Sale of Composite Supply

In a composite supply of goods and services, one element—either the goods or the services—will be considered the principal supply. If you are unsure which is the principal or secondary supply, you can create separate invoices for the goods and services involved. The rate of tax applicable to the principal supply will apply to the entire composite supply.

To record the sale of composite supply, follow these steps:

- Create the service ledger under Indirect Expenses.

- In the Ledger Creation screen, set Include in Assessable Value calculation for to GST.

- Select Goods in Appropriate to field, as the principal supply is considered as goods in this example.

There are 3 options in Include in assessable value calculation for Appropriation.- Goods

- Goods and Services

- Service

When you select Services and Goods and Services Method of calculation is set to Based on Value.

However, for Goods, the user needs to choose the Method of calculation from the below.- Based on Quantity: Apportions the expense value based on quantity of the stock item. More quantity means more share of expense value.

- Based on Value: Apportions the expense value based on value of each stock item/service ledger more value means more share of expense value.

- Set GST applicability as Not Applicable.

- Press Ctrl+A to accept the ledger creation screen.

- Record sales of composite items.

- In the sales voucher, enter the Party A/c name and Sales ledger.

- Select the stock items and enter the Quantity and Rate.

- Select the service ledger (in this example, the ledger is applicable for transportation charges).

- Select the applicable tax ledgers. CGST and SGST for local sales and IGST for interstate sales.

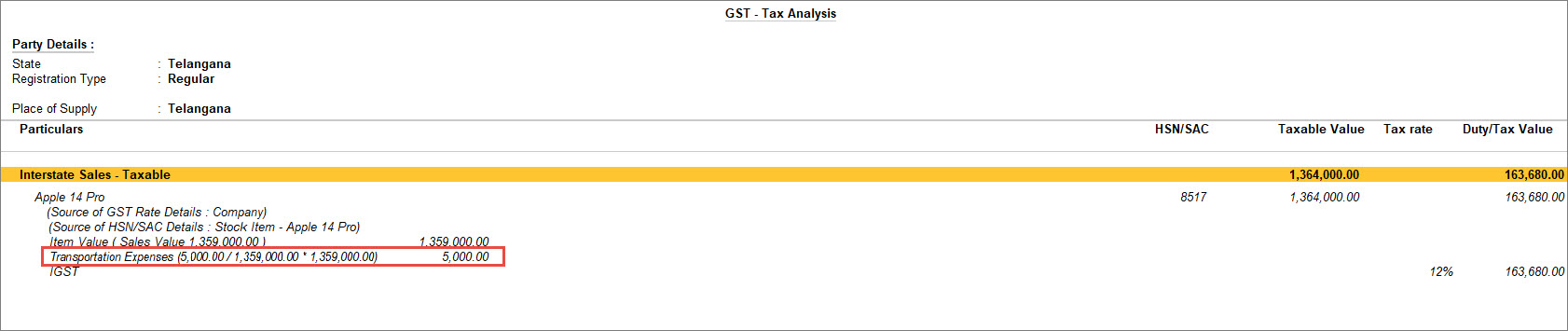

- To view the Tax Analysis, press Ctrl+O (Related Reports) > GST Tax Analysis. Press Alt+F5 (Detailed) to view the detailed breakup of the tax.

- Press Esc to return to the sales invoice.

- Press Ctrl+A to save the sales voucher.

Now that you have recorded a composite supply, you can see the transaction in the Outward Supplies of GSTR-1. To know more about GST Returns, refer to GSTR-1.