Record Import of Services Under GST Reverse Charge Mechanism (RCM)

In your business, you may be importing services from companies based outside of India. As per Section 2(11) of the IGST Act, the services imported from countries other than India are liable for reverse charge. This is irrespective of the nature of services – RCM or not. So, it does not matter if your service ledger is configured for reverse charge mechanism or not. The imported services fall in the category of RCM services.

In TallyPrime, you can account for import of services liable for reverse charge, raise a tax liability, increase Input Tax Credit (ITC), and claim ITC.

Moreover, TallyPrime automatically calculates the tax liability once you record a purchase voucher. However, you have the flexibility to raise the tax liability using a journal voucher if your business practices demand it.

Record Imports of Services

Whenever you import any services from any country to India, you can record the import of services using a purchase voucher. On recording a purchase voucher for import, the liability and the input tax credit are auto-calculated.

- Open the purchase voucher in the Accounting Invoice mode.

- Press Alt+G (Go To) > Create Voucher and press F9.

- Press Ctrl+H (Change Mode) > Item Invoice and press Enter.

If you have created multiple registrations in TallyPrime Release 3.0 or later, then to change the registration, press F3 (Company/Tax Registration) > type or select the Registration under which you want to create the voucher and press Enter.

- Provide the voucher details.

- Under Party A/c name, select the foreign party.

- Provide the party-related details.

- In the Receipt Details screen, provide the required information and press Ctrl+A to save.

- In the Party Details screen, Place of Supply: Enter the place of your company or warehouse.

- Under Particulars, select the RCM services edger created under Purchase Accounts and enter the Amount.

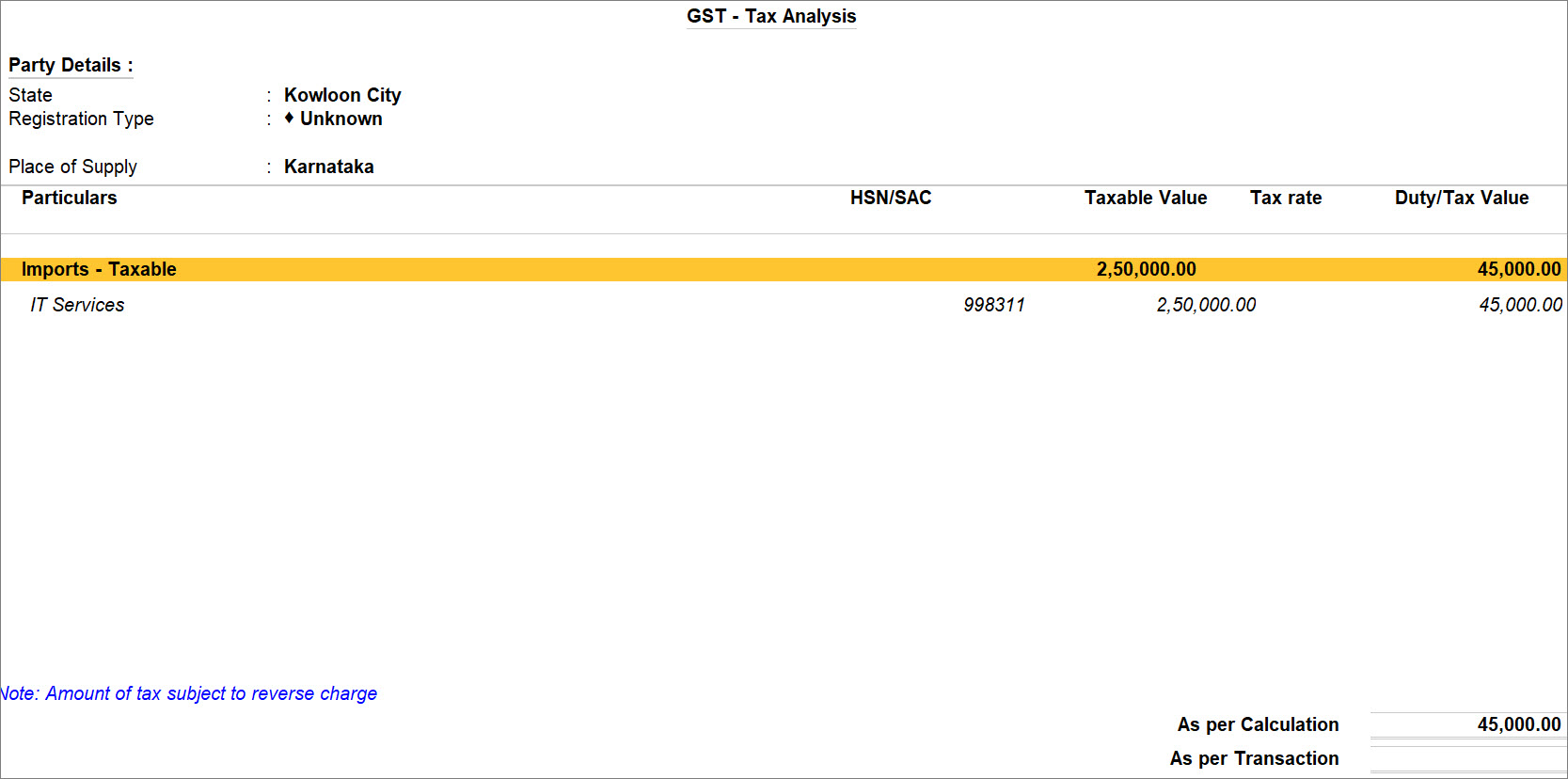

- If you want to view Tax Analysis, then press Alt+A (GST – Tax Analysis).

Alternatively, press Ctrl+O (Related Reports) > GST Tax Analysis.

The GST – Tax Analysis screen appears and you can see the amount of tax is subjected to reverse charge.

If you are on TallyPrime Release 1.1.3 or earlier, follow the step:

Press Ctrl+I (More Details) > type or select GST – Tax Analysis to view the tax details. Press Alt+F5 (Detailed) to view the reverse charge amount. - Provide other necessary details and press Ctrl+A, as always.

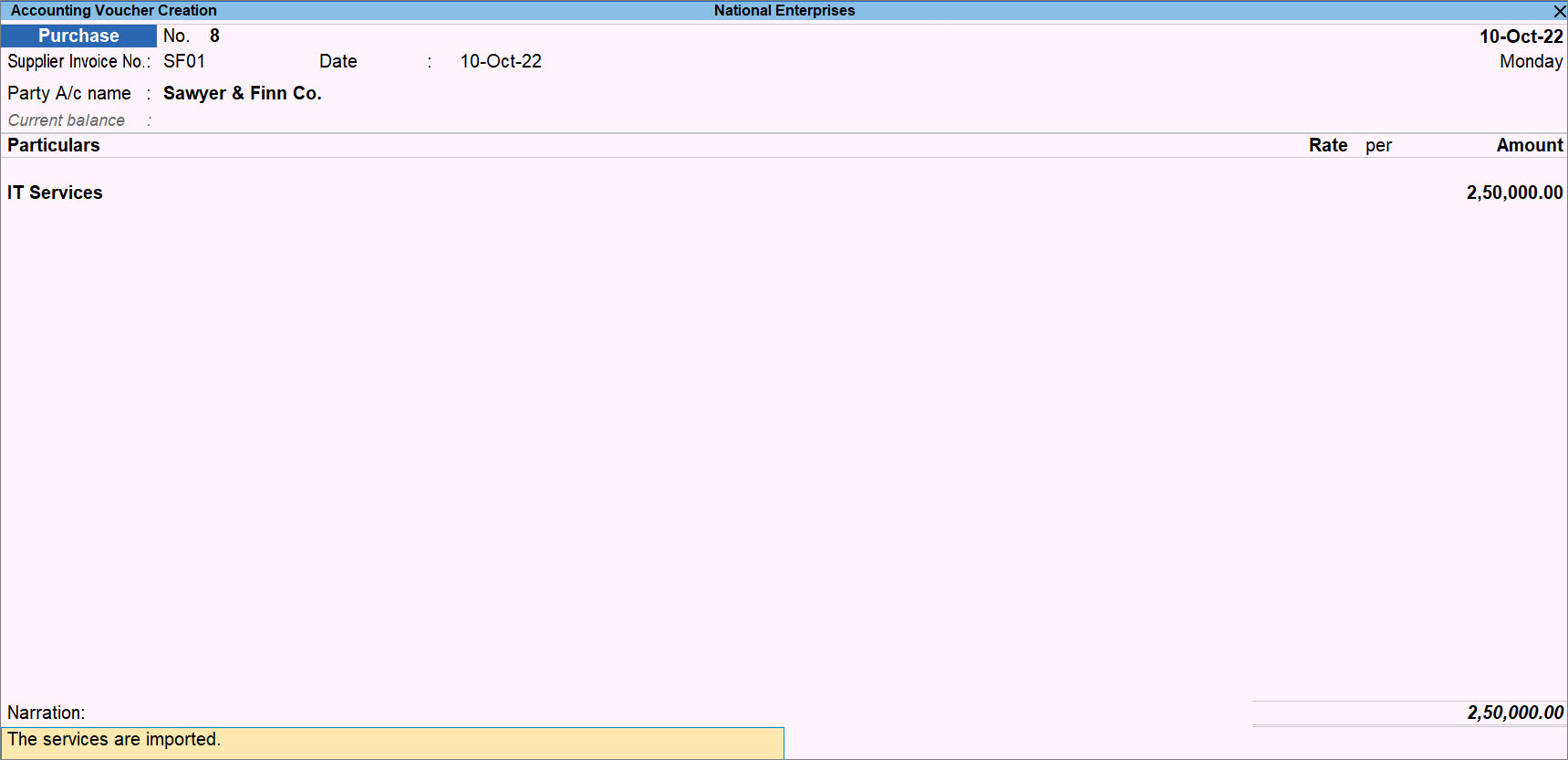

A sample Purchase Voucher recorded for the imported services appears as shown below:

Once you record the transaction for the import of services, the transaction gets included in the Return and starts appearing in GSTR-3B under the 3.1d. Inward Supplies (applicable for Reverse Charge) section as Import of Services.

Raise Tax Liability & Claim ITC

You can record a journal voucher for raising the tax liability to account for the tax to be paid under reverse charge for the import of services.

If you are using TallyPrime Release 3.0 or later releases, then you do not have to raise tax liability and claim ITC using Journal voucher. However, if you follow the practice of raising the liability and claiming ITC using Journal voucher, then you can follow the steps below.

- Press Alt+G (Go To) > Create Voucher > press F7 (Journal).

If you have created multiple registrations in TallyPrime Release 3.0 or later, then to change the registration, press F3 (Company/Tax Registration) > type or select the Registration under which you want to create the voucher and press Enter.

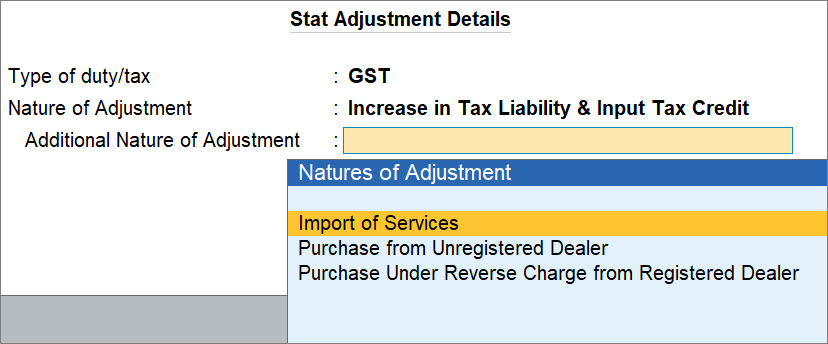

- Specify statutory adjustment details.

- Press Alt+J.

The Stat Adjustment Details screen appears. - Type of duty/tax: GST.

- Nature of Adjustment: Increase in Tax Liability & Input Tax Credit.

If you want to claim ITC in the subsequent month, then select Increase in Tax Liability. Thereafter, you will need to create a journal voucher in the subsequent month with Nature of Adjustment as Increase in Input Tax Credit.

- Additional Nature of Adjustment: Import of Services.

- Press Alt+J.

- Under By (Debit), select the IGST ledger.

- Credit the IGST ledger.

- Under To (Credit), select the IGST.

The screen to calculate the tax appears. - Enter Rate, Taxable Value, and press Enter.

The Taxable Value is the total value of imported services for which you want to raise the liability in a particular month.

- Under To (Credit), select the IGST.

- Provide other necessary details and press Ctrl+A, as always.

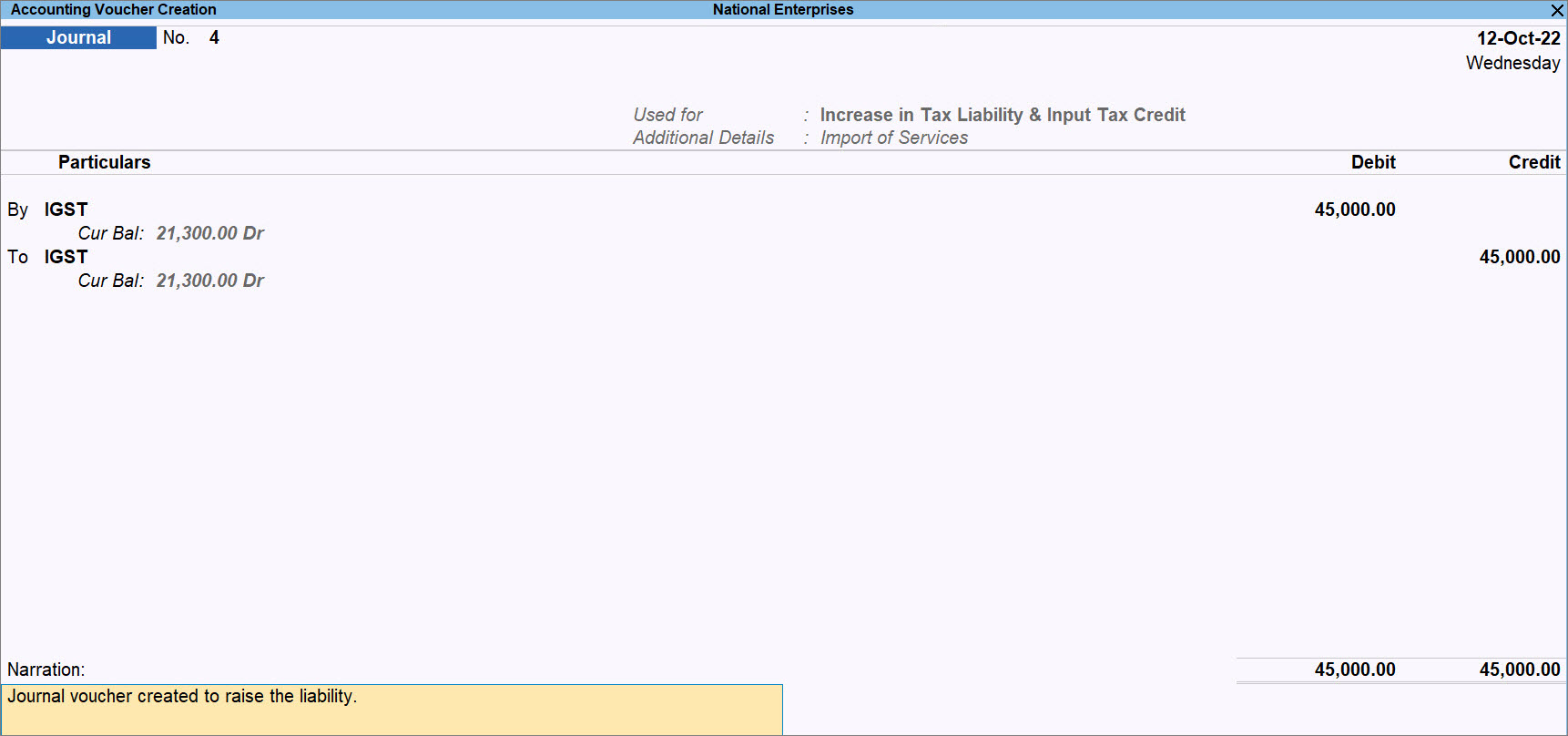

A sample journal voucher recorded to raise the tax liability for import of services appears as shown below:

- As always, press Ctrl+A to save.

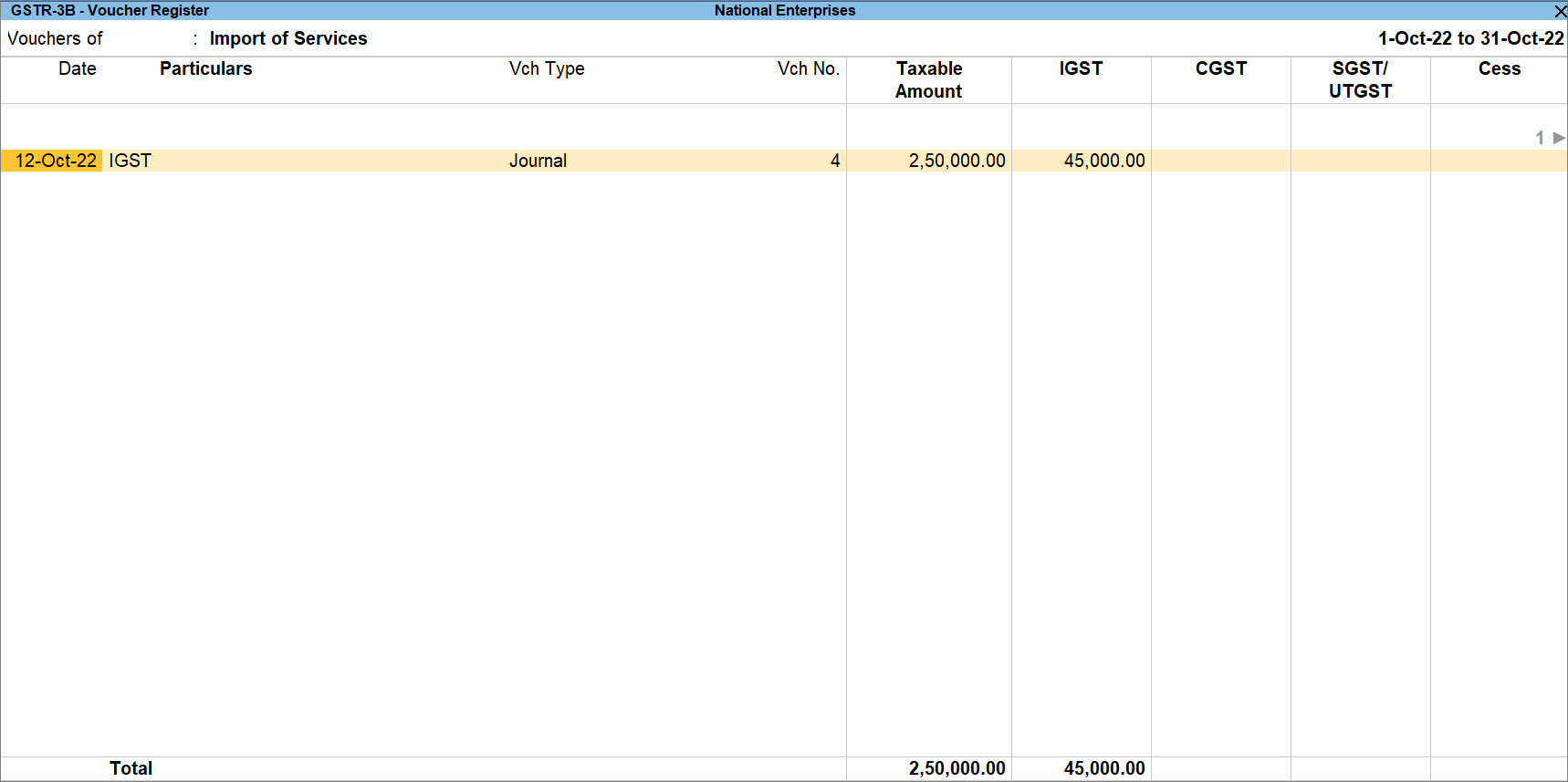

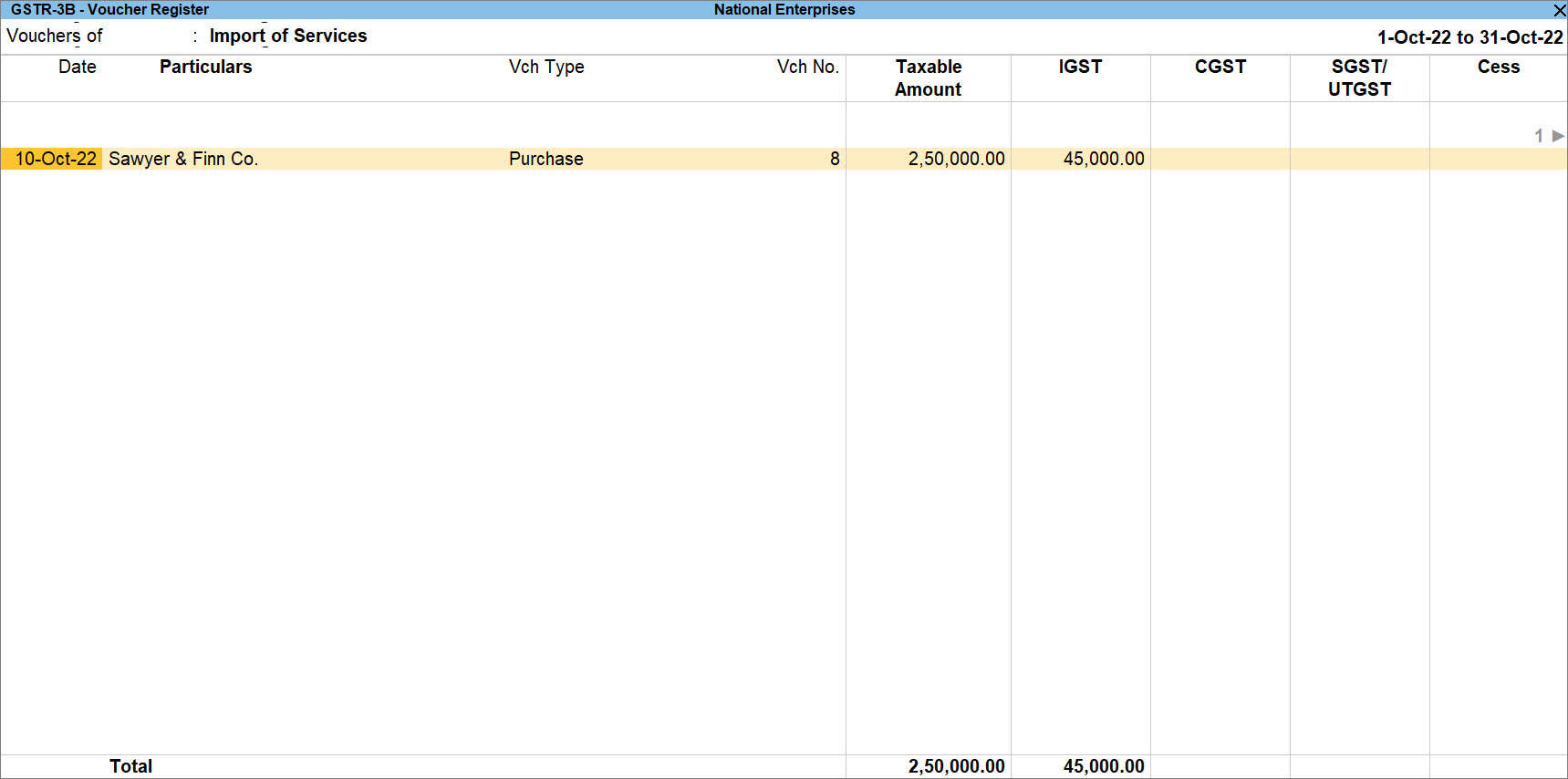

The journal voucher appears as Import of Services in GSTR-3B – Voucher Register as shown below: