You may need to split Company data in TallyPrime to manage the volume and size of your data, especially if your business involves dealing with a number of parties and selling or buying numerous stock items. Furthermore, if you have a practice of starting afresh at the beginning of each financial year, then the facility to split Company data in TallyPrime helps you have a separate data for each financial year. While splitting the data in TallyPrime, you may face some errors, and you will need to resolve those to proceed further.

The topic addresses the errors you may face and answers all the frequently asked questions (FAQ) about splitting Company data in TallyPrime.

After splitting the company, there can be a mismatch in the Stock Summary closing value because of the FIFO Perpetual stock valuation method applied to the stock item.

On selecting this method, the leftover stock is valued using the last purchase price as the reference. Hence, if the price of the item is increasing year-on-year, the value of closing stock inflates, regardless of the fact that the stock is from a previous year. To learn about stock item valuation methods, refer to Stock Valuation Methods.

Before you split the company, the Verify feature detects the error and allows you to make corrections, if any.

To know the complete procedure, refer to the Verify Company Data section under the Split Company Data in TallyPrime topic.

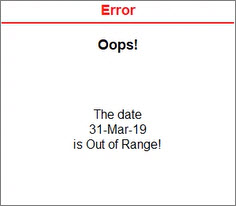

When the Closing Balance of a ledger does not fall between the current period of the Company

To solve this issue and proceed, follow the step given below.

- Open the Tally.SPL file in your data folder with Notepad.

You will know the ledger in which the Closing Balance date is out of range. - Open the ledger in TallyPrime and update the Closing Balance date within the range of current period.

- Split the data.

You can delete an unused voucher type, as it may not be needed in your business. For instance, if your business does not have a system of creating order vouchers before sales or purchase, then you may want to delete the voucher types.

To know how to delete a voucher type, refer to the Delete a Voucher Type section in the Voucher Types in TallyPrime topic.

This error occurs if you had altered the name of default ledgers or groups.

Before splitting the data, ensure that you retain the original names of all the default ledgers and groups.

If you do not know the admin level password, then you cannot split the company data.

However, you can export the data from the company and import to a new one and then you can split the data.

To know how to export and import company data, refer to the following sections:

- Export Masters and Transactions section in the Export Data in TallyPrime topic

- Import Masters and Import Transactions sections in the Import Data in TallyPrime topic

I am facing the error, “Duplicate Entry!” while splitting the data in TallyPrime. How can I proceed?

Before splitting the data, repair the data in TallyPrime to resolve any possible error.

Refer to the Repair Company Data in TallyPrime | Rewrite topic for more information.

Only the vouchers that affect the financial or inventory reports in your company data are carried forward when you split the data.

The sales and purchase order vouchers do not affect your company’s financial reports, and therefore, those vouchers are not carried forward.

It happens when the closing balance is available for the non-revenue ledgers and are cleared in the current financial year. When you split the data on the first day of the financial year, the bills that you had already cleared off are not considered during the split, and therefore, the cleared bills will still appear in the child companies.

This happens when there are multiple user roles. For instance, if there are three users – Admin, B, and C. And you log in with username B or C that do not have administrative rights, you will not see an option to split the data.

However, if you have forgotten the admin password, then follow the steps given below:

- Create a new Company.

To know how to create a company, refer to the Create a Company to Record Business Transactions section in the Set Up Your Company - Export data from the old Company of which you have forgotten the admin password.

To know how to export data, refer to the Export Masters and Transactions section in the Export Data in TallyPrime topic. - Import the data of the old Company to the new one.

To know how to import data, refer to the Import Masters and Import Transactions sections in the Import Data in TallyPrime topic.

The speed at which the data gets split depends on the volume of the data and the configuration of your computer. We recommend that you split data on the local hard disk on a computer with a higher RAM.

To know more, refer to the Recommended System Configurations for TallyPrime topic.

This happens when the payment of TDS applicable in the parent company is made in the child company.

For instance, if the parent company A has the period 1-Apr-2020 to 31-Mar-2022. Thereafter, the company is split into two parts – 1-Apr-2020 to 31-Mar-2021 (company B) and 1-Apr-2021 to 31-Mar-2021 (company C).

Now, if the payment for TDS of the last quarter of the first child company, that is, the company B is made on 7-Apr-2021 in the current child company C, then you will not be able to generate the TDS statutory report.

In such a case, you will need to split the parent company with the following periods:

- 1-Apr-2020 to 7-Apr-2021 (company B)

- 8-Apr-2021 to 31-Mar-2022 (company C)

Thereafter, you will be able to generate TDS statutory report in the first child company.

In the second child company C, you can retain the TDS entry, that is the TDS voucher dated 7-Apr-2021 to keep your books of accounts updated. The tax reference will be set to New Ref in the voucher after splitting data. You will need to alter the payment voucher to set the tax reference to End of List.

The unreconciled transactions will get carried forward when you split the company data.

You can merge two companies, say company A and company B, in TallyPrime by exporting the data from both the companies and importing it to a new company C.

The companies to be merged should have the same financial period.

On the other hand, the new company must have:

- F11 features of both the companies

- The financial period of both the companies.

Both the companies should have the same financial period, say, 1-Apr-2022 to 31-Mar-2023. The new company that you create must also have the financial period 1-Apr-2022 to 31-Mar-2023.

Follow the steps given below.

- From company A:

- Export the masters.

- Export the vouchers.

Similarly, export the masters and vouchers from company B.

To know how to export masters and transactions, refer to the Export Masters and Transactions section in the Export Data in TallyPrime

- Create a new company C with F11 features of both the companies.

To know how to create a company, refer to the Create a Company to Record Business Transactions section in the Set Up Your Company - Enter Financial year beginning from as the date in both the companies to be merged.

This ensures that the new company has the financial period same as the companies to be merged. - From company A to company C:

- Import the masters.

- Import the vouchers.

Similarly, import the masters and vouchers from company B to company C.

To know how to import masters and vouchers to a company, refer to the Import Masters and Import Transactions sections in the Import Data in TallyPrime

After importing the masters and transactions in the company C, you can check the same in Chart of Accounts and Day Book respectively.

You can also track the import of masters and transactions with a detailed log.

To enable the detailed log:

- Press Alt+O (Import) > Configuration.

- Type or select Enable detailed log (tally.imp) and press Enter.

- Press Ctrl+A to save the setting.