TCS Changes in Budget 2020 – New TCS Provisions in TallyPrime

TallyPrime provides you with a facility to calculate TCS on transactions as per TCS changes in budget 2020. Based on the TallyPrime version that you have installed, the process for aligning with the TCS changes in Budget 2020 will differ. There can be three scenarios –

- If you are new to TCS in TallyPrime or have never used the realisation method of TCS calculation as per changes in Budget 2020, then refer to TCS in TallyPrime.

- If you are on TallyPrime Release 1.1.4, and you had implemented the workaround provided in those releases, then follow the steps provided in the section – New Provisions for TCS in TallyPrime Release 1.1.4 Onwards.

- If you are on TallyPrime Release 1.1.3 or earlier, then refer to the section – Using TallyPrime Release 1.1.3 or Earlier for TCS Changes in Budget 2020.

New Provisions for TCS in TallyPrime Release 1.1.4 Onwards

This is applicable to users who have upgraded to TallyPrime Release 1.1.4 after using TallyPrime Release 1.1.3 or earlier for TCS Budget Changes 2020.

TallyPrime Release 1.1.4 offers you the new TCS provisions- Sale of Any Goods under Section 206C(1H).

If you used TallyPrime Release 1.1.3 or earlier releases for the TCS Budget Changes – 2020, applicable from 1st October 2020 and now upgraded to TallyPrime Release 1.1.4 or later releases, then you need to alter your TCS Nature of Goods master and transactions involving TCS. As a result, you will observe the right transactions appearing under relevant sections in the Form 27EQ report.

TCS Nature of Goods Master

After upgrading to TallyPrime Release 1.1.4 onwards, you can configure the TCS Nature of Goods master for calculating tax on realisation or accrual, as per your business requirement.

Before upgrading to this Release 1.1.4, the TCS Nature of Goods master appeared as shown below.

Once you upgrade to TallyPrime Release 1.1.4, the TCS Nature of Goods Master will also have the Tax calculation based on realisation option. It will appear as shown below.

You can alter the TCS Nature of Goods master for Tax calculation based on realisation or accrual and enter the threshold limit. Thereafter, TCS will be calculated accordingly in the transactions, based on the selection of TCS Nature of Goods.

TCS Nature of Goods Master (Realisation)

Follow the steps below to alter your TCS Nature of Goods master to calculate tax on receipt basis, i.e., realisation.

- Set Tax calculation based on realisation to Yes.

- Under Threshold/exemption limit, enter the amount as Rs. 50,00,000.

Once you specify the Threshold/exemption limit, the field Calculate tax on value exceeding exemption limit will appear. - Set Calculate tax on value exceeding Exemption Limit to Yes.

Once you set this option to Yes, the amount of TCS will be calculated based on the value that exceeds the threshold or exemption limit. For example, the threshold limit for Sale of Any Goods is Rs. 50,00,000. So, if the Receipt amount from the party is Rs. 50,10,000, then TCS will be calculated on Rs. 10,000.

However, if you set this option to No, then the tax will be calculated from Rs. 1, i.e. on Rs. 50,10,000.

The TCS Nature of Goods Master configured for Realisation will appear as shown below.

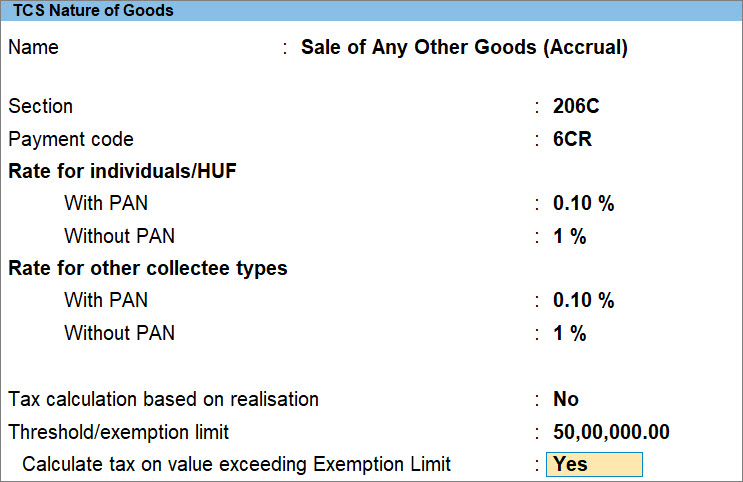

TCS Nature of Goods Master (Accrual)

Follow the steps below to configure your TCS Nature of Goods Master to calculate tax on accrual basis.

- Set Tax calculation based on realisation to No.

- Under Threshold/exemption limit, enter the amount, as Rs 50,00,000.

Once you specify the Threshold/exemption limit, the field Calculate tax on value exceeding exemption limit will appear.

- Set Calculate tax on value exceeding Exemption Limit to Yes.

Once you set this option to Yes, the amount of TCS will be calculated based on the value that exceeds the threshold or exemption limit. For example, the threshold limit for Sale of Any Goods is Rs. 50,00,000. So, if the Receipt amount from the party or sales to party is Rs. 50,10,000, then TCS will be calculated on Rs. 10,000.

However, if you set this option to No, then the tax will be calculated from Re. 1, i.e. on Rs. 50,10,000.

The TCS Nature of Goods Master configured for Accrual basis will appear as shown below.

Set up TCS at your preferred level

In TallyPrime Release 1.1.4 onwards, you have the flexibility to set up TCS at Stock Item or Sales ledger level. If you have an enormous number of Stock Items, then you can configure TCS at the Sales Ledger level, instead of configuring TCS in all the Stock Items individually. Once you set up TCS at the Sales ledger level, the TCS Nature of Goods will be inferred from the Sales ledger and TCS will be applied in transaction accordingly. However, if you have fewer stock items, then you can configure TCS at the Stock Item level.

Set up TCS in Stock Item

To configure TCS in a stock item, follow the steps below.

- Navigate to the Stock Item.

- Gateway of Tally > Alter > Stock Item > press Enter.

Alternatively, press Alt+G (Go To) > Alter Master > Stock Item and press Enter.

List of Stock Items appears. - Type or select the Stock Item that you want to alter, and press Enter.

The Stock Item Alteration screen appears.

- Gateway of Tally > Alter > Stock Item > press Enter.

- Press F12 (Configure) > set Set TCS Details to Yes and press Ctrl+A to save the setting.

Once you set the option to Yes, the Stock Item Master shows the Statutory Details fields. - Under Statutory Details:

- Set Is TCS Applicable to Applicable.

- Set Nature of Goods to Any.

Note: In Nature of Goods field, you have a flexibility to select specific TCS Nature of Goods for this Stock Item, or choose as Any to select the TCS Nature of Goods during the transaction. If you are not sure of the TCS Nature of Goods, then select Undefined. As a result, the TCS Nature of Goods will be inferred from the Sales Ledger and TCS will be applied in transaction accordingly.

- As always, press Ctrl+A to save the master.

Set Up TCS at Sales ledger level

You can set up TCS at the sales ledger level so that whenever you will use that ledger during voucher creation, TCS will be calculated accordingly. To set up TCS at the sales ledger level, follow the steps given below.

- Gateway of Tally > Alter > Ledger > type or select the sales ledger for which you want to set up TCS and press Enter.

Alternatively, press Alt+G (Go To) > Alter Master > Ledger > type or select the sales ledger for which you want to set up TCS and press Enter.

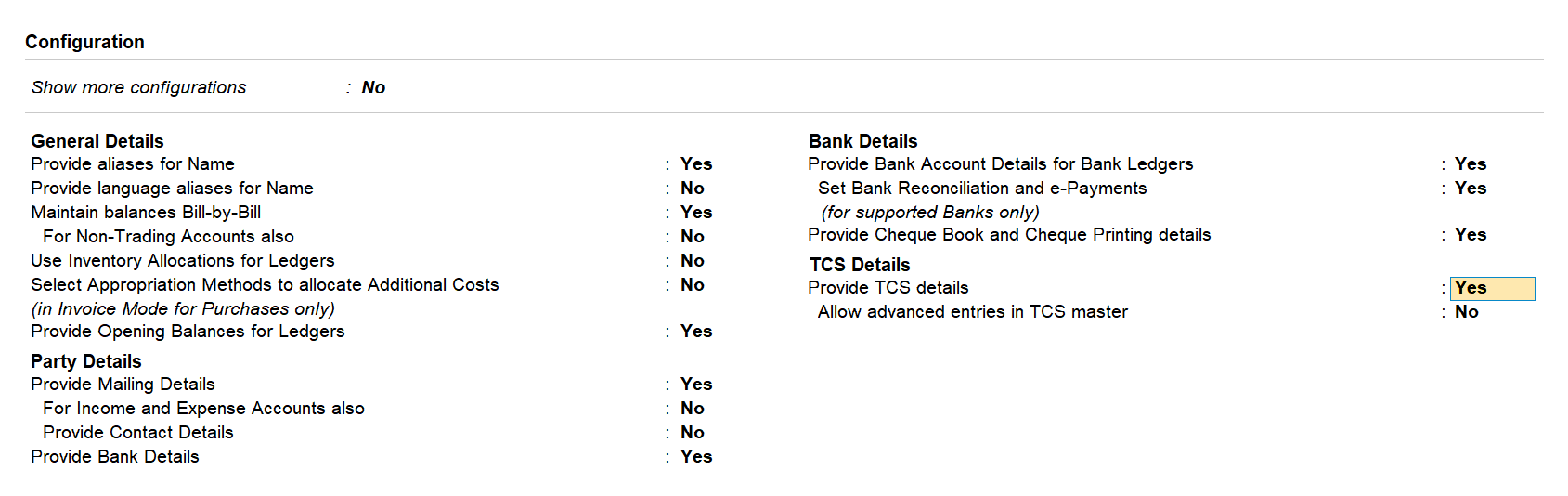

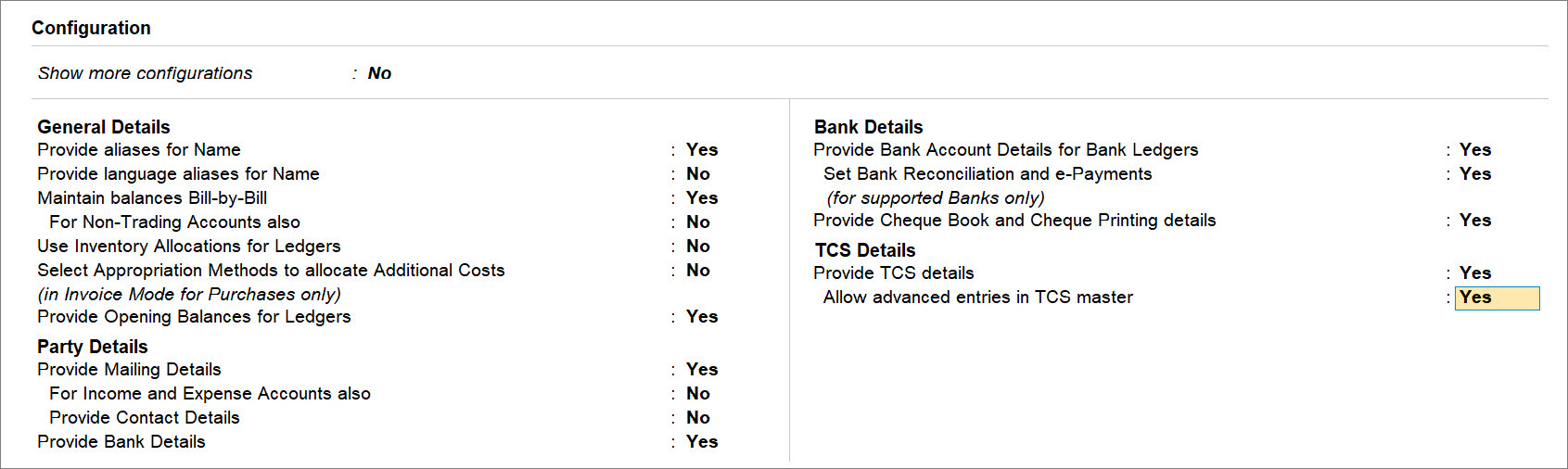

The Ledger Alteration screen appears. - Press F12 (Configure).

The Configuration screen appears. - Under TCS Details, set Provide TCS details to Yes.

Press Ctrl+A to save the setting. As a result, Statutory Details will appear on the Ledger Alteration screen. - Under Statutory Details:

- Set Is TCS Applicable to Yes.

- Set Nature of Goods to Any.

Note: In Nature of Goods field, you have a flexibility to select specific TCS Nature of Goods for this Sales ledger, or choose as Any to select the TCS Nature of Goods during the transaction. If you are not sure of the TCS Nature of Goods, then select Undefined. As a result, the TCS Nature of Goods will be inferred from the Stock Item and TCS will be applied in transaction accordingly.

- Press Ctrl+A to save the master.

TCS Advance Receipts

In TallyPrime Release 1.1.3 or earlier, there can be two types of TCS Advance receipt transactions that you had recorded – the ones below threshold limit and those exceeding threshold limit. After upgrading to TallyPrime Release 1.1.4 onwards, you will have to alter those transactions so that the transactions reflect in the appropriate sections of Form 27 EQ.

TCS Advance Receipt Below Threshold Limit

Before upgrading to TallyPrime Release 1.1.4, the TCS Advance Receipt transactions below the threshold limit will be in the Not Relevant in this Return section of the Form 27 EQ report. Moreover, the transactions without TCS duty ledger will be in the Not Relevant in this Return section of the Form 27 EQ report.

It is recommended that you keep the transactions dated in the last financial year (2020-21) unaltered. For the transactions that were recorded in the current financial year (2021-22), follow the steps given below.

After upgrading to TallyPrime Release 1.1.4 onwards, all such transaction will be still considered and will appear in the Not Relevant in this Return section of Form 27 EQ report. If you want to include the Not Relevant in this Return transaction in the Returns as Under Exemption limit section, then follow the steps given below.

- Alter the TCS Nature of Goods master to calculate TCS based on realisation.

To know how to do it, click here.Note: If you have already created two separate TCS Nature of Goods master for TCS calculation at realisation and accrual, then you do not need to do this.

- Press Alt+G (Go To) > type or select Form 27EQ and press Enter > Not Relevant in this Return > drill down on the transaction.

Alternatively, Gateway of Tally > Display More Reports > TCS Reports > Form 27EQ > Not Relevant in this Return > drill down on the transaction.

- Press F12 (Configure) > set Use TCS Allocations to Yes and press Ctrl+A to save the setting.

- In the TCS Allocation Details screen, select TCS Nature of Goods (with Realisation) from the List of TCS Nature of Goods and press Enter.

Since the TCS Advance Receipt voucher recorded for the party is below threshold limit, you will find the transaction in the Under Exemption limit section of Form 27 EQ as shown below.

TCS Advance Receipt Exceeding Threshold Limit

Before upgrading to TallyPrime Release 1.1.4, for a TCS Advance Receipt that exceeded the threshold limit, you must have selected the relevant TCS Nature of Goods in the TCS Allocation Details screen. As a result, the transaction would be in the Included in return section of Form 27 EQ in TallyPrime.

After upgrading to TallyPrime Release 1.1.4, you will not need to make any changes in the transaction, as it will be flagged as Advance Receipt and will be in the Included in return section of the Form 27 EQ in any of the following cases –

- TCS Nature of Goods (Realisation)

You can set Tax calculation based on realisation as Yes in TCS Nature of Goods and selected it in the TCS Allocation Details screen of the transaction.

The transaction will be in the Included in return section of Form 27 EQ, as it will be considered as Advance Receipt.

- TCS Nature of Goods (Accrual)

You can set Tax calculation based on realisation as No in TCS Nature of Goods and selected it in the TCS Allocation Details screen of the transaction.

TallyPrime will consider this as Advance Receipt, thereby displaying it in the Included in return section of Form 27 EQ.

TCS Sales Transaction

You may have recorded two type of TCS Sales transactions – below threshold limit and exceeding threshold limit.

TCS Sales Transaction Below Threshold Limit

Before upgrading to TallyPrime Release 1.1.4, for the TCS sales transactions that are below threshold limit, you may have set TCS Nature of Goods as Not Applicable in the TCS Allocation Details screen. After upgrading to TallyPrime Release 1.1.4 onwards, all such transaction will be still considered and appear under Not Relevant in this Return section of Form 27 EQ report.

It is recommended that you keep the transactions dated in the last financial year (2020-21) unaltered. For the transactions that were recorded in the current financial year (2021-22), follow the steps given below.

- Gateway of Tally > Alter > TCS Nature of Goods and press Enter.

Alternatively, press Alt+G (Go To) > Alter Master > type or select TCS Nature of Goods and press Enter. - Make the following changes in the TCS Nature of Goods Master:

- Set Tax calculation based on realisation to Yes.

- Under Threshold/exemption limit, enter Rs. 50,00,000.

Once you specify the Threshold/exemption limit, the field Calculate tax on value exceeding exemption limit will appear. - Set Calculate tax on value exceeding Exemption Limit to Yes.

- Press Ctrl+A to save the master.

You may want to consider transactions from the Not Relevant in this Return section in your returns, and therefore, you may want to move them to the Included in return section of Form 27 EQ. This is only possible when you select TCS Nature of Goods (Accrual). Furthermore, based on the exemption value that you have specified in TCS Nature of Goods, the transactions will appear in the Under Exemption limit or in the Collection at Normal rate section.

To include the transaction in the Included in return section, follow the steps given below.

- Alter the TCS Nature of Goods master to calculate TCS based on Accrual.

To know how to do it, click here.

Note: If you have already created two separate TCS Nature of Goods master for TCS calculation at realisation and accrual, then you do not need to do this.

- Press Alt+G (Go To) > type or select Form 27EQ and press Enter > Not Relevant in this Return > drill down on the transaction.

Alternatively, Gateway of Tally > Display More Reports > TCS Reports > Form 27EQ > Not Relevant in this Return > drill down on the transaction.

- Press F12 (Configure) > set Use TCS Allocations to Yes and press Ctrl+A to save the setting.

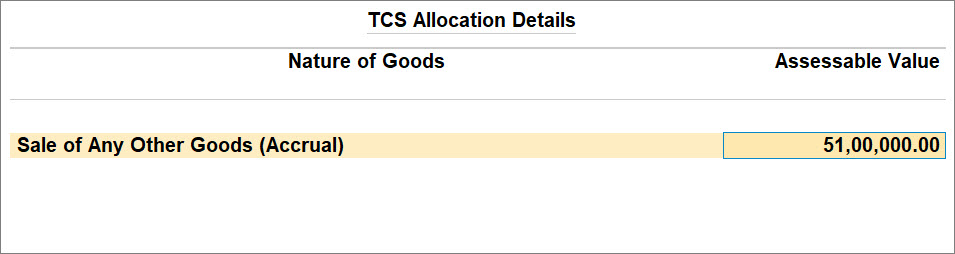

- In the TCS Allocation Details screen, select TCS Nature of Goods (Accrual) from the List of TCS Nature of Goods and press Enter.

- Press Ctrl+A to save the transaction.

Thereafter, the transaction will be in the Included in return section as Under Exemption limit in Form 27 EQ.

If you want to continue to retain the sales transaction on realisation basis, then you do not need to alter the transaction. It will continue to appear in the Not Relevant in this Return section of Form 27 EQ.

TCS Sales Transaction Exceeding Threshold Limit

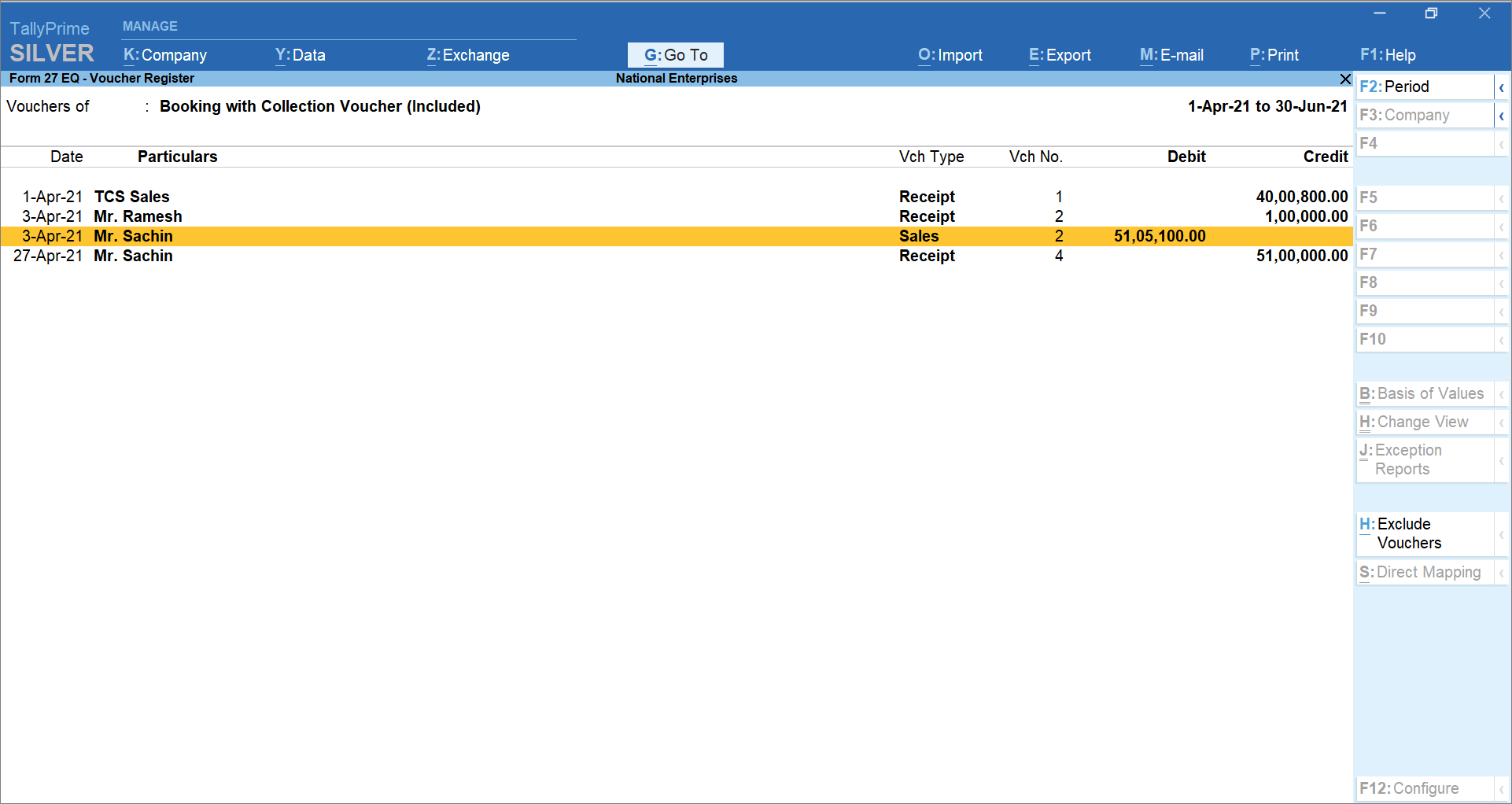

Before upgrading to TallyPrime Release 1.1.4, you must have recorded the transaction while selecting TCS Nature of Goods in the TCS Allocation Details screen.

As a result, the transaction would be in the Included in return section under Booking with Collection Voucher.

After upgrading to TallyPrime Release 1.1.4, you can modify the transaction using TCS Nature of Goods (Accrual). To do this, you can set Tax calculation based on realisation to No in TCS Nature of Goods and then select it in the TCS Allocation Details screen while recording the transaction as shown below.

In this case, the transaction will be in the Included in return section of Form 27 EQ, as it will be considered as Booking with Collection Voucher.

Note: In case you select TCS Nature of Goods (Realisation) in the transaction, then it will appear in the Not Relevant in this Return section of Form 27 EQ.

TCS Cash Sales with Duty transactions

Before upgrading to TallyPrime Release 1.1.4, you may have recorded some TCS Cash sales transactions with TCS duty by selecting TCS Nature of Goods.

As a result, the transactions will be in the Included in return section under Booking with Collection Voucher of Form 27 EQ.

After upgrading to TallyPrime Release 1.1.4, it will still be in the Included in return section under Booking with Collection Voucher in Form 27 EQ.

TCS Exemption for Parties that Deduct TDS

There may be cases in which the counter party has deducted TDS and such transactions will be exempted from TCS. In such a case, you will need to manually identify the transaction and modify it. If you have not collected the tax, then open the transaction and follow the steps given below.

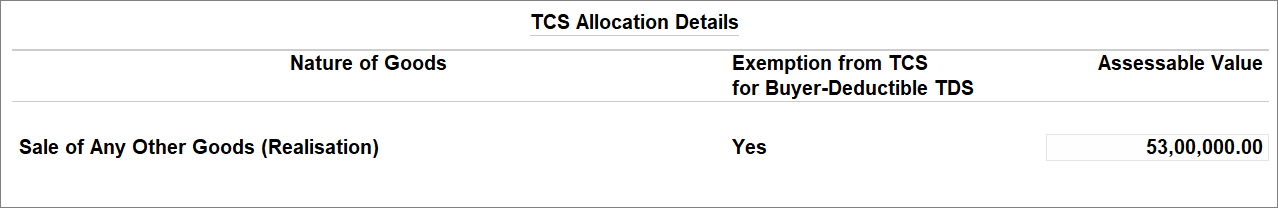

Transactions with TCS Nature of Goods (Accrual)

- Press F12 (Configure) > set Use TCS Allocations to Yes.

- In the TCS Allocation Details screen, press F12 (Configure) > set Specify exemption from TCS for buyer deductible TDS to Yes and save the setting.

The TCS Allocation Details screen appears. - In TCS Allocation Details screen:

- Under Nature of Goods, select TCS Nature of Goods (Accrual).

- Set Exemption from TCS for Buyer-Deductible TDS to Yes.

Press Ctrl+A to save the setting.

Now, there can be two scenarios –

- If you have collected the tax, then modify the transaction by removing the duty ledger.

- If you have not collected the tax, save the transaction. As a result, this transaction will be the part of Uncertain Transactions under the Challan details are not available section, as shown in the image below.

To resolve this exception, you need to provide Challan details and date, and as a result, the transaction will move to the Included in return section under Collection at Normal Rate. Moreover, you can go ahead to export the returns.

Transactions with TCS Nature of Goods (Realisation)

This is only applicable for an Advance Receipt transaction. In the Advance Receipt voucher, you may select TCS Nature of Goods (Realisation) in the transaction.

Now, there can be two scenarios –

- If you have collected the tax, then modify the transaction by removing the duty ledger.

- If you have not collected the tax, save the transaction. As a result, this transaction will be the part of Uncertain Transactions under the Challan details are not available section, as shown in the image below.

To resolve this exception, you need to provide Challan details and date, and as a result, the transaction will move to the Included in return section under Collection at Normal Rate. Moreover, you can go ahead to export the returns.

TCS exemption for government-listed parties

TCS shall not be collected by the seller if the buyer belongs to one of the categories mentioned below.

- Central Government, State Government, embassy, High Commission, legation, commission, consulate and the trade representation of a foreign State.

- A local authority.

- A person importing goods into India or any other person as the Central Government may, by notification in the Official Gazette.

If you have transactions with listed collectees, then you have to manually identify the TCS Govt party and follow the steps given below.

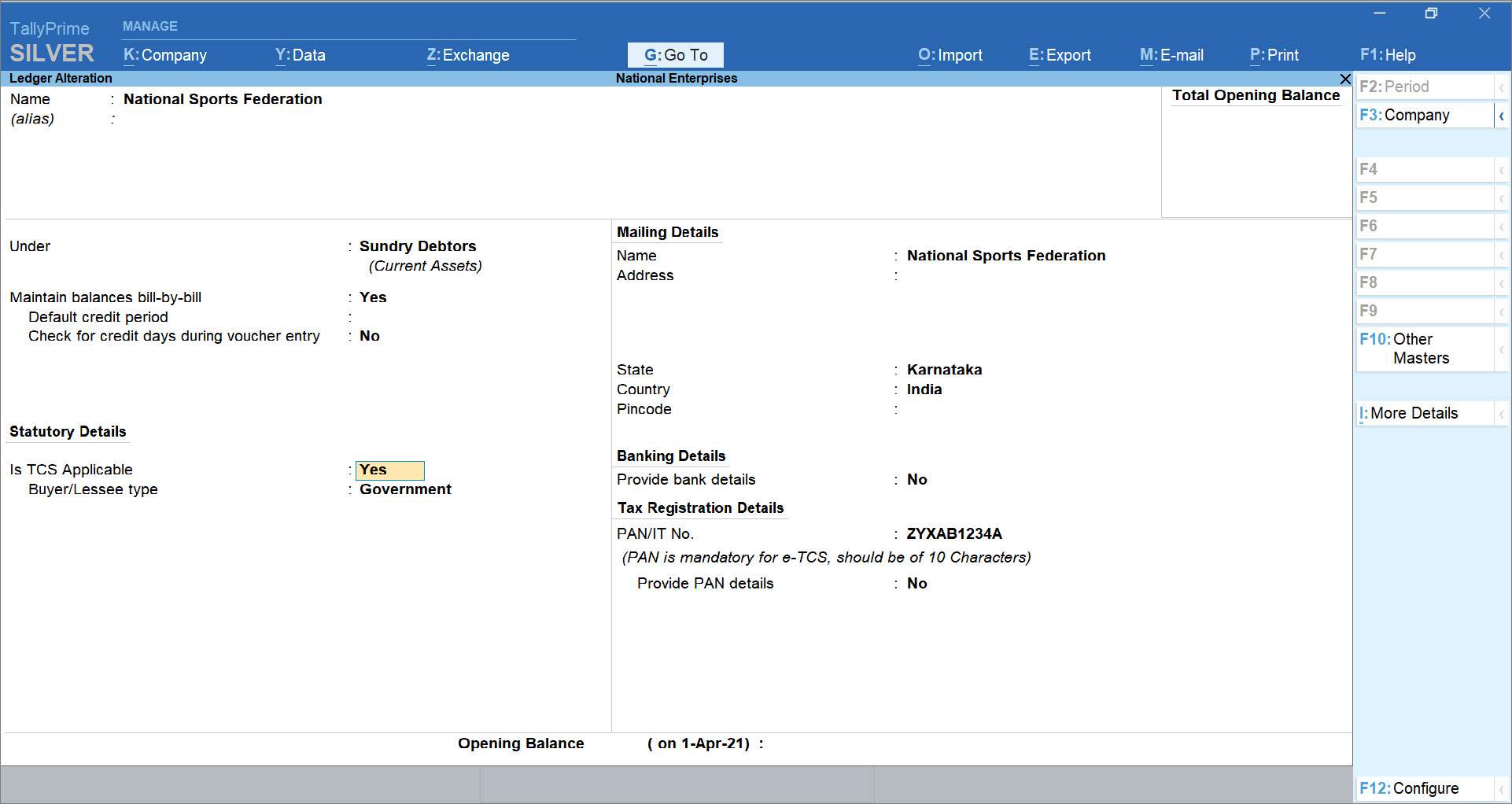

Party master

- Gateway of Tally > Alter > Ledger > type or select the master and press Enter.

Alternatively, press Alt+G (Go To) > Alter Master > Ledger > type or select the master and press Enter. - Set Is TCS Applicable to Yes.

- Press F12 (Configure) > set Allow advanced entries in TCS master to Yes.

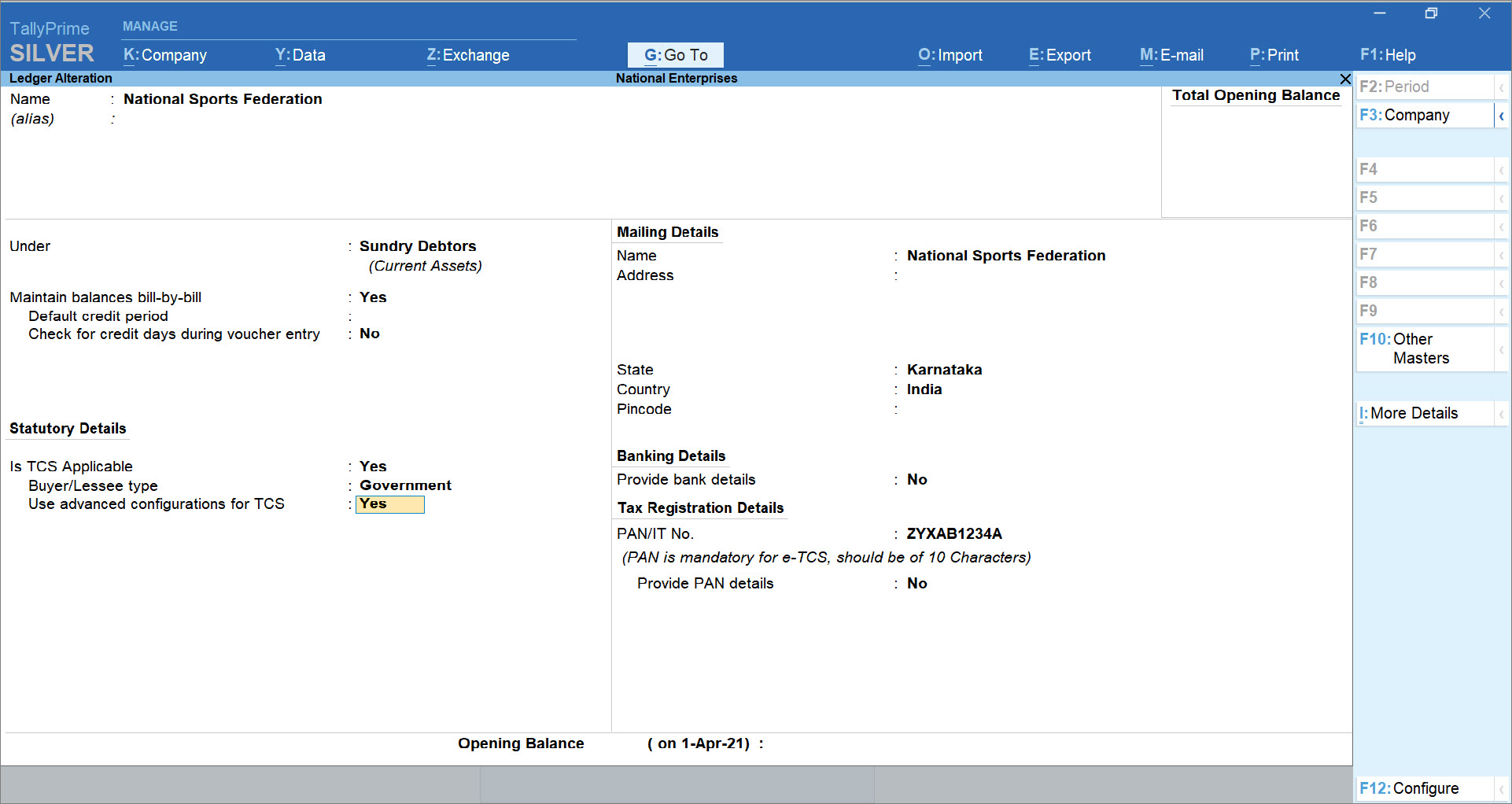

- Set Use advanced configurations for TCS to Yes and press Enter.

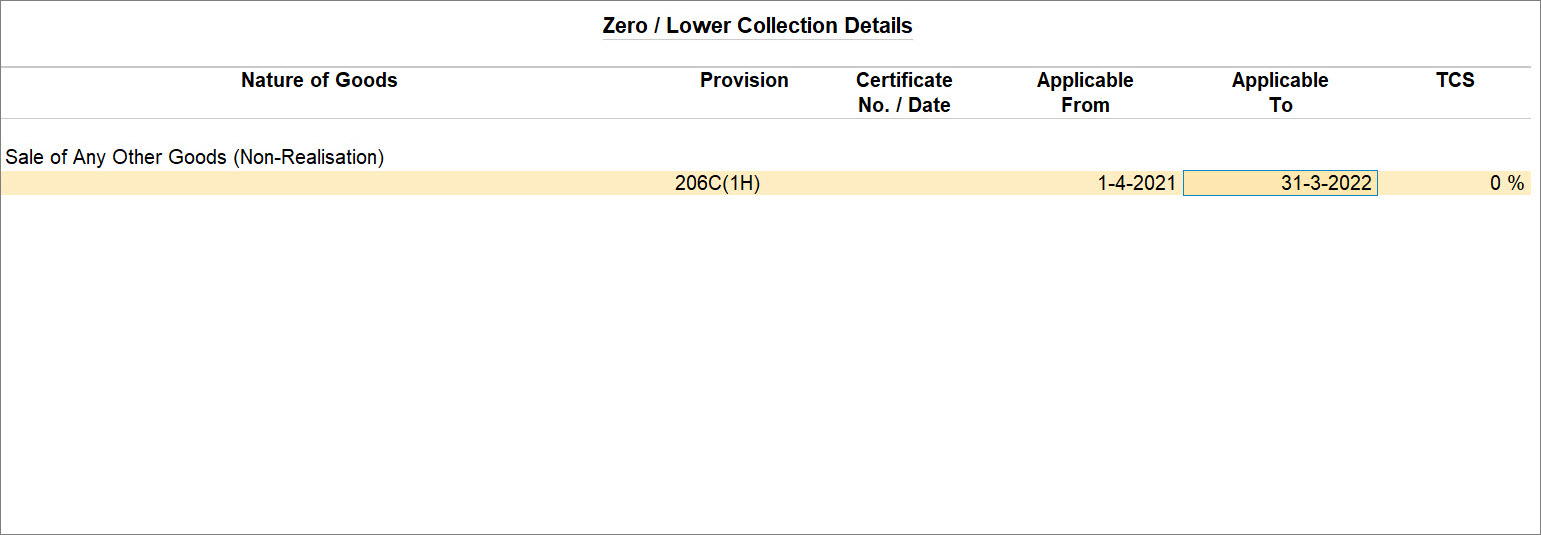

The Advanced TCS Configurations screen appears. - In the Advanced TCS Configurations screen, set Set/alter zero/lower rate for collection to Yes and press Enter.

The Zero/Lower Collection Details screen appears. - In the Zero/Lower Collection Details screen, make the follow selections:

- Under Nature of Goods, select the TCS Nature of Goods (Accrual) from the List of Nature of Goods.

- Under Provision, select 206C(1H) Collectees Eligible for Exemption.

- Enter the Applicable From and Applicable To dates and press Ctrl+A to save.

Transactions with the listed Collectee in which Tax is Collected

You first need to manually identify the transaction, and if you have collected tax, then modify the transaction by removing duty ledger and save the transaction.

As a result, the transaction will be Included in returns section under Collection at Zero/Lower Rate section. Thereafter, you can go ahead to export the returns.

Transactions with the listed Collectee in which Tax is not collected

For the transactions with the listed Collectee in which the tax is yet to be collected, you will need to follow the steps given below.

- Alter the collectee party master with the steps in the procedure for altering the collectee party master.

- Identify the transaction, drill down on it, and press Ctrl+A to save.

Thereafter, you can go ahead to export the returns.

Sale of Goods Taxable Under GST and TCS

While recording sales, you can select TCS and GST ledgers and view the autocalculated values in the invoice.

In this section

Enable GST and TCS features in sales ledger

You need to enable the GST and TCS features for the sales ledger, for tax calculation.

- Gateway of Tally > Create/Alter > Ledger > select the sales ledger > and press Enter.

Alternatively, press Alt+G (Go To) > Create Master/Alter Master > Ledger > select the sales ledger > and press Enter. - Set the option Is GST applicable to Applicable.

If the GST rate is not defined in the stock item, you can define it in the sales ledger.- Set the option Set/Alter GST Details to Yes.

- Select the Nature of transaction, and enter the GST Rate.

- Set the option Is TCS Applicable to Applicable.

- Select the Nature of Goods. You can create TCS Nature of Goods by selecting the required category from the predefined list.

If the nature of sale done in the business does not fall under any specific TCS category, you can use Consideration for Sale of Any Other Goods.

- As always, press Ctrl+A to save.

Similarly, enable the TCS feature in GST ledgers.

In case of interstate sales transactions, enable the TCS feature in the IGST ledger.

The sales and GST ledgers can now be selected in the voucher class, and in the sales invoice, for calculating GST and TCS.

Record sales invoice using TCS and GST ledgers

- Open the sales invoice, and select the party name and stock item.

- Gateway of Tally > Vouchers > press F8 (Sales).

Alternatively, press Alt+G (Go To) > Create Voucher > press F8 (Sales). - Select the Party A/c Name, and provide the Party Details.

- Select the stock item. Ensure the TCS Nature of Goods selected in the stock item is set to Any/Undefined/is same as that of the sales, GST and TCS ledgers.

- Enter the Quantity and Rate.

- Gateway of Tally > Vouchers > press F8 (Sales).

- Select the TCS and GST ledgers. The GST and TCS values will be autocalculated and displayed.

- Press Ctrl+O (Related Reports) > TCS – Tax Analysis > press Alt+F5 (Detailed). The break-up of taxes will appear.

- Press Esc to return to the sales invoice.

- Set the option Provide GST/e-Way Bill Details to Yes/No, as applicable.

- As always, press Ctrl+A to save.

This invoice will appear in TCS and GST returns.

Using TallyPrime Release 1.1.3 or Earlier for TCS Changes in Budget 2020

Finance Bill 2020 has amended Tax collection at Source (TCS) provisions to widen and deepen its tax base by including.

- Remittance under liberalised remittance scheme (LRS)

- Sale of overseas tour packages

- Sale of goods

This change shall come in force from 1st October 2020. Under this new changes TCS is required to be collected at the time of receipt or while debiting the amount, whichever is earlier.

Foreign Remittance through Liberalised Remittance Scheme OR Education loan taken under 80E and Remitted out of India – Section 206C(1G)(a)

An individual resident can send money to another country for investment or expenditure purpose under Liberalised Remittance Scheme (LRS). An authorised dealer who is receiving an amount or aggregate of an amount exceeding INR 7 lakhs during a financial year, from a single buyer for remitting outside India under LRS is liable to collect TCS.

Sale of overseas tour package – Section 206C(1G)(b)

A new TCS nature of goods has been introduced under Section 206C(1G)(b) where a seller of an overseas tour package receiving any amount from buyers purchasing the package is liable to collect TCS from the buyer and remit it to the department.

TCS on receiving an amount as consideration for sale of any goods as per section 206C(1), 206C(1F) and 206C(1G)] – Section 206C(1H)

Every seller, whose total sales, gross receipts or turnover from the business carried on by him exceed Rs. 10 Crores during the FY 2019-20 & onwards, and if the seller receiving an amount as consideration for sale of any goods of the value or aggregate of such value exceeding fifty lakh rupees during the FY 2020-21 & onwards to collect tax from the buyer. Sale consideration includes advance received for sale.

New TCS Provisions

|

Sl. No. |

Section |

TCS Nature of Goods |

|

1 |

Section 206C(1G)(a) |

Foreign Remittance through Liberalised Remittance Scheme |

|

2 |

Education loan taken under 80E and Remitted out of India |

|

|

3 |

Section 206C(1G)(b) |

Sale of overseas tour package |

|

4 |

Section 206C(1H) |

TCS on receiving an amount as consideration for sale of any goods as per section 206C(1), 206C(1F) and 206C(1G)] |

Section 206(1G)(a) | Foreign Remittance through Liberalised Remittance Scheme

An individual resident can send money to another country for investment or expenditure purpose under Liberalised Remittance Scheme (LRS). An authorised dealer who is receiving an amount or aggregate of an amount exceeding INR 7 lakhs during a financial year, from a single buyer for remitting outside India under LRS is liable to collect TCS.

The below table will give you the all the information related to the TCS on Foreign Remittance through Liberalised Remittance Scheme and Education Loan obtained under Section 80E.

|

Name |

1. Foreign Remittance through Liberalised Remittance Scheme 2. Education Loan obtained under Section 80E |

||||||||

|

Section Code |

206C |

||||||||

|

Payment Code |

Yet to be provided by the department Note: As the Payment Code is not yet notified by the department this field will be left blank and the same will not be printed on ITNS Challan 281. |

||||||||

|

Rate of Tax |

1. Foreign Remittance through Liberalised Remittance Scheme

2. Education loan obtained under Section 80E

|

||||||||

|

Threshold Limit |

Rs. 7,00,000/- |

||||||||

|

Effective From |

01-10-2020 |

Set Up Masters

- Enable TCS in Company: F11 > Enable Tax Collected at Source (TCS): Yes.

- Create TCS Master Category

- Set Up TCS in Party Ledger. In the party ledger

Record Remmitance – Using Sales Invoice

You have to manually keep track of amount received from each party in order to apply TCS when the threshold limit is crossed. You have to select TCS category in the transaction to charge tax. However, when the threshold limit is not crossed you can select Not Applicable as TCS category while recording the transaction.

For example: Recording first TCS Sales/Receipt transaction for Rs 6,00,000. Since the threshold limit of Rs 7,00,000 is not crossed, you have to manually keep track of amount received and select Nature of Goods as Not Applicable in the TCS Collection Allocations screen of the sales invoice.

To record a TCS sales when amount received below the threshold limit;

In a sales transaction using Accounting Invoice mode.

- Press F12 (Configure) > set Allow modification of Tax Details for TCS to Yes.

- Provide Party details and select the sales ledger.

- Under Particulars, select the TCS ledger created under Current Liabilities.

- Specify the amount and press Enter. The amount is under the threshold limit.

The TCS Collection Allocations screen is displayed. - Under Nature of Goods, select Not applicable since the amount is under threshold limit.

- Press Enter to return to voucher screen and display the voucher save option.

- Press O to save the transaction with overridden details.

In a separate transaction with the same party, you received an amount of 3,00,000 Rs. Since the total transaction amount is now 9,00,000 which is more than the threshold limit, the tax will be applicable on the exceeded amount – that is Rs. 2,00,000.

In a separate sales invoice:

- In the TCS Allocation Details screen, select Nature of Goods > Foreign Remittance under LRS for Rs. 1,00,000.

- Select the TCS duty ledger, and press Enter.

- In the Party Details screen, provide the Party Name, Collectee Type and PAN. Tax will be calculated, based on the PAN entered.

- Press Enter > and press O (Override) to accept the voucher without any conflicts.

- Print the invoice: Press Ctrl+P (Print) > C (Configure) > set Print TCS details to Yes.

Record Remittance – Using Receipt Voucher

- In a receipt voucher, select the party ledger and press Enter.

- In the TCS Allocation screen, select Nature of Goods as Not Applicable (for the Assessable Value of Rs. 6,00,000).

- Enter other details and press O (override) to save the voucher without any conflicts.

Once you receive the next payment (say Rs. 3,00,000) from the same party, record another Receipt voucher for the additional amount of Rs. 2,00,000 which has up and above the threshold limit of Rs. 7,00,000.

- In Receipt Voucher > TCS Allocation screen, select the TCS master category created earlier.

- Select the TCS duty ledger, and press Enter.

- In the Party Details screen, provide the Party Name, Collectee Type, and PAN. Tax will be calculated based on the PAN entered.

- Press Enter, and press O (Override) to accept the voucher without any conflicts.

- Print the invoice

Section 206C(1G)(b) | Record Sale of Overseas Tour Package

A new TCS nature of goods has been introduced under Section 206C(1G)(b) where a seller of an overseas tour package receiving any amount from buyers purchasing the package is liable to collect TCS from the buyer and remit it to the department.

The table below will give you all the information related to TCS on Sale of Overseas Tour Package

|

Name |

Sale of Overseas Tour Package |

||||

|

Section Code |

206C |

||||

|

Payment Code |

Yet to be provided by the department Note: As the Payment Code is not yet notified by the department this field will be left blank and the same will not be printed on ITNS Challan 281. |

||||

|

Rate of Tax |

|

||||

|

Threshold Limit |

NA |

||||

|

Effective From |

01-10-2020 |

Consider a scenario where the cost of overseas tour package is more than the threshold limit – for example Rs. 8,00,000.

Set Up Masters

- Create Nature of Goods Master

- Create TCS Duty Ledger, for example TCS on Sale of Overseas Tour Package.

- Create Sales Ledger, for example Overseas Tour Package.

- Create Party Ledger, for example Mr. Ashok.

Sale of Overseas Tour Packages – Using Sales Voucher

While receiving amount for the overseas tour packages sold the travel agency should collect TCS duty @ 5% from the buyer.

In a sales invoice:

- Select the sale ledger – Overseas Tour Package

- Select the Duty ledger – TCS on Sale of Overseas Tour Package.

- Provide other details and, as always, press Ctrl+A to save the invoice.

Sale of Overseas Tour Packages – Using Receipt Voucher

You also use receipt voucher to record the amount received on sale of overseas tour package and collect TCS.

In a receipt invoice:

- Select the party ledger – Mr. Ashok.

- Select the Duty ledger – TCS on Sale of Overseas Tour Package.

- Provide other details and, as always, press Ctrl+A to save the invoice.

Section 206C(1H) | TCS on Receiving an Amount as Consideration for Sale of Any Goods as per section 206C(1), 206C(1F) and 206C(1G)]

Every seller, whose total sales, gross receipts or turnover from the business carried on by him exceed Rs. 10 Crores during the FY 2019-20 & onwards, and if the seller receiving an amount as consideration for sale of any goods of the value or aggregate of such value exceeding fifty lakh rupees during the FY 2020-21 & onwards to collect tax from the buyer. Sale consideration includes advance received for sale.

No such TCS is to be collected, if the seller is liable to collect TCS under other provision of section 206C such as Section 206C (1), 206C (1F) and 206C (1G) or the buyer is liable to deduct TDS under any provision of the Act and has deducted such amount or export outside India.

The table below will give you all the information related to TCS on Sale of Any Goods.

|

Name |

TCS on receiving an amount as consideration for sale of any goods |

||||

|

Section Code |

206C |

||||

|

Payment Code |

Yet to be provided by the department As the Payment Code is not yet notified by the department this field will be left blank and the same will not be printed on ITNS Challan 281. |

||||

|

Rate of Tax |

As per Finance Bill 2020, the TCS rate for this category with PAN is 0.1% and No PAN will be 1%. Due to COVID 19 outbreak, department has reduced the rate by 25% for PAN holders. Therefore, PAN rate is reduced to 0.075% and No PAN remains as 1%. |

||||

|

Threshold Limit |

Rs. 50,00,000.00 |

||||

|

Effective From |

01-10-2020 |

Set Up Masters

- Set Up TCS in Company

- Create TCS Category Master, for example Sale of Any Goods.

- Set up party ledger, for example, Mr. Ramesh.

- Set Up TCS Duty Ledger, for example TCS on Sale of Any Goods.

Amount Received in Advance

Scenario 1: Advance received is below threshold limit

Let’s consider a scenario where the amount received in advance is below the TCS threshold limit.

On 1st Oct 2020, National Enterprises received TCS advance amount from Mr. Ramesh worth Rs 48,00,000.00 which is below threshold limit and TCS is not required to be collected on this. Let see the transaction in the books of National Enterprises.

You can record TCS advance receipt transaction using receipt voucher for the amount which is below threshold limit.

- Go to Gateway of Tally > Vouchers > F6: Receipt.

- Select the bank account into which the sales amount was received in the Account field.

- Under Particulars, select the party ledger.

- Specify the amount and press Enter. The amount is under the threshold limit.

The Bill-wise Details screen is displayed.

- Under Type of Ref, select Advance and under Name specify the reference number.

- Press Enter to return to voucher screen and display voucher save options.

- Press Y to save the transaction.

Scenario 2: Advance received is above threshold limit

You can record TCS advance receipt transaction using receipt voucher when the threshold is crossed. When the same party makes further transactions in the financial year where total aggregate receipt exceeds the threshold limit, you must charge TCS for excess amount by selecting the appropriate TCS category in the transaction.

Record the second receipt voucher for the same party and TCS category for Rs 3,00,000 as below:

- Go to Gateway of Tally > Vouchers > F6: Receipt.

- Select the bank account into which the sales amount was received in the Account field.

- Under Particulars, select the party ledger.

- Specify the amount. The amount is under the threshold limit.

- Press Enter to open Bill-wise Details screen.

- Under Type of Ref, select Advance and under Name specify the reference number.

- Press Enter to return to voucher screen.

- Select TCS duty ledger.

- Press Enter to display the TCS Collection Allocations screen.

- Under Nature of Goods, select the TCS category and enter the value of amount received that is over the threshold limit under Assessable Value.

- Press Enter and select Not Applicable under Nature of Goods in TCS Collection Allocations screen.

- Press Enter to return to voucher. TCS is calculated for the Assessable Value based on availability of PAN.

- Press Enter.

- Press O save the voucher with overridden details.

- Press Page Up key to view the saved voucher.

- Press Alt+P (P :Print) to print the invoice. The receipt voucher will display the TCS details as shown below:

Amount Received after Sales – Record a Sales and Settle using Receipt Vouchers

You have to manually keep track of sales made to each party in order to apply TCS when the threshold limit is crossed. You have to select TCS category in the transaction to charge tax. However, when the threshold limit is not crossed you can select Not Applicable as TCS category while recording the transaction.

For example: On 20th September 2020, TCS Sales transaction worth for Rs 60,00,000 already taken place and against which two receipts are going to take place in the month of October 2020. Since the threshold limit of Rs 60,00,000 is crossed, you have to manually keep track of amount received while making the transaction for below and over & above threshold crossed.

Record a sales transaction

- Go to Gateway of Tally > Vouchers > F8: Sales.

- Click F12: Configure and enable the option Allow modification of Tax Details for TCS? to be able to manually select the TCS category.

- Select the ledger of the party in the Party A/c name field.

- Under Name of Item, select the item(s) sold, enter the quantity and rate.

- Press Enter to display Accounting Details screen.

- Select the TCS sales ledger created for sale of any goods.

- Press Enter to display the Bill-wise Details screen, select New Ref and provide the reference number.

- Press Enter to return to voucher screen and display the voucher save options.

- Press Y to save the transaction.

Record the first receipt transaction

- Go to Gateway of Tally > Vouchers > F6: Receipt.

- Select the bank account into which the sales amount was received in the Account field.

- Under Particulars, select the party ledger.

- Specify the amount. The amount is under the threshold limit.

- Press Enter to display the Bill-wise Details screen.

- Under Type of Ref, select Agst Ref and select sales bill from the pending bills.

- Press Enter to return to voucher screen and display voucher save options.

- Press Y to save the transaction.

Record the second receipt transaction

- Go to Gateway of Tally > Vouchers > F6: Receipt.

- Select the bank account into which the sales amount was received in the Account field.

- Under Particulars, select the party ledger.

- Specify the amount. The amount is under the threshold limit.

- Press Enter to open Bill-wise Details screen.

- Under Type of Ref, select Agst Ref and select the sales invoice from the pending bills.

- Press Enter to return to voucher screen.

- Select TCS duty ledger. Press Enter to display the TCS Collection Allocations screen.

- Under Nature of Goods, select the TCS category and enter the value of amount received that is over the threshold limit under Assessable Value. The balance is considered as not applicable.

- Press Enter and select Not Applicable under Nature of Goods in TCS Collection Allocations screen.

- Press Enter to return to voucher. TCS is calculated for the Assessable Value based on availability of PAN.

- Press Enter.

- Press O save the voucher with overridden details.

Record the sale using receipt vouchers

You can record TCS sales transaction using a receipt voucher instead of the sales voucher.

Record the first receipt voucher

- Go to Gateway of Tally > Vouchers > F6: Receipt.

- Select the bank account into which the amount was received in the Account field.

- Under Particulars, select the TCS sales ledger.

- Specify the amount and press Enter. The amount is under threshold limit.

The TCS Collection Allocations screen is displayed.

- Under Nature of Goods, select Not Applicable since the amount is under threshold limit and enter the Assessable Value.

- Press Enter to return to voucher screen and display voucher save options.

- Press O save the voucher with overridden details.

Record the second receipt voucher

When the same party makes further transactions in the financial year which makes the total amount for sale of goods exceed the threshold limit, you have to charge TCS for the excess amount by selecting the appropriate TCS category in the transaction. Record the second receipt voucher for the same party and TCS category for Rs 5,00,000 as below:

- Go to Gateway of Tally > Vouchers > F6: Receipt.

- Select the bank account into which the amount was received in the Account field.

- Under Particulars, select the TCS sales ledger.

- Specify the amount and press Enter.

The TCS Collection Allocations screen is displayed.

- Under Nature of Goods, select the TCS category and enter the value of amount received that is over the threshold limit under Assessable Value.

- Press Enter to return to voucher screen.

- Select TCS duty ledger.

- Press Enter to display the Party Details screen. Enter the Party Name, Collectee Type, and PAN details.

Tax rate is applied based on the availability of PAN.

- Press Enter to display voucher save options.

- Press O save the voucher with overridden details.

- Press Page Up key to view the saved voucher.

- Press Alt+P (Print) to print the invoice.

TCS Sales with GST | Cash-Based TCS Sales of Stock Item

Set Up Masters

- Create a sales Ledger with GST, for example, Sale of Any Goods-GST.

- Create a GST duty ledgers under Duties and Taxes, for example, Central Tax & State Tax.

- Select Type of duty/tax as GST.

- Select Tax type as Central Tax or State Tax.

- Set Is TCS Applicable as Yes.

- Select Nature of Goods as Sale of Any Goods.

Ledger for Central Tax:

Ledger for State Tax:

- Stock Item with TCS, for example, Computers (Item No. 001)

In case of occasional cash sale to party for whom threshold is crossed.

Record Cash Sales for TCS – for Stock Item with GST

Recording cash TCS Sale transaction for Rs 1,00,000. Since the threshold limit of Rs 50,00,000 is crossed, you must manually keep track of amount received and select Nature of Goods in the TCS Collection Allocations screen of the sales invoice.

- Go to Gateway of Tally > Vouchers > F8: Sales.

- Click F12: Configure and enable the option Allow modification of Tax Details for TCS? to be able to manually select the TCS category.

- Select the ledger of the party in the Party A/c name field.

- Under Name of Item, select the item(s) sold, enter the quantity and rate.

- Press Enter to display Accounting Details screen.

- Select the TCS sales ledger for sale of any goods.

- Press Enter to display the TCS Collection Allocations screen.

- Under Nature of Goods, select the TCS category. The amount is pre-filled under Assessable Value retain the amount since TCS is applicable on the entire amount.

- Press Enter to return to voucher screen.

- Select GST Central tax duty ledger and press Enter. GST duty is calculated the Assessable Value.

- Press Enter to display the TCS Collection Allocations screen.

- Under Nature of Goods, select the TCS category. As TCS is applicable on GST duty value.

- Press Enter to return to voucher screen.

- Select GST State tax duty ledger and press Enter. GST duty is calculated the Assessable Value.

- Press Enter to display the TCS Collection Allocations screen.

- Under Nature of Goods, select the TCS category. As TCS is applicable on GST duty value.

- Select TCS duty ledger.

- Press Enter to display the Party Details screen. Enter the Party Name , Collectee Type , and PAN details.

Tax rate is applied based on the availability of PAN.

- Press Enter and save the transaction.

Record Cash Sales for TCS – Without Stock Item, for Sale of Any Goods with GST

Recording cash TCS Sale transaction for Rs 2,00,000. Since the threshold limit of Rs 50,00,000 is crossed, you must manually keep track of amount received and select Nature of Goods in the TCS Collection Allocations screen of the sales invoice.

- Go to Gateway of Tally > Vouchers > F8: Sales.

- Click F12: Configure and enable the option Allow modification of Tax Details for TCS? to be able to manually select the TCS category.

- Select the ledger of the party in the Party A/c name field.

- Under Particulars, select TCS sales ledger created for sale of any goods.

- Press Enter to display the TCS Collection Allocations screen.

- Under Nature of Goods, select the TCS category. The amount is pre-filled under Assessable Value retain the amount since TCS is applicable on the entire amount.

- Press Enter to return to voucher screen.

- Select GST Central tax duty ledger and press Enter. GST duty is calculated the Assessable Value.

- Press Enter to display the TCS Collection Allocations screen.

- Under Nature of Goods, select the TCS category. As TCS is applicable on GST duty value.

- Press Enter to return to voucher screen.

- Select GST State tax duty ledger and press Enter. GST duty is calculated the Assessable Value.

- Press Enter to display the TCS Collection Allocations screen.

- Under Nature of Goods, select the TCS category. As TCS is applicable on GST duty value.

- Select TCS duty ledger.

- Press Enter to display the Party Details screen. Enter the Party Name , Collectee Type , and PAN details.

Tax rate is applied based on the availability of PAN.

- Press Enter and save the transaction.

Form 27 EQ

You can view all TCS-related transactions in the Form 27EQ report in TallyPrime. All transactions for which the value has crossed the threshold limit where TCS is applicable are displayed under the Included Transactions category. Transactions that did not cross the threshold limit, for which TCS is not applicable and therefore no TCS allocation is done are part of Excluded Transactions.

For more details on Form 27 EQ, refer to TCS in TallyPrime > Form 27 EQ.