Online and Offline e-Invoice Generation on IRP Using TallyPrime

e-Invoicing is a system that allows the Invoice Registration Portal (IRP) to electronically verify B2B invoices. Accordingly, e-invoicing in TallyPrime provides you with a smooth experience to configure and generate e-invoices for your business. Once your e-invoice is generated successfully, the details of the e-invoice will reflect in GSTR-1.

TallyPrime’s e-invoicing solution can be easily used by all eligible entities such as taxpayers and tax consultants. In TallyPrime, you only have to record your sales transactions, as usual, and your e-invoice requirements will be covered in the same flow! Important details, such as IRN, Ack No., QR code, and e-Way Bill no., will be updated in the vouchers automatically, and you can proceed to print them. Moreover, TallyPrime will ensure that both your business and your compliance requirements are suitably addressed.

TallyPrime also provides you with the flexibility to generate e-invoices in bulk for multiple invoices. You can select one or more transactions from the e-Invoice report and generate the respective IRN, at your convenience.

Moreover, if you are using TallyPrime Release 3.0 or later releases, then you can generate e-Invoices for any GST registration or GSTIN during voucher creation or multiple GST registrations through Exchange by selecting multiple vouchers created for different registrations.

We understand how valuable your data is for you and your business, and we have provided various measures in TallyPrime to safeguard your data. All the requests for online e-invoicing will pass through Tally GSP (TIPL), which has been awarded ISO 27001:2013 certificate for its stringent security policies. The best part is that you will not need any additional software or plugins to enjoy the benefits of e-invoicing in TallyPrime.

Latest Updates from GST Council

The GST Council has announced that the Effective Date for e-invoicing will depend on the annual turnover of your business, as explained in the table below.

It is recommended that you upgrade to TallyPrime Release 2.0 or later to perform the e-invoicing activities seamlessly, despite the changes in API versions. If you want to find out how you can upgrade to TallyPrime Release 2.0, then click this link to watch our video.

| Businesses Having a Turnover of More Than… | Effective Date |

| 500 crores | 1st October 2020 |

| 100 crores | 1st January 2021 |

| 50 crores | 1st April 2021 |

| 20 crores | 1st April 2022 |

| 10 crores | 1st October 2022 |

| 5 crores | 1st August 2023 |

Online e-Invoicing

TallyPrime provides you with an online e-invoicing solution that fits right into your regular invoicing process. e-Invoicing in TallyPrime is not restricted to only a particular voucher type. Apart from regular sales invoice, TallyPrime supports e-invoicing for POS, debit notes, and credit notes. What’s more, even receipts and journal vouchers are supported for e-invoicing when they are used for sales.

Click here if you want to watch the Hindi version of the video.

No matter how you record your supplies in TallyPrime, you can easily generate an IRN while saving your invoice and print the QR code and other details. Later, if you want to update the details of your transaction, then you can easily cancel the current IRN and get a fresh IRN for your updated invoice. This will ensure that the details in your e-invoice are up-to-date.

TallyPrime also provides you with the flexibility to generate multiple e-invoices at the same time. If you do not want to generate the e-invoice while recording the transaction, then you can do it later from the e-Invoice report. You can select one or more transactions from the sections in the report and generate the respective IRN for your e-invoices.

Moreover, you also have the choice of generating an e-Way Bill along with your e-invoice using TallyPrime, or even generate only the e-Way Bill without the e-invoice, if required.

In this section

- Generate IRN and Print QR Code

- e-Invoice for service to a foreign party

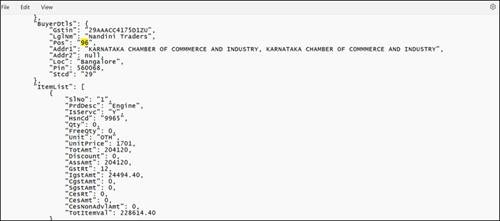

- e-Invoice for Transportation Services (HSN: 9965 & 9968)

- Generate Bulk IRN

- Cancel IRN

- Get IRN Information

Generate IRN and Print QR Code

Before you start recording your voucher for e-invoicing, ensure the following:

On the e-Invoice System:

- Register your business on IRP.

- Create an API user by selecting Tally (India) Pvt Ltd as the GSP. You have to enter this API user credentials in TallyPrime, whenever prompted.

In TallyPrime:

- Enable e-Invoicing.

- Enter the correct HSN/SAC, tax rates, and Type of Supply details in the ledgers and stock items.

- Enter the correct address, pincode, and GSTIN/UIN in the party masters.

- Update the ISO code for all your foreign currencies, if you are an exporter.

You can easily generate an IRN while saving your invoice and also print the QR code and other details.

While recording a GST Sales transaction,

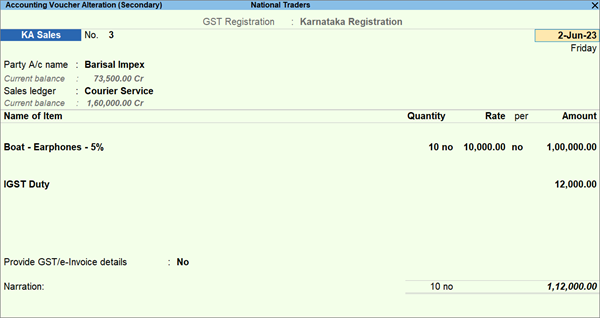

- Specify the required voucher details, such as the Party A/c name, Sales ledger, Name of Item, GST ledger, and so on.

To know how to use the multiple GST registrations feature during voucher creation, refer to the Enable GST for Your Company – Single and Multi-Registration section in the Getting Started with GST in TallyPrime topic. - Ensure that your invoice numbers do not start with zero (0) or special characters such as forward slash (/) or hyphen (-). Invoice numbers starting with zero or the above special characters are rejected by IRP.

- Set Provide e-Invoice details to Yes. The e-Invoice Details screen appears.

- Specify the Bill to place and Ship to place, if this is your first e-invoice for the party. These details will be carried forward in subsequent transactions with the party.

- Press Ctrl+A to save the details and to return to the voucher.

- Specify the Bill to place and Ship to place, if this is your first e-invoice for the party. These details will be carried forward in subsequent transactions with the party.

- As always, press Ctrl+A to save the voucher.

The following message will appear, prompting you to generate the invoice:

- Press Enter to continue.

- Specify the e-Invoice Login details, and press Enter.

In case of multiple GST registrations, log in with the credentials of the GST registration of which e-Invoice Login screen is displayed.

If one or more login credentials are incorrect, then TallyPrime shows an error message from the portal and you will need to log in again with the correct credentials.

If there is some network issue, or in other such scenarios, then the screen displays Request not sent (Login cancelled).

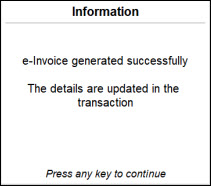

The details of the invoice gets exchanged with the e-Invoice system. On successful upload to IRP, the IRN details will get updated in the voucher, and the following message will appear:

- Print the invoice.

The e-invoice with the IRN and QR code will appear as shown below:

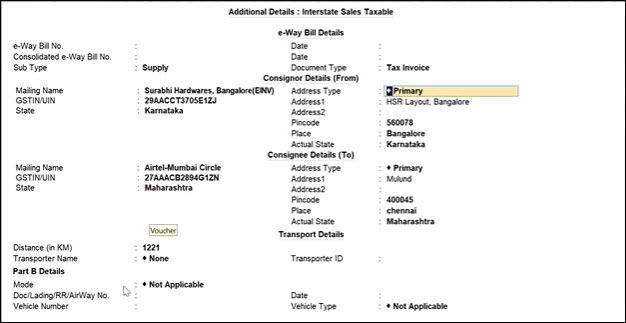

Mandatory Details for Generating e-Way Bill with e-Invoice

If you had chosen to generate an e-Way Bill along with your e-invoice, you will need to ensure that details, such as transporter information and accurate distance between pincodes, are correctly entered while recording the sales transaction.

Ensure that you specify these details in the Transporter Details section of the Statutory Details screen, while recording the invoice.

- Distance (in KM): Check the distance between the pincodes entered for Dispatch From and Ship To, and specify the Distance (in KM) accordingly.

If you are using TallyPrime Release 3.0 or later releases, then press Alt+L (Calculate Distance on Portal) and TallyPrime and you will be redirected to the link on the portal on which you can calculate the distance by providing the pin of both the places. - Vehicle Number and Vehicle Type: If the Mode of transport is Road, then Vehicle Number, Vehicle Type, and Date are mandatory for e-invoicing.

- Doc/Lading/RR/AirWay No.: If the Mode of transport is Other than Road (Ship/Air/Rail), then Doc/Lading/RR/AirWay No. and Date are mandatory for e-invoicing.

For more information, refer to e-Way Bill in TallyPrime.

Generate Bulk IRN/e-Invoice

If you do not want to generate an e-invoice while recording a transaction, then you can do it later from the Exchange menu. You can select one or more transactions, as needed, and generate the respective IRN for your e-invoices.

Click here to watch the Hindi version of the video.

- Press Alt+Z (Exchange) > Send for e-Invoicing.

The Send for e-Invoicing screen appears. You can view the transactions that are pending for generation and cancellation. - Select the required transactions and press S (Send) to send the details.

If you press S without selecting any transaction, then all the transactions will be sent for e-invoicing. If you are using the multiple GST registrations feature in TallyPrime Release 3.0 or later releases and e-Invoicing is applicable in more than one GST registrations, then the vouchers of those GST registrations that are ready for IRN Generation and Cancellation will be available for selection.

If your master details have changed and have a conflict with the transaction details, in TallyPrime Release 5.1, you will see a message. You can choose to check the conflicts and resolve them or proceed with the conflicts as is, if the details in the transactions are correct.

The following confirmation screen will appear, displaying the number of transactions lined up for IRN generation and cancellation.

If you are using the multiple GST registrations feature in TallyPrime Release 3.0 or later releases, then the total number of vouchers for IRN generation and cancellation from all GST registrations will be displayed. - Press Enter to continue.

- Specify the e-Invoice Login details and press Enter.

In TallyPrime Release 3.0 or later releases, if you are sending vouchers of multiple GST registrations for IRN generation and cancellation, then the e-Invoice Login screen for all the registrations will be displayed one by one. You will need to log in for all the registrations.

Once the transactions are uploaded to IRP, the IRN details will be updated in the voucher, and the following Exchange Summary will appear:

You will get an idea of how many e-invoices were generated or rejected by the e-Invoice System, or if any transactions could not be uploaded due to any technical difficulties.

If one or more login credentials are incorrect, then TallyPrime shows an error message from the portal and you will need to log in again with the correct credentials.

If there is some network issue, or in other such scenarios, then the screen displays Request not sent (Login cancelled).

Moreover, if you are using the multiple GST registrations feature in TallyPrime Release 3.0 or later releases, then the total number of vouchers from all GST registrations that are updated with IRN details and those that are rejected from the portal will be displayed.

For more details, you can go the e-Invoice report.

Cancel IRN/e-Invoice

There may be situations where the IRN is generated for a particular voucher, but you might have to cancel it. For example, this can happen when there is a change in the rate of an item, or if the party has cancelled the order. In such cases, you may want to cancel the invoice. As per department regulations, invoice cancellation has to be done within 24 hours of IRN generation.

- Press Alt+G (Go To) > type or select e-Invoice > press Enter.

Alternatively, Gateway of Tally > Display More Reports > GST Reports > e-Invoice > press Enter.

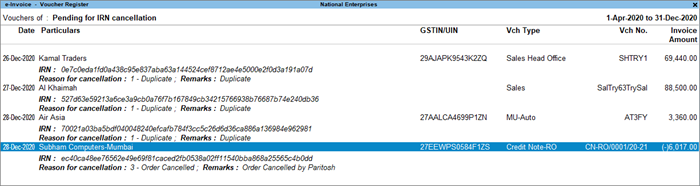

- Drill down from the IRN generated from e-Invoice system section to open the e-Invoice – Voucher Register screen.

- Select the voucher for which e-invoice needs to be cancelled, and press F10 (Cancel IRN).

Press Ctrl+F10 (Mark as Cancelled) when the e-invoice is cancelled through some other medium on IRP, and you want to update the status in TallyPrime. When you mark the IRN as cancelled, then this invoice will appear in the Marked as IRN Cancelled section under IRN Cancelled, instead of the For IRN Cancellation section under Pending.

- Select the Reason for cancellation and enter the Remarks.

- As always, press Ctrl+A to save the details.

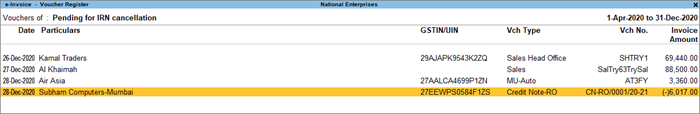

The voucher will move to the For IRN Cancellation section under Pending.

Now, you can send the e-Invoice for cancellation from the Exchange menu.

- Press Alt+Z (Exchange) > Send for e-Invoicing.

The Send for e-Invoicing screen appears. You can view the transactions that are pending for generation and cancellation. - Select the required transaction and press S (Send) to send the details.

If you press S without selecting any transaction, then all the transactions will be sent for e-Invoicing.

If you are using the multiple GST registrations feature in TallyPrime Release 3.0 or later releases and e-Invoicing is applicable in more than one GST registrations, then the vouchers of those GST registrations that are ready for IRN Generation and Cancellation will be available for selection.

The following confirmation screen will appear, with the number of transactions lined up for IRN generation and cancellation.

If you are using the multiple GST registrations feature in TallyPrime Release 3.0 or later releases, then the total number of vouchers for IRN generation and cancellation from all GST registrations will be displayed. - Press Enter to continue.

- Specify the e-Invoice Login details, and press Enter

In TallyPrime Release 3.0 or later releases, if you are sending e-Invoices of multiple GST registrations for generation and cancellation, then The e-Invoice Login screen for all the registrations will be displayed one by one. You will need to log in for all the registrations.

The Exchange Summary will appear after the cancellation is completed, and you can view the number of e-Invoices that are cancelled.

The voucher will move to the IRN cancelled from e-Invoice system section in the e-Invoice report. Even after cancellation, information like QR code and IRN details will be retained in the voucher for your reference in TallyPrime. You can also view the remarks you had entered while cancellation, using More Details.

If one or more login credentials are incorrect, then TallyPrime shows an error message from the portal and you will need to log in again with the correct credentials.

If there is some network issue, or in other such scenarios, then the screen displays Request not sent (Login cancelled).

Moreover, if you are using the multiple GST registrations feature in TallyPrime Release 3.0 or later releases, then the total number of vouchers from all GSTIN registrations that are updated with IRN details and those that are rejected from the portal will be displayed.

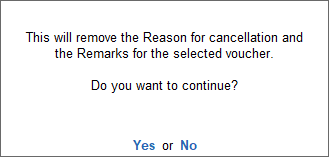

Undo IRN/e-Invoice Cancellation

In certain situations, you may have cancelled the IRN for a particular voucher in TallyPrime, but now you want to undo this cancellation. For example, this might be needed when you had selected the wrong voucher for cancellation, or 24 hours have already passed since IRN generation, and the e-Invoice System won’t accept the cancellation anymore. In such cases, you can undo the IRN cancellation.

The Undo Cancellation feature is available in the Pending for IRN Cancellation, Exported for IRN Cancellation, and Marked as IRN Cancelled sections of the e-Invoice report. You can select the required voucher from any of these sections and proceed to undo IRN cancellation.

When you undo IRN cancellation for the selected voucher, it will remove the details of the cancellation, such as the Cancelled status, the Reason for cancellation, and the Remarks, and move the voucher to its original section in the e-Invoice report.

The Undo Cancellation feature is applicable only for the e-invoices cancelled in TallyPrime, and it does not undo the cancellation updated in the e-Invoice portal. If a voucher is not cancelled on the e-Invoice portal, then it should not be marked as cancelled in TallyPrime.

- Press Alt+G (Go To) > type or select e-Invoice > press Enter.

Alternatively, Gateway of Tally > Display More Reports > GST Reports > e-Invoice > press Enter.

- Drill down from the required section, which can be either Pending for IRN Cancellation, Exported for IRN Cancellation, or Marked as IRN Cancelled.

- Press Alt+F5 for more details. You can see details of the cancellation, such as Reason for Cancellation and Remarks.

- Select the voucher for which you want to undo IRN cancellation.

- Press Alt+F10 (Undo IRN Cancellation). The following message will appear:

- Press Enter to proceed.

This will remove details of the cancellation (such as the Reason for cancellation and Remarks), and the voucher will be moved to its original section.

Get IRN Information

Sometimes, you may have generated or cancelled the IRN for vouchers in the offline mode using TallyPrime or some other software (or directly on IRP), and you may want to import the IRN information for those vouchers in TallyPrime. You can do so using the Get IRN Info facility, which will import the latest IRN, Ack. No., and Ack. Date along with the QR code from the e-Invoice system to the vouchers.

The facility is provided in the relevant sections of the e-Invoice report, such as Pending, Exported, or Rejected by e-Invoice System, where you can fetch the latest IRN information and update the vouchers.

- From the e-Invoice report, drill down from the relevant section.

In this example, you can see the Pending for IRN generation screen.

- Select the voucher and press Alt+L (Get IRN Info). The following screen appears:

- Press Enter to proceed.

- Specify the e-Invoice Login details, and press Enter.

In TallyPrime Release 3.0 or later releases, if you are sending vouchers of multiple GST registrations for IRN generation and cancellation, then The e-Invoice Login screen for all the registrations will be displayed one by one. You will need to log in for all the registrations.

TallyPrime will fetch the latest IRN information from the e-Invoice system. The voucher will be updated and moved to the IRN Generated section.

e-Invoice for Exports

As in your regular sales transactions, you can easily generate e-invoices for your export transactions. Moreover, you do not have to worry about certain details such as the tax rate and the POS code. In all such transactions, the POS value will be automatically updated as 96 and IGST will be applied.

- Record your sales invoices for exports, as usual, with the necessary setup for e-invoicing.

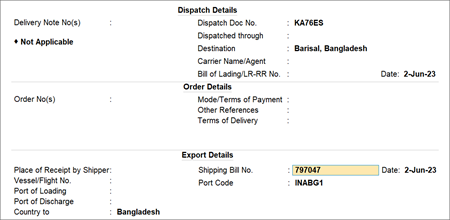

- Specify the relevant Dispatch Details, Order Details, and Export Details.

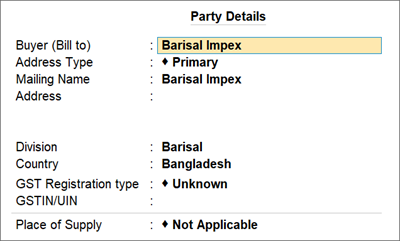

- Specify the relevant Party Details.

Even when the Place of Supply is Not Applicable, the POS value for the transaction will be automatically updated as 96 and IGST will be applied.

- Press Ctrl+A to save the transaction.

- Generate the JSON file by pressing Alt+Z (Exchange) > Send for e-Invoicing > Offline Export.

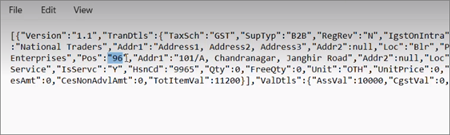

- Go to the folder where the JSON file is saved, and open the JSON file in the Notepad format.

You can see that the POS value is automatically updated as 96.

e-Invoice for service to a foreign party & billing to local or interstate party

According to notification No. 07/2021 – Central Tax (Rate), export freight will now be taxable under GST from 01-Oct-2022. Section 12(8) of the IGST Act states, “Provided that where the transportation of goods is to be place outside India, the place of supply shall be the place of destination of such goods”. So as per the proviso of Section 12(8) read with section 7(5) of IGST Act, all outbound freight transactions when billed to Indian customers, with the place of supply as Other Territory will attract IGST, with effect from 01-Oct-2022.

For example, if you are billing a local or interstate party for providing any service (say Airport Transport) to a party located out of India, you need to apply IGST on such transactions. Also, the state of the Consignee receiving the services and the place of supply should be marked as Other Territory.

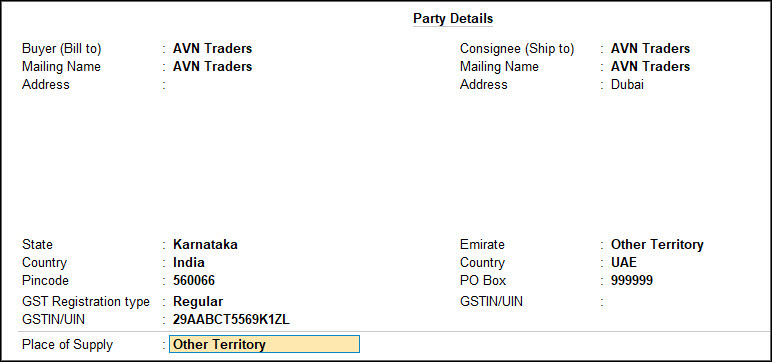

- While recording a sales transaction, in the Party Details screen:

- Under Buyer (Bill to), select the ledger created for interstate party or local party who is billed for the service.

- Under Consignee (Ship to), select the ledger created for the foreign party who receives the service.

If you do not see this option, press F12 (Configure) > set Provide separate Buyer and Consignee details to Yes.- Select the Country other than India – for example UAE that the party receiving the service belongs to.

The Emirates option, instead of State, appears for UAE. - Emirates: Select New Emirates > enter Other Territory.

From Release 3.0.1 onwards, if the Buyer is from India & the Consignee is from another country, then the Emirate will be automatically sent as Other Territory, and the State Code will be sent as 97.

- Enter the Pincode as 999999.

From Release 3.0.1 onwards, if the Buyer is from India & the Consignee is from another country, then the State or Emirate will be automatically sent as Other Territory, and the Pincode will be sent as 999999.

- Select the Country other than India – for example UAE that the party receiving the service belongs to.

-

Place of Supply: Select Other Territory. This is the place where the party receives the service.

For e-invoice generation, the place of supply must be entered as Other Territory; else, TallyPrime will display the following error: The State of the field is required.

- In the sales transaction, select the service ledger (say Airport Transport) and IGST ledger.

- Provide e-Invoice Details: Yes.

- Bill to place: Select the place of the party (local or interstate) who is billed for the service.

- Ship to place: Select the place of the foreign party who receives the service.

- Accept the screen. As always, press Ctrl+A to save.

Ensure that F12 (Configure) > Send e-Invoice Details after saving the Voucher is set to Yes for generating e-invoice for the foreign party.

On saving the screen, the e-invoice is generated successfully, displaying the following message:

- Generate the JSON file by pressing Alt+Z (Exchange) > Send for e-Invoicing > Offline Export.

- Go to the folder where the JSON file is saved, and open the JSON file in the Notepad format.

You can see that the POS value is automatically updated as 97.

e-Invoice for Transportation Services (HSN: 9965 & 9968) by Mail/Courier Inside India

If you are providing transportation services by mail or courier within India (HSN 9965 and 9968), then the State Code has to be specified as 96 (Foreign Country) for the Place of Supply, even when the party is local or intrastate. This is as per the latest updates of the IGST Act (sub-section (8) under section 12), effective from 30th January 2023.

Accordingly, you can easily make the necessary updates while recording e-Invoices in TallyPrime.

In TallyPrime Release 3.0 or later versions

- Record your GST Sales transaction, as usual, with the necessary setup for e-invoicing.

- Update the following details in the transaction:

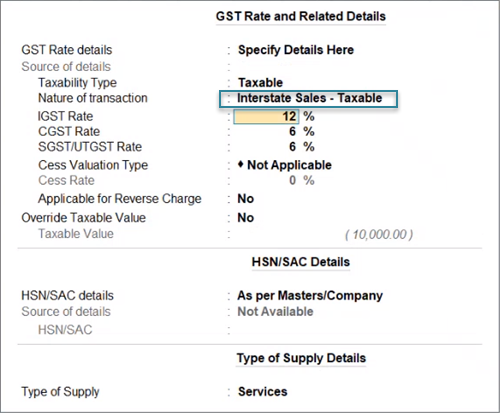

- Nature of Transaction as Interstate:

The Nature of Transaction has to be overridden as Interstate even when the party is local, so that IGST will be applied in this transaction.

After selecting the transportation ledger, the GST Rate and Related Details screen appears. In this screen, specify the Nature of transaction as Interstate Sales Taxable.

- Nature of supply as IGST:

- In the transaction, set Provide GST/e-Invoice details to Yes.

The Additional Details: Interstate Sales Taxable sub-screen will appear. - Set Supplies under section 7 of IGST Act to Yes.

- In the transaction, set Provide GST/e-Invoice details to Yes.

- Nature of Transaction as Interstate:

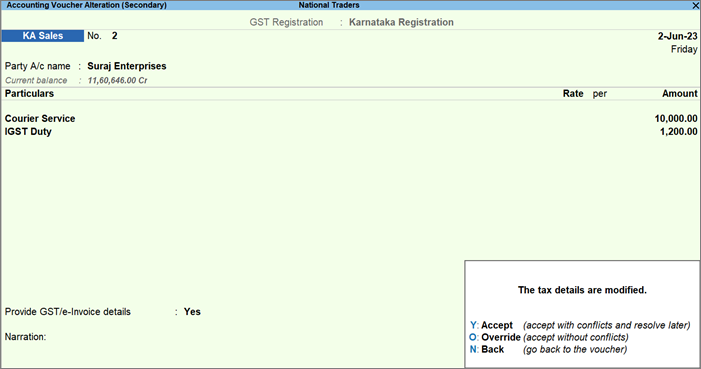

- Save the transaction, as per your requirement:

- Press Y (Accept), if you want to accept the transaction with the conflict in details. You can resolve this conflict at your convenience by going to Uncertain Transactions in the GSTR-1 or e-Invoice report. After accepting the values, you can directly proceed to generate the JSON.

- Press O (Override), if you want to accept the transaction without any conflict in details. After overriding the values, you can directly proceed to generate the JSON.

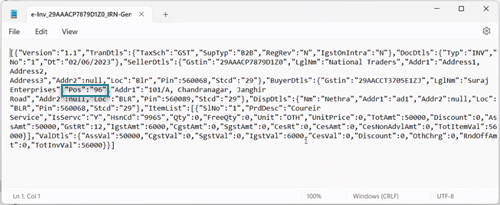

- Generate the JSON file by pressing Alt+Z (Exchange) > Send for e-Invoicing > Offline Export.

- Go to the folder where the JSON file is saved, and open the JSON file in the Notepad format.

You can see that the POS value is automatically updated as 96.

Now you can upload the JSON file on the e-Invoice portal at your convenience.

In TallyPrime Release 2.1 or earlier versions

If you are using TallyPrime Release 2.1 or earlier versions, then you have to open the JSON file and manually update the value for POS as 96.

- Record your GST Sales transaction, as usual, with the necessary setup for e-invoicing.

- Generate the JSON file by pressing Alt+Z (Exchange) > Send for e-Invoicing > Offline Export.

- Go to the folder where the JSON file is saved, and open the JSON file in the Notepad format.

- Set the value for PoS as 96, and save the file.

- Ensure that Reverse charge and invoice type IGST on Intra are enabled.

After updating the applicable transactions, you can directly upload them on the e-Invoice portal.

Offline e-Invoicing (JSON Export)

TallyPrime also allows you to carry out e-invoicing in the offline mode, in case you do not have continuous access to the internet, or if you don’t want to send your invoice details directly to the portal. In such cases, you can export the details of your e-invoice to a JSON file and then upload it on IRP at your convenience.

What’s more, TallyPrime creates the offline files in the format and size recommended by IRP. If the data size is more than 2 MB, then the information will be split into multiple files, each of which will be less than 2 MB.

Click here to watch the Hindi version of the video.

In this section

Generate IRN and Print QR Code

Offline Export

- Press Alt+Z (Exchange) > Send for e-Invoicing.

The Send for e-Invoicing screen appears. You can view the transactions that are pending for generation and cancellation. - Select the required transactions and press X (Offline Export) to export the details. If you press X without selecting any transaction, then all the transactions will be exported.

If you are using the multiple GST registrations feature in TallyPrime Release 3.0 or later releases and e-Invoicing is applicable in more than one GST registrations, then the vouchers of those GST registrations that are ready for IRN Generation and Cancellation will be available for selection.

The following confirmation screen will appear, with the number of transactions lined up for IRN generation and cancellation.

If you are using the multiple GST registrations feature in TallyPrime Release 3.0 or later releases, then the total number of vouchers for IRN generation and cancellation from all GST registrations will be displayed. - Press Enter to continue. The Export screen will appear.

- Press C (Configure), if you want to change any details, such as the Folder path where JSON files will be exported.

- Press E (Send) to export the JSON files.

The JSON files will be saved in the specified folder:

Bulk Upload on IRP

After exporting the JSON files, you can upload them on IRP and generate IRN information for the uploaded vouchers.

- Open the IRP home page, and click Login.

- Log in with your username and password.

- Click e-Invoice > Bulk Upload.

The Invoice Bulk Upload screen will appear. - Browse the JSON file and click Upload.

You can view the details of the uploaded invoice, along with the Ack No., Ack Date, and IRN.

- Click the Download Excel button. An MS Excel file will open, where you can see the IRN information for the vouchers.

Update Details in TallyPrime and Print QR Code

Now you have to update the e-invoice details, such as IRN, Ack No., and Ack Date, in the respective vouchers in the e-Invoice report.

- From the e-Invoice report, drill down from the For IRN generation section under Exported.

- Select the relevant voucher and press Alt+S (Manually Update IRN Info).

The Update IRN Info screen will appear:

- Enter the IRN, Ack. No., and Ack. Date. You can copy this information from the MS Excel sheet and paste it in the relevant fields.

- As always, press Ctrl+A to save the details.

The IRN info will be updated in the voucher. However, in the offline method, the QR Code will not be printed in the voucher.

If you want the QR Code to be printed, then select the required voucher and press Alt+L (Get IRN Info). This can be done only when you have an active internet connection.

The following screen appears:

- Press Enter to continue.

- Specify the e-Invoice Login details in the following screen, and press Enter to continue.

You can view the status of the upload in the Exchange Summary:

The details will be downloaded and updated in the voucher. Now you can print the e-Invoice details such as IRN, Ack. No., and Ack. Date, along with the QR code.

Cancel IRN/e-Invoice

Offline Export

You can cancel the voucher in the offline mode by uploading the JSON file on IRP.

- Press Alt+Z (Exchange) > Send for e-Invoicing.

The Send for e-Invoicing screen appears. You can view the transactions that are pending for generation and cancellation. - Select the required transactions and press X (Offline Export) to export the details.

If you press X without selecting any transaction, then all the transactions will be exported.

If you are using the multiple GST registrations feature in TallyPrime Release 3.0 or later releases and e-Invoicing is applicable in more than one GST registrations, then the vouchers of those GST registrations that are ready for IRN Cancellation will be available for selection.

The following confirmation screen will appear, with the number of transactions lined up for IRN generation and cancellation.

- Press Enter to continue. The Export screen will appear.

- Press C, if you want to change any details, such as the Folder path where JSON files will be exported.

- Press E to export. A JSON file will be created for the voucher to be cancelled:

Bulk IRN/e-Invoice Cancel

After exporting the required JSON files, you can upload them on IRP and generate IRN information for the selected vouchers.

- Open the IRP home page, and click Login.

- Log in with your username and password.

- Click e-Invoice > Bulk IRN Cancel.

- Browse the JSON file and click Upload.

The e-Invoice will be cancelled, and you can view the details such as IRN, Cancel Reason, Cancel Date, and Status.

- Click the Download Result Excel button. An MS Excel file will open, where you can see the IRN information for the vouchers.

Now when you open the e-Invoice report in TallyPrime, you can find the voucher in the For IRN Cancellation section under Exported.

- Select the voucher and press Alt+L (Get IRN Info). The following screen appears:

- Press Enter to proceed.

- Specify the e-Invoice Login details, and press Enter.

You can view the status of the upload in the Exchange Summary:

TallyPrime will fetch the latest IRN information from the e-Invoice system. The voucher will be updated and moved to the IRN Generated section.

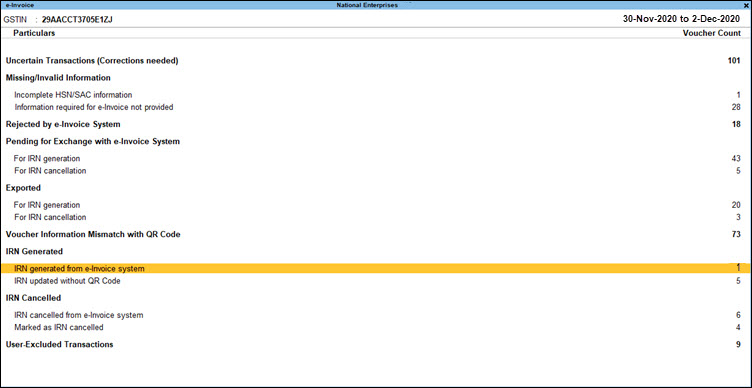

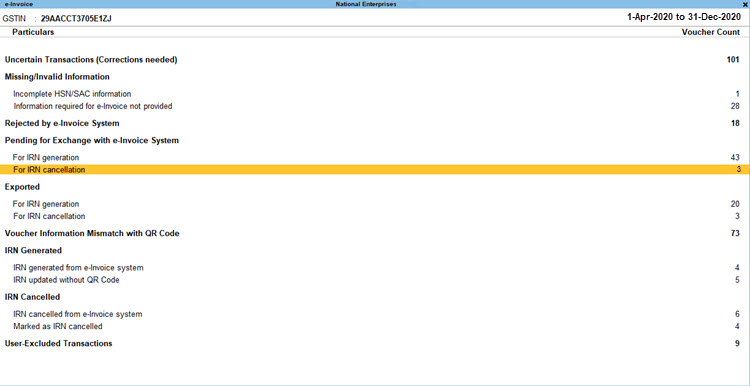

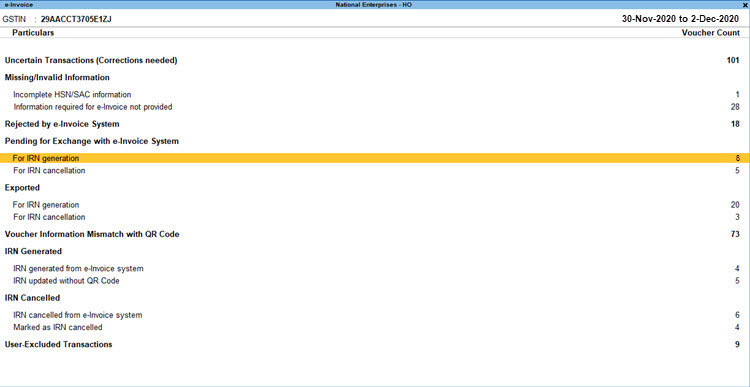

View e-Invoice Report

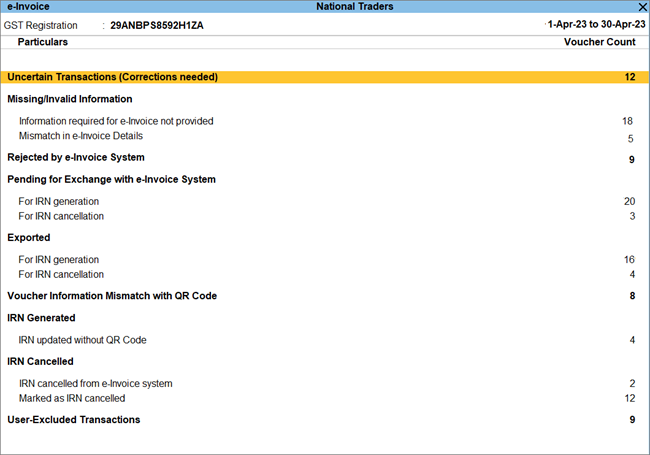

The e-Invoice report is a one-stop shop for your e-invoicing needs in TallyPrime. You can view the e-invoice status of your transactions, and take the next steps accordingly. You can perform e-invoicing operations such as IRN generation and cancellation of one or many transactions. You can also view the transactions where the details are incomplete or incorrect, and easily update the required information.

Moreover, you can open the e-invoice portal directly from the report, if required, by pressing Alt+V (Open e-Invoice Portal).

Press Alt+G (Go To) > type or select e-Invoice > press Enter.

Alternatively, Gateway of Tally > Display More Reports > GST Reports > e-Invoice > press Enter.

You can see the following sections depending on the status of your GST sales transactions.

IRN Register

The IRN Register is a single location where you can check the e-invoice status and other details of your transactions. If required, you can also remove IRN information from certain vouchers by pressing Alt+V (Remove IRN Info).

Uncertain Transactions (Corrections needed)

This section lists the transactions where there is mismatch or incomplete information in the voucher, ledger, or stock item. You can drill down from the transactions and resolve the uncertainties. You can also accept the transactions as is, or recompute the values, if needed.

Missing/Invalid Information

To generate an e-Invoice, your transaction must contain all the necessary information, which includes HSN/SAC details or address details such as Pincode, State, and Place. However, if any of these crucial details is missing or invalid, then you can easily correct it by referring to the Missing/Invalid Information section.

What’s more, this section comes with the following sub-sections, where you can quickly find and correct the transactions.

- Information required for e-Invoice not provided

- Mismatch in e-Invoice Details

Once you resolve these transactions, they will appear under Pending > For IRN Generation.

Refer to the e-Invoice Reports section of the e-Invoice – FAQ topic for more information.

Rejected by e-Invoice System

This section lists the transactions where IRN generation/cancellation requests were rejected by IRP. The rejection can happen due to reasons such as duplicate IRN, invalid HSN code, and so on. You can drill down to the transaction and update it with the relevant details. After the transaction has been updated, press Alt+R (Mark as Resolved) to resolve the transaction. After being resolved, the transaction will appear under Pending > For IRN Generation.

Pending for Exchange with e-Invoice System

This section lists the transactions that are ready for IRN generation or cancellation, as they have no uncertain or missing information. You can proceed to the Exchange menu (Alt+Z (Exchange) > Send for e-Invoicing), and send the transactions to IRP for e-invoicing.

Exported

After the transactions are successfully sent to IRP for IRN generation or cancellation, they will appear in the Exported section.

Voucher Information Mismatch with QR Code

This section lists the transactions that were modified, either accidentally or deliberately, after the IRN was generated. This includes modifications in details such as voucher number, HSN, amount, and so on. You can drill down from this section, and press Alt+F1 for more details. You can see the invoice in two lines. The first line represents the transaction as per your books, while the second line represents the same transaction as per IRP. You can either update the transaction, as required, or cancel the IRN.

IRN Generated

This section lists the transactions where the IRN is generated from IRP, or manually updated in the offline mode using TallyPrime or other software. You can further update IRN information for the required transaction by pressing Alt+S (Manually Update IRN Info).

IRN Cancelled

This section lists all the transactions where the IRN is cancelled from IRP, or manually marked as cancelled in the offline mode in TallyPrime or other software.

User-Excluded Transactions

This section lists the transactions that you have chosen to exclude from the e-invoicing process. However, if you want to include certain transactions from this list for e-invoicing, then you can select the transactions and press Alt+H (Include Vouchers).

Security Levels for e-Invoicing

You can provide additional security for e-invoicing in TallyPrime by creating users with special rights, and authorizing them for specific operations. If you want to prevent any user from using the e-Invoicing feature or accessing the report, then you can use the Security Control feature to set up the required security levels.

- Press Alt+K (Company) > User Roles.

- Select the security level (for example, Data Entry) from the List of Security Levels, and press Enter.

- Under Disallow/Allow the following Facilities, select the Type of Access for e-Invoicing.

- Press Ctrl+A to save the the security settings.

Based on the specified security level and access, you can easily control the use of e-invoicing in TallyPrime.