GST – Errors & Resolutions

This page list the possible errors and resolutions related to GST-specific scenarios.

Release 6.1 – Related

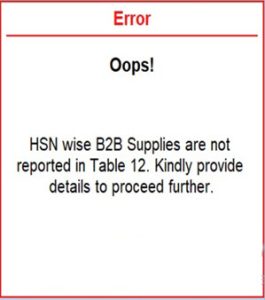

Cause:

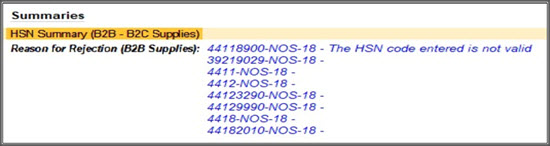

This error occurs during GSTR-1 filing (either via the portal or JSON upload) when the HSN summary for B2B supplies is left blank. As the GSTIN has built mandatory B2B HSN validation, this error is triggered on the GST portal.

Scenario 1: B2B Sales exist, but HSN is not provided

Check your books or portal for any B2B transactions, including NIL-rated or exempted sales, where HSN details are missing or skipped, using Accept as is.

Solution 1:

Update those transactions with the correct HSN details. Regenerate the HSN summary and proceed with filing GSTR-1.

Scenario 2: Only B2C sales exist and no B2B transactions

Solution 2:

If your business has only B2C transactions or interstate supplies to unregistered dealers, and no B2B sales:

-

The portal has mandated an HSN summary for B2B Supplies due to the validation.

-

As a workaround, enter a dummy transaction of (Rs 1/-) as HSN summary as exempted or NIL-rated value in the HSN summary for B2B Supplies to bypass the error.

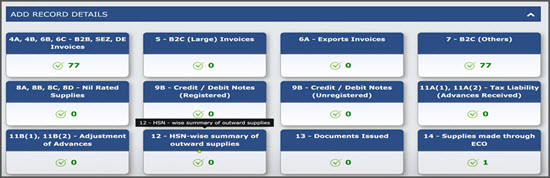

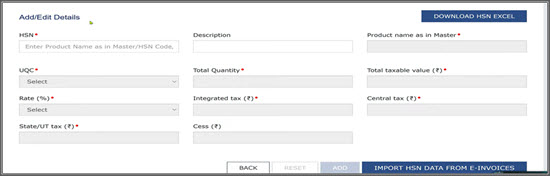

To add dummy HSN data:

-

Log in and open the HSN summary

-

Fill the HSN summary for B2B supplies

-

Click Add, then Save the screen.

-

Proceed to file GSTR-1.

Resolution:

You are recommended to upgrade to the latest TallyPrime release and use the Connected GST feature to identify and correct errors within the product.

To resolve GSTR-1 Filing Errors, check if there is any error related to GSTIN and proceed to make the necessary corrections.

If still errors are shown, continue with the checks below:

-

Go to Document Summary and verify if any voucher numbers contain special characters or spaces. If found, remove them.

-

Validate the party GSTIN using Validate GSTIN/UIN to know whether any party GSTIN has been cancelled, suspended, or inactive. If any such GSTIN is found, move those transactions to the B2C table.

-

Validate the HSN details with the e-Invoice or e-Waybill credential.

If still errors persist, export separate JSON file for each section of GSTR-1. Try uploading each section individually. If any section shows any error, correct the data for that section and try uploading it again.

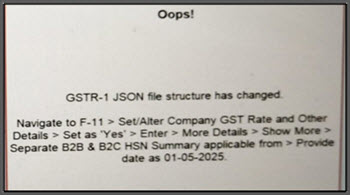

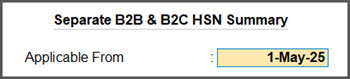

Cause: This error occurs when you try to upload GSTR-1 for May 2025, but the date for the Separate B2B and B2C HSN Summary applicable from is set as 1-5-2025.

Resolution: Set the date for the Separate B2B and B2C HSN Summary applicable from 1-5-2025.

Resolution:

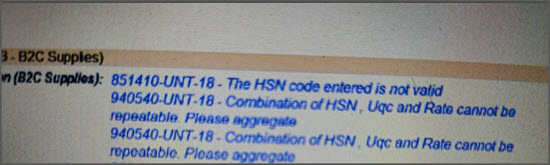

As part of the Phase 2 enhancement, reporting HSN codes in Table 12 of GSTR-1 is now mandatory.

-

Businesses with an Aggregate Annual Turnover (AATO) above ₹5 crore must report 6-digit HSN codes.

-

Businesses with AATO up to ₹5 crore must report 4-digit HSN codes.

Taxpayers with AATO of up to 5 cr – Taxpayers must report 4-digit HSN codes for goods and services. Manual entry is allowed, but a warning will appear. You can still file GSTR-1 after entering HSN manually.

Taxpayers with AATO of more than 5 cr – Taxpayers must report 6-digit HSN codes for goods and services. Manual entry is allowed, but a warning will appear if the HSN is incorrect. GSTR-1 can still be filed after manual entry.

Based on your turnover, make sure all HSN codes in your data have a consistent length before uploading, i.e., either 4, 6, or 8 digits.

If an HSN code is invalid, you can validate HSN using your e-Invoice or e-Way Bill credentials.

Note: Sometimes, in the Books, HSN is 851410, but as per the HSN drop-down in the GST portal, it is 85141000 or 8514. HSN provided in the books should exactly match with drop-down. To know more, refer to the checklist for HSN.

Cause: This error occurs when changes are made after exporting the GSTR-1, such as deleting a voucher, changing the party, modifying the voucher number, and so on.

Resolution:

-

Go to GSTR-1 report > HSN Summary – 12 > GSTR-1 – HSN/SAC Summary.

-

Press Alt+V (Alter Summary) and select Yes to continue with the alteration.

-

Alter the values and press Ctrl+A to save.

-

Press Alt+R (Reset Summary) and select Yes to restore the original values.

The values are now refreshed. You can try filing the GSTR-1 report again.

Cause: This error occurs during export or upload of the GSTR-1 report, when one or more transactions don’t meet GST validation requirements.

Resolution 1: Export or upload the GSTR-1 report without the HSN and Document Summary.

-

In the Upload GST Returns report, disable the HSN and Document Summary.

-

Press Alt+Z (Exchange) > Upload GST Returns > GSTR-1.

-

Press Ctrl+B (Basis of Values) and set Include HSN Summary and Include Document Summary to No.

-

Press Ctrl+A to save.

-

-

Press X (Export) or S (Send Online) to upload the report.

Resolution 2: Export or upload the GSTR-1 report for a shorter period.

-

Press Alt+Z (Exchange) > Upload GST Returns > GSTR-1.

-

Press F2 (Period) to set a shorter period, say 5 days.

Note: When a partial period is selected, HSN and Document Summary will not appear. -

In the Upload GSTR-1 report, select one or more vouchers by using the Space bar and press X (Export) or S (Send Online) to upload the report.

Resolution 3: Export or upload the Nil Summary, B2CS Summary, HSN Summary, and Document Summary individually.

This helps identify the specific Summary with issues, which must be corrected manually.

-

Press Alt+Z (Exchange) > Upload GST Returns > GSTR-1.

-

In the Upload GSTR-1 report, select the Summary and press X (Export) or S (Send Online) to upload the report.

If the error persists, check the date for the Separate B2B and B2C HSN Summary applicable from and set it to 1-5-2025, to exclude the transactions before the applicability date manually.

For example. If GST registration is done on 10th May 2025, then updating the GST applicability date as 1st May’2025 will exclude the transactions from 1st to 9th May 2025.

-

Press F11 (Company Features) > Set/Alter GST Rate details > More Details > Show More.

-

Select Separate B2B and B2C HSN Summary applicable from and update the Applicable From date as 1-May-2025.

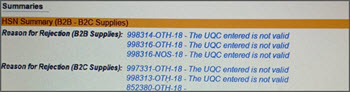

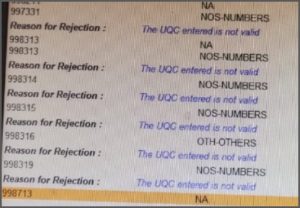

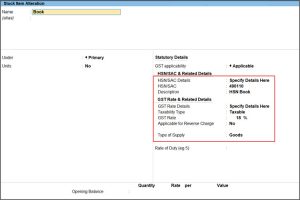

Cause: The Unit Quantity Code (UQC) is invalid.

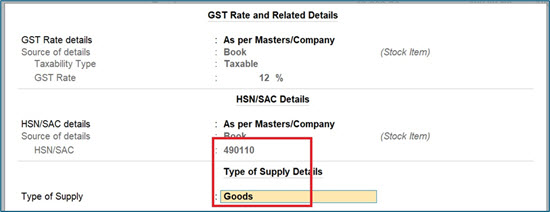

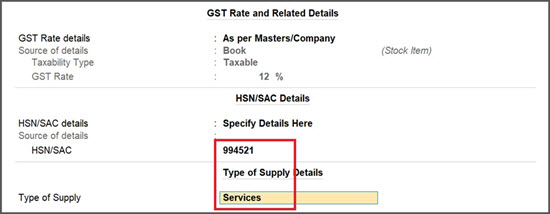

Note: When the HSN code starts with 9, the Type of supply should be Services, and the UQC should be NA. UQC as OTH is not allowed for services. When the HSN code doesn’t start with 9, the Type of supply should be Services, and the UQC should be NA.

Resolution:

-

Open the particular voucher in the alteration mode.

-

In the GST Rate and Related Details screen,

You can also update your HSN/SAC and Type of Supply for your Stock Items, so that the correct Type of Supply will get applied automatically from your next transaction.

Cause: This error occurs when there is a mismatch in the filing frequency periodicity either on the portal or in the books.

Resolution: Ensure that you have set the Periodicity of GSTR-1 to Quarterly and then configure the the Upload GSTR-1 report if you are using TallyPrime Release 5.0 or later versions.

Set the Periodicity of GSTR-1 to Quarterly

-

Press F11 (Company Features) > Enable Goods and Services Tax (GST) > GST Details.

-

Set the Periodicity of GSTR-1 as Quarterly.

-

Press Ctrl+A to save.

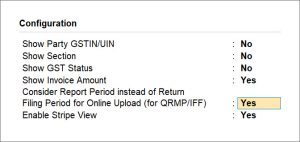

If you are on TallyPrime Release 5.0 or later versions, and wish to upload the report online, configure the Upload GSTR-1 report.

-

Press Alt+Z (Exchange) > Upload GST Returns > GSTR-1.

-

If you are going to upload the report online, press F12 (Configure) and set Consider Report Period instead of Return Filing Period for Online Upload (for QRMP/IFF) to Yes.

If you are on TallyPrime Release 3.0 or later versions, and wish to upload the report offline, you can configure the Upload GSTR-1 report.

-

Press Alt+Z (Exchange) > Upload GST Returns > GSTR-1.

-

If you are going to upload the report offline, in the Upload GSTR-1 report > press X (Export Offline) > F9 (Export Section wise files).

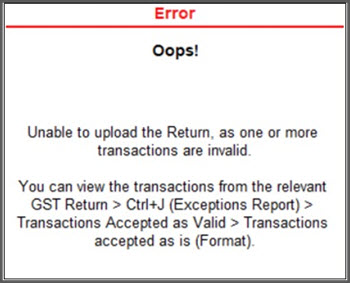

Cause: This error occurs if you have accepted any transaction as valid or as is, despite getting an error.

Resolution:

-

Press Alt+G (Go To) > type or select GSTR-1 > and press Enter.

-

In the GSTR-1 report, press Ctrl+J (Exception Reports) > Transactions Accepted as Valid.

-

Resolve the errors and resave the vouchers under Transactions accepted as is.

-

Upload the GSTR-1 report again.

If the error persists upload the GSTR-1 report for a shorter period.

-

Press Alt+Z (Exchange) > Upload GST Returns > GSTR-1.

-

Press F2 (Period) to set a shorter period, say 5 days.

Note: When a partial period is selected, HSN and Document Summary will not appear. -

In the Upload GSTR-1 report, select one or more vouchers by using the Space bar and press S (Send Online) to upload the report.

Cause: As part of the Phase 3 enhancement, uploading Summary reports is mandatory. This error occurs if any of the Summary reports such as the Nil summary, B2CS summary, HSN Summary, and Document Summary are not uploaded.

Resolution:

Upload the Nil Summary, B2CS Summary, HSN Summary, and Document Summary individually.

-

Press Alt+Z (Exchange) > Upload GST Returns > GSTR-1.

-

In the Upload GSTR-1 report, select the Summary report and press X (Export) or S (Send Online) to upload the report.

This helps identify the specific Summary with issues, which must be corrected manually.

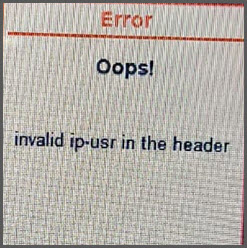

Cause:

This error occurs when the network connection changes during the upload or filing process of GSTR-1 report. For example:

-

You start the process on office Wi-Fi and switch to a mobile hotspot midway, or vice versa.

-

Your Network solution provider changes (e.g., from Airtel to Jio or Vodafone).

Resolution:

-

Press Alt+Z (Exchange) > All GST Options > GST Login & Logout to log out of the session.

-

Reconnect to the desired network and try uploading or filing GSTR-1 report again.

This will establish a fresh, valid session and allow you to continue without issues.

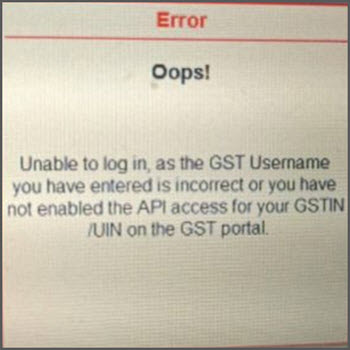

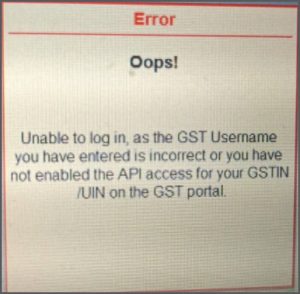

Cause 1: This error occurs when you’re working with multiple GST registrations for a single company in TallyPrime, and the username doesn’t match the GSTIN you’re uploading for.

Resolution 1:

-

Make sure you enter the username exactly as registered on the GST portal for the specific GSTIN. Use the correct username that matches the GSTIN you’re trying to upload.

-

Check for any spelling mistakes in the username.

Cause 2: Your API access not enabled for connected GST from TallyPrime.

Resolution 2: To use connected services in TallyPrime, you can enable the API access on the GST portal.

GST Transactions, Reports, & Returns

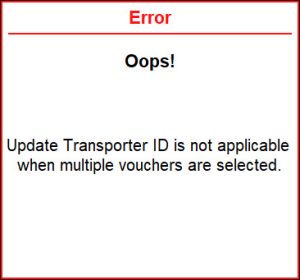

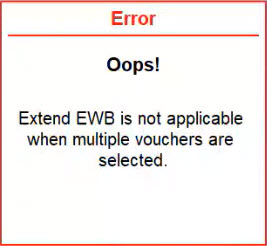

Cause

This error occurs if you have selected multiple transactions in the e-Way Bill – Voucher Register report to update the Transporter ID.

Resolution

- In the e-Way Bill report, drill down to the e-Way Bill – Voucher Register screen.

- Select the required transaction, press F8 (Update Transporter ID).

You can update the Transporter ID details by selecting only one transaction at a time.

- In the Update Transporter ID Details screen, enter the Transporter ID, and press Enter or Y to save.

Cause

This error occurs if you have selected multiple transactions in the e-Way Bill – Voucher Register report to update the Transporter ID.

Resolution

- In the e-Way Bill report, drill down to the e-Way Bill – Voucher Register screen.

- Select the required transaction, press F7 (Update Part B).

You can update the Part B details by selecting only one transaction at a time.

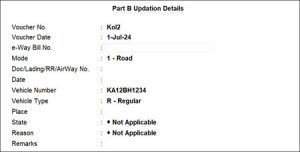

- In the Part B Updation Details screen, enter the required details, and press Enter or Y to save.

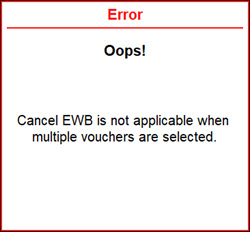

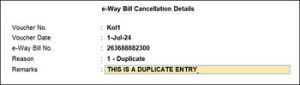

Cause: This error occurs if you have selected multiple transactions in the e-Way Bill – Voucher Register report to cancel the e-Way Bill.

Resolution:

- In the e-Way Bill report, drill down to the e-Way Bill – Voucher Register screen.

- Select the required transaction, press F10 (Cancel EWB).

Note: You can cancel the e-Way Bill by selecting only one transaction at a time. - In the e-Way Bill Cancellation Details screen, enter the required details, and press Enter or Y to save.

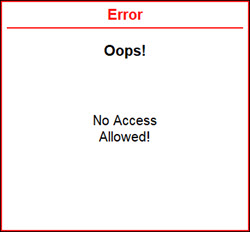

Cause: This error occurs if your user role does not have access to alter vouchers.

Resolution:

If you have admin access:

- Log in with the administrator credentials.

- Press Alt+K (Company) > Change User.

- In the Change User screen, enter the Username and Password of the administrator.

- Set up access to Vouchers.

You can now log in using your user credentials and easily alter/delete your vouchers in the GSTR-1 report.

Cause

This error occurs if your user role does not have access to alter vouchers and will not be able to reset the delete request that’s been set earlier.

Resolution

If you have admin access:

- Log in with the administrator credentials.

- Press Alt+K (Company) > Change User.

- In the Change User screen, enter the Username and Password of the administrator.

- Set up access to Vouchers.

You can now log in using your user credentials and easily alter/delete your vouchers in the GSTR-1 report.

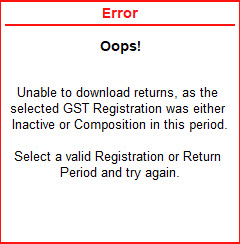

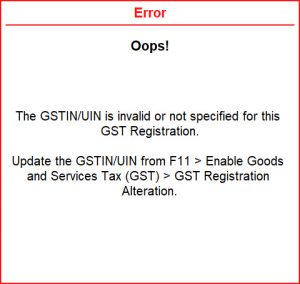

Cause:

This error occurs for one of the following reasons:

- You have invalid GSTIN/UIN for the company and you try downloading the GST returns from Exchange menu.

- You have invalid GSTIN/UIN for one or more GST Registrations and you try downloading the GST returns from Exchange menu.

Resolution:

Mention valid GSTIN/UIN for the company.

- In TallyPrime, press F11 (Company Features) and set Enable Goods and Services Tax (GST) to Yes.

- In the GST Registration Alteration screen, update the valid GSTIN/UIN.

- As always, press Ctrl+A to save.

Now, you will be able to download the GST returns from the Exchange menu.

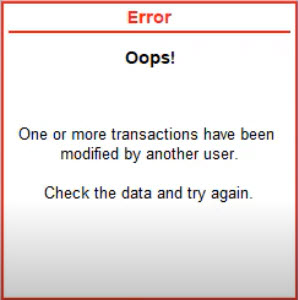

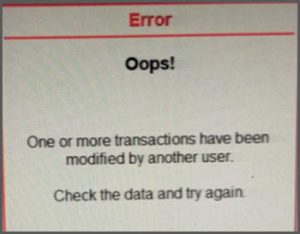

Cause: This error occurs for one of the following reasons:

- When you try to export or file the return and transactions are getting altered by another user, simultaneously.

- When you try to export the GSTR-1 return, and there are changes in the transactions or summary reports, that are modified by another user.

- When you try to upload the GSTR-1 returns and there are changes done by another user in the Upload GSTR-1 report.

- When you try to file the GSTR-1 returns and there are one or more changes done by another user in the Summary reports or other transactions.

- When you try to file the GSTR-3B returns and there are one or more changes done by another user in the Summary reports or other transactions.

Resolution: To resolve this error, you will need to come back to the GSTR-1 or GSTR-3B report and check for the changes reflected in the report. You can check if the refreshed values appearing in the screen are fine or not and take decision accordingly. You can either alter the changes or file the GSTR-1 or GSTR-3B report with the same changes.

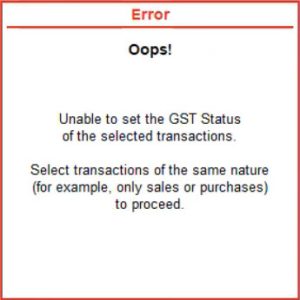

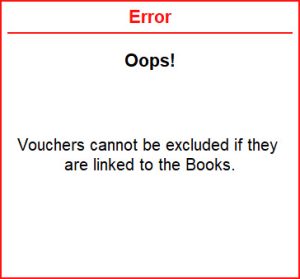

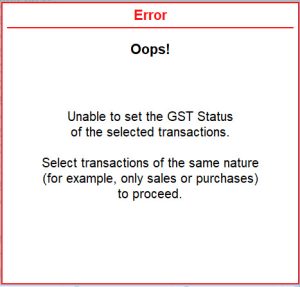

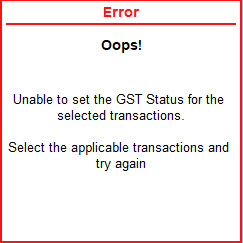

Cause: This error occurs when you select purchase and sales transactions together in the GSTR-3B – Resolution of uncertain Transactions, and press Alt+S (Set GST Status) to set the status of the returns.

Resolution: Select transactions of same nature, for example, either sales or purchase voucher and try to set the GST status again.

Cause: This error appears when you try to set the GST status by selecting both inward and outward transactions in the Ledger Voucher – GST report or Ledger Outstanding – GST report.

Resolution: Select transactions of same nature, for example, either inward transactions or outward transactions and try setting the GST status again.

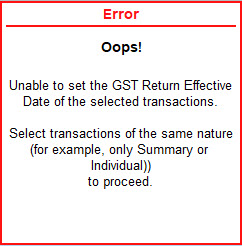

Cause: In the GSTR-1 Uncertain Transactions, there are summary transactions (sales and purchases in bulk) and individual transactions. This error occurs when you select the summary transactions and and individual transactions together, and press Alt+S (Set GST Status) to set the status of the returns.

Resolution: Select transactions of same nature, for example, either summary transactions or individual transactions and try to set the GST status again.

Cause: In the GSTR-1 report, under the Marked for Deletion On Portal bucket, there are summary transactions and individual transactions. This error occurs when you select the summary transactions and and individual transactions together, and press Alt+L (Set Effective Date) to set the GST Return effective date. Refer to the GST Return Effective Date section, to know more.

Resolution: Select transactions of same nature, for example, either summary transactions or individual transactions and try to set the GST Return effective date.

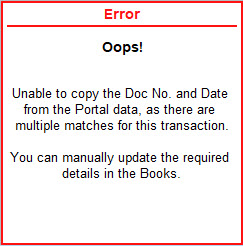

Cause: This error occurs when you try to copy the document no. and date from the Portal data and there are multiple matches available for a single transaction or book entry in the GST portal data. In this case, either the date, voucher number and GSTIN of one of the transactions in the Book matches with multiple other vouchers available in the portal.

Resolution: Update the required details manually in the Books, so that, the transactions available on Books will have only one transaction matching in the portal.

Cause: This error occurs if you try to alter the vouchers in the GSTR Reconciliation report and your user role does not have access to alter vouchers.

Resolution: You need admin access to resolve this error.

If you have admin access:

- Log in with the administrator credentials.

- Press Alt+K (Company) > Change User.

- In the Change User screen, enter the Username and Password of the administrator.

- Set up access to Vouchers.

- As always, press Ctrl+A to save the screen.

You can now log in using your user credentials and easily alter/delete your vouchers in the GSTR Reconciliation report.

Cause: This error occurs when you try to log in to a GST session with an invalid GSTIN/UIN.

Resolution: Update your GSTIN/UIN and try again.

Cause: This error occurs when try to log out of a GST registration session but fail to do so due to some exchange error.

Resolution: You need to wait for the GST registration session to get over and then try resetting your GST login. To reset your GST login, press F1 (Help) > Troubleshooting > Reset GST Login.

Cause: This error occurs when there are multiple GST registration sessions in progress for multiple companies and you try to log out of one or more sessions but fail to do so due to some exchange error.

Resolution: You need to wait for the GST registration sessions to get over and then try resetting your GST login. To reset your GST login, press F1 (Help) > Troubleshooting > Reset GST Login.

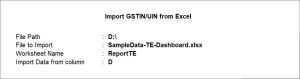

Cause: This error occurs when you press Alt+L (Fetch Details Using GSTIN/UIN) for multiple parties in the Validate Party GSTIN/UIN report and more than one parties have invalid GSTINs/UINs.

Resolution: In the Validate Party GSTIN/UIN report, press F9 (Edit Details) and update the valid GSTIN/UIN for the parties, under the GSTIN/UIN column. After updating, you can press fetch details for the parties using GSTIN/UIN.

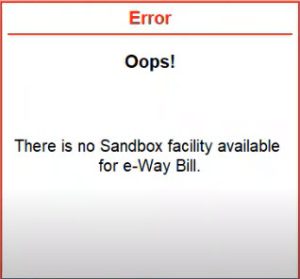

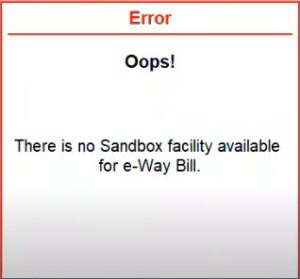

Cause: This error occurs when you have enabled the Sandbox access but during the alteration of a stock item, you don’t have any dummy credentials to validate HSN/SAC info for e-Way Bill. These dummy credentials are only for trial purpose.

Resolution: You need to get the proper credentials to validate HSN if you are registered for e-Way bill as there are no option to demonstrate trails in TallyPrime.

Also, you have to set the Enable Sandbox Access option for the particular Company in TallyPrime to No.

In TallyPrime, press F11 (Company Features) > Ctrl+I (More Details) > under Other Details, set Enable Sandbox Access to No.

After disabling Sandbox, you can enter the correct credentials to validate HSN.

Cause: This error occurs when you press Alt+L (Fetch Details Using GSTIN/UIN) for a single party in the Validate Party GSTIN/UIN report and the party has invalid GSTIN/UIN.

Resolution: In the Validate Party GSTIN/UIN report, press F9 (Edit Details) and update the valid GSTIN/UIN for the parties, under the GSTIN/UIN column. After updating, you can fetch details for the particular party using GSTIN/UIN.

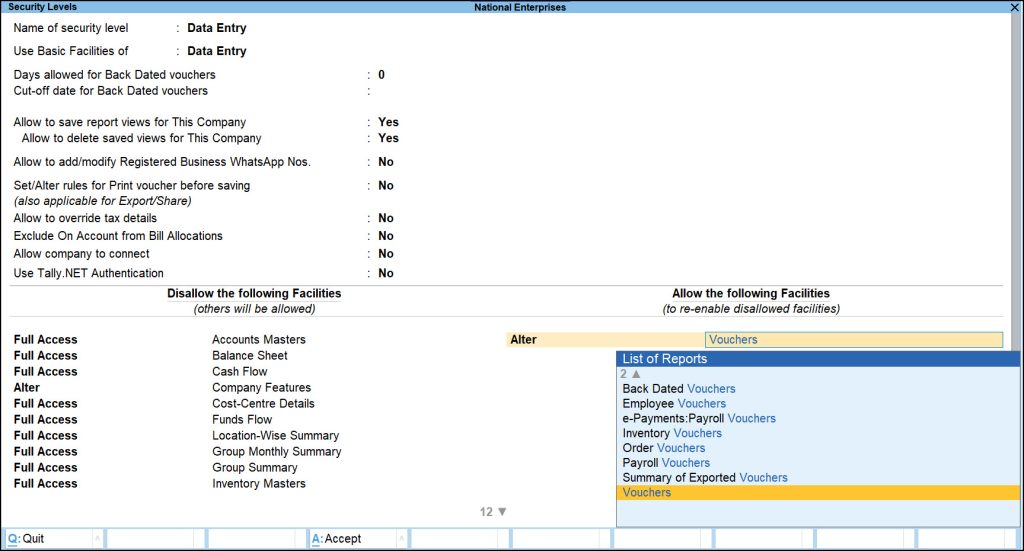

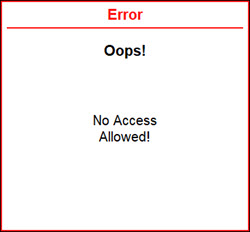

Cause: This error occurs when you try to access the Map UOM to UQC report and your user role does not have access to Inventory Masters.

Resolution: You need admin access to resolve this error.

If you have admin access:

- Log in with the administrator credentials.

- Press Alt+K (Company) > Change User.

- In the Change User screen, enter the Username and Password of the administrator.

- Set up access to Vouchers.

- Press Alt+K (Company) > User Roles.

- In the Security Levels screen, select Data Entry > Enter.

- Provide the required access to Inventory Masters from the Allow the Following Facilities section.

- As always, press Ctrl+A to save the screen.

You can now log in using your user credentials and easily access the Map UOM to UQC report.

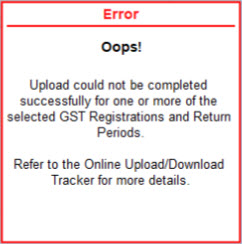

Cause: This error appears when you try to upload one or more GST returns and one of the returns fails to get uploaded

Resolution: To resolve this you need to check the GST registrations that failed to upload through the Online Upload/Download Tracker report. Check the associated return periods and identify the reasons for the failures.

In TallyPrime, press F1 (Help) > Troubleshooting > under Connected Services, select Online Upload/Download Tracker.

After you identify the reasons for failures and resolve them, try uploading the GST returns again.

Cause: This error appears when the data size is more and the returns take more time to get uploaded.

Resolution: To resolve this issue, you can open the GST report (GSTR-1/GSTR-3B/CMP-08) for which the error appears. In the particular report, a message will be displayed confirming that the upload is in progress. After the upload is complete, you can refresh and you will receive the confirmation message from the portal about the same.

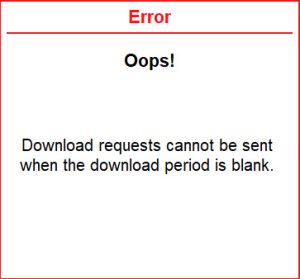

Cause: This error happens when attempting to download GST returns with an empty download period. If the GST returns file was previously downloaded and you try to download the file again without setting a new period, the error will appear.

Resolution: Check for the download period and enter the correct value before downloading the GST returns.

Cause: This error occurs when you try to upload the GSTR-1 returns and the changes done by another user in the Upload GSTR-1 report.

Resolution: To resolve this error, you will need to come back to the GSTR-1 report and check for the changes reflected in the report. You can check if the refreshed values appearing in the screen are fine or not and take decision accordingly. You can either alter the changes or file the GSTR-1 report with the same changes.

e-Way Bill

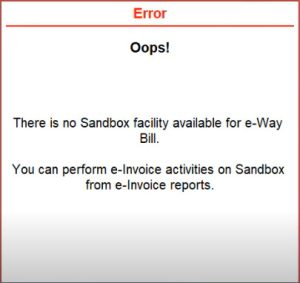

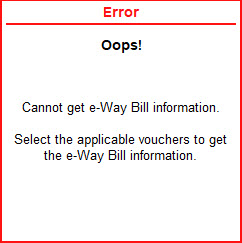

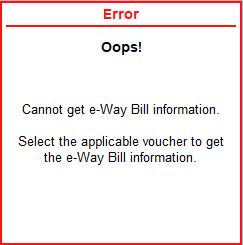

Cause: This error occurs for one of the following reasons:

- When the e-Invoice Sandbox is not enabled and you try to generate the e-Way bill.

- When you try to get the e-Way bill No. and the e-Invoice (Sandbox) is not available.

- When you are in the GST Rate Setup screen, and press Alt+B (Get HSN/SAC Info) for one of the stock items.

- When you attempt to access the e-Way Bill from the e-invoice report using the Sandbox facility for a company that has both the e-Way Bill and e-invoice features enabled.

- When you have enabled the Sandbox access and try to Send for e-Way Bill but you don’t have the dummy credentials supported by the GST department available in the e-Way bill.

Resolution: You need to have the e-Invoice (Sandbox) credentials or the proper credentials for the e-Way bill to generate the e-Way bill, e-Way bill no. and the HSN/SAC Info.

You have to use the valid credentials registered in the GST portal to generate e-Way bill. After you set the Enable Sandbox Access option for the particular Company in TallyPrime to No, you can generate e-Way Bill with valid credentials. e-Way bill portals do not provide you Sandbox facility.

In TallyPrime, press F11 (Company Features) > Ctrl+I (More Details) > under Other Details, set Enable Sandbox Access to No.

However, e-Invoice allows Sandbox facility and you can generate e-Invoices using dummy credentials and explore the feature. After you get comfortable with the feature, you can use valid credentials instead of the dummy data.

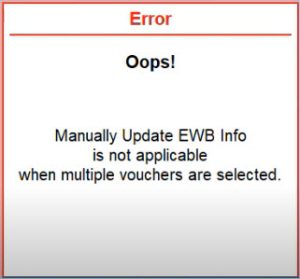

Cause: This error occurs when you are in the e-Way Bill – Voucher Register and select multiple transactions, then press Alt+Q (Manually Update EWB Info).

Resolution: Manually Update EWB Info is not applicable for multiple transactions. Select a single voucher in the e-Way Bill – Voucher Register and then press Alt+Q (Manually Update EWB Info).

GSTN Portal

Cause:

This error occurs when you attempt to upload the quarterly GSTR-3B report. TallyPrime currently supports uploading monthly GSTR-3B report. Therefore, when you upload the quarterly report, this error is displayed for the GSTR-3B report for the 1st and 2nd month.

Resolution:

Since TallyPrime doesn’t support the uploading of the quarterly GSTR-3B report, you can open the GSTR-3B report for the 3 months of the quarter and manually update the values on GST portal.

Once, TallyPrime starts supporting PMT-08, it will also support the quarterly return filing of the GSTR-3B report.

PMT-08 defines a situation where the taxpayer opting for quarterly return filing is required to make the monthly payments based on the supplies made during the month. The tax paid in the first two months of the quarter will be credited and adjusted while filing the quarterly return in the GSTR-3B report.

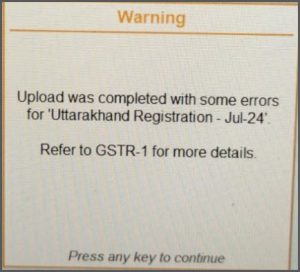

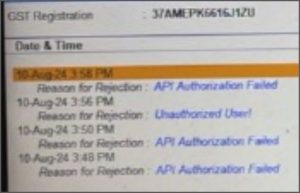

Cause: This error occurs if some of the vouchers/summaries were rejected by GSTN portal during the upload.

Resolution:

- From the GSTR-1 report, drill down from Rejected by GST portal (to be reuploaded) section.

Drill down, even if count for the bucket is zero.

- Resolve the errors, if there are any.

The following errors might appear:

Inactive GSTIN – Along with the effective date, change the Master Registration type as Unregistered (without removing GSTIN) and also update voucher supplementary as Unregistered.

HSN summary – If the HSN starts with ’99’, then Type of Supply should be Service. If the HSN does not start with ’99’, then Type of Supply should be Goods. If your Type of Supply is Service, TallyPrime considers UQC as NA. Drill down from the HSN summary and rectify the Type of Supply to match with HSN/SAC code. Also, rectify the Type of Supply in the item or ledger master, so that the transactions of subsequent return periods are accurate.

Document summary – Check if the invoice number has any space/special characters. The invoice number can only contain ‘-‘ and ‘/’.

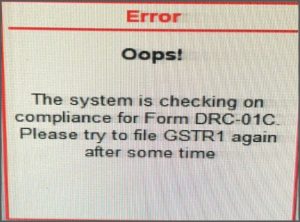

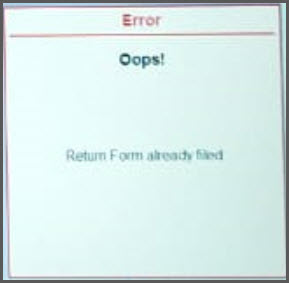

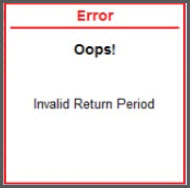

Cause: This error occurs when the return is already filed, either from TallyPrime or directly on portal, and you are trying to file the return again.

Resolution:

Check the Return period for which you are trying to file the GSTR-1 report. If it is for an older period, then it has been already filed. Change the Return period to current period, for which you need to file the return. If you are already filing for the current period and this error appears, then return is already filed.

Cause: This error occurs when the Username is not matching with the GSTIN or your API access not enabled for connected GST from TallyPrime.

Resolution:

To use connected services in TallyPrime, API access needs to be enabled on the GST portal.

In case of multi-registrations for a single Company in TallyPrime, the username should match with the GSTIN which you are trying to upload and username should be same as that of the GST portal. Also check for the spelling mistakes in the username.

Cause: If you are getting this error in a multi-user environment, then probably another user has modified a voucher that you are trying to upload/file.

If you are not in a multi-user environment and you are getting this error despite any changes being made in another instance, there could be issues with either HSN summary or Document summary.

Resolution: If you are getting this error in a multi-user environment, you can press escape, and after refreshing the reports, you can continue with the activity.

If you are not in a multi-user environment and you are getting this error, then you can disable the HSN summary and Document summary through Basis of Value during the upload.

To upload your GST returns, follow these steps:

- In the upload GSTR-1 report, select all except the B2CS and Nil summary.

- Upload all individual vouchers.

- Then select and upload the Nil summary, B2CS summary, HSN summary, Document summary, and so on.

If one of these summaries fails during the upload, it might be due to one of the following possible reasons:

- In the HSN summary, you might have created your own UQC and selected Accept as is.

- Some of your voucher numbers might have special characters/space and you have selected Accept as is for them.

- You have created a different name for state or imported it from other software which has the name of state different from TallyPrime, either in terms of spelling or use of special characters, such as ‘&’.

If you are unable to rectify, you are recommended to add such summary reports manually on the portal.

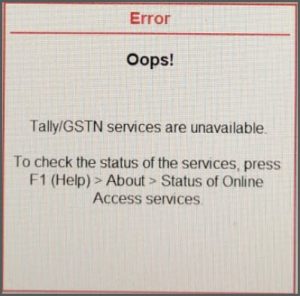

Cause: This error appears when either TallyPrime or GSTN services are down.

Resolution: Refer to the Tally Services Status page. Once the servers are up and running and the services are displayed as available, try again.

Cause: This error occurs when the periodicity of GSTR-1 doesn’t match while uploading the report.

Resolution: In case of Invoice Furnishing Facility (IFF), the Periodicity (monthly/quarterly) defined in F11 (Company Feature) in TallyPrime should match with the portal. Select the Periodicity of GSTR1 as Monthly or Quarterly, based on the annual turnover of your business and set the same in the GST portal as well. To know more about periodicity and other filing details, refer to our blog.

Cause: This error occurs due to uncertainty in HSN summary.

Resolution:

If the HSN starts with ’99’, then Type of Supply should be Service. If the HSN does not start with ’99’, then Type of Supply should be Goods. If your Type of Supply is Service, TallyPrime considers UQC as NA. Drill down from the HSN summary and verify the voucher for Type of Supply.

For current month, rectify the vouchers, if required.

For current return period, where the vouchers are already passed, each voucher has to be corrected one by one. For subsequent return periods, in one time master correction, wherever the HSN doesn’t start with ’99’, the Type of Supply should be Goods. Wherever the HSN doesn’t start with ’99’, the Type of Supply should be Services.

Currently in case of e-invoice, if there is any uncertainty for HSN summary and mismatch in Type of Supply, they can be resolved using the uncertain resolution experience. For GST reports, correction has to be done manually by drilling down from the HSN Summary to each voucher that has an error.

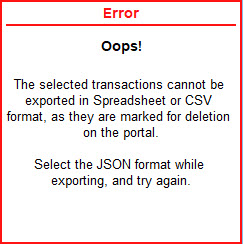

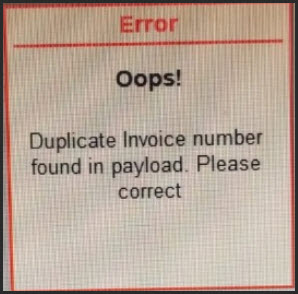

Cause: This error occurs when there are vouchers with delete requests and regular vouchers with same voucher number.

Resolution: In the GST report, you can select the vouchers under Marked for Deletion on Portal and press Alt+Q (Reset Delete Request) to remove them. The transaction no longer appears under Marked for Deletion on Portal in the GST report. After doing so, upload the regular vouchers.

Cause: This error occurs if authorized signatory is not defined or details of E-mail/Phone number is not updated on the GST portal.

Resolution: You can update your authorized signatory, E-mail/Phone number on the GST portal.

- Log in to GST portal.

- Navigate to Services > Registration > Amendment of Registration Non-Core Fields.

Various tabs for editing data will be displayed on the screen. - Click the Authorised Signatory tab. Update your authorized signatory.

If details are already added but you are still getting the error, the the PAN provided during filing is not matching with the PAN declared for authorized signatory on GST portal for the given GSTIN.

This is PAN of authorized signatory and not of the company. In case of multi-registration, ensure that the PAN provided matches with the PAN of authorized signatory declared for that GSTIN on the GST portal.

Cause: The error occurs when the network used for connected services is changed in between the upload/filing process. For example, if you had Logged in with office WiFi and you change to mobile hotspot for upload or vice-versa. This error will also appear if your Network service provider changes from Airtel to Jio/Vodafone to others.

Resolution: Log out from the session using Exchange Menu and continue with the uploading/filing again with new OTP.

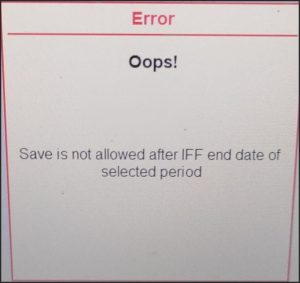

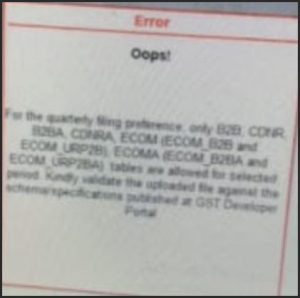

Cause: In case of IFF, if you are uploading vouchers of sections other than B2B/CDNR /B2BA/CDNRA in first or second month of the quarter, this error is encountered.

Resolution: In Upload GSTR-1 report, enable Show section and consider Report Period instead of Filing Period for online upload (for QRMP/IFF) configurations.

In the Upload GSTR-1 report:

- Select the period.

- Select only vouchers belonging sections of B2B/CDNR/B2BA/CDNRA.

- In case of IFF upload in first and second month, select only B2B and CDNR vouchers.

- Upload the report.

Note: Do not select vouchers of other sections.

If the error still persists, then you need to check the Exceptions Report.

- In TallyPrime, open GSTR-1 report.

- Press Ctrl+J (Exception Reports).

- Under List of Exception Reports, select Transactions accepted as valid and press Enter.

- Select Transactions accepted as is (Format) and drill down to view the transactions.

- Update the GSTIN and HSN, wherever the resolution required.

- Press Ctrl+A to save.

After this, you can try oploading the GSTR-1 report again.

Cause: This error occurs when certain fields such as UQC, Voucher number, state name and so on, were set as Accept as is and TallyPrime detects the uncertainty during the upload.

Resolution: If you are getting this error in a multi-user environment, you can press escape, and after refreshing the reports, you can continue with the activity.

If you are not in a multi-user environment and you are getting this error, then you can disable the HSN summary and Document summary through Basis of Value during the upload.

To upload your GST returns, follow these steps:

- In the upload GSTR-1 report, select all except the B2CS and Nil summary.

- Upload all individual vouchers.

- Then select and upload the Nil summary, B2CS summary, HSN summary, Document summary, and so on.

If one of these summaries fails during the upload, it might be due to one of the following possible reasons:

- In the HSN summary, you might have created your own UQC and selected Accept as is.

- Some of your voucher numbers might have special characters/space and you have selected Accept as is for them.

- You have created a different name for state or imported it from other software which has the name of state different from TallyPrime, either in terms of spelling or use of special characters, such as ‘&’.

If you are unable to rectify, you are recommended to add such summary reports manually on the portal.

Cause: This error can occur due to multiple reasons, such as GSTN servers being down or any change in the users setup, such as firewall addition.

Resolution: You can check if you have recently updated any infrastructure changes on your system such as firewall addition, addition of any security validations to your network settings, and so on.

To overcome this, whitelist these IP addresses, URLs, and hostnames by adding them to Windows Proxy or Firewall Exceptions list. To know more refer to Add IP Addresses, URLs, and Hostnames to Windows Proxy or Firewall Exceptions List. If there is no network change, you can refer to status.tallysolutions.com and check if the GST services are down.

If the issue still persists, you can opt for a workaround by directly performing the operation on the GST portal temporarily. If the issue still continues, you can reach out to TallyCare.

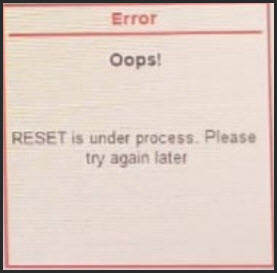

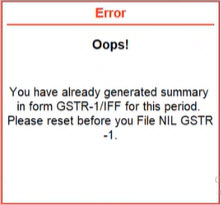

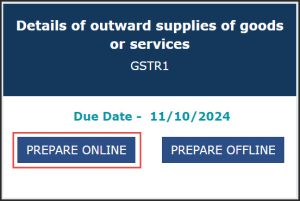

Cause: This error occurs when you have already initiated the Nil return filing process on the portal, but attempt to file the Nil return again from TallyPrime without completing the initial process.

Resolution:

You have to go the GST portal and reset the GSTR-1 filing.

- Log in to the GST portal.

- Select Services > Returns > Returns Dashboard.

- In the File Returns screen, select Period for which you are going to reset the GSTR-1 filing and click Search.

- Under Details of outward supplies of goods and services, select PREPARE ONLINE.

- The GSTR-1/IFF page appears, where you can click RESET at the bottom of the page.

Your GSTR-1 filing will be reset. Now you can file the Nil return from TallyPrime.

Cause:

This error occurs when you try to download the GSTR-3B Quarterly report for the 1st and 2nd month of quarter because GSTR-3B Quarterly report is not supported in TallyPrime.

Resolution:

GSTR-3B Quarterly return is not supported in TallyPrime. If you want to file GSTR-3B Quarterly return, during the download, provide Period as last month of the quarter to prevent errors.

For filing GSTR-3B quarterly return, refer GSTR-3B report in TallyPrime for the quarter and manually update the consolidated values on the portal.