GST Rate Details are overridden in transaction

Cause

While passing a sales voucher if you have changed the Taxable value in the GST Rate and Related Details screen.

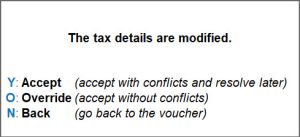

The GST rate details are prefilled based on stock items or ledgers, but TallyPrime allows you to change them during data entry. If you do, you will see a prompt to save the transaction with Conflict (Y: Accept), which can be verified later during return filing. If the change is intentional and no further review is needed, you can save the voucher by selecting O: Override.

As you try to save the voucher, a screen appears in the bottom right corner, as shown below:

If you press O (Override), the voucher will not come up in the GSTR-1 report under the uncertainties and will be listed under Included in Return.

If you press Y (Accept), you can accept the conflicts and resolve later.

Resolution

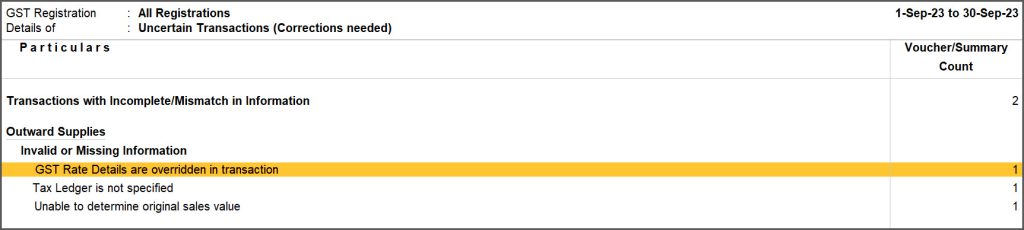

- Open the GSTR-1 report.

- Select Uncertain Transactions (Corrections needed).

- Drill down further and select GST Rate Details are overridden in transaction.

- Drill down further to view the overridden value.

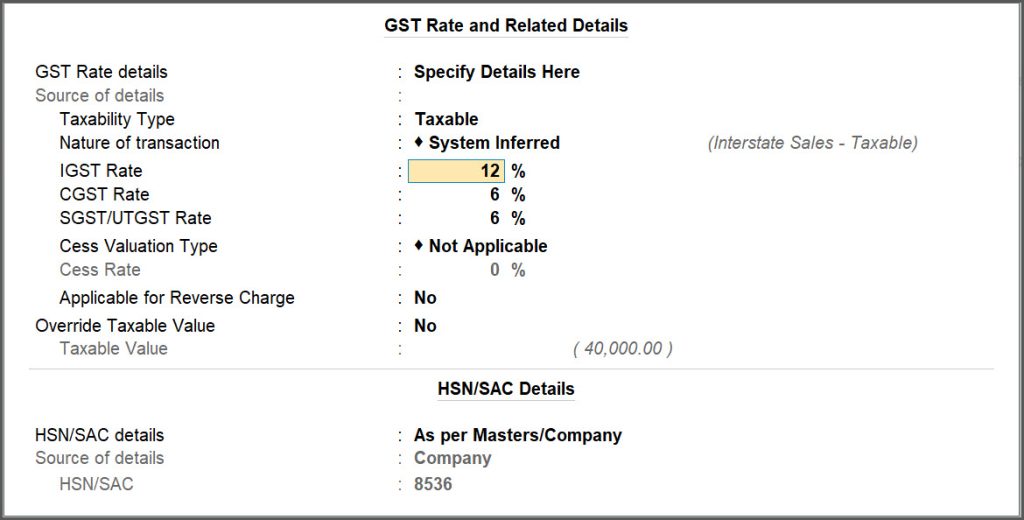

A sample image of GST Rate and Related Details sub-form appears, as shown below:

- Change the value, as per your preference and Accept.

- Select Ctrl+J (Accept As Is).

Now the voucher is listed under Included in Return.