Moving service tax credit from Service Tax Report (ST3) to Excise Report (ER 1)

You can move the input service credit to excise input credit.

To move the Service Tax credit from ST3 to ER 1 form

- 1.Record a purchase transaction with service tax, as shown below:

2. Gateway of Tally > Display More Reports > Service Tax Reports > Form ST3.

Alternatively, press Alt+G (Go To) > type or select Service Tax Reports > Form ST3 > and press Enter.

- Click Included Transactions.

- Select the required transaction.

- Click Move to Excise on the left menu bar.

- Select the Tax Unit Name, as required.

- Press Enter to save.

To view the transaction in ER 1 report

- 1.Gateway of Tally > Display More Reports > Statutory Reports > Central Excise Reports > Manufacturer > Form ER 1.

-

Alternatively, press Alt+G (Go To) > type or select Central Excise Reports > Form ER 1 > and press Enter.

-

The transaction appears in the excise report.

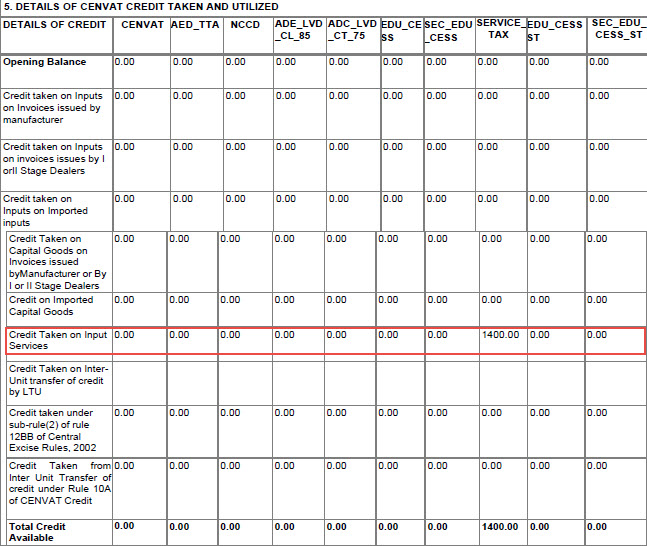

The print preview of the excise report appears as shown below: