Account for ISD Credit Under GST in TallyPrime

In your business, you may receive Input Tax Credit (ITC) on common invoices for input services availed by all the branches that have same PAN number but different GSTIN/UIN. For example, your head office may be purchasing certain services availed by all the branches in your business. Subsequently, the ITC will also be distributed among all the branches. In this case, the head office becomes the Input Service Distributor (ISD) that credits IGST or SGST/UTGST and CGST to other branches. The ISD issues an ISD invoice for distribution of ITC, and you will need to account for ISD credit in TallyPrime.

Thereafter, you will need to record ITC availed from the ISD in TallyPrime.

- Press Alt+G (Go To) > Create Voucher > press F7 (Journal).

- Specify statutory adjustment details.

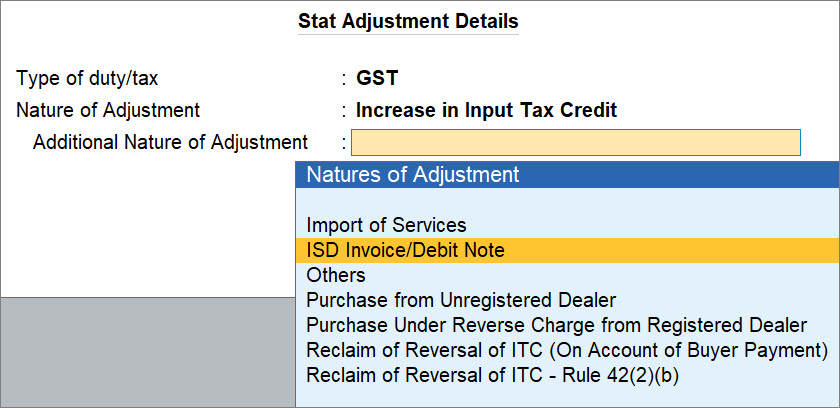

- Press Alt+J (Stat Adjustment).

The Stat Adjustment Details screen appears. - Type of duty/tax: GST.

- Nature of Adjustment: Increase in Input Tax Credit.

- Additional Nature of Adjustment: ISD Invoice/Debit Note.

- Press Alt+J (Stat Adjustment).

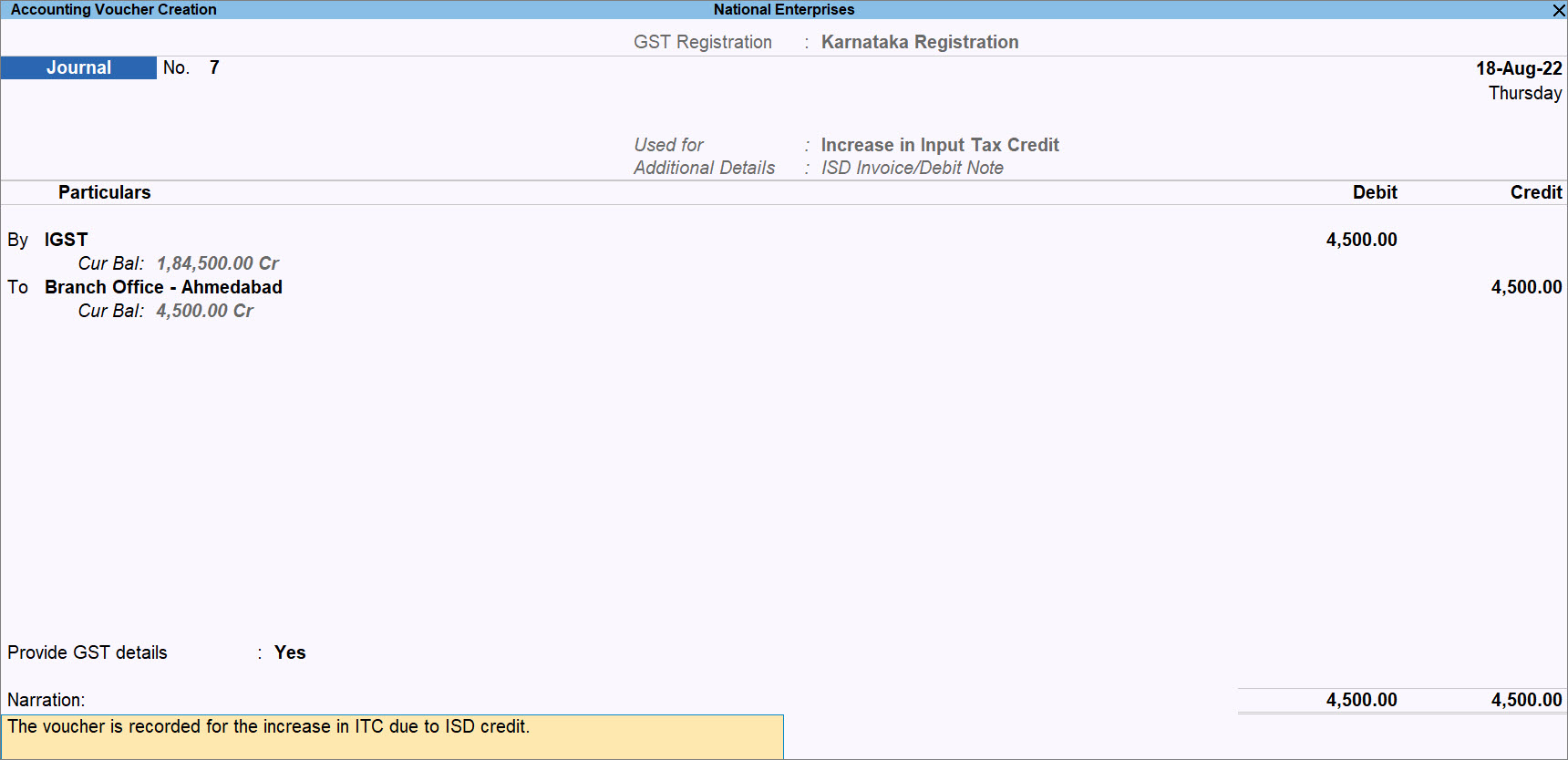

- Under By (Debit), select the tax ledgers, as applicable, and enter the amount of ITC.

- Under To (Credit), select the purchase, expense, or branch account ledger, as applicable, and enter the amount of ITC.

- Provide the details of ISD Invoice.

- Provide GST Details: Yes.

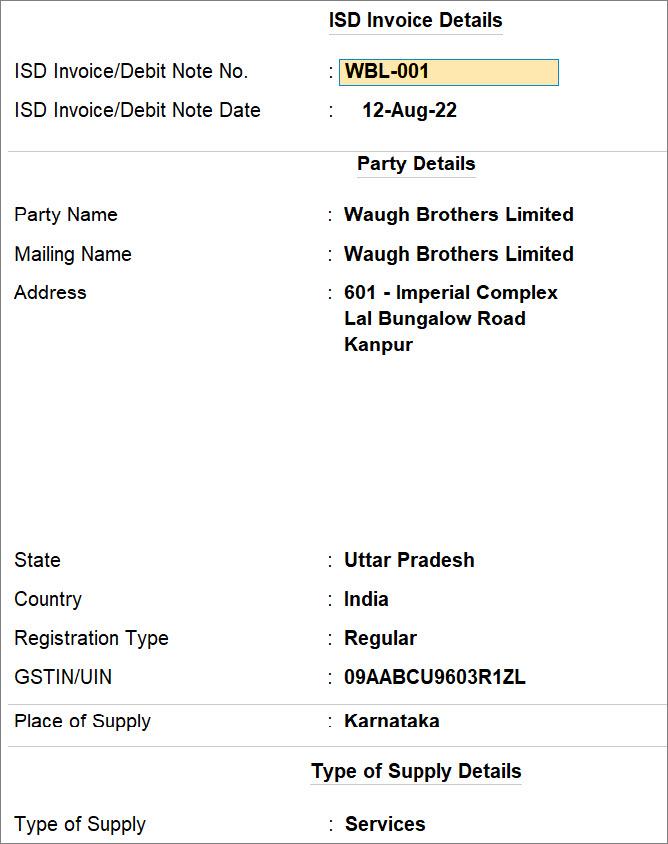

The ISD Invoice Details screen appears. - ISD Invoice/Debit Note No.: Enter the invoice number or debit note number of the invoice or debit note provided by the ISD.

- ISD Invoice/Debit Note Date: Enter the date on which ISD Invoice or Debit Note was provided by the ISD.

- Registration Type: Regular.

- GSTIN/UIN: Enter the GSTIN or UIN of the supplier.

- Place of Supply: The place of supply will be prefilled based on the transaction (sales, purchase, or others).

You can change it, if needed. - Type of Supply: Services.

The others details will be prefilled based on the ledger or information entered in the last journal voucher created for the party.

You can change, if needed.

- Provide GST Details: Yes.

- Provide other necessary details, as needed, and press Ctrl+A.

A sample journal voucher recorded for the increase in ITC due to ISD credit appears as shown below:

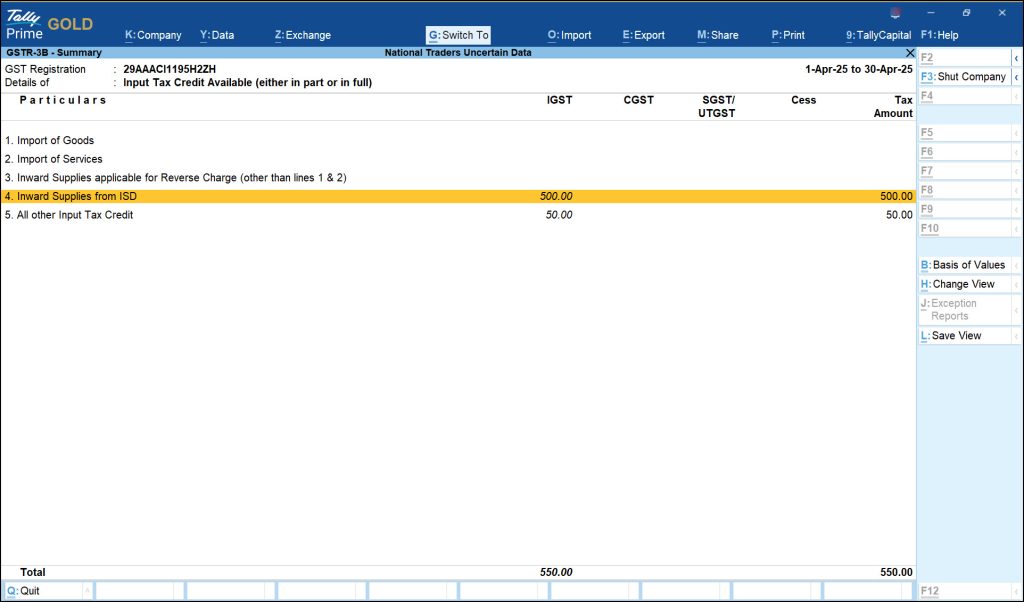

The voucher will be included in return and will appear under 4A: Input Ta Credit Available (Either in part or in full) > Inward supplies from ISD.