Download Excel File with Sample Data for Import

Sample Excel Files for the most frequently used scenarios for importing data from Excel worksheets into TallyPrime are listed below. Apart from downloading Sample Excel Files with no data, you can also download the sample files with data from this page and use them for your reference.

If you want to practice importing some sample data by downloading the Sample Excel Files, you can download the data with the corresponding sample files from this page. Before you import, refer to prepare/set up data based on import scenario.

To use the Sample Excel Files for importing your data, delete the sample data, record details of your Masters and Transactions, and directly import the data from the Sample Excel File into TallyPrime.

To know more about how to use Sample Excel Files for importing data, ![]() or refer to Import Data from Excel File Provided by TallyPrime.

or refer to Import Data from Excel File Provided by TallyPrime.

Sample Excel File with Data for Masters

The Sample Excel Files with data for varied types of Masters are listed below for your easy reference. You can download the Zip files by clicking on the Zip file links.

Accounting Masters

Ledger with General Details

- The Excel file contains ledgers with general details such as Customer, Sellers, Sales/Purchase ledger etc.

- Download the zip file from here.

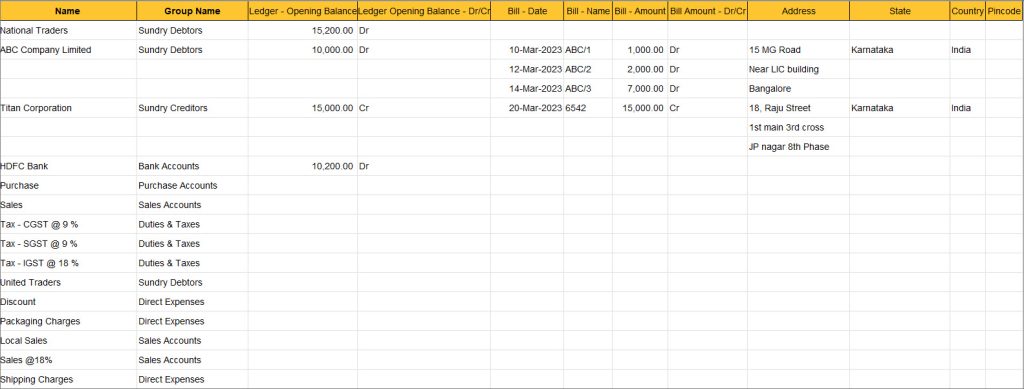

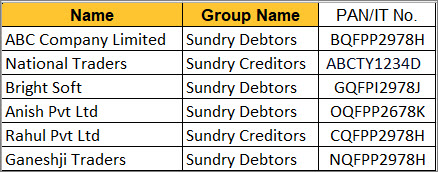

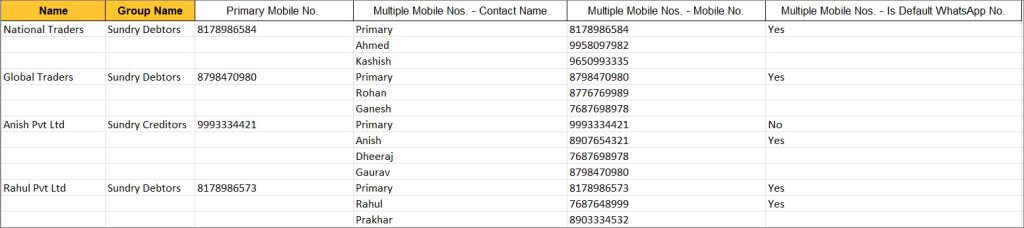

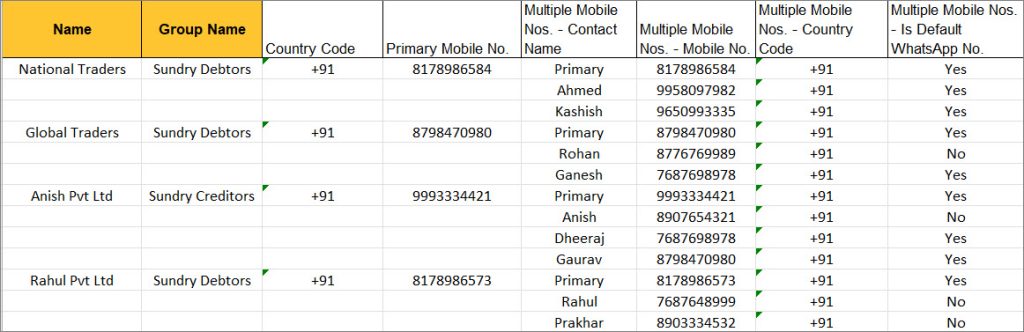

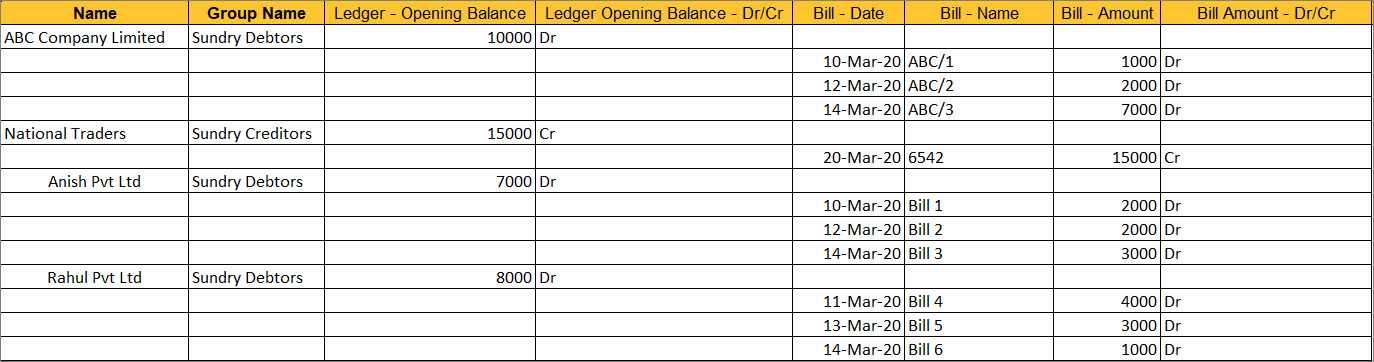

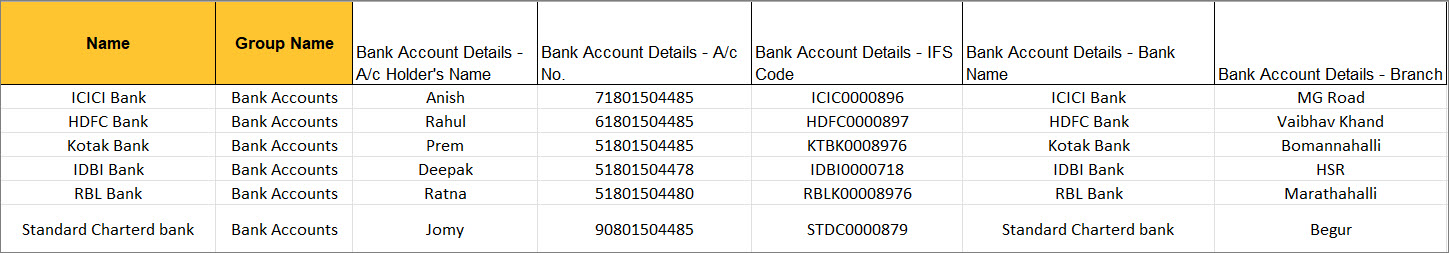

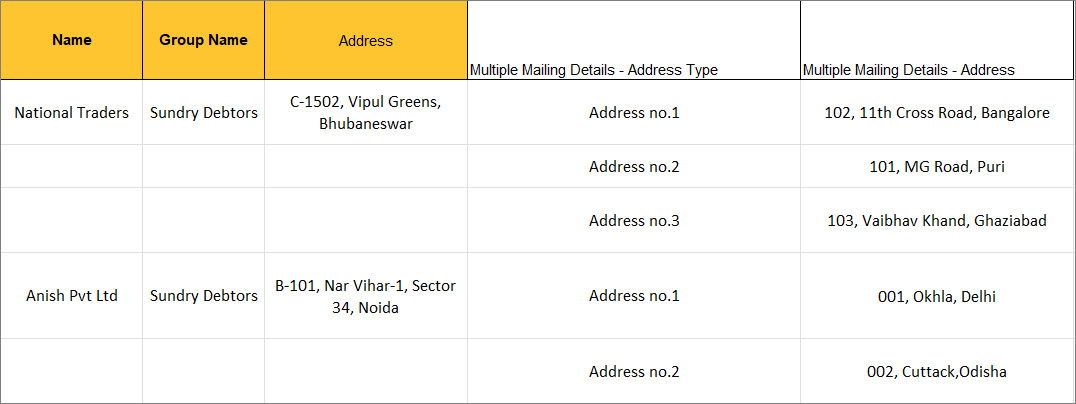

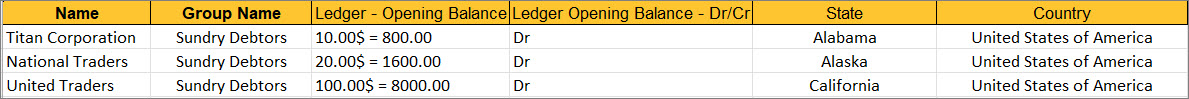

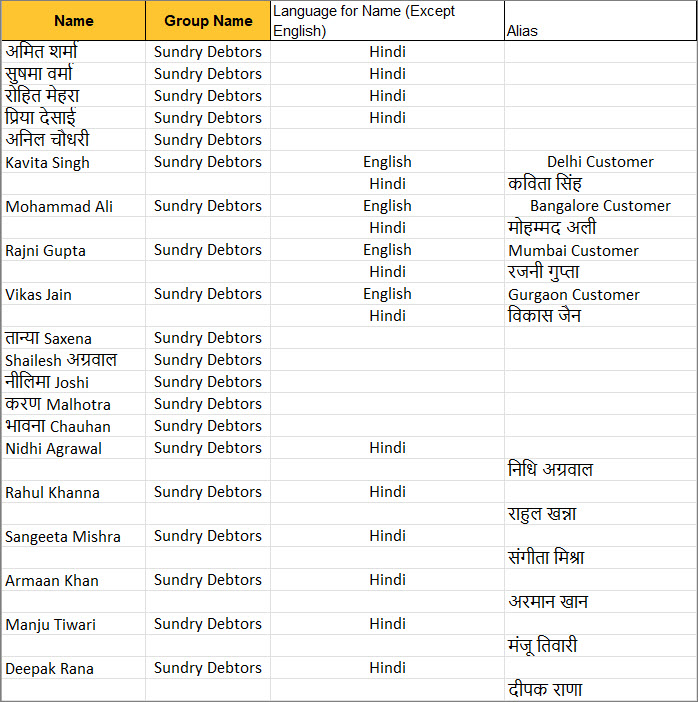

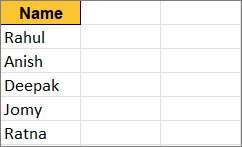

Click for a sample image of the Excel file.

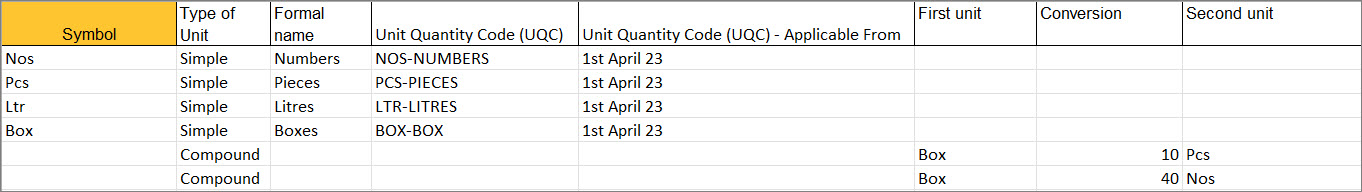

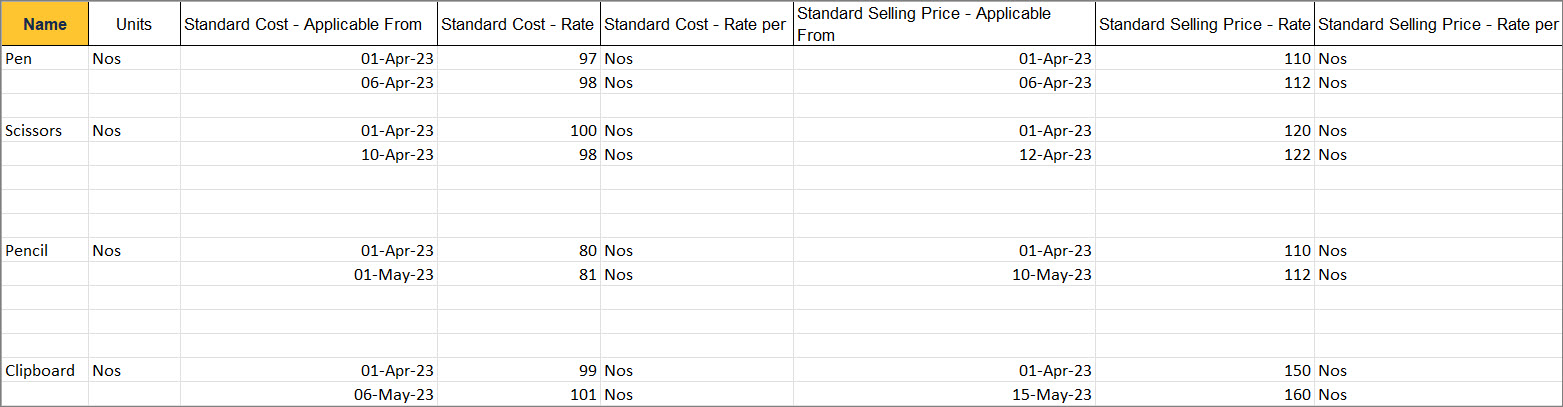

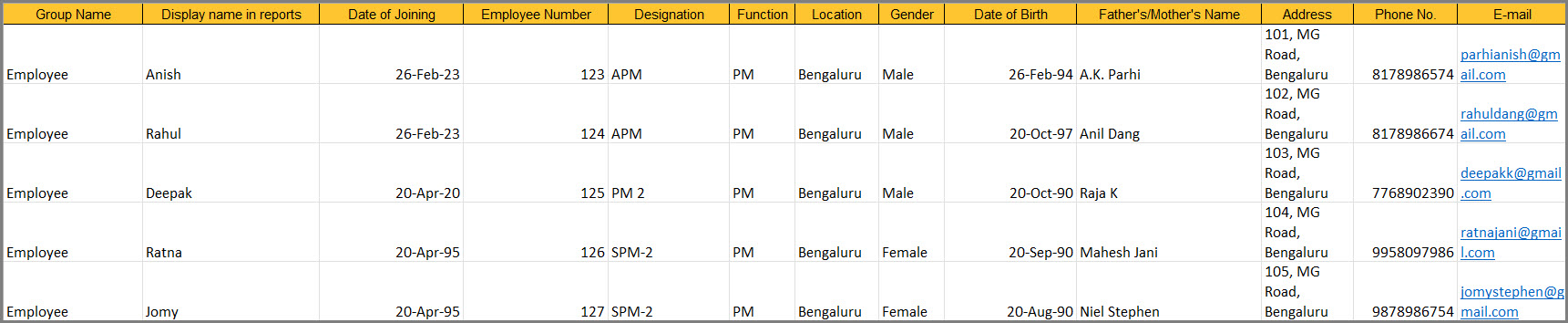

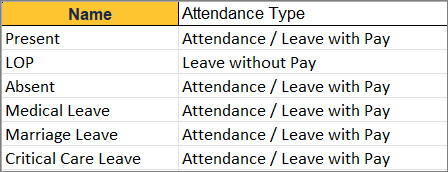

Click for a sample image of the Excel file.

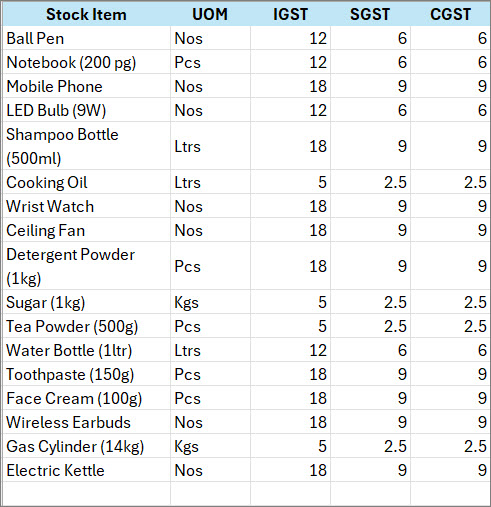

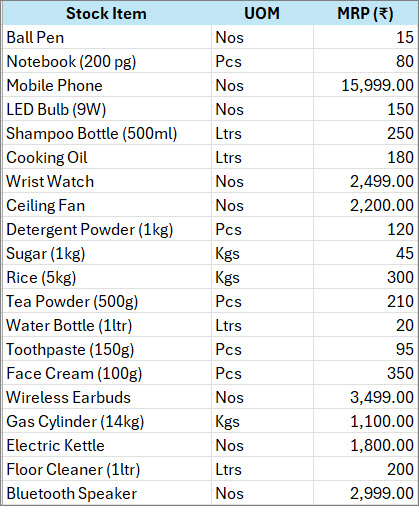

Click for a sample image of the Excel file.

Click for a sample image of the Excel file.

Click for a sample image of the Excel file.

Click for a sample image of the Excel file.

Click for a sample image of the Excel file.

Click for a sample image of the Excel file.

Click for a sample image of the Excel file.

Click for a sample image of the Excel file.

Click for a sample image of the Excel file.

Click for a sample image of the Excel file.

Click for a sample image of the Excel file.

Click for a sample image of the Excel file.

Click for a sample image of the Excel file.

Click for a sample image of the Excel file.

Click for a sample image of the Excel file.

Click for a sample image of the Excel file.

Click for a sample image of the Excel file.

Click for a sample image of the Excel file.

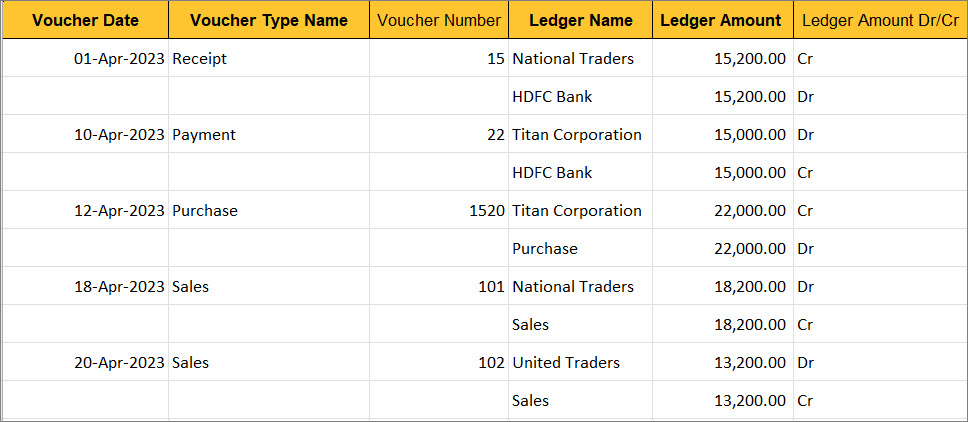

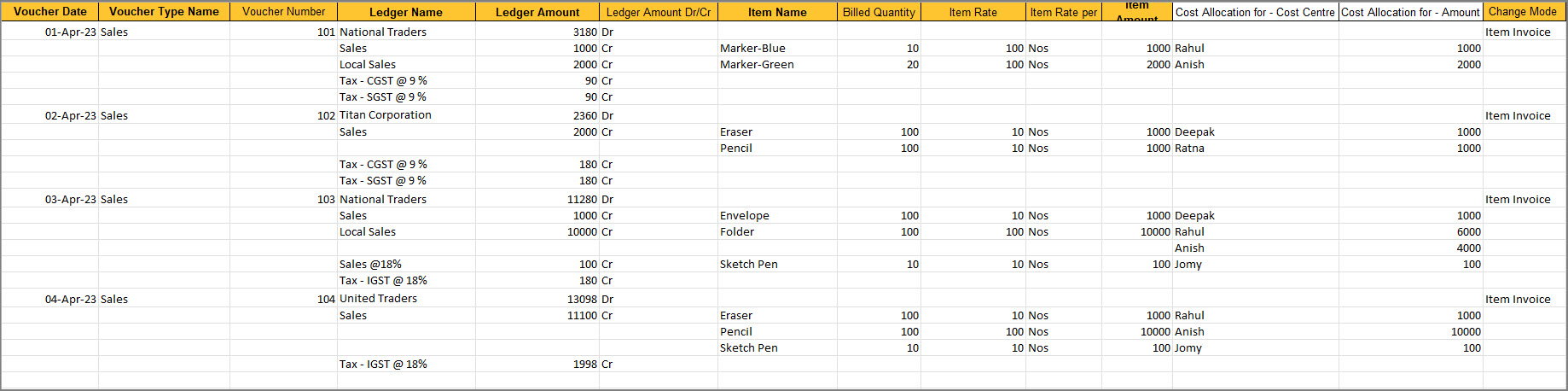

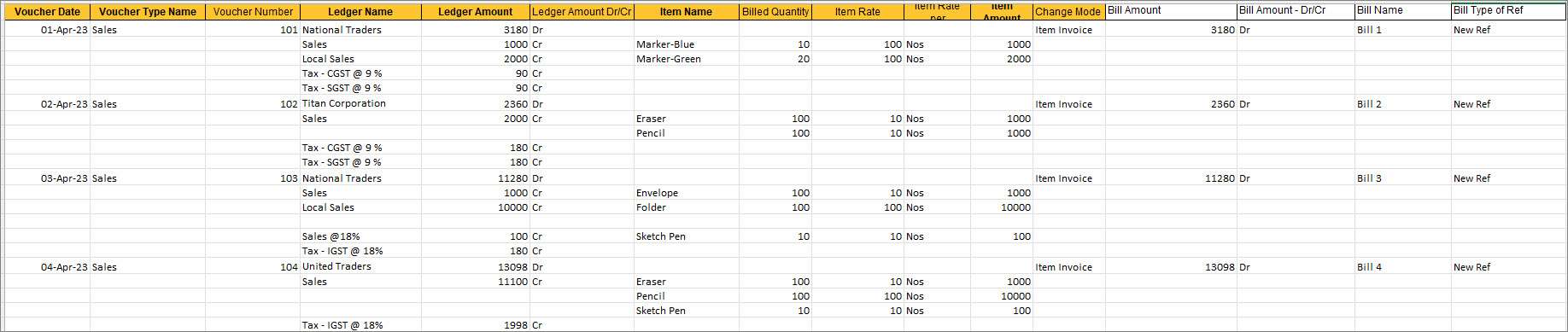

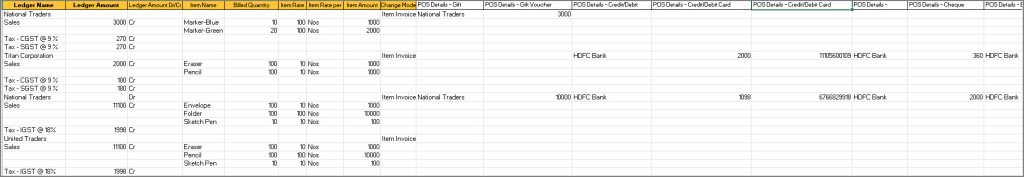

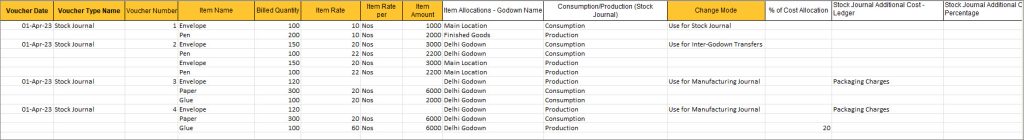

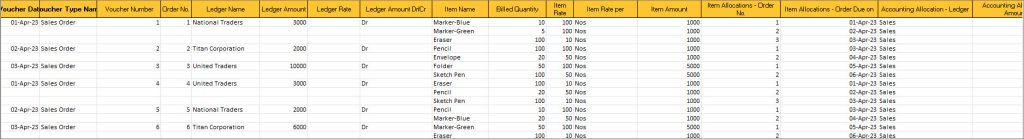

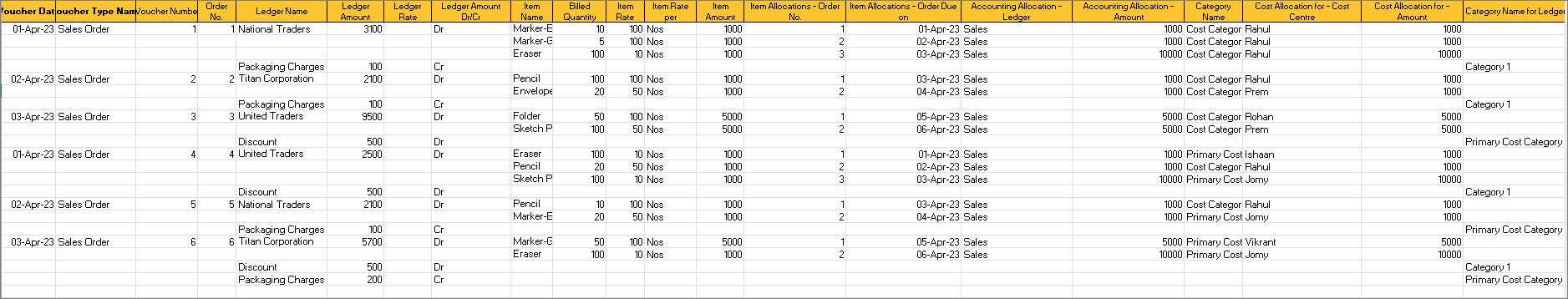

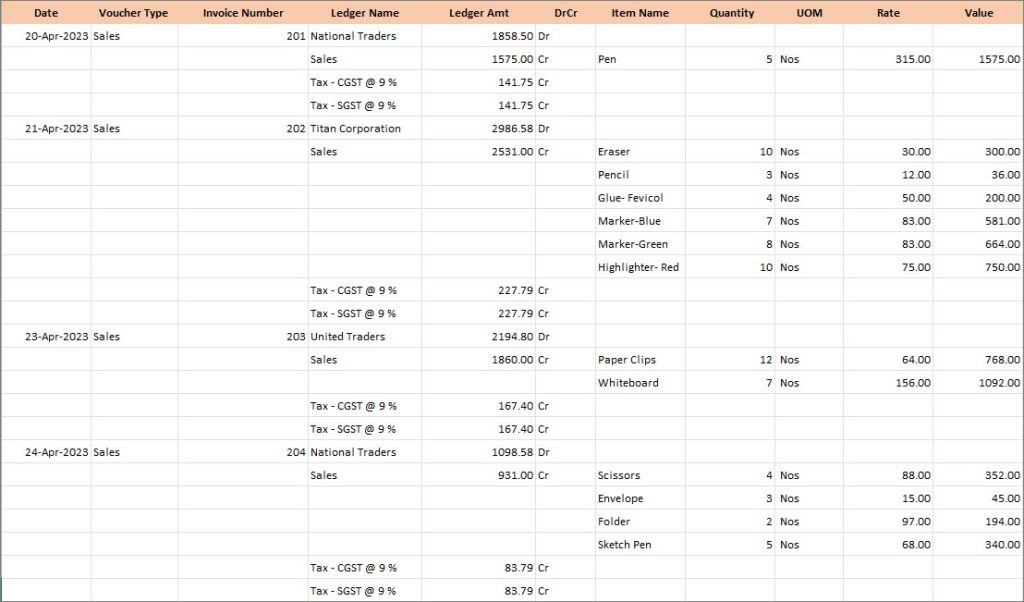

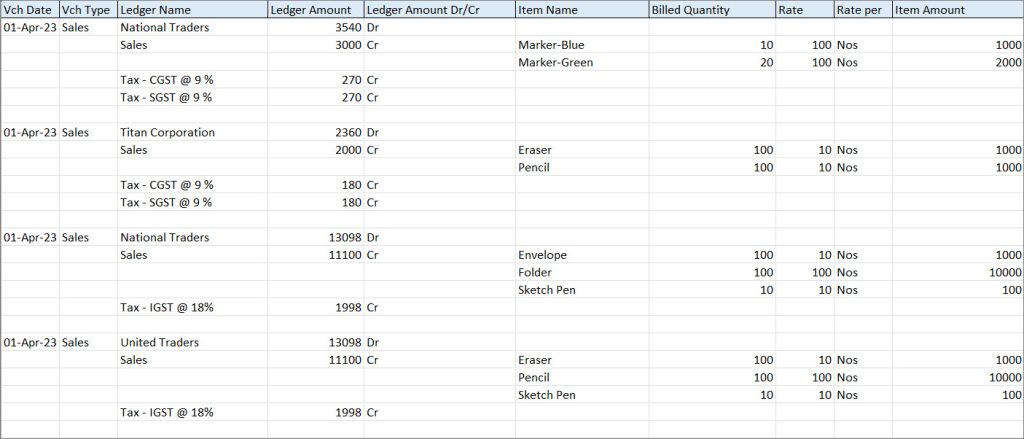

The Sample Excel Files with data for varied type of Transactions are listed below for your easy reference. You can download the Zip files by clicking on the Zip file links. Click for a sample image of the Excel file.

Click for a sample image of the Excel file.

Click for a sample image of the Excel file.

Click for a sample image of the Excel file.

Click for a sample image of the Excel file.

Click for a sample image of the Excel file.

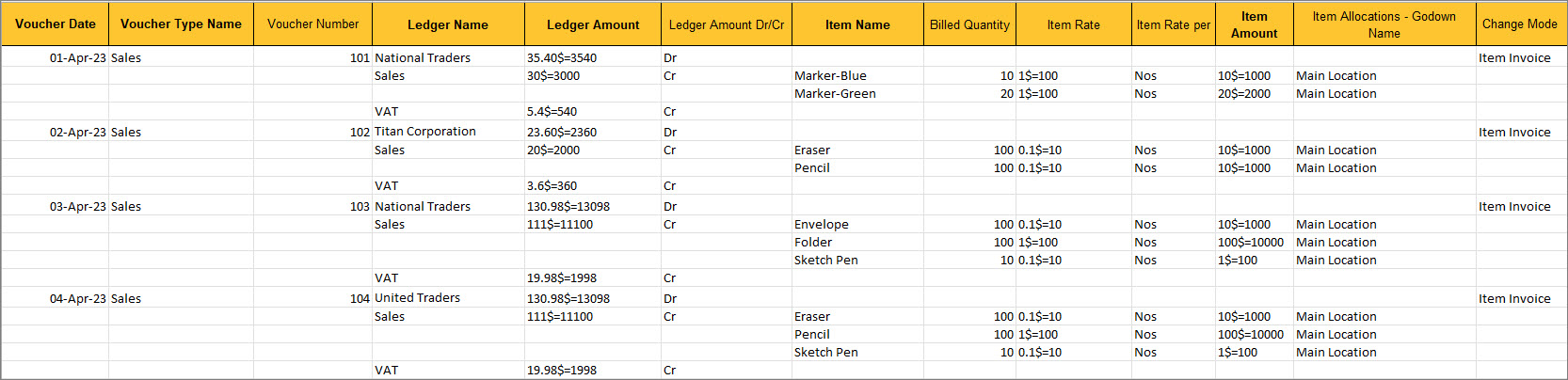

Click for a sample image of the Excel file.

Click for a sample image of the Excel file.

Click for a sample image of the Excel file.

Click for a sample image of the Excel file.

Click for a sample image of the Excel file.

Click for a sample image of the Excel file.

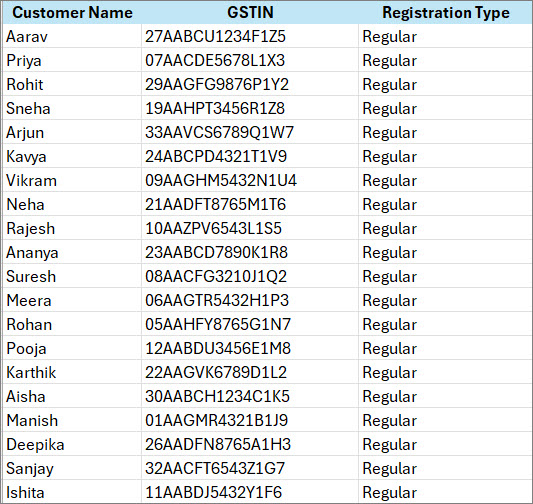

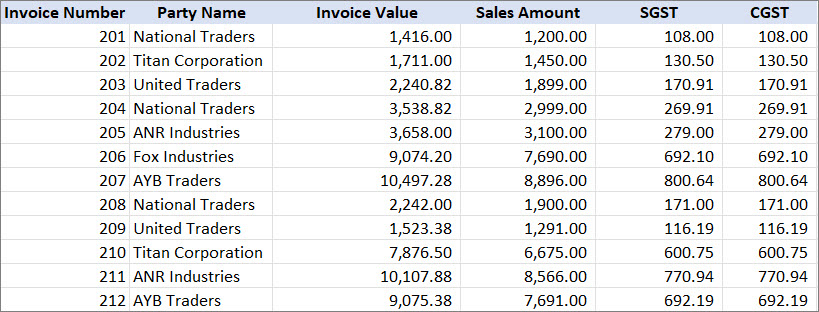

Some additional sample files with data and the corresponding mapping templates are listed below for your easy reference. You can download the Zip files by clicking on the Zip file links. To know more about how to create Mapping Templates for Masters, Click for a sample image of the Excel file.

Click for a sample image of the Excel file.

Click for a sample image of the Excel file.

Click for a sample image of the Excel file.

Click for a sample image of the Excel file.

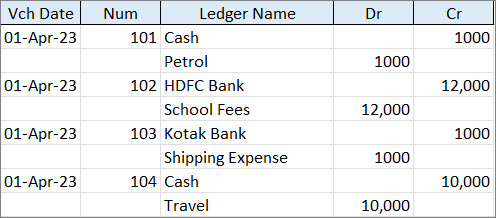

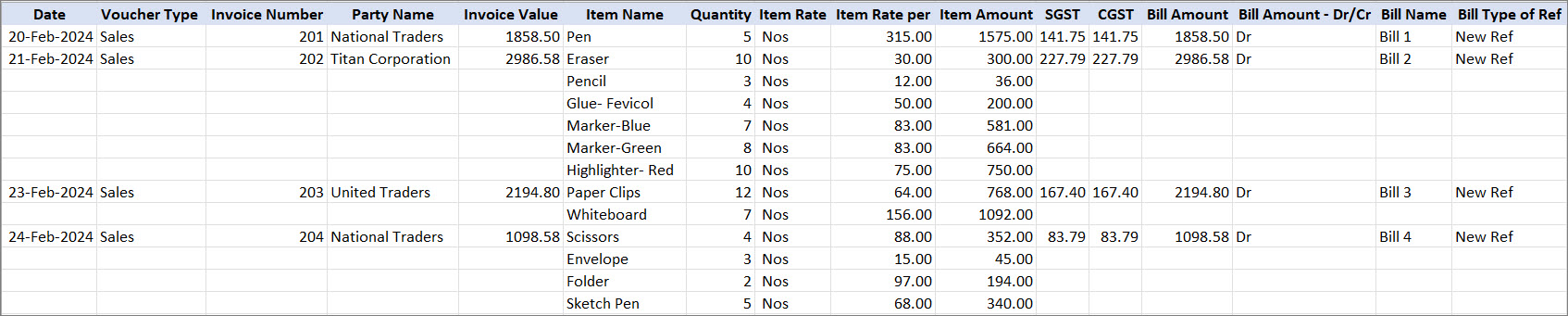

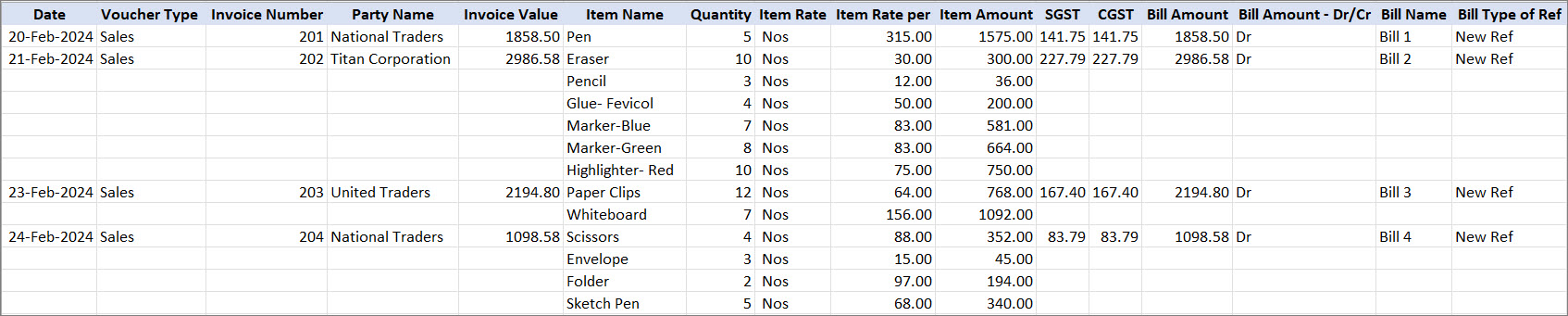

Some additional sample files with data and the corresponding mapping templates are listed below for your easy reference. You can download the Zip files by clicking on the Zip file links. To know more about how to create Mapping Templates for Transactions, Click for a sample image of the Excel file.

Click for a sample image of the Excel file.

Click for a sample image of the Excel file.

Click for a sample image of the Excel file.

Click for a sample image of the Excel file.

Click for a sample image of the Excel file.

Click for a sample image of the Excel file.

Click for a sample image of the Excel file.

Click for a sample image of the Excel file.

Click for a sample image of the Excel file.

Click for a sample image of the Excel file.

To know more about importing data from Excel files to TallyPrime, refer to How to Import Data in TallyPrime. Masters Group Ledger Contact Name Cost Centres Cost Category Stock Group Stock Category Units Godown/Location Stock Item Employee Group Employee Category Employee Attendance/Production Type All Vouchers Ledger with Data in a Specific Field

Ledger with Primary Mobile No. and Default WhatsApp No.

Ledger with Multiple Mobile Nos.

Ledgers with Opening Balance and Multiple Bill-wise Details

Bank Ledger with Bank Details

Party Ledger with Bank Details

Ledgers with Multiple Addresses

Ledgers with Multicurrency Details

Ledgers with Multilingual Details

Cost Centres

Inventory Masters

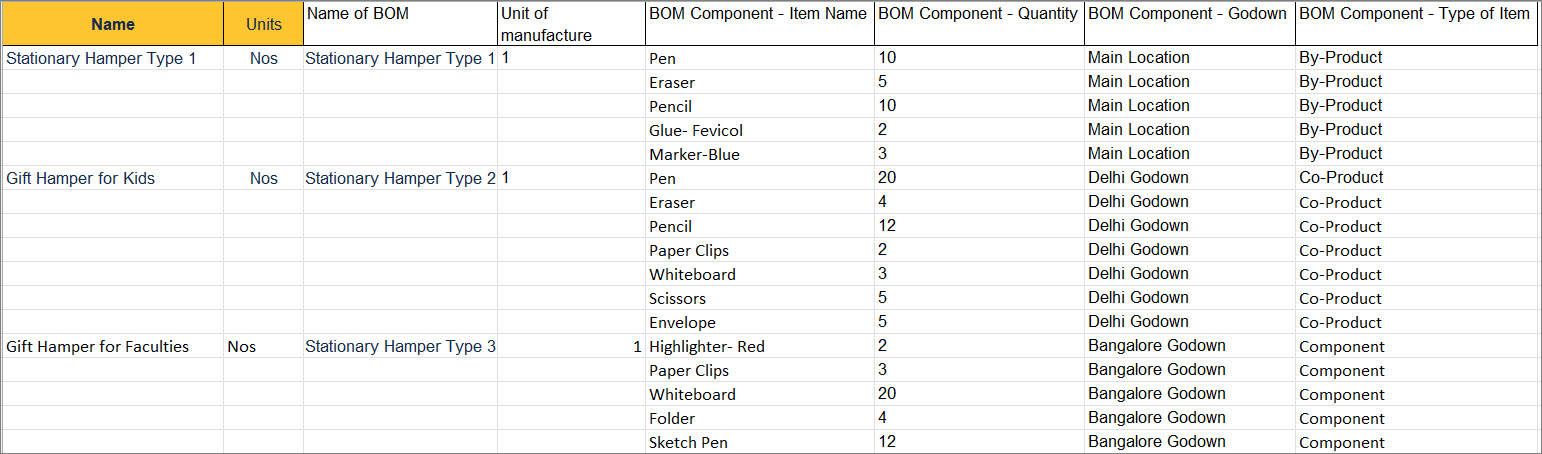

Stock Item with BoM Details

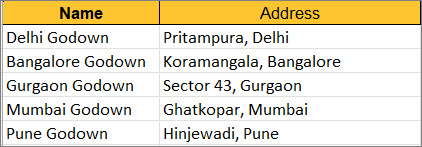

Godown or Location

Simple and Compound Units

Stock Item with Price List

Stock Item with Standard Price and Standard Cost

Payroll Masters

Employee – General

Employee – Salary Details

Attendance Type

Employee Group

Sample Excel File with Data for Transactions

Accounting Vouchers

Vouchers – General

Sales Voucher with Multicurrency Details

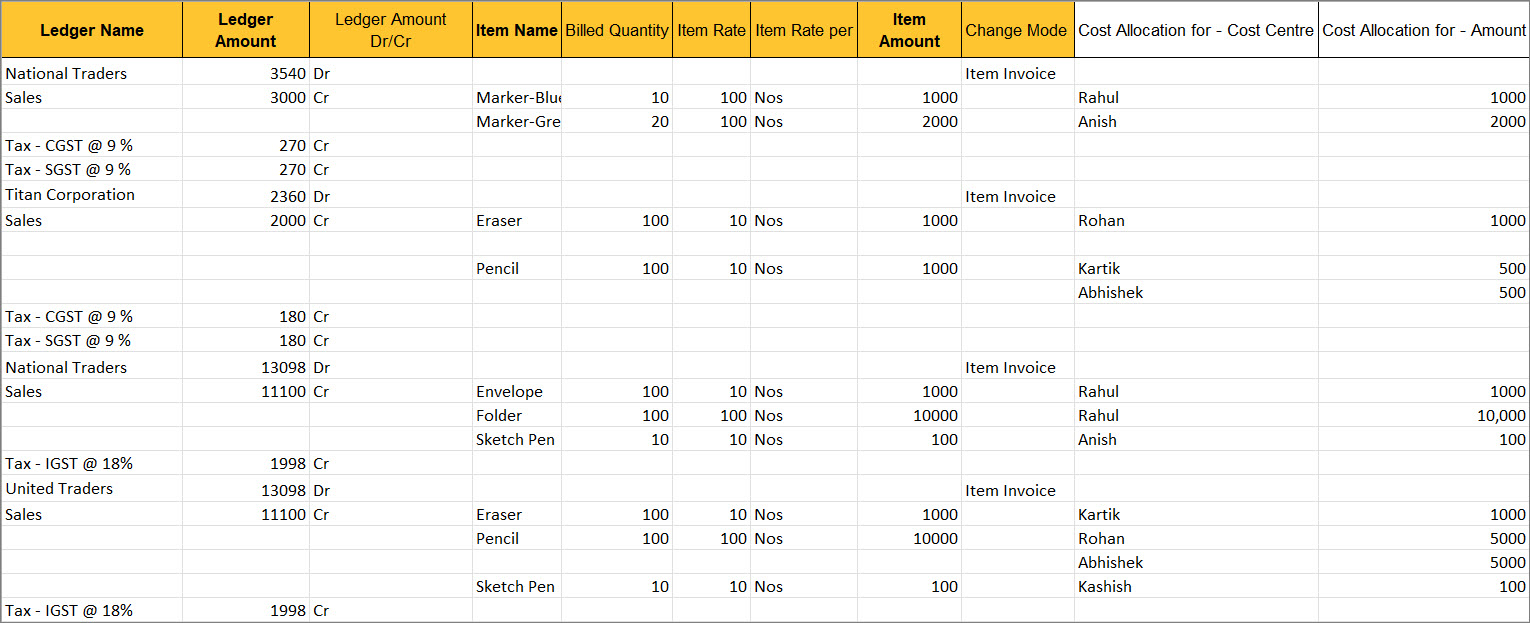

Sales Voucher with Cost Centre Allocation

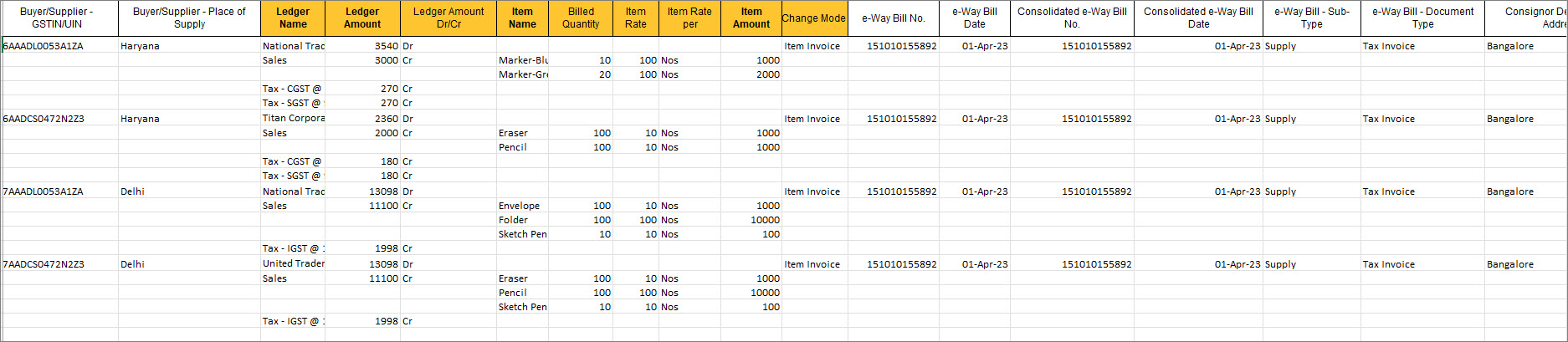

Sales Voucher with GST, e-Way and e-Invoice Details

Sales Voucher with Accounting Allocation and Cost Centre Allocation

Sales Voucher with Bill Allocation

POS Vouchers Sales Invoice

Inventory Vouchers

Stock Journal Vouchers

Order Vouchers

Sales Order with Accounting Allocation

Sales Order with Accounting Allocation for Sales and Expense Ledger

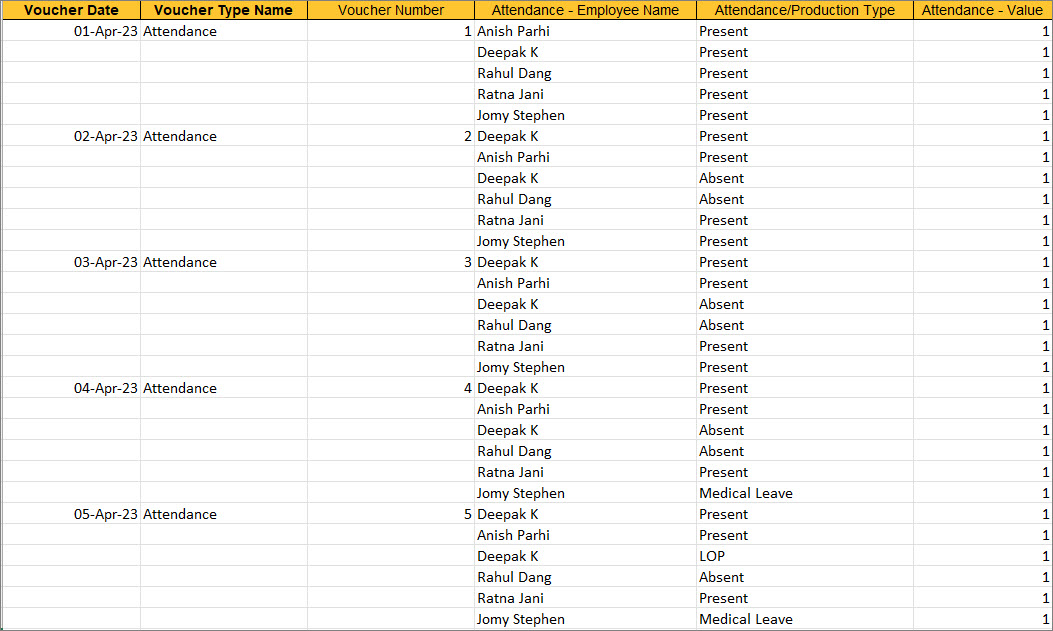

Payroll Vouchers

Attendance Voucher

Payroll Voucher

Sample Data with Mapping Templates for Masters

![]()

Ledger with GSTIN

Stock Items with GST Details

Stock Items with MRP Details

Stock Items with BOM Details

Stock Items in User Defined Formats

Sample Data with Mapping Templates for Transactions

![]()

Ledger Entries in Multiple Rows

Ledger Entries in Multiple Columns

Ledger Amount in the same Column

Ledger Amount in Two Columns

Vouchers with Unique Values

Sales Vouchers in Multiple Columns

Sales Vouchers in Multiple Rows

Sales Vouchers in Multiple Columns with Bill Allocations

Vouchers in Multiple Columns with Bill Allocations

Vouchers in Multiple Rows with Bill Allocations

Sales Voucher in Multiple Columns without Inventory

Names and Aliases in TallyPrime for Mapping

To know more about the names and aliases for mapping, click here.

Sl No.

Field Grouping

Field Name

Aliases

1

General Details

Parent Group Name

Under, Parent Name

2

General Details

Group behaves like a sub-ledger

Is Sub Ledger

3

General Details

Nett Credit/Debit Balances for Reporting

Is Addable

4

General Details

Language for Name (Except English)

Language Alias

5

General Details

Used for calculation (for example: taxes, discounts)

Basic Group Is Calculable

6

General Details

Method to allocate when used in purchase invoice

Addl Alloc Type

Sl No.

Field Grouping

Field Name

Aliases

1

General Details

Group Name

Under, Parent

2

General Details

Notes

Narration

3

General Details

Language for Name (Except English)

Language Alias

4

General Details

Cost centres are applicable

Is Cost Centres On

5

General Details

Activate Interest Calculation

Is Interest On

6

General Details

Check for credit days during voucher entry

Is Credit Days Chk On

7

General Details

Inventory values are affected

Affects Stock

8

General Details

Allow cost allocation (stock item)

Is Cost Tracking On

9

General Details

Tax/Duty – Percentage of Calculation

Rate Of Tax Calculation

10

General Details

Tax/Duty – Valuation Type

Cess Valuation Method

11

General Details

Currency of Ledger

Ledger Currency

12

General Details

Behave as Duties & Taxes Ledger

Is Behave as Duty

13

General Details

Nature of Payment/Goods

TDS Rate Name

14

Tax Registration Details

Tax/Unique Identification Number

Tax Identification No.

15

General Details

Position Index in Reports

Sort Position

16

Bank Ledger – Bank Account Details

Effective Date for Reconciliation

Starting From

17

Bank Ledger – Bank Account Details

Bank Account Details – A/c Holder’s Name

Bank Acc Holder Name

18

Bank Ledger – Bank Account Details

Bank Account Details – A/c No.

Bank Account Details – Account Number, Bank Account Details – Account No.

19

Bank Ledger – Bank Account Details

Bank Account Details – Branch

Bank Branch Name

20

Bank Ledger – Bank Account Details

Bank Account Details – BSR Code

Bank BSR Code

21

Bank Ledger – Bank Account Details

Bank Account Details – Client Code

Bank Client Code

22

Bank Ledger – Bank Account Details

Enable Cheque Printing

Is Cheque Printing Enabled

23

Auto Reconciliation

Enable Auto Reconciliation

Is ABC Enabled

24

Other Ledgers – Bank Details

Bank Details – A/c No.

Bank Details – Account Number, Bank Details – Account No.

25

Other Ledgers – Bank Details

Bank Details – Ref ID

Bank Details – Reference ID

26

Bill Allocations

Maintain balances bill-by-bill

Is Billwise On

27

Opening Bank Reconciliation Details

Opening Bank Reconciliation – Bank Date

Bankers Date

28

Mailing Details

Primary Mobile No.

Primary Mobile Number, Ledger Mobile

29

Multiple Mobile Numbers Details

Multiple Mobile Nos. – Mobile No.

Multiple Mobile Nos. – Mobile Number

30

Mailing Details

Ledger Contact

31

Mailing Details

Phone No.

Ledger Phone, Phone Number

32

Mailing Details

Fax No.

Ledger Fax

33

Mailing Details

E-mail

E-mail address, E-mail ID

34

Statutory Details

Include in Assessable Value calculation – Duty/Tax Type

Appropriate For

35

Statutory Details

Include in Assessable Value calculation – Appropriate to

GST Appropriate To

36

Statutory Details

Include in Assessable Value calculation – Method of calculation

Excise Alloc Type

37

Tax Registration Details

PAN Effective Date

PAN Applicable From

38

Tax Registration Details

GST Registration – Assessee of Other Territory

Is Oth Territory Assessee

39

Tax Registration Details

GST Registration -GSTIN/UIN

GST Number, GST No., GST Identification Number

40

Tax Registration Details

GST Registration – Use Ledger as common Party

Is Common Party

41

Additional GST Details

Is the Party a Transporter

Is Transporter

42

VAT Registration Details

Date of VAT Registration

VAT Applicable Date

43

VAT Registration Details

Type of Party

VAT Tax Exemption Nature

44

VAT Registration Details

Exemption Certificate No.

VAT Tax Exemption Number

45

Interest Calculation Details

Include transaction date for interest calculation – For amounts added

Interest Incl Day Of Addition

46

Interest Calculation Details

Include transaction date for interest calculation – For amounts deducted

Interest Incl Day Of Deduction

47

Interest Calculation Details

Calculate Interest Transaction-by-Transaction

Interest on Bill-wise

48

Interest Calculation Details

Calculate Interest Based on

Type of Interest on

49

Interest Calculation Details

Override Parameters for each Transaction

Override Interest

50

Interest Calculation Details

Override advance parameters

Override Adv Interest

51

Multiple Mailing Details

Multiple Mailing Details – GSTIN/UIN

Multiple Mailing Details – GST Number, Multiple Mailing Details – GST No.

52

Multiple Mailing Details

Multiple Mailing Details – Assessee of Other Territory

Multiple Mailing Details – Is Oth Assessee Territory Assessee

53

Mailing details in Local Language

Mailing details in Local Language – Name

Mailing Name Native

54

Mailing details in Local Language

Mailing details in Local Language – Address

Address Native

55

Mailing details in Local Language

Mailing details in Local Language – Country

Country Name Native

56

e-Payments Details

Enable e-Payments

Is E-banking Enabled

57

e-Payments Details

Generate Payment Instructions in Batches

Pay Ins is Batch Applicable

58

e-Payments Details

Specify Product Code based on

Product Code Type

59

e-Payments Details

Export/Upload Payment instructions on Voucher Creation

Is Export On Vch Create

60

e-Payments Details

Allow export of transactions with mismatch on bank details

Allow Export with Errors

61

e-Payments Details

Folder Path – Payment Instructions

Payment Inst Location

62

e-Payments Details

Folder Path – New Intermediate Files

New IMF Location

63

e-Payments Details

Folder Path – Imported Intermediate Files

Imported IMF Location

Sl No.

Field Grouping

Field Name

Aliases

1

General Details

Category Name

Cost Category Name

2

General Details

Parent Name

Under

3

General Details

Language for Name (Except English)

Language Alias

4

General Details

Show opening balance for revenue Items in reports

Revenue Led For OpBal

5

Bank Details

Bank Details – Transaction Type

Bank Details – Account Number, Bank Details – Account No.

6

Bank Details

Bank Details – Ref ID

Bank Details – Reference ID

Sl No.

Field Grouping

Field Name

Aliases

1

General Details

Language for Name (Except English)

Language Alias

Sl No.

Field Grouping

Field Name

Aliases

1

General Details

Parent Group Name

Under, Parent Name

2

General Details

Language for Name (Except English)

Language Alias

Sl No.

Field Grouping

Field Name

Aliases

1

General Details

Stock Category

Under

2

General Details

Stock Category

Language Alias

Sl No.

Field Grouping

Field Name

Aliases

1

General Details

Formal name

Original Symbol

2

Statutory Details

Unit Quantity Code (UQC)

Reporting UQC Name

3

Compound Unit

First unit

Base Units

4

Compound Unit

Second unit

Additional Units

Sl No.

Field Grouping

Field Name

Aliases

1

General Details

Godown

Under

2

General Details

Godown

Has no Space

3

General Details

Godown

Is Internal

4

General Details

Godown

Is External

5

General Details

Godown

Job Name

6

General Details

Godown

Language Alias

Sl No.

Field Grouping

Field Name

Aliases

1

General Details

Part No.

Part Number

2

General Details

Alias – Part No.

Alias – Part Number

3

General Details

Notes

Narration

4

General Details

Group Name

Parent Name, Under

5

General Details

Category

Stock Category

6

General Details

Units

UOM, Base Units

7

General Details

Alternate units

Additional Units

8

General Details

Opening Balance – Value

Opening Value

9

General Details

Language for Name (Except English)

Language Alias

10

Item Allocations Details

Item Allocations – Godown

Item Allocations – Location

11

Item Allocations Details

Item Allocations – Mfg. Date

Item Allocations – Manufacturing Date, Item Allocations – Mfd On

12

Item Allocations Details

Item Allocations – Location

Item Allocations – Godown

13

Additional Details

Track date of manufacturing

Has Mfg Date

14

Additional Details

Use expiry dates

Is Perishable on

15

Additional Details

Enable Cost Tracking

Is Cost Tracking On

16

Additional Details

Maintain in Batches

Is Batchwise on

17

Behaviour

Ignore difference due to physical counting

Ignore Physical Difference

18

Behaviour

Ignore negative balances

Ignore Negative Stock

19

Behaviour

Treat all sales as new manufacture

Treat Sales as Manufactured

20

Behaviour

Treat all purchases as consumed

Treat Purchases as Consumed

21

Behaviour

Treat all rejections inward as scrap

Treat Rejects as Scrap

22

Behaviour

Use expired batches during voucher entry

Allow Use of Expired Items

23

BOM Details

Name of BOM

Component List Name

24

BOM Details

Unit of manufacture

Component Basic Qty

25

BOM Details

BOM Component – Item Name

BOM Component – Name Of Item, BOM Component – Stock Item Name

26

BOM Details

BOM Component – Godown

BOM Component – Location

27

BOM Details

BOM Component – Type of Item

BOM Component – Nature of Item

28

BOM Details

BOM Component – Rate (%)

Addl Cost Alloc Perc

29

BOM Details

BOM Component – Location

BOM Component – Godown

30

Default Accounting Allocation (Purchase)

Accounting Allocation (Purchase) -Percentage

Accounting Allocation (Purchase) – Class rate

31

Default Accounting Allocation (Purchase)

Tax classification Purchase – GST

Tax classification Purchase – GST Classification Nature

32

Default Accounting Allocation (Purchase)

Tax classification Purchase – TDS

Tax classification Purchase – TDS Classification Name

33

Default Accounting Allocation (Purchase)

Tax classification Purchase – VAT

Tax classification Purchase – VAT Classification Name

34

Default Accounting Allocation (Sales)

Accounting Allocation (Sales) – Percentage

Accounting Allocation (Sales) – Class rate

35

Default Accounting Allocation (Sales)

Tax classification Sales – GST

Tax classification Sales – GST Classification Nature

36

Default Accounting Allocation (Sales)

Tax classification Sales – TCS

Tax classification Sales – TCS Classification Name

37

Default Accounting Allocation (Sales)

Tax classification Sales – VAT

Tax classification Sales – VAT Classification Name

38

MRP Details

Allow MRP modification in voucher

Modify MRP Rate

39

Other Tax Details

Rate of Duty

Basic Rate of Excise

40

Price List

Item Quantities – From

Starting From

41

Price List

Item Quantities – Less than

Ending At

42

Statutory details

Is Excise Applicable

GVAT Is Excise Appl

43

Statutory details

Rate of VAT

Basic Rate of Excise

44

Reorder Details

Reorder – Quantity

Reorder Base

45

Reorder Details

Reorder Level – Period

Reorder Period

46

Reorder Details

Reorder Level – Criteria

Reorder as Higher

47

Reorder Details

Reorder Level – Rounding Method

Reorder Round Type

48

Reorder Details

Reorder Level – Rounding Limit

Reorder Round Limit

49

Reorder Details

Minimum Order – Quantity

Minimum Order Base

50

Reorder Details

Minimum Order – Criteria

Min Order As Higher

51

Reorder Details

Minimum Order – Rounding Type

Min Order Round Type

Sl No.

Field Grouping

Field Name

Aliases

1

General Details

Category

Cost Category

2

General Details

Parent Group Name

Under, Parent Name

3

General Details

Language for Name (Except English)

Language Alias

Sl No.

Field Grouping

Field Name

Aliases

1

General Details

Language for Name (Except English)

Language Alias

Sl No.

Field Grouping

Field Name

Aliases

1

General Details

Group Name

Under, Parent Name

2

General Details

Category

Employee Category

3

General Details

Display name in reports

Emp Display Name

4

General Details

Notes

Narration

5

General Details

Date of resignation/retirement

Deactivation Date

6

General Details

Language for Name (Except English)

Language Alias

7

Salary Details

Salary – Effective From

Period From

8

Salary Details

Salary – Rate

Emp Time Rate

9

Employee Details

Employee Number

Mailing Name

10

Employee Details

Phone No.

Contact Numbers

11

Employee Bank Details

Employee Bank Details – A/c No.

Employee Bank Details – Account Number, Employee Bank Details – Account No.,

12

Payroll Banking Details

Payroll Banking Details – A/c No.

Payroll Banking Details – Account Number, Payroll Banking Details – Account No.

13

Payroll Banking Details

Payroll Banking Details – Ref ID

Payroll Banking Details – Reference ID

14

Statutory Details

EPS account number

FPF Account Number

15

Statutory Details

Emirates ID Number

Identity Number

16

Statutory Details

Emirates ID Expiry Date

Identity Expiry Date

Sl No.

Field Grouping

Field Name

Aliases

1

General Details

Name

2

General Details

Parent Name

Under

3

General Details

Alias

4

General Details

Language for Name (Except English)

Language Alias

5

General Details

Attendance Type

Production Type

6

General Details

Unit

Base Units, UOM

Sl No.

Field Grouping

Field Name

Aliases

1

General Details

Voucher Date

Invoice Date

2

General Details

Voucher Number

Invoice Number, Invoice No., Voucher No.

3

General Details

Reference No.

Supplier Invoice No.

4

General Details

Reference Date

Supplier Invoice Date

5

General Details

Voucher Applicable Upto

Active To

6

General Details

Destination Godown

Destination Location

7

General Details

Source Godown

Source Location

8

General Details

Destination Location

Destination Godown

9

General Details

Source Location

Source Godown

10

General Details

Order No.

Order Number

11

General Details

Name on Receipt

Basic Voucher Cheque Name

12

General Details

GST Type

Vch GST Class

13

Ledger Details

Ledger Rate

Rate Of Invoice Tax

14

Ledger Details

Description of Ledger

Basic User Description

15

Item Details

Item Name

Stock Item, Name of Item

16

Item Details

Item Amount

Stock Item Amount

17

Item Details

Item Description

Stock Item Description

18

Item Details

Quantity UOM

UOM

19

Item Details

Item Rate

Stock Item Rate

20

Item Details

Item Rate per

Stock Item Rate Per

21

Item Details

Consider as Scrap

Is Scrap

22

Item Details

Discount Amount (Cash/Trade)

EI Discount Amt

23

Item Details

Marks

Basic Package Marks

24

Item Details

No. of Packages

Basic Num Packages

25

Order Details

Order No(s)

Basic Purchase Order No

26

Order Details

Order – Date

Basic Order Date

27

Order Details

Mode/Terms of Payment

Basic Due Date of Pymt

28

Order Details

Other References

Basic Order Ref

29

Order Details

Terms of Delivery

Basic Order Terms

30

Dispatch/Receipt/Party’s Document Details

Dispatched through

Basic Shipped by

31

Dispatch/Receipt/Party’s Document Details

Destination

Basic Final Destination

32

Dispatch/Receipt/Party’s Document Details

Carrier Name/Agent

EI Check Post

33

Dispatch/Receipt/Party’s Document Details

Date and Time of Issue

Basic Date Time Of Invoice

34

Dispatch/Receipt/Party’s Document Details

Motor Vehicle No.

Basic Ship Vessel No

35

Export/Import Details

Place of Receipt by Shipper

Basic Place of Receipt

36

Export/Import Details

Vessel/Flight No.

Basic Ship Vessel No, Basic Flight No.

37

Export/Import Details

Port of Loading

Basic Port of Loading

38

Export/Import Details

Port of Discharge

Basic Port of Discharge

39

Export/Import Details

Country to

Basic Destination Country

40

Additional Details

Reason for Issuing Note

GST Nature of Return

41

Additional Details

Buyer’s Debit Note No.

Buyer’s VAT Party

Trans Return Number

42

Additional Details

Buyer’s Debit Note – Date

Buyer’s VAT Party

Trans Return Date

43

Additional Details

Supplier’s Debit/Credit Note No.

Supplier’s VAT Party

Trans Return Number

44

Additional Details

Supplier’s Debit/Credit Note – Date

Supplier’s VAT Party

Trans Return Date

45

Attendance Details

Attendance – Value

Attendance –

Attd Type Value

46

Item Allocations Details

Item Allocations – Godown Name

Item Allocations –

Location Name

47

Item Allocations Details

Item Allocations – Location Name

Item Allocations –

Godown Name

48

Item Allocations Details

Item Allocations – Tracking No.

Item Allocations –

Tracking Number

49

Item Allocations Details

Item Allocations – Batch/Lot No.

Item Allocations –

Batch Name

50

Item Allocations Details

Item Allocations – Source Godown

Item Allocations –

Source Location

51

Item Allocations Details

Item Allocations – Destination Godown

Item Allocations –

Destination Location

52

Item Allocations Details

Item Allocations – Source Location

Item Allocations –

Source Godown

53

Item Allocations Details

Item Allocations – Destination Location

Item Allocations –

Destination Godown

54

Item Allocations Details

Item Allocations – Mfg. Date

Item Allocations –

Mfd on

55

Item Allocations Details

Item Allocations – Expiry Date

Item Allocations –

Expiry Period

56

Item Allocations Details

Item Allocations – Order Due on

Item Allocations –

Order Due Date

57

Item Allocations Details

Item Allocations – Pre-Close Quantity

Item Allocations –

Order Pre closure Qty

58

Item Allocations Details

Item Allocations – Reason for Pre-Close

Item Allocations –

Order Pre closure Reason

59

Item Allocations Details

Item Allocations – Pre-Close Date

Item Allocations –

Order Pre closure Date

60

Item Allocations Details

Item Allocations – Disc%

Item Allocations –

Batch Discount

61

Item Allocations Details

Item Allocations – Cost Tracking To

Item Allocations –

Dynamic Cst No

62

Item Allocations Details

Item Allocations – Track Component

Item Allocations –

Is Track Component

63

Bill Allocations

Interest – % per

Interest Style

64

Bill Allocations

Interest – on

Interest Balance Type

65

Bill Allocations

Interest – By

Interest Appl From

66

Bill Allocations

Interest – Rounding

Round Type

67

Bill Allocations

Interest – Limit

Round Limit

68

Component Allocation

Component Allocation – Godown Name

Component Allocation – Location Name

69

Component Allocation

Component Allocation – Item Name

Component Allocation –

Name of Item

70

Component Allocation

Component Allocation – Track

Component Allocation –

Nature of Component

71

Component Allocation

Component Allocation – Due on

Component Allocation –

Order Due Date

72

Component Allocation

Component Allocation – Actual Quantity

Component Allocation –

Billed Qty

73

Component Allocation

Component Allocation – Mfg Dt.

Component Allocation –

Mfd On

74

Component Allocation

Component Allocation – Expiry Date

Component Allocation –

Expiry Period

75

Customer’s Name and Address

Customer’s Name

Party Name

76

e-Invoice Details

e-Invoice – Ack No.

IRN Ack No.

77

e-Invoice Details

e-Invoice – Ack Date

IRN Ack Date

78

e-Invoice Details

e-Invoice Cancellation – Reason for Cancellation

e-Invoice Cancellation –

IRN Cancel Reason

79

e-Invoice Details

e-Invoice Cancellation – Remarks

e-Invoice Cancellation –

IRN Cancel Code

80

GST Rate & Related Details

GST Nature of Transaction

GST Ovrdn Stored Nature

81

GST Rate & Related Details

GST Classification

GST Ovrdn Classification

82

GST Rate & Related Details

GST Rate Details

GST Rate Infer Applicability

83

GST Rate & Related Details

Taxable Value

GST Ovrdn Assessable Value

84

GST Rate & Related Details

GST Source of Details

GST Item Source

85

GST Rate & Related Details

Applicable for Reverse Charge

GST Ovrdn

Is Rev Charge Appl

86

GST Rate & Related Details

Eligible for Input Tax Credit

GST Ovrdn Ineligible ITC

87

GST Rate & Related Details

GST Taxability Type

GST Ovrdn Taxability

88

HSN/SAC & Related Details

HSN/SAC

GST HSN Name

89

HSN/SAC & Related Details

HSN Description

GST HSN Description

90

HSN/SAC & Related Details

HSN/SAC Source of Details

HSN Item Source

91

HSN/SAC & Related Details

HSN/SAC Classification

HSN Ovrdn Classification

92

Party Details (Buyer/Supplier)

Buyer/Supplier – GSTIN/UIN

Buyer/Supplier –

GST Number

93

Party Details (Buyer/Supplier)

Buyer/Supplier – Is Bill of Entry available

Buyer/Supplier –

Is BOE Not Applicable

94

Party Details (Buyer/Supplier)

Buyer/Supplier – Supplies under section 7 of IGST Act

Buyer/Supplier –

Is GST Sec Seven Applicable

95

Party Details (Buyer/Supplier)

Buyer/Supplier – Country (POS)

Buyer/Supplier – Place Of Supply Country

96

Party Details (Buyer/Supplier)

Buyer/Supplier – Assessee of Other Territory

Buyer/Supplier –

Party GST Is

Other Territory Assessee

97

Party Details (Consignee)

Consignee (ship to)

Basic Buyer Name

98

Party Details (Consignee)

Consignee – Address Type

Consignee –

Buyer Address Type

99

Party Details (Consignee)

Consignee – Mailing Name

Consignee –

Basic Buyer Address

100

Party Details (Consignee)

Consignee – GSTIN/UIN

Consignee – GST Number

101

Process Instruction

Nature of Processing

Additional Narration

102

Stat Adjustment (GST)

Stat Adjustment (GST) – Type of Duty/Tax

stat Payment Type

103

Stat Adjustment (GST)

Stat Adjustment (GST) – Nature of Adjustment

Tax Adjustment

104

Stat Adjustment (GST)

Stat Adjustment (GST) – Additional Nature of Adjustment

GST Additional Details

105

Stat Adjustment (GST)

Stat Adjustment (GST) – Rate

Stat Adjustment –

GST Tax Rate

106

Stat Adjustment (GST)

Stat Adjustment (GST) – Taxable Value

Stat Adjustment –

GST Assessable Value

107

Stat Adjustment (GST)

Stat Adjustment (GST) – ISD Invoice/Debit/Credit Note No.

Stat Adjustment –

ISD Document Number

108

Stat Adjustment (GST)

Stat Adjustment (GST) – ISD Invoice/Debit/Credit Note Date

Stat Adjustment – ISD Document Date

109

Stat Adjustment (GST)

Stat Adjustment (GST) – Eligible for Input Tax Credit

Stat Adjustment –

Is Eligible for ITC

110

Stat Adjustment (GST)

Stat Adjustment (GST) – Type of Supply

Stat Adjustment – GSTITCDocumentType

111

Type of Supply Details

Type of Supply

GST Type of Supply

112

Voucher Status

Change Mode

Vch Entry Mode,

Voucher Mode

113

Voucher Status

Optional

Is Optional

114

Voucher Status

Post-Dated

Is Post Dated

115

Voucher Status

Cancelled

Is Cancelled

116

Bank Allocations

Bank Allocations – Ref ID

Bank Allocations –

Transaction Name

117

Bank Allocations

Bank Allocations – A/c No.

Bank Allocations –

Account Number,

Bank Allocations –

Account No.

118

Bank Allocations

Bank Allocations – Inst No.

Bank Allocations –

Instrument Number

119

Bank Allocations

Bank Allocations – Favouring Name

Bank Allocations –

Payment Favouring

120

Bank Allocations

Bank Allocations – Inst Date

Bank Allocations –

Instrument Date

121

Bank Allocations

Bank Allocations – Cross using

Bank Allocations –

Cheque Cross Comment

122

Bank Allocations

Bank Allocations – Remarks

Bank Allocations – Narration

123

Bank Allocations

Bank Allocations – Ledger Name

Bank Allocations –

Bank Party Name

124

Bank Allocations

Bank Allocations – PDC Issue Date

Bank Allocations –

Post-Dated Cheque Issue

Date, PDC Actual Date

125

Bank Allocations

Bank Allocations – PDC Note

Bank Allocations – Post-Dated Cheque Note, PDC Remarks

126

Point of Sale Details

POS Details – Credit/Debit Card

POS Details –

POS Card Ledger

127

Point of Sale Details

POS Details – Credit/Debit Card Amount

POS Details –

POS Card Ledger Amount

128

Point of Sale Details

POS Details – Cash tendered

POS Details –

POS Cash Received

129

Advance Payment/Receipt/Refund Details

Advance Payment/Receipt/Refund Details – Taxable Value

Advance Payment/Receipt/

Refund Details – Amount

130

Tax Type Allocations

Tax Type Allocations Additional Details – Nature of Payment

Tax Type Allocations

Additional Details – Subtype

131

Tax Type Allocations

Tax Type Allocations – Cess Liability

Tax Type Allocations –

GST Cess Liability

132

GST Advance Adjustment Details

GST Advance Details – Month Year

GST Advance Details –

GST Advance Date

133

TDS Party Details

TDS Party Details – Deductee Type

TDS Party Details –

Cash Party Ded Type

134

TDS Party Details

TDS Party Details – PAN Number

TDS Party Details –

Cash Party PAN

135

TDS Bill Allocations

TDS Bill Allocations – TDS Nature of Payment

TDS Bill Allocations –

Category

136

TDS Bill Allocations

TDS Bill Allocations – Assessable Amount

TDS Bill Allocations –

TDS Tax Obj Assb Value

137

TDS Bill Allocations

TDS Bill Allocations – Paid Amount

TDS Bill Allocations –

TDS Deduct Amt

138

TCS Party Details

TCS Party Details – Collectee Type

TCS Party Details –

Cash Party Ded Type

139

TCS Party Details

TCS Party Details – PAN Number

TCS Party Details –

Cash Party PAN

140

Stat Adjustment (GST) Details

Stat Payment (GST) – Type of Payment

Stat Payment (GST) –

Tax Payment Type

141

Stat Adjustment (GST) Details

Stat Payment (GST) – Period From

Stat Payment (GST) –

Tax Pay Period From Date

142

Stat Adjustment (GST) Details

Stat Payment (GST) – Period To

Stat Payment (GST) –

Tax Pay Period To Date

143

Stat Payment (TDS) Details

Stat Payment (TDS) – Period From

Stat Payment (TDS) –

Tax Pay Period From Date

144

Stat Payment (TDS) Details

Stat Payment (TDS) – Period To

Stat Payment (TDS) –

Tax Pay Period To Date

145

Stat Payment (TCS) Details

Stat Payment (TCS) – Period From

Stat Payment (TCS) –

Tax Pay Period From Date

146

Stat Payment (TCS) Details

Stat Payment (TCS) – Period To

Stat Payment (TCS) –

Tax Pay Period To Date

147

Ledger – HSN/SAC & Related Details

Ledger – HSN/SAC Details

Ledger – GST HSN Infer Applicability

148

Item – HSN/SAC & Related Details

Item – HSN/SAC Details

Item – GST HSN Infer Applicability

149

VAT Details

Withheld Certificate No.

Inventory Approval Number