Record Import of Services Under GST RCM

All services imported from a different country are liable for reverse charge. TallyPrime helps you in automatically calculating the tax liability once you record a purchase voucher.

The topic Purchases with GST in TallyPrime further showcases the business scenarios that TallyPrime handles with ease.

Let us proceed using the sample company, National Electronics, which arranges IT services from an American agency.

Before you begin | Prerequisites

- Make sure you are familiar with creating Purchase vouchers in TallyPrime.

- Ensure that the service ledger is configured as Applicable for Reverse Charge.

Create Voucher for Import of Services

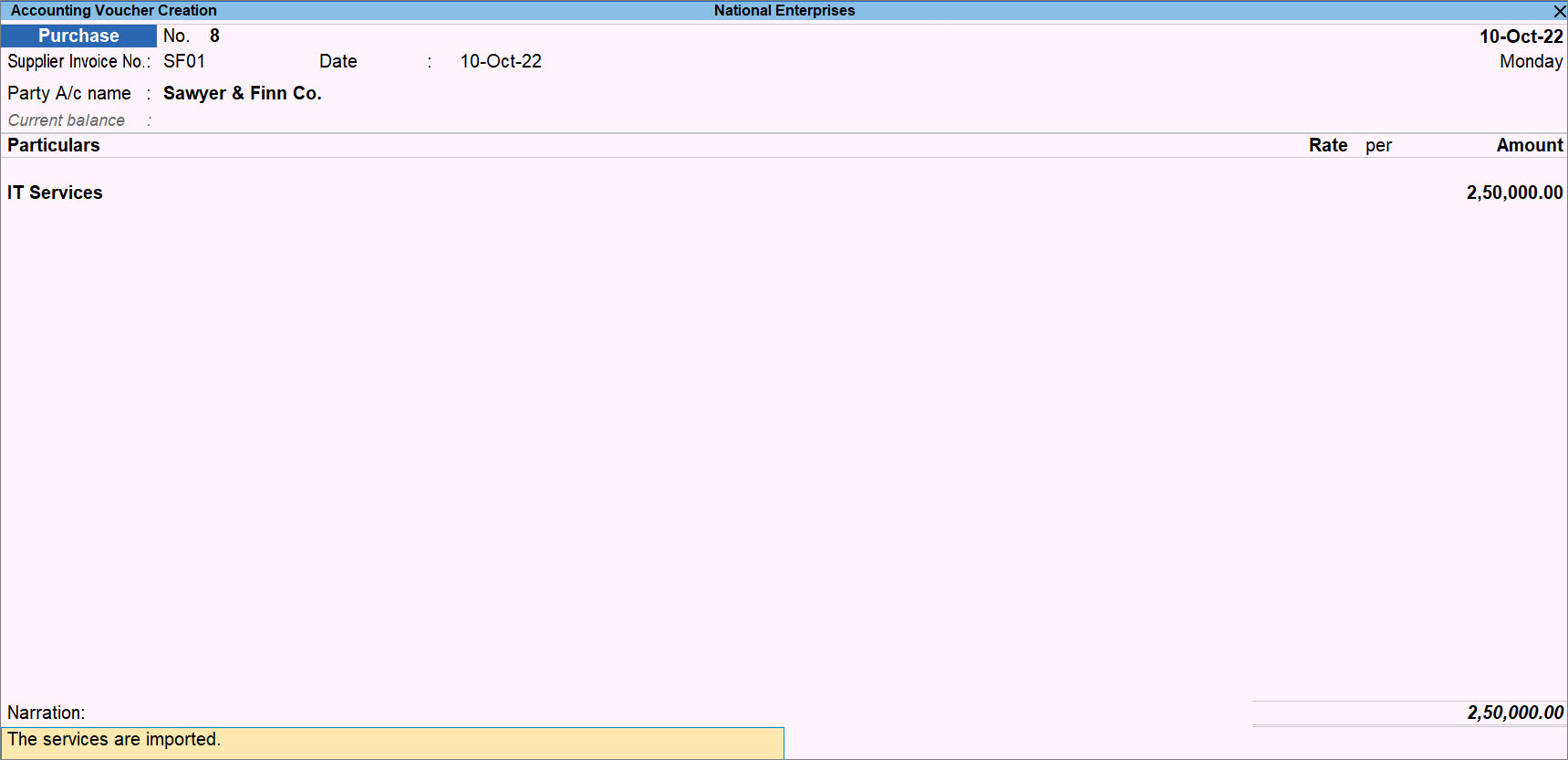

When you record a purchase voucher for import, the tax liability and ITC are auto-calculated.

- Press Alt+G (Go To) > Create Voucher > F9 (Purchase), and press Ctrl+H to choose Accounting Invoice.

- Under Party A/c name, select the ledger of the party located outside India.

- In Party Details, specify the Place of Supply where your company has availed the service.

- Under Particulars, select the service ledger under Purchase Accounts, configured with RCM, and enter the Amount.

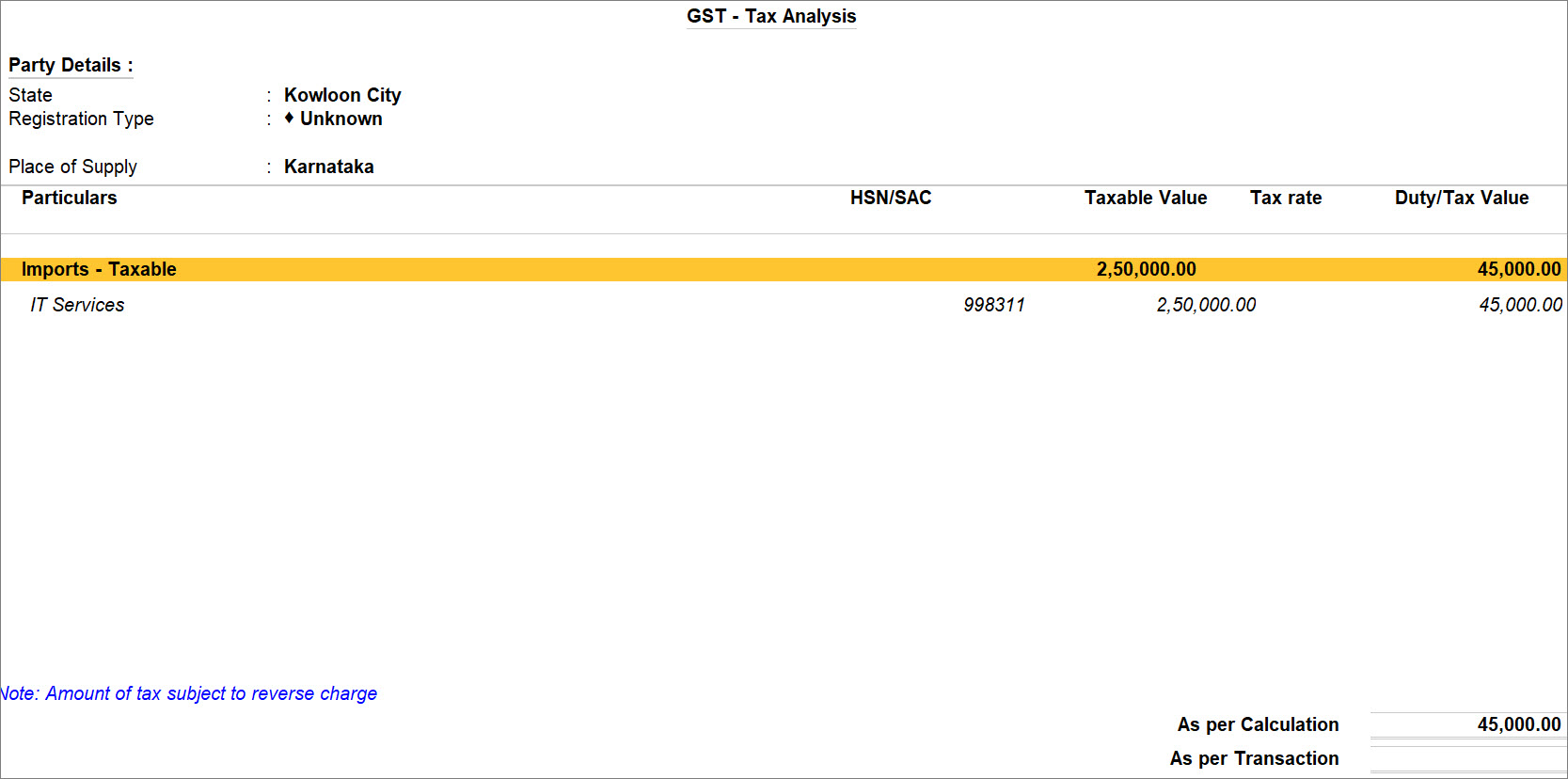

- If you want to view Tax Analysis, then press Alt+A to view GST – Tax Analysis.

You can see that the amount of tax is subjected to reverse charge.

- Save the voucher by pressing Ctrl+A.

The transaction appears in GSTR-3B under 3.1d. Inward Supplies (applicable for Reverse Charge) as Import of Services.

Create Voucher for Courier Services from Outside India

When you avail courier services from outside India, you can record this using a purchase voucher. IGST is applicable for such supplies, under Section 7 of the IGST Act.

- Press Alt+G (Go To) > Create Voucher > F9 (Purchase), and press Ctrl+H to choose Accounting Invoice.

- Press F12 (Configure) and enable Modify GST & HSN/SAC related details.

If you are on Rel 2.1 and earlier, you can see the option as Modify Tax Rate details of GST.

If you do not see this option, set Show more configurations to Yes. - Select the Purchase ledger where the GST rate is defined.

- In GST Details, set the Classification/Nature as Interstate Purchase Taxable.

- Under Party A/c name, select the party ledger with a different country.

- In Party Details, specify the Place of Supply where your company has availed the service.

- Select the IGST ledger.

- Set the option Provide GST details to Yes.

- In Statutory Details, enable Supplies under section 7 of IGST Act.

- Press O to override the values.

Note: If you press Y (Enter) instead of O, then the transaction will appear as an exception in the GST report.

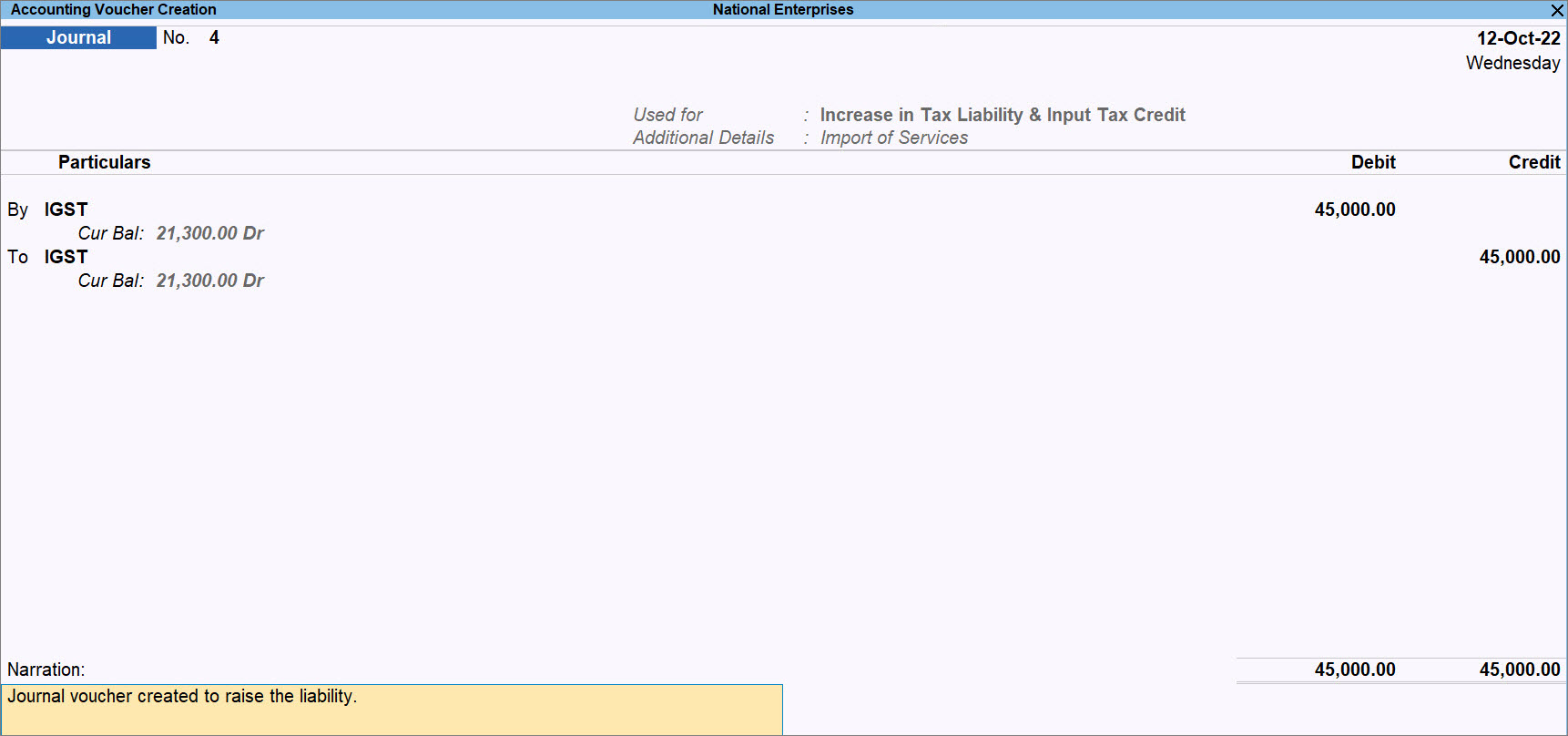

Create Journal Voucher to Raise Tax Liability & Claim ITC

Applicable to TallyPrime Release 2.1 & earlier versions

If you are on TallyPrime Release 2.1 or earlier releases, then you have to raise tax liability and claim ITC using a Journal voucher. In Releases 3.0 and later, this is auto-calculated.

- Press Alt+G (Go To) > Create Voucher > press F7 (Journal).

- Press Alt+J to update the Statutory Adjustment Details:

- Type of duty/tax: GST

- Nature of Adjustment: Increase in Tax Liability & Input Tax Credit

If you want to claim ITC in the subsequent month, then select Increase in Tax Liability. Thereafter, you will need to create a Journal voucher in the subsequent month with the Nature of Adjustment as Increase in Input Tax Credit. - Additional Nature of Adjustment: Import of Services

- Under By (Debit), select the IGST ledger.

- Credit the IGST ledger.

- Under To (Credit), select the IGST ledger.

The screen to calculate the tax appears. - Enter the Rate and Taxable Value, and press Enter.

The Taxable Value is the total value of imported services for which you want to raise the liability in a particular month.

- Under To (Credit), select the IGST ledger.

- Press Ctrl+A to save the details.

The Journal voucher appears in GSTR-3B – Voucher Register under Import of Services.