Record Vouchers for GST Adjustments in TallyPrime

GSTR-1 and GSTR-3B are monthly returns while GSTR-9 is the annual return. You pay GST on the basis of the tax amount in the respective returns. If there are any adjustments for tax liability and Input Tax Credit (ITC) so that the actual amount appears in the GST returns, then you need to record journal vouchers for GST adjustments in TallyPrime. Along with GSTR-1 and GSTR-3B, the changes after recording journal vouchers for GST adjustment will also get updated in GSTR-9 Annual Computation report, which is the aggregation of data in your books of account.

There can be some discrepancies due to reversal of tax liability or for instance the Input Tax Credit (ITC) is:

- Less than the value you need to claim

- In excess of the claimable value

In such cases, you can account for such adjustments using journal vouchers in TallyPrime so that the values of the claimable ITC and that availed are same.

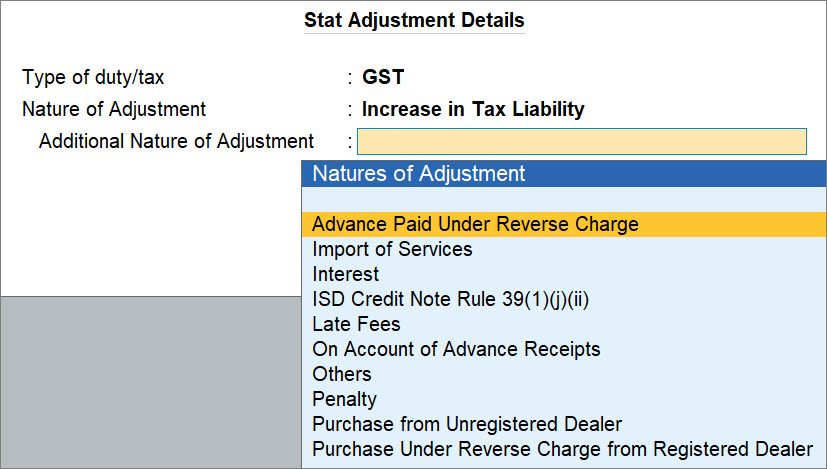

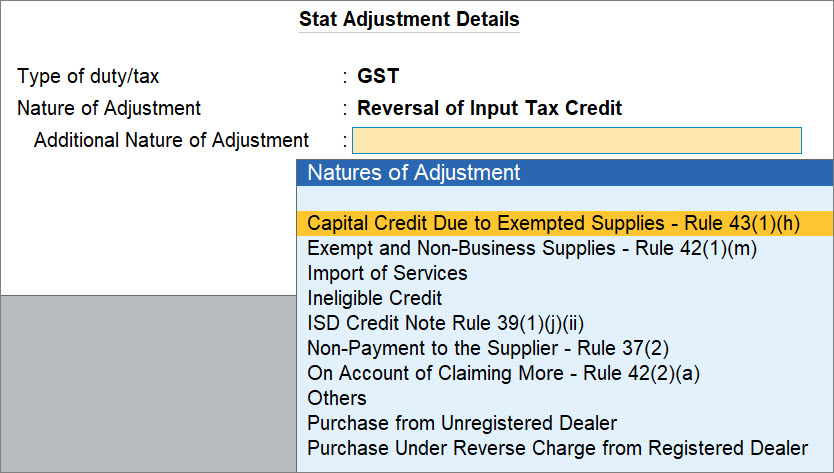

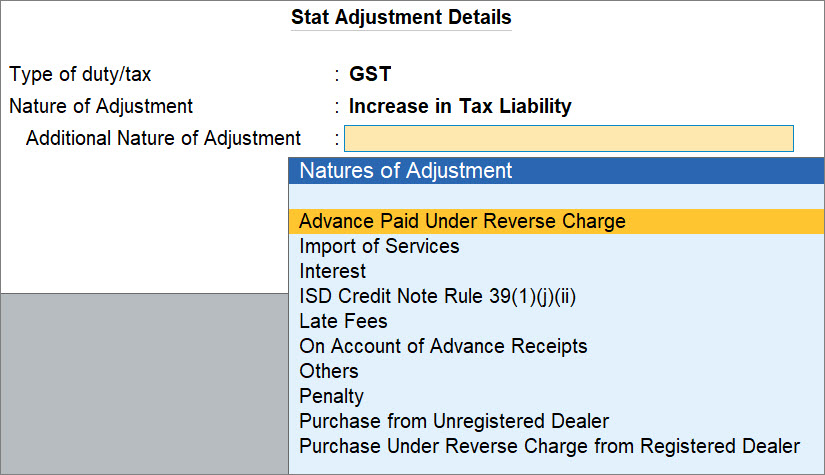

TallyPrime Release 3.0 onwards, you have an advanced GST adjustment facility which will enable you to select the appropriate scenario using Nature of Adjustment and Additional Nature of Adjustment options under the Stat Adjustment Details screen as shown below:

You can select from the gamut of options that cover varied business scenarios.

To quote a few examples, you can account for:

- Increase in Tax Liability and Input Tax Credit due to:

- Import of Services

- Purchase from Unregistered Dealer

- Purchase Under Reverse Charge from Registered Dealer

- Penalty

- Others

- Decrease in Tax Liability due to:

- Cancellation of Advance Receipts

- Import of Services

- Purchase from Unregistered Dealer

- Purchase Under Reverse Charge from Registered Dealer

- Reversal of Input Tax Credit due to:

- Import of Services

- Ineligible Credit

- Purchase from Unregistered Dealer

- Purchase Under Reverse Charge from Registered Dealer

With the Additional Nature of Adjustments, you can ensure that the vouchers appear in the appropriate sections in GSTR-1 and GSTR-3B.

Adjustments Against Input Tax Credit (ITC) under GST

You can use the ITC of integrated tax (IGST), central tax (CGST), and state tax (SGST)/union territory tax (UTGST) to set off the liability created for IGST, CGST, and SGST/UTGST in TallyPrime, respectively.

The order in which tax credit can be set off is given below:

|

Additional Details |

Ledgers to be Debited and Credited |

|

Input Tax Credit |

Set off against the liability |

|

CGST |

CGST (set off complete liability) and then IGST (in that order) |

|

IGST |

Integrated tax (set off complete liability) Remaining credit, if any, to be utilised to pay CGST, or SGST/UTGST, in any order and any proportion |

|

SGST/UTGST |

SGST/UTGST (set off complete liability) and then IGST (in that order) |

In TallyPrime, you can raise an RCM tax liability and then set off your taxes with ITC using a journal voucher.

If you want to know how to raise a liability for RCM purchases and claim ITC, then refer to the Raise Tax Liability and Input Tax Credit section in the RCM Purchases Under GST in TallyPrime topic.

In this section:

- Scenarios for adjustments against Input Tax Credit

- GST adjustment in TallyPrime for increase of Input Tax Credit

- GST adjustment for reversal of ITC

Scenarios for adjustments against Input Tax Credit

|

Scenario |

Debit Ledger |

Credit Ledger |

|

Paying CGST, when only CGST credit is available |

|

Credit the CGST ledger to set off the payable amount of the available ITC. |

|

Paying CGST, when CGST and IGST credits are available |

|

|

|

Paying SGST/UTGST, when only SGST credit is available |

|

Credit the SGST/UTGST to set off the payable amount of the available ITC. |

|

Paying SGST/UTGST, when SGST/UTGST and IGST credits are available |

|

|

|

Paying IGST, when only IGST credit is available |

|

Credit the IGST ledger to set off the payable amount of the available ITC. |

|

Paying IGST, when IGST, CSGT and SGST/UTGST credits are available |

|

|

|

Paying cess liability, when only cess credit is available |

|

Credit the cess ledger to set off the payable amount of the available ITC. |

GST adjustment for increase in Input Tax Credit

If you have availed ITC on purchases other than that reported on the purchases in GSTR-3B, then you can record a journal voucher in TallyPrime to adjust for the increase in ITC.

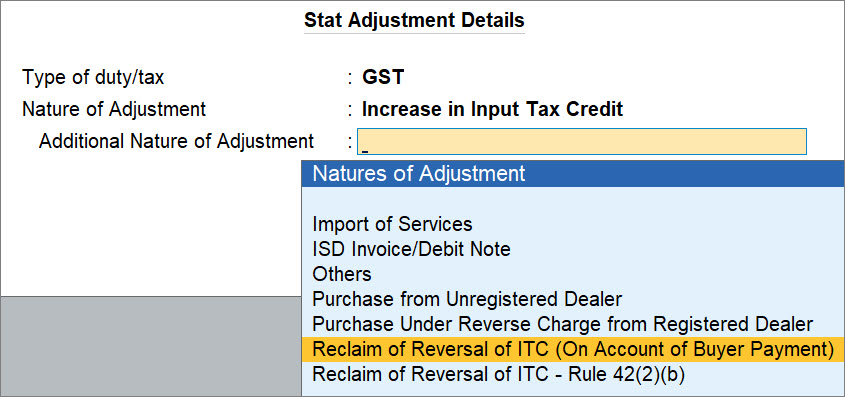

- In a Journal Voucher, specify statutory adjustment details.

- Press Alt+J (Stat Adjustment).

The Stat Adjustment Details screen appears. - Type of duty/tax: GST.

- Nature of Adjustment: Increase in Input Tax Credit.

- Additional Nature of Adjustment: Reclaim of Reversal of ITC (On Account of Buyer Payment).

You can select the appropriate nature of transaction depending on the adjustment scenario. Accordingly, you can select the applicable debit and credit ledgers for the adjustment done, as mentioned in the Nature of Adjustment for Increase in Input Tax Credit table.

- Press Alt+J (Stat Adjustment).

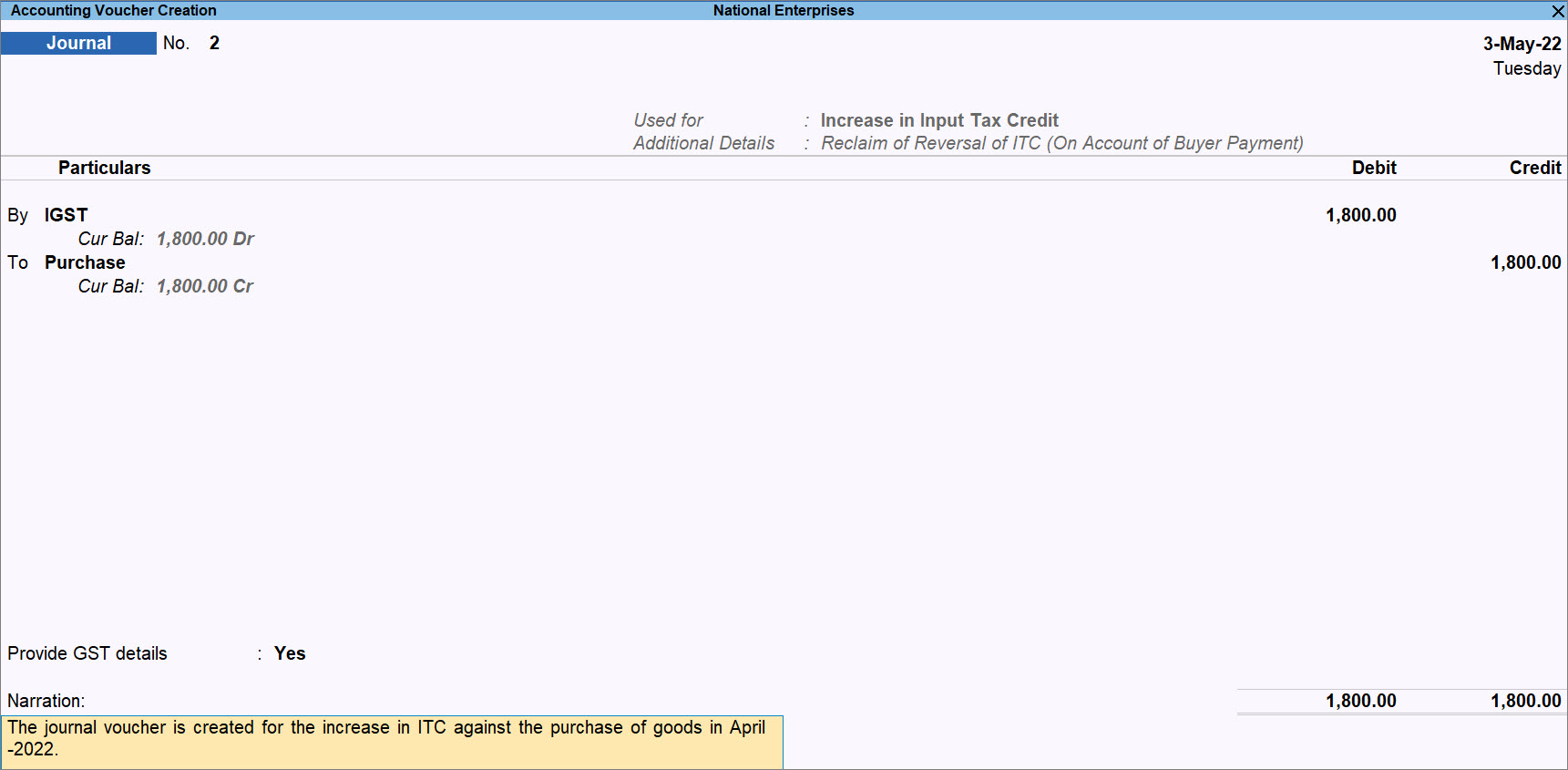

- Add Debit and Credit ledgers and enter their amounts.

- Under By (Debit), select the tax ledgers, as applicable, and enter the amount of ITC.

- Under To (Credit), select the purchase or expense ledger, as applicable, and enter the amount of ITC.

Once you select the ledger under To (Credit), the Inventory Allocations screen appears. You can select stock items and provide Quantity and Rate, if needed.

- Provide other necessary details, as needed, and press Ctrl+A to save.

A sample journal voucher recorded for the increase in ITC appears as shown below:

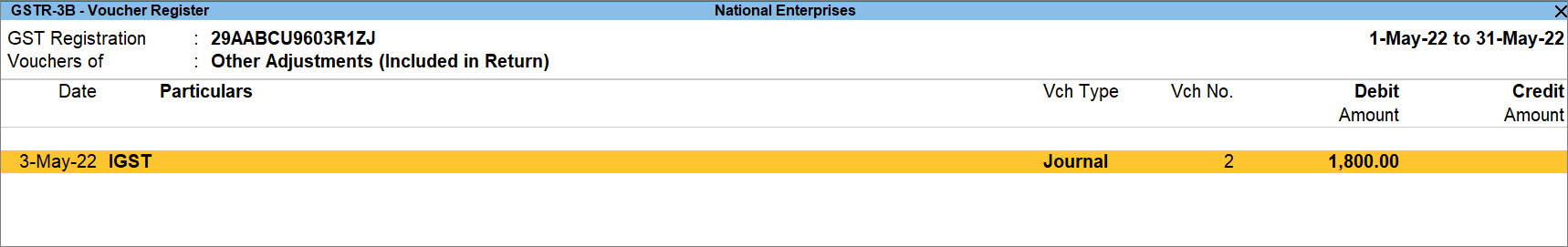

The voucher gets included in the return for the period and appears in GSTR-3B as Other Adjustments.

Nature of Adjustment for Increase in Input Tax Credit

|

Additional Natures of Adjustment |

Ledgers to be Debited and Credited |

| Import of Services |

Debit – IGST or SGST/UTGST and CGST, as applicable Credit – Imported purchases or expense ledger |

| ISD Invoice/Debit Note |

Debit – IGST or SGST/UTGST and CGST, as applicable Credit – Branch Office ledger |

| Others |

Debit – IGST or SGST/UTGST and CGST, as applicable Credit – Purchase or expenses ledger |

| Purchase from Unregistered Dealer |

Debit – IGST or SGST/UTGST and CGST, as applicable Credit – Purchase or expenses ledger |

| Reclaim of Reversal of ITC (On Account of Buyer Payment) |

Debit – IGST or SGST/UTGST and CGST, as applicable Credit – Purchase or expenses ledger |

| Reclaim of Reversal of ITC – Rule 42(2)(b) |

Debit – IGST or SGST/UTGST and CGST, as applicable Credit – Purchase or expenses ledger |

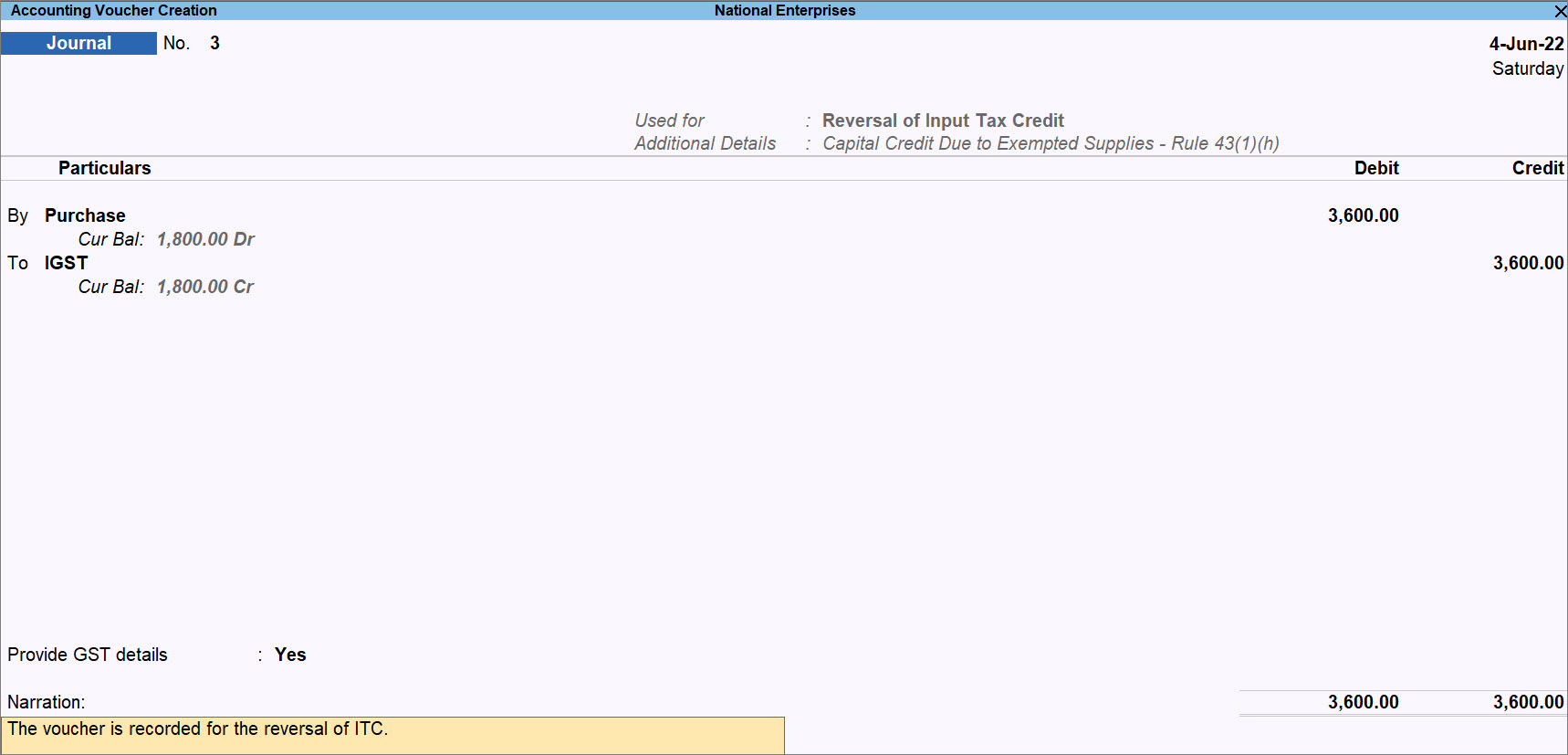

GST adjustment for reversal of ITC

In case of decrease in ITC, you will need to reverse the ITC.

Reversal of ITC can be done for trading goods, capital goods, goods meant for self-consumption and services. You can reverse the ITC using a journal voucher.

Follow the procedure for the increase in Input Tax Credit with the following changes.

- In a Journal Voucher, specify statutory adjustment details.

- Press Alt+J (Stat Adjustment).

The Stat Adjustment Details screen appears. - Type of duty/tax: GST.

- Nature of Adjustment: Reversal of Input Tax Credit.

- Additional Nature of Adjustment: Capital Credit Due to Exempted Supplies – Rule 43(1)(h).

You can select the appropriate nature of transaction depending on the adjustment scenario. Accordingly, you can select the applicable debit and credit ledgers for the adjustment done, as mentioned in the Nature of Adjustment for Reversal of Input Tax Credit table.

- Press Alt+J (Stat Adjustment).

- Add Debit and Credit ledgers and enter their amounts.

- Under By (Debit), select the purchase, expense, or current assets ledger, as applicable.

- Under To (Credit), select the tax ledgers, as applicable and enter the amount of Input Tax Credit.

- Provide other necessary details, as needed, and press Ctrl+A to save.

A sample journal voucher recorded for the reversal of ITC appears as shown below:

Natures of Adjustment for Reversal of Input Tax Credit

|

Additional Natures of Adjustment |

Ledgers to be Debited and Credited |

|

Capital Credit Due to Exempted Supplies – Rule 43(1)(h) |

Debit – Purchase, expenses or current assets ledger Credit – Integrated tax and cess ledgers |

|

Exempt and Non-Business Supplies – Rule 42 (1)(m) |

Debit – Purchase, expenses or current assets ledger Credit – Central and state tax or integrated tax, and cess ledgers |

|

Import of Services |

Debit – Current assets ledger Credit – Central and state tax or integrated tax, and cess ledgers |

|

Ineligible Credit |

Debit – Current assets ledger Credit – Central and state tax or integrated tax, and cess ledgers |

|

ISD Credit Note Rule 39(1)(j)(ii) |

Debit – Current assets ledger Credit – Integrated tax and cess ledgers |

|

Non-Payment to the Supplier – Rule 37(2) |

Debit – Purchase, expenses or current assets ledger Credit – Central and state tax or integrated tax, and cess ledgers |

|

On Account of Claiming More – Rule 42(2)(a) |

Debit – Purchase, expenses, or current assets ledger Credit – Central and state tax or integrated tax, and cess ledgers |

| Others |

Debit – Purchase, expenses, current assets ledger Credit – Central and state tax or integrated tax, and cess ledgers |

|

Purchase from Unregistered Dealer |

Debit – Expenses/current assets ledger Credit – Central and state tax or integrated tax, and cess ledgers |

| Purchase Under Reverse Charge from Registered Dealer |

Debit – Expenses/current assets ledger Credit – Central and state tax or integrated tax, and cess ledgers |

If you want to know how to record a journal voucher for the reversal of Input Tax Credit in TallyPrime Release 2.1 or earlier releases, then click here

- Gateway of Tally > Vouchers > press F7 (Journal).

Alternatively, press Alt+G (Go To) > Create Voucher > press F7 (Journal). - Press Alt+J (Stat Adjustment) , select the options as shown below:

- Select the required Additional Details.

- Press Enter to save and return to the journal voucher.

- In the journal voucher, debit the expense or party ledger, and credit the integrated tax, central tax, state tax/UT tax or cess ledgers.

- Accept the screen. As always, you can press Ctrl+A to save.

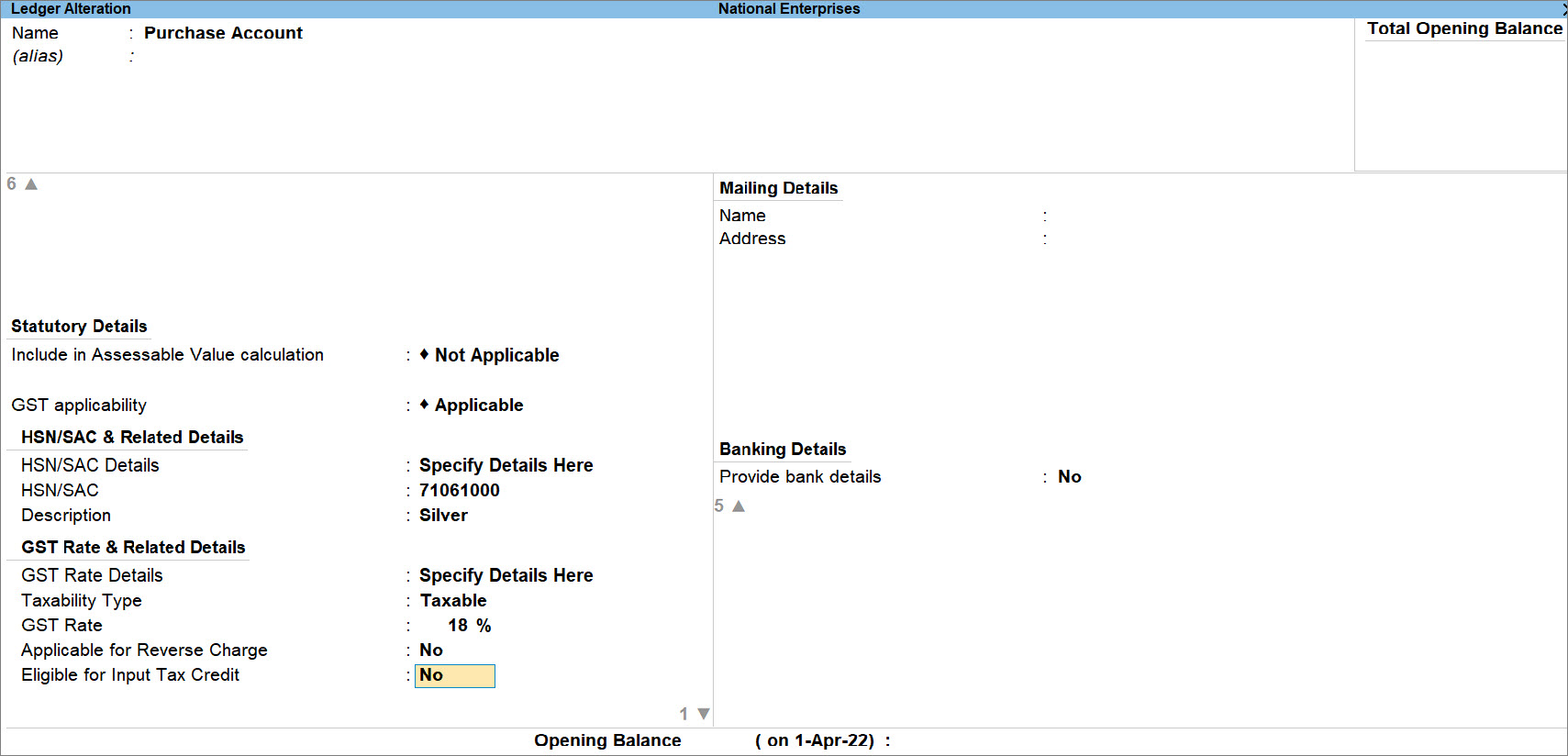

GST Adjustment in TallyPrime for Ineligible Input Tax Credit

In some situations, stock items may be eligible at the time of purchase. However, the stock items later becomes ineligible, because of a new rule introduced by the department. In such cases, you can record a journal voucher to reverse it.

You can record purchases of stock items on which ITC cannot be claimed, by setting the option Eligible for Input Tax Credit to No in the respective group/ledger or stock group/item.

In this section:

- Ineligibility of tax credit during purchases

- Reversal of ITC due to Ineligibility

Setting up purchase ledger with ITC Ineligibility

There may be a scenario in which you cannot claim ITC on the voucher, as the services availed will be ineligible for ITC.

In TallyPrime, you can ensure that the purchase ledger you use in a purchase voucher is not eligible for ITC.

- Press Alt+G (Go To) > Alter Master > Ledger > type or select the purchase ledger and press Enter.

- Eligible for Input Tax Credit: No.

If you do not see this option, then press F12, set Eligible for Input Tax Credit to Yes and press Ctrl+A.

If you have recorded some vouchers using the ledger or have set the configuration at least once, then you will get a screen to set the Effective Date. The ledger becomes ineligible for Input Tax Credit right from the date entered under Effective Date.

- As always, press Ctrl+A to save the ledger.

Henceforth, whenever you use this ledger in a purchase voucher, the voucher will not be considered for ITC.

Reversal of ITC due to Ineligibility

There may be purchases on which you have claimed ITC either accidentally or the purchases must be eligible for ITC at the time of voucher creation. However, later, you need to reverse the tax credit due to ITC ineligibility.

To configure purchase ineligible for ITC, refer to Setting up purchase ledger with ITC Ineligibility.

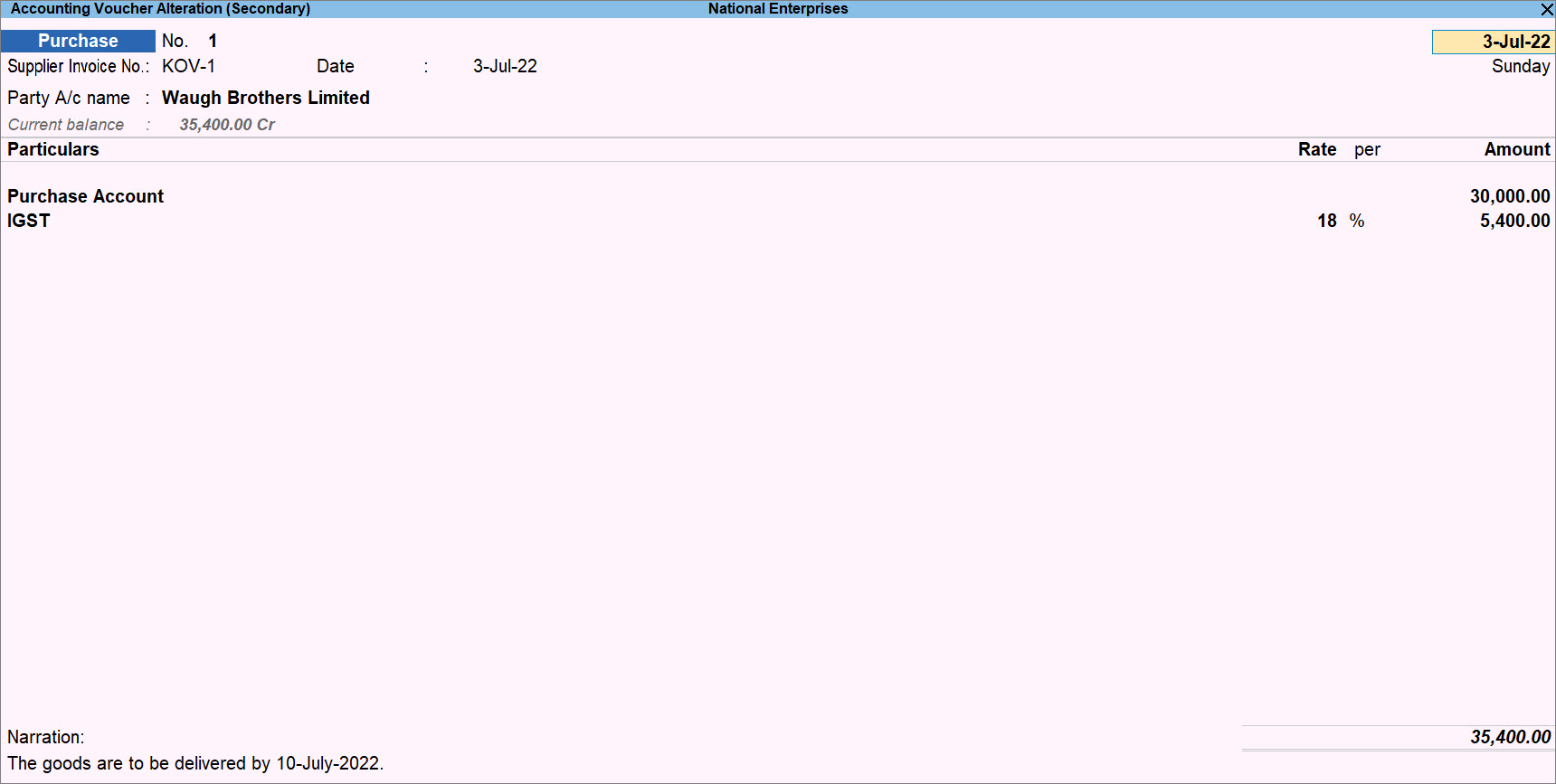

The purchase voucher on which tax credit is claimed appears as shown below:

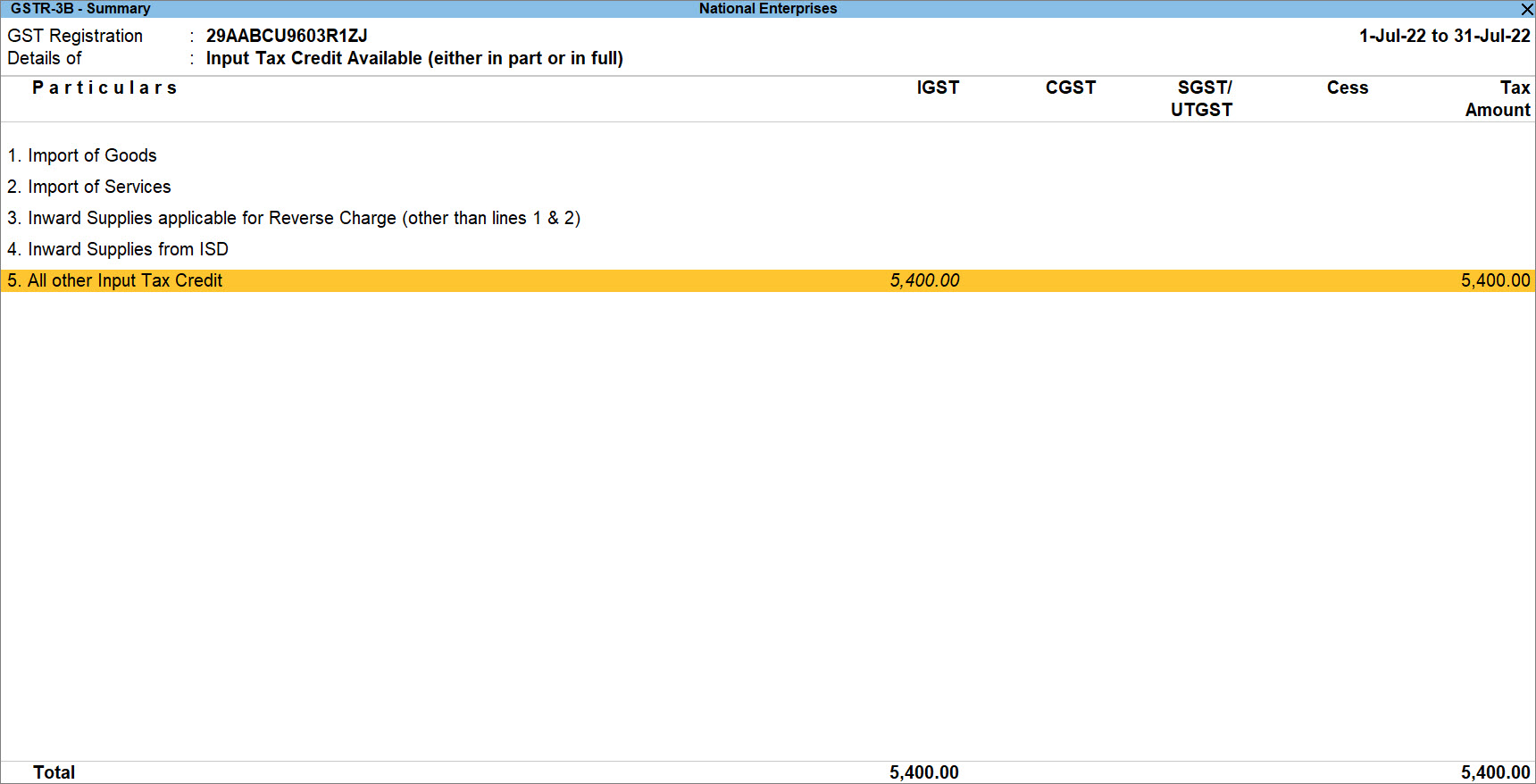

In GSTR-3B, this voucher appears in GSTR-3B under the Eligible for Input Tax Credit section as All other Input Tax Credit.

Later on, you realise the purchase is ineligible for ITC. You can reverse the tax credit by recording a journal voucher.

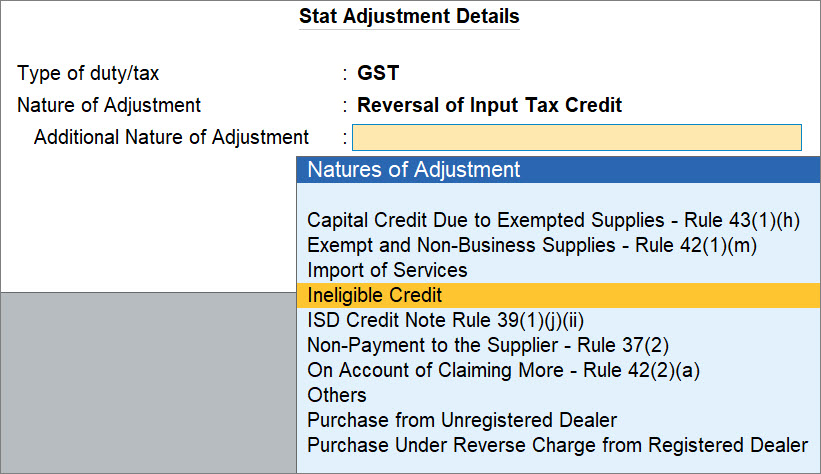

- In a Journal Voucher, specify statutory adjustment details.

- Press Alt+J (Stat Adjustment).

The Stat Adjustment Details screen appears. - Type of duty/tax: GST.

- Nature of Adjustment: Reversal of Input Tax Credit.

- Additional Nature of Adjustment: Ineligible Credit.

- Press Alt+J (Stat Adjustment).

- Add Debit and Credit ledgers and enter their amounts.

- Under By (Debit), select the purchase or expense ledger, as applicable and enter the amount of Input Tax Credit.

Once you select the ledger under By (Debit), the Inventory Allocations screen appears. You can select stock items and provide Quantity and Rate, if needed.

- Under To (Credit), select the tax ledgers, as applicable and enter the amount of Input Tax Credit.

- Under By (Debit), select the purchase or expense ledger, as applicable and enter the amount of Input Tax Credit.

- Provide other necessary details, as needed, and press Ctrl+A to save.

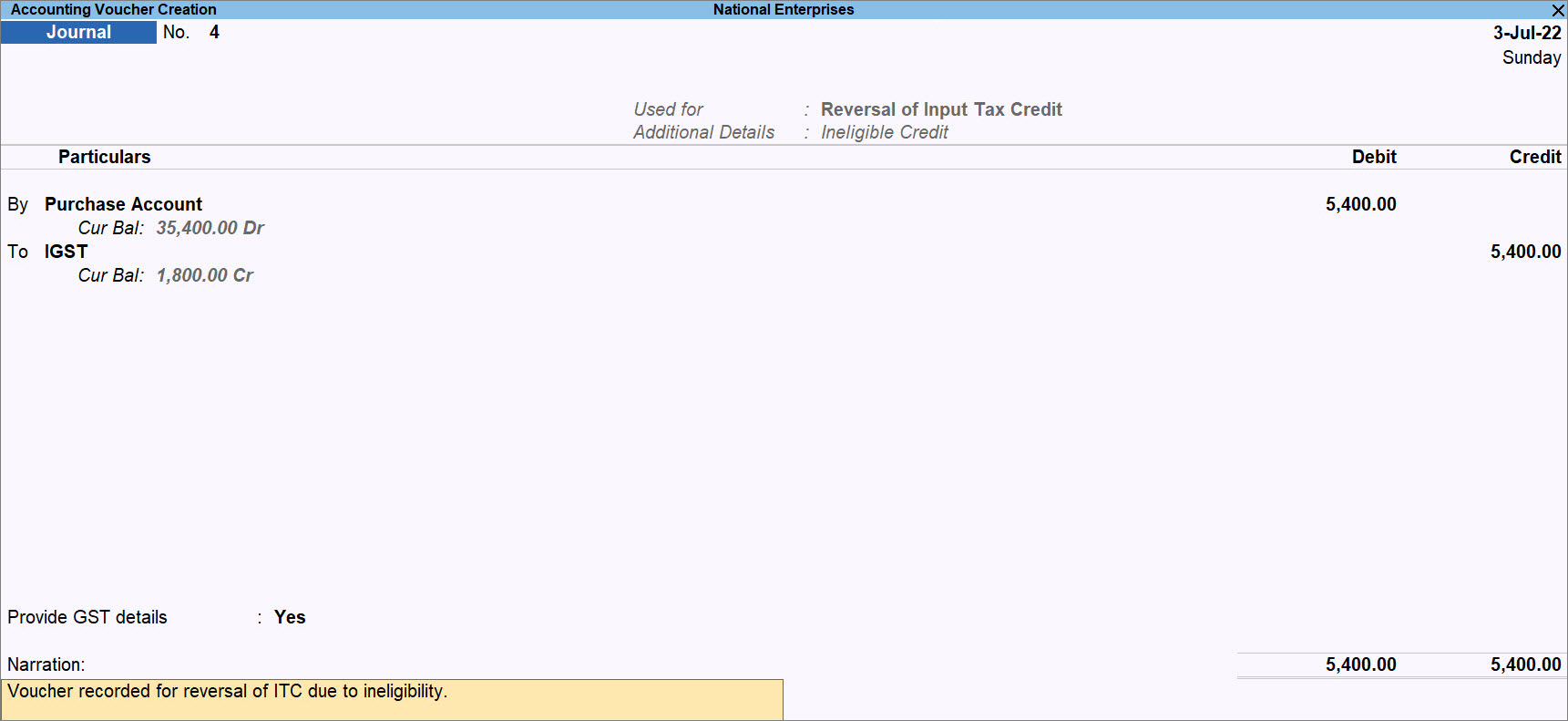

A sample journal voucher recorded for the reversal of ITC due to ineligibility appears as shown below:

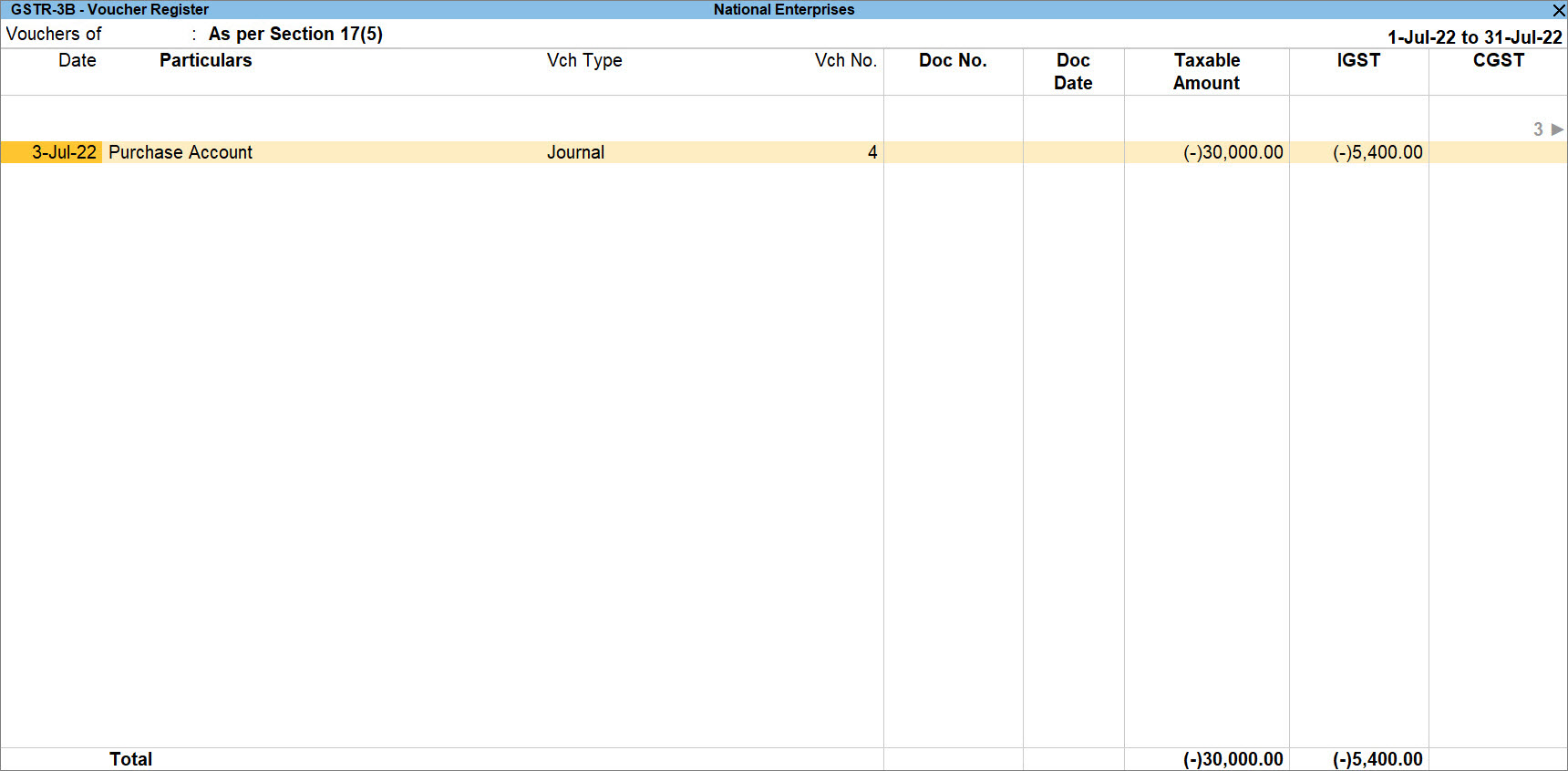

The voucher gets included in the return for the period in the Ineligible for Input Tax Credit section under As per Section 17(5) of GSTR-3B.

GST Adjustment for Increase in Tax Liability

If you need to pay the tax more than that recorded in TallyPrime, then you will need to record a journal voucher for the increase in tax liability.

For example, when you purchase goods and services liable for a reverse charge, you need to create an RCM tax liability in TallyPrime.

There can be two scenarios – increase in tax liability and decrease in tax liability, and you will need to make GST adjustments in both the cases.

To know more about the RCM transactions and how to raise RCM tax liability in TallyPrime, refer to the Record Reverse Charge Mechanism (RCM) Purchases Under GST in TallyPrime topic.

In TallyPrime, you will need to account for the increase in tax liability in scenarios as shown in the Stat Adjustment Details screen while creating a journal voucher for adjustment.

Natures of Adjustment and section or topic for reference

GST Adjustment for Decrease in Tax Liability

You may have raised tax liability in TallyPrime. However, there is a decrease in tax liability and you need to make adjustments for it. You can record a journal voucher for the same.

Similar to the experience when you record a journal voucher for the increase in tax liability, you get the options to select for the decrease in tax liability in the Stat Adjustment Details screen.

Natures of Adjustment and section or topic for reference

The order in which tax credit can be offset is given below:

|

Input Tax Credit |

Set-off against the Liability |

|

Central tax |

Central tax (set-off complete liability) and then integrated tax (in that order). |

|

Integrated tax |

Integrated tax (set-off complete liability). Remaining credit, if any, to be utilised to pay central, or state tax/UT tax, in any order and any proportion. |

|

State tax/UT tax |

State tax/UT tax (set-off complete liability) and then integrated tax (in that order). |

If you want to know how to record a journal voucher for decrease in tax liability in TallyPrime Release 2.1 or earlier releases, click Scenario Debit Ledger Credit Ledger Paying central tax liability, when only central tax credit is available. Credit the central tax ledger to set-off the payable amount to the extent of credit available. Paying central tax liability, when central tax and integrated tax credits are available. Paying state tax liability, when only state tax credit is available. Credit the state tax ledger to set-off the payable amount to the extent of credit available. Paying state tax liability, when state tax and integrated tax credits are available. Paying integrated tax liability, when only integrated tax credit is available. Credit the integrated tax ledger to set-off the payable amount to the extent of credit available. Paying integrated tax liability, when integrated tax, central tax and state tax/UT tax credits are available. Paying cess liability, when only cess credit is available. Credit the cess ledger to set-off the payable amount to the extent of credit available.

Alternatively, press Alt+G (Go To) > Create Voucher > press F7 (Journal).

Interest, Penalty, Late Fee, and Others in GST

You can record a journal voucher to raise the liability towards interest, penalty, late fee, or other dues.

Interest: Interest has to be paid in case of:

- Delay in the payment of tax.

- Input tax credit claimed more than the applicable amount.

- GST paid is lesser than what is required to be paid.

Late Fees: When there is a delay in filing GST returns, the departments charges an amount as Late Fees.

Penalty: In case of delay in filing GSTR, not filing GSTR, incorrect invoicing, fraudulent activities, and other such scenarios, you need to pay penalty to the department.

Others: Amount to be paid for many reasons, such as:

- Not registered under GST, despite the requirement by the law

- Absence or reduction of TDS deductions

- Absence or reduction of TCS collection

- Any other violation of the rules that will lead to litigation

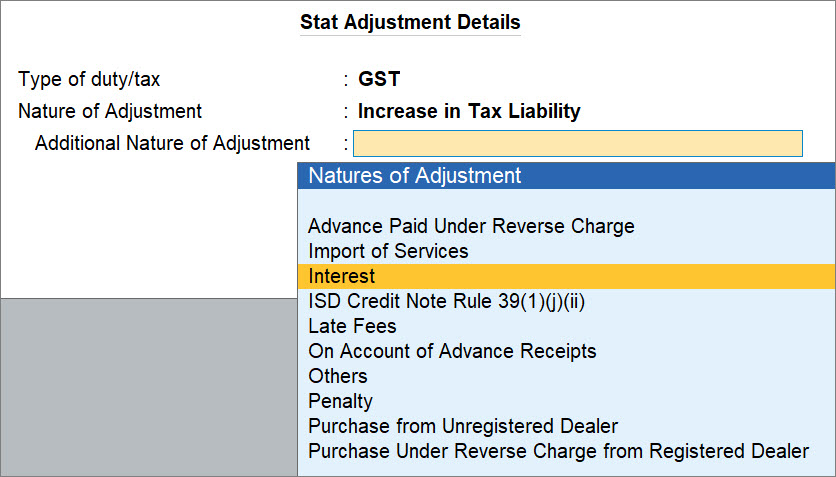

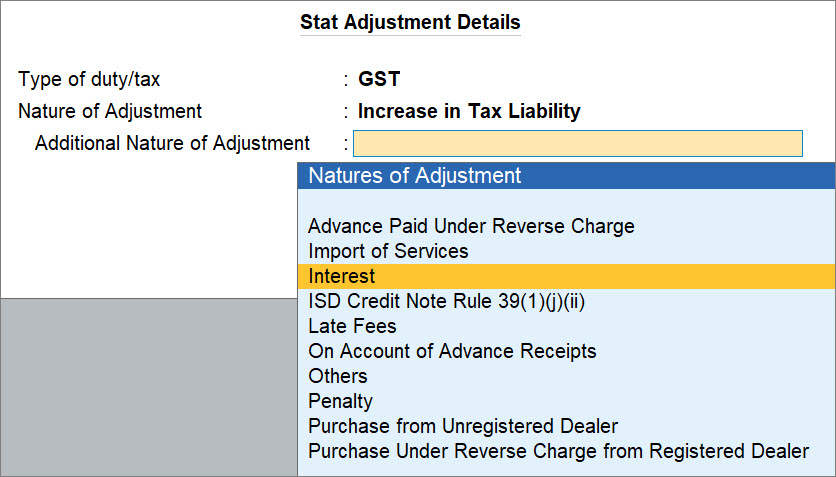

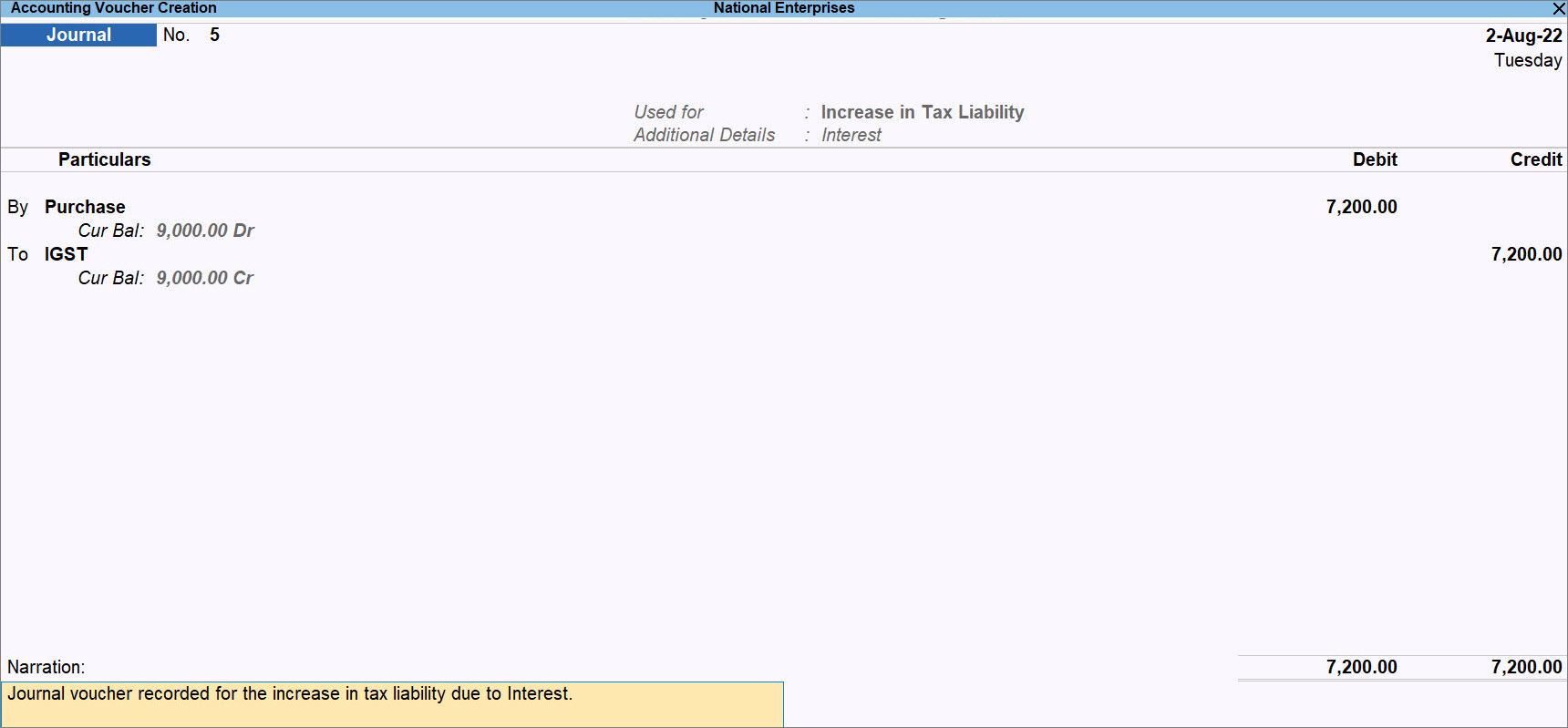

- In a Journal Voucher, specify statutory adjustment details.

- Press Alt+J (Stat Adjustment).

The Stat Adjustment Details screen appears. - Type of duty/tax: GST.

- Nature of Adjustment: Increase in Tax Liability.

- Additional Nature of Adjustment: Interest.

You can select the appropriate nature of transaction depending on the adjustment scenario. Accordingly, you can select the applicable debit and credit ledgers for the adjustment done, as mentioned in the Natures of Adjustment for increase in tax liability due to Interest, Penalty, Late Fee, and Others table.

- Press Alt+J (Stat Adjustment).

- Add Debit and Credit ledgers and enter their amounts.

- Under By (Debit), select the purchase or expense ledger, as applicable and enter the amount of tax.

Once you select the ledger under By (Debit), the Inventory Allocations screen appears. You can select stock items and provide Quantity and Rate, if needed.

- Under To (Credit), select the tax ledgers, as applicable and enter the amount of tax.

- Under By (Debit), select the purchase or expense ledger, as applicable and enter the amount of tax.

- Provide other necessary details, as needed, and press Ctrl+A to save.

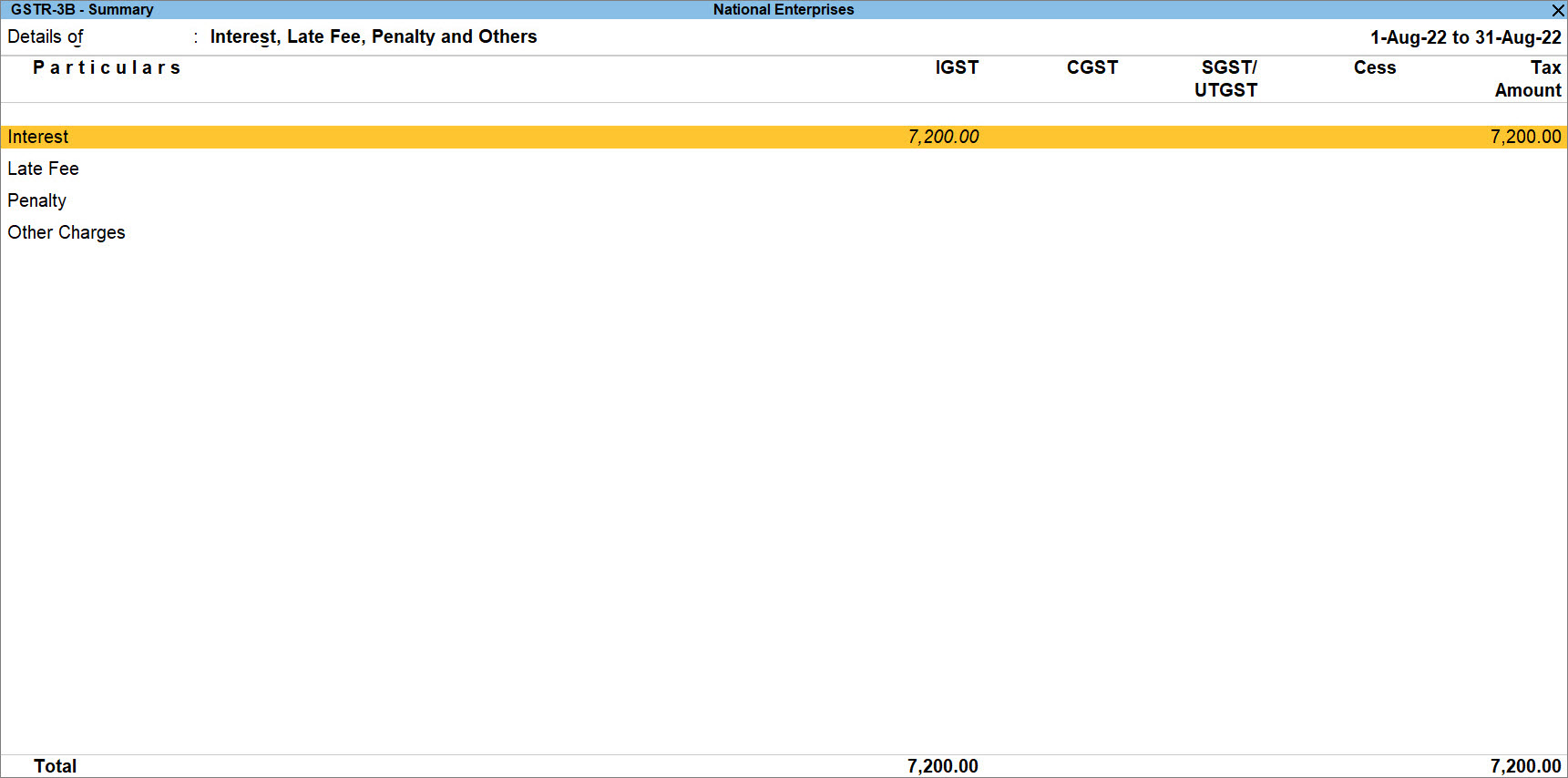

A sample journal voucher recorded for the increase in tax liability due to interest in TallyPrime, is shown below:

The voucher gets included in the return for the period in the 6.1 Interest, Late Fee, Penalty and Others section of GSTR-3B.

Natures of Adjustment for increase in tax liability due to Interest, Penalty, Late Fee and Others

The table documents the ledgers to be debited and credit while recording the increase in tax liability because of Interest, Penalty, Late Fee, and Other Dues.

|

Natures of Adjustment |

Ledgers to be Debited and Credited |

|

Interest |

Debit – Purchase, expenses or party ledger Credit – Central and state tax or integrated tax, and cess ledgers |

| Penalty |

Debit – Purchase, expenses or party ledger Credit – Central and state tax or integrated tax, and cess ledgers |

|

Late Fees |

Debit – Purchase, expenses or party ledger Credit – Central and state tax or integrated tax, and cess ledgers |

|

Others |

Debit – Purchase, expenses or current assets ledger Credit – Central and state tax or integrated tax, and cess ledgers |

If you want to know how to record a journal voucher for Interest, Liability, Late Fees, and Others in TallyPrime Release 2.1 or earlier releases, then click here

- Gateway of Tally > Vouchers > press F7 (Journal).

Alternatively, press Alt+G (Go To) > Create Voucher > press F7 (Journal). - Press Alt+J (Stat Adjustment) , select the options as shown below:

- Type of duty/tax – GST.

- Nature of Adjustment – Increase of Tax Liability.

- Additional Details – Interest.

- Press Enter to save and return to the journal voucher.

- Debit the expenses or party ledger, and enter the amount of interest liability.

- Credit the ledger grouped under Current Liabilities.

- Accept the screen. As always, you can press Ctrl+A to save.

Similarly, you can record the journal voucher by selecting the Additional Details in the Stat Adjustment Details as:

- Penalty, for penalty payable.

- Late Fee, for late fee payable.

- Others, for other dues payable.

GST Adjustment for Refunds

This section is not relevant to the users using TallyPrime Release 3.0 or later releases.

Your business may involve refund in many scenarios that majorly include interest, late fees, penalty, or others. In such cases, you can record a journal voucher for tax adjustments.

Natures of Adjustment and ledgers to be debited and credit

| Additional Details | Ledgers to be Debited and Credited |

|

Interest |

Debit – Bank ledger Credit – Central and state tax or integrated tax, and cess ledgers, or current assets ledger |

|

Late Fees |

Debit – Bank ledger Credit – Central and state tax or integrated tax, and cess ledgers, or current assets ledger |

|

Others |

Debit – Bank ledger Credit – Central and state tax or integrated tax, and cess ledgers, or current assets ledger |

|

Penalty |

Debit – Bank ledger Credit – Central and state tax or integrated tax, and cess ledgers, or current assets ledger |

Refund of Tax Credit under GST

This section is not relevant to the users using TallyPrime Release 3.0 or later releases.

You can claim the excess amount paid as tax, interest, penalty, late fee or other dues as refund using a journal voucher.

- Gateway of Tally > Vouchers > press F7 (Journal).

Alternatively, press Alt+G (Go To) > Create Voucher > press F7 (Journal). - Press Alt+J (Stat Adjustment) , select the options as shown below:

- Type of duty/tax – GST.

- Nature of Adjustment – Refund.

- Additional Details – Interest.

- Press Enter to save and return to the Journal voucher.

- Debit the bank ledger, and enter the amount of interest liability.

- Credit the GST ledgers or ledger grouped under Current Assets.

- Accept the screen. As always, you can press Ctrl+A to save.

Similarly, you can record the journal voucher by selecting the Additional Details in the Stat Adjustment Details as:

- Not Applicable, for refund of excess tax payment made.

- Penalty, for refund of excess payment made towards penalty.

- Late Fee, for refund of excess payment made towards late fee.

- Others, refund of excess payment made towards other dues.

Adjustment for Opening Balance

This section is not relevant to the users using TallyPrime Release 3.0 or later releases.

You can record a journal voucher to transfer the closing balance of tax credits of VAT, additional tax, cess, surcharge, CENVAT, service tax, krishi kalyan cess, and special excise duty/additional excise duty as opening balance under GST.

As GST is a new tax structure, the tax credits of previous tax regime will not be automatically carried forward to the GST account. Based on the date from which you want to maintain the books of accounts under GST, you need to carry forward the tax credit to state/central tax by recording a journal voucher.

TCS Adjustment in GST

This section is not relevant to the users using TallyPrime Release 3.0 or later releases.

An e-commerce operator can deduct TCS on the goods and services received. The deductee, who has supplied the goods or rendered the service, can claim the TCS amount as tax credit.

An e-commerce operator can deduct TCS on the goods and services received. The deductee, who has supplied the goods or rendered the service, can claim the TCS amount as tax credit.

- Gateway of Tally > Vouchers > press F7 (Journal).

Alternatively, press Alt+G (Go To) > Create Voucher > press F7 (Journal). - Press Alt+J (Stat Adjustment) , select the options as shown below:

- Type of duty/tax – GST.

- Nature of Adjustment – Increase of Input Tax Credit.

- Additional Details – TCS Adjustment.

- Press Enter to save and return to the Journal voucher.

- Debit the integrated tax/central tax/state tax/UT tax/cess ledger and enter the amount that can be claimed as credit.

- Credit the ledger grouped under Current Assets.

- Accept the screen. As always, you can press Ctrl+A to save.

TDS Adjustment in GST

This section is not relevant to the users using TallyPrime Release 3.0 or later releases.

The government or government agency can deduct TDS on the goods and services received. The deductee, who has supplied the goods or rendered the service, can claim the TDS amount as tax credit. You can record a journal voucher to adjust the TDS amount.

- Gateway of Tally > Vouchers > press F7 (Journal).

- Alternatively, press Alt+G (Go To) > Create Voucher > press F7 (Journal).

- Press Alt+J (Stat Adjustment) , select the options as shown below:

- Type of duty/tax – GST.

- Nature of Adjustment – Increase of Input Tax Credit.

- Additional Details – TDS Adjustment.

- Press Enter to save and return to the Journal voucher.

- Debit the integrated tax/central tax/state tax/UT tax/cess ledger and enter the amount that can be claimed as credit.

- Credit the ledger grouped under Current Assets.

- Accept the screen. As always, you can press Ctrl+A to save.