e-Invoicing Under KSA e-Invoice Integration Phase – FAQ

You will get the answers to all the frequently asked questions regarding e-Invoicing under KSA e-Invoice Integration Phase – be it your authentication process, onboarding in TallyPrime, e-Invoice generation for different voucher types, and e-Invoice reports in TallyPrime.

KSA e-Invoice Integration – Authentication with e-Invoice System

This section provides the answers to the frequently asked questions regarding the authentication with the e-Invoice System for KSA e-Invoice Integration Phase.

Yes, after splitting the company data, you can continue uploading the e-Invoices, even from the newly created companies.

You are recommended to use TallyPrime Edit Log, as Edit Log will always be enabled in the product. This helps you to identify if there are any modifications made to the vouchers for which e-Invoice is already generated.

The fundamental difference between e-Invoice Generation (Phase 1) and e-Invoice Integration (Phase 2) is that the Phase 2 requires you to integrate your e-Invoicing solution such as TallyPrime with ZATCA or say, e-Invoice system.

e-Invoice Generation (Phase 1): On 4-Dec-21, the Phase 1 was introduced in which a company registered under VAT had to provide electronic invoices and related electronic notes.

e-Invoice Integration (Phase 2): On 1-Jan-21, the Phase 1 was introduced in which a company registered under VAT has to integrate their e-Invoicing solutions such as TallyPrime with the e-Invoice system.

To update TallyPrime for a transition from e-Invoice Generation (Phase 1) to e-Invoice Integration (Phase 2), you need to contact your Tally partner, who will help you upgrade your Tally license for e-Invoice Integration Phase.

Yes, you can generate an e-Invoice, as per the Phase 1 method, if the following conditions are met:

- The document date falls under e-Invoice Generation Phase 1, that is before e-Invoice Integration Phase became applicable to your company.

- Voucher type is enabled for e-Invoicing.

Yes, you can generate e-Invoices under e-Invoice Integration Phase, even if your business’s turnover is under the threshold limit of e-Invoice Generation Phase 1. You will need to inform ZATCA about the same.

If you have upgraded for e-Invoice Integration Phase, you can still generate e-Invoices under e-Invoice Generation Phase 1 if the voucher date falls under the same.

No, once you upgrade your license for e-Invoice Integration Phase, the TDL for e-Invoice Generation Phase 1 will already be available in it.

Once you enable e-Invoice Integration Phase under F11 (Company Features), you cannot disable it. However, it is important to note that if the date of your invoice is after the date on which e-Invoice Integration Phase got applicable to your business, then it is mandatory for you to generate e-Invoices under e-Invoice Integration Phase.

Is it mandatory to disable e-Invoice Generation before enabling e-Invoice Integration in TallyPrime?

Yes, it is mandatory to disable e-Invoice Generation before enabling e-Invoice Integration in TallyPrime.

In TallyPrime, once you specify the applicability date for e-Invoice Integration, the e-Invoice Generation end date will be equal to it and will get updated automatically.

Yes, you can upgrade your Tally license from e-Invoice Generation Phase 1 to e-Invoice Integration Phase in the future, too.

In such scenarios, you will need to connect with your Tally partner to reestablish the connect with the e-Invoice System.

To know more, refer to Generate e-Invoice Login Credentials.

You will be notified on your the same e-mail ID which is mentioned in the company creation/alteration screen.

It is available in the Company folder as e-Invoice Certification file. The e-Invoice Certification file will also be available in the e-mail we sent to you when you generated or revoked the e-Invoice Login Credentials.

The e-mails have the following subject lines, based on the scenario:

- Your e-Invoice Certificate is Updated

- Your e-Invoice Login Credentials are Revoked

In such a case, you’ll need to connect with Tally partner with your complete licensing details, along with your company name, VAT registration number, and Tally license number.

As per the guidelines by ZATCA, enabling auto-login for companies with same credentials is not allowed. Here’s an excerpt from ZATCA:

“Persons subject to the e-Invoicing Regulation cannot access the system without logging into the system using a unique login and password or biometrics”. Also, “Having a default password or factory password is not allowed. Each system must require the user to reset the password on first use”.

You must have an active TSS and active Phase II e-Invoice utility to generate e-Invoices under e-Invoice Integration Phase.

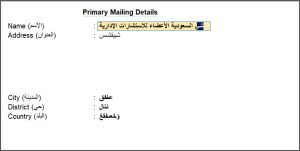

No, you cannot submit CSR form with an Arabic company name.

However, you can provide company mailing details, including the company name in Arabic using F11 (Company Feature).

- Open TallyPrime and press F11 (Company Features).

- Set Enable Value Added Tax (VAT) to Yes and press Enter.

- In the VAT Details screen, press F12 (Configure).

- In the Configuration screen, set Show mailing details in local language to Yes.

- Set Mailing details in local language to Yes.

- In the Primary Mailing Details screen, enter the name of the company and mailing details in Arabic.

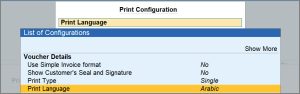

If you want to print your invoice in Arabic only, you can select Print Type as Single and Print Language as Arabic in Print Configuration.

Onboarding for e-Invoicing Under e-Invoice Integration Phase

This section answers the questions related to setting up TallyPrime for e-Invoicing under e-Invoice Integration. Moreover, you will get to know the answers to the questions related to the steps in the entire onboarding process.

If your Company name has changed, we recommend that you create a new Company in TallyPrime and perform a KSA e-Invoice onboarding using the new name. This approach ensures proper separation of business financial data and compliance with e-Invoicing requirements.

If you prefer to continue with your current Company data in TallyPrime, you can revoke your credentials and onboard again. However, this approach may result in non-compliance with ZATCA, and the taxpayer will be responsible for any warnings or notices issued by ZATCA.

Once the company name is changed, you will not be able to archive previously generated e-Invoices (including Credit Notes). Hence, before making the change, ensure that:

- All e-Invoices are archived, including any pending Credit Notes.

- All e-Invoices under the Upload for e-Invoice Generation Unsuccessful (Reupload) section in the e-Invoice Overview report are reuploaded.

Consult your Tax advisor to confirm whether Credit Notes for earlier e-Invoices (issued under the previous Company name) should be generated under the old name or the new one.

Also, to print all your previous records, update the Mailing Name of your Company in the Company Alteration screen.

To update the Company name:

-

Revoke e-Invoice login credentials on TallyPrime and e-Invoice System (Fatoora portal).

-

Send an e-mail to tallysolutions.com with the following details:

-

Previous Company Name

-

New Company Name

-

A screenshot of the CSR Form or the updated e-invoice Certificate

-

-

After receiving our confirmation, update the Mailing Name of your Company in the Company Alteration screen.

-

Proceed with the onboarding process again using the new Company name.

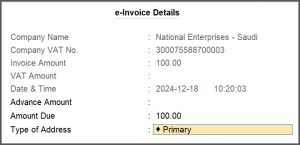

While passing the sales voucher,

- Enter relevant details, such as Party A/c Name, Sales Ledger, Name of Item, and VAT Ledger.

- Set Show e-Invoice details to Yes and press Enter.

- In the e-Invoice Details screen, select the relevant address from the Type of Address field.

- Ensure that each address given in the List of Address Types should have a specific seller ID (for example, Commercial Registration No. (CRN), MOMRAH License No., and so on). The selected address with the given seller ID details will be exchanged on the ZATCA portal.

To generate OTP:

- Log in to https://fatoora.zatca.gov.sa/.

- Click Onboard New Solution Unit/Device.

- Type 1 and generate OTP.

- Click the Copy Code button.

- Open Certificate Signing Request (CSR) Form in TallyPrime and paste the copied OTP in the OTP generated on the e-Invoice System field.

To set up TallyPrime for e-Invoice Integration Phase, follow the steps given below.

- Upgrade the Tally license and make sure that the Phase TDL is updated.

- Enable e-Invoice Integration Phase from F11 (Company Features) > Enable Value Added Tax (VAT).

- Enable e-Invoice Integration Phase and enter the Applicable from date.

- Select Generate and press Enter to generate e-Invoice Login Credentials.

- Fill up the CSR form and enter the OTP generated on the FATOORA portal.

- Submit CSR form.

That’s it! You’re all set to use TallyPrime for your e-Invoicing needs.

To know more, refer to the Set Up TallyPrime for e-Invoice Integration (Phase Two) section in the Generate e-Invoice Online Using TallyPrime | e-Invoice Integration (Phase Two) topic.

You will need to log in to the Fatoora portal in order to generate the OTP that remains valid for one hour.

You will need to follow the process to generate e-Invoice Login Credentials.

If e-Invoice Login Credentials is already generated and active, then Tally asks you to renew it when you enter the e-Invoice Integration applicability date.

Onboarding refers to the process of getting new e-Invoice Login Credentials against a new company or EGS unit for the first time. However, when you have already onboarded your Company or EGS unit, you can renew e-Invoice Login Credentials within five years of generation. It gets expired if you do not renew it for more than five years.

On the other hand, if you revoke the e-Invoice Login Credentials, then you will need to get onboarded by generating them for your company or EGS unit.

You will need revoke your e-Invoice Login Credentials from the Fatoora portal and TallyPrime both.

To know how to revoke e-Invoice Login Credentials, refer to the Revoke e-Invoice Login Credentials section in the Generate e-Invoice Online Using TallyPrime | e-Invoice Integration (Phase Two) topic.

You cannot use a e-Invoice Login Credentials generated in a software in another.

It is necessary to revoke the active e-Invoice Login Credentials on your current software and from the Fatoora portal.

Thereafter, you can apply for a new e-Invoice Login Credentials from the new software.

Yes, TallyPrime will restart and the data will get migrated.

Yes, you can either Save or Send the CSR form after saving, as required.

To check the e-Invoice Generation Phase History in TallyPrime, press F11 (Company Features) > enable Value Added Tax (VAT) > press Ctrl+I (More Details) > e-Invoice Integration Phase History and press Enter.

You can view all the details such as the status of Onboarding, Renewal, and Revoke with Issue Date and Revocation date. Moreover, you can select Yes to view CSR details also Yes/No with view CRS details.

Once you upgrade TallyPrime for e-Invoice Integration Phase and generation the e-Invoice Login Credentials with an OTP, you will not need to log in to the e-Invoice system unless your e-Invoice Login Credentials is expired or revoked.

Yes, you can generate e-Invoices in a multi-user environment, if the admin has not disallowed you under User Roles from doing so. Moreover, you need to ensure that the company data is located in the same folder, and e-Invoice certificate is available in the folder.

No, you cannot use the same e-Invoice certificate for another Company with different VAT registrations. You will need a different set of e-Invoice Login Credentials to perform e-Invoicing activities in a Company with different VAT registration.

The option is not applicable for e-Invoicing generation or integration phase.

Yes, you can generate the e-Invoices from another TallyPrime application, as long as the TDL for e-Invoice Integration Phase is loaded in the same.

If you have generated e-Invoice Login Credentials, then you can generate e-Invoices even if you had removed Telephone, Mobile, and E-mail from the Company. However, when you try to revoke or renew e-Invoice Login Credentials, you get an error due to the absence Telephone, Mobile, and/or E-mail in the Company.

Yes, you can use Phase 2 integration solution without using Phase 1 generation TDL.

However, you cannot use Phase 1 TDL and Phase 2 TDL together against a single Tally serial no. If you want to generate e-Invoice using Phase 2 TDL, you will have to purchase the add on and attach it to your license. You will have to get Phase 2 TDL and delink the Phase 1 TDL. However, if you want to generate e-Invoice using Phase 1 TDL, you can do it using either Phase 1 TDL or Phase 2 TDL.

For pricing details related to Phase 2 Integration TDL, check with your Tally partner.

TSS and Phase 2 are connected to each other and that’s why, they will have to be renewed together. Yes, there are renewal charges applicable for Phase 2 Integration TDL. You can check with your Tally partner for the same.

The mandatory fields in company creation/alteration which are applicable for e-Invoicing certificate generation are as follows:

- Company name without special characters

- Telephone No.

- Mobile No.

- E-mail ID

- Building No.

- City

- District

- Postal Code

- Address

- Seller ID

When you are closing your business and surrendering your VAT, you need to revoke your e-Invoice login credentials. Similarly, if you have submitted wrong information while submitting Certificate Signing Request (CSR) form, then you need to revoke the e-Invoice login credentials.

To know more, refer to Revoke e-Invoice Login Credentials.

Yes, it is possible, provided your Tally serial number, company VAT number, and company name are same.

To copy the e-Invoice certificate from one company to another to generate e-Invoices,

- Do onboarding in the first company. An e-Invoice certificate must have generated and saved in the company folder.

- Copy this e-Invoice certificate file from the data folder of the first company and save the file in the data folder of the second company.

- Now in TallyPrime, check the company name, VAT Number and Tally serial number for the second company. It should be same as the first company’s details.

- Enable integration phase in the second company but do not generate the credentials.

- Press the down arrow key from Integration phase applicability date option and provide archived folder location.

- In Gateway of Tally, press F1 (Help) > Troubleshooting > Restore e-Invoicing certificate.

To know more, refer to Restore e-Invoicing Details in Another Company.

If your e-Invoice certificate is deleted from the company folder, it will not affect e-Invoice generation, provided that the last status in the e-Invoicing Integration Phase (History) is set to “Onboarded” or “Renewed.” To know more, refer to View e-Invoice Integration (History).

To configure company mailing details in Arabic,

- Open the company in TallyPrime.

- Press F11 (Company Features) > Enable VAT > F12 (Configure) > Set Show mailing details in local language to YES.

Yes, the mailing details are mandatory to generate e-Invoice.

To know more, refer to Generate e-Invoice for a single Sales invoice.

To fix this error, navigate to the Certificate Signing Request (CSR) form and review the location field. Ensure that it contains only letters and numbers, with no special characters.

To know more about CSR form, refer to View CSR Details.

No, you can’t activate the Phase II TDL for Indian license. However, you can purchase TDL on international license. If you don’t have an international license, you can upgrade the Indian license to International license for activating Phase II TDL. You can connect with your Tally Partner to activate the Phase II TDL for Indian license.

e-Invoicing – Masters and Vouchers

This section answers the frequently asked questions regarding e-Invoice generation under KSA e-Invoice Integration Phase in TallyPrime. You will get to know the answers to the questions for e-Invoice generation in any voucher type applicable for e-Invoicing – be it Sales, Point of Sales, Credit Note, Debit Note, or Advance Receipt.

To check your current KSA Integration Utility version,

- Ensure that you are on the latest release of TallyPrime/TallyPrime Edit Log.

- Press F1 (Help) > TDLs & AddOns.

In the TDL Management screen, you will see the latest KSA Integration Utility TDL configured.

If the TDL Management screen displays an older version of KSA Integration Utility,

- Press F1 (Help) > Settings > License > Manage License > F5 (Update).

If you are unable to update to the latest KSA Integration Utility version, then add the TallyPrime/TallyPrime Edit Log application, required ports, IP addresses, URLs, and host names to your Windows proxy/firewall exception list.

After receiving a new VAT No. from ZATCA, you should create a new company in TallyPrime, as you are not allowed to change the VAT No. in the existing company and generate new credentials.

Using new VAT number and registration date, complete the onboarding again. At the same time, close the financial books for the old company.

For Optional vouchers, TallyPrime doesn’t allow to generate e-Invoice.

You can connect with Tally Support to analyze the problem.

To avoid errors and warnings from ZATCA, ensure that the below-mentioned fields are filled in the Mailing details of the party ledgers:

- Name (both in English and Arabic)

- Address (both in English and Arabic)

- Building number

- City (both in English and Arabic)

- District (both in English and Arabic)

- Postal Code

- Country (both in English and Arabic)

- Additional Buyer ID

Standard e-Invoices are issued for B2B and B2G transactions. Moreover, the buyers use B2B invoices to claim input VAT.

On the other hand, simplified e-Invoices are issued for B2C transactions.

You can continue to use the existing voucher types.

The e-Invoice will get created for e-Invoice Generation Phase 1 or e-Invoice Integration Phase, depending on the voucher date.

ZATCA does not allow e-Invoices for duplicate voucher numbers, irrespective of the type of a voucher be it sales, advance receipt, debit note, or credit note.

Voucher number differentiation does not even depend on the type of invoice – standard and simplified.

Therefore, we recommend you to add prefix or suffix after the voucher number so that you can have different voucher numbers.

Press F11 (Company Features) > enable Value Added Tax (VAT) and press Enter.

Under VRN Type, select Company Registration or Headquarter Registration, as applicable to your business.

If the goods or services you are selling are not subject to VAT, exempt from tax, or zero-rated, then it is mandatory to for you to enter the reason for zero rate or exemption manually.

Yes, it is mandatory to select the Reason for Return for Debit Notes and Credit Notes.

While recording the Debit Note or Credit Note, enable Provide VAT details.

You can then mention the Reason for Return.

You cannot delete a transaction after saving it. However, you can cancel or alter the transaction before sending for e-Invoice generation to the e-Invoice system.

When you create a ledger for discount, ensure that Include in assessable value calculation for is enabled for VAT and discount is apportioned correctly.

ZATCA does not consider non-assessable discounts.

For a B2B invoice, you need to generate an e-Invoice at the time of voucher creation. However, if you fail to generate an e-Invoice in real time, then you will need to provide a valid reason to the e-Invoice system.

On the other hand, for a B2C invoice, you have 24 hours to generate an e-Invoice.

Yes, you can generate multiple e-Invoices in TallyPrime through Exchange. Once you generate, you also get an Exchange Summary that informs you about the number of vouchers for which the e-Invoice got generated, those rejected by the e-Invoice system, and the ones that were not uploaded successfully on the e-Invoice System.

During voucher creation, enable Show e-Invoices details.

You can then mention the due amount receivable.

You need to allow e-Invoicing in the Receipt Voucher Type.

Once you allow e-Invoice in the Receipt Voucher Type, the default voucher is Advance Receipt, whenever you create a receipt voucher.

To know how to record the Advance Receipt for e-Invoice, refer to the Generate e-Invoice for Advance Receipt section in the Generate e-Invoice Online Using TallyPrime topic.

If you want to record a normal receipt voucher, then you will need to maintain a separate receipt voucher type.

No, you will not be able to delete or alter transactions after generating e-Invoices.

Yes, you can do so. For a B2B invoice, you need to generate an e-Invoice immediately after you record the voucher. On the other hand, if is a B2C advance receipt, you have 24 hours to generate an e-Invoice.

Yes, you can easily adjust the advance received from a customer in the sales invoice and upload it for e-Invoicing.

To know how to do it, refer to the Adjust advance received in Sales invoice section in the Generate e-Invoice Online Using TallyPrime | e-Invoice Integration (Phase Two) topic.

No, e-Invoicing is not applicable for receipts, unless it is an advance receipt.

You do not need to record a Credit Note if your e-Invoice is rejected by the e-Invoice System. If the Edit Log is enabled in your TallyPrime, you can make the necessary changes to the invoice, based on the reason for rejection and reupload the Invoice on the e-Invoice System.

To enable e-Invoice for a voucher type:

- Press Alt+G (Go To) > Alter Master > Voucher Type > type or select the name of the Voucher Type and press Enter.

- Allow e-Invoicing: Yes.

To know more about enabling e-Invoicing for a voucher type, refer to the Alter Voucher Types for e-Invoicing section in the Generate e-Invoice Online Using TallyPrime | e-Invoice Integration (Phase Two) topic.

e-Invoicing is applicable for Sales, PoS Invoice, Credit Note, Debit Note, and Receipt voucher types.

No, it is not mandatory to upload vouchers for e-Invoicing everyday.

However, you should know that ZATCA requires e-Invoices for B2B vouchers in real-time basis and for B2C vouchers, you can generate e-Invoices within 24 hours of voucher creation.

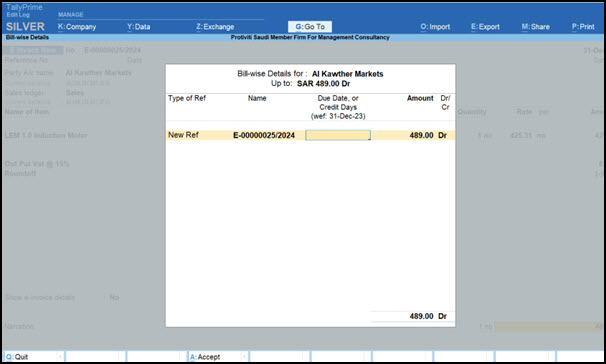

No, providing Bill-wise Details in Advance Receipt is not mandatory as per the regulations by ZATCA.

However, we recommend you to enable the Maintain Balance Bill-by-Bill option under F11 and party ledger.

In an Advance Receipt, you need to select Advance as a type of reference and provide details.

This enables you to show the tax liability in the Advance Receipt Details screen and set off the advance receipt e-Invoice with the Sales e-Invoice.

The mandatory fields are VRN Type and VRN No. for B2B invoices.

The following fields are recommended by ZATCA. In the absence of below mentioned fields, ZATCA accepted the invoice but with warning.

B2C:

1. Party name in Arabic

2. Other Buyer ID

B2B:

1. Party name, address, City, and District in Arabic

2. Building No., and and Postal Code

3. Country

Export:

1. Party Name, address, and City in Arabic

2. Other Buyer ID

3. Country

For every field, only Arabic is mandatory.

Yes, it is mandatory to provide ledger mailing details in Arabic to generate the e-invoice.

The mandatory fields are mentioned below:

1. Stock Item name in Arabic

2. If taxability is other than taxable, then reason for exemption is mandatory in Arabic.

Yes, it’s mandatory to generate e-Invoice for export transactions.

Yes, while creating master, you can enable description option from F12 (Configure) and enter the default description in English and Arabic version.

Yes, it is mandatory to create company name in English to generate e-invoice from TallyPrime.

You can ignore this warning, as it does not require any action from you.

It appears due to a glitch on the ZATCA portal. In the future releases, you will not face such warnings, as confirmed by ZATCA.

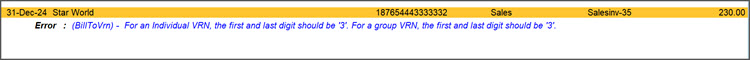

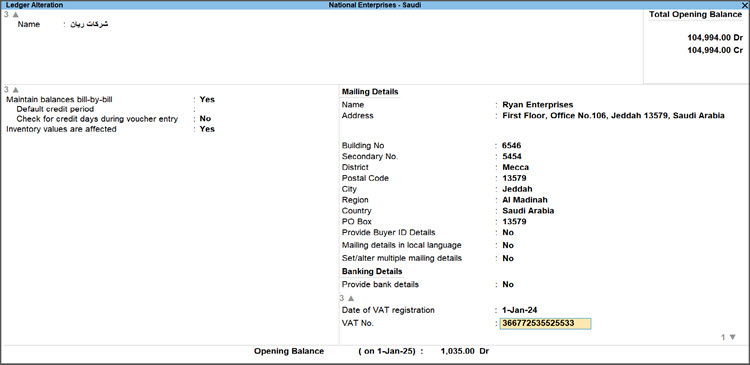

Cause: The VAT No. mentioned for the particular party is incorrect.

Resolution:

Check the VAT No. in the VAT Details screen for the particular party.

- Open the particular party ledger in alteration mode.

- Update the VAT No. to make sure that it is of 15 digits, starting and ending with the digit ‘3’.

- Press Ctrl+A to save.

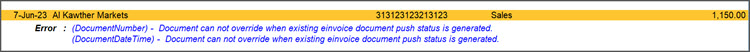

Cause: For e-Invoicing, you should ensure that your voucher types, such as Sales or Credit Note, should maintain a unique series of numbering. This error occurs when you have a Voucher with an Invoice No. that already exists for another voucher or has been previously uploaded on the ZATCA portal.

Resolution:

Ensure that each voucher type has a unique numbering with a prefix or suffix in the Invoice No. to make the series of vouchers unique.

1. Go to the e-Invoice Overview report, and select Uncertain Transactions (Correction Needed) section.

2. Select the transaction and press Alt+S (Update e-Invoice).

If you are again getting the message that the e-invoice is not generated and is moved under Uncertain Transactions (Correction Needed) section, then check in your Day Book if any voucher with the same Invoice No. is available or deleted or cancelled.

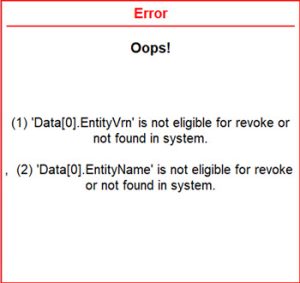

Cause: The Original Company Name used during the onboarding has been changed.

Resolution:

The Company Name should exactly match with the Company Name specified in the e-Invoice certificate, which is saved in the company data folder.

Change the Company Name:

- Open the Company in alteration mode and update the Company Name.

- Press Ctrl+A to save.

Cause: After revoking the e-Invoice credentials, you should generate new credentials. Somehow, you have missed to generate the new credentials.

Resolution: In the e-Invoice Integration Phase (History), if the latest status is not Onboarded or Renewed, then you must generate or renew e-Invoice Login Credentials for your Company.

Cause: The stock item or ledger name is not updated in Arabic language.

Resolution: You can open the stock item in alteration mode and update the name or Language Alias of the stock item or the accounting ledger in Arabic.

Cause 1: The Taxability of the stock item or the accounting ledger is set to Exempt, Zero-rated or Non-Vatable, but the Reason for tax exemption/zero rate field is empty.

Resolution 1: You can open the stock item or the ledger in the alteration mode and update the Reason for tax exemption/zero rate.

Cause 2: If the transaction is export or GCC transaction but user didn’t provide reason for tax exemption or zero-rated in the Show e-Invoice details field.

Resolution 2:

- Select the voucher and press Enter to open it in the alteration mode.

- Set the Show e-Invoice details to Yes.

- In the e-Invoice Details screen, update the Reason for tax exemption/zero-rate and save.

- In the e-Invoice Details screen, update the Reason for tax exemption/zero-rate.

e-Invoice Reports

This section has answers to all the frequently asked questions on the e-Invoicing reports of TallyPrime.

You may be unable to archive e-Invoices in TallyPrime due to one of the following reasons:

- You changed the Company Name in the Certificate Signing Request (CSR) Form but are trying to archive invoices generated under the old Company Name.

- Your system doesn’t have the relevant C++ files. You can download the C++ files from Microsoft Visual C++ Redistributable latest supported downloads.

- The invoice details contain special characters like backslashes (\) or double quotes (“), in the address, item/ledger name, or description.

The purpose of Show mailing details in local language available under Enable VAT menu in Company Features is to update the company details in local language. If you will not provide the company details in local language, you might receive warnings from ZATCA after e-Invoice generation.

e-Invoice report provides you with the status of vouchers so that you can take actions, as needed.

Press Alt+G (Go To) > type or select e-Invoice Overview and press Enter.

Alternatively, Gateway of Tally > Display More Report > VAT Report > e- Invoice Overview.

If the e-Invoice generation is rejected by the e-Invoice system, you get an error for rejection from the e-Invoice system.

In some cases, the e-Invoice system might accept the voucher for e-Invoicing. However, it will show a warning about an error that needs to be fixed in the future invoices.

When a voucher does not have the mandatory information for e-Invoice or has incorrect or invalid information, the voucher moves to the Uncertain Transactions (Corrections Needed) section.

You can drill down from the section to identify the nature of error and take actions to alter the voucher for successful e-Invoice generation.

It is important to note that you will not be able to delete the voucher.

The Ready for Exchange with e-Invoice System contains vouchers that have all the mandatory information for e-Invoice, but you haven’t generated the e-Invoices at the time of voucher creation.

These are the transactions that are sent to the e-Invoice system for e-Invoicing, but the upload for e-Invoice generation was unsuccessful. You will need to reupload such vouchers on the e-Invoice system.

You can open these transactions only in the display mode.

The transactions under the section are rejected by the e-Invoice system or ZATCA, as there must be some incorrect information or mismatch with that provided on the portal.

If Edit Log is enabled in TallyPrime, you can make the necessary changes in such vouchers and upload them on the e-Invoice system again.

The option Alt+U is given in “Upload for e-Invoice Generation Unsuccessful (Reupload)” bucket, where invoices having in-process status appear. The purpose of this button is to get the final status of Invoice. The final status can move the invoice into “uncertain transactions” bucket, “generate successfully” bucket, or “rejected by e-Invoice” bucket, as the case may be.

Due to traffic on e-Invoicing portal, this status appears. However, in the backend, TallyPrime continuously tries to upload invoice on portal. It might happen that, in TallyPrime, the status is “Reupload” but in Tally server, the final status has been received.

The uploaded details will remain as is, on revocation of the e-Invoice certificate on Fatoora portal and in TallyPrime.

No, you do not need to pass these transactions again. Occasionally, while generating the e-Invoices in TallyPrime, the response time taken by ZATCA to update the status of the transactions is greater than the usual.

In such a scenario, TallyPrime shows you an Information message stating that the upload of the document on the e-Invoice System is unsuccessful. You can press any key and continue passing other transactions, while TallyPrime attempts to fetch status from the ZATCA portal in the backend. Meanwhile, the delay in retrieving status details for e-Invoice generation does not stop you from passing other transactions.

After some time, you may go to the Upload for e-Invoice Generation Unsuccessful (Reupload) section in the e-Invoice Overview report, and press Alt+U (Get Status) to get the latest status of the transactions.

Uncertain Transactions from e-Invoice Overview Report

Resolution: For B2B invoices, address is mandatory

Resolution: For B2B invoices, building number is mandatory.

Resolution: For B2B invoices, City is mandatory.

Resolution: For B2B invoices, PinCode (Postal Code) is mandatory.

Resolution: For B2B invoices, District is mandatory.

Resolution: This is Saudi PIN format. PIN should be of 15 digits where first and last digit should be 3.

Resolution: The length of Company’s and party’s pincode is exact 5. More than or less than 5 is not allowed.

Resolution: Sometimes, due to rounding off this error appears. Check (Quantity * Rate) – allocated discount amount + allocated additional cost amount. The answer should be equal to the line item taxable amount, on which VAT should be calculated.

This error generally comes when you made some changes in the invoice and saved it without opening “show e-Invoice details” field.

Scanning QR Code

This section lists the FAQ related to scanning the e-Invoice QR code using the E-Invoice QR Code Reader KSA application.

You may not be able to view the seller’s details after scanning the e-Invoice QR code using the E-Invoice QR Code Reader KSA application due to the following reasons:

-

Mismatch in Seller Name: The application displays the Company name as the Seller’s Name. If the Company name configured in TallyPrime does not exactly match the name registered with the VAT Registration Number (VRN) on the e-Invoice portal, the seller’s details will not appear.

-

Mismatch in Invoice Data: If any of the details such as, Seller’s VAT Registration Number (VRN), Invoice Date and Time, Invoice Total (including VAT), or VAT Total, do not match the data recorded on the e-Invoice portal, the seller’s details will not be shown in the application.