Best Practices & Enhancements in GST for a Smooth Migration

TallyPrime comes with many enhancements in GST that will assist you in a pleasant migration to the latest release and significantly reduce the uncertain transactions. You can also make the most of Connected GST features such as return upload, download, and filing.

You can follow these best practices in GST before and after the migration. This will ensure that your transactions appear smoothly in GST reports in the relevant sections. Further, you can also enjoy many other enhancements, without any configuration or action from your side.

Configure Before Migrating to the Latest Release

During migration, you have many flexibilities that will ensure the transactions appear in the relevant sections of the returns, thereby preventing uncertain transactions.

It is recommended that you take a backup of your company data, before migrating your company or updating the configurations.

- In the Migrate screen, press C (Configure).

- Configure voucher numbering, HSN/SAC, and difference in tax values, as per your business requirements.

In releases between 3.0 and 5.0, you may have configured these options in the Basis of Values in GST returns. Ensure that you specify the same configuration here. For example, if you had entered 1 as the value in Ignore difference in tax values up to, then ensure that you enter the same value here.

- Press Ctrl+A to save the configuration.

Now you can migrate to the latest release without a worry. - In the Migrate screen, press R (Migrate).

This is one of the best practices in GST that will ensure that these transactions from your current release will be included in the relevant GST sections after migration.

Configure After Migrating to the Latest Release | HSN/SAC Summary Applicability

You can now easily configure the applicability of HSN/SAC Summary for your transactions. This will help you in preventing uncertain transactions related to HSN/SAC, especially in sections (such as B2C) where HSN/SAC Summary might not be applicable.

- Press F11 and set the Enable Goods and Services Tax (GST) option to Yes.

- Set the Set/Alter Company GST Rate and Other Details option to Yes.

- Configure options for HSN/SAC Summary.

- Show HSN/SAC Summary for:

- None: The HSN/SAC Summary will not be created for any transactions. This is especially helpful for businesses that don’t maintain inventory in TallyPrime.

- All Sections: The HSN/SAC Summary will be created for all your transactions.

- All Sections Except B2C: The HSN/SAC Summary will be created for all other sections (such as B2CS, B2CL, CDNUR, Nil Rate, Exempt, and Non-GST) except B2C.

- Length of HSN/SAC: You have the flexibility to set the length of HSN/SAC as 4, 6, or 8, based on the annual turnover of your business.

- Show HSN/SAC Summary for:

- Enter the Effective Date from which you want to apply the configuration.

- Press Ctrl+A to save the configuration.

Refer to HSN/SAC Summary for more details.

Use Enhancements to Reduce Uncertain Transactions

In addition to the best practices in GST, you can use many features that will greatly reduce the number of uncertain transactions.

Manage supplier invoice number and date with ease

Your inward transactions without supplier invoice number and date will no longer appear as Uncertain Transactions in GSTR-3B. There is no need to manually resolve these transactions, as they will appear under the relevant sections of the return.

In GSTR-2A and GSTR-2B, such transactions will appear under Available Only in Books. You can reconcile your returns by updating the supplier invoice number and date. If you have downloaded these details from the GST portal, then you can easily copy them to your books.

Resolve Uncertain Transactions in bulk

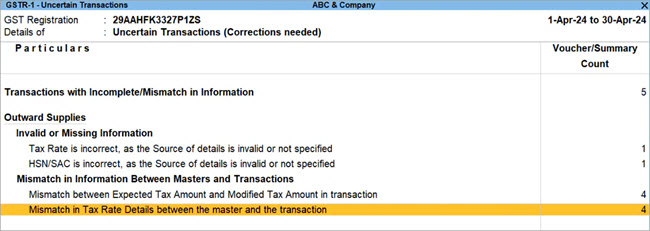

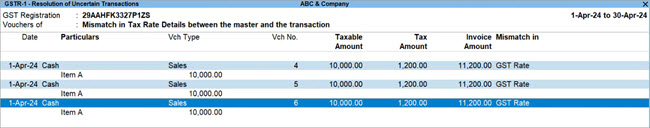

In the masters, you might have updated some GST details such as tax rate, HSN/SAC, or GST Registration. Subsequently, any mismatch in values between masters and transactions can lead to uncertain transactions in your returns.

However, you no longer have to correct such details one by one. You can simply select the required uncertain transactions and resolve them in one go.

- Press Alt+G (Go To) > GSTR-1 > Uncertain Transactions (Corrections needed).

- Drill down from the required section.

- Select the required transactions and press Alt+W (Update as per Masters).

In this way, you can quickly resolve the issue across many transactions in one go.

Handle non-GST transactions easily

Your non-GST transactions will now be handled in a much easier manner, as they will no longer appear as Uncertain Transactions. There is no need to manually resolve such transactions, as they will appear under the Not Relevant for This Return section of GST reports.

Update GST Status of vouchers without interruptions

With TallyPrime, you can now easily update the GST Status of vouchers without any delays in your day-to-day work. You can also explore other flexibilities to ensure accuracy in GST.

Update GST details in masters

You can now update GST-related details in your masters without any interruptions in your tasks. Based on your requirements, you can choose to update the GST Status of vouchers either while saving the masters or while opening the GST reports. This will ensure that the vouchers appear in the appropriate sections in your returns.

- Press F11 and set the Enable Goods and Services Tax (GST) option to Yes.

- Set the Set/Alter Company GST Rate and Other Details option to Yes.

You can see that the option Update GST Status of Vouchers after Master Alteration is set to No, by default.

This will ensure that the details are recomputed only when you open the GST reports, thereby preventing any immediate interruptions.

However, if you want to update the GST status during master alteration, then set this option to Yes. - Press Ctrl+A to save the configuration.

Refer to Re-computing GST Status of Voucher for more details.

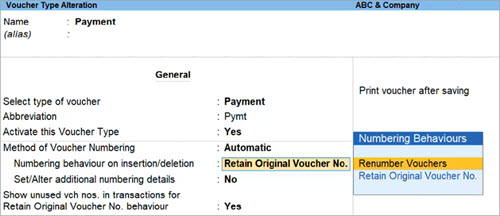

Update voucher numbering in voucher types

In any voucher type, you can now update the voucher numbering behaviour to Renumber Vouchers or Retain Original Voucher No, without delays due to recomputation.

The details will be recomputed only when you open the GST reports. This prevents any immediate interruptions.

Moreover, when your vouchers are renumbered due to insertion or deletion of transactions, the GST status of vouchers will be updated only when you open the GST reports. This will help you continue your day-to-day work without delays.

These best practices in GST along with the enhancements will help you in easy migration, and also significantly reduce the number of uncertain transactions.

To know more about the upcoming release, refer to our Release Notes for TallyPrime 5.0.