Invalid Source of GST Details

Applicable to Release 5.1 and later.

Cause

This occurs if you changed the source of GST Details for a stock item already participating in a transaction. Say you have changed the Group of a stock item from Fabric to Fabric-Main Godown.

Resolution

- Press Alt+G, type or select GSTR-1 and press Enter.

- Press F2 (Period) to change the period, if needed.

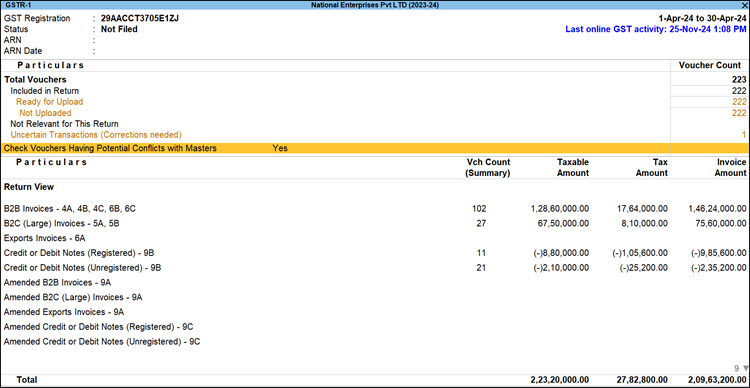

The GSTR-1 report displays the option Check Vouchers Having Potential Conflicts with Masters set to Yes.

This option appears if you have updated the GST details or source of GST Details for a master participating in the transaction of that Return period. - Drill down from the option for TallyPrime to check for the transactions with conflicts, and press Enter or Y to confirm.

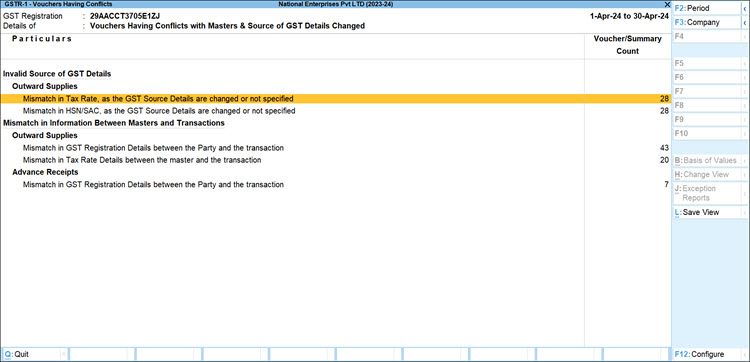

The GSTR-1 – Vouchers Having Conflicts report displays the following types of conflicts, section-wise, under the Invalid Source of GST Details section.- Mismatch in Tax Rate, as the GST Source Details are changed or not specified

- Mismatch in HSN/SAC, as the GST Source Details are changed or not specified

- Resolve the conflicts.

(The resolution is the same for both exceptions)

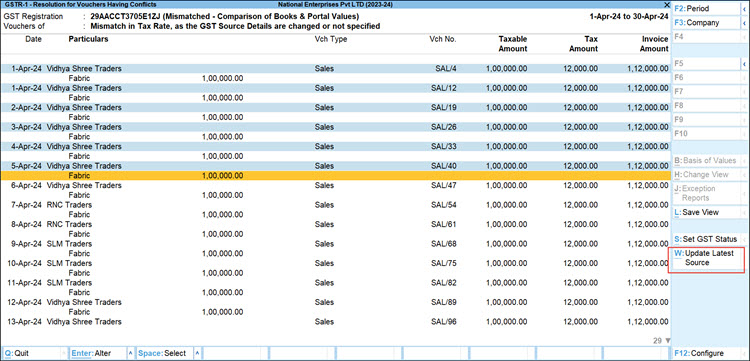

- Drill from the required conflict type.

- Select one or more transactions and press Alt+W (Update Latest Source).

The transactions are updated with the latest source of GST details.