GST Returns for Regular – SEZ Companies – GSTR-1, GSTR-3B, and GST Annual Computation

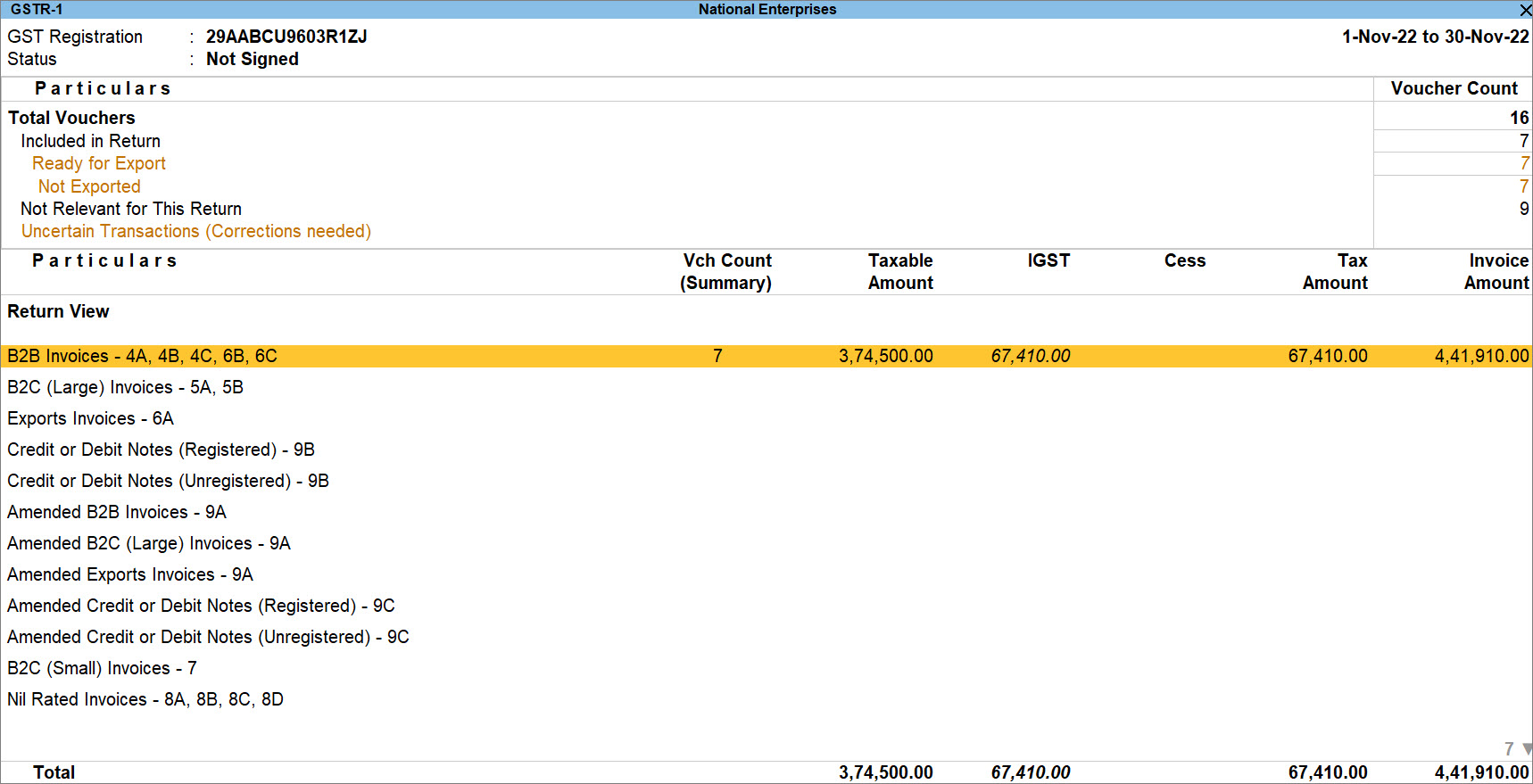

Just like a business with regular registration, as a Regular – SEZ dealer, you need to file GSTR-1, GSTR-3B, and GSTR-9 at the end of your return period. TallyPrime ensures that your transactions appear in sections of the GST returns, based on their nature and the registration type of the counterparty and the rules applicable to Regular – SEZ companies.

In TallyPrime, you can set your return period in your Company and view the details in GSTR-1,GSTR-3B, and GST Annual Computation immediately after you open the reports.

What’s more, you can export your GST returns from TallyPrime whenever needed. If you are using the multi-GSTIN feature in TallyPrime, then you have the flexibility to export GST returns of all GST registrations or a specific GST registration, as needed.

You can easily open the GST return reports in TallyPrime and view the data for a period. To open:

- GSTR-1: Press Alt+G (Go To) > type or select GSTR-1 and press Enter.

Alternatively, Gateway of Tally > Display More Reports > GST Reports > GSTR-1 and press Enter.

To know about the sections of the report in which the transactions of different natures appear, refer to Natures of of Transactions and Section in GSTR-1, GSTR-3B, and GST Annual Computation. - GSTR-3B: Press Alt+G (Go To) > type or select GSTR-1 and press Enter.

Alternatively, Gateway of Tally > Display More Reports > GST Reports > GSTR-3B and press Enter.

To know about the sections of the report in which the transactions of different natures appear, refer to Natures of of Transactions and Section in GSTR-1, GSTR-3B, and GST Annual Computation. - GST Annual Computation: Press Alt+G (Go To) > type or select GST Annual Computation and press Enter.

Alternatively, Gateway of Tally > Display More Reports > GST Reports > GST Annual Computation and press Enter.

To know about the sections of the report in which the transactions of different natures appear, refer to Natures of of Transactions and Section in GSTR-1, GSTR-3B, and GST Annual Computation.

The below table gives you a holistic view of the sections of GSTR-1, GSTR-3B, and GST Annual Computation based on the respective natures of transaction.

Natures of of Transactions and Section in GSTR-1, GSTR-3B, and GST Annual Computation

|

Nature of Transaction |

Know More About It |

Section in GSTR-1 |

Section in GSTR-3B |

Section in GST Annual Computation |

|---|---|---|---|---|

|

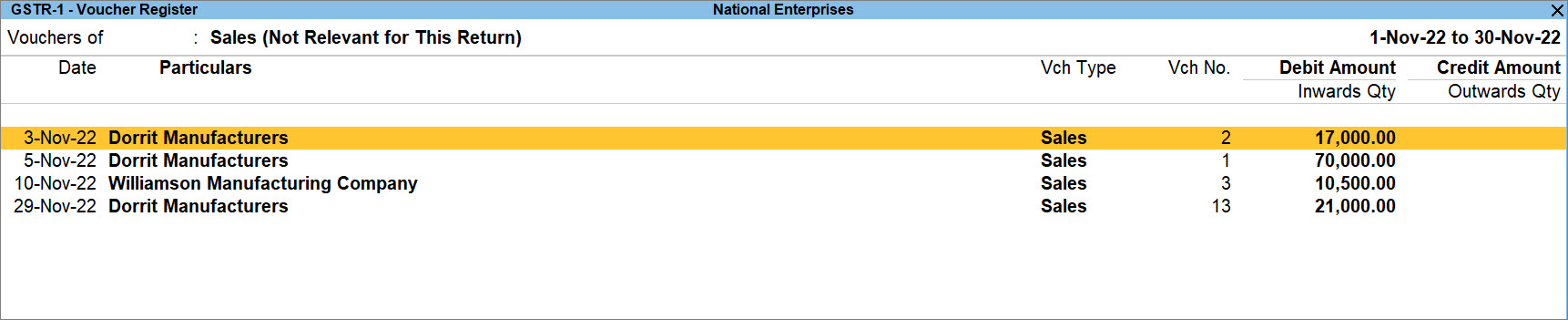

Sales of goods to a Regular dealer |

Refer to

Sales of Goods to Regular Party section in the Sales of Goods and Services in TallyPrime (Regular – SEZ) topic. |

Not Relevant for This Return > Non-GST Transactions.

|

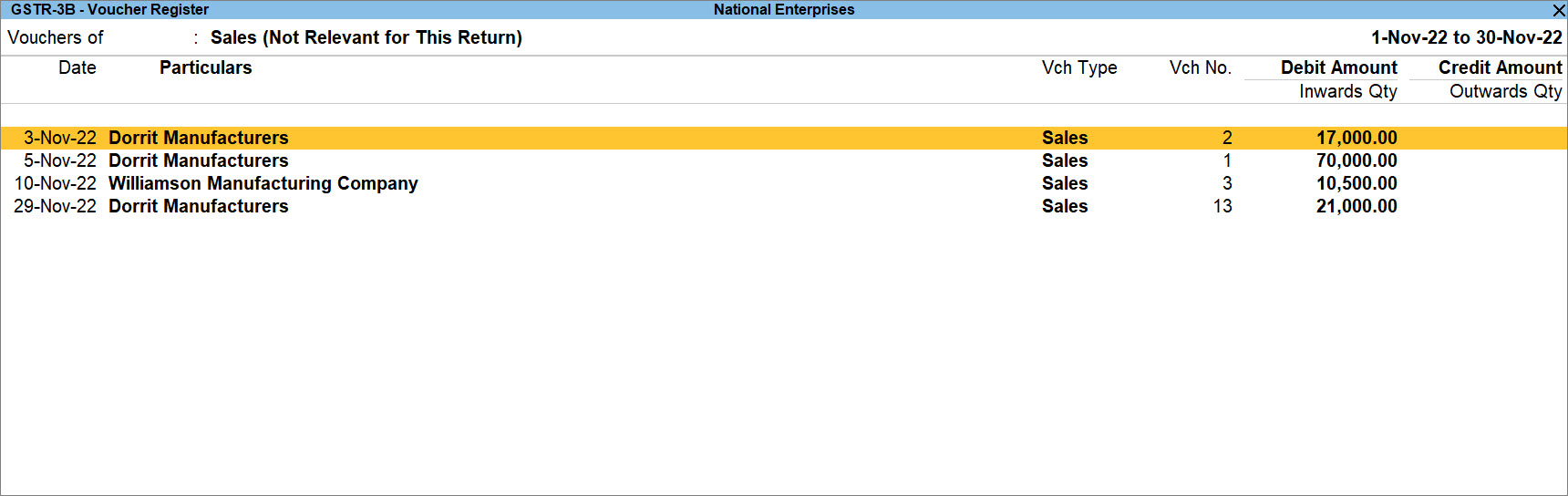

Not Relevant for This Return

|

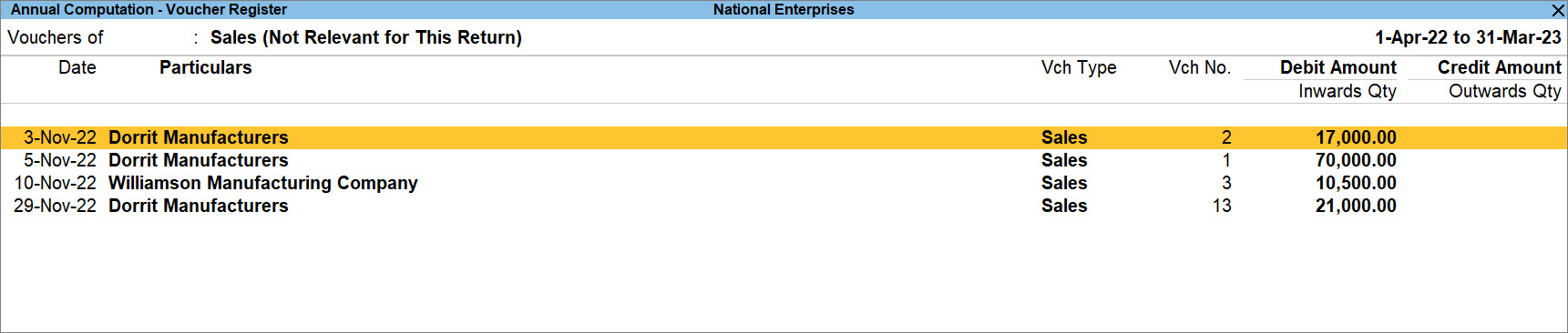

Not Relevant for This Return

|

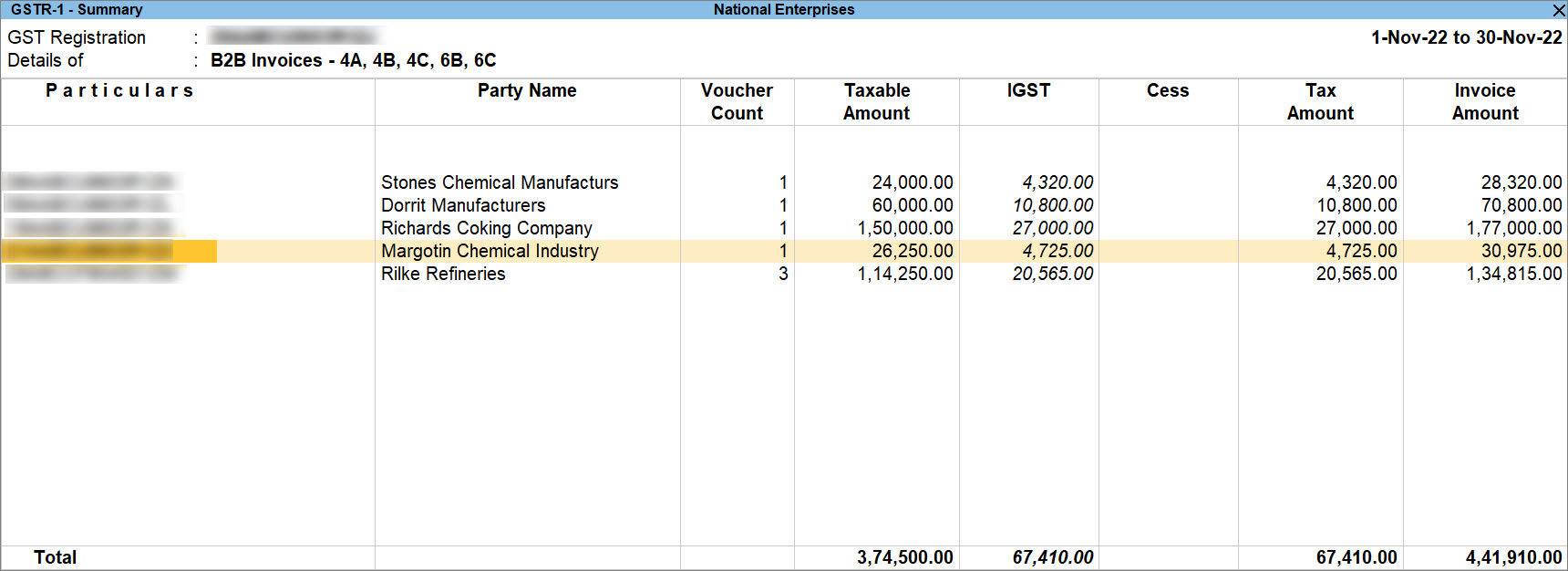

| Sales of goods to a Regular – SEZ dealer | Refer to the

Sales of Goods to Regular – SEZ Party section in the Sales of Goods and Services in TallyPrime (Regular – SEZ) topic. |

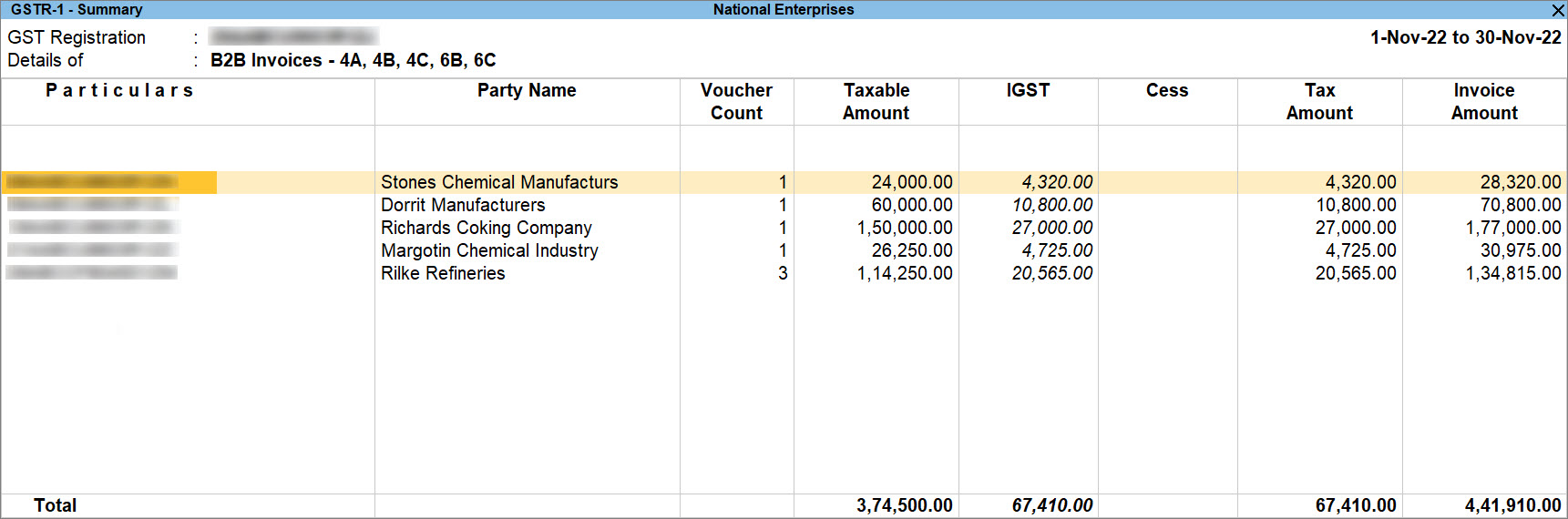

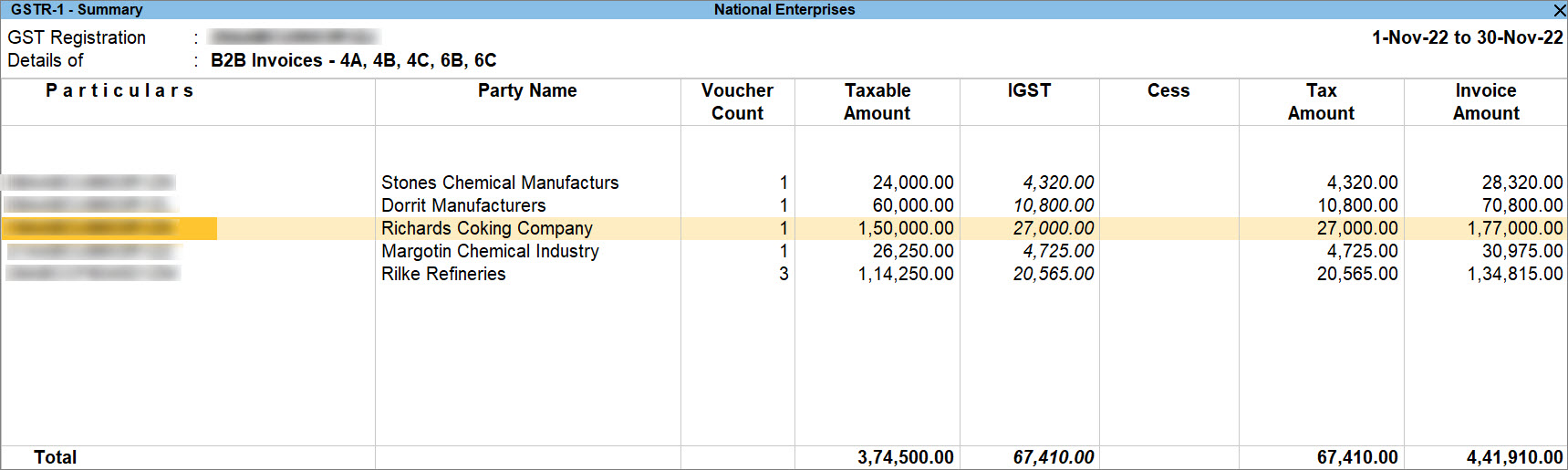

B2B Invoices – 4A, 4B, 4C, 6B, 6C

|

3.1 Tax on Outward and Reverse Charge Inward Supplies

|

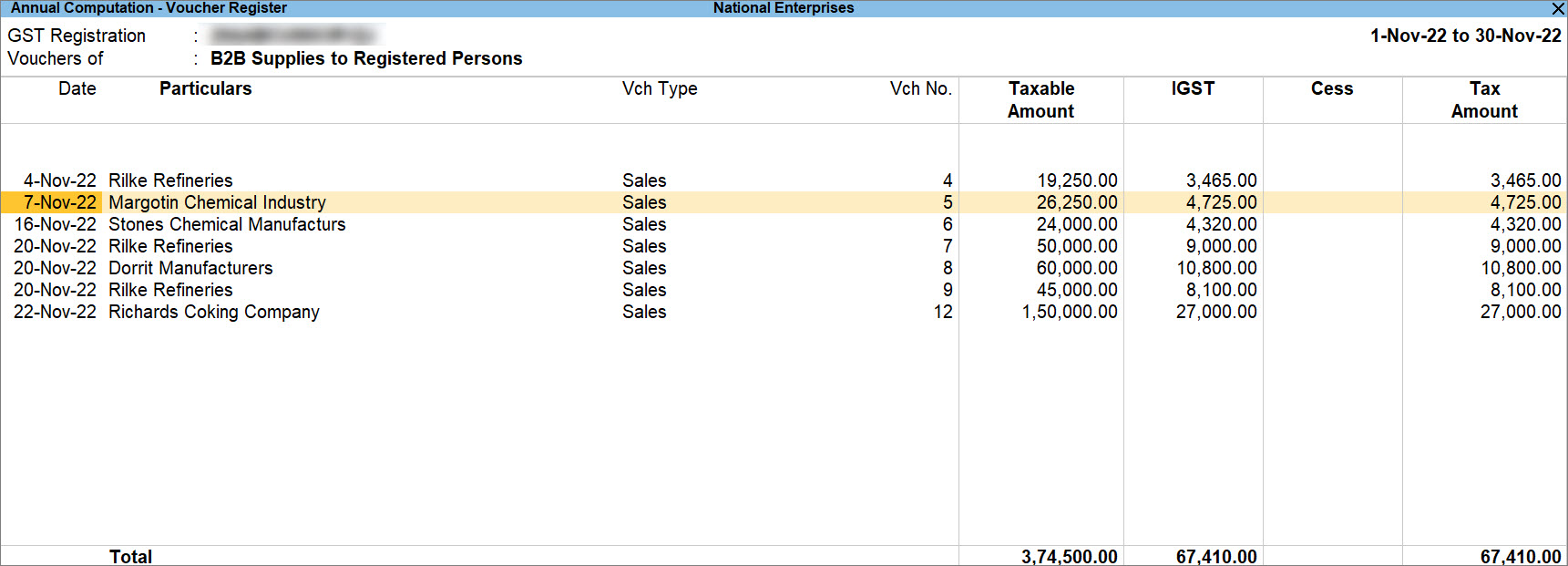

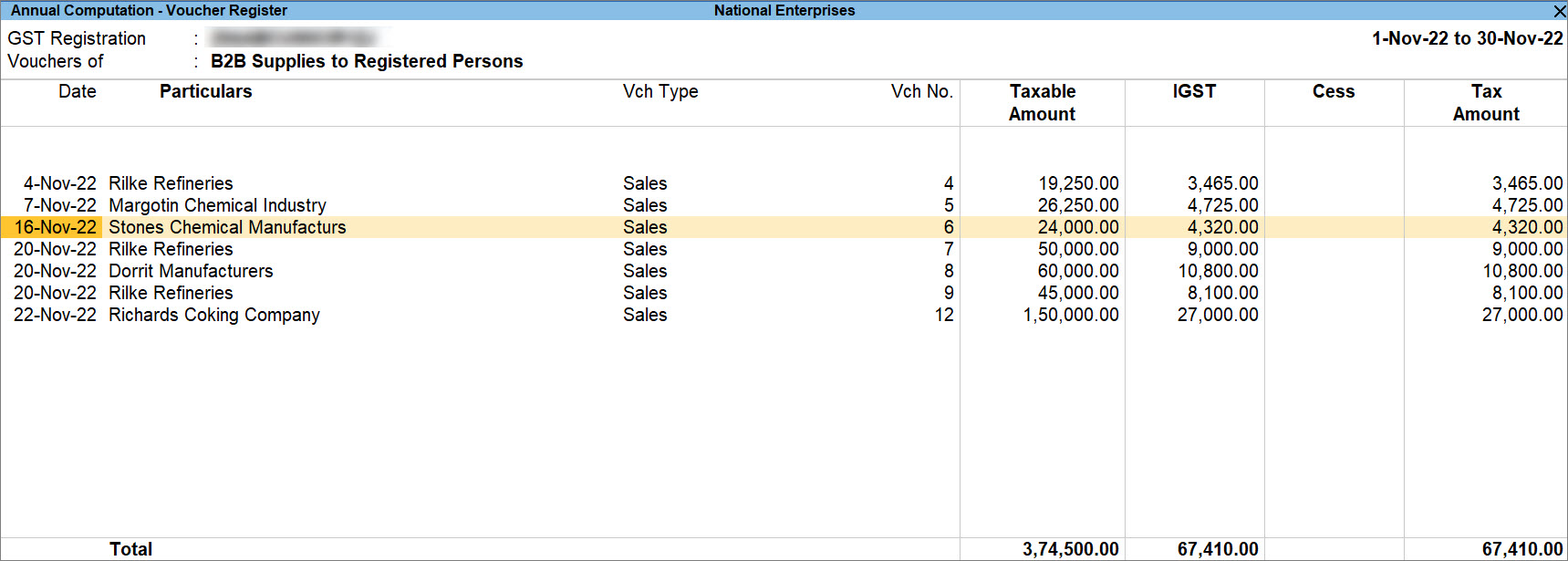

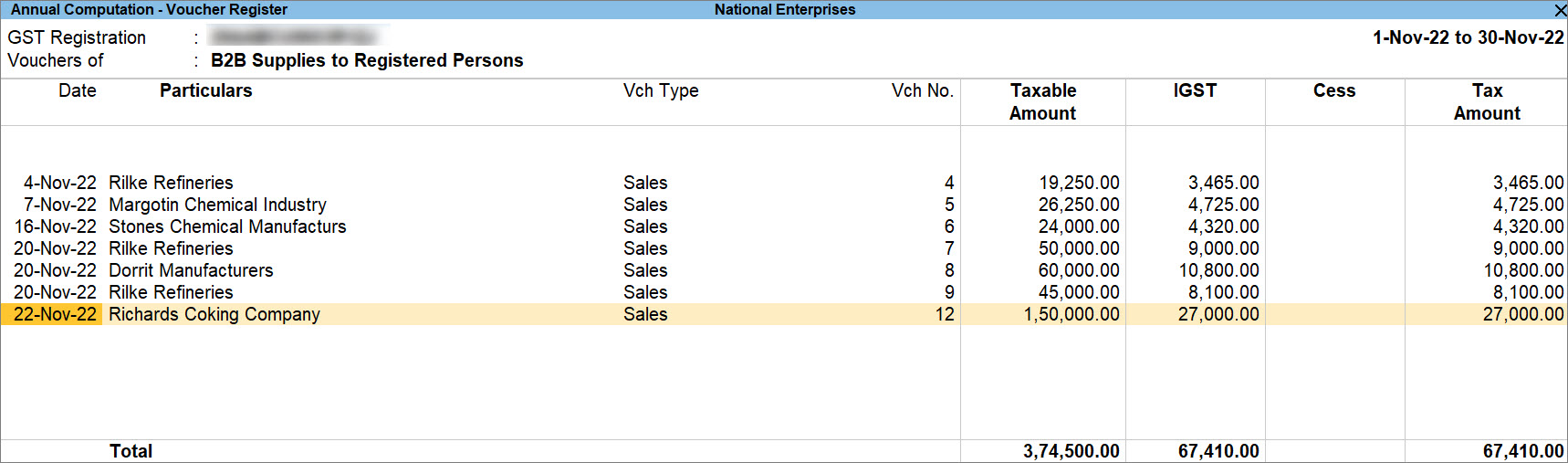

Outward and Inward Supplies on Which Tax is Payable (Including Advances) > Supplies to Registered Persons including Credit/Debit Note (B2B) > B2B Supplies to Registered Persons > drill down to any month to view the vouchers.

|

| Sales of service to a Regular dealer | Refer to the

Sales of Services to Regular Party section in the Sales of Goods and Services in TallyPrime (Regular – SEZ) topic. |

B2B Invoices – 4A, 4B, 4C, 6B, 6C

|

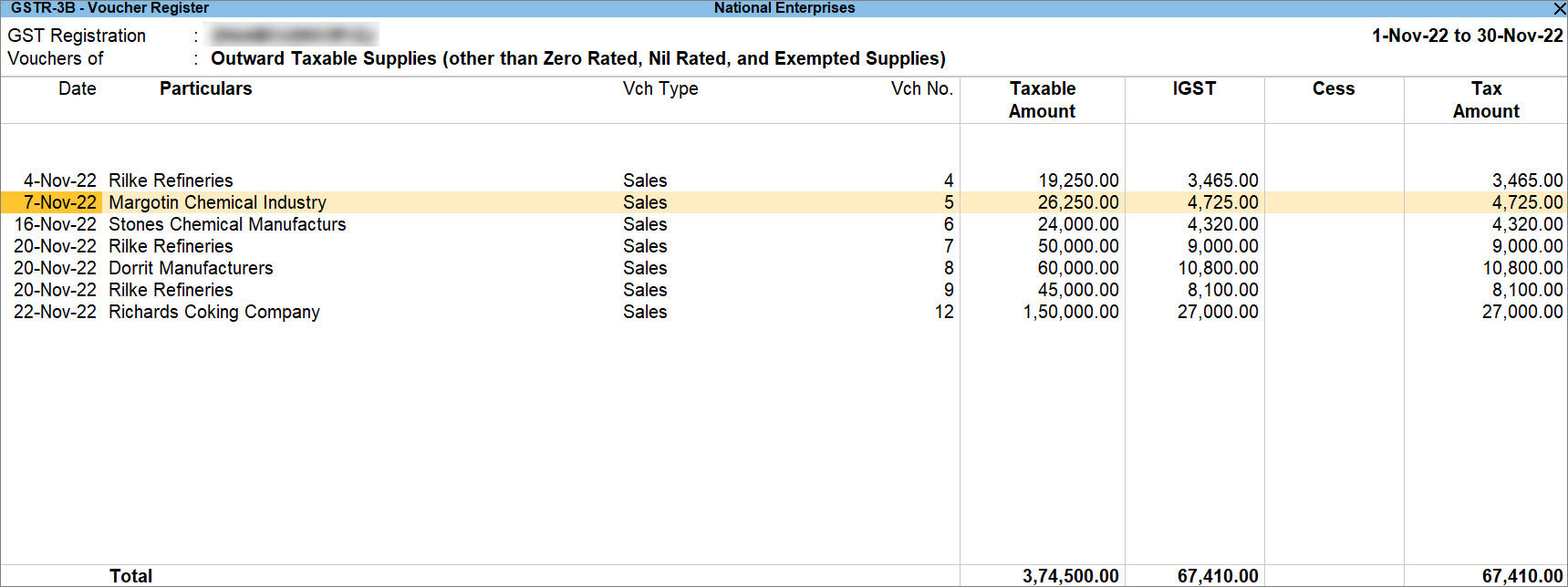

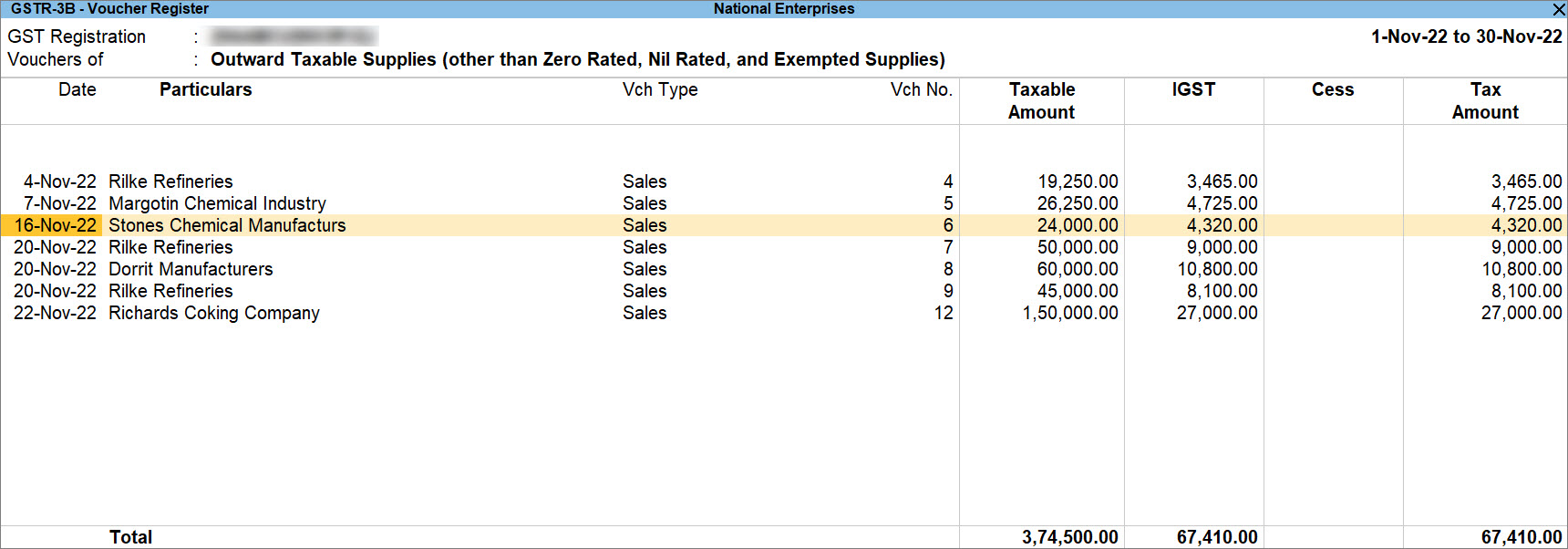

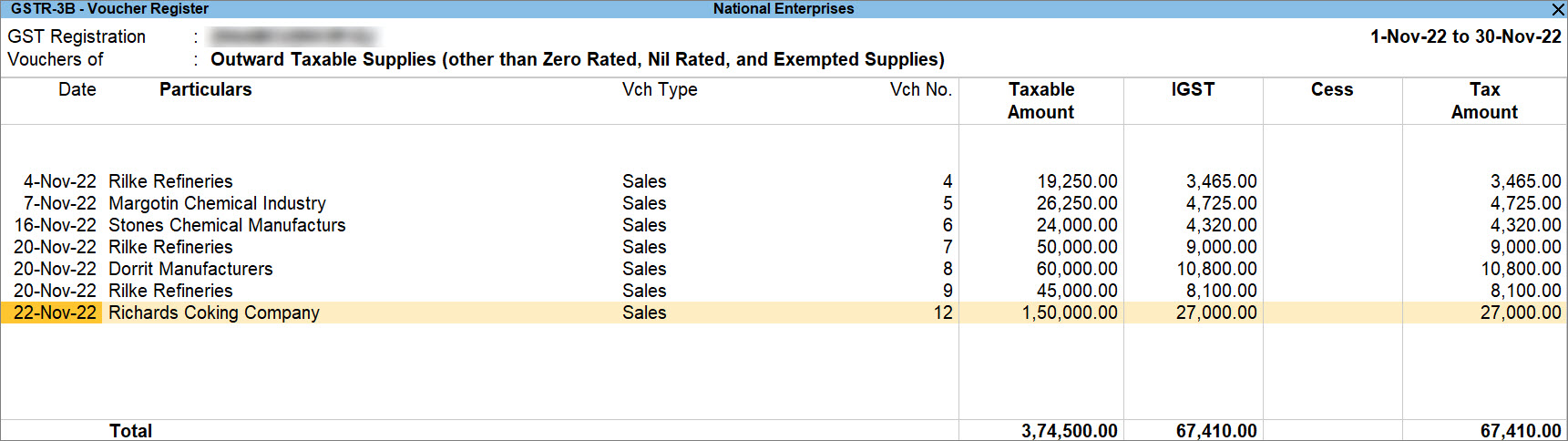

3.1 Tax on Outward and Reverse Charge Inward Supplies > Outward Taxable Supplies (other than Zero Rated, Nil Rated, and Exempted Supplies).

|

Outward and Inward Supplies on Which Tax is Payable (Including Advances) > Supplies to Registered Persons including Credit/Debit https://help.tallysolutions.com/tally-prime/taxation-compliance/gst-sez/salesNote (B2B) > B2B Supplies to Registered Persons > drill down to any month to view the vouchers.

|

| Sales of service to a Regular – SEZ dealer | Refer to the Sales of Services to Regular – SEZ Party section in the Sales of Goods and Services in TallyPrime (Regular – SEZ) topic. |

B2B Invoices – 4A, 4B, 4C, 6B, 6C

|

3.1 Tax on Outward and Reverse Charge Inward Supplies > Outward Taxable Supplies (other than Zero Rated, Nil Rated, and Exempted Supplies).

|

Outward and Inward Supplies on Which Tax is Payable (Including Advances) > Supplies to Registered Persons including Credit/Debit Note (B2B) > B2B Supplies to Registered Persons > drill down to any month to view the vouchers.

|

| Purchase of goods from a Regular dealer | Refer to the Purchase of Goods from Regular Party section in the Purchase of Goods and Services in TallyPrime (Regular – SEZ) topic. |

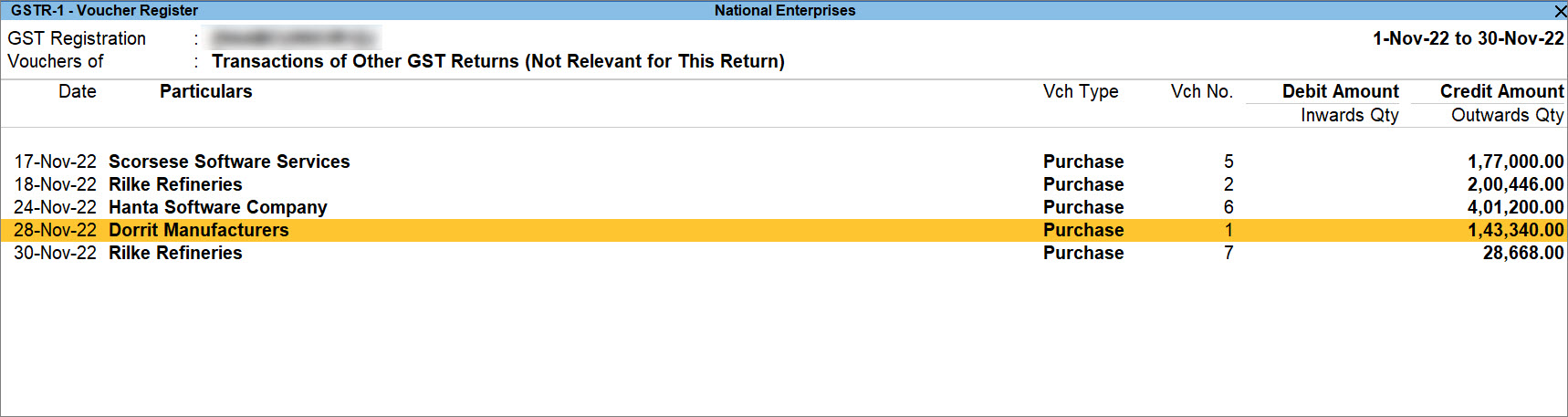

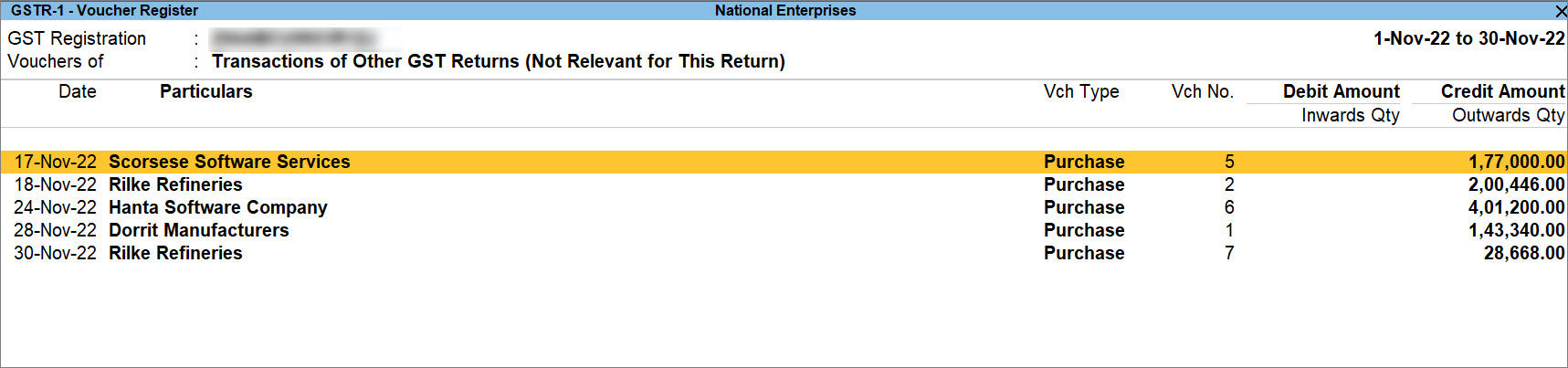

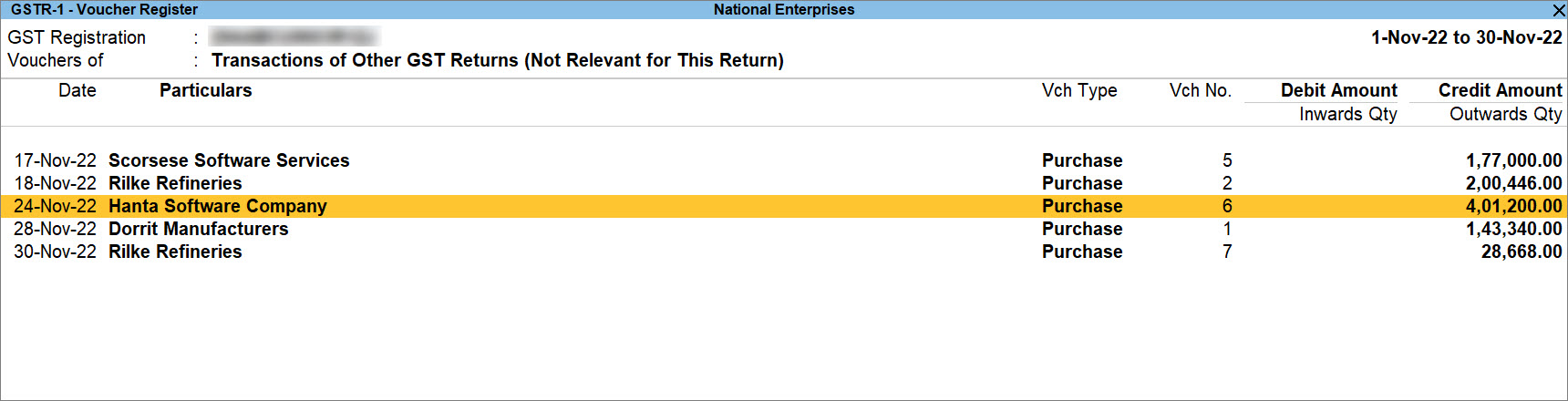

Not Relevant for This Return > Transactions of Other GST Returns

|

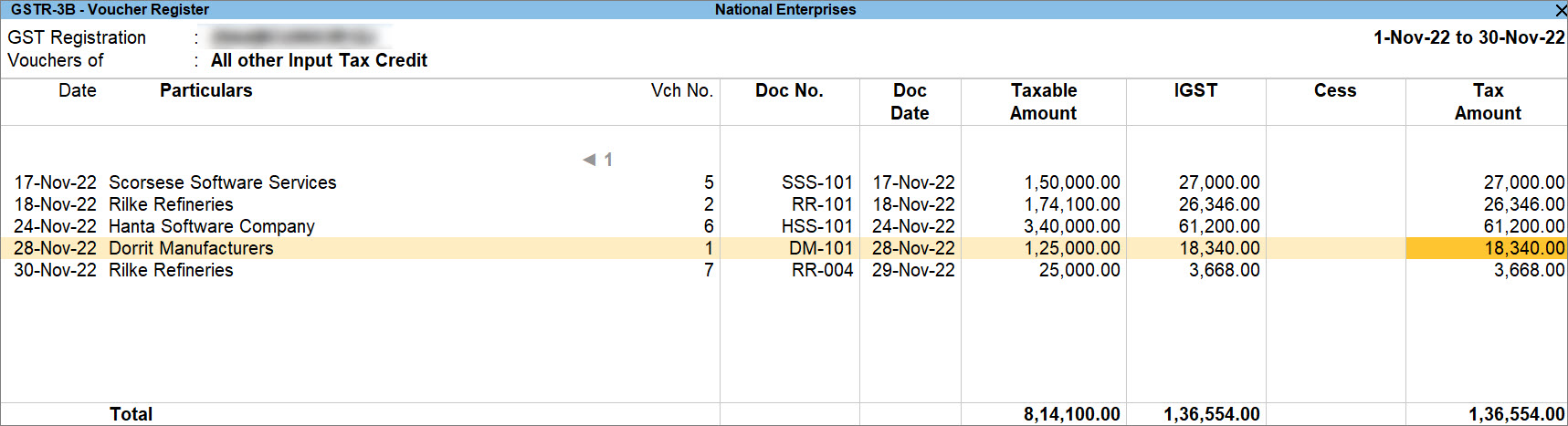

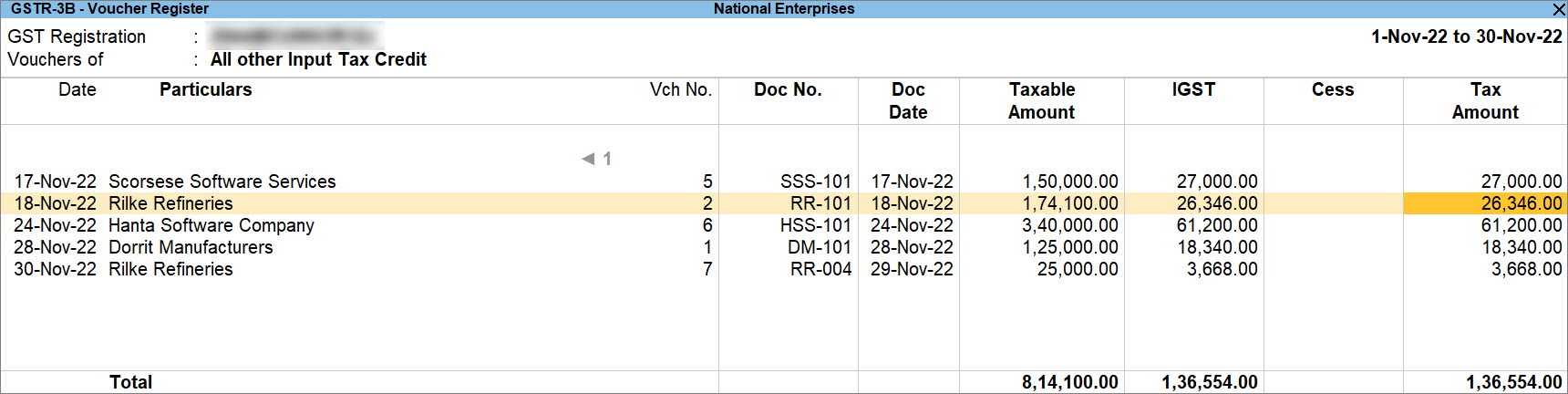

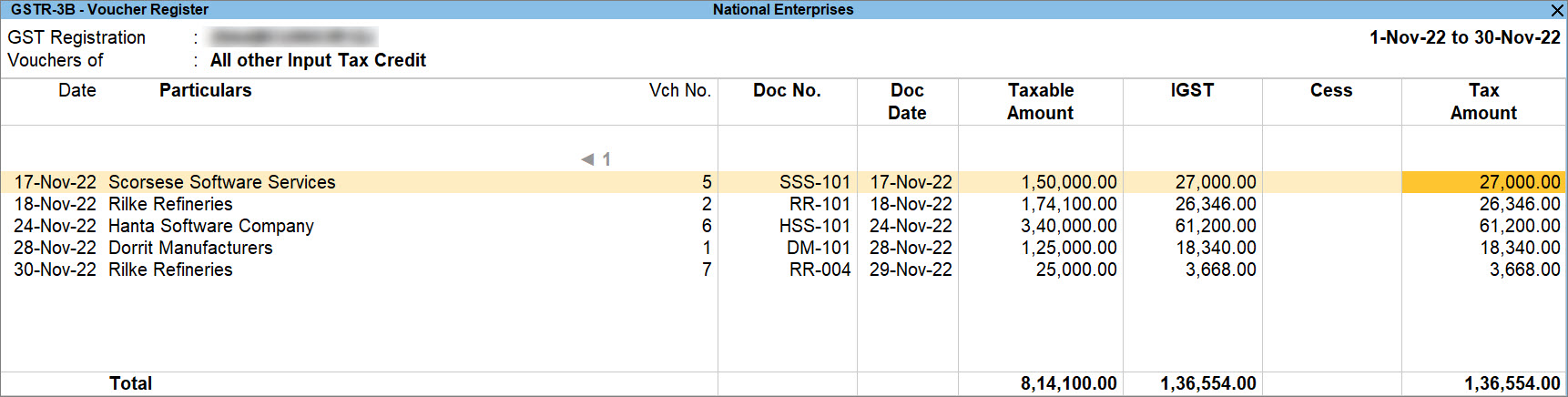

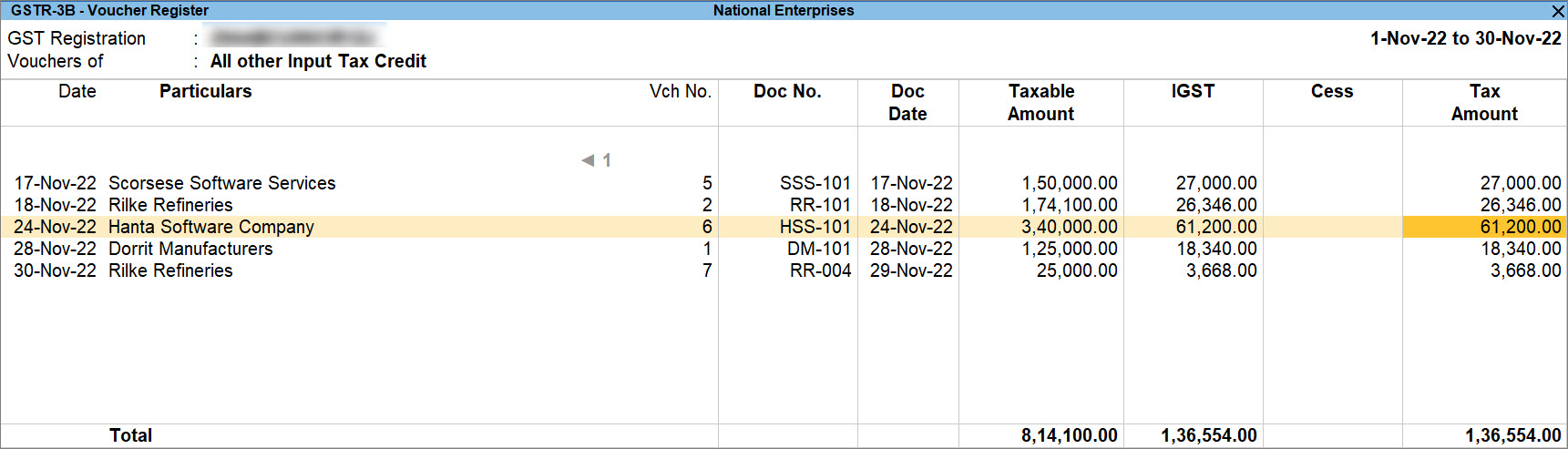

A. Input Tax Credit Available (either in part or in full) > All other Input Tax Credit

|

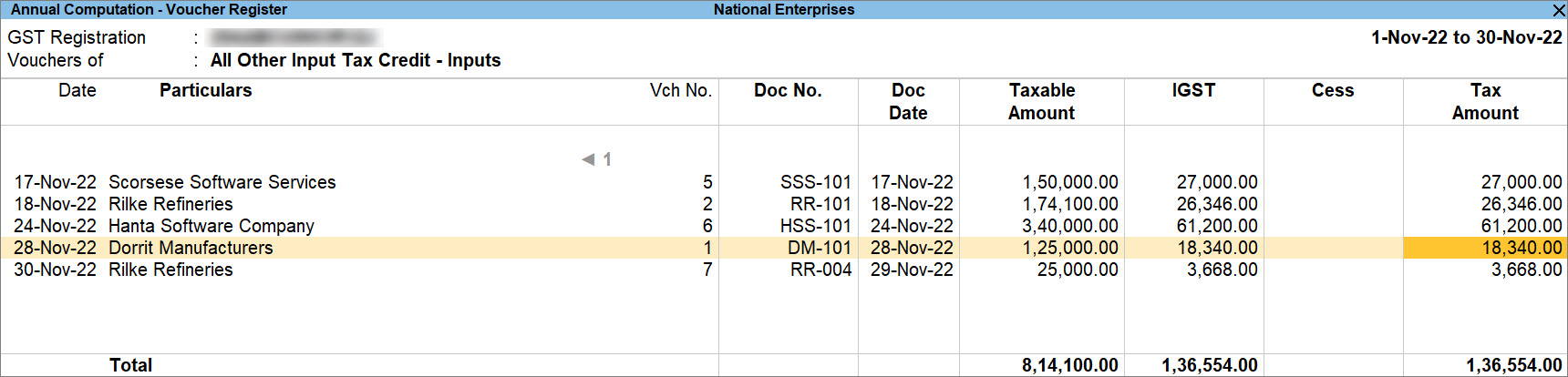

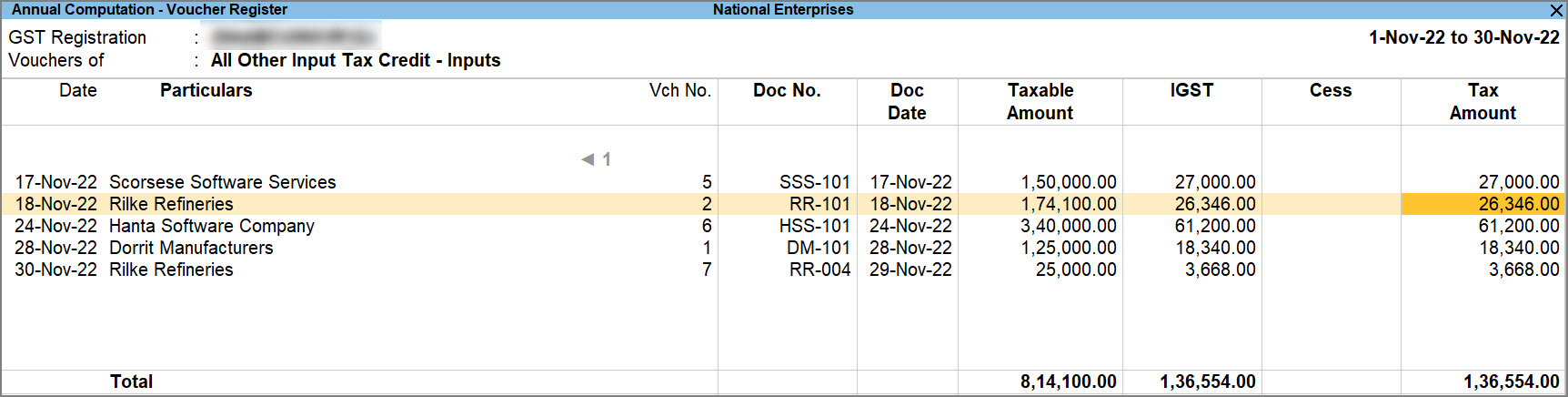

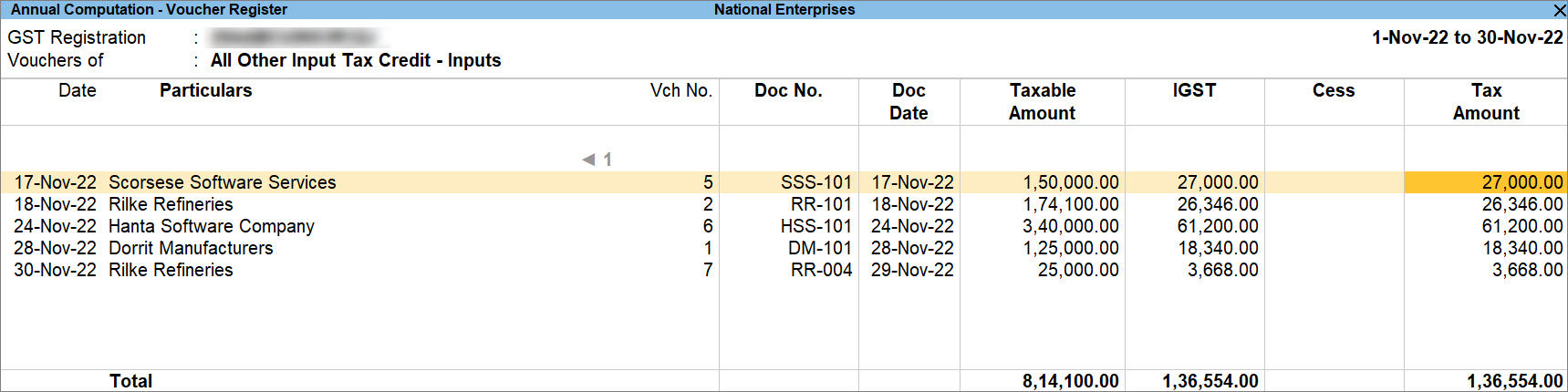

Input Tax Credit > All Other Input Tax Credit > All Other Input Tax Credit – Inputs > drill down to any month to view the vouchers.

|

| Purchase of goods from a Regular – SEZ dealer |

Refer to the Purchase of Goods from Regular – SEZ Party section in the Purchase of Goods and Services in TallyPrime (Regular – SEZ) topic. |

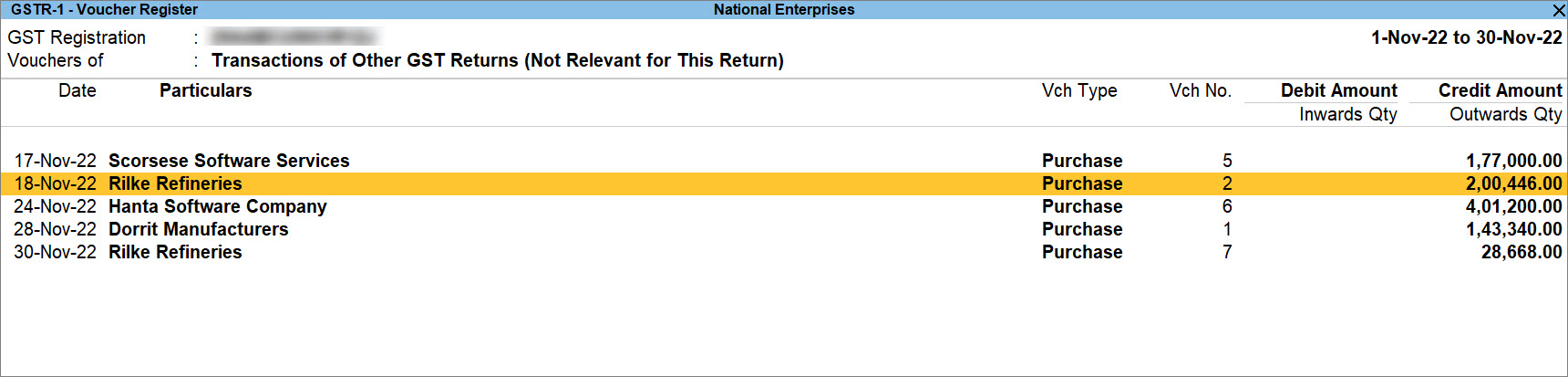

Not Relevant for This Return > Transactions of Other GST Returns

|

A. Input Tax Credit Available (either in part or in full) > All other Input Tax Credit

|

Input Tax Credit > All Other Input Tax Credit > All Other Input Tax Credit – Inputs > drill down to any month to view the vouchers.

|

| Purchase of service from a Regular dealer | Refer to the Purchase of Services from Regular Party section in the Purchase of Goods and Services in TallyPrime (Regular – SEZ) topic. |

Not Relevant for This Return > Transactions of Other GST Returns

|

A. Input Tax Credit Available (either in part or in full) > All other Input Tax Credit

|

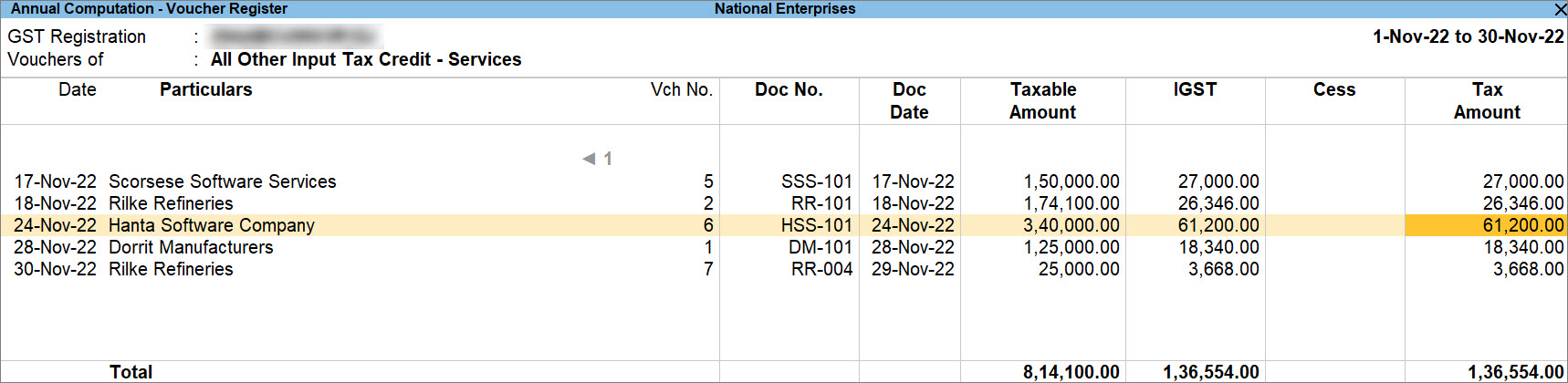

Input Tax Credit > All Other Input Tax Credit > All Other Input Tax Credit – Services > drill down to any month to view the vouchers.

|

| Purchase of service from a Regular – SEZ dealer | Refer to the Purchase of Services from Regular – SEZ Party section in the Purchase of Goods and Services in TallyPrime (Regular – SEZ) topic. |

Not Relevant for This Return > Transactions of Other GST Returns

|

A. Input Tax Credit Available (either in part or in full) > All other Input Tax Credit

|

Input Tax Credit > All Other Input Tax Credit > All Other Input Tax Credit – Services > drill down to any month to view the vouchers.

|

To know more about GST Returns in TallyPrime, refer to the following topics.