What’s New in 6.1

What’s New in 6.1

| हिन्दी |

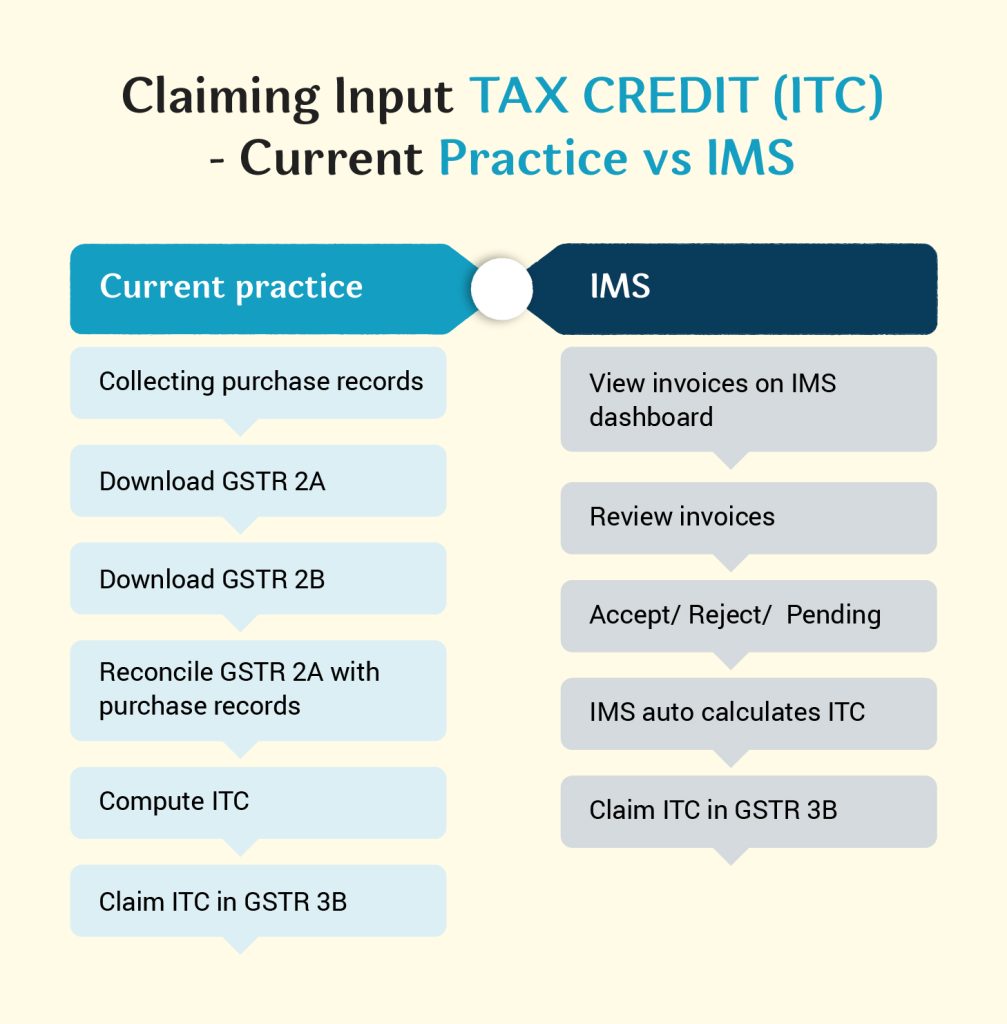

TallyPrime 6.1 launches the Invoice Management System (IMS), which simplifies ITC tracking with features like consolidated invoice views, action status updates, IMS-ITC Summary, and GSTR-2B recomputation.

Apart from IMS, you get many delightful offerings such as a comprehensive Edit Log Summary, MSME form updates, GST enhancements, and smarter bank reconciliation.

Stay on Top of Your ITC with IMS

IMS in TallyPrime offers you complete control of your ITC. With intuitive reports and action-based processes, you can reconcile invoices, set statuses, and file returns with confidence, all within your regular accounting flow.

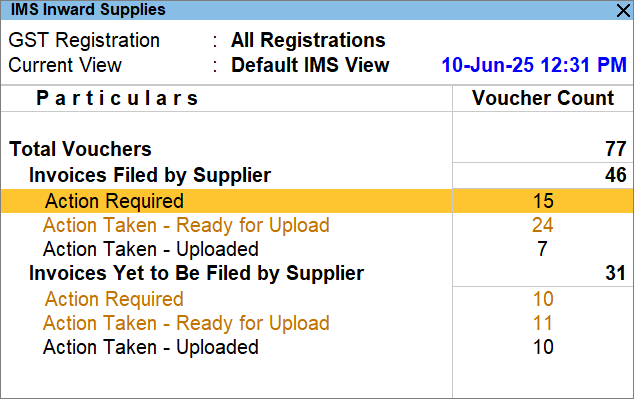

Easy invoice review: View supplier invoices as per the GST portal, in a comprehensive IMS Inward Supplies report (![]() ). Clearly identify the matched, mismatched, and missing invoices.

). Clearly identify the matched, mismatched, and missing invoices.

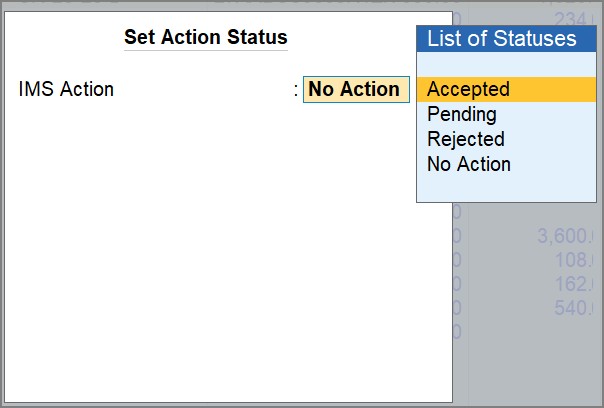

Set Action Status: Mark invoices as Accepted, Rejected, Pending, or No Action, based on reconciliation (![]() ). Ensure that only valid ITC is considered in GSTR-2B & GSTR-3B.

). Ensure that only valid ITC is considered in GSTR-2B & GSTR-3B.

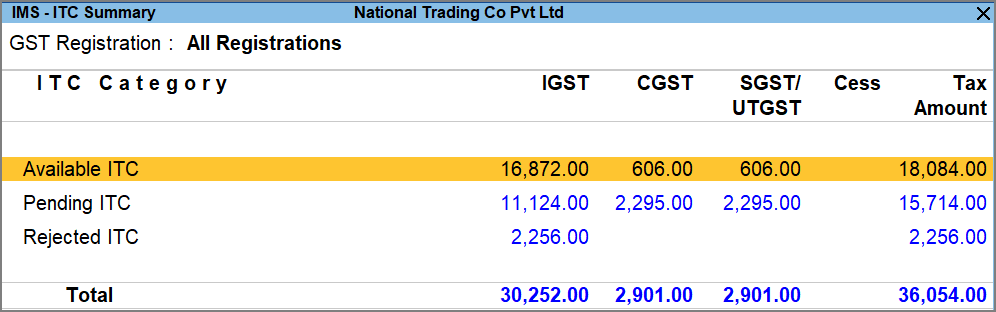

Worry-free ITC tracking: Use IMS – ITC Summary (![]() ) to get a consolidated view of your Available, Pending, and Rejected ITC. Make data-driven decisions before filing returns.

) to get a consolidated view of your Available, Pending, and Rejected ITC. Make data-driven decisions before filing returns.

Recompute GSTR-2B in a click: View the latest ITC in GSTR-2B (![]() ), based on the actions set in IMS. Ensure your GSTR-3B filing is accurate and up to date.

), based on the actions set in IMS. Ensure your GSTR-3B filing is accurate and up to date.

Add Remarks for clear audits: Capture remarks for your invoices, for convenient tracking or future reference (![]() ). View these remarks across reports and export them to Excel for review or audit.

). View these remarks across reports and export them to Excel for review or audit.

Comprehensive Edit Log Summary

Get a full picture of the changes in your vouchers & masters, using the Edit Log Summary.

All-inclusive summary: Track the numbers and versions for altered, non-altered, and deleted vouchers (![]() ) and masters (

) and masters (![]() ).

).

Ease of navigation: Start with the overall summary and drill down to individual vouchers and masters, to see what’s changed across versions.

Flexible filters: Filter reports by activity type, version period, or users. You can also switch between configured versions, all versions, and choose to view everything or only the altered data.

Tracking user activities: When security is enabled, you can see who made which changes to vouchers and masters.

Enhanced MSME Experience

Revised MSME Form 1: TallyPrime now supports the revised MSME Form 1 Annexure (![]() ), with supplier-wise summary.

), with supplier-wise summary.

PAN & bill details: View the PAN details of your MSME parties (![]() ), along with the paid & outstanding bills, within or after 45 days.

), along with the paid & outstanding bills, within or after 45 days.

Easy configuration: View summaries of multiple suppliers, apply filters, and tailor the report to meet both internal audit and compliance.

Seamless export & upload: Export data directly into the Excel template and easily upload the file on the MCA portal (![]() ).

).

Banking Enhancements

Convenient split: All the unreconciled transactions in the split company will now appear as Opening BRS.

Easier Manual Bank Reconciliation

- Include manually reconciled transactions.

- View updated values for transactions reconciled in the subsequent period.

Enhanced Experience in Bank Reconciliation

- Potential Match configuration is introduced in the Find Match and Modify Match screens.

- In the Reconciled report, view the Bank Date even for the book transactions reconciled via linking.

- Import the Payment Reverse File from anywhere in TallyPrime.

- The Import Summary is enhanced to display a detailed break-up based on Payment Status.

Seamless sync: Override the manual transaction status in the destination company during synchronisation.

GST Enhancements

Easier reconciliation: Reconcile GST transactions, even if there is a difference in the taxable amount between your books and the portal data.

Enhanced GSTR-1 filing: Upload GSTR-1 data offline using MS Excel (.xlsx) and CSV (.csv) files. This provides greater flexibility and convenience for offline filing.

Enhancements as per IMS

Section for rejected invoices: View invoices rejected in IMS Inward Supplies in a separate section in GSTR-2B. These transactions are excluded from ITC and return filing, but you can review them anytime.

Auto-reconciliation for IMS: Under Company GST Details, you can now enable automatic reconciliation for IMS. This will automatically mark the reconciled vouchers as Accepted in IMS Inward Supplies.