Reasons for Rejection of e-Invoice and Resolutions

NIC has published the following error codes, error message, the reasons for the errors and the corresponding resolutions to help you resolve errors faced during e-Invoice upload to the NIC portal.

If the error message is not available here, check the page published by NIC https://einv-apisandbox.nic.in/api-error-codes-list.html

.highlight { font-weight: bold; background-color: rgb(248, 233, 150); } #searchInput { border: 2px solid #CCE0F4; border-radius: 5px; font-size: 14px; width: 50%; } .searchContainerScroll { background-color: white; position: fixed; top: 70px; box-shadow: 0px 2px 5px rgba(0, 0, 0, 0.1); padding: 15px 15px 5px 15px; transition: top 1s; } .searchContainer { width: 100%; min-width: 300px; background-color: white; padding: 15px 15px 5px 0px; top: -10px; }

Most Frequent Errors/Rejections

Understanding Rejection Terms: TallyPrime vs e-Invoice

As the rejection messages are based on GSTIN, the terminologies in TallyPrime vary in some instances. Hence, we have provided a table to facilitate a better understanding between TallyPrime and e-Invoice terminology.

| e-Invoice Terminology | TallyPrimeTerminology | Length |

| Field Location | Bill from place (earlier to Release 2.1) & Invoice bill from place (Release 3.0 and later) – F11:Company Feature | 3 to 50 (Alpha) |

| Field Document Number | Invoice Number / Voucher Number |

16 (Alpha-Numeric) with / or – The voucher number must not:

|

| State Field is Required | For all Invoices – its company State field (F11:Company Features> Enable Goods and Services Tax (GST) > Bill from place (earlier to Release 2.1) & Invoice bill from place (Release 3.0 and later) | |

| For specific Invoice – its Party (Party Details / Consignee Details using Ctrl+I (More Details or Dispatch From Details section under e-Invoice Details using Ctrl+I (More Details) | ||

| Field Address 1/Field Address 2 |

For All invoices – its company addresses For specific Invoices – Its Party master – Check ledger master or party details for buyer and consignee – 1st Line / 2 refers to 2nd line |

Address 1 – 1 to 100 (Alpha Numeric) Address 2 – 3 to 100 (Alpha Numeric) |

| Field Legal Name |

For all transactions – its company: Mailing Name Go to Company Alteration > Mailing Name |

3 to 100 (Alpha Numeric) |

|

For specific Invoice – Its Party: Mailing Name Go to Party alteration > Mailing Name |

||

| Field Product Description | Stock Item name | 3 to 100 (Alpha Numeric) |

| Field POS | Place of Supply – In party details/supplementary details check Place of Supply | |

| Recipient Pin Code | Buyer PIN code – Check party master or party details screens with PIN code | 6 digits |

| Recipient should be SEZ | Buyer details – Registration type should be SEZ | |

| State code does not match | For All Transactions – State name is not selected in the list in F11:Company Features > State – select the details from list | |

| For specific Invoices – State name is not selected properly in Party details / Place of supply | ||

| GSTIN is inactive or cancelled | Verify GSTIN status / If cancelled or inactive Registration type should be Unregister |

| Error Message/Scenario | Reason for Error | Resolution |

| IRN cannot be generated with a document date prior to 30 days from today for suppliers with a turnover 10 Crores. |

This error occurs when you try to generate an IRN for an invoice with an invoice date older than 30 days. As per the latest e-Invoicing regulations effective from 1 April 2025, businesses with an aggregate turnover of ₹10 crore or above must report invoices to the Invoice Registration Portal (IRP) within 30 days of recording an invoice. |

You are recommended to generate the IRN on the same day or within 30 days of invoice creation to avoid rejection. However, if the e-Invoice has already been rejected, you can take the following actions: Scenario 1: The e-Invoice does not need to be retained for the same return period.

Scenario 2: The e-Invoice needs to be retained for the same return period. Issue a credit note against the rejected e-Invoice.

You can also generate e-Invoices from Alt+Z (Exchange) > Send for e-Invoicing screen, within the permissible window of 30 days. |

|

Duplicate IRN

|

You might be attempting to create an IRN that is already generated. |

When trying to generate an e-invoice, you will receive a duplicate IRN if the IRN number has already been generated, cancelled, and repassed with another entry in the same cancelled voucher or with a previous voucher number with a new invoice. Say for Voucher No 1, you have generated an e-invoice, which you have cancelled later. If you are now generating an e-invoice for another voucher with the same voucher number, you will be prompted with a duplicate IRN error. In this case, record the new voucher with a separate voucher number. Also, remove the IRN from the e-invoice details and then generate the e-invoice through the new voucher.

|

| The field Address 1 must be a string with a minimum length of 1 and maximum length of 100 | Address 1/Address 2 is not as per the required format |

The maximum length of address allowed is 200 characters (100 against address line 1 and 100 against address line 2). Tally will combine and incorporate the maximum possible characters in first and second address lines (after truncating to nearest word). However, if address is beyond 200 characters it will get rejected by NIC. Hence ensure the Party masters and Company dispatch address and in accordance with this. Please remove any additional information (Ex: Contact person name / phone / e-mail etc. mentioned as part of address.) that is not relevant or is not a property of address. |

| The field Address 2 must be a string with a minimum length of 3 and maximum length of 100 | ||

| GSTIN is inactive or cancelled | GSTIN is inactive or cancelled by department or tax payer. |

Check if the GSTN is correct. If yes, click the Sync GSTIN from GST CP API.

If you get the status as Active, then you can restart your request to generate the IRN. However, if GSTIN is still inactive due to business closure, you can change the said transactions as Sales to Unregistered/Consumer so that such transactions can participate in B2C table. |

| Invalid GSTIN | GSTIN provided is incorrect |

Provide the correct GSTIN Verify the GSTIN using below link |

| The State field is required | State code is not specified |

State code refers to the State selected under F11 (Company Features) or in the ledger of the party for which the invoice is recorded. When you do not specify the State, you will not be be able to generate an e-Invoice. You can check the State on the following paths:

Here’s how to resolve the error in such vouchers. If you are using TallyPrime Release 3.0 and later, then follow the steps given below:

If you are using TallyPrime Release 2.1 and earlier, then the vouchers will be found in the Mismatch due to tax amount modified in voucher section. You need to ensure that the State is selected under F11 (Company Features) and the ledger created for the party. |

| The field unit must be a string with a minimum length of 3 and a maximum length of 8. | This error occurs when the UQC is not selected in the Stock Item master. |

When you create or alter Stock Items, ensure that for given Unit of Measurement – UQC (Unit Quantity Code) is selected. Once you select the UQC in the stock item and save it, you can generate e-Invoices. |

| The field Location must be a string with a minimum length of 3 and a maximum length of 50 |

Location is not as per the required format |

The field Location refers to the Invoice bill from place set under the GST Details of the F11 (Company Features). You can check it on the following path: F11 (Company Feature) > Enable Goods and Service Tax (GST) > GST Details. If the Invoice bill from place is lesser than 3 characters or greater than 50 characters, then the vouchers get rejected by the e-Invoice system. Here’s how to resolve the error in such vouchers. If you are using TallyPrime Release 3.0 and later, then follow the steps given below:

If you are using TallyPrime Release 2.1 and earlier, then the vouchers will be found in the Missing/Invalid Information section. You need to ensure that Invoice bill from place is specified in the required format. |

| 6 digit HSN code is mandatory for taxpayers with greater than or equal to 5 Cr |

6 digit HSN code is mandatory for taxpayers with greater than or equal to 5 Cr |

The e-invoice system for the Goods and Services Tax (GST) has been revised for taxpayers with an Annual Aggregate Turnover (AATO) of Rs. 5 crores and above. At least 6 digit HSN is mandatory in e-invoices for such taxpayers from the 15th of December 2023 You can resolve this rejection by updating the stock item or ledger with the correct HSN/SAC details. If the the HSN/SAC is starting with the 01 to 98 chapter, ensure that the Type of supply is configured as Goods, and if the chapter is 99 then Services, with proper applicability date. Update transactions Ledger-wise or Stock Item-wise

Once you have updated the HSN/SAC, go to the e-Invoice report to mark the rejected transactions as resolved and try resending the request.

|

| The field rounding off amount must be between 99 and -99 |

Reason1 : Ledger type is selected as “Invoice Rounding” in expenses, sales ledger or duty ledger, selected under expenses or sales, where enabled the option invoice rounding and accepted, later changed to the duty ledger. Reason2 : This error even occurs in vouchers, where round-off is not used. The reason for this could be in any of the ledgers used in the invoice type of ledger would have been chosen as Invoice rounding. This could be in the party, sales, or additional ledger |

Reason1 Alter the expense and sales ledger

Alter the duty ledger

Reason2

|

|

The field document number must match the expression'((a-zA-Z1-9)(1)(a-zA-Z0-9/-)(0,15))$’ (or) The document number doesn’t match with regular expression |

Document Number is not as per the required format |

Document Number references to the Voucher No. enter during voucher creation. A Document Number must fulfill the following criteria:

Here’s how to resolve the error in such vouchers. If you are using TallyPrime Release 3.0 and later, then follow the steps given below:

If you are using TallyPrime Release 2.1 and earlier, then the vouchers will be found in the Information required for e-Invoice not provided section. You need to ensure that the document number is correct. |

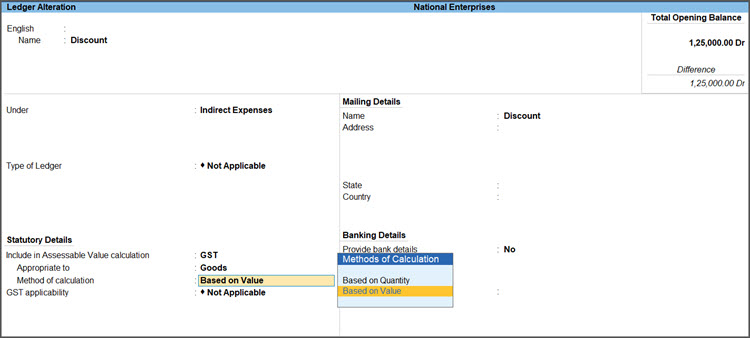

The field Assessable Amount (Total Amount – Discount) must match the regular expression ^\d+.?\d{0,2}$. The field Assessable Amount (Total Amount – Discount) must be between 0 and 999999999999.99. |

This error occurs if the discount ledger is configured under the Sales Account, with:

|

The e-Invoice gets generated. The voucher also gets updated with the Ack no. and IRN. |

| The field rounding off amount must be between 99 and -99 |

Reason1 : Ledger type is selected as “Invoice Rounding” in expenses, sales ledger or duty ledger, selected under expenses or sales, where enabled the option invoice rounding and accepted, later changed to the duty ledger. Reason2 : This error even occurs in vouchers, where round-off is not used. The reason for this could be in any of the ledgers used in the invoice type of ledger would have been chosen as Invoice rounding. This could be in the party, sales, or additional ledger. |

Reason1 Alter the expense and sales ledger

Alter the duty ledger

Reason2

|

| The field Product Description must be a String with a minimum length of 3 and the maximum length of 300 |

The Stock item name is not as per the required format |

Stock item Name is the product, which is dealt with for any Business, ensure the stock item Name provided should hold Min 3 to max 100 characters. |

| Recipient cannot be SEZ for – {0} transaction |

SEZ GSTIN has been passed as GSTIN in Recipient details for the specified type of transaction |

Only the Registration type is configured as Regular, however, its being SEZ party – party type should be configured ie., in the party master alteration > enable set/alter GST details > Under Party type select “SEZ” |

| The document date should not be future date. |

This error occurs if you have recorded an invoice for a future date and are trying to generate an e-Invoice for the same. e-Invoice system generates e-Invoice only for the transactions with current date or the backdated ones based on your business turnover. |

The e-Invoice gets generated. |

|

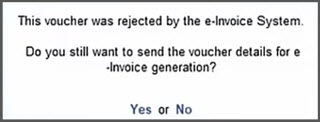

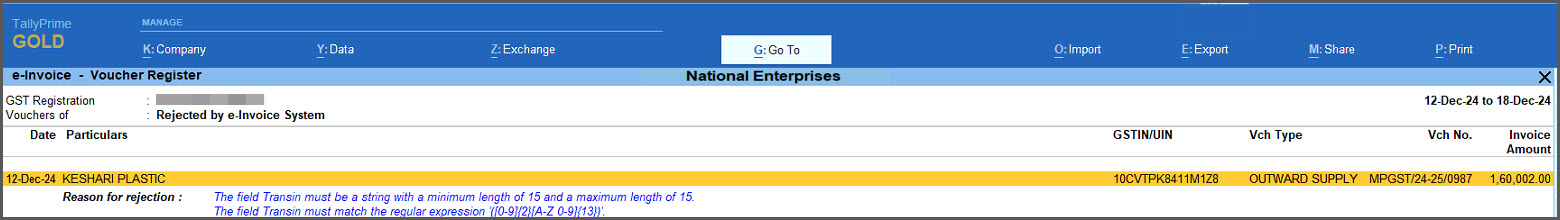

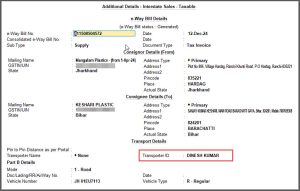

The field Transin must be a string with a minimum length of 15 and a maximum length of 15. The field Transin must match the regular expression ‘({0-9}{2}{A-Z 0-9}{13})’. |

This error occurs in the e-Invoice – Voucher Register report when the Transporter ID is not a valid ID of 15 digits. If you are using e-Invoice with e-Way Bill, you can also see this error in the e-Invoice report under the Rejected by e-Invoice System section. If you are using only e-Way Bill, then you can see this error in the e-Way Bill report under the Rejected by e-Way Bill System. |

|

| The field Transport document number must match the regular expression |

Transporter Document Number is not as per the required format |

Transporter document number in the e-Way Bill Details should follow the below validation

|

| The State field is required | State code is not specified |

State code refers to the State selected under F11 (Company Features) or in the ledger of the party for which the invoice is recorded. When you do not specify the State, you will not be be able to generate an e-Invoice. You can check the State on the following paths:

Here’s how to resolve the error in such vouchers. If you are using TallyPrime Release 3.0 and later, then follow the steps given below:

If you are using TallyPrime Release 2.1 and earlier, then the vouchers will be found in the Mismatch due to tax amount modified in voucher section. You need to ensure that the State is selected under F11 (Company Features) and the ledger created for the party. |

| The field Legal Name must be a String with a minimum length of 3 and maximum length of 100 |

The field Legal Name is not as per the required format |

Legal Name is the Entity registered Business with a specific Name. Under Mailing Name, ensure the Legal Name of the Business is provided to captured and should hold Min 3 to max 100 characters. |

| The JSON value could not be converted to System.Nullable`1[System.Int32]. Path: $.Data.EwbDtls.Distance | LineNumber: 0 | BytePositionInLine: 1969 |

The entered Pin to Pin Distance is invalid |

This message is shown when both e-Invoice and e-Way Bill is generated. The distance provided in e-Way Bill details is invalid. Please check https://ewaybillgst.gov.in/Others/P2PDistance.aspx to validate the proper Distance |

| e-invoice option is not enabled for this GSTIN. |

This happens because you have not registered for e-Invoicing with the necessary details on the e-Invoice portal. |

While you might have already enabled the e-Invoicing in TallyPrime, you need to complete the enablement process on the e-Invoice portal.

|

| Cancel the current e-Invoice generation request done in the e-invoice1 portal and send a new request for e-Invoice. |

If you have generated the e-Invoice from e-Invoice2 portal, then this error occurs, as you can get IRN or cancel from TallyPrime only on the e-Invoice1 portal. |

The e-invoice will be marked as Cancelled on the e-Invoice2 portal. You can then record a new transaction and generate e-Invoice from TallyPrime. |

e-Way Bill Errors

| Error Message | Reason for Error | Resolution |

|---|---|---|

|

The distance between the pincodes given is too high or low. |

The provided distance is incorrect. A difference of +/- 10% is allowed, and distance must fall within that range. |

If you are using TallyPrime Release 5.0 and later,

If you are using TallyPrime Release 3.0 and later, then you can navigate to the link for the calculation of the distance from within the product.

You will be redirected to the portal on which you can calculate the distance between the pincodes. However, if you are using TallyPrime Release 2.1 or earlier, then you can open the following link on a browser and calculate the distance between the pincodes: |

|

The distance between the pincodes given is too high |

The provided distance is incorrect. A difference of +/- 10% is allowed, and distance must fall within that range. |

If you are using TallyPrime Release 3.0 and later, then you can navigate to the link for the calculation of the distance from within the product.

You will be redirected to the portal on which you can calculate the distance between the pincodes. However, if you are using TallyPrime Release 2.1 or earlier, then you can open the following link on a browser and calculate the distance between the pincodes: |

Invoice Errors

| Error Message | Reason for Error | Resolution |

|---|---|---|

| Incorrect user id/User does not exists |

|

Ensure that the User ID and password used to generate the e-Invoice are the same credentials registered on the IRP.

If you can log in successfully, the credentials are valid for the GSTIN registered on the e-Invoice portal. If the login fails, the credentials are invalid, inactive, or do not belong to the selected GSTIN.

Ensure that you use the same credentials in TallyPrime for e-Invoice generation. |

|

Mismatch between HSN/SAC and Type of Supply.

|

This error occurs if you have entered an SAC code for goods or an HSN code for a service. |

For goods, ensure that the HSN starts with 1-98 and the Type of Supply is Goods. For services, ensure that the SAC starts with 99 and the Type of Supply is Services. In a Stock Item with HSN, if you have selected Service as Type of Supply, then,

The e-Invoice gets generated. For a stock item with SAC created for services, if you have selected Goods as Type of Supply, then you can resolve the error in a similar way.

|

|

The field Location must be a string with a minimum length of 3 and a maximum length of 50. |

This error occurs when the field Invoice bill from Place in the GST Details screen has less than 3 or more than 50 characters. |

The e-Invoice gets generated. |

|

Recipient should be SEZ for transaction SEZWOP. |

This error occurs when you try to generate an e-Invoice for a party with Registration Type as SEZ but it has GSTIN/UIN of a Regular party.

|

The e-Invoice gets generated.

|

| GSTIN/UIN is not specified/invalid. |

Cause 1: This error occurs when you try to generate an e-Invoice for a voucher in which the GSTIN/UIN for your party is either invalid or cancelled/suspended due to non-filing of GSTR-3B for 2 consecutive months. Cause 2: This error occurs if all transactions are shown as rejected, which may happen when the company-level GSTIN/UIN of your company is incorrect or invalid. |

Resolution 1:

The e-Invoice gets generated. Resolution 2:

|

| The document date should not be future date.

|

This error occurs if you have recorded an invoice for a future date and are trying to generate an e-Invoice for the same. e-Invoice system generates e-Invoice only for the transactions with current date or the backdated ones based on your business turnover. |

The e-Invoice gets generated. |

|

The field Assessable Amount (Total Amount – Discount) must match the regular expression |

This error occurs if the discount ledger is configured under the Sales Account, with:

|

The e-Invoice gets generated. The voucher also gets updated with the Ack no. and IRN. |

|

The field Transin must be a string with a minimum length of 15 and a maximum length of 15. The field Transin must match the regular expression ‘({0-9}{2}{A-Z 0-9}{13})’. |

This error occurs in the e-Invoice – Voucher Register report when the Transporter ID is not a valid ID of 15 digits. If you are using e-Invoice with e-Way Bill, you can also see this error in the e-Invoice report under the Rejected by e-Invoice System section. If you are using only e-Way Bill, then you can see this error in the e-Way Bill report under the Rejected by e-Way Bill System. |

|

|

IRN details are not found |

When trying to Get IRN info, this error is received when user has changed either Doc number, Doc Date and Doc Type post generating the IRN. |

Don’t fire the same request simultaneously. This results in one request giving the error as ‘Duplicate IRN request’. Best way to avoid firing of IRN request repeatedly for the same request, is update in your system with IRN number when the response comes back. Next time check the IRN, if it is not there, then fire for IRN. |

|

HSN code(s)-{0} is invalid |

Wrong HSN code is being passed |

Pl check the HSN code being passed and cross-check the correctness of HSN code on e-invoice portal. Still, if you feel it is correct, then please send the details to the helpdesk for verification at e-invoice system side. Verify the details from below link |

| 6 digit HSN code is mandatory for taxpayers with greater than or equal to 5 Cr |

6 digit HSN code is mandatory for taxpayers with greater than or equal to 5 Cr |

The e-invoice system for the Goods and Services Tax (GST) has been revised for taxpayers with an Annual Aggregate Turnover (AATO) of Rs. 5 crores and above. At least 6 digit HSN is mandatory in e-invoices for such taxpayers from the 15th of December 2023 You can resolve this rejection by updating the stock item or ledger with the correct HSN/SAC details. If the the HSN/SAC is starting with the 01 to 98 chapter, ensure that the Type of supply is configured as Goods, and if the chapter is 99 then Services, with proper applicability date. Update transactions Ledger-wise or Stock Item-wise

Once you have updated the HSN/SAC, go to the e-Invoice report to mark the rejected transactions as resolved and try resending the request.

|

|

Combination of goods and service items are not allowed for inter state transaction with POS same as the supplier state |

Items list has entries for both goods and services for inter state transaction |

Items of both goods and services are not allowed in same invoice for inter state transaction |

|

Supplier GSTIN state code does not match with the state code passed in supplier details |

The state code passed and first two digits of the GSTIN passed in the Supplier details do not match |

In the Supplier details, first two digits of the GSTIN should match the state code passed. Tally maps the State code against each state internally. In case user has created any state manually and are used, the said error triggers. Select the State from the given list of States. |

|

Recipient GSTIN state code does not match with the state code passed in recipient details |

The state code passed and first two digits of the GSTIN passed in the Recipient details do not match. |

In the Recipient details, first two digits of the GSTIN should match the state code passed. Tally maps the State Code against each state internally. In case user has created any state manually and are used, the said error triggers. Select the State from the given list of States. |

|

IRN details cannot be provided as it is generated more than {0} days prior |

When trying to Get IRN info, this error is received when user has tried getting IRN info after 3 days. Note: Currently e-Invoice support for getting IRN info is limited to 3 days from day of Generation. This can be changed by NIC in the future. |

|

Vital Errors

| Error Message | Reason for Error | Resolution |

|---|---|---|

|

GSTIN is inactive or cancelled |

GSTIN is inactive or cancelled by department or tax payer . |

Check if the GSTN is correct. If yes, click the Sync GSTIN from GST CP API.

If you get the status as Active, then you can restart your request to generate the IRN. However, if GSTIN is still inactive due to business closure, you can change the said transactions as Sales to Unregistered/Consumer so that such transactions can participate in B2C table |

|

Invalid Gstin |

GSTIN provided is incorrect |

Provide the correct GSTIN Verify the GSTIN using below link |

|

Enrolled Transporter not allowed this site |

The user who is not registered with GSTN but enrolled as transporter in E Way Bill portal is trying to login to eInvoice system |

This is not allowed |

|

Invalid From Pincode or To Pincode |

PIN code passed is wrong |

Pass the correct PIN code. Check the PIN code on the portal using the below link https://einvoice1.gst.gov.in/Others/MasterCodes Select Pincodes from the available radio buttons. |

This error occurs when the e-Invoice credentials entered while generating the e-Invoice does not match the credentials registered on the IRP.

This error occurs when the e-Invoice credentials entered while generating the e-Invoice does not match the credentials registered on the IRP.