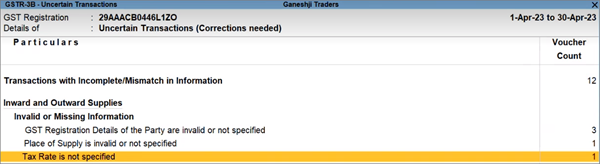

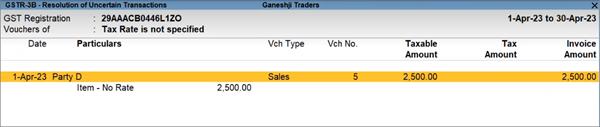

Tax Rate is not specified

Cause

Tax Rate is missing.

Resolution

You can resolve this exception using any one of the following methods, as per your convenience.

Update transactions Ledger-wise or Stock Item-wise

This is a convenient way for updating all your transactions at once for a particular stock item or ledger.

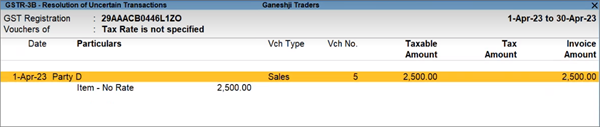

- Drill down from the exception to view the transactions that have to be updated.

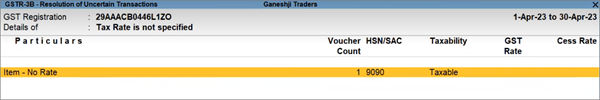

- Press F5 (Stock Item-wise) or Ctrl+F5 (Ledger-wise), as per your business needs.

The transaction details will be listed as per the relevant stock items or ledgers.

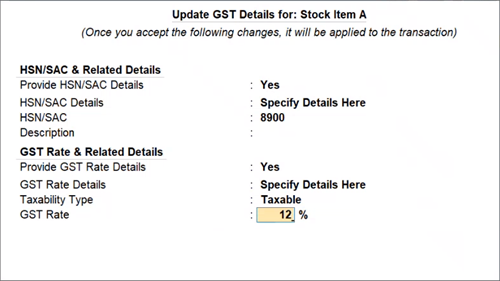

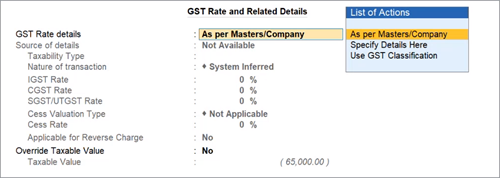

- Select the required stock item or ledger, and press Alt+S (Update GST Details).

The Update GST Details screen appears. - Update the GST Rate.

- Press Enter to save the details.

It is recommended that you press Enter here, and not Ctrl+A, to ensure that the proper Effective Date is applied. Refer to the Effective Date section, to know more.

The Effective Date screen appears.

- Specify the Effective Date for revised GST details.

- Press Enter to accept the details..

All the transactions recorded with the stock item or ledger will be resolved with the updated details.

Update transactions one by one

You also have the choice to update the Tax Rate for your transactions one by one, if needed.

- Drill down from the exception to view the transactions that have to be updated.

- Press Enter on the required transaction, and update the IGST Rate, CGST Rate, and SGST/UTGST Rate, as needed.

- Press Enter to save the details.

It is recommended that you press Enter here, and not Ctrl+A, to ensure that the proper Effective Date is applied. Refer to the Effective Date section, to know more.

The Effective Date screen appears.

- Specify the Effective Date for revised GST details.

- Press Enter to accept the details.

The transaction will be resolved with the updated details. Similarly, you can resolve the other transactions one by one.