Enable Connected Banking in TallyPrime

As a first step to setting up Connected Banking, you will need to enable Connected Banking in TallyPrime and link a mobile number to your Tally.NET ID and accept the terms and conditions. This mobile number is used for OTP verification whenever you log in to Connected Banking in TallyPrime.

- Press Alt+Z (Exchange) > All Banking Options > Login & Logout.

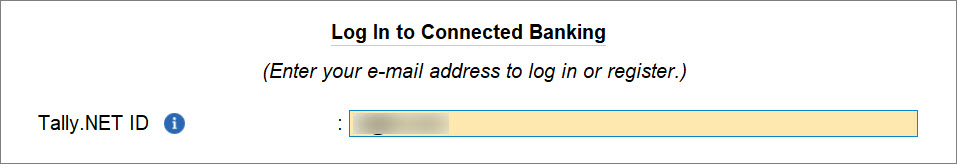

- In the Log In to Connected Banking screen, enter your Tally.NET ID.

If you are working with multiple users under a license site, then refer to Approve User Access to Connected Banking for non-admin users.

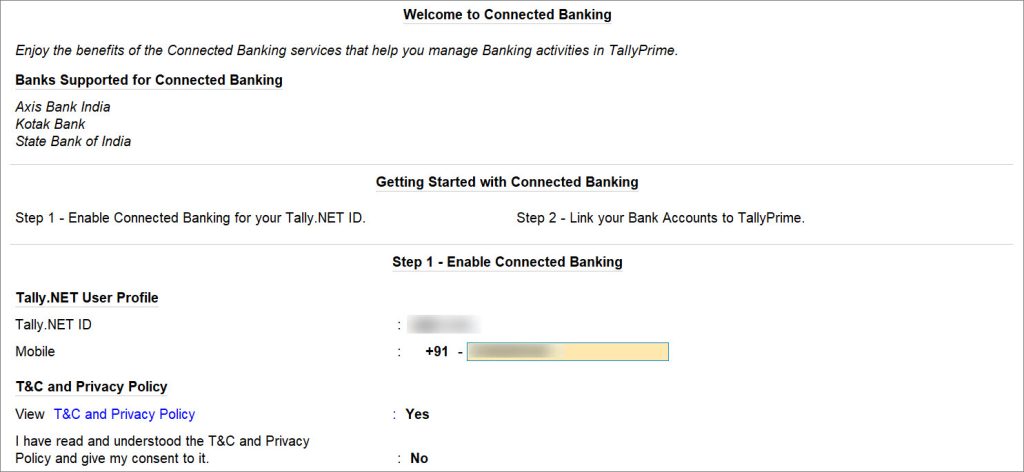

- Enter your Tally.NET password.

- Enter the mobile number that you want to link to your Tally.NET ID.

- View T&C and Privacy Policy: Yes.

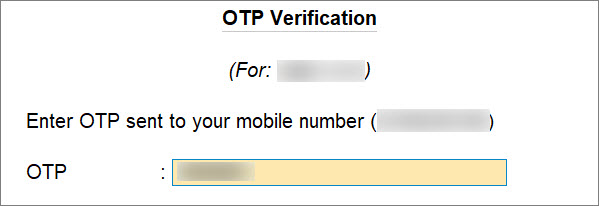

You will get redirected to the web page where you can read the T&C and Privacy Policy and then accept it. - Enter the OTP received on your mobile number.

If you do not receive the OTP, press Alt+R (Resend OTP).

The mobile number gets linked to your Tally.NET ID and the Connected Banking gets enabled.

As a result, you get logged in and can use the Connected Banking services.

You can proceed to connect your bank accounts to TallyPrime.

If your password does not meet the new password policy introduced for Connected Banking, then you will need to change the password.

Link Mobile Number to Tally.NET ID on the Portal

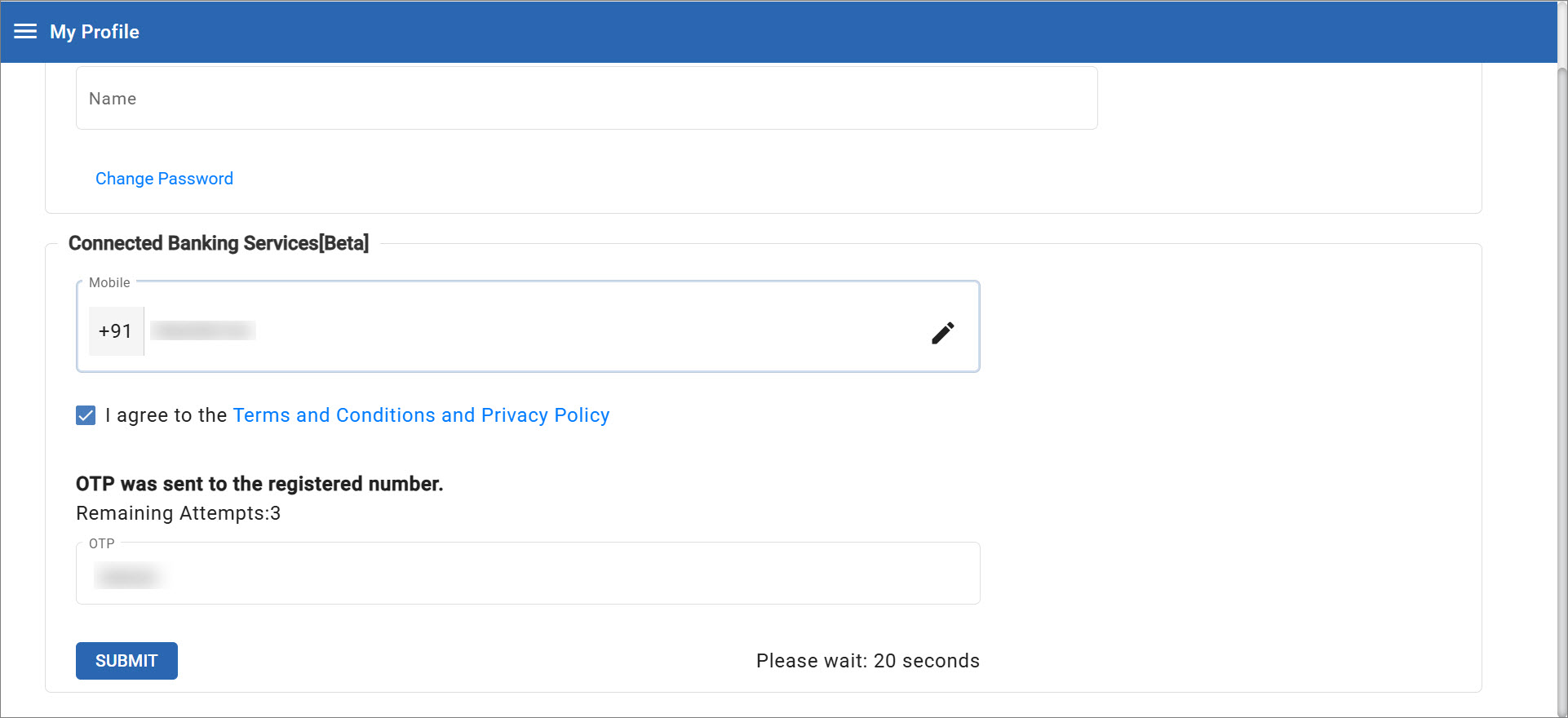

- Log in to the Tally Solutions Customer Portal.

- Click MY PROFILE.

- Update the mobile number.

- Under Connected Banking Services, click the edit icon.

- Enter the mobile number and click the tick mark icon (✓).

- Check the box to agree with Terms and Conditions & Password Policy.

- Click UPDATE.

- Click OK.

- Enter the 6-digit OTP sent on your mobile number.

- Click SUBMIT.

The mobile number gets linked to your Tally.NET ID.