Connect and Disconnect Bank Accounts from TallyPrime

Connecting your bank accounts to TallyPrime allows you to use the Connected Banking facilities such as getting bank balance and bank statement.

You can also reconnect or disconnect your bank accounts from TallyPrime, when needed.

Connect Bank Accounts

When you connect to a specific Bank, a Connection ID gets generated. This is the reference ID for the connection initiated with the Bank.

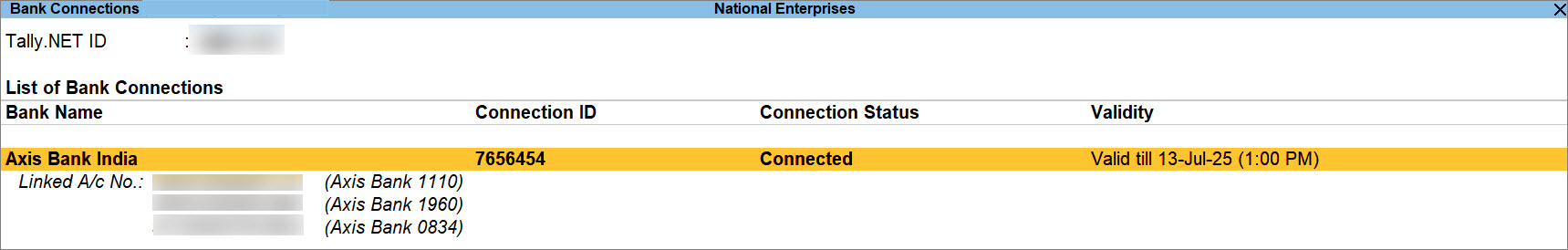

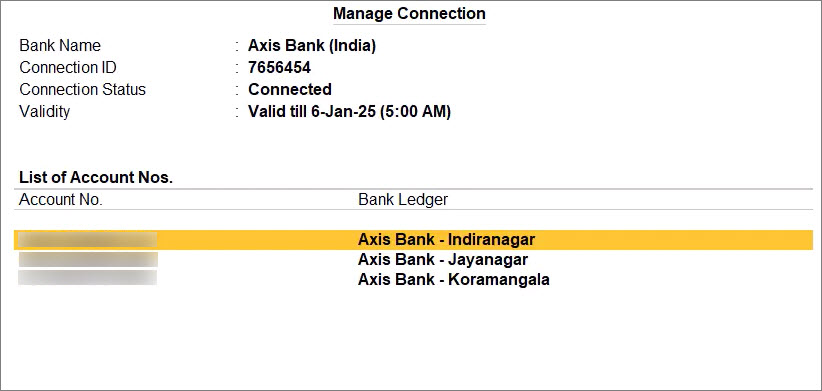

Once the connection is successful, you get a list of account numbers with the matching Bank ledgers.

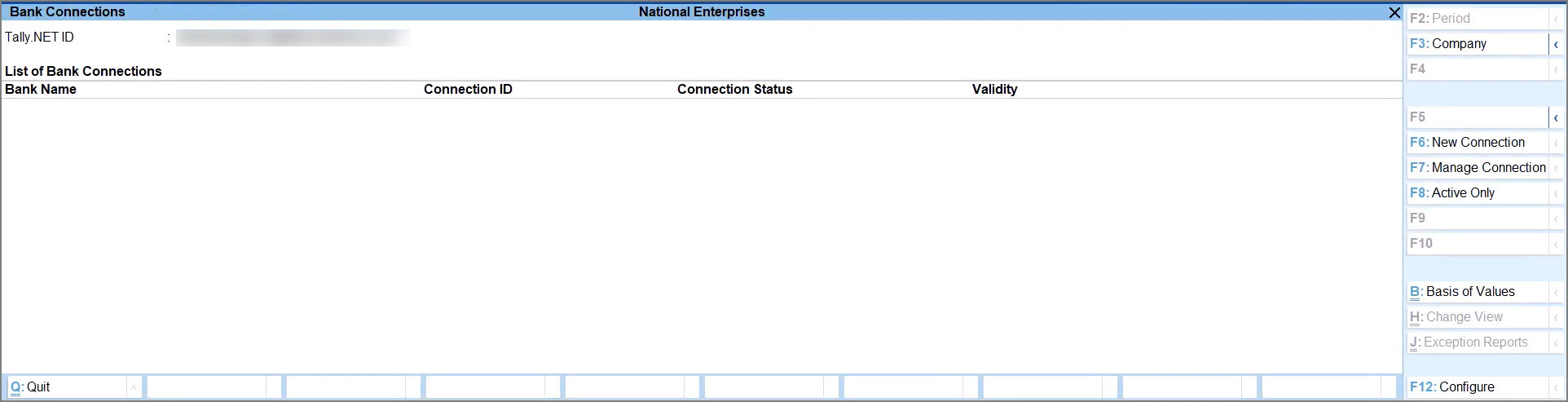

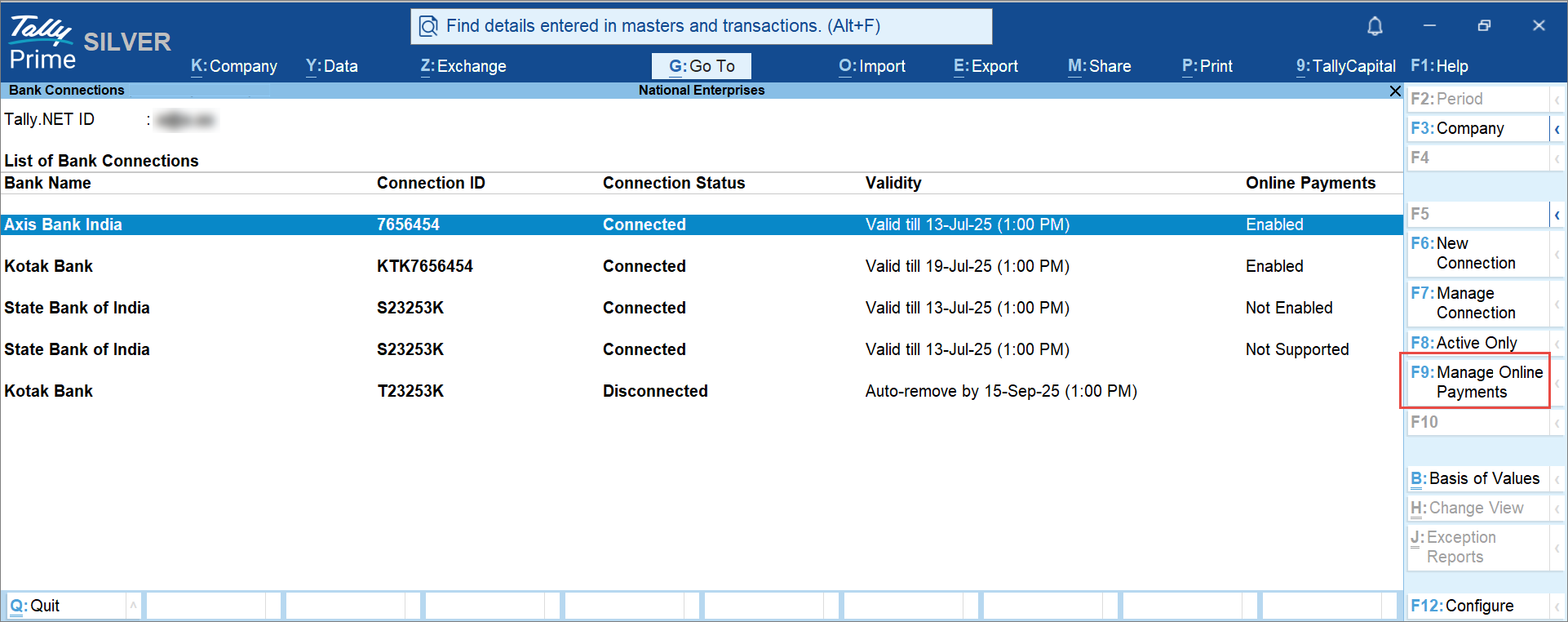

- Press Alt+Z (Exchange) > All Banking Options > Bank Connections.

If you have not logged in to Connected Banking already, then you will need to log in. - Press F6 (New Connection).

- Select the relevant bank.

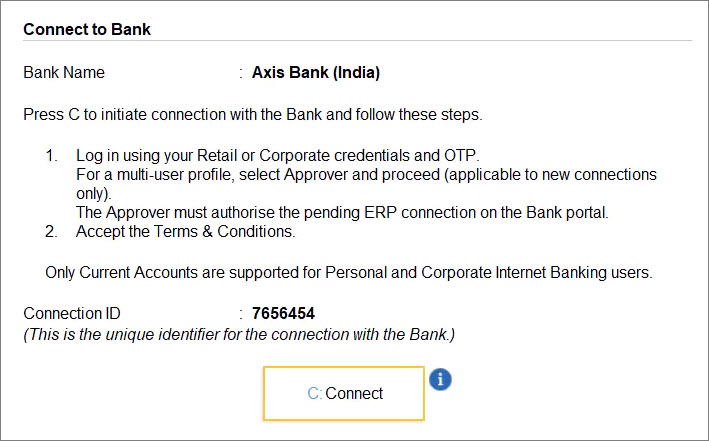

A connection ID gets generated.

If there are connections pending for approval for the bank, then you will get a message.

In that case, you can press Y to proceed.- If you are an Axis Bank customer, refer to Connection with Axis Bank.

- If you are a Kotak Mahindra Bank customer, refer to Connection with Kotak Mahindra Bank.

- In the Connect to Bank screen, press C (Connect).

- Consequently, you get redirected to the respective bank portal.

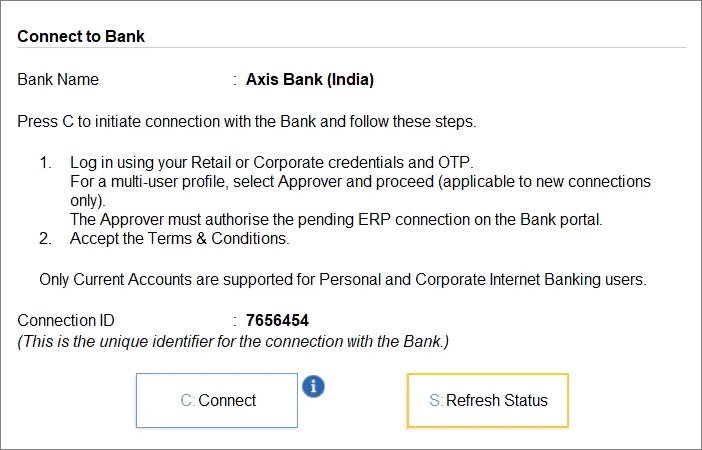

Once you establish the connection with the bank on the portal, you can refresh the status. - Press R (Refresh Status).

The status of the connection gets displayed in the Bank Connections report as Connected.

Once you establish the connection with the bank, the bank accounts get linked. If there are ledgers matching the bank accounts, then the ledgers also get displayed.

After the one-time setup, you can log in to Connected Banking at any point in time. Thereafter, using Connected Banking in TallyPrime, you can:

If you are not logged in, then you will need to log in with Tally.NET ID, password, and OTP.

Reconnect Bank Accounts

You can reconnect to the bank using an existing Connection ID in the following scenarios:

- The connection is still in progress.

- The connection has expired when:

- The connection has crossed its validity.

- The mobile number has been changed.

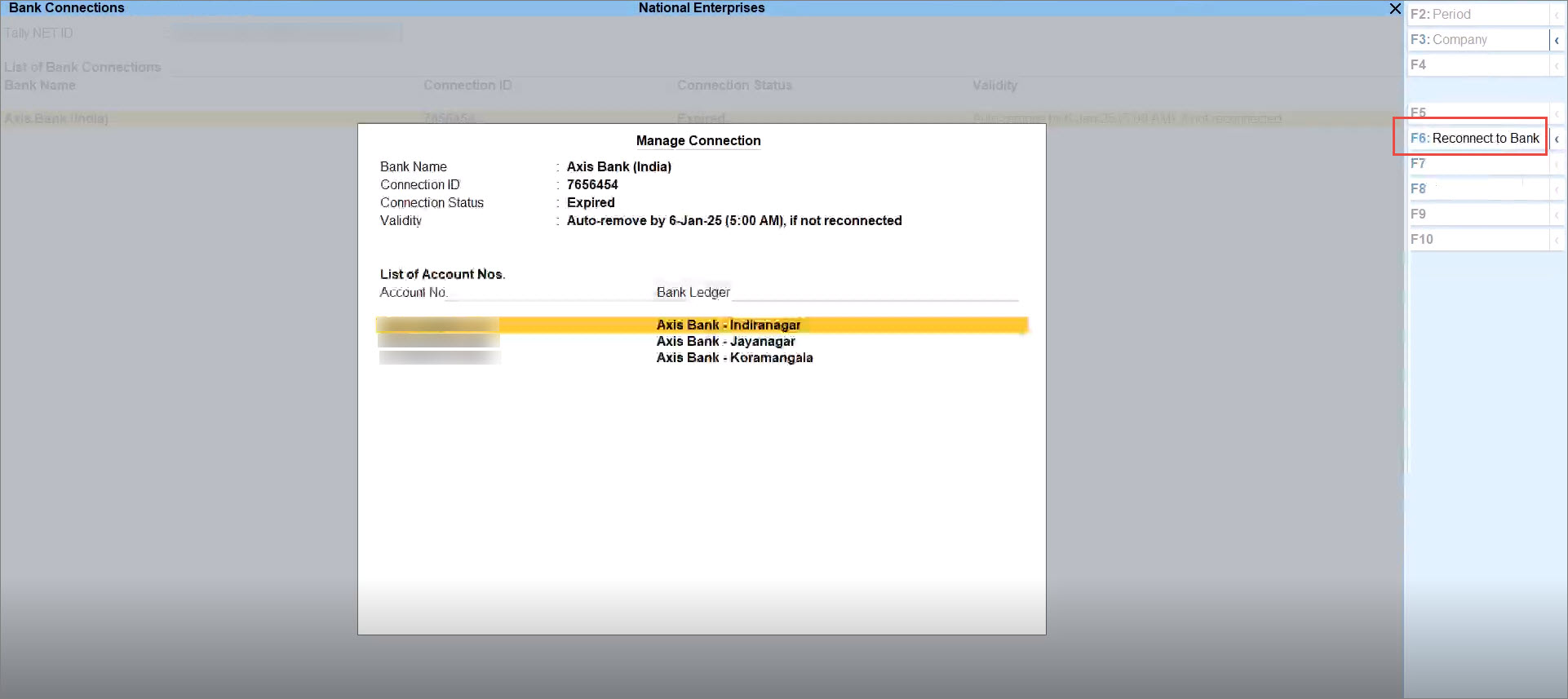

- Select the bank connection, and press Enter or F7 (Manage Connection).

- Press F6 (Reconnect to Bank).

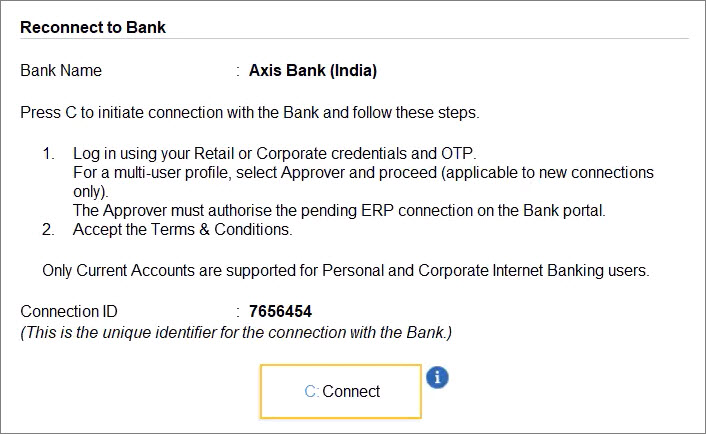

- In the Reconnect to Bank screen, press C (Connect).

Consequently, you get redirected to the bank portal.

Refer to Reconnect with Axis Bank or Reconnect with Kotak Mahindra Bank to know more.

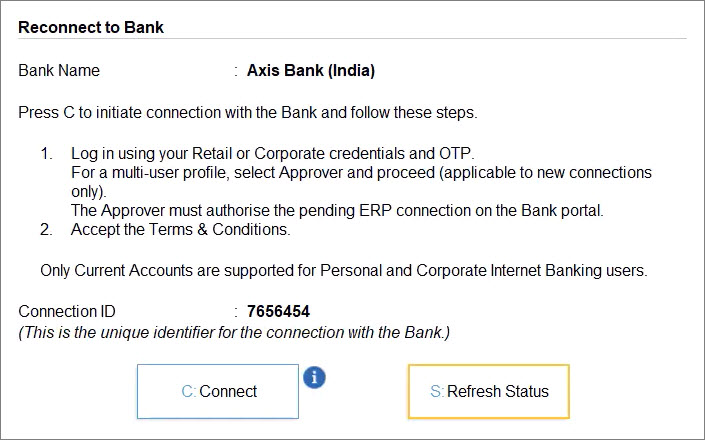

Once you establish the connection with the bank on the portal, you can refresh the status. - Press R (Refresh Status).

The Bank Accounts get connected.

Disconnect Bank Accounts

Some of your bank accounts might be dormant. So, you might not want to use the bank accounts through Connected Banking. When you do not want to use bank accounts of a specific bank, you can disconnect from the bank.

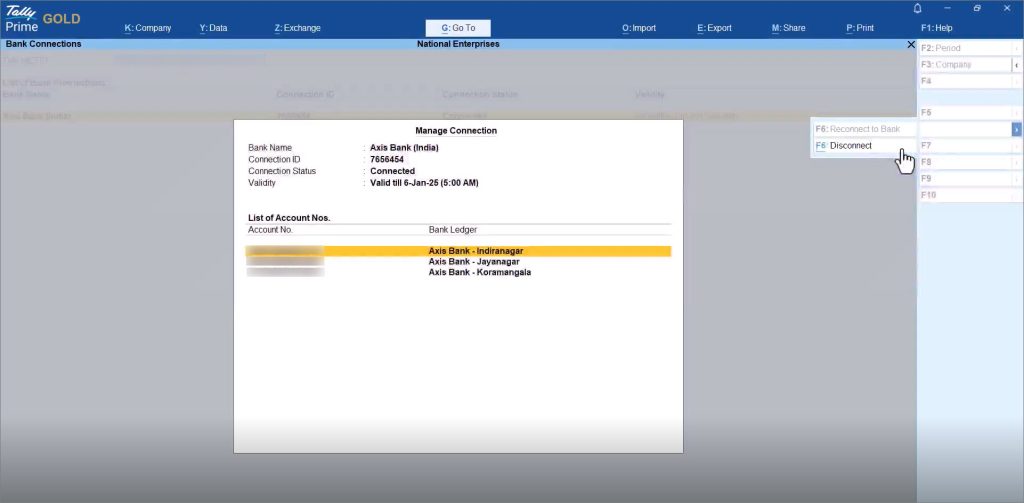

- In the Manage Connection screen, press Alt+F6 (Disconnect).

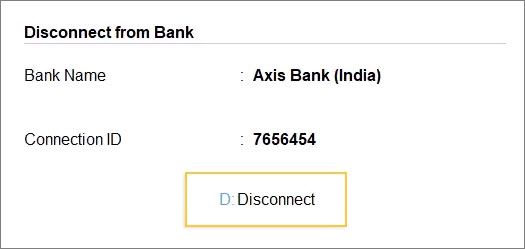

- In the Disconnect from Bank screen, press D (Disconnect).

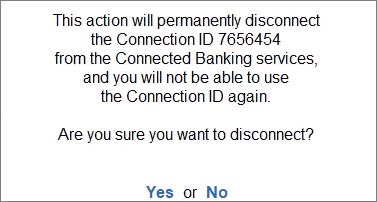

- Press Y to disconnect from the bank.

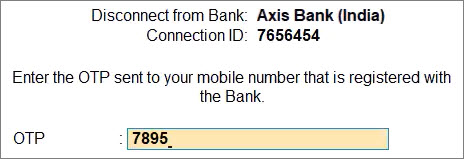

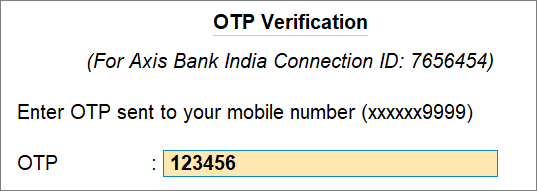

In the case of Axis Bank, you will need to enter the OTP received on the mobile number registered with the Bank.

However, in the case of Kotak Mahindra Bank, the OTP is not required.

The Bank Accounts get disconnected.

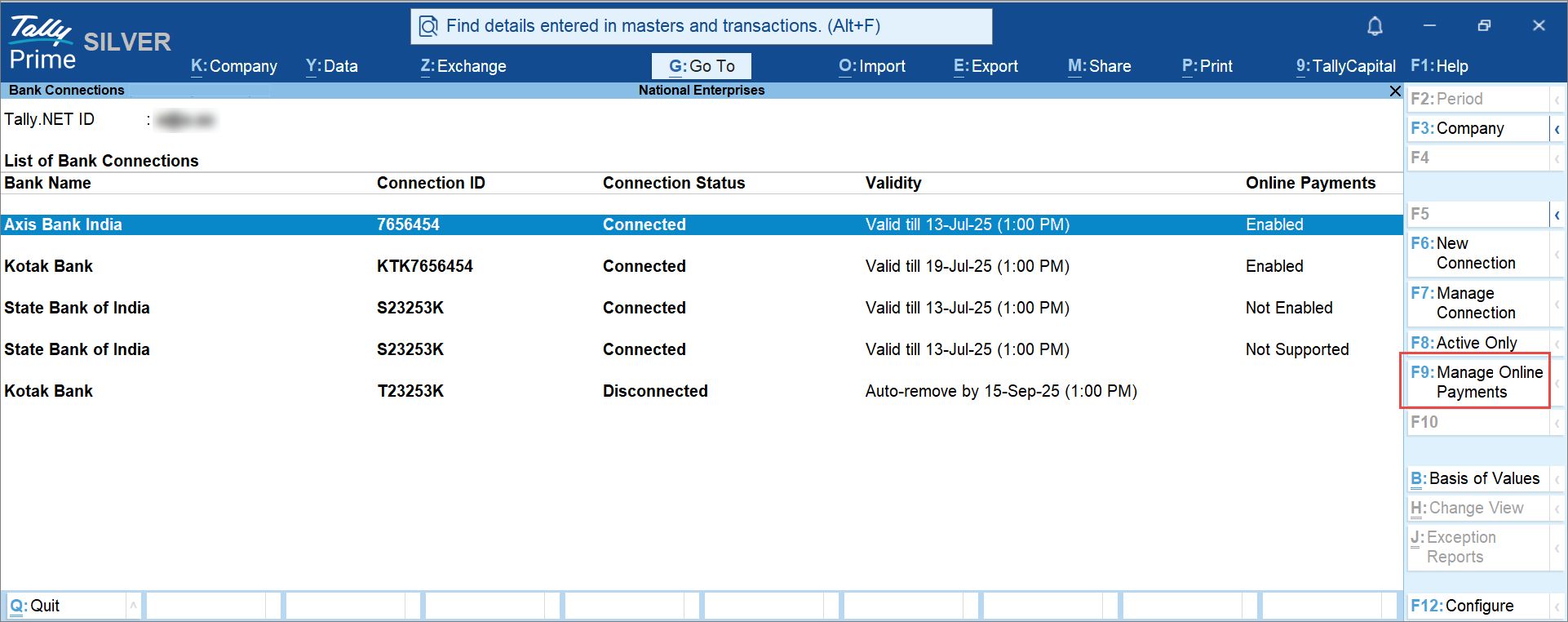

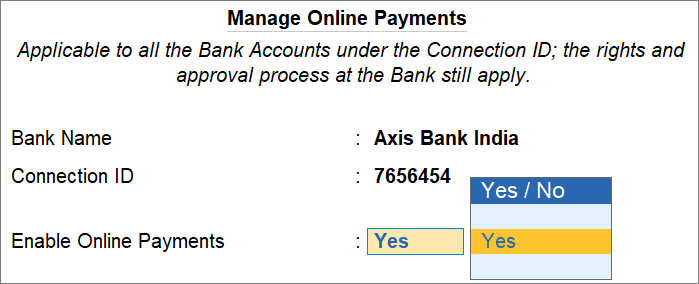

Enable Online Payments for Bank Connection

To start sending payments online using Connected Banking, you need to enable online payments for a specific Bank Connection.

Before you enable online payments, it is important to note the following:

-

Online payments can be enabled only by the user who initiated the Bank Connection.

-

Once you enable online payments:

-

Online payments get enabled for all the bank accounts under the Bank Connection.

-

All the users using the Bank Connection can send payments online using Connected Banking.

- If the e-Payments in the Bank Ledger configurations is not enabled already, then it gets enabled when you enable online payments.

-

-

While you enable online payments in TallyPrime, the restriction, approval process, and regulations by the bank remain unchanged on the bank portal.

-

Press Alt+Z (Exchange) > All Banking Options > Bank Connections, and select the Bank Connection.

-

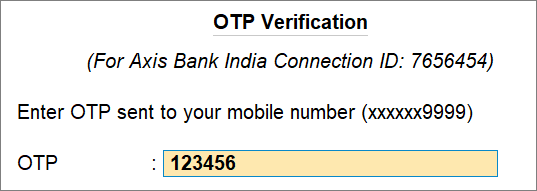

Enter the OTP sent to your mobile number that is linked to your Tally.NET ID.

The online payments get enabled.

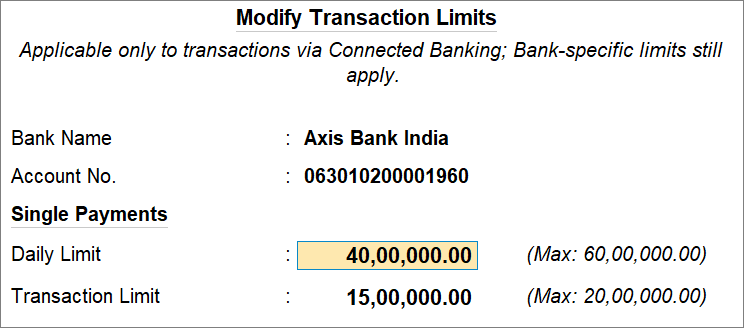

Set Transaction Limits for Online Payments through a Bank Account

By setting the transaction limits for a specific bank account, you ensure that the payment amount does not exceed the limit set by you.

Before you set the transaction limits, it is important to note the following:

-

The transaction limits can be set only by the user who has access to the bank account with online payments enabled.

-

Once you set the limits, they get applicable to all the users who are using the bank account.

-

The transaction limits set in TallyPrime are applicable only to payments initiated using Connected Banking.

The limits, restrictions, and the approval process set by the bank remain unchanged on the bank portal. So, if the bank policy undergoes a change and the bank decreases the limits, then these limits will automatically decrease in TallyPrime to align with the bank policy.

-

In the Bank Connections report, select the bank connection and press Enter or F7 (Manage Connection).

-

Select the bank account using Spacebar and press Alt+L (Manage Limits).

-

Enter the Daily Limit, which applies to all the transactions sent in a day.

-

Enter the Transaction Limit, which applies to a single transaction.

The limits entered by you should be under the maximum limit displayed on the screen.

- Enter the OTP.

The Transaction Limits will get applicable.

Once the limits are modified, you will get a notification on your e-mail address and mobile number.If you have increased the Transaction Limits, then the new limits get applicable after 24 hours. Within that period, if you set the Transaction Limits again, then the previous request will get discarded.

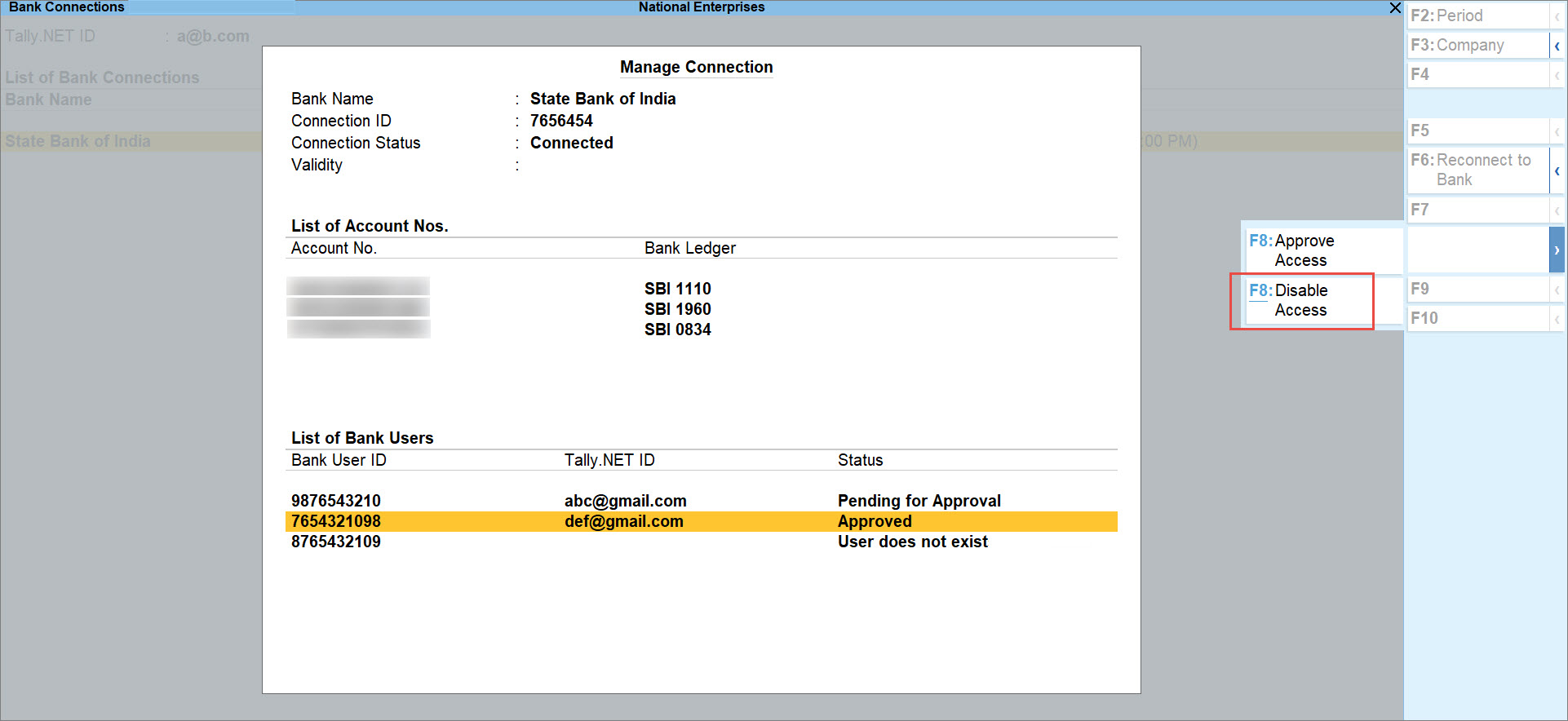

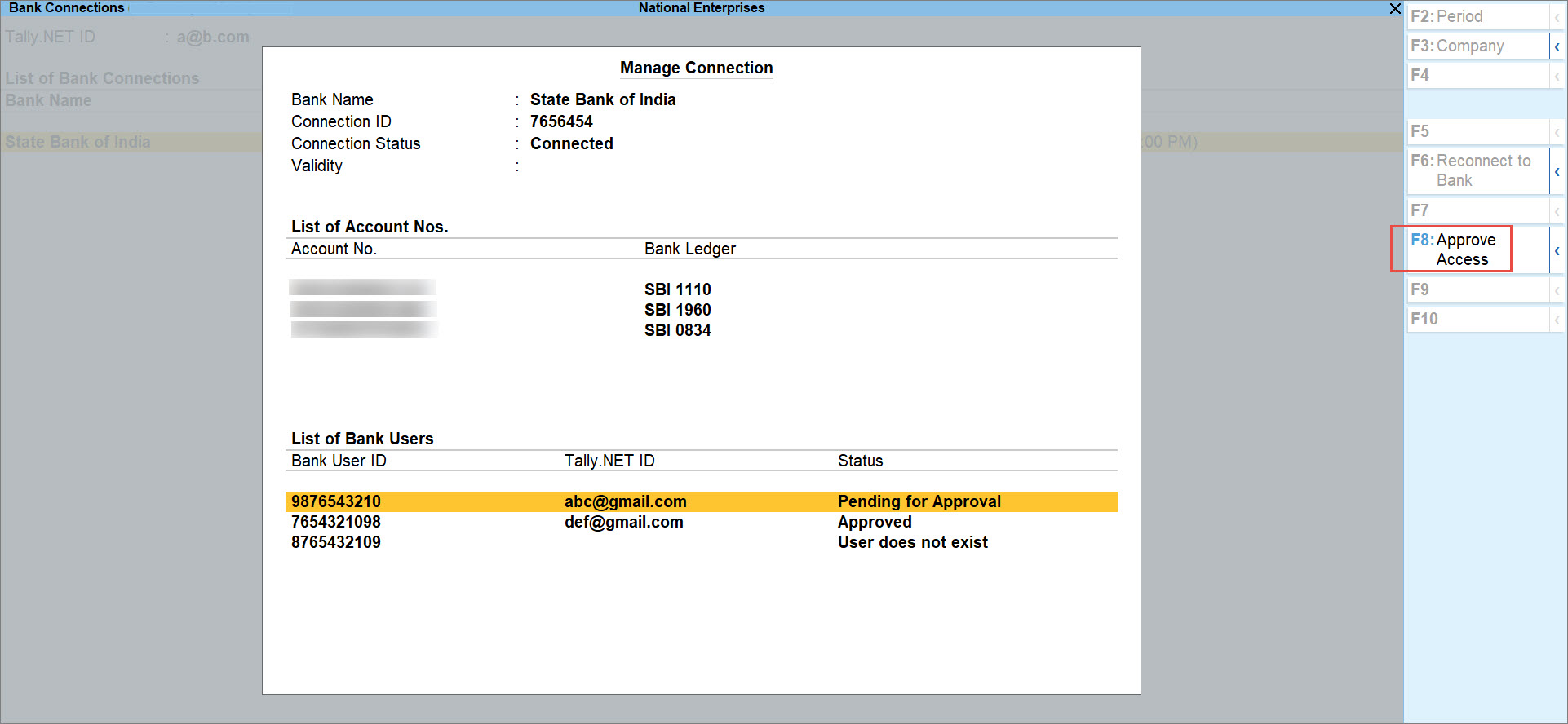

Manage User Access to Bank Accounts

If there are multiple users in a bank and your bank follows the system of approval, then you will see the list of users in the Manage Connection screen. You will need to approve user access to bank accounts.

However, in the list of users, a user might have the status as User does not exist when:

- The user has not linked the mobile number.

- The user does not have a Tally.NET ID.

Approve User

You can approve access for the users for whom approval is pending.

- In the Bank Connections report, press F7 (Manage Connection).

- Select the user, and press F8 (Approve Access).

- Press Y to confirm.

The user will be able to access the Connected Banking services.

Disable User Access

If you want to disable bank access for a few users, then you can easily do so.