Reasons for Rejection of e-Invoice and Resolutions

NIC has published the following error codes, error message, the reasons for the errors and the corresponding resolutions to help you resolve errors faced during e-Invoice upload to the NIC portal.

If the error message is not available here, check the page published by NIC https://einv-apisandbox.nic.in/api-error-codes-list.html

Most Frequent Errors/Rejections

Understanding Rejection Terms: TallyPrime vs e-Invoice

As the rejection messages are based on GSTIN, the terminologies in TallyPrime vary in some instances. Hence, we have provided a table to facilitate a better understanding between TallyPrime and e-Invoice terminology.

| e-Invoice Terminology | TallyPrimeTerminology | Length |

| Field Location | Bill from place (Rel 2.1) & Invoice bill from place (Rel 3.0) – F11:Company Feature | 3 to 50 (Alpha) |

| Field Document Number | Invoice Number / Voucher Number | 16 (Alpha-Numeric) with / or – |

| State Field is Required | For all Invoices – its company State field (F11:Company Features> Enable Goods and Services Tax (GST) > Check State in Bill from place) | |

| For specific Invoice – its Party (Party Details / Consignee Details using Ctrl+I (More Details or Dispatch From Details section under e-Invoice Details using Ctrl+I (More Details) | ||

| Field Address 1 | For All invoices – its company addresses | Address 1 – 1 to 100 (Alpha Numeric) |

| Field Address 2 | For specific Invoices – Its Party master – Check ledger master or party details for buyer and consignee – 1st Line / 2 refers to 2nd line | Address 2 – 3 to 100 (Alpha Numeric) |

| Field Legal Name | For all transactions – its company: Mailing Name | 3 to 100 (Alpha Numeric) |

| For specific Invoice – Its Party: Mailing Name | ||

| Field Product Description | Stock Item name | 3 to 100 (Alpha Numeric) |

| Field POS | Place of Supply – In party details/supplementary details check Place of Supply | |

| Recipient Pin Code | Buyer PIN code – Check party master or party details screens with PIN code | 6 digits |

| Recipient should be SEZ | Buyer details – Registration type should be SEZ | |

| State code does not match | For All Transactions – State name is not selected in the list in F11:Company Features | |

| For specific Invoices – State name is not selected properly in Party details / Place of supply | ||

| GSTIN is inactive or cancelled | Verify GSTIN status / If cancelled or inactive Registration type should be Unregister & e-Invoice Not required |

| Error Message/Scenario | Reason for Error | Resolution |

|

IRN is already generated and registered with GSTN Lookup Portal by other IRP

|

You can perform Get IRN from TallyPrime to connect to only the einvoice1 portal. In case you have manually generated IRN on the einvoice2 portal (e-invoice2.gst.gov.in), you will not be able to perform Get IRN/cancellation from TallyPrime. |

You can perform one of the following:

|

| The field Location must be a string with a minimum length of 3 and a maximum length of 50 | Location is not as per the required format |

The field Location refers to the Invoice bill from place set under the GST Details of the F11 (Company Features). You can check it on the following path: F11 (Company Feature) > Enable Goods and Service Tax (GST) > GST Details. If the Invoice bill from place is lesser than 3 characters or greater than 50 characters, then the vouchers get rejected by the e-Invoice system. Here’s how to resolve the error in such vouchers. If you are using TallyPrime Release 3.0 and later, then follow the steps given below:

If you are using TallyPrime Release 2.1 and earlier, then the vouchers will be found in the Missing/Invalid Information section. You need to ensure that Invoice bill from place is specified in the required format. |

|

The field document number must match the expression'((a-zA-Z1-9)(1)(a-zA-Z0-9/-)(0,15))$’ (or) The document number doesn’t match with regular expression |

Document Number is not as per the required format |

Document Number references to the Voucher No. enter during voucher creation. A Document Number must fulfill the following criteria:

Here’s how to resolve the error in such vouchers. If you are using TallyPrime Release 3.0 and later, then follow the steps given below:

If you are using TallyPrime Release 2.1 and earlier, then the vouchers will be found in the Information required for e-Invoice not provided section. You need to ensure that the document number is correct. |

|

The Document date should not be a future date. |

The Document Date specified is of future Date |

e-Invoice generated for future day that is, not equal to the current date. Check the Document date that is being passed and it should not be of a date greater than today’s date. |

| The State field is required | State code is not specified |

State code refers to the State selected under F11 (Company Features) or in the ledger of the party for which the invoice is recorded. When you do not specify the State, you will not be be able to generate an e-Invoice. You can check the State on the following paths:

Here’s how to resolve the error in such vouchers. If you are using TallyPrime Release 3.0 and later, then follow the steps given below:

If you are using TallyPrime Release 2.1 and earlier, then the vouchers will be found in the Mismatch due to tax amount modified in voucher section. You need to ensure that the State is selected under F11 (Company Features) and the ledger created for the party. |

| The field Address 1 must be a string with a minimum length of 1 and maximum length of 100 | Address 1/Address 2 is not as per the required format |

The maximum length of address allowed is 200 characters (100 against address line 1 and 100 against address line 2). Tally will combine and incorporate the maximum possible characters in first and second address lines (after truncating to nearest word). However, if address is beyond 200 characters it will get rejected by NIC. Hence ensure the Party masters and Company dispatch address and in accordance with this. Please remove any additional information (Ex: Contact person name / phone / e-mail etc. mentioned as part of address.) that is not relevant or is not a property of address. |

| The field Address 2 must be a string with a minimum length of 3 and maximum length of 100 | ||

| The pin code does not match with state code of supplier | The available PIN Code XXX of Buyer does not belong to his/her State |

Consider that you have selected a state in the party ledger but specified the Pincode of another state. In such cases, the e-Invoice will not get generated. Here’s how to resolve the error in such vouchers. If you are using TallyPrime Release 3.0 and later, then follow the steps given below:

If you are using TallyPrime Release 2.1 and earlier, then the vouchers will be found in the Information required for e-Invoice not provided section. You need to ensure that the State and Pincode specified in the party ledger match. |

| The JSON value could not be converted to System.Nullable`1[System.Int32]. Path: $.Data.EwbDtls.Distance | LineNumber: 0 | BytePositionInLine: 1969 | The entered Pin to Pin Distance is invalid |

This message is shown when both e-Invoice and e-Way Bill is generated. The distance provided in e-Way Bill details is invalid. Please check https://ewaybillgst.gov.in/Others/P2PDistance.aspx to validate the proper Distance |

| The field Legal Name must be a String with a minimum length of 3 and maximum length of 100 | The field Legal Name is not as per the required format |

Legal Name is the Entity registered Business with a specific Name. Under Mailing Name, ensure the Legal Name of the Business is provided to captured and should hold Min 3 to max 100 characters. |

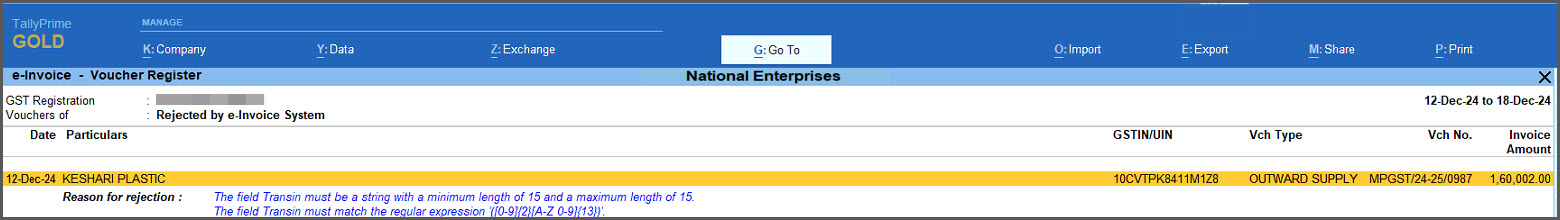

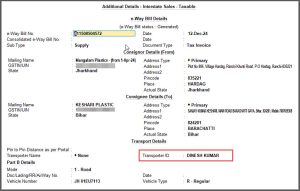

| The field Transport document number must match the regular expression | Transporter Document Number is not as per the required format |

Transporter document number in the e-Way Bill Details should follow the below validation

|

| The field rounding off amount must be between 99 and -99 |

Reason1 : Ledger type is selected as “Invoice Rounding” in expenses, sales ledger or duty ledger, selected under expenses or sales, where enabled the option invoice rounding and accepted, later changed to the duty ledger. Reason2 : This error even occurs in vouchers, where round-off is not used. The reason for this could be in any of the ledgers used in the invoice type of ledger would have been chosen as Invoice rounding. This could be in the party, sales, or additional ledger |

Reason1 Alter the expense and sales ledger

Alter the duty ledger

Reason2

|

| The field Product Description must be a String with a minimum length of 3 and the maximum length of 300 |

The Stock item name is not as per the required format |

Stock item Name is the product, which is dealt with for any Business, ensure the stock item Name provided should hold Min 3 to max 100 characters. |

| Recipient cannot be SEZ for – {0} transaction |

SEZ GSTIN has been passed as GSTIN in Recipient details for the specified type of transaction |

Only the Registration type is configured as Regular, however, its being SEZ party – party type should be configured ie., in the party master alteration > enable set/alter GST details > Under Party type select “SEZ” |

| Duplicate IRN |

You might be attempting to create an IRN that is already generated. |

When trying to generate an e-invoice, you will receive a duplicate IRN if the IRN number has already been generated, cancelled, and repassed with another entry in the same cancelled voucher or with a previous voucher number with a new invoice. Say for Voucher No 1, you have generated an e-invoice, which you have cancelled later. If you are now generating an e-invoice for another voucher with the same voucher number, you will be prompted with a duplicate IRN error. In this case, record the new voucher with a separate voucher number. Also, remove the IRN from the e-invoice details and then generate the e-invoice through the new voucher.

|

| The HSN – {0} does not belong to Goods |

The provided HSN Code is not a valid HSN code for Goods. |

In a ledger or stock item, when the Type of Supply is selected as Goods, but the HSN/SAC belongs to Service, the e-Invoice with the ledger does not get generated. Here’s how to resolve the error in such vouchers.

Verify the details from below link: |

| The HSN – {0} does not belong to Service |

The provided SAC Code is not a valid SAC code for Services. |

In a ledger or stock item, when the Type of Supply is selected as Service, but the HSN/SAC belongs to Goods, the e-Invoice with the ledger does not get generated. Here’s how to resolve the error in such vouchers.

Verify the details from below link |

| The field unit must be a string with a minimum length of 3 and a maximum length of 8. |

This error occurs when the UQC is not selected in the Stock Item master. |

When you create or alter Stock Items, ensure that for given Unit of Measurement – UQC (Unit Quantity Code) is selected. Once you select the UQC in the stock item and save it, you can generate e-Invoices. |

| e-invoice option is not enabled for this GSTIN. |

This happens because you have not registered for e-Invoicing with the necessary details on the e-Invoice portal. |

While you might have already enabled the e-Invoicing in TallyPrime, you need to complete the enablement process on the e-Invoice portal.

|

| Cancel the current e-Invoice generation request done in the e-invoice1 portal and send a new request for e-Invoice. |

If you have generated the e-Invoice from e-Invoice2 portal, then this error occurs, as you can get IRN or cancel from TallyPrime only on the e-Invoice1 portal. |

The e-invoice will be marked as Cancelled on the e-Invoice2 portal. You can then record a new transaction and generate e-Invoice from TallyPrime. |

e-Way Bill Errors

| Error Message | Reason for Error | Resolution | Error Code |

|---|---|---|---|

|

The distance between the pincodes given is too high or low. |

The provided distance is incorrect. A difference of +/- 10% is allowed, and distance must fall within that range. |

If you are using TallyPrime Release 3.0 and later, then you can navigate to the link for the calculation of the distance from within the product.

You will be redirected to the portal on which you can calculate the distance between the pincodes. However, if you are using TallyPrime Release 2.1 or earlier, then you can open the following link on a browser and calculate the distance between the pincodes: |

4013 |

|

The distance between the pincodes given is too high |

The provided distance is incorrect. A difference of +/- 10% is allowed, and distance must fall within that range. |

|

If you are using TallyPrime Release 3.0 and later, then you can navigate to the link for the calculation of the distance from within the product.

You will be redirected to the portal on which you can calculate the distance between the pincodes. However, if you are using TallyPrime Release 2.1 or earlier, then you can open the following link on a browser and calculate the distance between the pincodes: https://ewaybillgst.gov.in/Others/P2PDistance.aspx 4038 |

Invoice Errors

Vital Errors

| Error Message | Reason for Error | Resolution | Error Code |

|---|---|---|---|

|

Invalid Token |

1. Token has expired 2. While calling other APIs, wrong GSTIN / User Id/ Token passed in the request header |

1. Token is valid for 6 hours , if it has expired, call the Auth. API again and get new token 2. Pass correct values for GSTIN, User Id and Auth Token in the request headers while calling APIs other than Auth API |

1005 |

|

Authentication failed. Pls. inform the helpdesk |

Wrong formation of request payload |

Prepare the request payload as per the API documentation |

1007 |

|

Invalid login credentials |

Either UserId or Password are wrong |

Pass the correct UserId and Password |

1008 |

|

Invalid Client-ID/Client-Secret |

Either the ClientId or the ClientSecret passed in the request header is wrong |

Pass the correct ClientId and the ClientSecret |

1010 |

|

Decryption of password failed |

Auth.API is not able to decrypt the password |

Use the correct public key for encrypting the password while calling the Auth API. The public key is sent by mail while providing the access to Production environment as well as available for download from the portal under API user management. This public key is different on Sandbox and Production and it is different from the one used for verification of the signed content.Refer to the developer portal for encryption method used and sample code. |

1013 |

|

Inactive User |

Status of the GSTIN is inactive or not enabled for E Invoice |

Please verify whether the GSTIN is active and enabled for E Invoice from the E Invoice portal |

1014 |

|

Invalid GSTIN for this user |

The GSTIN of the user who has generated the auth token is different from the GSTIN being passed in the request header |

Send the correct GSTIN in the header for APIs other than Auth API |

1015 |

|

Decryption of App Key failed |

Auth.API is not able to decrypt the password |

Use the correct public key for encrypting the appkey while calling the Auth API. The public key is sent by mail while providing the access to Production environment as well as available for download from the portal under API user management. This public key is different on Sandbox and Production and it is different from the one used for verification of the signed content.Refer to the developer portal for encryption method used and sample code. |

1016 |

|

Incorrect user id/User does not exists |

User id passed in request payload is incorrect |

Pass the correct user id. If not available, please log in to the portal using the main user id (the one without ‘ |

1017 |

|

Client Id is not mapped to this user |

The UserId is not mapped to the ClientId that is being sent as request header |

Please send the correct userId for the respective clientId. If using direct integration as well as through GSP or through multiple GSPs, please pass the correct set of ClientId |

1018 |

|

Incorrect Password |

Password is wrong |

Use the correct password, if forgotten, may use forgot password option in the portal |

1019 |

|

Password should contains atleast one upper case, one lower case, one number and one special characters like [%,$,#,@,_,!,*] |

Password being set is very simple |

Password should contains atleast one upper case, one lower case, one number and one special characters like [%,$, |

3003 |

|

This username is already registered. Please choose a different username. |

User id is already available in the system |

Use a different user id |

3004 |

|

Invalid Mobile Number |

The Mobile number provided is incorrect |

Provide the correct mobile number, Incase the number has changed, may update it in GSTN Common Portal and try after some time. If issue still persists, contact helpdesk with complete details of the issue. |

3006 |

|

You have exceeded the limit of creating sub-users |

The number of sub user creation limit is exceeded |

Up to 10 subusers for each of the main GSTIN and additional places of business can be created |

3007 |

|

Sub user exists for this user id |

There is already a subuser with the same user id is already created |

Use a different user id for the sub user creation |

3008 |

|

Mobile No. is blank for this GSTIN ..Pl use update from GST Common Portal option to get the mobile number, if updated in GST Common Portal. |

The GSTIN master data does not have mobile number in eInvoice System |

Please get the mobile number updated at the GSTN common portal |

3012 |

|

Sorry, your GSTIN is deregistered in GST Common Portal |

Attempting to use a GSTIN which is cancelled |

Please check the status of the GSTIN on the GSTN common portal. If it is active, contact the helpdesk with GSTIN details |

3015 |

|

There are no subusers for this gstin |

Some user action has failed due to internal server issue or unexpected user data |

Try after some time, if issue still persists, report to helpdesk with complete details of the issue |

3021 |

|

The New PassWord And Old PassWord Cannot Be Same |

While changing the password, new password can not be same as old password |

The New and Ols password should be different while changing the password |

3023 |

|

Change of password unsuccessfull,pls check the existing password |

Password could not be changed since the current password provided is incorrect |

Provide the correct current password while changing the password |

3024 |

|

Already This Account Has Been Freezed |

Trying to freeze an account which is already frozen |

You can freeze only active account |

3025 |

|

You are already registered Pl. use already created username and password to login to the system.If you have forgotten username or password,then use Forgot Username or Forgot Passowrd options to get the username and password!!” |

Attempting to create another account which is already created |

Use forgot password option to retrieve the user name or password in case currently not available |

3027 |

|

GSTIN is inactive or cancelled |

GSTIN is inactive or cancelled by department or tax payer . |

Check if the GSTN is correct. If yes, click the Sync GSTIN from GST CP API.

If you get the status as Active, then you can restart your request to generate the IRN. However, if GSTIN is still inactive due to business closure, you can change the said transactions as Sales to Unregistered/Consumer so that such transactions can participate in B2C table |

3029 |

|

Invalid Gstin |

GSTIN provided is incorrect |

Provide the correct GSTIN Verify the GSTIN using below link |

3030 |

|

Invalid User Name |

Attempting to login with wrong user id |

Use the correct user id |

3031 |

|

Enrolled Transporter not allowed this site |

The user who is not registered with GSTN but enrolled as transporter in E Way Bill portal is trying to login to eInvoice system |

This is not allowed |

3032 |

|

Your account has been Freezed as GSTIN is inactive |

User is trying to login with an account which is freezed since the GSTIN is not active |

Check the status of the GSTIN on the GSTN common portal. If active in common portal, report the same to helpdesk |

3033 |

|

Your account has been cancelled as GSTIN is inactive |

User is trying to login with an account which is cancelled since the GSTIN is not active |

Check the status of the GSTIN on the GSTN common portal. If active in common portal, report the same to helpdesk |

3034 |

|

Your account has been suspended as GSTIN is inactive |

User is trying to login with an account which is suspended since the GSTIN is not active |

Check the status of the GSTIN on the GSTN common portal. If active in common portal, report the same to helpdesk |

3035 |

|

Your account has been inactive |

Attempting to logging with a user id which is not active |

Check the status of the user id, if in freeze state, create a new account |

3036 |

|

CommonEnrolled Transporter not allowed this site |

A user with common enrolled opting is trying to use the eInvoice system |

eInvoice system can not be used by the GSTIN which has opted for common enrolment under E Way Bill |

3037 |

|

Invalid From Pincode or To Pincode |

PIN code passed is wrong |

Pass the correct PIN code. Check the PIN code on the portal using the below link https://einvoice1.gst.gov.in/Others/MasterCodes Select Pincodes from the available radio buttons. |

3042 |

|

Something went wrong, please try again after sometime |

Attempting to carryout some on the system or passing some data which is not expected |

Please check the data or the operation which you have just performed. If issue still persists, please share the complete details to the helpdesk |

3043 |

|

This registration only for tax payers not GSP. |

The option is available for the the Taxpayers and not for GSPs |

This option is not available / applicable for GSP |

3044 |

|

Sorry you are not enabled for e-Invoicing System on Production. |

Ineligible taxpayer is trying to register for the eInvoice system |

In case the turnover is above 500crores in any of the financial years in GST regime, use the enrol option in eInvoice portal |

3046 |