Configure Specified Person Higher Tax Rate (Under Section 206AB)

Finance Bill 2021 introduced Section 206AB of the Income Tax Act which will take effect from 1st July 2021. It is a special provision for the deduction of tax at source at a higher rate for the non-filers (Specified Person) of Income Tax Return.

The tax would be deducted at source at twice the rate as specified under the relevant category or at a rate of 5%, whichever is higher, in cases where any amount or sum or income is paid or payable or credited to the Specified Person:

- who has not filed their Income Tax Return for two years immediately prior to the year in which tax is required to be deducted.

- where the aggregate of tax deducted at source in each of the two previous years is Rs 50 thousand or more.

Therefore, for FY 2021-22, the buyer would have to deduct the TDS at a higher rate from seller/vendor/supplier who has not filed their Income Tax Return for both the FY 2019-20 and FY 2020-21 and the aggregate of TDS is Rs 50 thousand or more during each of FY 2019-20 and FY 2020-21.

Tax deductors can verify if any party is a ‘Specified Person’ as defined in Section 206AB by entering a valid PAN in the department’s portal. A PAN that has not been filed for the past two years and any TDS that has been deducted from the party which is Rs 50 thousand or more will be found on such list. Parties whose PANs fall under the Specified Person list will be taxed at source at twice the rate as specified under the relevant category or at a rate of 5%, whichever is higher.

For more information on the scope and application of Section 206AB of the Income Tax Act 1961, click on the blog link below.

Section 206AB & 206CCA-Compliance Check Facility

TDS on Purchases

You can create an accounting voucher for recording purchases with applicable TDS.

Configure Masters

TDS Nature of Payment

- Gateway of Tally > Create/Alter > type or select TDS Nature of Payments > select any Nature of Payment (if you are altering any existing Nature of Payment) > and press Enter.

Alternatively, press Alt+G (Go To) > Create Master/Alter Master > type or select TDS Nature of Payments > select any Nature of Payment (if you are altering any existing Nature of Payment) > and press Enter.

The TDS Nature of Payment Creation/Alteration screen appears.

- Enter the required fields in the TDS Nature of Payment Creation/Alteration screen, as applicable.

- Press Y to accept the screen. You can also press Enter to save the master screen.

Party Ledger

- Gateway of Tally > Create/Alter > type or select Ledger > select any Party ledger (if you are altering any existing Party ledger) > and press Enter.

Alternatively, press Alt+G (Go To) > Create Master/Alter Master > type or select Ledger > select any Party ledger (if you are altering any existing Party ledger) > and press Enter. - Under Statutory Details, set the options:

- Is TDS Deductable to Yes.

If you do not see the Statutory Details field, then press F12 (Configure) and set Provide TDS details to Yes. - Deductee type to Individual/HUF-Resident.

- Deduct TDS in Same Voucher to Yes. The Deduct TDS in Same Voucher screen appears.

If you do not see the Deduct TDS in Same Voucher screen, then press F12 (Configure) and set Allow advance entries in TDS master to Yes.- Select All Items from the List of Nature of Payments.

- Use Advanced TDS Entries to Yes

If you do not see this field under Statutory Details, the press F12 (Configure) and set Allow advance entries in TDS master to Yes.

The Advanced TDS Entries screen appears.- Set the option for Set/Alter Zero/Lower Deduction to Yes. The Zero/Lower Deduction Details screen appears.

- Provide the details in Zero/Lower Deduction Details screen:

- Select the Nature of Payment configured at a higher rate from the List of Nature of Payments.

You can create Nature of Payment on the fly by pressing Alt+C. - Select 197 Lower Deduction from the List of Provisions.

- Provide a unique certificate number under Certificate No./Date.

We would recommend using certificate number as ‘0000’, so that the future migration will be taken care of automatically.

- Enter Applicable From date.

- Enter Applicable To date.

- Enter the TDS at twice the rate as specified under the relevant category or at a rate of 5%, whichever is higher.

Ctrl+Enter on the master will open the master on the fly so that you can check the specified TDS rate before applying. - Select End of List twice to return to the Ledger screen.

- Select the Nature of Payment configured at a higher rate from the List of Nature of Payments.

- Is TDS Deductable to Yes.

- Set the other configurations in the Ledger Creation/Alteration screen, as needed.

- Press Y to accept the screen. As always, you can press Ctrl+A to save the master.

If you have configured the Party ledger using the procedure given above and want to file your returns, then click here to know how to do it following the latest norms with the remark value assigned by the government.

Record Credit Purchase

Below are the steps to record a Purchase voucher in the Accounting Invoice mode. Similarly, you can also record a Purchase voucher in the Item Invoice mode. With TallyPrime, you can switch between the modes interchangeably by pressing Ctrl+H (Change mode) for recording purchase, based on your requirement.

- While recording a Purchase voucher, enter the Amount. The TDS Nature of Payment Details screen appears.

If you want to know how to record a Purchase voucher, then click here. - Select the appropriate Nature of Payment from the List of TDS Nature Of Pymt. The Assessable Value will be prefilled from the Purchase voucher screen.

- Select TDS from the List of Ledger Accounts. It will deduct the TDS amount accordingly.

The TDS will be calculated based on the applicable tax rate configured at twice the rate as specified under the relevant category or at a rate of 5%, whichever is higher.

- Provide the Narration, if needed.

- Press Y to accept the screen. As always, you can press Ctrl+A to save the voucher.

TDS on Payment

Payment voucher is used to record cash and bank payments. You can record a Payment voucher in Single and Double entry mode with the Specified Person with applicable TDS configured at a higher rate. It means the TDS will be calculated based on the applicable tax rate configured at twice the rate as specified under the relevant category or at a rate of 5%, whichever is higher.

Adjust TDS in Purchase Against Advance

You can create an accounting voucher for the advance payment made to a party or a Specified Person with applicable TDS configured at a higher rate. You can adjust the advance paid by recording a purchase invoice on to the party.

To know more on how to record TDS on Advance Payment, click here.

Purchase Return/Cancellation

If you want to record a return or cancellation against a previous purchase, then you can record this using a Debit Note with the Specified Person with applicable TDS configured at a higher rate.

No PAN

If a PAN is not available for any party, TDS will be calculated using the rate specified for no PAN in the category master.

However, in some cases the tax rate may be configured as 15% with PAN, while without PAN it is 20%. As a result of doubling the 15% tax rate, the specified value becomes 30%, which is higher than 20% (tax incurred when no PAN is provided). TDS will be deducted at the rate of whichever is higher, in this case, it would be 30%.

File Returns Under Section 206AB

You may have configured the TDS Party ledger so that the tax deduction takes place based on the higher rate. In the Zero/Lower Collection Details screen of the Party ledger, the Certificate No. must be 0000, which will help you identify the transactions recorded for the Party.

Now, according to the recently implemented changes by the government, before filing your returns, you need to highlight the transactions in which the tax is deducted on the higher rate. It means that you will need to identify the transactions with the Party and highlight them with the norms set by the government.

Here are the details of the remark value to added in the transactions before filing returns:

| Sl. No. | Return Form | Scenario | Remark Value to Highlight the Transaction before Filing Returns |

|

1. |

Form 26Q | Tax deduction is on the higher rate under section 206AB for non-filing of return of income. | Add a remark value U. |

|

2. |

Form 27Q | Tax deduction is on the higher rate under section 206AB for non-filing of return of income by the non-resident having a permanent establishment in India. | Add a remark value J. |

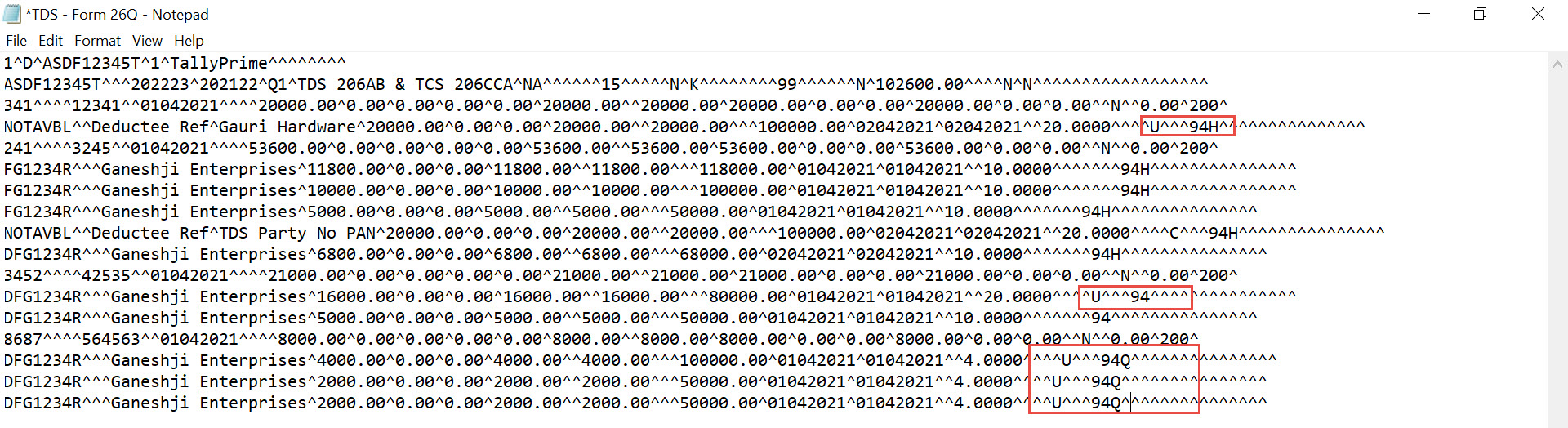

You must have exported the .text file for the respective return forms, as applicable to your business. All you need to do is identify the transactions with 0000 as the certificate no. and then replace the letter A with U or J, as applicable, so that you can file returns with the remark value required by the government. Follow the steps given below to make the changes in the .text file before filing the returns.

- Open the .text file.

- Identify the transactions recorded for the Party.

- Press Ctrl+F.

- Under Find what: type 0000 and press Enter or click Find Next.

- Identify the transactions with 0000 at the end of the row.

If the Zero/Lower Collection Details screen of the Party ledger Party ledger is not configured with 0000 as the Certificate No., then press Ctrl+F, enter Party’s PAN or Name of the Party, and press Enter to identify the PAN or Party.

- In the identified transactions, replace the alphabet A with:

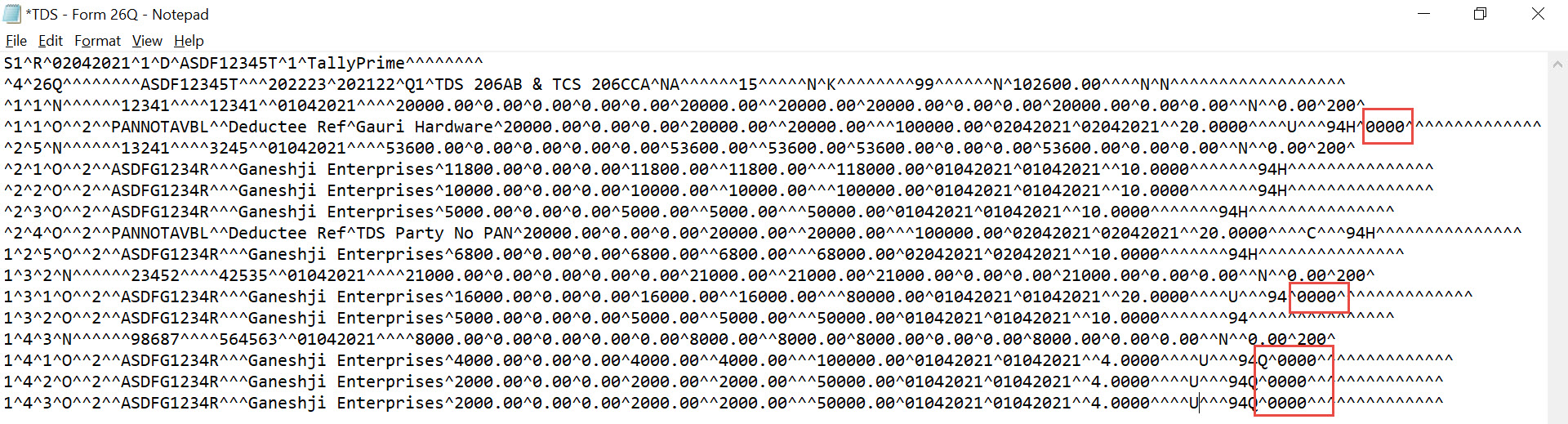

- After entering the applicable remark value, remove 0000 from the rows.

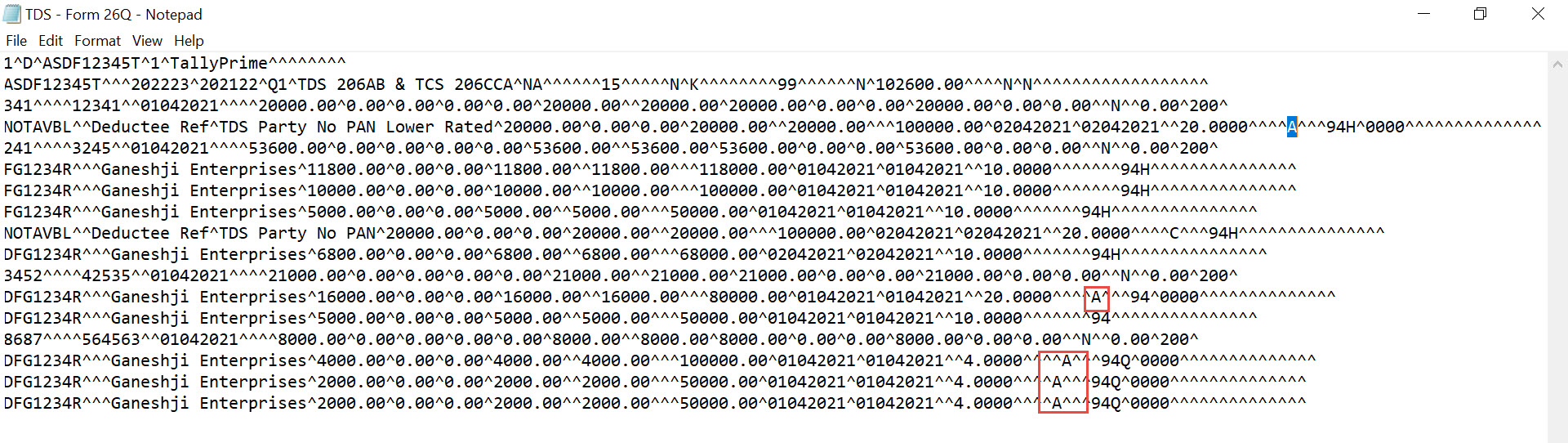

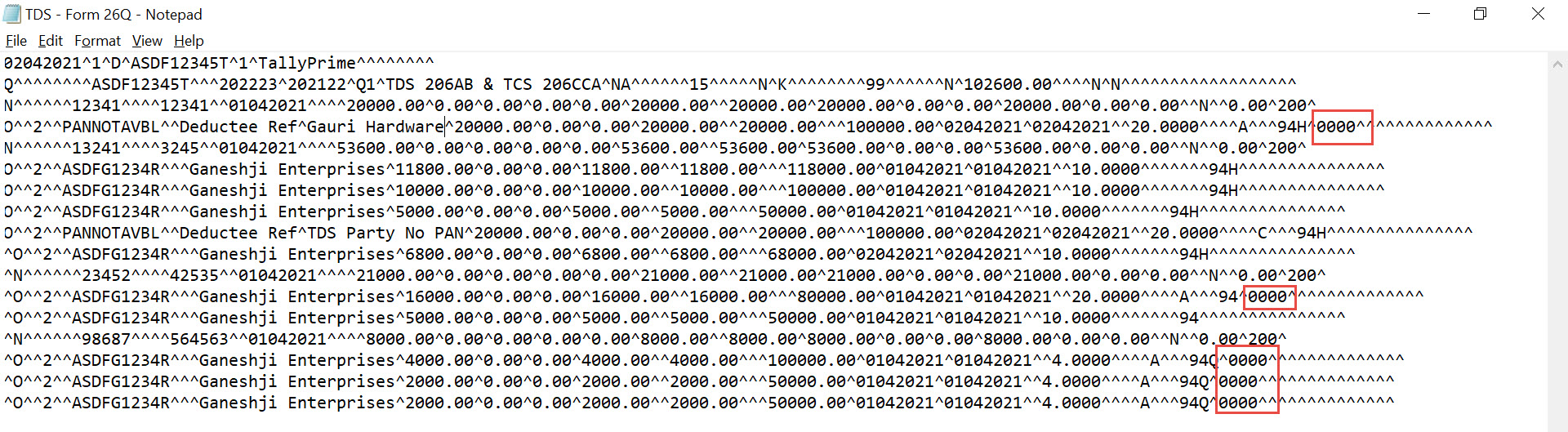

.text file before removing 0000 appears as shown below.

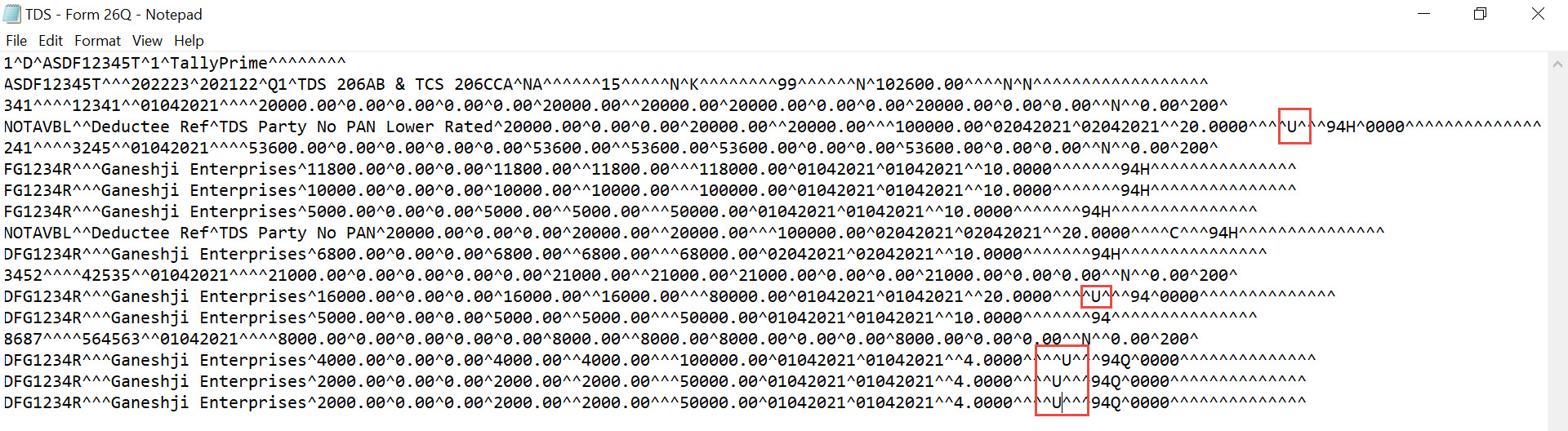

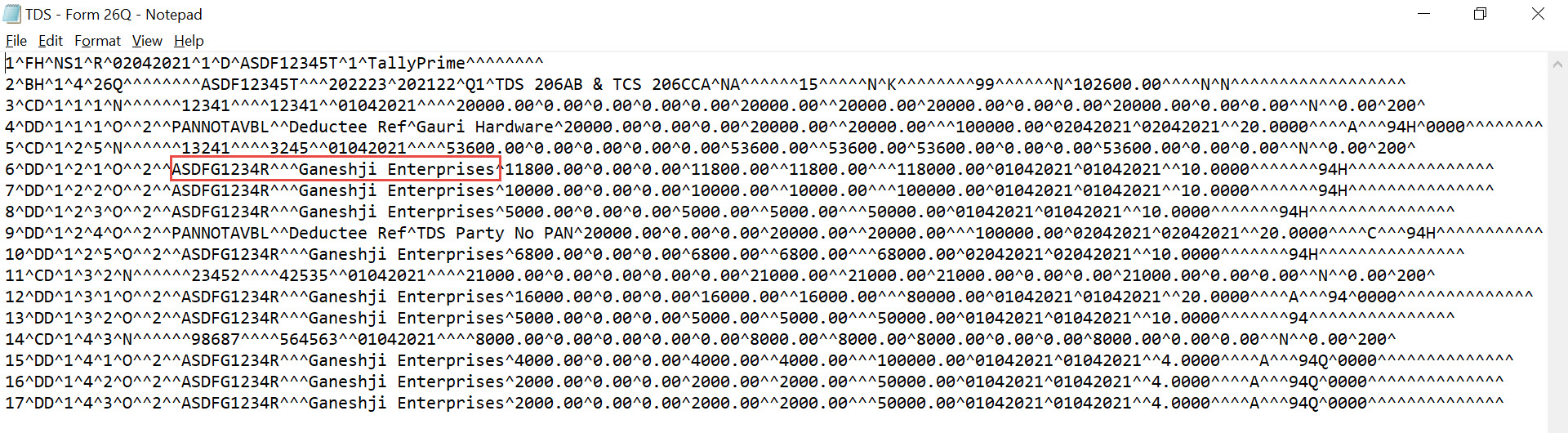

.text file after removing 0000 appears as shown below.

- Press Ctrl+S to save the .text file.

After making the changes and saving the .text file, you can go ahead and file the returns.