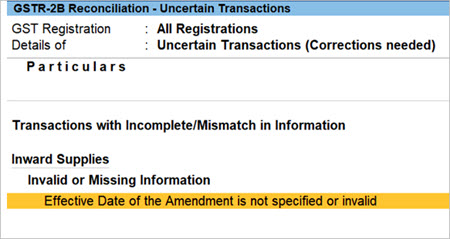

Effective Date of the Amendment is not specified or invalid

Cause

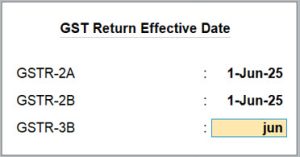

When you alter a transaction after signing the Return, it becomes an Amendment invoice, which cannot be added in the current period. However, you can move it to the subsequent return period. So, you will need to provide the effective date for amendment of the invoice in the subsequent period.

Resolution

Depending on the nature of transaction, the invoice may appear under GSTR-1, GSTR-3B, GSTR-2A, or GSTR-2B.

- Open the relevant GST report > Uncertain Transactions (Corrections needed).

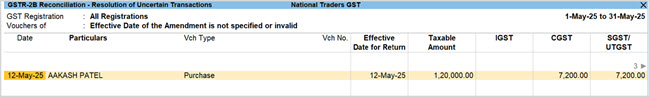

- Drill down from Effective Date of the Amendment is not specified or invalid.

- Press Alt+L (Set Effective Date).

- Enter a date of the subsequent return period.

- Press Ctrl+A to save the details.

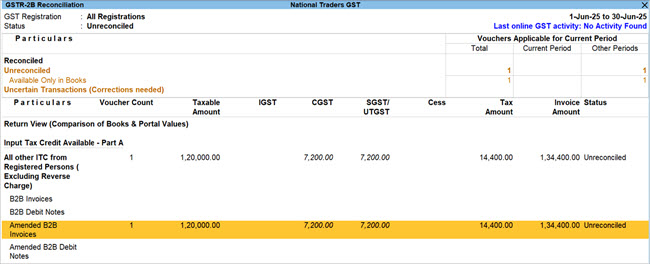

When you open the Return report for the subsequent period, you will find the transaction under the respective section for amended invoices. For example, Amendment B2B Invoices – 9A in GSTR-1 or Amended B2B Invoices in GSTR-2B.