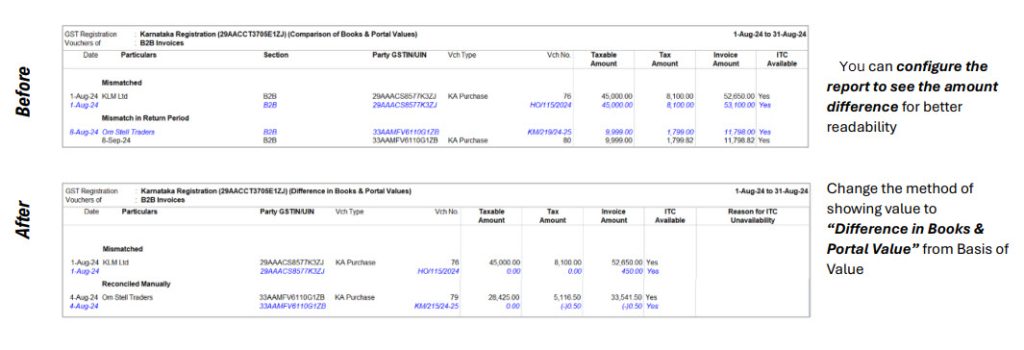

Press Ctrl+B (Basis of Values) > set the Method of showing values from Portal to one of the following:

- Comparison of Books & Portal Values

- Difference of Books & Portal Values

Note: Ensure not to set this option as None.

If you are still unable to view the details, reset the GSTN Data for GSTR-3B for the return period and download GSTR-3B from the portal again.

The Reset Delete Request option is available for invoice-level transactions such as B2B and CDNR. This will help you remove the delete request for a voucher that is valid in the current Return period but was uploaded to the portal with a delete request in the earlier period.

Therefore, it is not applicable for summaries such as B2CS and HSN Summary.

The experience of updating GST Status of vouchers have been enhanced in TallyPrime Release 5.0.

When you insert or delete a voucher, the voucher gets saved without any interruption for updating the GST Status. However, next time you open your GST report, the GST Status of the vouchers are updated as per the addition or deletion of the voucher.

There is no exclusive option to directly export GSTR-2 in TallyPrime Release 5.0.

However, you can export GSTR-2 from the GSTR-2A Reconciliation and GSTR-2B Reconciliation reports:

- Select File Format as Excel (Spreadsheet).

- Set As per old format (GSTR-2) to Yes.

You can export GSTR-2 in the old format from GSTR-2A and GSTR-2B Reconciliation reports. However, these reports do not contain the following details and therefore are not displayed in the old format:

- Eligibility for ITC

- Availed ITC Integrated Tax

- Availed ITC Central Tax

- Availed ITC State/UT Tax

- Availed ITC Cess

Additionally, the HSN/SAC Summary is not part of the data exported in the old format. This limitation is due to the inherent structure of the GSTR-2A and GSTR-2B Reconciliation reports, which were not originally designed to provide these specific details in the old format.

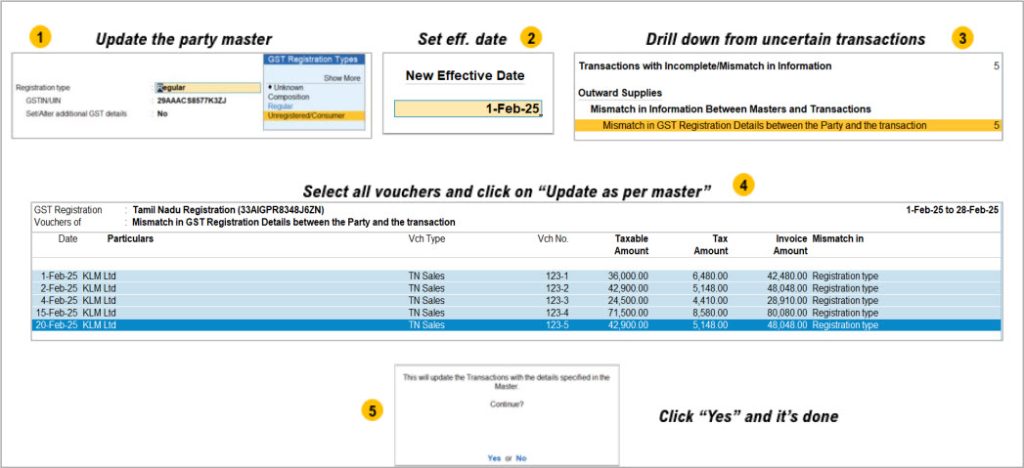

If you are updating the GST registration type, then the vouchers can easily updated in a single click.

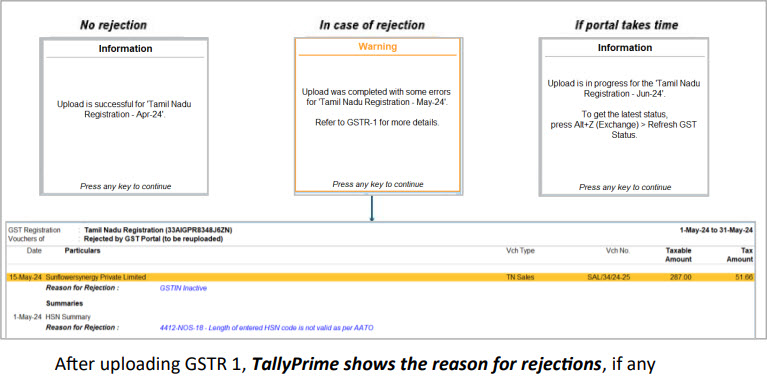

After uploading GSTR-1, TallyPrime shows the reasons for any rejections. If there are any delays from the portal, the details will be automatically updated.

Connected GST – Reconciliation

The tax rates are not getting displayed because of the changes introduced by the government in API version 4.0. This version does not include any tax rate details. So, the tax rates are not getting displayed for both the existing period and the old period.

The GST rates are not getting displayed because of the changes introduced by the government in API version 4.0. This version does not include any tax rate details. So, the tax rates are not getting displayed for both the existing period and the old period.

TallyPrime Release 5.1 onwards, the GSTR-2B Return Type is displayed by default on the download landing page because GSTR-2B always contains the confirmed Input Tax Credit (ITC). You are expected to download the GSTR-2B return most frequently. So, it has been set as the default Return Type.

The GSRT-3B Reconciliation report helps you to compare your Books value with the Portal value and reconcile the transactions where needed. For more information, refer to the Reconcile GSTR-3B section of the File GSTR-3B topic.

TallyPrime Release 5.0 facilitates exporting GSTR-2 in a few simple steps.

While exporting the GSTR-2A Reconciliation or GSTR-2B Reconciliation, ensure to:

- Select the File Format as Excel (Spreadsheet).

- Set As per old format (GSTR-2) to Yes, and export.

The configuration Ignore difference in invoice amount is applicable only for your Inward (purchase) transactions, when the invoice amount does not match with the amount uploaded by the supplier.

For example, the amount in a purchase invoice with TDS/TCS will be less than the sales amount recorded and uploaded by the supplier, where TDS/TCS is not applicable.

In the GSTR-2 Reconciliation – Voucher Register report for Available Only in Books

- Press F12 (Configure).

- Set the option Show potential matches between Books and Portal to Yes.

You can now use the option Alt+W (Copy Doc No. & Date) to reconcile the voucher.

Yes, you can copy the Doc No. and Date from the portal data and both transactions will get updated.

However, the transactions will start appearing under the Uncertain Transactions section in your report due to Duplicate Voucher No./Document No.

The JSON file for GSTR-2A does not include the Trade Name and therefore the name is retrieved in the download process.

Connected GST – Online Upload/Download Activity Tracker

The Online Upload/Download Activity Tracker lets you view the activities related to uploading and downloading your Returns from the portal. Therefore, no drill-down option from any row is available in this report.

Yes, you can specify the required Return period and apply the existing Apply Filter feature in TallyPrime to view details as per your needs.

The Online Upload/Download Activity Tracker allows you to view important details about the GST exchange activity and does not support deleting any activities.

In TallyPrime Release 5.0, you can resolve multiple transactions appearing under the Uncertain Transactions section due to a common error.

In the GST Report, drill down from Uncertain Transactions (Corrections needed), drill down further from one of the following sections:

- Mismatch in GST Registration Details between the Party and Transaction

- Mismatch in Tax Rate Details between the master and transaction

- Mismatch in GST Registration Details between the GST Registration master and the transaction

Press spacebar to select more than one transaction that you want to resolve, and press Alt+W (Update Latest Source).

The tax rates are updated in the selected transactions based on the latest details available in the mater.

- In the GSTR-3B report, press Ctrl+B (Basis of Value).

- Set the option Method of showing values from Portal to one of the following, as needed:

- Compare Books and Portal Values

- Difference in Books & Portal Values

The configuration is not saved by default once you close the report. Next time you want to view the report with the Portal value, you can set the option as needed and save the view for future reference.

Yes, using TallyPrime Release 5.0, you can now easily print the ARN in the GSTR-3B Return Form.

- Open GSTR-3B > press Alt+P > Return Form.

- Press I (Preview) to view the ARN.

Once you have validated if the ARN is shown correctly in the preview, you can print the report.

You can view the Portal values for GSTR-3B on selecting a valid return period. Viewing the portal values for any specified period that is not a valid Return period is not supported.

In the GSTR-2B Reconciliation – Voucher Register report

- Press F12 (Configure) > set the option Show Doc No. and Date to Yes.

This will help identify the transactions for which the Doc No. and Date are missing. - Select the transaction, and press Alt+V (Update Doc No. & Date)

- Enter the Doc No. and Date, and save.

While resolving a mismatch for a single transaction under Uncertain Transactions, you can copy the details from either transaction to master or master to transaction.

However, when you select more than one transaction, you can only use Alt+W (Update as per Master) which allows you to update the details in the transaction as per their respective masters.

Connected GST – GSTIN & HSN/SAC

In TallyPrime Release 5.0, you can resolve multiple transactions appearing under the Uncertain Transactions section due to a common error.

- In the GST Report, drill down from Uncertain Transactions (Corrections needed), drill down further from the Tax Rate is incorrect section.

- Press spacebar to select more than one transaction, and press Alt+W (Update Latest Source).

The tax rates are updated in those transactions based on the details available in the mater.

No. You do not need any credentials to validate or fetch GSTIN info.

Yes, you must have a valid license and TSS to be able to validate or fetch GSTIN Info.

Currently, no API is supported for fetching and validating HSN information. You will require to login to the NIC Portal to validating the HSN information.

- In the Ledger Creation/Alteration screen, press F12 (Configure)

- Ensure that the option Provide GST Registration Details is set to Yes.You will find the option Alt+L (Fetch Details Using GSTIN/UIN) in the right button bar.

To be able to successfully fetch the GSTIN/UIN details of parties from the portal, you need to the meet the following:

- The GSTIN/UIN field should not be empty.

- The GSTIN/UIN should contain 15 alphanumeric characters as per the applicable format.

- In the Bills Payable report, press F12 (Configure).

- Set the option Show Overdue Days from Bill Date as Yes.

You can then view days since when the payments are pending in the column Age of Bill in Days that appears adjacent to the Due on column, and plan the payments accordingly.

This will also help in deciding on reversal of ITC payment that is not made (in full or part) within 180 days from the invoice date.

Can all users in a multi-user environment upload and download GST Returns in TallyPrime Release 5.0?

TallyPrime Release 5.0 supports upload and download activities once you are logged in to Connected GST. In a multi-user environment, the same login details can be used in multiple computers to perform the upload and download activities.

If you are on TallyPrime Release 4.1 or earlier, you need to validate the HSN/SAC code separately before creating the HSN/SAC Summary.

Using TallyPrime Release 5.0, you can set the option to create the HSN/SAC Summary with the required validation for the B2C section.

- Press F11 > Set/Alter Company GST Rate and Other Details.

- Under the Additional Configuration section, set the option Create HSN/SAC Summary for as one of the following as needed.

- None: This will skip validation of HSN/SAC details and no HSN/SAC Summary will be created.

- All Sections: This will validate HSN/SAC details in all sections for any Uncertain Transactions and generate the HSN/SAC Summary.

This is the default settings under this option. - All Sections Except B2C: This will validate HSN/SAC details in all sections, except B2C, for any Uncertain Transactions and generate the HSN/SAC Summary.

Absolutely, you can.

When you set the option Create HSN/SAC Summary for from All Sections to None or All Sections Except B2C, in TallyPrime Release 5.0, you will be prompted to enter the effective date.

Based on the date of the transactions until which you have already created the HSN/SAC Summary for all sections, enter the effective date to avoid any impact on the earlier HSN/SAC Summary.

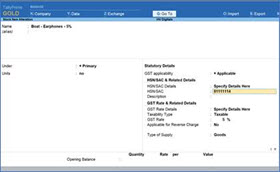

TallyPrime Release 5.0 facilitates specifying the length of the HSN/SAC to be GST compliant.

- Press F11 > Set/Alter Company Rate and Other Details.

- Set Create HSN/SAC Summary for to All Sections or All Sections Except B2C.

- Select 4, 6, or 8 as the Minimum length of HSN/SAC, as applicable based on your annual turnover.

The default length is set to 4.

Note: In case your business deals with services, you can enter the length as 6, instead of 8. - Enter the effective date, as applicable, and save.

The prompt that appears on altering a master will enable you to update the GST Status of the related vouchers due to changes in GST details in the master. However, we understand that updating the GST Status at that point could be dependent on various aspects and time-consuming.

Therefore, you can now set the preference in the Company Features screen and skip the prompt from appearing while saving a master.

- Press F11 (Company Features) > Set/Alter Company FST Rate and Other Details.

- Set Update GST Status of Voucher after Master Alteration to No., and save.

Any further updates to the GST Status of vouchers due to alteration in master details will be considered when you open the GST reports.

When you fetch GSTIN/UIN, Trade Name of business and Legal Name of business are obtained. Since businesses are typically identified with the Trade Name, the same is filled as Ledger Name, as well. In case of proprietorship, the Legal Name is of the owner. However, the ledgers are generally created and identified by the name of the business name and not by the name of the owner. In case Trade Name is blank in response, the Legal Name is filled as the Ledger Name. In any case whatsoever, you can always edit the auto-populated name, as per your requirement.

GST – General

You can cancel e-Way Bill and e-Invoice from TallyPrime, only if those are generated in TallyPrime. If you have generated them from anywhere else, you can proceed for cancellation from the portal.

You need to check whether the the cancellation details are already exchanged with the portal. If it has already been done, then you will not see the options to cancel e-Way Bill and e-Invoice again in TallyPrime.

Yes, the cancellation details for both the e-Way Bill and e-Invoice will be saved even if you pressed No while exchanging the cancellation details with the portal.

If you are in TallyPrime Release 7.0 or later and generated e-Invoice with TallyPrime, you will be able to verify the IRN Generation Date & Time from the e-Invoice report. Depending on the time limit of 24-hours, you will be able to see the cancellation details for the e-Invoice.

If the 24-hours time limit has not exceeded, you will be able to see the cancellation details and proceed for the cancellation of e-Invoice. If the time-limit of 24-hours has not exceeded, you will be able to see the cancellation details but will not able to cancel the e-Invoice. In such a case, you will have to pass a Credit Note against the e-Invoice.

This is applicable for e-Way Bills generated with Part B details, as well.

Yes, it is possible to cancel or delete the voucher in your Company Books. Press Alt+X or Alt+D, and then proceed accordingly.

No, the cancellation details will remain in the voucher, and can be exchanged with the portal for the cancellation of e-Way Bill and e-Invoice. The voucher will be retained in the Company Books.

Yes, you can cancel the e-Invoice from TallyPrime only if you are cancelling within the 24-hour time limit.

Provisions of Finance Act 2022 notified on 28th Sep 2022 is to be applicable from 1st Oct 2022. According to it, the 18-month Rule (September of next FY) is now changed to 20-month Rule (November of next FY).

The Finance Act, 2022, effective from 1st October 2022, shortens the time to issue credit notes and make corresponding tax adjustments from approximately 20 months to 18 months. This change requires prompt action and increased awareness among businesses to ensure compliance with the new rules.

TallyPrime Release 5.0 and later versions support this by allowing users to amend the date or set an effective date for an invoice in line with the 20-month rule change.

The amendment introduced by the Finance Act, 2022, effective from 1st October 2022, reduces the time frame for issuing credit notes and making corresponding tax adjustments from approximately 20 months to 18 months. This change requires businesses to act promptly to stay compliant with the new rules.

For GSTR-1 reporting, you can update the Credit Notes and Tax Adjustments using either the effective date or the amendment date under the new 20-month rule.

Yes, you can now adjust advances received for an indefinite period, without being restricted to the 20-month rule. This is particularly useful for businesses like banquet hall services, events, exhibitions, and marriages, where advances can be received up to 2 years before the event. The current 18-month limit should be removed, allowing for indefinite adjustment of advances.

Currently, transactions with an invalid effective date will appear in the Invalid Effective Date under Uncertain Transactions. These transactions can be re-accepted to include them in the returns.

Form GSTR-1A is an amendment return of Form GSTR-1 that is filed for a tax period by a taxpayer. You can amend any record filed or any error identified in a particular GSTR-1. You can also report any transaction missing from the current GSTR-1 in the GSTR-1A report of the same tax period.

GSTR-1A will be available to a taxpayer after filing of GSTR-1 or on the due date of GSTR-1, which ever is later. You can file the GSTR-1A any time before filing GSTR-3B of the same tax period. Form GSTR-1A is an optional facility and can be filed only once for a particular tax period. The changes made in GSTR-1A will be auto populated in the your GSTR-3B.

Say, you have filed GSTR-1 for July-24 but have not filed GSTR-3B of July-24, and you have modified one or more invoices. You can file such invoices as part of GSTR-1A of July-24. The combined value of GSTR-1 and GSTR-1A will be considered for GSTR-3B. Note that if an invoice is present in both GSTR-1 and GSTR-1A, then the values shown in GSTR-1A will be considered.

Currently, TallyPrime does not support Form GSTR-1A. However, as an alternative, if you have modified or added any invoices after filing GSTR-1, such transactions will be reflected under the Uncertain transactions section of your GSTR-1. Drill down from that section to review the respective invoices, manually update the correct details of the following invoices on the portal:

- Invoices modified: Effective Date of the Amendment is not specified or invalid

- Invoices added: Transaction cannot be added in this Return period, as the Return is filed. Such transactions cannot be uploaded

Although GSTR-1A is available, you can set the effective date for the following month and upload the amendments in your regular GSTR-1.

The latest version of TallyPrime (Release 3.0 and later) comes with a new and improved facility for reconciliation, in which you can easily reconcile your transactions using GSTR-2A Reconciliation and GSTR-2B Reconciliation reports. Accordingly, the GSTR-2 report will no longer be available for export, so that you can maintain seamless reconciliation using GSTR-2A Reconciliation and GSTR-2B Reconciliation reports.

The latest version of TallyPrime (Release 3.0 and later) comes with a new and improved facility for reconciliation, in which you can easily reconcile your transactions using GSTR-2A Reconciliation and GSTR-2B Reconciliation reports. Accordingly, even if you had reconciled your transactions in GSTR-2 in an earlier release, the transactions will now appear as unreconciled transactions in the GSTR-2A Reconciliation and GSTR-2B Reconciliation reports, because all the three reports are different. This will help you maintain seamless reconciliation using GSTR-2A Reconciliation and GSTR-2B Reconciliation reports.

Once you upgrade to TallyPrime 3.0 or later versions, Import of Goods will no longer appear as a Nature of Adjustment, because the GST module in TallyPrime has been updated to comply with the latest requirements of the GST department.

However, this change will not affect the transactions that were recorded in earlier versions of TallyPrime.

Cause

This issue occurs when the TDS or TCS ledger was initially created under the Duties & Taxes group. Additionally, the Type of Duty/Tax was selected as GST and the Tax Type was selected as IGST, SGST, CGST, Cess, or Kerala Flood Cess. Later, the Type of Duty/Tax was again changed to TDS, TCS, or Other.

All the transactions recorded using the above ledgers will appear as Uncertain Transactions under Mismatch between Expected Tax Amount and Modified Tax Amount in transaction.

Solution

You can resolve this issue by upgrading to TallyPrime Release 3.0.1 or later, and by reaccepting the TDS/TCS ledger.

- In TallyPrime Release 3.0.1 or later, open the relevant company.

- Press Alt+G (Go To) > Alter Master > Ledger, and select the relevant TDS or TCS ledger.

Note: You can also alter the ledgers from Gateway of Tally or from Chart of Accounts, as needed. - In the Ledger Alteration screen, press Ctrl+A to re-save the ledger and press U to proceed with recomputation.

Now all the transactions will appear in the respective sections of the GST reports.

If this issue still persists, then you can take a backup of your company data and repair it using Ctrl+Alt+R. Then the transactions will appear in the respective sections of the GST reports.

However, if only a few vouchers are affected, then you can manually resave them to resolve this issue.

Cause

Over the last 5 years after GST implementation, various rules have been additionally implemented, one of them being related to HSN. Accordingly, the requirement is to maintain and report HSN and print invoices with HSN as per the latest notification:

| Customers with turnover below 5 crore |

|

| Customer with turnover greater than 5 crore | HSN is mandatory at 6 digits |

HSN is also required for e-Way Bill and e-Invoice generation. Therefore, if you had not provided the HSN details in ledgers or stock items, post migrating the data to TallyPrime Release 3.0, the respective sales transactions will be detected as Uncertain Transactions in the Returns.

You can resolve this exception in a few simple steps as shown below.

Note that resolving the exception by providing the necessary HSN details will display the correct HSN summary matching the turnover shown across the Returns data.

Resolution

Step 1: Alter the stock item or ledger that needs correction and provide the required HSN details.

Step 2: Enter the Effective Date.

- If you want to resolve it only for current financial year, enter the recent effective date, for example 01 April 2023 or 01 May 2023.

- If you want to resolve it for previous return periods, enter an earlier effective date depending on the periods for which the transaction should be considered.

Step 3: Press U (Accept Master and Update GST Status of Vouchers) for TallyPrime to recompute the GST Status of the respective vouchers.

Step 4: Once the master is saved, drill down in GSTR-1, and accept the details for the corresponding stock item or ledger.

- Press Alt+G (Go To) > type or select GSTR-1 to open the GSTR-1 report.

- Drill-down from the Uncertain Transactions > HSN is invalid/missing.

- Select stock item or ledger, based on where you had updated the HSN details and press Enter.

The GSTR-1 – Resolution of Uncertain Transactions > Update GST Details for: for the corresponding stock item or ledger appears.

- Press Ctrl+A to save the screen.

The transactions gets resolved and will no more appear under the Uncertain Transactions. Based on the effective date you have entered, the transactions appear appropriate section in the respective return period.

As per the latest GST rules, sales of goods to SEZ will be considered as Sales to SEZ, while the sales of services to SEZ will be treated as Interstate Sales.

This has been done to ensure that GST rules are applied consistently across goods, services, and natures of transaction.

Accordingly, you can also select the relevant Nature of transaction while recording the entry.

From January 2021, GSTN has started to auto-fill the details of GSTR-2B data in GSTR-3B, for claiming appropriate input tax credit.

As per this rule, purchase returns have to be reported under the ITC Reversal section, although there is no impact on the net ITC eligible. This change has been applied in TallyPrime Release 3.0.

Sales with negative values will be considered as sales returns and included in GSTR-1 as credit notes. This will maintain consistency in the details between your company books and the GST portal.

In Release 3.0, the values will not be split across different sections, irrespective of the type of GST return.

In GSTR-3B, both the Taxable and Nil-Rated/Exempt values will be recorded in the Taxable section, while exclusively Nil-Rated/Exempt transactions will be captured in section 3.1c. Thereby, the values in TallyPrime will be a true reflection of the return values recorded on the portal.

The above transaction contains both Sales (Dr Party, Cr Sales) and Sales Return (Cr Party, Dr Sales), which might cause issues while filing returns on the portal.

To ensure that the details are represented correctly, you will have to update the relevant Nature of Transaction, which you can easily do from the Uncertain Transactions section.

The above transaction contains both Sales (Dr Party, Cr Sales) and Purchase (Cr Purchase), which might cause issues while filing returns on the portal.

To ensure that the details are represented correctly, you will have to update the relevant Nature of Transaction, which you can easily do from the Uncertain Transactions section.

You can easily record Deemed Exports in TallyPrime Release 3.0 in one of the following ways:

- In the party ledger, set the Registration Type as EOU (Export-Oriented Unit). All your sales to such parties will be considered as Deemed Export.

- In the party ledger or the transaction, set the Nature of Transaction as Local/Interstate Deemed Exports.

You can easily record purchase from a Deemed Exporter in one of the following ways:

- In the party ledger, set the Registration Type as Deemed Exporter. All your purchases from such parties will be considered as Purchased Deemed Export.

- In the party ledger or the transaction, set the Nature of Transaction as Local/Interstate Purchase Deemed Exports.

To record a transaction against a party such as a Consumer, UN/Embassy Body, or Unregistered Dealer, you can configure the required Registration Type in the respective party ledger.

Alternatively, you can directly specify the Registration Type in the Party Details screen while recording the transaction.

In TallyPrime Release 3.0, the following Natures of Transaction have been renamed for better clarity and accuracy, without any impact on your existing transactions.

|

Previous Nature of Transaction (In Releases Earlier Than TallyPrime 3.0) |

New Nature of Transaction (In TallyPrime 3.0 and Later Releases) |

|---|---|

| Deemed Exports – Taxable/Exempt/Nil-Rated | Interstate Deemed Exports – Taxable/Exempt/Nil-Rated |

| Intrastate Deemed Exports – Taxable/Exempt/Nil-Rated | Local Deemed Exports – Taxable/Exempt/Nil-Rated |

| Intrastate Purchase Deemed Exports – Taxable/Exempt/Nil-Rated | Local Purchase Deemed Exports – Taxable/Exempt/Nil-Rated |

| Purchase Deemed Exports – Taxable/Exempt/Nil-Rated | Interstate Purchase Deemed Exports – Taxable/Exempt/Nil-Rated |

As per GST rules, credit notes against consumers will be recorded as B2CL (if the invoice value is more than Rs 2.5 lakhs) or B2CS (if the invoice value is less than or equal to Rs 2.5 lakhs).

The government has now introduced the concept of a consolidated credit note, where one credit note will be used against multiple sales invoices. Accordingly, you do not have to furnish the details of all your original invoices on the portal.

Therefore, in the credit note in TallyPrime, you will have to provide the details of the original invoices, by going to More Details (Ctrl+I) > GST > Original Invoice Value of B2CS/B2CL.

You might have filed your return on the GST portal and signed it in TallyPrime. However, in some scenarios, incorrect values might have been recorded on the GST portal due to a data entry error. You can easily rectify such transactions in TallyPrime and specify the Effective Date, after which they will be recorded as Amended transactions in the return.

However, if the error is noted after an invoice is already issued to your party, then it is recommended that you issue a credit/debit note for the difference in amount. Alternatively, you can issue a credit note for the full amount, and then issue a new invoice. It is also recommended that Amendments be used only for correcting mistakes in data entry.

As per the latest GST rules, purchases from unregistered dealer are not applicable for reverse charge. Hence, there will not be any option in TallyPrime to configure such purchases for reverse charge.

In purchases from unregistered dealers, if any item is applicable for reverse charge, then such transactions will be also eligible for reverse charge. On the other hand, regular purchases will not be applicable for reverse charge, even when purchased from unregistered dealers.

As per GST rules, both GST and non-GST goods or services cannot be recorded in the same invoice. You have to maintain separate invoices for regular taxable goods and non-GST goods (such as Petroleum products and Alcohol for the purpose of human consumption).

Invoices containing only non-GST items will be recorded in Section 8 of GSTR-2 and Section 3.1e of GSTR-3B. On the other hand, if an invoice contains both GST and non-GST items, then only the value of GST items will be considered in GST returns.

The value of non-GST items will be included in the total invoice value but excluded from tax calculation.

You can easily resolve the mismatch in tax values by going to the Uncertain Transactions sections in GSTR-1 and GSTR-3B. However, if you want to ignore minor differences in tax values, then you can easily configure this in Company Features Alteration.

- Press F11 > Set Alter Company GST Rate and Other Details > F12, and enable Ignore difference in tax values.

- In the Company GST Details screen, specify the required value in the Ignore difference in tax values up to field.

- Press Ctrl+A to save the details.

Now, minor mismatches in tax values will be ignored as per the value specified in Company Features Alteration, and such transactions will not be recorded in Uncertain Transactions.

As per GST rules, when the Transporter ID is provided in e-Way Bills and e-Invoices, then the Vehicle Number need not be provided.

This rule has been implemented in TallyPrime Release 3.0. Thereby, if your e-Way Bills or e-Invoices contain the Transporter ID but not the Vehicle Number, they will be recorded seamlessly, without going into Uncertain Transactions.

The following features in Release 3.0 will further enhance your e-invoicing experience:

- Multi-GSTIN support: You can now generate e-Invoices for different tax registrations within the same company.

- Calculate PIN-to-PIN distance: While generating e-Invoice along with e-Way Bill, you can now easily verify the PIN-to-PIN distance on the portal at the click of a button.

- Default report period: For ease of use, the default period for opening the e-Invoice report is set to 3 days from the last date of voucher entry. Once the report opens, you can press F2 to alter the period, as needed. The F11 option for specifying the default period will no longer be available.

- Product Description: You now have the option to send the Product Description as blank during e-Invoice generation, if you do not want to share the details of the name of the stock item or ledger.

You can select the required option by pressing F11 (Company Features) > e-Invoice Details, and set the Send Product Description as Blank for e-Invoice option as Yes or No, as needed.

The following features in Release 3.0 will further enhance your e-invoicing experience:

- Calculate PIN-to-PIN distance: While generating e-Way Bill, you can now easily verify the PIN-to-PIN distance on the portal at the click of a button.

- Print in two modes: Based on the level of detailing needed, you can now print your e-Way Bill in two modes: Detailed and Condensed.

- Print e-Way Bill without invoice: Depending on your business practice, you can now print only your e-Way Bill without printing the invoice.

There might be a difference between the Taxable Amount and the Invoice Amount due to a difference in the round-off method. The e-Invoice System allows for a difference in Tax Amount up to Rs 1, provided that you report the differential amount as round-off.

As per the portal, the round-off rule is applicable as shown below:

- Scenario 1: If the IGST is calculated as 2345.04, then, after round-off, the total invoice value should range between 2344.00 and 2347.00.

- Scenario 2: If the IGST is calculated as 10241.00, then, after round-off, the total invoice value should range between 10240.00 and 10242.00

Therefore, if you are manually rounding off the tax amounts in the transaction, then you have to ensure that the round-off rules are followed.

In the Party Details screen of a Sales Voucher, make sure to enter all required e-invoice details, including the Address, Pincode, GSTIN/UIN, and Place of Supply. These details are essential for the precise generation and validation of the e-invoice.

The following enhancements have been introduced in HSN Summary:

- Outward and inward supplies: HSN Summary is now supported for both outward and inward supplies, and can be viewed in GSTR-1 as well as Annual Computation report.

- Multi-GSTIN support: You can now view the HSN summary for only one of your GSTINs or across all your GSTINs, depending on your business needs.

- Flexibility to update values: You can now manually alter the HSN Summary, if you want to report any differences in details, such as HSN, Tax Value, and Quantity.

- Sales and sales return in same month: In the same return period, when a return contains both sales and sales return of equal value, the net HSN Summary will appear as zero.

The NIC has provided the Sandbox portal only for trial or practice, and the GSTIN database might not be fully updated at all times. Therefore, a few GSTINs might be rejected even when they are perfectly valid.

If you are facing such an issue, you can still experience a Sandbox demo by using some of the following sample GSTINs:

- 33AACCT3705E005

- 05AAACE8354Q1Z6

- 05AAACE6641E2Z0

- 23AABCS9608N2ZZ

TallyPrime now provides the facility to cross-check the GST details between your masters and transactions, whenever any changes are made. This will ensure the accuracy of your GST details and easy resolution of any differences.

If there are any differences in details (such as Tax Rate or Registration Type), the above message will appear, wherein you will have the choice to either accept the master and update the voucher, or accept the master and update the voucher later in the return.

There might be a difference in the count of uncertain transactions due to the following reasons:

- Duplicate voucher numbers: If there any duplicate voucher numbers while migrating company data to Release 3.0 from earlier releases, then these will appear in the Uncertain transactions section of your return, and lead to a difference in the count.

- Incorrect or invalid voucher number: In earlier releases, transactions were included in the return even when an incorrect or voucher number was used. However, such transactions will be marked as Uncertain transactions from Release 3.0, considering that the GSTR-2A Reconciliation report has been introduced to ensure better compliance.

- Incorrect or invalid HSN/SAC: In earlier releases, transactions were included in the return even when an incorrect or invalid HSN/SAC was used. However, to comply with the latest GST regulations, such transactions will be marked as Uncertain transactions from Release 3.0.

- Undefined Nature of transaction: In earlier releases, when the type of transaction was not specified (for example, as sales or as purchase), such transactions were marked as Not relevant. However, to comply with the latest GST regulations, such transactions will be treated as Uncertain transactions from Release 3.0.

- Incorrect or invalid GSTIN format: From Release 3.0 onwards, the GSTIN format of parties will be validated as per the latest GST regulations. Hence, you might see a few more uncertain transactions where the GSTIN is marked as incorrect or invalid, especially in the case of parties such as embassies or e-commerce operators.

- Reverse charge sales: In earlier releases, reverse charge sales with duty ledger and duty amount were included in returns. However, to comply with GST regulations, such transactions will be marked as Uncertain transactions from Release 3.0.

- Incorrect tax ledger: In earlier releases, transactions were included in the return even when an incorrect ledger was selected, and the transaction was accepted as is. However, to comply with the latest GST regulations, such transactions will be marked as Uncertain transactions from Release 3.0, even if the transactions were accepted as is in the earlier release.

- Overridden details in intrastate or interstate Deemed Export: In earlier releases, transactions were included in the return when the overridden Nature of transaction was the same as the default nature. However, to comply with the latest GST regulations, such transactions will be marked as Uncertain transactions from Release 3.0, even if the overridden details were accepted as is in the earlier release.

- Special characters in e-Way Bill Document Number: In earlier releases, e-Way Bills were generated even when the Document Number contained special characters. However, to comply with the latest GST regulations, such transactions will be marked as Uncertain transactions from Release 3.0.

When GST in enabled in the company in Release 3.0, the Billing Address can be tagged to a certain GST Registration master, and printed during multi-voucher printing.

On the other hand, when GST is not enabled, the selected Address Type will be printed as usual during multi-voucher printing.

After you generate the e-Invoices successfully, they get auto-populated in GSTR-1 report. Subsequently, if such Party registration becomes ‘Inactive’ during that month, the GST System will display error. You will not be allowed to file the GSTR-1 until such invoices are deleted. If it is within 24 hours, you may cancel the e-Invoice and delete it from GSTR-1. However, if it is beyond 24 hours, you need to consult your tax practitioner on possible resolution.

You can follow the below-mentioned steps to delete the e-Invoices:

- Open GSTR-1 report.

- Delete the e-Invoices under B2B Invoices – 4A, 4B, 4C, 6B, 6C.

You may issue credit notes against such parties. However, since the registration is ‘Inactive’, the e-Invoices cannot be generated and neither can be uploaded in GSTR-1 (they can be kept only for the books). - You can upload the deleted B2B e-Invoices as B2C Invoices.

In earlier versions (up to TallyPrime Release 5.0), even after deleting transactions under a GST registration, you could not delete the GST registration if you had multiple GST registrations.

This issue has been addressed in Release 5.1. If you create a GST registration in 5.1, enter transactions, delete them, and then attempt to delete the GST registration, it will work as expected.

However, for existing data from Releases 3.0 to 5.0, if a GST registration is empty with no transactions and you load the data into 5.1, you may still be unable to delete the GST registration. To resolve this, follow one of the option below:

Option 1: Create a dummy transaction against the GST registration for the same return and period.

Option 2: Take a data backup and rewrite the data, which will then allow you to delete the GST registration.

If both e-Way Bill and e-Invoice have been generated for a voucher, you must cancel the e-Way Bill before cancelling the e-Invoice. To avoid cancelling both of them individually one after the other, you can open the voucher in alteration mode and press Alt+X (Cancel) or Alt+D (Delete). This cancels or deletes the voucher along with the e-Way Bill and e-Invoice.

Alternatively, you can save the cancellation details in the voucher using Ctrl+I (More Details) and then exchange the e-Way Bill and e-Invoice with the portal for cancellation.

Import GST Data for Reconciliation

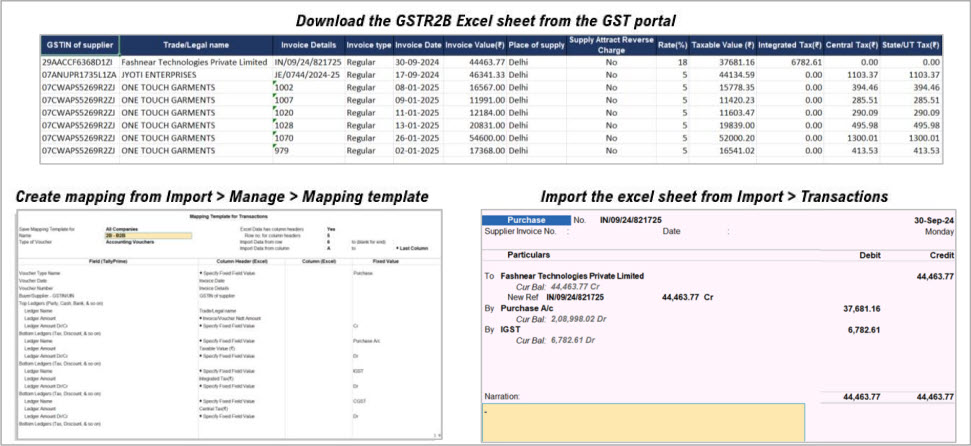

You can import transactions from GSTR-2B Excel sheet into TallyPrime using the following steps:

- Download the GSTR2B Excel from the portal.

- Map the fields in TallyPrime.

- Press Alt+O (Import) > Transactions.

You can find more details about the failed import by going to F1 > Troubleshooting > Event Log. You can verify the reasons and take the necessary action for a seamless import.

The GST Registration might not appear if it is a composite GST Registration. However, if the Registration was Regular in the GST Registration history, then it will be available for selection.

The file might not appear for import due to the following reasons:

- The selected GST Registration and the selected Return Type information might not be matching the file to be imported.

- There might be multiple files in the zipped folder. In such cases, you have to extract the files and try again.

- Some files may not be listed, as they might not be required or relevant for reconciliation activity.

This might happen when the JSON file is corrupted or tampered, or the Return Type is invalid. In such cases, you can view and select the JSON file by clicking Show more in the list of files.

If the file does not appear even after clicking Show more, then cross-check the JSON file and ensure that the GSTIN is matching the GST Registration.

In such cases, download the JSON file again and ensure that the file is not tampered in any way, and try again.

If one or more transactions could not be imported in TallyPrime, then you can compare the sections in the reconciliation report with that on the portal, and cross-check the transactions. In this way, you can find out the transactions that were not imported.

This might appear when the JSON file is missing certain information. In such cases, you can manually mark the status as Reconciled for the relevant vouchers.

Reconcile GST Data

You can account for such cases in TallyPrime using the following steps:

- While recording GST purchases, select the Place of Supply as per the State of the supplier, in the Party Details screen.

- After recording the above transaction, go to the Uncertain Transactions section of the relevant report (such as GSTR-1 or GSTR-1A Reconciliation), select the above transaction, and press Alt+V (Accept As Is).

If the return is filed after the annual cut-off, then you have to manually reconcile the transactions in GSTR-2B. Subsequently, you have to exclude this transaction from GSTR-3B, which will mark the transaction as ITC Not Available.

The Place of Supply rule states that ITC will not be applicable if the POS and supplier state are the same, but the recipient state is different. Moreover, the SEZ purchases are considered as interstate purchases, therefore this scenario will not be applicable.

The ITC Not Available section is applicable for SEZ transaction only after the annual return filing, if you have received any invoices from the supplier. You will not be able to claim ITC for such invoices, and the details will be listed in the ITC Not Available section.

As per the rules for GSTR-2B, only IMPGSEZ & IMPG purchases will be included in the return, and not purchase returns or escalations. You can track such transactions under the Not relevant section of GSTR-2B Reconciliation.

Considering GSTR-2B applicability from 1st Aug 2020, the following rules will apply:

- Transactions recorded before this date will appear under Not relevant in GSTR-2B Reconciliation.

- Transactions recorded on or after this date will appear as either Unreconciled or Reconciled in GSTR-2B Reconciliation.

This can happen when the Effective Date was provided only for GSTR-2B and not for GSTR-2A. You have to update the Effective Date in both the returns to ensure that the transaction is resolved from the Uncertain transactions section.

Currently, there is no option to record the transactions directly in TallyPrime. You have to refer to the details available in such transactions and manually record the corresponding transactions in the books.

You can learn more about the GST reconciliation options in TallyPrime by referring to the following articles:

- GSTR-1 Reconciliation

- GSTR-2A Reconciliation

- GSTR-2B Reconciliation

If such transactions are not needed in the books, then you can go to GSTR-2B Reconciliation > Available only On Portal section, and delete the relevant entries by pressing Alt+D.

The values in Available ITC and Unavailable ITC in GSTR-2B Reconciliation may not exactly match the values of the relevant tables/sections in GSTR-3B. This happens because GSTR-3B contains many kinds of adjustment entries.

Export GST Data

Yes, TallyPrime supports exporting the GSTR-1 report in JSON format for multiple months, but it does not support exporting the report for multiple months in CSV format.

You cannot export the Document Summary from the GSTR-1 Report because it might lead to a mismatch in the count. For example, if a user has multiple registrations and uses the same voucher numbering for both, the counts might not match up correctly due to the automatic numbering feature.

You are unable to set the option Export the Return in a single file to Yes because the file format is not set to Excel (Spreadsheet).

To enable this option,

- Open a report in TallyPrime and press Alt+E (Export).

- Select Current and press C (Configure).

- Set the File Format to Excel (Spreadsheet).

- Press Ctrl+A to Save.

The reconciled values are not included in the report, as the details are being exported from GSTR-2A or GSTR-2B Reconciliation report.

This message appears when certain transactions selected by you are already being exported by another user.

This message appears when certain transactions selected by you have been deleted by another user.

You can cross-check your transactions and try again. It is best to export all the selected transactions once again.

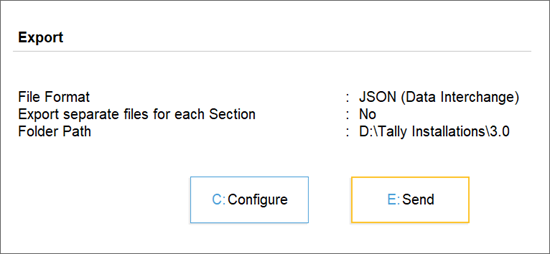

You can create individual JSON files for each section of GSTR-1 by enabling the Export separate files for each Section option in the Export screen.

Multiple files might be created when you are exporting multiple GST Registrations or multiple sections for the same GST Registration.

In some cases, multiple JSON files might be created when there are a large number of transactions. This is done to ensure that the JSON file does not exceed the size limit for uploading on the portal.

Export the GST Return in required format (JSON) but include uploaded invoices before exporting. If you do not include already exported invoices, then only the new invoices or blank return will be exported. To include already uploaded invoice while uploading the returns:

- Alt+Z (Exchange) > All GST Options > Upload GST Returns.

- Select GSTR-1 and press Enter.

- In the Upload GST Returns screen, press F8 (Included Uploaded).

- Press S or click Send (Online) to upload the return directly or click Export to create offline upload file.

Yes, you can update the Numbering Series Details for any Voucher Type from the Uncertain Transactions (Corrections needed) section of a report which will have the duplicate vouchers.

No. If you try to select multiple transactions using the Space bar, the update screen will open only for the transaction where your cursor is placed.

In release 5.1, the Yes or No prompt for GST updates appears only when an entire GST update is necessary. When you go to the GST Outstanding reports, and try to update the voucher number or the month of transaction, you will see an Yes or No prompt while saving the master, rather than the prompt to update the GST status.

However, the prompt to update the GST Status appears only when a more detailed update is required.

In TallyPrime Release 5.1, if you have set the party as an unregistered/consumer, the cursor will by default skip the GSTIN/UIN field. If the party is marked as Unregistered/Consumer, the cursor will skip the GSTIN/UIN field. You will need to use the Backspace and enter the details.

TallyPrime Release 5.1 onwards, the label Incorrect Tax Ledger has been updated to Incorrect Registration Type or Tax Ledger is selected in Bank transaction. You can now identify mistakes related to either the registration type or the tax ledger by locating these transactions in the Uncertain Transactions section of the GSTR-1 report.

Some of the vouchers may be listed under the Uncertain Transactions section of GTSR-1. You can drill down from the respective section and resolve the uncertain transactions so that they participate in the correct section, and then export.

In case no vouchers or only some vouchers are displayed during export, check the voucher count under the section No Action Required. If any vouchers exist there, then you might have already exported the return. To re-export GSTR-1 with all the transactions again, enable the option to include transactions in which no action is required.

- Press Alt+E (Export) > GST Returns.

- On the Export GST Returns screen, press Ctrl+B (Basis of Values).

- Set the option Include transactions where no action is required to Yes.

If you have enabled e-Invoicing, you will get the option Include transactions where no action is required (excluding invoices with IRN information). - Press X (Export) to export the JSON file.

All transactions in GSTR-1 will be exported.

In TallyPrime, you can reconcile such transactions by going to the Matched with difference in values section of the GSTR-2A Reconciliation report.

However, in the upcoming releases of TallyPrime, such transactions will get automatically reconciled, whenever there is a mismatch in values between the portal and the books.

In TallyPrime, you have to manually reconcile transactions with TDS values. However, in the upcoming releases of TallyPrime, such transactions will get automatically reconciled.

The Ineligible for ITC section captures the transactions where you are not claiming Input Tax Credit.

For example, you might have made some purchases while travelling in a different state. In such cases, CGST and SGST might be charged by the supplier, instead of IGST, even though the purchase has happened in a different state for you.

Such cases will appear in Uncertain Transactions, owing to the difference in tax type. Subsequently, when you accept the transactions as is, they will appear in the Ineligible for ITC section, as ITC cannot be claimed for such transactions.

The name of the party will appear in the report if the party ledger with the same name is available in TallyPrime. However, if the party ledger is not available, then the name of the party may appear as blank, with only the GSTIN.

You can manually reconcile transactions with decimal differences by going to the GSTR-2A Reconciliation report.

- Press Spacebar to select the transactions that you want to reconcile.

- Press Alt+S (Set GST Status) and set the Status of Returns as Reconciled.

- Press Ctrl+A to save the details.

It is mandatory to enter the supplier credit/debit note number in your books, as this information must appear under the respective sections in GSTR-2A and GSTR-2B on the portal.

This will ensure that the reconciliation of your GST data happens in a seamless manner.

It is mandatory to enter the supplier credit/debit note number in your books. Therefore, if you have not received the supplier credit/debit note number in the same month as the transaction, you can update the effective date of the credit/debit note and specify it for the upcoming month.

In this way, this transaction will be considered for the upcoming month, and you can file the return without any worries.

If you want to add or modify a transaction in an already signed period, then you have to undo the signing and then make the necessary changes.

However, if the transaction is already uploaded on the portal, then you have to update the Effective Date as well, so that the transaction will be processed in the upcoming month, along with the revised or updated details.

As this transaction has three natures of goods and two different party ledgers, the values cannot be bifurcated to capture against each party. Hence, you may find a mismatch in the values captured in the drill-down reports of Table 5. However, this will not affect the filing of GSTR-3B, as the appropriate values will be displayed in the relevant sections of the returns.

Currently, such transactions cannot be identified as returns or as adjustments made towards sales/purchase in debit note, credit note and journal vouchers. We will consider this requirement and provide an appropriate solution in our upcoming release.

The transactions of transport fall in the category of reverse charge. The expenses of transporting the goods is incurred by the supplier. The scenario of cash payment is a purchase transaction, and purchases will not be captured in GSTR-1. This purchase transaction will form part of section 3.1(d) of GSTR-3B.

The JSON and Excel formats for consolidated debit or credit notes are not available on the department portal. If you are using TallyPrime for filing returns, you need to link a debit or credit note against only one corresponding original invoice. If you are using TallyPrime only to record transactions and not for filing returns, you can record the debit or credit notes against multiple original invoices. While filing returns on the portal, you can manually enter the details of multiple original invoices against which the debit or credit notes were recorded.

You can press Alt+J (Accept as is), to accept the voucher as a valid transaction, and include it in the relevant tables of GSTR-1 and GSTR-3B returns.

The user-defined name entered for the ledger in TallyPrime, may or may not be the same as the trading name registered with GSTN. Also, the registered Trading Name gets auto populated under Receiver Name in the GST portal. Hence, the Receiver Name will be blank in the GSTR-1 file exported from TallyPrime.

The transactions of the party type Government Entity, was captured in Table 3.2 Supplies made to UIN holders of GSTR-3B, which is not required by the GSTN.

Such interstate transactions of taxable goods with government entity, are captured in Table 3.1 a – Outward taxable supplies (other than zero rated, nil rated and exempted) as specified by the department.

As the department has not asked for any bifurcation of transactions with party type as government Entity. All the parties which have been created earlier under, government entity will be mapped to the party type Not Applicable.

You can do the following to identify the differences.

- Check if any of the transactions are appearing under Uncertain Transactions (Corrections needed) of GSTR-1 or GSTR-3B, and resolve them.

- Check if any of the transactions are appearing under Not relevant for returns. Check those transactions and include them if relevant.

- Check for sales entries recorded in Receipt or Journal vouchers. These transactions are included in the GST returns, but will not form part of the Sales Register.

New natures of transactions are introduced for interstate sales made to Embassy/UN body.

- Interstate Sales to Embassy/UN Body Exempt

- Interstate Sales to Embassy/UN Body Nil Rated

- Interstate Sales to Embassy/UN Body Taxable

- GSTR-1 – The relevant values of vouchers recorded with the new natures of transaction, will be captured in the following sections:

- B2C Invoices – 4A, 4B, 4C, 6B, 6C

- Credit/Debit Notes(Registered) – 9B

- Nil Rated Invoices – 8A, 8B, 8C, 8D

- GSTR-3B – The relevant values of transactions recorded with the new natures of transaction, will be captured in the following tables:

- Taxable transactions in 3.1(a) Outward taxable supplies (other than zero rated, nil rated and exempted)

- Exempt and nil rated transactions in 3.1(c) Other outward supplies (Nil rated, exempted)

- Taxable transactions in 3.2 – Supplies to UIN holders

Exempt sales will get captured in table 9 (Nil Rated Invoices) in the return format view of GSTR-1.

It is required to show GST calculation in the delivery challan. A delivery challan can only be used for the transfer of stock between branches operating with the same GSTIN number within a state.

The GST details recorded in the delivery challan will not have an impact on GSTR-1.

You can view the tax-rate-wise break-up in the Summary view of GSTR-1 and GSTR-3B.

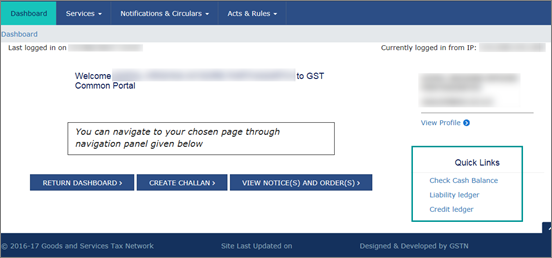

To know your GST liability and ITC, log in to the GST portal, and check your e-ledgers, that is, Liability Ledger and Credit Ledger.

In TallyPrime:

- To view GST liability, Gateway of Tally > Display More Reports > Statutory Reports > GST Reports > GSTR-1.

Alternatively, press Alt+G (Go To) > type or select GSTR-1 > and press Enter. - And, to view the ITC, Gateway of Tally > Display More Reports > Statutory Reports > GST Reports > GSTR-2.

Alternatively, press Alt+G (Go To) > type or select GSTR-2> and press Enter.

Or - Gateway of Tally > Display More Reports > Account Books > Ledger.

Alternatively, press Alt+G (Go To) > type or select Ledger Voucher > and press Enter. - Select the GST ledger. In the Ledger Vouchers report, the debit balance displays the ITC. And the credit balance displays the tax liability.

Or - Gateway of Tally > Display More Reports> Account Books > Group Summary > type or select Duties & Taxes.

Alternatively, press Alt+G (Go To) > type or select Group Summary > type or select Duties & Taxes > and press Enter. - The debit and credit balances of GST ledgers appear in the Group Summary.

When debit notes and credit notes are recorded against B2C(Large) Invoices – 5A, 5B for unregistered dealers or consumers, they will appear in Credit/Debit Notes (Unregistered) – 9B in GSTR-1. Debit notes and credit notes recorded against B2C(Small) Invoices – 7 will not appear here. They will appear with negative values in the same table.

Uncertain transactions > Party GSTIN Incorrect > Accept as is

In GST returns, press F5 : Nature View

In GST Returns, press F12:Configure, set Yes for “Show Tax types in separate columns”

It displays the number of transactions that are excluded from the returns. Drill down to view the Summary of Excluded Vouchers for the selected period.

“Uncertain Resolutions (Correction required)” displays the count of all vouchers with insufficient GST related information. You can correct exceptions in the vouchers before exporting GST returns. You need to update the missing information and resolve the mismatches to include these in the return.

To know more please refer :

Quarterly GSTR-3B is not supported in TallyPrime. Periodic return filing (Monthly/Quarterly) is supported only for GSTR-1.

In the QRMP scheme (where tax is paid for the first and second months through self-assessment or a fixed amount), GSTR-3B has to be filed for the full quarter in the last month of the quarter.

You can file the return using the following steps:

- In TallyPrime, open GSTR-3B for the relevant quarter.

- Note down the consolidated values and enter them in the Excel Utility Tool.

- Create a JSON file using the Excel Utility Tool and upload it on the portal

Alternatively, you can also refer to the GSTR-3B values in Tallyprime, and enter them directly on the GST portal while filing returns.

A company with multiple branches having a single GSTIN within the state can maintain data, and file returns with ease through TallyPrime.

For this, you need to

- Ensure different voucher types are maintained for each branch, to generate unique invoice numbers.

- Synchronise all the companies’ data to consolidate all the transactions to a single master company (to merge all the branch data).

- File GST returns from the consolidated data in master company.

If it is an offline environment, you can export your data from each branch and import it manually into the master company.

If you have multiple branches in different states having different GSTINs for all the branches, you need to file GST returns branch-wise using different companies for each branch. You can create a group company for viewing the consolidated data across all branches for filing income-tax returns.

We suggest you to upgrade to TallyPrime Release 4.0, load the Company data, and re-save the vouchers of RCM purchases or the ones created for the purchase from unregistered dealers.

Once you open the vouchers and press Ctrl+A to save, the vouchers will move to their respective sections in GSTR-3B.

If it doesn’t work, then take a backup of your Company data and repair by pressing Ctrl+Alt+R and verify it.

We suggest you to upgrade to TallyPrime Release 4.0 and repair your Company data by pressing Ctrl+Alt+R. Thereafter, the vouchers with Nature of Transaction as Import of Services Exempt or Import of Services Nil rated will be a part of only in the 4A2 – Import of Services section of GSTR-3B.

We suggest you to upgrade to TallyPrime Release 4.0 and load your Company data in it. Thereafter, you can either open the e-Invoice Register and re-save the voucher by pressing Ctrl+A or repair the Company data by pressing Ctrl+Alt+R. Thereafter, the voucher will be available in the respective section in the e-Invoice report.

In TallyPrime Release 4.0, such vouchers will not be considered as Uncertain Transactions. However, for the vouchers recorded in TallyPrime Release 3.0 or 3.0.1, you can simply load the Company data in TallyPrime Release 4.0 and repair it by pressing Ctrl+Alt+R. Thereafter, the vouchers will get included in the return.

We suggest you upgrade to TallyPrime Release 4.0 and repair your Company data by pressing Ctrl+Alt+R.

Thereafter, the previously and newly recorded vouchers will not be rejected by the portal and display the UoM as the following:

- The voucher created for stock items: UoM displayed as OTH

- The voucher created for services: UoM displayed as NA

While configuring Export, set Export a single file for the set Period as Yes.

To know more about it, refer to the Generate the JSON file for a Quarter (For IFF Available for QRMP Dealers) section in the GSTR-3B Report in TallyPrime topic.

Depending on the type of data you have provided in your transactions, some transactions might not have complied with the GST Portal requirements for uploading and filing. To know more, refer to the Filing GSTR-1 Returns: Errors & Resolutions topic.

If you are using TallyPrime Release 3.0, refer to the Rel 3.0 – GSTR-1/GSTR-3B Exceptions & Resolutions topic.

If you are using TallyPrime Release 2.1 or earlier versions, refer to the Rel 2.1 & Earlier – GSTR-1 Exceptions and Resolutions topic.

In some cases, transactions accidentally appear in the Marked for Deletion on Portal section of GSTR-1 due to some changes in the transaction details, as explained below. You can easily address such cases by making the suggested updates.

This exception occurs when the Voucher No. or Document No. is duplicate. In case of duplicate voucher numbers, drill down to the voucher and update the voucher number. In case of duplicate document numbers, you can update the voucher numbering from the respective voucher type master. Refer to Duplicate Voucher No./Document No. for the detailed resolution.

This exception occurs when certain GST Registration Details are missing or invalid for your party.

You can resolve this exception using any one of the following:

This exception occurs when the Tax Ledger is missing in the transaction. To resolve this exception, you can update the relevant tax ledgers in the transactions. Refer to Tax Ledger is not specified for the detailed resolution.

This exception occurs when the Taxability Type is missing or invalid in GST details for stock items. You can resolve this exception using any one of the following:

This exception occurs when the HSN/SAC is missing or invalid in GST details for stock items.

You can resolve this exception using any one of the following:

This exception occurs when an incorrect Tax Ledger is selected in the transaction. You can resolve this exception by updating the transaction with the correct tax ledger. Refer to Incorrect Tax Ledger is selected for the detailed resolution.

This exception occurs when the Tax Rate is missing in GST details for stock items.

You can resolve this exception using any one of the following:

To view the data in GSTR-3B report:

- Open the GSTR-3B report, and press F2 (Period) to change the period.

It is possible that the report opened for a period where there is no transaction data. - Ensure that the required configurations are enabled based on the data that you want to view.

- If you are still not able to view the data, contact Tally support.

- GST would be applicable on the supply of goods or services as against the present concept of tax on the manufacture and sale of goods or services.

- GST would be a destination-based tax as against the present concept of origin-based tax.

- The list of exempted goods and services would be kept to a minimum and harmonized for the Centre and the States as far as possible.

- Exports would be zero-rated.

- IGST credit to be fully utilized before using credit of CGST or SGST for tax payments.

- Credit of CGST paid on inputs may be used only for paying CGST on the output. Credit of SGST paid on inputs may be used only for paying SGST on the output.

The Goods and Services Tax (GST) is a value-added tax that is levied on most goods and services sold for domestic consumption in India. The GST rate structure is divided into four categories:

0% (Exempted): Certain goods and services are exempted from GST, such as fresh vegetables, fruits, unprocessed food items, healthcare services, education services, and more.

5% (Lower rate): Essential items such as LPG, kerosene, medicines, and other items fall under this category.

12% and 18% (Standard rate): Most goods and services fall under this category, including processed food items, clothes, electronic items, transportation services, and more.

28% (Higher rate): Luxury goods and services such as cars, yachts, and other expensive items fall under this category.

In addition to these four categories, there is a special rate of 0.25% that applies to rough precious and semi-precious stones and a rate of 3% that applies to gold and other precious metals. The GST rate structure is periodically reviewed and revised by the GST Council to ensure that it is aligned with the changing economic conditions and needs of the country.

The following lists the taxes that will be replaced by GST:

|

Taxes replaced by GST at the centre |

Taxes replaced by GST at the state |

Taxes not covered under GST |

| Central Excise duty | State VAT | Alcohol for human consumption |

| Duties of Excise (Medicinal and Toilet Preparations) | Central Sales Tax | Electricity |

| Additional Duties of Excise (Goods of Special Importance) | Purchase Tax | Sale/purchase of Real Estate |

| Additional Duties of Excise (Textiles and Textile Products) | Luxury Tax | Five specified petroleum products (to be brought under GST later on recommendation of GSTC) |

| Additional Duties of Customs (commonly known as CVD) | Entry Tax (All forms) | Tobacco Products |

| Special Additional Duty of Customs (SAD) | Entertainment Tax (except those levied by the local bodies) | |

| Service Tax | Taxes on advertisements | |

| Cesses and surcharges, when they are related to supply of goods or services | Taxes on lotteries, betting and gambling | |

| State cesses and surcharges insofar as far as they relate to supply of goods or services |

All goods and services are likely to be covered under GST except the following:

- Alcohol for human consumption

- Electricity

- Sale/purchase of Real Estate

- Five specified petroleum products (to be brought under GST later on recommendation of GSTC)

- Tobacco products

Effective from 1st February 2019, IGST credit has to be fully utilized before using CGST or SGST credits for tax payments.

Prior to the amendment in the GST Act, input tax credit was allowed to be adjusted against GST liability in the order shown below:

|

Input tax credit |