Reconcile GSTR-1 Data | GSTR-1 Reconciliation Report

GSTR-1 is a tax return that has to be filed by a regular dealer on the GSTN portal. If you are a regular dealer, then you have to upload the details of all your outward supplies (or sales transactions) every month or quarter, as per the turnover from the previous Financial Year. After you have uploaded or filed your returns, it is always recommended that you reconcile the portal data with the data in your company books.

Reconciliation of return data is always a healthy habit, especially if your data is being filed by an employee in a different branch office or any third party such as an auditor or chartered accountant. This will help you in verifying the data on the portal with the data in your company books, and identify any differences between the data.

Considering the sheer number and variety of transactions, it might sound daunting to track all the differences in GST details. But with TallyPrime at your fingertips, you don’t have to worry about reconciliation at all. You only have to download your GSTR-1 data in TallyPrime, and the relevant details from the portal will appear seamlessly in the GSTR-1 Reconciliation report, along with the details in your company books. After that, you can verify the details and easily make the necessary changes.

Here’s how TallyPrime can make your reconciliation journey easier:

Assured compliance

Form GSTR-1 contains different sections or tables for recording many types of supplies, such as B2B Invoices, Amendment to B2B Invoices, and so on. However, with TallyPrime at your fingertips, you do not have to go to any pains to sorting your GST data separately. The GSTR-1 Reconciliation report is perfectly mapped to the tables of form GSTR-1, and all your GST inward supplies will be automatically assigned to the relevant tables. Once your details are imported, you can rest assured that these details will be seamlessly reflected in the respective sections as well. Refer to the Return View section to know more.

Easy, intuitive design

We understand that GST compliance can become tricky due to the sheer variety of transactions and amendments involved. You might be worried if you will be able to find all the transactions that require your attention. However, the GSTR-1 Reconciliation report has got you covered. All the sections that require your action will be highlighted in amber colour, while the values from the portal will be presented in blue colour for easy identification.

You also might be trying to figure out what would be the best way to track your reconciled and unreconciled uploaded transactions. However, the GSTR-1 Reconciliation report is so flexible that it will keep evolving according to the nature of your transactions. For example, if your imported data contains a few transactions that are present only on the portal, then such transactions will automatically appear in a new section called Available Only on Portal.

What’s more, you have the option to configure the GST Return Effective Date for a transaction. For some reason, you might not have been able to upload a transaction on GST portal in the same month, or you might have agreed with your counterparty to upload the transaction in the subsequent month. For such transactions, you can easily update the GST Return Effective Date, as needed. Such transactions will automatically appear under Mismatch in Return Period.

Unmatched performance

GST transactions are typically filled with so many details, and the more transactions you have, the bulkier your data might get. However, with TallyPrime, you do not have to worry about the size of your data. The GSTR-1 Reconciliation report will always be instantly available, that is, as soon as you import your GSTR-1 file, the return information will be reflected in the reports in real-time. Even when you have thousands of GST transactions, GSTR-1 Reconciliation will load the details in a jiffy.

Multi-GSTIN support

If your business consists of multiple GST registrations/GSTINs, then the GSTR-1 Reconciliation report provides you with an amazing view of your combined GST details and activities across registrations. You also have the flexibility to view GSTR-1 Reconciliation for only one registration, from any of your companies. You can view and resolve your uncertain transactions for all GSTINs combined or for one GSTIN at a time, based on your business practice.

Additional flexibilities

What’s more, GSTR-1 Reconciliation report provides you with with a host of flexibilities. For example, after importing the GSTR-1 data, you can either compare the values in your books and in the portal side by side, or you can view the difference between the values, depending on your convenience. You also have other options such as viewing the report for all your transactions, or for specific transactions such as Available only in Books or Excluded, but available on Portal. What’s more, you can also choose to ignore minor differences in values between your company books and portal, which might arise use to factors such as rounding off.

If you are on a previous release of TallyPrime, click here to know more about GSTR-1 Reconciliation.

- Gateway of Tally > Display More Reports > Statutory Reports > GST Reports> GSTR-1.

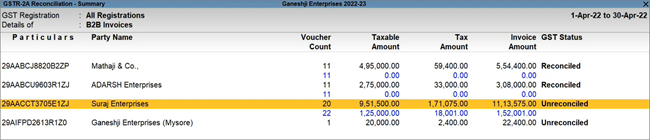

Alternatively, press Alt+G (Go To) > type or select GSTR-1 > and press Enter. - Press Ctrl+H (Change View) > Status Reconciliation. The Status Reconciliation screen appears as shown below:

Voucher Count: Displays the total count of vouchers under the particular table for the reporting period.

Activity Status

- To Be Uploaded: Displays the number of vouchers yet to be exported. The count vouchers that are not yet exported to GSTR-1 return file are displayed in this column.

- Uploaded: Displays the number of vouchers exported. This column is automatically updated when a voucher is exported to GSTR-1 return file.

- Rejected by GST: Displays the count of vouchers marked as Rejected by GST. You can mark the voucher status as rejected when GST rejects the voucher for reasons such as, duplicate invoice, reference of original transaction is not found in case of debit/credit note, GSTIN of any user being suspended, and so on.

- Accepted: Displays the count of vouchers marked as Accepted. You can mark the status as accepted when input tax claim made by the buyer in the GSTR-1A.

- Rejected: Displays the count of vouchers marked as Rejected. You can mark the status as rejected when the buyer rejects the voucher details as displayed in the GSTR-1A.

Reconciliation Status

Not Reconciled: Displays the count of vouchers marked as Not Reconciled. You can mark the status as Not Reconciled when the details in the online portal do not match with your books.

Reconciled: Displays the count of vouchers marked as Reconciled. You can mark the status as Reconciled when the details in the online portal match with your books

Set Status

- Drill down from any table to view the voucher register with list of vouchers and change the status of the voucher.

- The voucher register displayed on drill down from a table in Status Reconciliation screen appears as shown below:

- Select a voucher or multiple vouchers using Spacebar.

- Press Alt+S (Set Status).

- Select the Activity status and Reconciliation status of the voucher based on the details in the GST portal and press Enter.

The status change based on the status set for each transaction, is displayed in the Voucher Register. Press Alt+F5 (Detailed) to view the reason provided for the status Rejected by GST.

- Press Esc to return to the Status Reconciliation screen. The voucher count in columns is changed based on the status updates.

Status-wise View

You can view the status reconciliation in the status-wise view.

- Press F8 (Status-wise View) in the Status Reconciliation screen.

F12 (Configure)

Show uncertain transactions: Enable this option to view the number vouchers that are not included in the returns due to incomplete information or mismatch. This voucher count is displayed at the bottom of the Status Reconciliation screen.

Directly Download GSTR-1 from TallyPrime

GSTR-1 reconciliation is now easier than ever. You can now download your GSTR-1 right here from TallyPrime, without the need for visiting the GST portal or carrying out any other manual activity. This will help you in reconciling your returns without any hassles.

The best part is that you have the flexibility to download returns for multiple GST Registrations, multiple Return Types, and multiple Return Periods, in one go!

You can also set the default return types while downloading GST Returns. Further, TallyPrime automatically identifies the period of the previously filed and downloaded returns. Accordingly, the subsequent period will be prefilled during the next download.

Moreover, you also have the option to redownload any previously downloaded returns. The latest downloads will replace the existing versions.

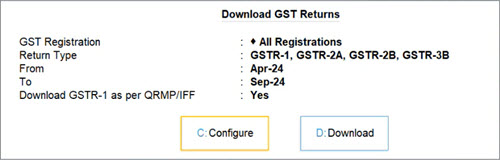

- Press Alt+Z (Exchange) > Download GST Returns.

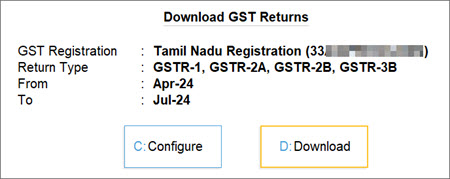

The Download GST Returns screen appears, in which you can see that all the Return Types are selected, by default.

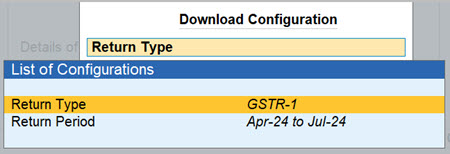

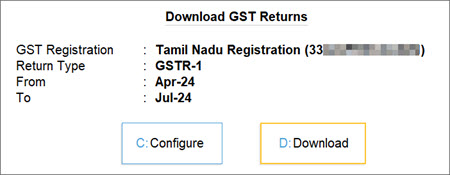

- Press C (Configure) to set the required Return Type, that is GSTR-1, and the Return Period.

You also have the option to set the default return types for download. - In the Download GST Returns screen, press D (Download).

- Log in to your GST profile, if you have not already done so.

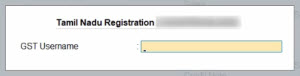

- Enter your GST Username.

- Enter the OTP received on your registered mobile number, after which your summaries will be exported to the GST portal.

Once you have logged in, the session will be valid for six hours, which will ensure the safety and security of your activities.

- Enter your GST Username.

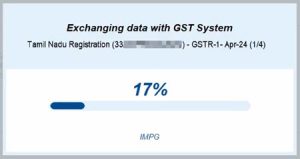

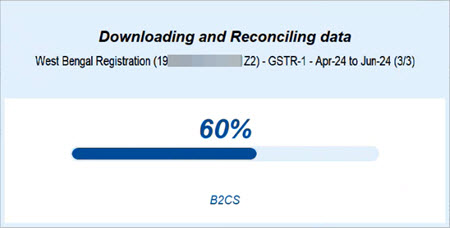

Once GSTR-1 download is initiated, you can easily track the progress.

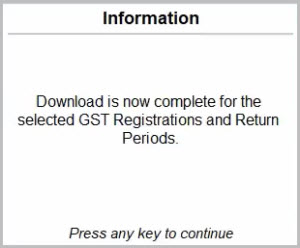

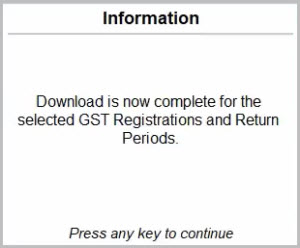

Once the GSTR-1 data is downloaded from the GST portal, you will receive a confirmation.

Now you can view the downloaded details in the GSTR-1 Reconciliation report.

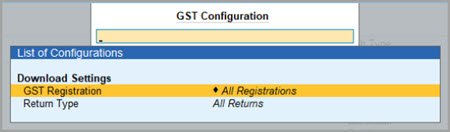

Configure Default Return Types for Download

TallyPrime provides you with flexibility to set one or more return types, such as GSTR-1 and GSTR-2B, based on your business preferences.

Subsequently, these return types will be automatically considered as your default returns for download.

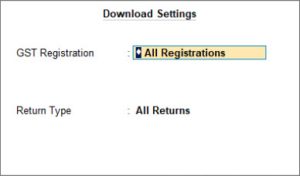

- Press Alt+Z (Exchange) > GST.

- Select the required Return Type, such as GSTR-1.

You also have the flexibility to select multiple Return Types or All Returns.

- Press Ctrl+A to save the configuration.

The selected return types will be considered as the default in subsequent downloads.

Download GSTR-1 as per QRMP/IFF

GSTR-1 reconciliation for QRMP dealers is now easier than ever. Once you have uploaded and filed GSTR-1 as per IFF, you can easily download your filed returns right here from TallyPrime. Instead of visiting the GST portal or carrying out any other manual activity, you only have to enable the QRMP/IFF option while downloading GSTR-1.

The best part is that you won’t have to configure this again and again. Once you have enabled the option, your subsequent downloads for GSTR-1 will be automatically considered for QRMP/IFF. You can disable the option again, whenever you want to.

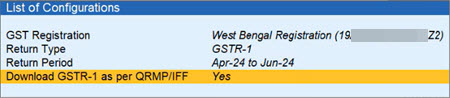

- Press Alt+Z (Exchange) > Download GST Returns.

- Press C (Configure) to set the required options.

- Select the GST Registration, Return Type (that is, GSTR-1), and Return Period.

- Enable the Download GSTR-1 as per QRMP/IFF option.

- Press Ctrl+A to save the configuration.

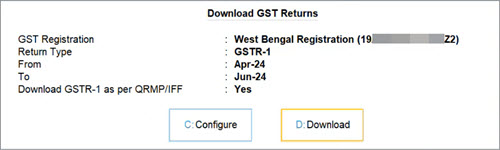

- In the Download GST Returns screen, press D (Download).

Once GSTR-1 download is initiated, you can easily track the progress. The details will be downloaded for the individual months as well as for the entire quarter that was selected.

Once the GSTR-1 data is downloaded from the GST portal, you will receive a confirmation.

You can view the downloaded details in the GSTR-1 Reconciliation report.

Manually Import GSTR-1 Data

This is the first step in an amazingly simple reconciliation process. You only have to import the GSTR-1 file in to the GSTR-1 Reconciliation report, after which all the relevant values from the portal will be captured in extensive detail and unparalleled flexibility.

- In the GSTR-1 Reconciliation report, press Alt+O (Import) > GST Returns.

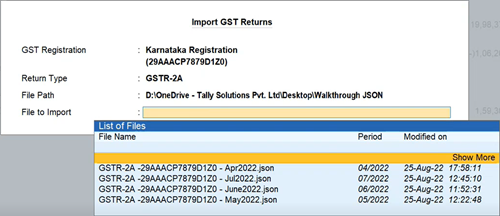

The Import GST Returns screen appears. Provide the required details to import the GST details.- GST Registration: The GST Registration for the company is selected by default. If you have created multiple GST registration for the company, you can select the GST Registration, as needed.

- Type of Return: Select the return for which you need the GST details from the portal.

- File Path: Location of the return file.

- File to import: Select the JSON file that you will import into TallyPrime.

- Press Ctrl+A to accept.

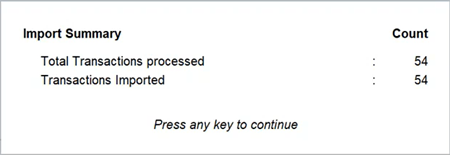

You can see the Import Summary, which will provide you a clear picture of the number of transactions processed, imported, or failed to import.

- Press any key to continue.

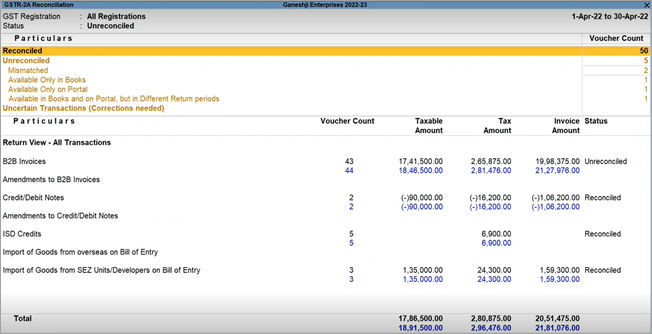

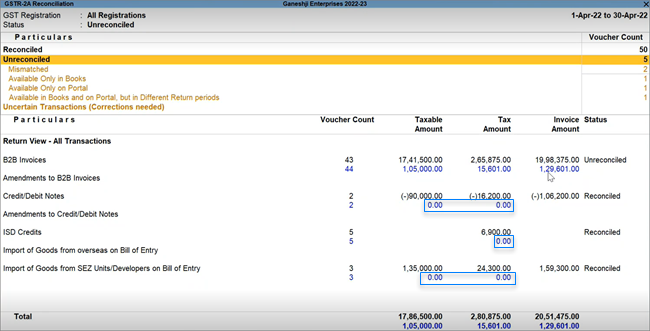

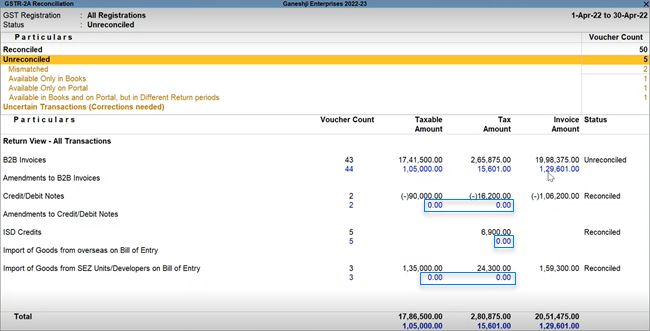

You can see that the imported details will be captured seamlessly in the Total Vouchers section (under Unreconciled) as well as in the Return View section, where the respective values from the portal will be highlighted in blue.

Once you have imported the file, your returns will display a comparative view of the values.

Importing GST Returns helps you compare the same with the data in your returns and reconcile as needed to keep your data up-to-date and accurate.

For more information, refer to the GSTR-1 topic.

View GSTR-1 Reconciliation

Header | View Company Information

The header section in GSTR-1 Reconciliation captures some of your key information up front, such as the Company name, GST Registration, Period, Status of returns (Signed/Not Signed), and so on. If required, you can change one or more of these necessary details, and the contents of the reports will be updated accordingly.

![]()

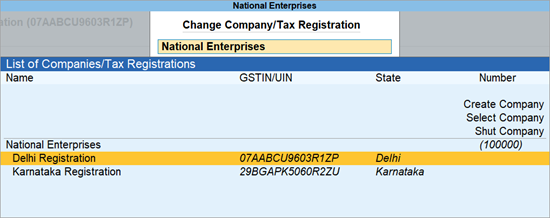

What’s more, if your business consists of multiple GST registrations/GSTINs, then the GSTR-1 Reconciliation report provides you with an amazing view of your combined GST details and activities across registrations. However, TallyPrime also provides you with the flexibility to view GSTR-1 Reconciliation for only one registration, from any of your companies.

View GSTR-1 Reconciliation for a specific GSTIN

Press F3 (Company/Tax Registration) and select the required company or registration from the list.

The GSTR-1 Reconciliation report will then open for the selected registration.

![]()

Based on your requirements, you can even set a particular registration as the default using the Save View feature, so that GSTR-1 Reconciliation will open the details of your desired registration every time.

Total Vouchers | View Statistics & Verify Details

The Total Vouchers section gives you a bird’s eye view of the key numbers and details across your GST transactions. You will get a clear picture of the number of reconciled, unreconciled, and uncertain transactions. You can drill down from each of these sub-sections to take a closer look at the transaction details.

The Total Vouchers section will display the following sections, based on your actions and transactions:

- Reconciled

- Unreconciled

- Mismatched

- Available Only in Books

- Available Only on Portal

- Available in Books and on Portal, but in Different Return periods

- Uncertain Transactions (Corrections needed)

Total Vouchers

This section will give you an overall count of the vouchers involved in GSTR-1 Reconciliation. You can drill down to the Statistics screen for a detailed breakup of the type of vouchers involved. For example, you can see how many journal vouchers are included in the return, and how many are not relevant or uncertain. The best part is that you can further drill down to see the full list of journal vouchers that have been recorded during the return period.

Reconciled

The Reconciled section will provide you with a count of the transactions in GSTR-1 that are already reconciled, and you don’t have to worry about them from a filing perspective.

However, if you want to verify the transactions, you can further drill down to see the full list of reconciled transactions in the selected period.

Unreconciled

The Unreconciled section will provide you with a count of the transactions in GSTR-1 that are yet to be reconciled. After you import the GSTR-1 data, you can see that the Unreconciled transactions will be further categorised into Available Only in Books, Available Only on Portal, and Mismatch in Return periods.

You can further drill down to see the full list of unreconciled transactions in the selected period.

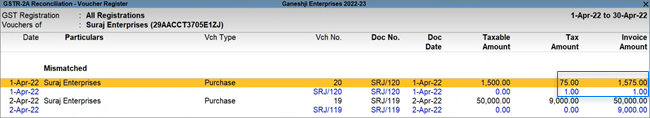

Mismatched

This section will capture the unreconciled transactions in which the GST details are not matching between your books and the portal. There might be differences in values such as prefix/suffix in Vch No. and Doc No., Tax Amount, and so on.

You can further drill down to see the full list of unreconciled transactions in the selected period.

Available only in Books

This section captures all the transactions that are present only in your books, but are yet to listed in your party’s GSTR-1. You can make a note of such transactions and correspond with your parties, as needed.

You can further drill down to see the full list of transactions available only in your books in the selected period.

Available only on Portal

This section captures all the transactions that are present exclusively on the portal, and not in your company books. For such transactions, you can easily record a corresponding entry in your books.

You can further drill down to see the full list of transactions available only on the portal in the selected period.

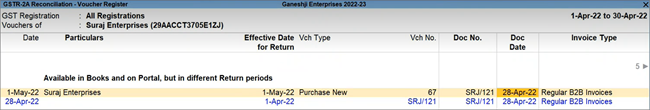

Mismatch in Return periods

This section captures transactions that are present in both your books and on the portal, but in different periods, which leads to issues in reconciliation.

You can further drill down to see the full list of transactions in the selected period.

Excluded, but available on Portal

This section captures transactions that have been excluded from returns, but are present on the portal.

You can further drill down to see the full list of transactions excluded from the current return period.

Uncertain Transactions (Corrections Needed)

This section captures all the transactions with GST-related errors. You can drill down further from the section to view all such uncertain details and correct them. Even if you have hundreds of transactions, you can easily find and fix a particular error.

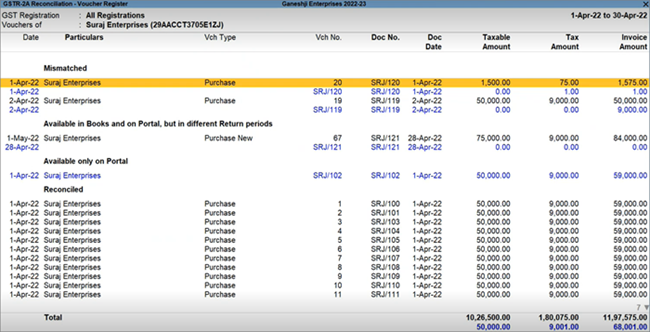

Return View | View GST Details as per Form GSTR-1

The Return View section is your personal map of the GSTN portal. Every section or table in Form GSTR-1 is faithfully represented in this section, so that you can conveniently view and compare the values. After you have imported the GSTR-1 data, you can see that the values from the portal will appear alongside the values in your books, in the relevant sections.

The values from the portal will be highlighted in blue for easy identification, and wherever the books and portal data are reconciled, the values in blue will appear as zero.

You can drill down from any of the above sections for a more detailed view of the status of reconciliation for your transactions.

In this screen, you can either reconcile the values for the required parties, or you can further drill down from a party and reconcile the transactions for that particular party.

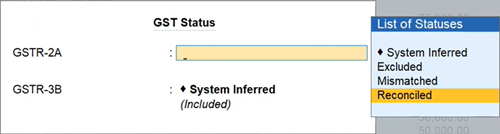

You can easily view the reconciliation status for your parties by enabling the Show Reconciliation option from F12 (Configure). You can see the reconciliation status in the GST Status column.

Now you can drill down from any of the parties with Unreconciled status, and view your transactions in greater detail. You can see that your unreconciled transactions are categorised in different sections, so that you can easily take the necessary actions for resolving any differences in transactions.

You can view your transactions in the following sections:

- Mismatched

- Mismatch in Return periods

- Available only on Portal

- Reconciled

Mismatched

In the Mismatched section, you can easily find and resolve any differences between your book and portal values, such as prefix/suffix in Vch No. and Doc No., Tax Amount, and so on. You can refer to the values under the columns and figure out if there any issues.

What’s more, you can explore F12 (Configure) and view other factors that might lead to mismatch. such as differences in Invoice Type, Reverse Charge details, and so on. Once you enable these options, the respective columns will start appearing in the report.

Resolve Mismatched transactions

Let us take the example of a difference in the Tax Amount for a transaction in your books and on the portal. Sometimes, there might be a minor difference in the Tax Amount, if you and your party follow different practices for rounding off your amounts.

For such transactions with minor issues, you can easily update the reconciliation status by pressing Alt+S (Set GST Status), and set the status as Reconciled. However, you can also update the amount in your books, if you want to match the amount appearing on the portal.

The transaction will now appear in the Reconciled section instead of the Mismatched section.

Mismatch in Return periods

Sometimes, there might be a mismatch in the date of the transaction, due to which it might appear in different return periods for you and your party. This might have happened if you have received the supply in a particular month, while your party has issued an invoice for the same transaction in the previous month.

For such transactions, you can simply update the GST Return Effective Date in your books, by pressing Alt+L (Set Effective Date).

After you update the date and make it consistent with your party, the transaction will move to the Reconciled section.

Available only on Portal

This section captures all the transactions that are available in your party’s GSTR-1, but not in your books.

For such transactions, you can easily record a corresponding entry in your books.

You can view the transaction in greater detail by pressing Alt+R (GST Portal View).

Now you can note down all the necessary details, such as Invoice No., Section and Invoice Type, and record the transaction in your books using the same details.

After you record the transaction and make it consistent with your party, the transaction will move to the Reconciled section.

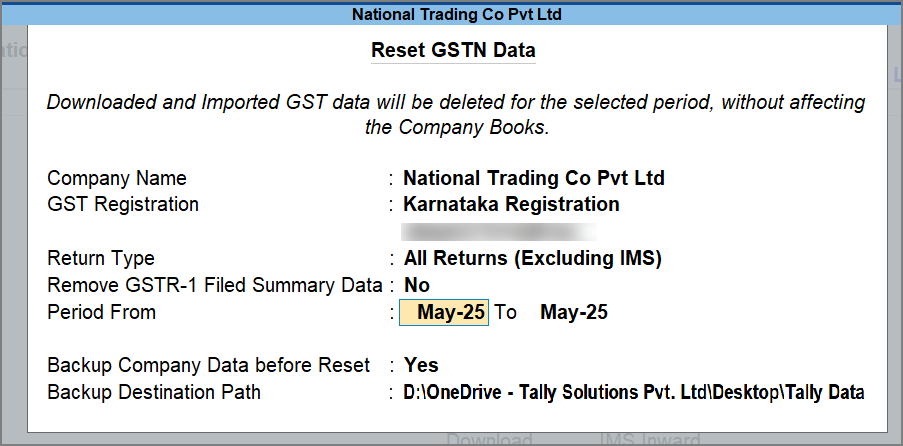

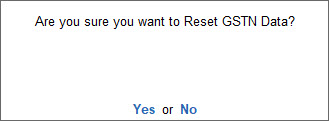

Reset GSTN Data

If you are on TallyPrime Release 2.1 or earlier, this is not applicable.

In case you had imported GST Returns into TallyPrime to reconcile the portal data with your return data, you might need to remove them, especially if:

- You have already reconciled the data and no longer need the imported data.

- The imported data is corrupted and cannot be used.

- You have imported an incorrect JSON file.

In such situations, you can easily remove the unwanted GSTN data using the Reset GSTN Data feature in TallyPrime for any selected period depending on your need.

- Press F1 (Help) > Troubleshooting > Reset GSTN Data.

- Provide details of the company and period from which you need to remove the GSTN data.

- Company Name: If you have loaded more than one company, you can select the company for which you want to reset the GSTN Data.

- GST Registration: Based on the selected company, this will get prefilled. However, if you have created multiple registrations for the selected company, you can select the GST Registration.

- Return Type: Select the return type from the list of Return Types including GSTR-1, GSTR-2A, GSTR-2B, GSTR-3B, IMS Inward, or All Returns (Excluding IMS).

If you select GSTR-1 or All Returns (Excluding IMS), then you can choose to Remove GSTR-1 Filed Summary Data, if needed. - Period: You can update the From date from when you wish to reset the GSTN Data. However, the To date is prefilled and you will not be able to change it.

- The From date is prefilled by default by the latest among the following:

- Books beginning from date of the company

- Financial year beginning date of the company

- GST applicability date (01-Jul-2017) as per Department

- GST applicability date as specified by you for the respective GSTIN

- The To date is prefilled as per the latest date of any stat data available for the vouchers. If no such date is available, TallyPrime will prefill the To date with the Books beginning from date of the company. This field cannot be changed.

- The From date is prefilled by default by the latest among the following:

- Select Backup details: It is recommended that you take a backup of the company data before you reset the data.

- Accept the screen. As always, press Ctrl+A to save.

TallyPrime prompts you with the following query:

- Press Enter to confirm reset. The following information screen appears confirming successful reset of GSTN Data.

Resetting GSTN data ensures that any unwanted GSTN data imported from the portal is removed from TallyPrime data.