View and Reconcile IMS Inward Potential Matches

Despite taking all precautions, some GST transactions may remain unreconciled due to minor differences in Date, GSTIN, or Doc No. The IMS Inward Supplies report in TallyPrime intelligently identifies such transactions where most key details match, like Taxable and Tax Amount, apart from minor differences in the Date, GSTIN, and Doc No. These potential matches are grouped under sections – Excluding Doc No. & Date or Excluding GSTIN, Doc No. & Date. You can either update the details manually or choose to copy details and update the transactions so that they can be reconciled.

In this section

-

Press Alt+G (Go To) > type or select Invoice Management System, and press Enter.

-

Drill down from the required section to the IMS Inward – Voucher Register.

-

Press F8 (Potential Matches) to view the IMS Inward – Potential Matches report.

-

Press T to Continue with the selected period in the IMS Inward Supplies report, or press P to Change Period, if required.

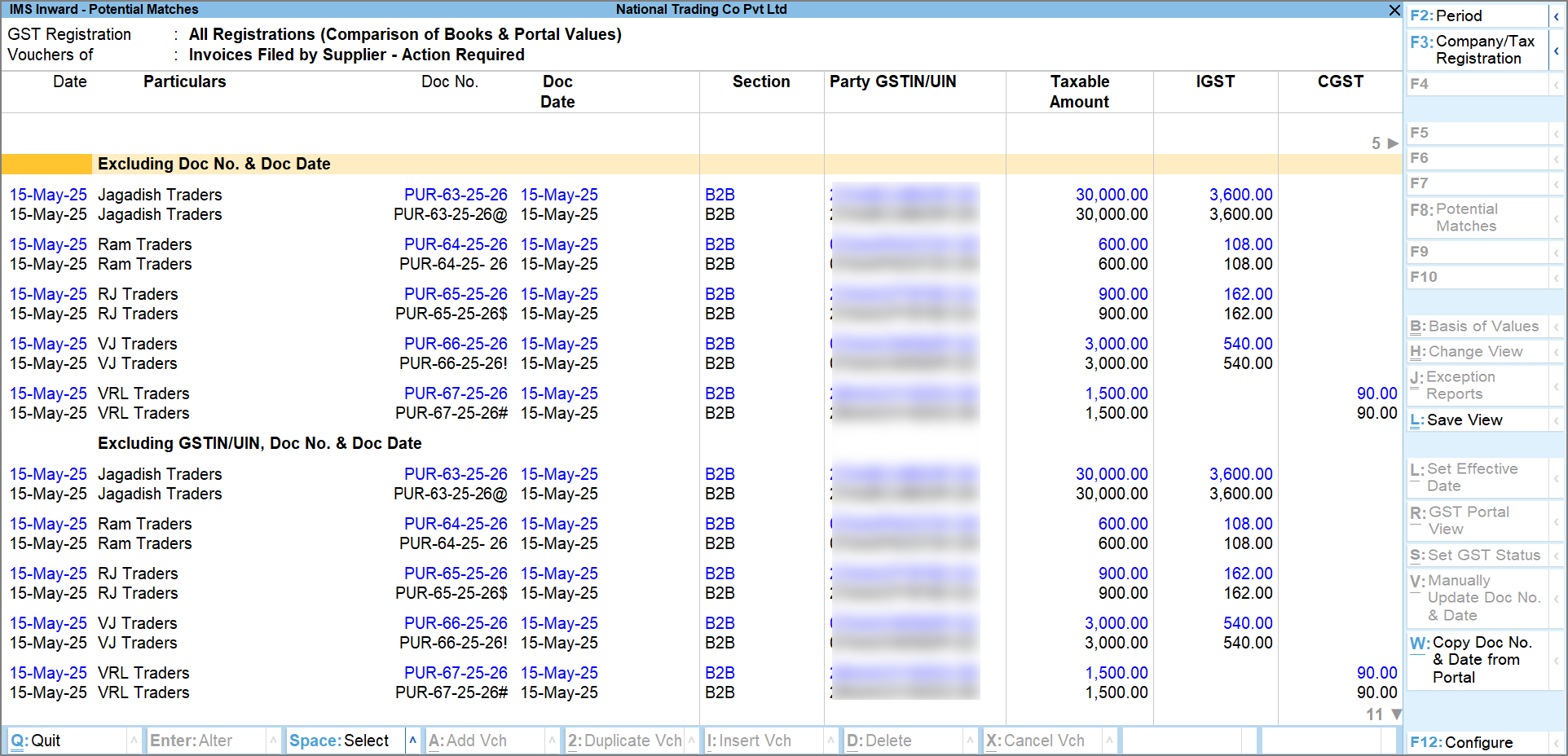

You can view the Potential matches grouped under Excluding Doc No. & Doc Date and Excluding Party GSTIN/UIN, Doc No. & Doc. Date.

Excluding Doc No. & Doc Date

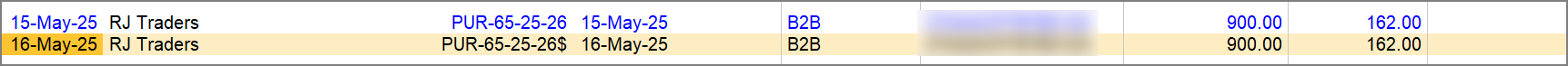

Under this section, you can view the transactions that are similar in all aspects except the Doc No. and Doc Date, which might appear correctly on the portal but not in your books (B2B), and vice versa.

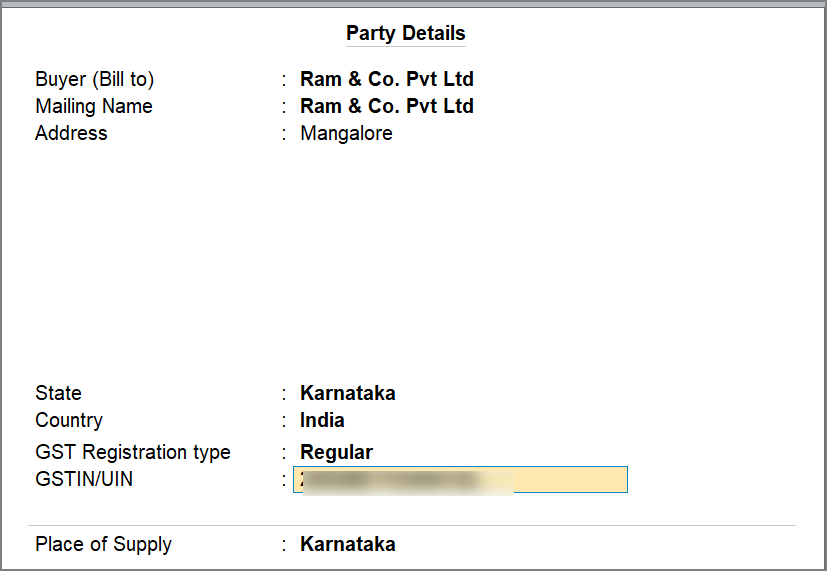

For example, let us take the following transactions recorded for Ram & Co. Pvt Ltd.

You can see two transactions, one corresponding to your books and the other (in blue) corresponding to the details on the portal. Both transactions are similar in all aspects except the Doc No., which appears correctly (PUR-55-25) on the portal but not in your books (PUR-55-25). However, you can easily resolve this by specifying the correct Doc No. in your transaction.

Resolve the differences automatically

-

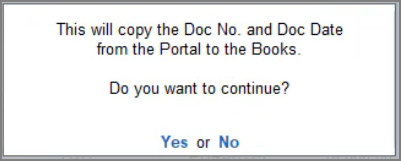

Press Spacebar to select the portal transaction, and then press Alt+W (Copy Doc No. & Date from Portal) to copy the document number and document date from the portal.

-

Press Y to continue.

The transaction will move to the Reconciled section.

Resolve the differences manually

-

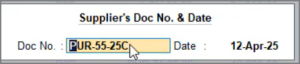

Press Spacebar to select the book transaction, and then press Alt+V (Manually Update Doc No. & Date).

-

Update the details manually and press Ctrl+A to save the Supplier’s Doc No. & Date.

The transaction will move to the Reconciled section.

Excluding Party GSTIN/UIN, Doc No. & Doc Date

Under this section, you can view the transactions that are similar in all aspects except the Doc No. and Doc Date, and GSTIN/UIN of the party, which might appear correctly on the portal but not in your books (B2B), and vice versa. Note that you can update only the document number and date from the IMS Inward Supplies – Potential Matches report. The GSTIN/UIN must be updated manually in the transaction.

To update the GSTIN/UIN:

The transaction will move to the Reconciled section.