Record Advance Payments or Receipts of Full Advance Amount without impacting GST ledgers

You can enter the full advance amount in the advance receipt and payment voucher without selecting the tax ledgers. The tax amount will be calculated as an indicative value, and will not appear in the GSTR-3B report.

This improved experience includes the following:

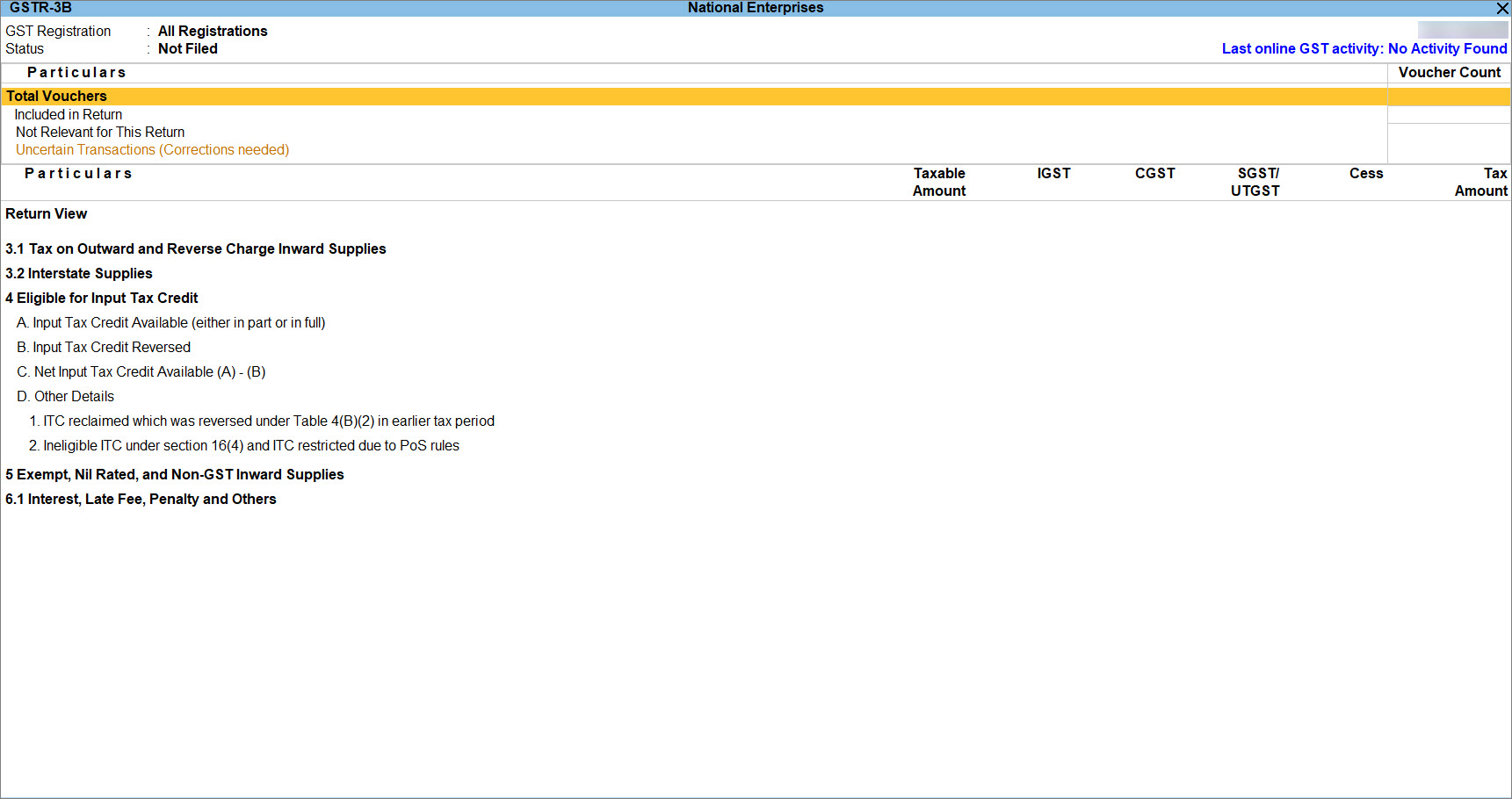

- The advance amount received and paid, and the tax values computed on them, are not captured in the computation section of the GSTR-3B report.

You can raise the tax liability to capture it in GSTR-3B only when the purchase and sales invoices are not recorded in the return period.

- You can view the full advance amount in the Amount column of the receipt or the payment voucher by entering it in the Advance Amount column of the advance receipt or payment details sub-screen.

- The full advance amount will be displayed in the Bill-wise Details screen of the sales invoice for adjusting it with the sales value.

- The full advance amount can be reconciled in the bank reconciliation report.

- The outstanding amount payable or receivable appears in the outstanding report.

- For advance payments and receipts recorded by selecting stock items or ledgers configured for reverse charge, the taxes are calculated and displayed as indicative values, in the Advance Receipt Details and Advance Payment Details screens of the receipt and payment vouchers, respectively. Also a note on applicability of reverse charge appears for easy identification.

You can also view the advance payments that are not adjusted.

- Press Alt+G (Go To) > type and select Outstanding Advance Receipts.

To know more about Advances & Adjustments, refer to the How to Record Advances Received Under GST in TallyPrime topic.