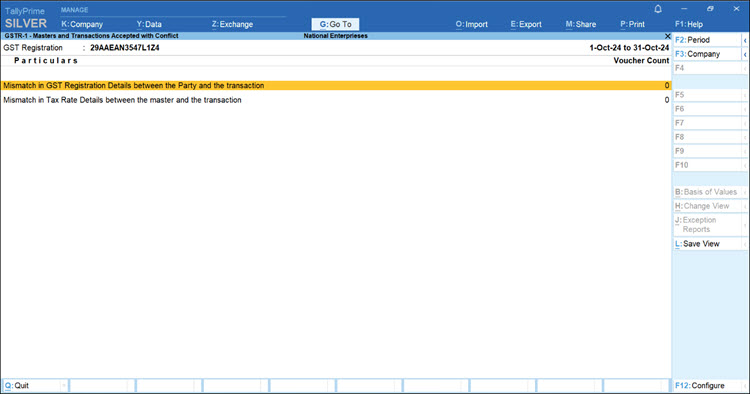

Mismatch in GST Registration Details between the Party and the transaction

Cause

If you have changed the GST Registration or Tax Rate details of the party master.

Resolution

You can resolve a single transaction or multiple transactions together.

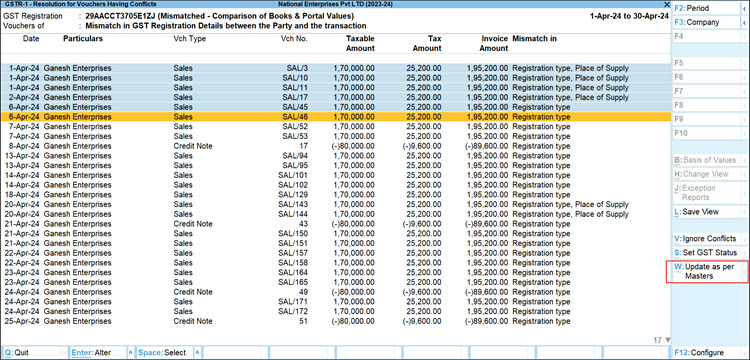

Resolve the conflict for one or more transactions in one go | Update as per Masters

- Select one or more transactions, and press Alt+W (Update as per Masters).

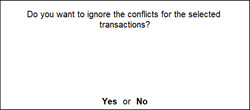

- Press Enter to confirm the update for the selected transactions.

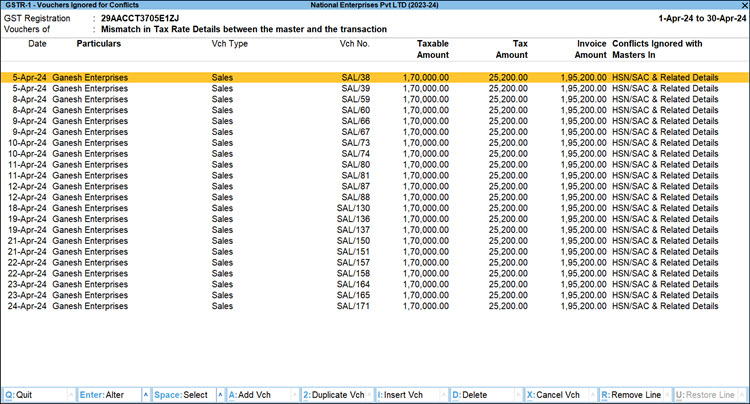

In case you want to skip resolving the transaction now, you can select Ignore Conflicts.

- Select the transactions and press Alt+V (Ignore Conflicts).

- Press Enter to confirm.

- View the report with all the transactions for which you had ignored the conflict.

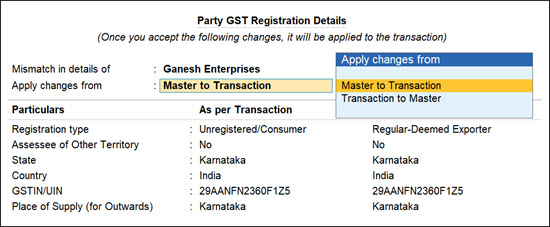

Apply changes from Master to Transaction or Transaction to Maters

- Drill down from the transaction entry for which you want to resolve the conflict.

- In the Party GST Registration Details screen, validate the differences under As per Transaction and As per Master.

- Resolve the conflict.

- If the master details are correct, retain Apply changes from as Master to Transaction.

- If the transaction details are correct and you want to update the master, press Backspace, and under the Apply changes from option, select Transaction to Master.

- If the master details are correct, retain Apply changes from as Master to Transaction.

- Set the Effective Date, and press Enter to update the transaction or master as per your choice.