Complete Guide for HSN/SAC Issues

Facing issues with HSN/SAC? Here is how you can maintain your HSN/SAC for a smooth GSTR-1 filing.

Resolve Invalid, Mismatched or Missing HSN/SAC

With TallyPrime, you can effortlessly fix invalid or missing HSN/SAC before filing your GSTR-1.

-

In GSTR-1, open Uncertain Transactions (Corrections Needed).

-

Drill down from HSN/SAC is Invalid, Mismatched, or Not Specified.

-

Press F5 (Stock Item-wise) to view the stock items to be updated.

The Voucher Count tells you the number of transactions that will get resolved when you update the stock item. -

Drill down from a stock item.

-

Under HSN/SAC Details, select Specify Details Here.

Ensure that you have validated and set the length of HSN as per your annual turnover. -

Specify the HSN/SAC details.

Ensure that you enter an HSN for your goods. -

Set the New Effective Date, based on the period in which you want to apply the changes in HSN.

-

Press Ctrl+A to save the details.

The changes get applied in all the relevant vouchers.

-

Similarly, you can update the other stock items, which will easily resolve all the relevant vouchers.

-

In GSTR-1, open Uncertain Transactions (Corrections Needed).

-

Drill down from HSN/SAC is Invalid, Mismatched, or Not Specified.

-

Press Ctrl+F5 (Ledger-wise) to view the ledgers to be updated.

The Voucher Count tells you the number of transactions that will get resolved when you update the ledger. -

Drill down from a ledger.

-

Under HSN/SAC Details, select Specify Details Here.

-

Specify the HSN/SAC details.

Ensure that you enter an SAC for your services. -

Set the New Effective Date, based on the period in which you want to apply the changes in SAC.

-

Press Ctrl+A to save the details.

The changes get applied in all the relevant vouchers.

-

Similarly, you can update the other ledgers, which will easily resolve all the relevant vouchers.

I. Update HSN/SAC in GST Classifications

-

Press Alt+G (Go To) > Create/Alter Master > GST Classification.

-

Under HSN/SAC Details, select Specify Details Here.

-

Specify the HSN/SAC details

-

Set the New Effective Date (for alteration), based on the period in which you want to apply the changes in HSN/SAC.

-

Press Ctrl+A to save the details.

II. Select GST Classification in Transactions

-

Open the Sales voucher alteration screen.

-

Press F12, enable Modify GST & HSN/SAC related details, and press Ctrl+A to save.

-

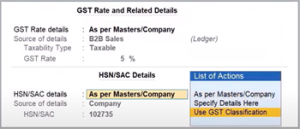

In Sales alteration, select the GST sales ledger.

The GST Rate and Related Details appears. -

Specify the HSN/SAC details as Use GST Classification.

-

Press Ctrl+A to save the details.

In GSTR-1, you can see that your vouchers will appear in their respective sections and not under Uncertain Transactions.

In this way, TallyPrime provides you with flexible methods, which ensure your vouchers are correctly categorised and resolved.

-

Press F11 and enable Set/Alter Company GST Rate and Other Details.

-

Under HSN/SAC Details, select Specify Details Here.

-

Specify the HSN/SAC details.

-

Set the New Effective Date, based on the period in which you want to apply the changes in HSN/SAC.

-

Press Ctrl+A to save the details.

The changes get applied to all the relevant transactions and the uncertainties are resolved.

Cause

This error occurs if you have entered an SAC for goods or an HSN for services.

Solution

For goods, ensure that the HSN starts with 1-98 and the Type of Supply is Goods. For services, ensure that the SAC starts with 99 and the Type of Supply is Services.

In a Stock Item with HSN, if you have selected Service as the Type of Supply, then,

-

Press Alt+G (Go To) > Alter Master > Stock Item.

-

Open the required Stock Item.

- Change the Type of Supply to Goods.

-

Press Ctrl+A to save the transaction.

Similarly, for a stock item with SAC created for services, ensure that you have selected Services as the Type of Supply.

Fix GST Portal Rejections due to HSN/SAC

If there are any issues in HSN/SAC, they can lead to rejections on the GST portal. Here is how you can fix them.

Cause

This error occurs when saving the HSN Summary while filing GSTR-1, either online or through JSON.

Solution

Remove any manually entered descriptions and keep only the auto-filled ones. Try saving again. If the error still appears, wait for some time and try again to upload.

Cause

This error occurs during GSTR-1 filing, either via the portal or JSON upload, when the HSN Summary for B2B supplies is left blank or there are no B2B transactions. As the GSTIN has mandated B2B HSN validation, this error appears on the GST portal.

Scenario 1: B2B Sales are present, but HSN is not provided

Check your books or portal for any B2B transactions, including nil-rated or exempted sales. The HSN details may have been missed or skipped, using Accept as is.

Solution

Update the transactions with the correct HSN details. Regenerate the HSN Summary and proceed with filing GSTR-1.

Scenario 2: Only B2C sales are present, and no B2B

Your business may have only B2C or interstate supplies to unregistered dealers, and no B2B sales. However, the portal has mandated HSN Summary for B2B supplies.

As a workaround to bypass the error, you can enter a dummy transaction of Rs 1/- as exempted or nil-rated value in the HSN Summary for B2B supplies.

-

Log in and open the HSN Summary

-

Log in to the GSTN portal using your credentials.

-

Open the RETURN DASHBOARD.

-

In the File Return screen, fill in the details and click Search.

-

Under GSTR-1, click PREPARE ONLINE.

-

Under ADD RECORD DETAILS, search for section or table 12 – HSN-wise summary of outward supplies.

-

-

Fill the HSN Summary for B2B supplies.

-

Under Add/Edit Details, enter the details, such as UQC.

This is based on the supply type and the details available in your books in TallyPrime. -

Enter the Quantity (1), Taxable Value (₹1), and GST Rate (0%).

-

-

Click Add and save the screen.

-

Proceed to file GSTR-1.

Scenario 3: The HSN/SAC Summary is set as All Sections Except B2C

This error may also occur if your HSN/SAC Summary is configured as All Sections Except B2C, in F11 (Company Features).

Solution

-

Press F11 > Set/Alter Company Rate and Other Details.

-

Set Create HSN/SAC Summary for to All Sections.

-

Press Ctrl+A to save the details.

Cause

The Unit Quantity Code (UQC) is invalid. When the HSN starts with 99, the Type of Supply should be Services, and the UQC should be NA. OTH is not allowed as the UQC for services. When the HSN does not start with 99, the Type of Supply should be Goods, and the UQC should not be NA.

Solution

Ensure that you have specified the relevant UQC. For example, if you want to report room rent, then create room charges as a stock item to track the number of days, and add the relevant UQC and not NA.

-

Open the voucher.

-

Drill down to the GST Rate and Related Details screen and update the details.

-

If the Type of Supply is Goods, then the HSN should not start with 99.

-

If the Type of supply is Services, then the SAC should start with 99.

-

-

Press Ctrl+A to save the voucher.

You can also update your HSN/SAC and Type of Supply for your stock items, so that the details get applied automatically from your next transaction.

Cause

In case of Services, the HSN/SAC should begin with 99, which identifies the code as a SAC and not an HSN.

Solution

-

Press Alt+G (Go To) > Alter Master and open the relevant ledger.

-

Under Statutory Details, update the HSN/SAC details.

-

If the Type of Supply is Goods, then the HSN should not start with 99.

-

If the Type of supply is Services, then the SAC should start with 99.

-

If the HSN/SAC is incorrect, validate and enter the appropriate HSN/SAC.

The GST portal also offers you the facility to search and verify your HSN/SAC.

-

-

Press Ctrl+A to save the details.

Cause

This error occurs when you try to upload GSTR-1 for May 2025, but the applicable date is not set for Separate B2B and B2C HSN Summary.

Solution

-

Press F11 (Company Features) > Set/Alter GST Rate details > More Details > Show More.

-

Select Separate B2B and B2C HSN Summary applicable from and update the Applicable From date as 1-May-2025.

-

Press Ctrl+A to save the details.

Cause

This error occurs when changes are made after exporting the GSTR-1, such as deleting a voucher, changing the party, modifying the voucher number, and so on.

Solution

It is recommended that you upgrade to TallyPrime Release 6.1 or later, which refreshes your invoices and sends the latest data.

However, if the error persists, then you can manually reset the HSN/SAC Summary.

-

Open GSTR-1 > HSN Summary – 12 > GSTR-1 – HSN/SAC Summary.

-

Press Alt+V (Alter Summary) and select Yes to continue with the alteration.

-

Press Ctrl+A to resave the summary.

-

Press Alt+R (Reset Summary) and select Yes to restore the original values.

The values are now refreshed. You can file your GSTR-1 again.

Further, if any delete requests had been raised, then you can reset them.

-

Press Alt+Z (Exchange) > All GST Options > Upload GST Returns > GSTR-1.

-

Press Alt+Q (Reset Delete Request).

-

Press Ctrl+A to proceed.

Cause

It is mandatory to enter the HSN/SAC in table 12 of GSTR-1.

Solution

-

Ensure that you have set the length of HSN/SAC, based on your turnover.

-

If an HSN is invalid, you can validate the HSN using your e-Invoice or e-Way Bill credentials.

-

In some cases, the HSN in your books may be 851410, but as per the HSN drop-down on the GST portal, it may be 85141000 or 8514.

The HSN provided in the books should exactly match the value on the portal. To know more, refer to the checklist for HSN.

Cause

This issue may occur when multiple UQCs are being used for a single HSN, and the combination of HSN – HSN Description is not unique for each UQC.

Solution

If you have used multiple UQCs for a single HSN, you have to modify the descriptions and keep the HSN – HSN Description combination unique for each UQC for a particular HSN. You can do this by importing the Excel sheet or CSV file in the offline tool.