Conflicts Between Masters and Transactions for the Current Return period or All Return Periods

Conflicts between masters and transaction may appear if you change GST details at the company level, for say any compliance reasons. It may also impact the GST Status of the vouchers and move transactions into the Uncertain Transaction section of your Returns.

Say you changed the HSN/SAC details or disabled the e-Invoicing feature in the GST Details for the company. You can view the affected transactions for that Return period or All Return periods.

- Update the GST Details for your company.

- Press F11 to open the Company Features.

- Under Set/Alter Company GST Rate and Related Details: Yes, make changes to the HSN/SAC details, set the Effective Date, and save.

- Press Alt+G (Go To) type or select GSTR-1 and press Enter.

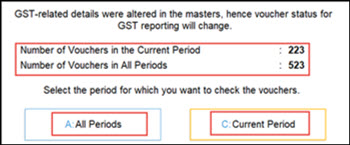

A message window appears displaying the impact on vouchers caused due to the change in GST details of the company.

- In the message window, review the impact and select the required option.

- Press C (Current Period) to check impacted vouchers of the current Return period.

- Press A (All Periods) to check the impacted vouchers for all Return periods.

It is recommended that you resolve the issues for the impacted vouchers before proceeding with filing your returns.