GSTR-1 upload is now a walk in the park for you and your business. You can upload your returns on the GST portal right here from TallyPrime, without the need for any manual activity.

Based on your business needs, you have the flexibility to upload one or all of your transactions and summaries for the required return period. Further, if there are any rejections from the portal, then you can resolve such transactions in an easier and faster manner. There is no need to manually download the rejected transactions from the portal and export them in TallyPrime.

In this way, the Upload feature will save a lot of your time and effort, which you can utilise for the growth and expansion of your business. You will always have the utmost clarity about the status of your transactions, right here in TallyPrime.

Before uploading your GSTR-1, ensure that you have enabled API access on the GST portal.

Upload GSTR-1

Once you have enabled API requests, you can proceed to upload your GSTR-1.

Ensure that you have resolved all exceptions and conflicts for a seamless upload experience.

- Press Alt+G (Go To) > GSTR-1.

- In the GSTR-1 report, select the return period and GST registration for which you want to upload your vouchers.

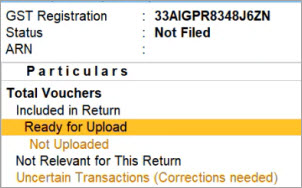

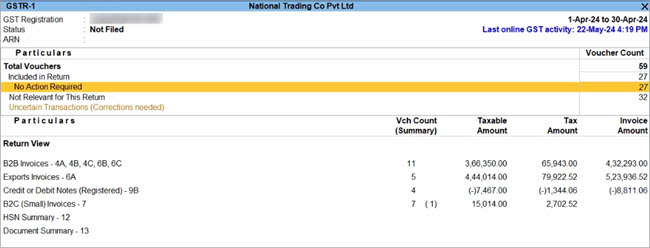

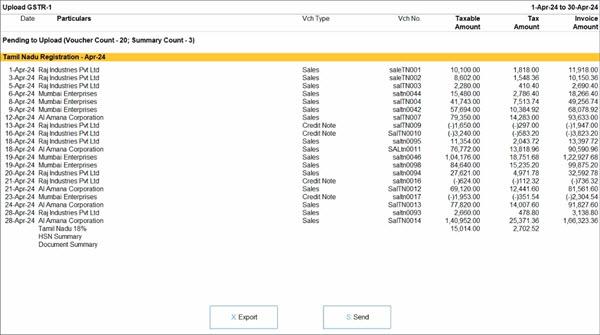

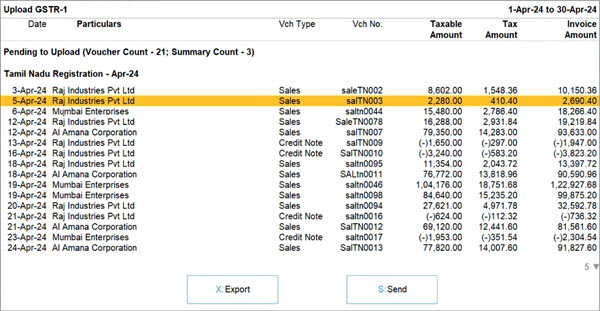

In the Ready for Upload section, you can see the transactions that are pending for upload to the GST portal.

- Press Alt+Z (Exchange) > Upload GST Returns > GSTR-1.

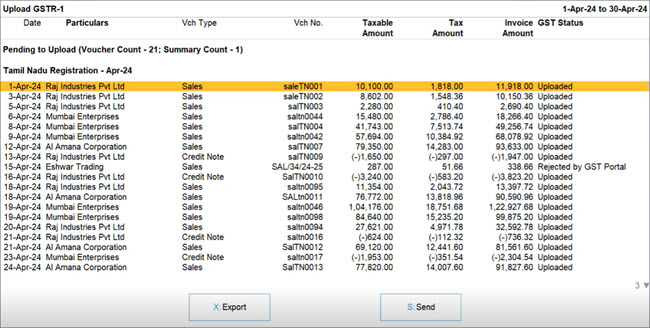

- In the Upload GST Returns screen, press F12 (Configure) to add the required options, such as Party GSTIN/UIN, GST Status, and the Sections as per the GST portal.

Tip: The GST Status column will help you view the status of the transaction, such as Uploaded, Mismatched and Rejected by GST Portal. - Press Ctrl+B (Basis of Values) to configure further options, as per your business needs.

- Include transactions mismatching with GST data: This option will help you re-upload the mismatched transactions after making the necessary updates in your books.

- Include transactions where Upload is in progress: This option will help you re-upload the transactions for which upload is already in progress.

- Include transactions Rejected by GST Portal: This option will help you re-upload the rejected transactions after making the necessary updates in your books.

- Include Delete Requests: This option will help you delete those transactions from the portal that are already deleted from your books.

- Press Spacebar to select the vouchers you want to upload.

If you want to upload all the vouchers, then you do not have to select any of the vouchers.

- Press S (Send) to upload.

- Log in to your GST profile, if you have not already done so.

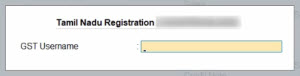

- Enter your GST Username.

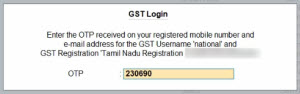

- Enter the OTP received on your registered mobile number, after which your vouchers will be exported to the GST portal.

Once you have logged in, the session will be valid for six hours, which will ensure the safety and security of your activities.

- Enter your GST Username.

You will receive the confirmation once the upload is complete.

The uploaded vouchers will now be moved to the No Action Required section.

Based on your recent activities, you can always see your last online GST activity in the top right corner of the report.

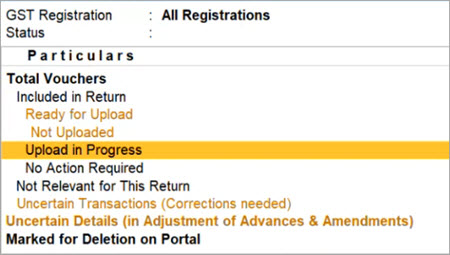

Upload in Progress

Sometimes, some of your vouchers might not get instantly uploaded on the GST portal. This can happen due to server-related issues or higher traffic on the GST portal. These transactions will be saved in the Upload in Progress section in GSTR-1.

In such cases, you can easily refresh the GST status of the vouchers after some time.

Resolve Vouchers Rejected by GST Portal

In TallyPrime Release 5.1 & later releases

Sometimes, your vouchers may get rejected by the GST portal if certain details are missing or incorrect. For example, the GSTIN of the party might be cancelled, inactive, or suspended, or the HSN or tax rate might be incorrect. When the GSTIN of the party is inactive, you need to change their Registration Type from Regular to Unregistered/Consumer, either in the master or for specific transactions. Similarly, if any voucher is rejected by the e-Invoice System or e-Way Bill system due to an inactive GSTIN, you can change the Registration Type of those parties from Regular to Unregistered/Consumer.

If there are many vouchers for the same party, handling each one individually can be time-consuming.

From TallyPrime Release 5.1, you can easily identify such vouchers in the Rejected by GST Portal (to be reuploaded) section, where inactive GSTINs are grouped separately. You can then update either the master or, select multiple vouchers and convert them from B2B to B2C.

Let’s go through the steps to manage a rejected voucher due to an inactive GSTIN.

Checking for Inactive GSTINs before upload

You can avoid rejections from GST portal by checking for inactive GSTINs before uploading your return.

- Open GSTR-1 report for the period.

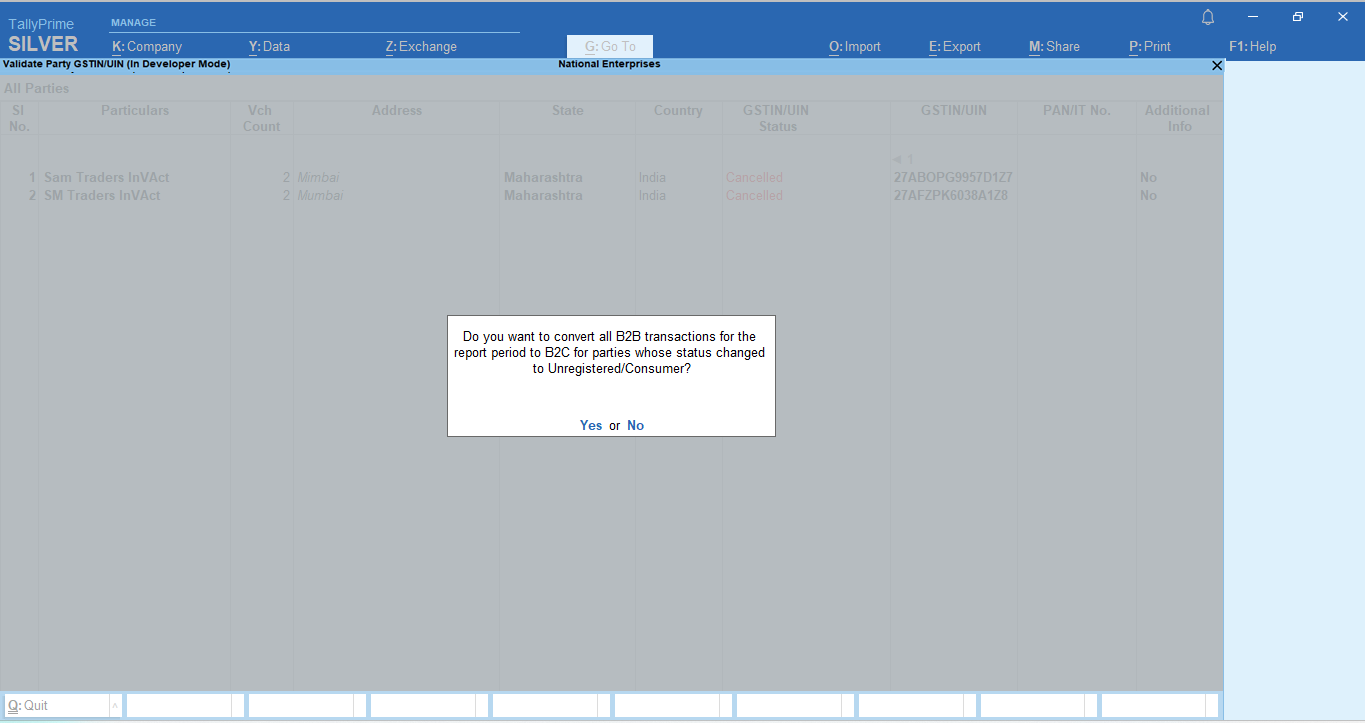

- Press F6 (Validate Party GSTIN/UIN) to view all the applicable parties for the period.

The Validate Party GSTIN/UIN screen appears. - Press Alt+L (Fetch Details Using GSTIN/UIN) to see each party’s current GSTIN/UIN status.

Status like Cancelled, Inactive, or Suspended are considered as inactive. - Press Ctrl+B (Basis of Values) to filter with inactive GSTIN/UIN.

- Select Status as Inactive GSTIN/UIN.

All parties with inactive, cancelled, or suspended GSTIN/UIN will appear.

Resolving Inactive GSTIN Issues

Once inactive GSTINs are identified, you can use one of these two methods in TallyPrime:

Update master and all related transactions

- Press F9 (Update Details) to edit the report.

- In the GSTIN/UIN field, press backspace and alter the Registration Type from Regular to Unregistered/Consumer.

- Enter the Effective Date for this change.

TallyPrime will update all related transactions from B2B to B2C for the period.

Convert specific transactions only

- Filter the inactive GSTIN/UIN.

- Press F5 (Voucher-wise) to view each B2B transaction with the inactive GSTIN.

- Select transactions you want to convert.

- Press Alt+V (Convert to B2C) to convert select voucher from B2B to B2C, leaving the party ledger unchanged.

TallyPrime updates only the selected transactions for the period from B2B to B2C.

Handling rejected vouchers after upload

If the GSTN portal rejects vouchers because of an inactive GSTIN, TallyPrime displays these transactions separately under Rejected by GST Portal (to be reuploaded). This section groups vouchers with inactive GSTINs separately from other rejection reasons for easier management.

- Press Alt+G (Go To) > type or select GSTR-1.

- Drill down from Rejected by GST Portal (to be reuploaded).

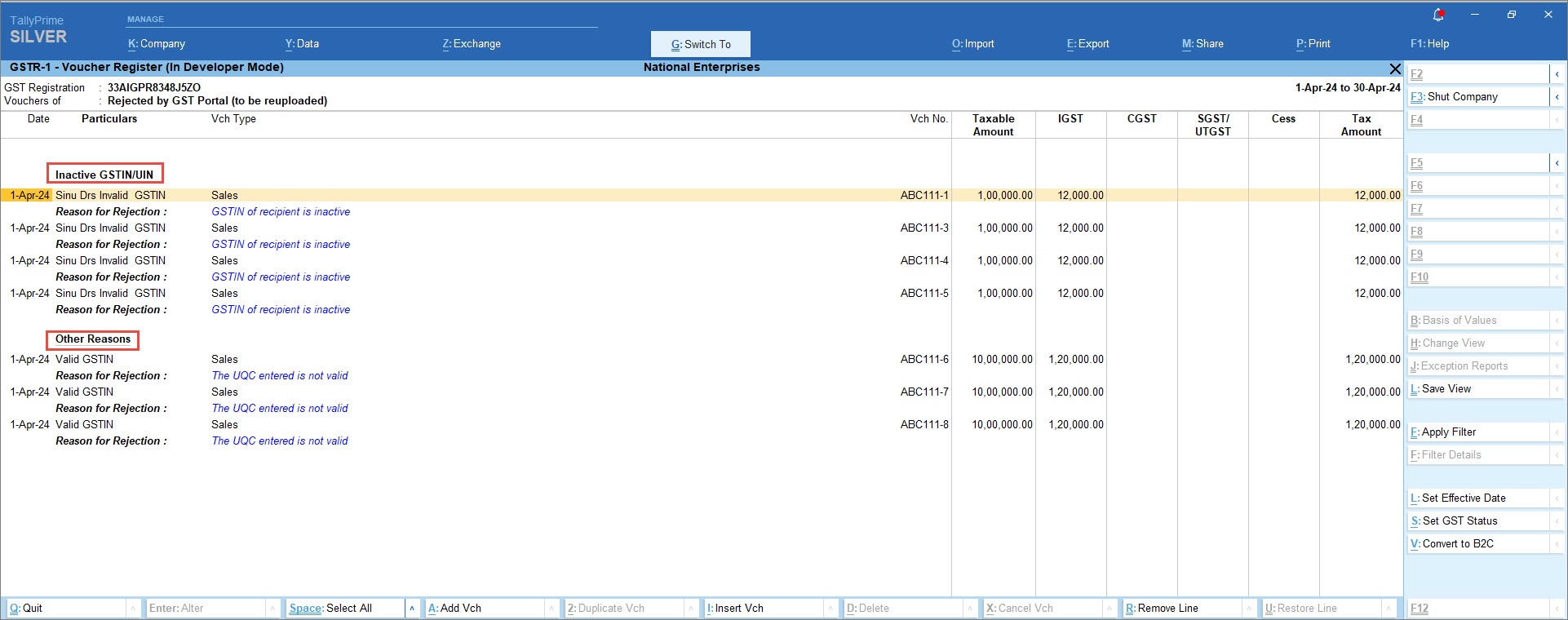

You can see there are two groups, one for Inactive GSTIN/UIN and one for Other Reasons.

- Select multiple vouchers from “inactive GSTIN/UIN’ group of transactions using Spacebar which you want to convert from B2B to B2C

- Press Alt+V (Convert to B2C) to change the party’s Registration Type from Regular to Unregistered/Consumer for each selected voucher.

In case you select mix of vouchers from Inactive GSTIN/UIN and Other Reason group, Convert to B2C will convert only on those vouchers belongs to Inactive GSTIN/UIN.

In TallyPrime Release 5.0 & earlier releases

Sometimes, some of your vouchers might get rejected by the GST portal, if any of the information happens to be incomplete or incorrect. For example, the GSTIN of a party might be inactive, invalid or suspended, or the HSN or tax rate might be incorrect.

However, with the Connected GST experience, you can easily identify such issues and resolve them in a seamless manner.

- Press Alt+G (Go To) > type or select GSTR-1.

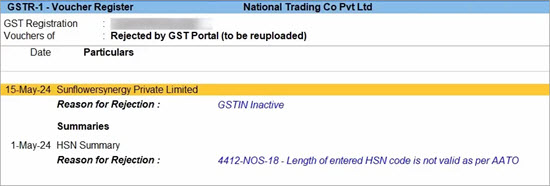

- Drill down from Rejected by GST Portal.

You can view the vouchers and summaries rejected by the portal, along with the Reason for Rejection.

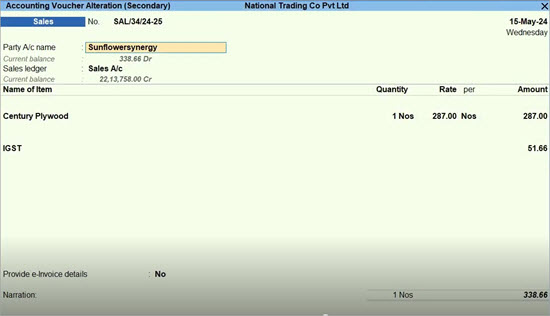

Let us take an example where the GSTIN of the party is inactive. - Open the Sales voucher.

To view the GST Portal View of the invoice, press Ctrl+O (Portal View). You will get a clearer view of the invoice details recorded on the portal, along with the Reason for Rejection.

- In Party A/c name, press Ctrl+Enter to open and update the party ledger.

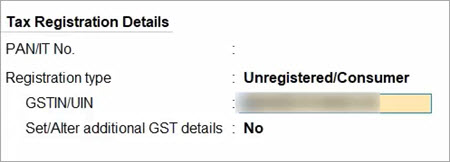

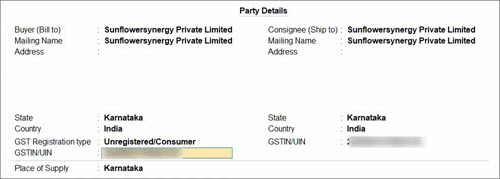

- Set the Registration type to Unregistered/Consumer, if this is a B2C transaction.

On the other hand, if this is a B2B transaction, then you can update the correct GSTIN/UIN.

- Enter the Effective Date.

- Press Ctrl+A to save the details.

- Set the Registration type to Unregistered/Consumer, if this is a B2C transaction.

- In the voucher, under Party Details, select the GST Registration type to Unregistered/Consumer.

- Press Ctrl+A to save the voucher.

In this way, you can easily resolve any other rejections from the GST portal and upload them again, as per your convenience.

Manage e-Invoice Requirements During Upload

The current e-Invoicing feature will continue to take care of your e-Invoicing needs. You don’t have to worry about uploading your e-Invoices separately. In GSTR-1, the e-Invoices that are already uploaded will appear under the No Action Required section.

However, the Upload feature comes with many flexibilities to meet your e-Invoicing requirements. You can upload your transactions with or without e-Invoices, as needed, or upload the e-Invoices that are available only in your books and not on the portal.

In this section

Upload with e-Invoices

You can choose to upload your transactions with or without e-Invoices by simply configuring the relevant option during upload.

- Press Alt+Z (Exchange) > Upload GST Returns > GSTR-1.

- In the Upload GST Returns screen, press F12 (Configure) and enable the Include e-Invoices (with IRN information) option, if you want to upload your e-Invoice transactions.

- Press Spacebar to select the transactions you want to upload for e-Invoicing.

If you want to upload all the transactions, then you do not have to select any of the transactions.

- Press S (Send) to upload.

Based on your configuration, the selected invoices will get uploaded for e-Invoicing.

Upload e-Invoices Available Only in Books

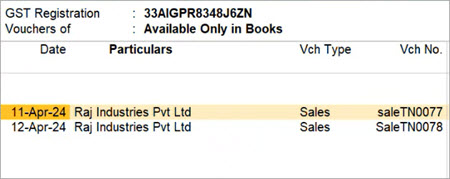

Sometimes, some of your e-Invoices might be available only in your books and not on the portal. You can easily identify such transactions from the GSTR-1 report and upload them seamlessly on the portal. This will take care of the e-Invoicing requirements for such transactions.

- Press Alt+G (Go To) > GSTR-1.

- Drill down from the Available Only in Books section.

You can view the required e-Invoice transactions and make a note of the voucher numbers.

- Press Alt+Z (Exchange) > Upload GST Returns > GSTR-1.

- Identify the same transactions using the voucher numbers, and press Spacebar to select them.

- Press S (Send) to upload.

The selected e-Invoices will get uploaded on the portal.