Upload GSTR-3B from TallyPrime

GSTR-3B upload is now a walk in the park for you and your business. You can upload your returns on the GST portal right here from TallyPrime, without the need for any manual activity.

Based on your business needs, you have the flexibility to upload one or all of your summaries for the required return period. Further, if there are any rejections from the portal, then you can resolve such issues in an easier and faster manner. There is no need to manually download the summary from the portal and export them in TallyPrime.

In this way, the Upload feature will save a lot of your time and effort, which you can utilise for the growth and expansion of your business. You will always have the utmost clarity about the status of your returns, right here in TallyPrime.

Ensure that you have resolved all exceptions and conflicts for a seamless upload experience.

- Press Alt+G (Go To) > GSTR-3B.

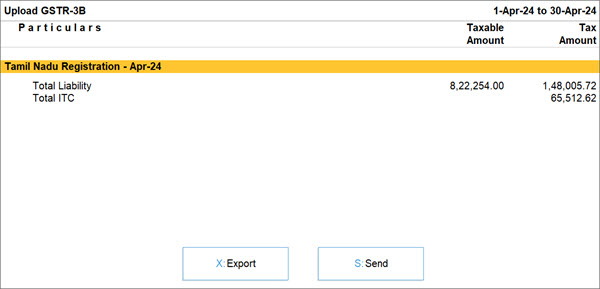

- In the GSTR-3B report, select the return period and GST registration for which you want to upload your summaries.

- Press Alt+Z (Exchange) > Upload GST Returns > GSTR-3B.

- In the Upload GST Returns screen, press Spacebar to select the summaries you want to upload.

If you want to upload all the summaries, then you do not have to select any of the entries.

- Press S (Send) to upload.

- Log in to your GST profile, if you have not already done so.

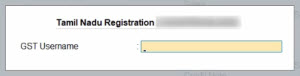

- Enter your GST Username.

- Enter the OTP received on your registered mobile number, after which your summaries will be exported to the GST portal.

Once you have logged in, the session will be valid for six hours, which will ensure the safety and security of your activities.

- Enter your GST Username.

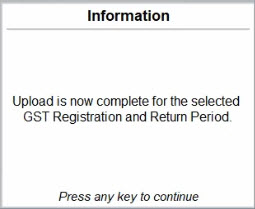

You will receive the confirmation once the upload is complete.

The uploaded summaries will appear in the No Action Required section.

Based on your recent activities, you can always see your last online GST activity in the top right corner of the report.