Input Tax Credit (ITC) to be Booked on Reverse Charge (RCM) Under GST

You can view the details of liability or input credit to be booked or claimed, on purchases under reverse charge, and import of goods and services, in the report provided for Input Credit to be Booked in GSTR-3B.

View the Summary of Input Tax Credit for Input Credit to be Booked

- Gateway of Tally > Display More Reports > Statutory Reports > GST Reports > GSTR-3B.

Alternatively, press Alt+G (Go To) > type or select GSTR-3B > and press Enter. - Press Enter on Input Credit to be Booked. You can view the details of liability or input credit to be booked or claimed, on purchases under reverse charge, and import of goods and services. These details appear for three months, which is the current month and previous two months. You can change the period to view the relevant details.

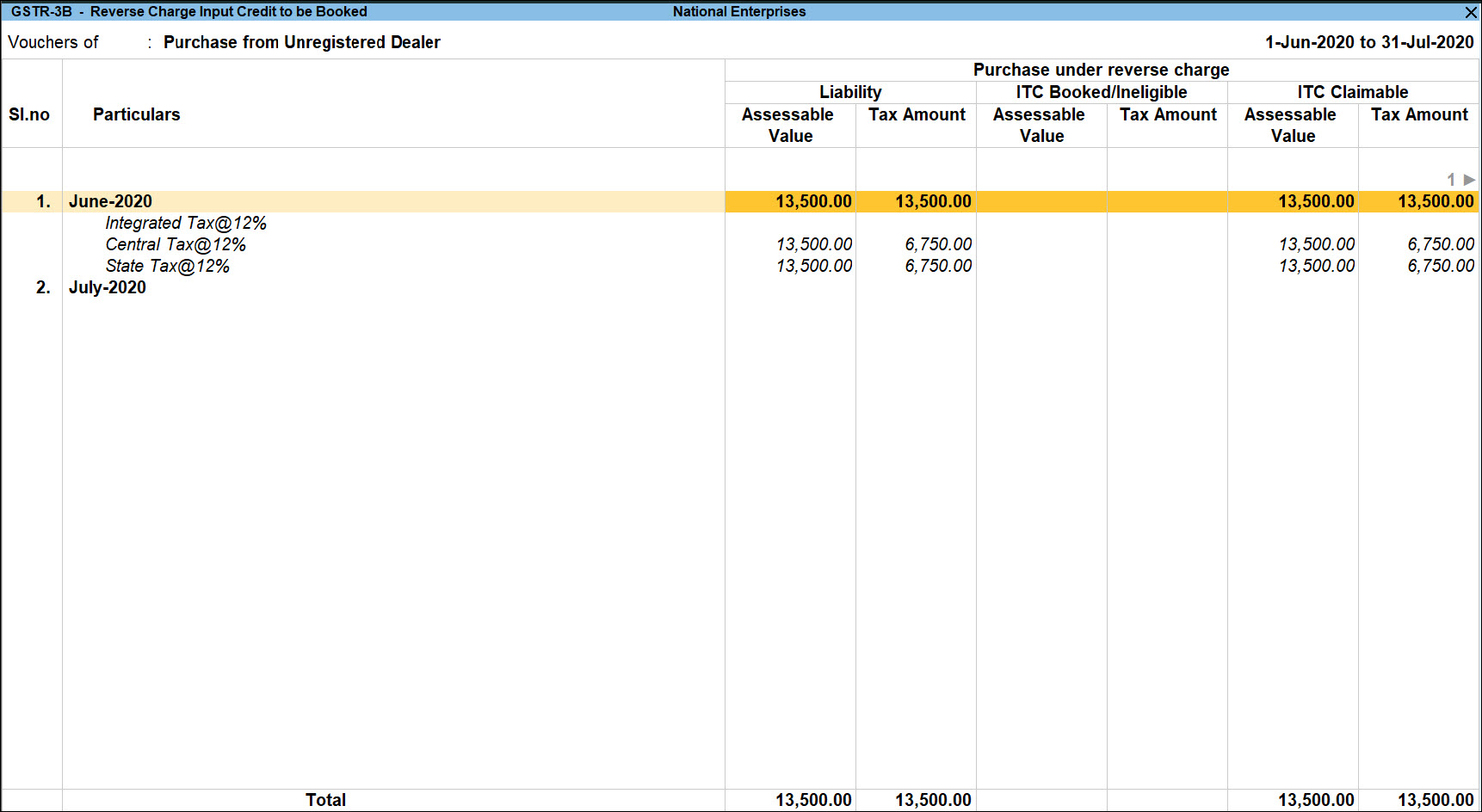

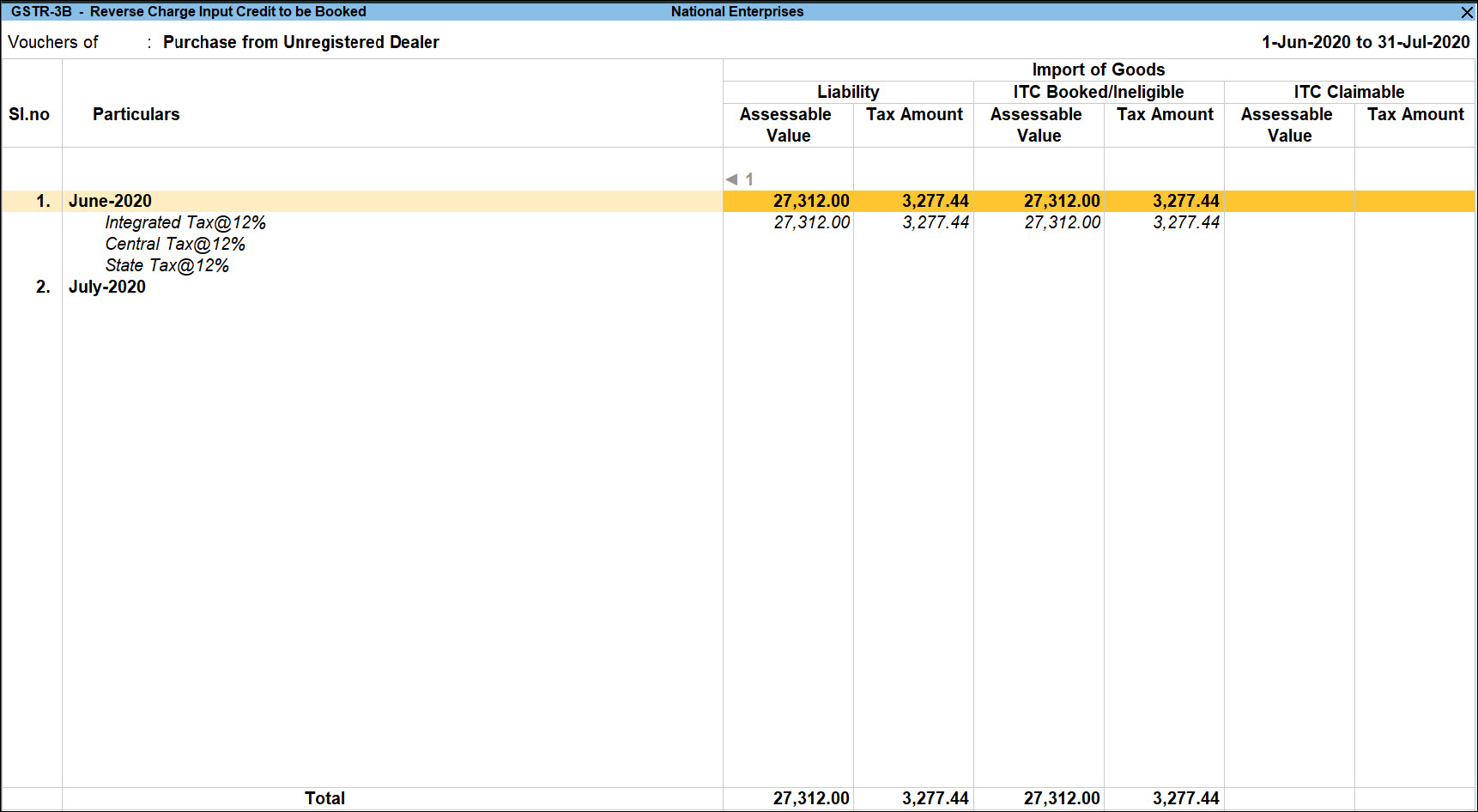

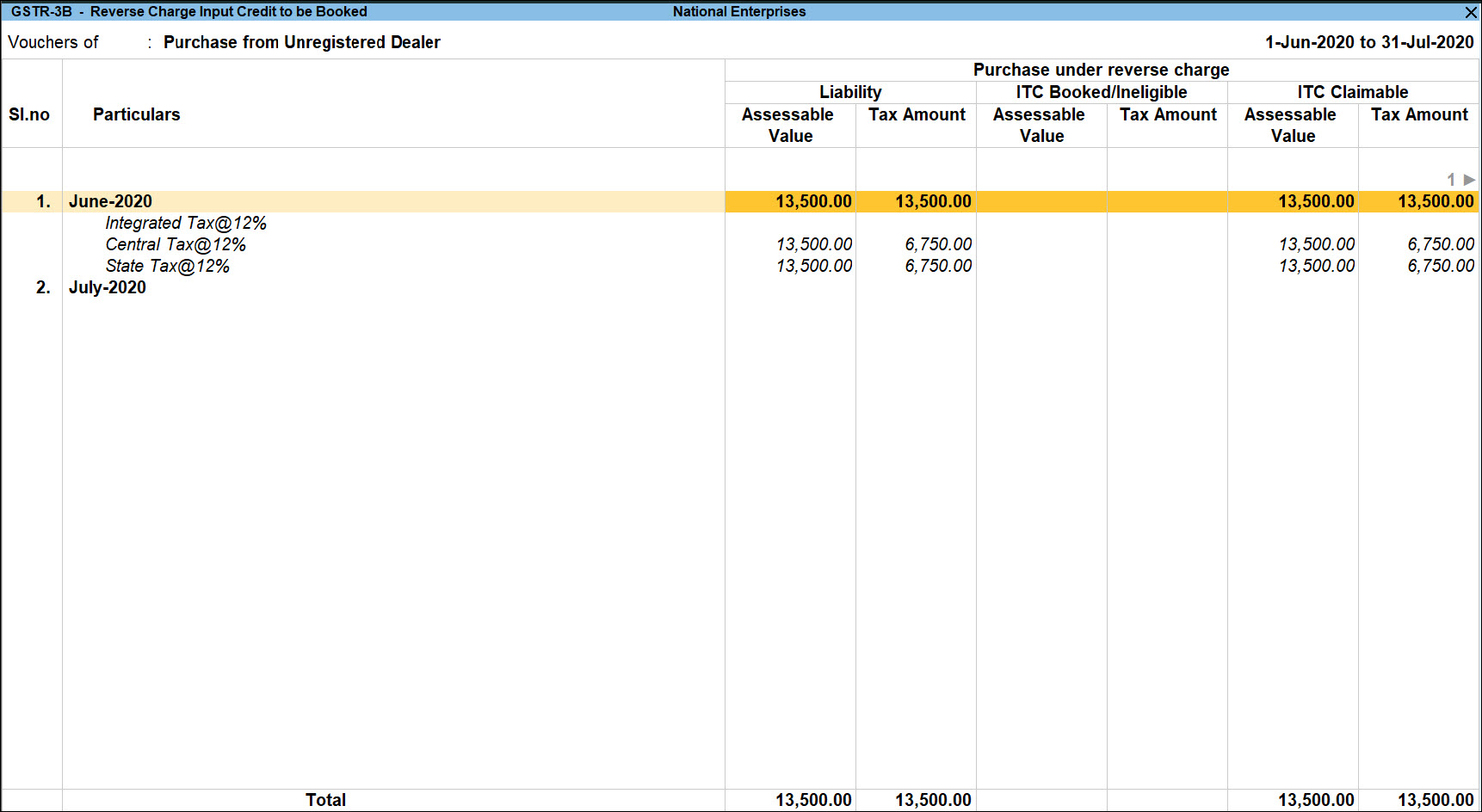

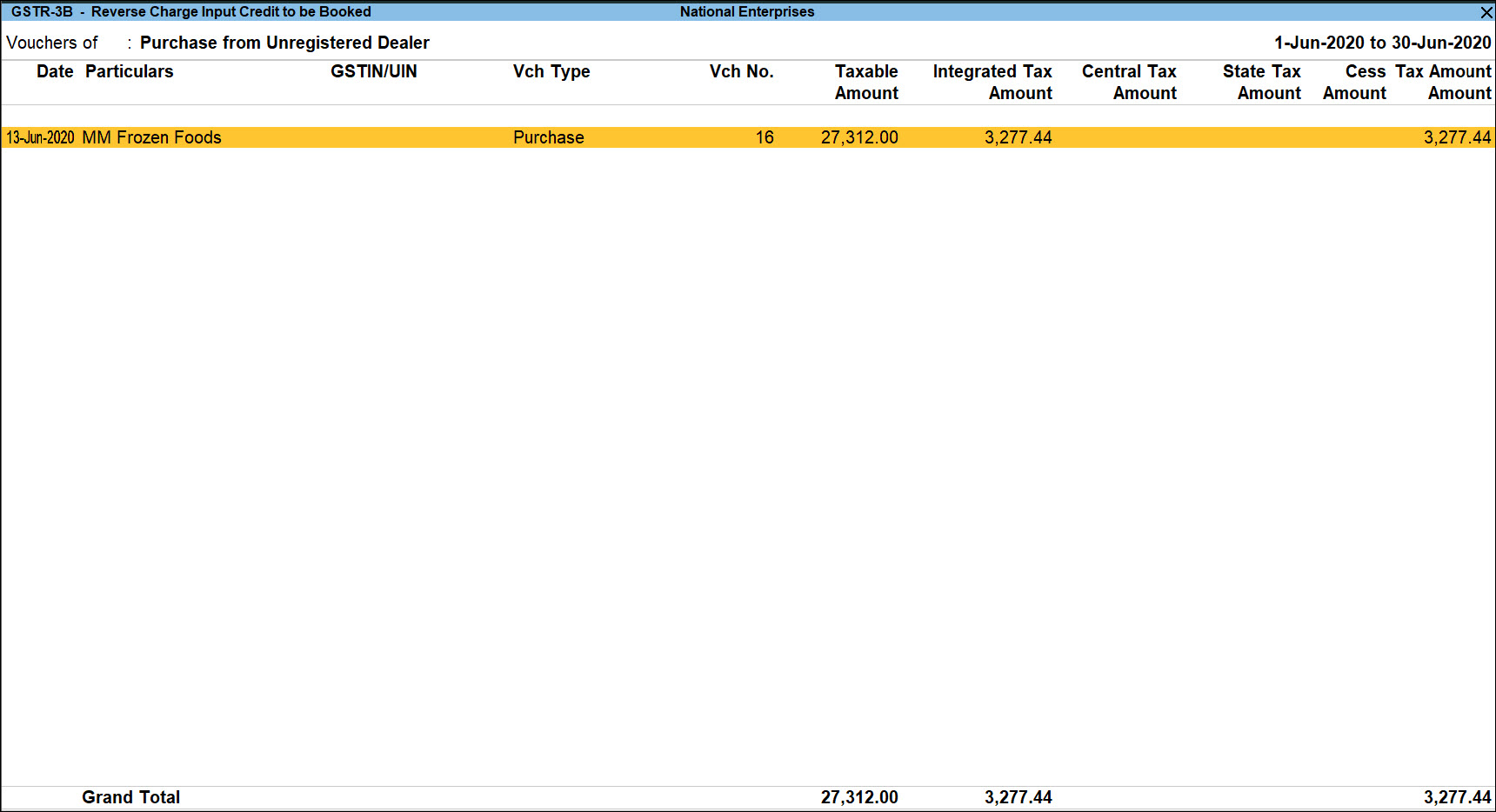

- Press Alt+F5 (Detailed). Based on the transactions, the report appears for purchases under reverse charge, import of services and import of goods, as shown below:

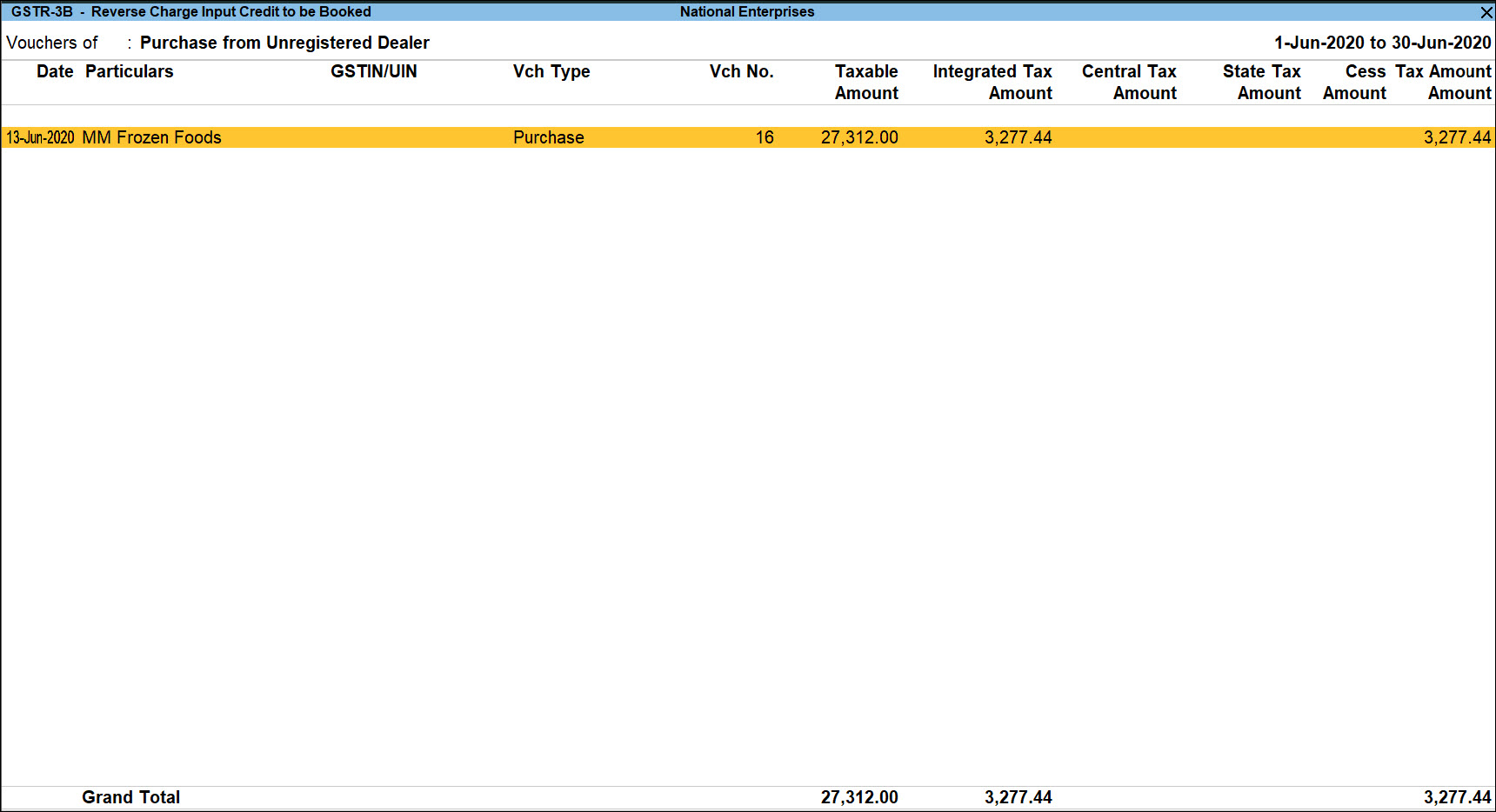

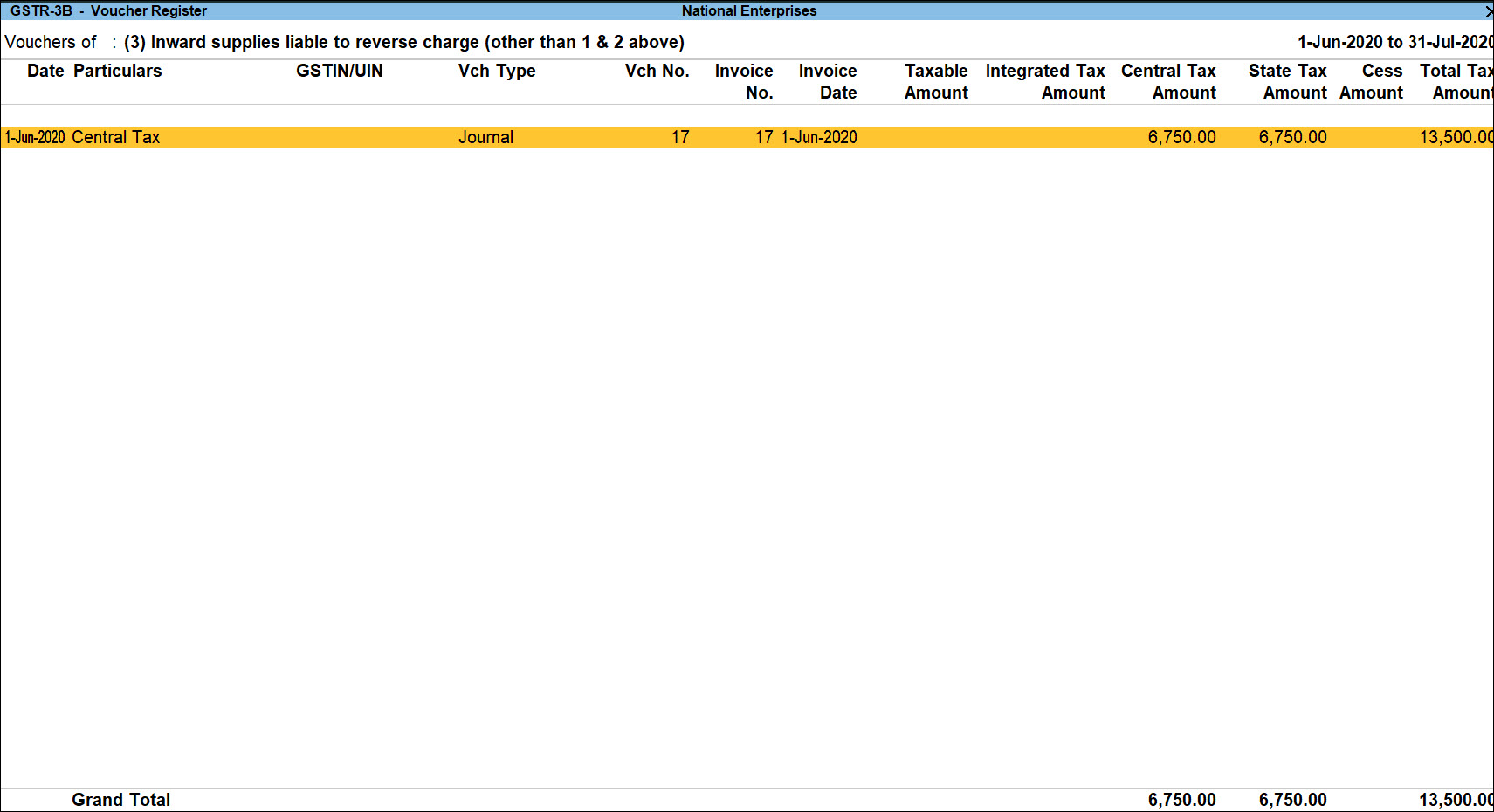

- Select one of the sections, and press Enter to view the Voucher Register of journal vouchers.

- Press F8 (Show Journals) to view the purchases recorded in the selected month.

To view the Purchase vouchers again, Pres F8 (Show Purchases).

Similarly, you can view the journal vouchers, and purchases recorded for import of goods and import of services.

Ctrl+B (Basis of Value): You can configure the values in your report for that instance, based on different business needs. In GSTR-3B Reverse Charge Input Credit to be Booked, you can display Purchases or Journals. Press Ctrl+B (Basis of Values) > set Show Vouchers of as Purchases or Journals. Press Esc to view the default values.

From GSTR-3B Reverse Charge Input Credit to be Booked summary report, Press Alt+J (Stat Adjustment) to record journal transactions for booking the pending liability or tax credit.

Raise Liability in One Tax Period and Claim Input Credit in the Subsequent Period

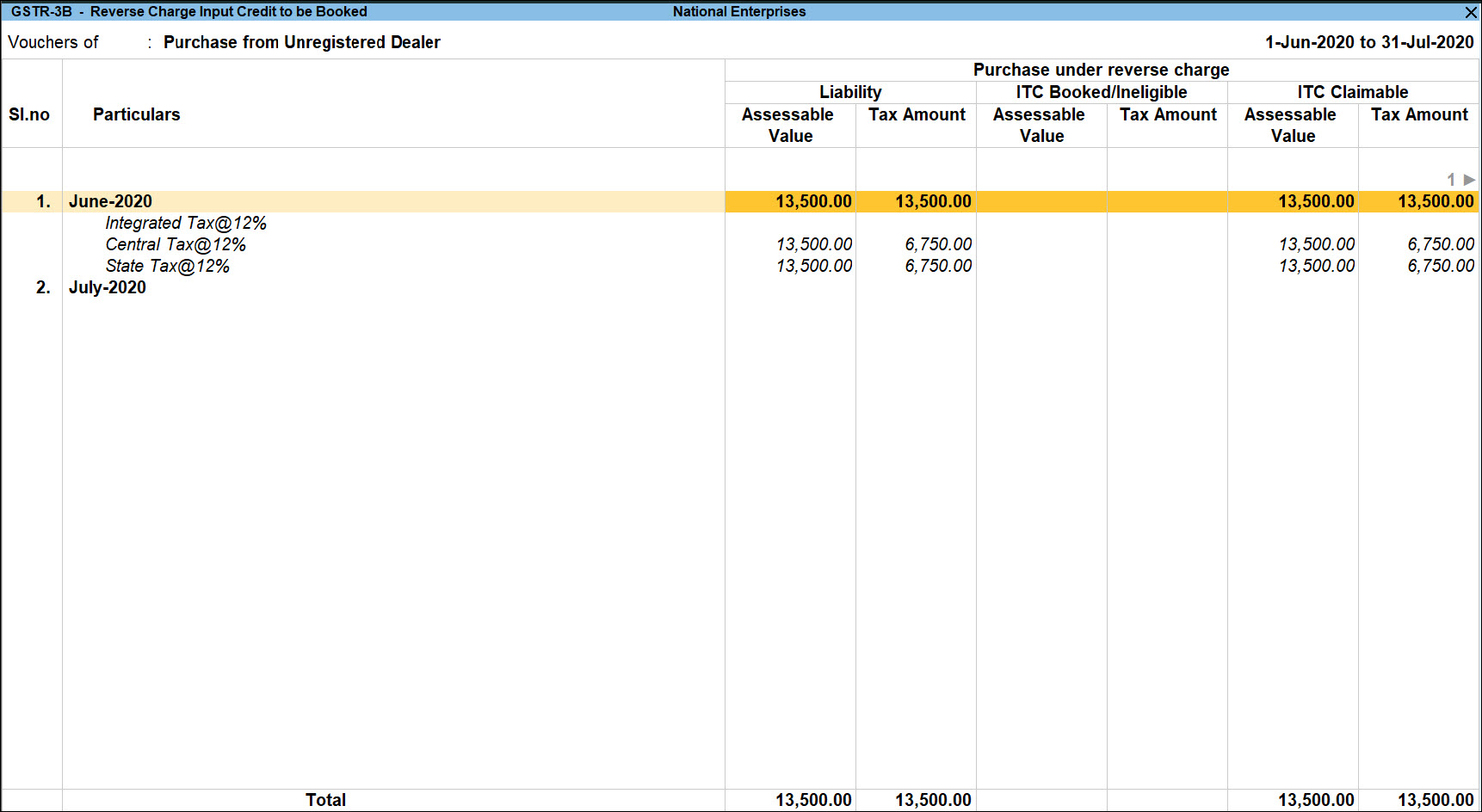

On purchases made under reverse charge in the current return period, if you record only the tax liability, and claim tax credit in the subsequent period, the vouchers will appear accordingly in this report.

Journal voucher for purchases made under reverse charge in the month of August, recorded in August.

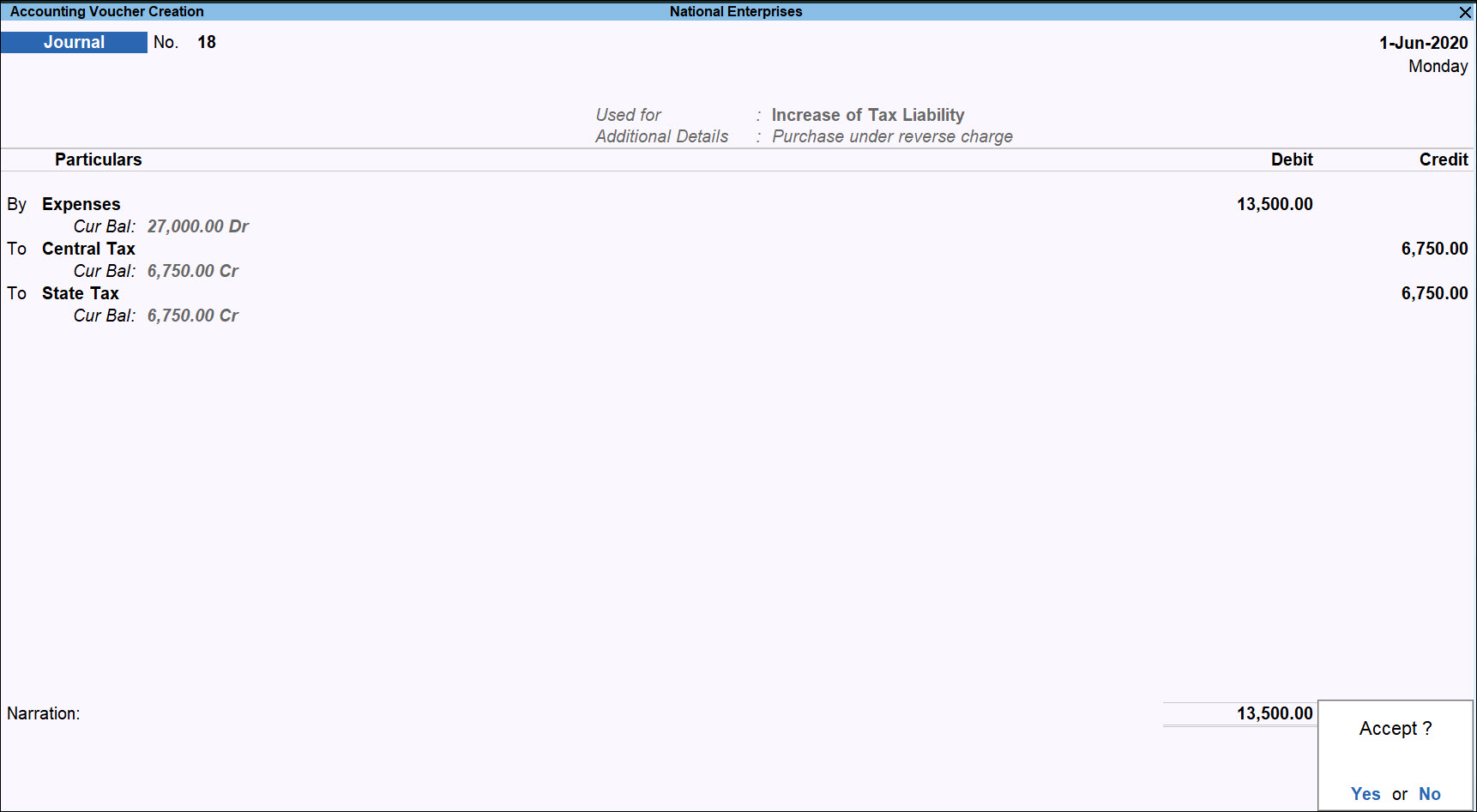

The report generated for the month of June appears as shown:

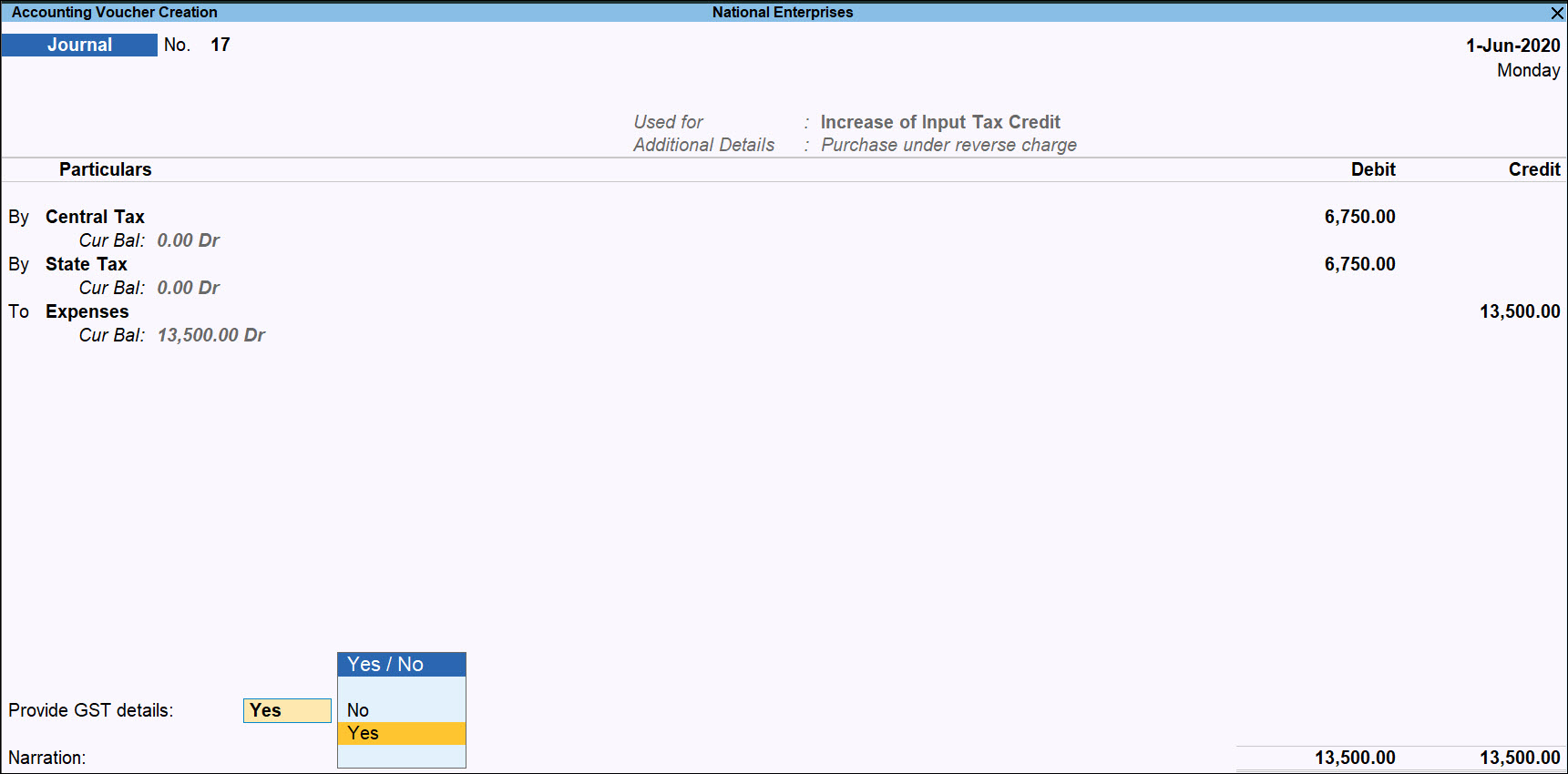

While recording a journal voucher in June, to claim tax credit against the liability raised in the same or previous month, set the option Provide GST details to Yes.

Enter the period as August in the Reverse Charge Details screen.

Accept the screen. As always, you can press Ctrl+A to save.

The report for the month of June appears as shown:

Eligible Input Credit – Capture from Purchases or Journal Vouchers

Based on the availability of purchases or journal vouchers, the values will be captured accordingly in Eligible ITC section of GSTR-3B.

In this section

- Recorded only purchase vouchers

- Purchases with journal voucher recorded for tax liability

- Purchases with journal voucher recorded for tax liability in same month, and input tax credit claimed in the subsequent month

- Exclude journal voucher to capture only purchases in GSTR-3B

Recorded only purchases vouchers

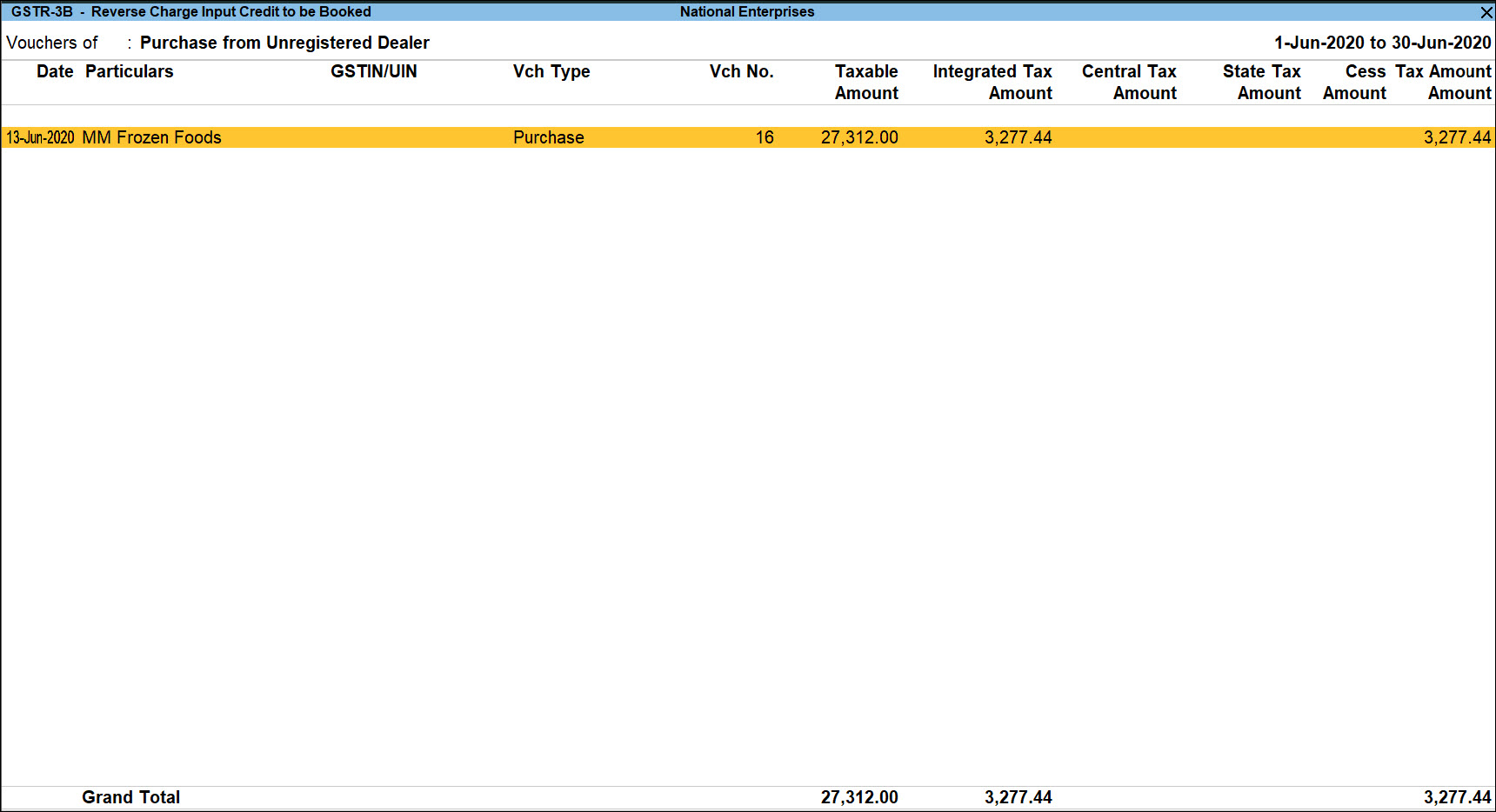

When you have recorded only purchases, without raising liability or input credit, only the purchase value appears as shown below:

- Inward supplies (liable to reverse charge) in 3.1(d)

- Eligible ITC in 4(A)(3)

- Input tax credit booked in Reverse Charge Input Credit to be Booked.

- Press Enter to view the purchase voucher.

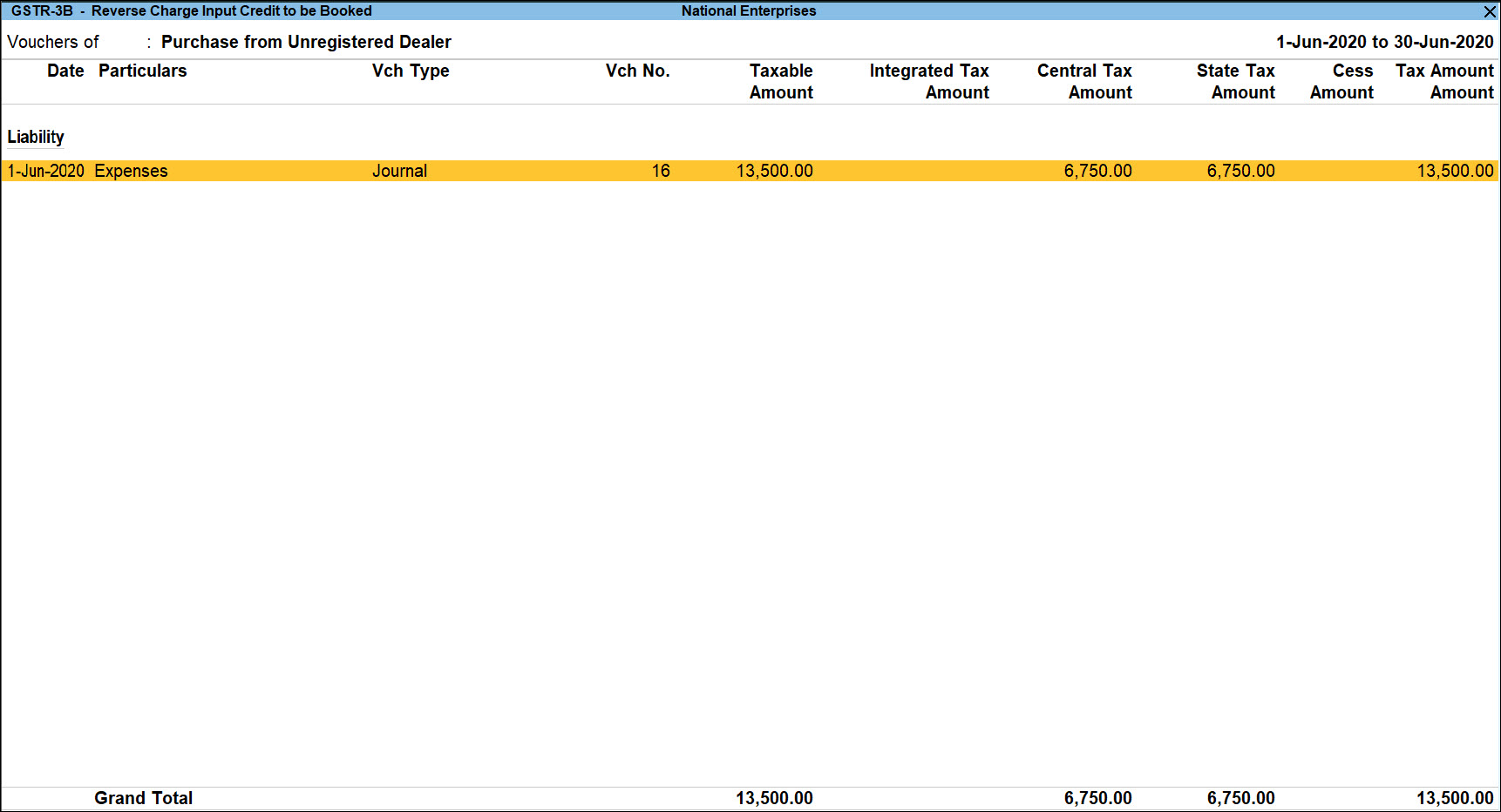

Purchases with journal voucher recorded for tax liability

When you have recorded journal voucher only to raise the liability on the purchases made:

- The purchases will be moved to No direct implication in return table.

- Only journal values will be considered in GSTR-3B.

Purchases with journal voucher recorded for tax liability in same month, and input tax credit claimed in the subsequent month

When you have recorded journal voucher to raise the liability on purchases made in a particular month, and claimed tax credit in the subsequent month:

- The purchase voucher will not appear in the report generated for the subsequent month, as it was recorded in the previous tax period.

- Only journal voucher recorded in the subsequent month for claiming input tax credit appears in GSTR-3B.

- Included in Return as Participating in return tables in GSTR-3B.

- Inward supplies (liable to reverse charge) in 3.1(d)

- Input Credit to be Booked in Reverse Charge Input Credit to be Booked.

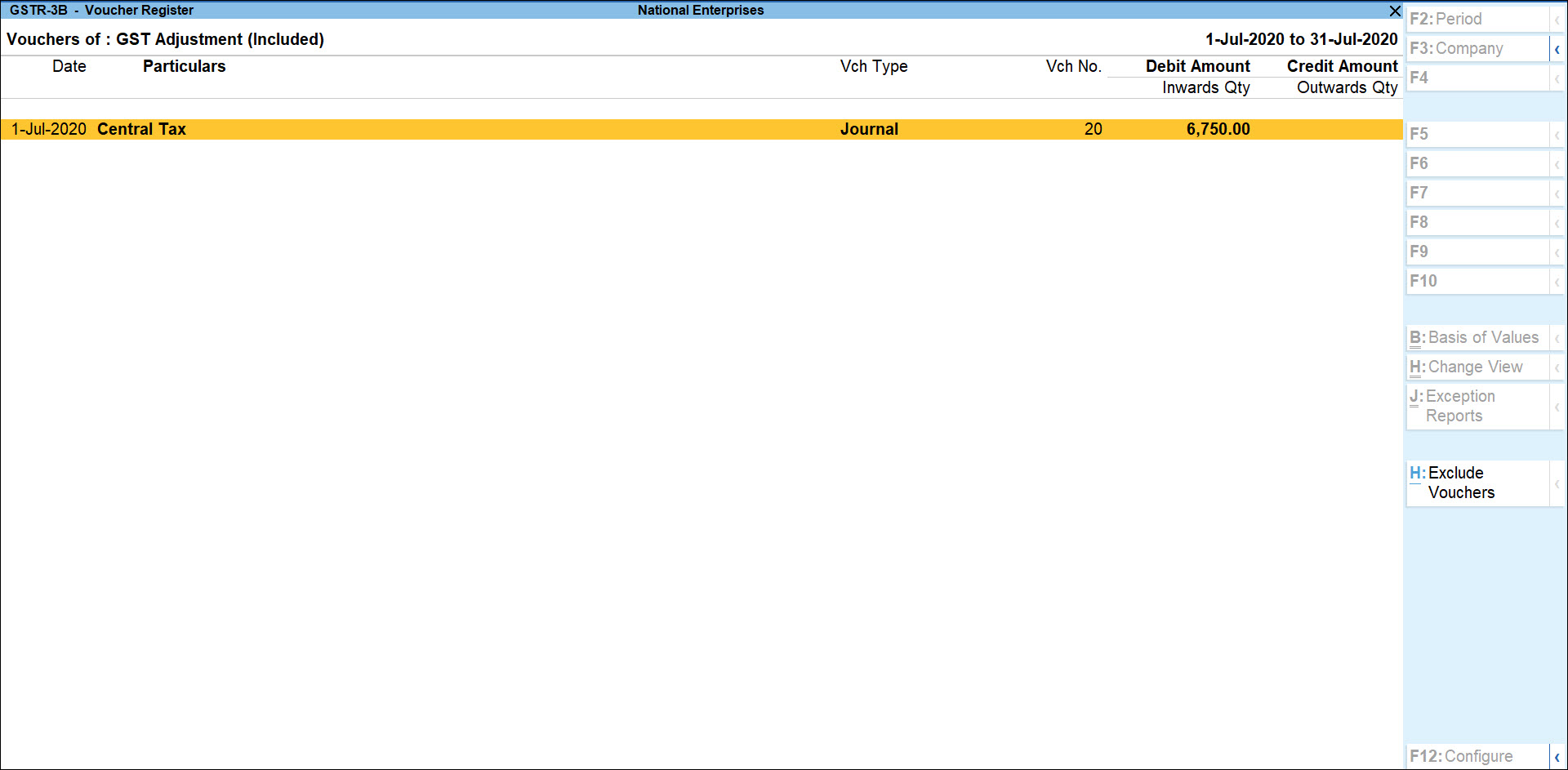

- Press Enter to view the journal voucher recorded for tax liability in June, and tax credit claimed in July.

- Press F8 (Show Purchases) to view the purchase voucher.

- Included in Return as Participating in return tables in GSTR-3B.

Exclude journal voucher to capture only purchases in GSTR-3B

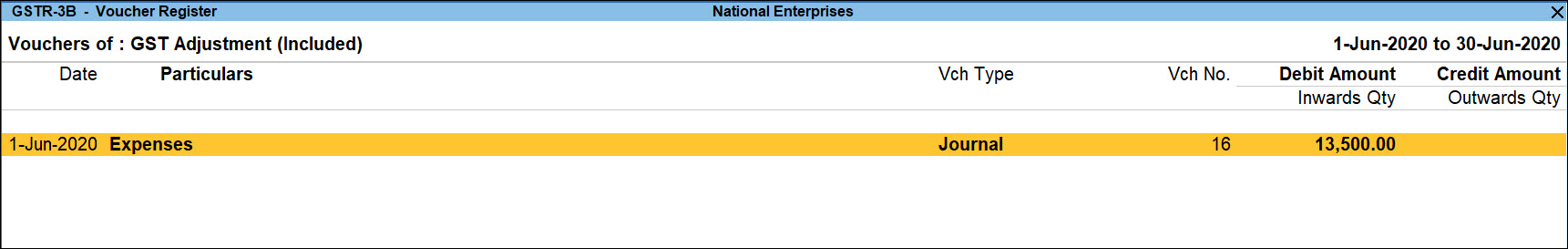

- Select Participating in return table and press Enter.

- Press Enter on GST Adjustment.

- Select the journal voucher and press Alt+H (Exclude Vouchers).

The purchase voucher will appear in Participating in return table section with relevant details in GSTR-3B.