Record GST-TDS on Metal Scrap using TallyPrime

As per the Notification No. 25/2024-CT by the department, purchase of metal scrap falling under Chapters 72 to 81 of the Customs Tariff Act, 1975, attracts TDS at 2% if the stock value exceeds ₹2,50,000. In TallyPrime, you can easily comply with this regulation by passing the purchase invoices and accounting for TDS using a Journal voucher. Note that a specific GSTIN is required to deduct TDS for such supplies apart from the regular GSTIN.

You can view the taxable amount that attracts TDS in the Ledger Voucher report and file GSTR-7 accordingly with the required TDS amount, that is, 2% of the taxable value.

Purchase of Metal Scrap

You can record the purchase of goods like metal scraps using the Purchase voucher in Item Invoice mode.

- Ensure that the Stock Item is configured with the HSN code falling under Chapters 72 to 81 of the Customs Tariff Act.

- Open the purchase voucher in the Item Invoice mode.

- Press Alt+G (Go To) > Create Voucher and press F9.

- Press Ctrl+H (Change Mode) > Item Invoice and press Enter.

- Provide the voucher details.

To learn how to create a Purchase voucher, refer to the Local Purchase and Interstate Purchase sections in the Record Purchases Under GST in TallyPrime topic. - Select the stock item from List of Stock Items.

- Provide other necessary details and press Ctrl+A to save the voucher.

Similarly, you can record other vouchers as well with the stock value exceeding ₹2,50,000 and account for TDS using a Journal voucher.

Deduct TDS on Purchase of Metal Scrap

If the stock value for purchasing metal scrap exceeds ₹2,50,000, 2% TDS must be deducted on the taxable value using a Journal voucher. Similarly, if multiple invoices from the same party have a combined stock value exceeding ₹2,50,000, 2% TDS must be deducted on the total taxable value.

It is to be noted that a specific GSTIN is required to deduct TDS for such supplies apart from the regular GSTIN.

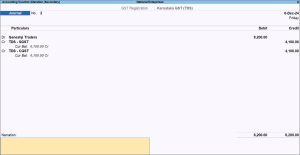

- Press Alt+G (Go to) > Create Voucher > press F7 (Journal).

Alternatively, Gateway of Tally > Vouchers > press F7 (Journal). - Specify the TDS deduction details.

- In Dr, select the party ledger, and specify the Debit amount which should be 2% of the taxable amount of the purchase invoice.

- In Cr, select the TSD ledgers for CGST and SGST and specify the Credit amount.

To learn how to create a tax ledger, refer to Creation of Tax Ledger.

- Provide Narration, if any, and accept the voucher creation screen. As always, press Ctrl+A to save.

Similarly, you can record other Journal vouchers to account for TDS for invoices with the stock value exceeding ₹2,50,000 for the other parties.

Extract Data from Tally to File GSTR-7

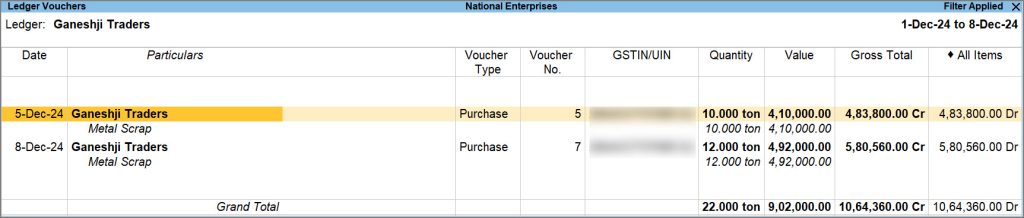

In TallyPrime, you can calculate the total taxable amount on the purchase of metal scraps from a party by using the Ledger Voucher report and file GSTR-7 with TDS deduction details. You can apply Filter in the report to view the transactions exceeding the stock value of ₹2,50,000.

- Press Alt+G (Go to) > type or select Ledger Voucher > and press Enter.

Alternatively, Gateway of Tally > Display More Reports > Account Books > Ledger. - Select the required ledger to view the Ledger Vouchers report.

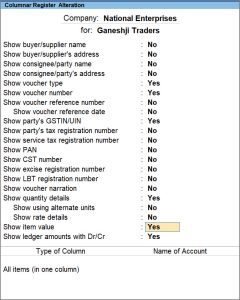

- Configure the report to view stock item details in columar.

- Press Alt+F5 (Detailed) to view the transactions with stock items on the Ledger Vouchers report.

- Apply Advanced Filter to filter the required stock item with the required invoice value.

- Press Ctrl+F (Apply Filter) and press F7 (Advanced Filter).

Under List of Options, Voucher (Filter Rows) will selected. - Under List of Fields select Stock Item Name and under List of Conditions select equal to, and select the stock item.

- Select and in the next row, and under List of Options select Voucher (Filter Rows).

- Under List of Fields select Stock Value and under List of Conditions select greater than, and enter the stock value as 2,50,000.

- Press Ctrl+F (Apply Filter) and press F7 (Advanced Filter).

The Ledger Vouchers report will display the vouchers containing the stock item Metal Scrap and stock value greater than 2,50,000.

You can view the value on which you have to deduct 2% TDS under the Value column while filing GSTR-7. The value in this case is 9,02,000 for which the amount for TDS deduction (2%) will be 18,040.

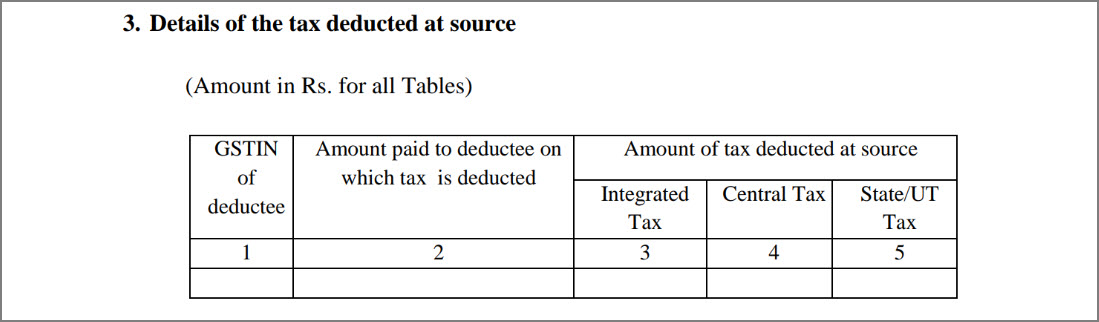

Now, in GSTR-7 you can enter the details in Column 3.

- Under GSTIN of deductee, enter the GSTIN of the supplier.

- Under Amount paid to deductee on which tax is deducted, enter the total taxable value. In this case, it is 9,02,000.

- Under Amount of tax deducted at source, enter the entire 2% of the total taxable value under Integrated Tax if the transaction was with an interstate party. In this case, it will be 18,040.

OR - Under Amount of tax deducted at source, enter 1% of the total taxable value under Central Tax and State/UT Tax each if the transaction was with a local party. In this case, it will be 9020.