Filing GSTR-1 Returns: Errors & Resolutions

This topic will take you through some of the issues that might occur while preparing your returns using the GST Offline Tool or while filing your returns on the GST portal.

The following is a list of errors that may occur with respect to filing GSTR-1 and the corresponding resolutions/workarounds.

Download the Latest Offline Utility and File Returns on the GST Portal

This error may appear while uploading the JSON file to the GST portal. Below are the possible solutions.

- Copy the data as a backup.

- Download and install the latest release of TallyPrime.

- Open the company data in TallyPrime.

- Ensure all Incomplete/Mismatch in information in GSTR-1 are resolved, and all masters GSTIN including HSN details are validated.

- In case, e-Invoice is applicable to your business, you need to open the GSTR-1 report in CSV format, and upload the files created for sections other than B2B, and exports. For more information, refer to the Use the GST Offline Tool.

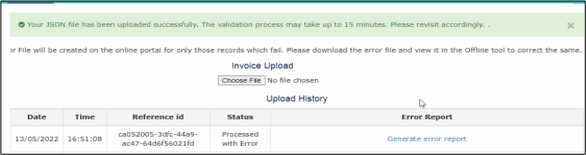

If the error appears again, and the Status is Processed with Error, then error report is generated in the GST portal.

To know the cause, under the Error Report column click Generate error report.

- Download the error report from the GST portal.

- On GST portal > Downloads > Offline Tools > Returns Offline Tool.

- Click Download to download the error report.

-

Open the downloaded error report file. Refer to the Use the GST Offline Tool.

The errors are listed for transactions. While filing GSTR-1, the common errors and solutions are mentioned on the table below:Error Cause & Solution Invalid UQC Cause: UQC for HSN is blank or not valid or created New UQC where GSTIN accepts values only from the recommended list. Solution:

- Gateway of Tally> Alter > Unit.

- Press Enter to select the Unit Quantity Code (UQC) from the list of Units.

- On Unit Quantity Code (UQC) field, select the UQC from List of UQCs.

The list is published as per the GSTIN updates. If a new UQC is selected from the list, press Ctrl+A to save and try to upload on GSTR-1.

Inactive GSTIN Cause: According to GST norms, if your GST Registration is cancelled, your GSTIN is no longer valid. Solution: Make a note of the inactive GSTINs and follow the steps below to convert those transactions (where inactive GSTIN was used) from B2B to B2C sales.

- Press Alt+G > search GSTR-1.

- Press Enter on B2B Invoices 4A, 4B, 4C, 6B, 6C.

- Select the inactive GSTIN and change the nature of transactions as Sales to Consumer – Taxable.

Note: In case you need to move multiple transactions to B2C, then alter the party master’s Registration Type as Consumer and remove the GSTIN to avoid the same error for upcoming Transactions billed for the customer.

State code is not available.

or,

The place of supply and state code of the supplier should be different for Inter State Supply.Cause:

- New state created by the users instead of selecting state from List of States

- Data is imported from other software

- Due to spelling errors while creating a new state

- Letters of the state is created with upper case

- The state code starting and Place of supply are different

Solution:

- TallyPrime has listed all the states and their state code as per the GSTN Master sheet. Recommend selecting the state from List of states, so that the respective state code can be assigned accordingly while exporting returns.

- In case the place of supply is modified during voucher entry, ensure the place of supply is the same as the supplier state when IGST is collected, or the place of supply code is the same as the supplier state when CGST / SGST is collected. For example, when the place of supply is Karnataka, GSTIN / State Code should be always starting with 29.

HSN does not belong to the service/Goods

or,

Invalid HSN/SACCause: Type of supply is wrongly configured in inventory or accounting Master. Solution:

In case of Services, HSN/SAC should begin with the number 99, which identifies the code as a SAC and not an HSN. Click here to know the correct HSN details. Make a Note of HSN/ SAC for reference.

- Gateway of Tally > Alter > select the Ledger, and press Enter.

- Under Statutory Details, ensure the Type of Supply is selected as Goods, and HSN/SAC starting with other than 99, and if the Type of Supply is Services, the HSN/SAC is starting from 99. In case of incorrect HSN code, validate the details from HSN code and enter the appropriate HSN/ SAC.

Voucher number not maintained for invoices.

or,

Invoice number does not exist.Cause: An invoice number is must for any GST transactions not exceeding 16 characters, containing alphanumeric with/without special characters including “-“or “/” for any financial year. Generally, this is found in Journal or Receipt vouchers wherein GST is levied and doesn’t have voucher number series. Solution:

- Check the voucher type and ensure that all Invoices with GST have Invoice Numbering set.

- In GSTR-1, select Document Summary and check the serial number for any voucher type. If it is blank, provide the voucher number in the relevant vouchers and try to upload with a new JSON.

IGST is mandatory for interstate supply and CGST & SGST should not be present. Cause:

- The nature of transactions is overridden.

- The place of supply is changed during the entry.

- In case the transaction supplies covered under section 7 of IGST Act, SGST and CGST, and IGST are counted as wrong for the interstate supply. Wherein IGST to be charged although supplier and buyer in the same state in case of courier services.

Solution: Follow the steps below to resolve the error:

- Make a note of the invoice number displayed in error report.

- Check the place of supply and the State of the Buyer to whom goods are billed.

- Select the appropriate nature of transaction if the nature of transaction is overridden.

- In the Statutory Details screen, set the option Supplies under section 7 of IGST Act to Yes. For more information, click here.

Date is invalid, the invoice date cannot be before the registration date. Cause: The invoice date is earlier than the date buyer obtained for GST registration or GSTIN. Solution: Before the date of GST registration, all such transactions should be B2C sales. After confirming the date from the customer, or check the effective date of registration from Goods & Services Tax (GST) | Services, create a new party with GSTIN Number and then start issuing GST invoice. Please enter some value in IGST tax amount field / Export Sales Transactions. Cause: Sales invoice for a foreign party with a Nil Rated item, wherein by default the nature of the transaction will Export Nil Rated, and GST Payment type should capture as WOPAY instead of picking WPAY. Solution:

- From the error report, note the transaction.

- Open JSON file through Notepad and search for exp_typ:WPAY.

- Update WPAY to WOPAY.

- Save the file and re-upload the JSON file.

Error in JSON structure validation. Cause: The GSTN portal cannot recognize the uploaded JSON file, or there are structural errors in the uploaded JSON file. Solution: Follow the steps below to resolve the error:

- Ensure that the GSTIN is specified on the JSON file. If the same is blank or not available,

- Gateway of Tally > press F11 > set Enable Goods and Services Tax (GST) as Yes.

- Check whether the Company GSTIN is provided, if not provide the same and re-export the JSON file.

- Secondly, ensure that the uploaded JSON file is the latest and has been exported from the latest TallyPrime Release.

Errors encountered while uploading the file. Cause: Due to multiple users accessing the GSTN portal to upload the file. Solution: Try to upload the JSON file after some time or login to the GST portal from another browser and retry.

Workaround: If you have more than 500 invoices in a particular table (for example, B2B), you have to:

- Download the invoice data from the portal.

- View it in the GST Offline Tool and make the required modifications.

- Generate a fresh JSON from the GST Offline Tool.

- Re-upload your data to the GST portal.

In the Prepare Online section, the invoice count does not get refreshed after I add the invoice details. - Click the Generate Summary button that appears at the bottom of the GSTR-1 online form, to refresh the invoice count and values.

You can use Chrome to open the offline utility tool. Download Chrome and make it your default browser.

This error may appear while uploading the JSON file to the GST portal.

The possible causes and resolutions to resolve the error are listed below.

Before you start the process, it is recommended that you:

- Take a backup of your Company data.

- Download and install the latest release of TallyPrime.

Checklist – 1

Ensure that all the incomplete/mismatched information in the GSTR-1 report is resolved. To know more about how to resolve the transactions with any uncertainties or mismatched information, refer to the Rel 3.0 – GSTR-1/GSTR-3B Exceptions & Resolutions topic.

Checklist – 2

Ensure that all the required details have been mentioned in the HSN Summary so that the HSN summary can be uploaded along with the GSTR-1 report.

- Open the GSTR-1 report > select HSN/SAC Summary.

- Ensure that a 6-digit HSN/SAC code has been mentioned for all the stock item/ledger master if the turnover is greater than 5 Crores.

If HSN/SAC code is not provided for stock item/ledger master and the exception has been accepted as is, then exclude the HSN Summary export along with the GSTR-1 report.- To check whether the HSN exception has been accepted as is:

- Open the GSTR-1 report.

- Select Ctrl+J (Exception Reports) > Transactions Accepted as Valid.

- Select Transaction accepted as is (format).

The GSTR-1 – Transactions Accepted as Valid screen appears, as shown below:

- While exporting the GSTR-1 return, ensure that the HSN summary is excluded.

To exclude the HSN summary:- Open GSTR-1 report > Export > GSTR Returns.

- Press Ctrl+B (Basis of value) > set Include HSN Summary to No.

- To check whether the HSN exception has been accepted as is:

- If the HSN Summary for any master has negative values, then exclude it while generating the GSTR-1 report and uploading it on the portal manually. Follow the above-mentioned process to exclude the HSN Summary.

- Ensure that the HSN number has an even number of digits (2, 4, 6, or 8) and as per the business turnover, so that a valid HSN has been uploaded.

- Ensure the Unit Quantity Code (UQC) is mapped for all HSNs.

Checklist – 3

- Ensure your Document Summary has valid information.

- Ensure that it displays the count of the voucher type used for each nature of documents recorded during the return period along with the voucher number, From & To.

- In the case of manual voucher numbering, wherein you might have numbered as per your need and not in sequence, exclude the the document summary and upload it manually on the portal.

Checklist – 4

- Ensure to validate the GSTIN for the particular return period.

- Validate the GSTIN of the buyer before generating the GSTR-1 report to ensure their GSTIN is not inactive or cancelled, as their transaction needs to be moved to B2C. You can use an online GSTIN validation facility, an e-Way bill or e-Invoice credential to validate the data. To know more, refer to the Validate GSTIN/UIN and HSN/SAC Online in TallyPrime topic.

- Make a note of the inactive GSTINs and follow the steps below to convert those transactions (where inactive GSTIN was used) from B2B to B2C sales.

- Press Alt+G (Go To) > GSTR-1 report.

- In the GSTR-1 report select B2B Invoices 4A, 4B, 4C, 6B, 6C and press Enter.

- Select the inactive GSTIN and change the nature of transactions to Sales to Consumer – Taxable.

Note: In case you need to move multiple transactions to B2C, then alter the party master’s Registration Type as Consumer and remove the GSTIN with the effective date.

After validating all these checklists, you can file your GSTR-1 report smoothly.

B2B section of GSTR-1 exported from TallyPrime in Excel or CSV format is not getting imported because of the changes made in the GST offline tool Version 3.1.3.

For details, refer to the section Use the GST Offline Tool in the topic File GSTR-1.

B2B section of GSTR-1 is not getting imported because of the changes made in the GST offline tool Version 3.1.3.

For details, refer to the section Use the GST Offline Tool in the topic File GSTR-1.

There is no provision to upload the invoices for the following sections from the Excel template to the GST Offline Tool:

- Exempt sheet – Nil Rated, Exempt, Non-GST columns

- Docs sheet – Documents issued column

Workaround: You have to manually enter the details for these columns directly on the GST portal by referring to the table-wise format of GSTR-1.

This issue may occur when multiple UQCs are being used for a single HSN, and HSN Code – HSN Description combination is not unique for each UQC for a given HSN code.

Workaround: If you have used multiple UQCs for a single HSN, you have to modify the descriptions and keep the HSN Code – HSN Description combination unique for each UQC for a given HSN code. You can do this by importing the Excel sheet or CSV file in the offline tool.

Cause: This error occurs when invoice numbers are already available in GSTR-1, or when there is a mismatch in tax details.

Solution: Download the error report from the GST portal.

In the GST Offline Tool:

- Go to the section Open Downloaded Error File from GST Portal and click Open.

- Enter the path on your computer where the error report is present.

- Note down the GSTINs and the associated invoice numbers.

On the GST portal (www.gst.gov.in):

Go to Login > Return Dashboard.

- Select the period.

- Go to Prepare Online.

- Click the relevant section (B2B or CDNR).

- Select the relevant GSTIN and Invoice Number (Uploaded by Supplier/Uploaded by Tax Payer), and take the required action.

We have noted this query and reported the same to the GSTN team for a possible resolution.

We have noted this query and reported the same to the GSTN team for a possible resolution.

The e-commerce transactions are not accepted as B2B transactions in the portal. You need to record the sales transactions by selecting Sales to consumer as the nature of transaction, to view it under B2C.

We have noted this issue and reported the same to the GSTN team for a possible resolution.

Workaround: You have to manually enter the negative quantities in the HSN Summary on the portal.