Access e-Invoice Sandbox through TallyPrime for e-Invoice Trial

If you are a GST-registered dealer eligible for e-Invoicing, then you can use TallyPrime to experience e-Invoicing on the e-Invoice Sandbox (or e-Invoice trial) portal, before generating e-Invoices on the live Invoice Registration Portal (IRP).

To experience e-Invoice generation through the e-Invoice Sandbox portal, here is all you need:

- TallyPrime Release 1.1.4 or later installed on your computer

- Client ID – AACCT29GSPB5H8G, which is required during e-Invoice Sandbox registration

- One-time registration on the e-Invoice Sandbox portal to generate your Sandbox username and password

After generating your username and password on the e-Invoice Sandbox portal, you can enable Sandbox access in TallyPrime and experience a trial of e-Invoicing. It is recommended that you take a backup of your company data before running the e-Invoice trial, so that your latest data remains safe.

Moreover, if you are using TallyPrime Release 3.0 or later releases, then you can try the feature for any GST registration during voucher creation or multiple GST registrations through Exchange by selecting multiple vouchers created for different GST registrations.

You can try this feature in the Educational Mode as well. The only limitation is that transactions cannot be recorded for any other date apart from the first, second, and last days of a month.

Once you have experienced e-Invoicing through the Sandbox portal, it is mandatory to disable the Sandbox access feature in TallyPrime, before generating e-Invoices on the live IRP.

What is e-Invoice Sandbox

The e-Invoice Sandbox portal enables you to experience the complete e-Invoicing process as a trial. This will help you get familiar with the process and ensure that you do not face any difficulty while generating the actual e-Invoice on the live IRP.

To use the e-Invoice Sandbox portal, you will need the following:

- Client ID: You will need the client ID AACCT29GSPB5H8G for registering on the Sandbox trial portal.

- e-Invoice Sandbox registration: This is a two-step process.

- As you enter your details in the registration form, the portal validates your eligibility to use the Sandbox portal.

If you are a GST-registered dealer and eligible for e-Invoicing, you will need to register on the Sandbox portal. You are eligible for registration if your turnover in the last financial year is INR 5 Crore or more, as per the department. During the registration process, the portal verifies the eligibility as you enter your GSTIN/UIN. - On successful validation, you will need to create your login credentials – username and password.

- As you enter your details in the registration form, the portal validates your eligibility to use the Sandbox portal.

If you are using TallyPrime Release 3.0 and want to try IRN activities on e-Invoice Sandbox portal for multiple GST registrations, then you will need to register for all your registrations on the Sandbox portal.

- TallyPrime Release 1.1.4 or later: The e-Invoice Sandbox access feature is supported in Release 1.1.4 or later versions of TallyPrime

- Valid Tally Software Services (TSS): It is recommended that you have a valid TSS for a seamless e-Invoicing experience on the portal. However, you can also use TallyPrime Educational Mode to generate e-Invoices on the portal, along with its data entry limitations.

Register on the e-Invoice Sandbox Portal

You will need the e-Invoice Sandbox username and password to log in to the Sandbox from within TallyPrime for e-Invoice generation. For e-Invoice Sandbox registration, follow the steps given below.

- Navigate to the e-Invoice Sandbox registration page.

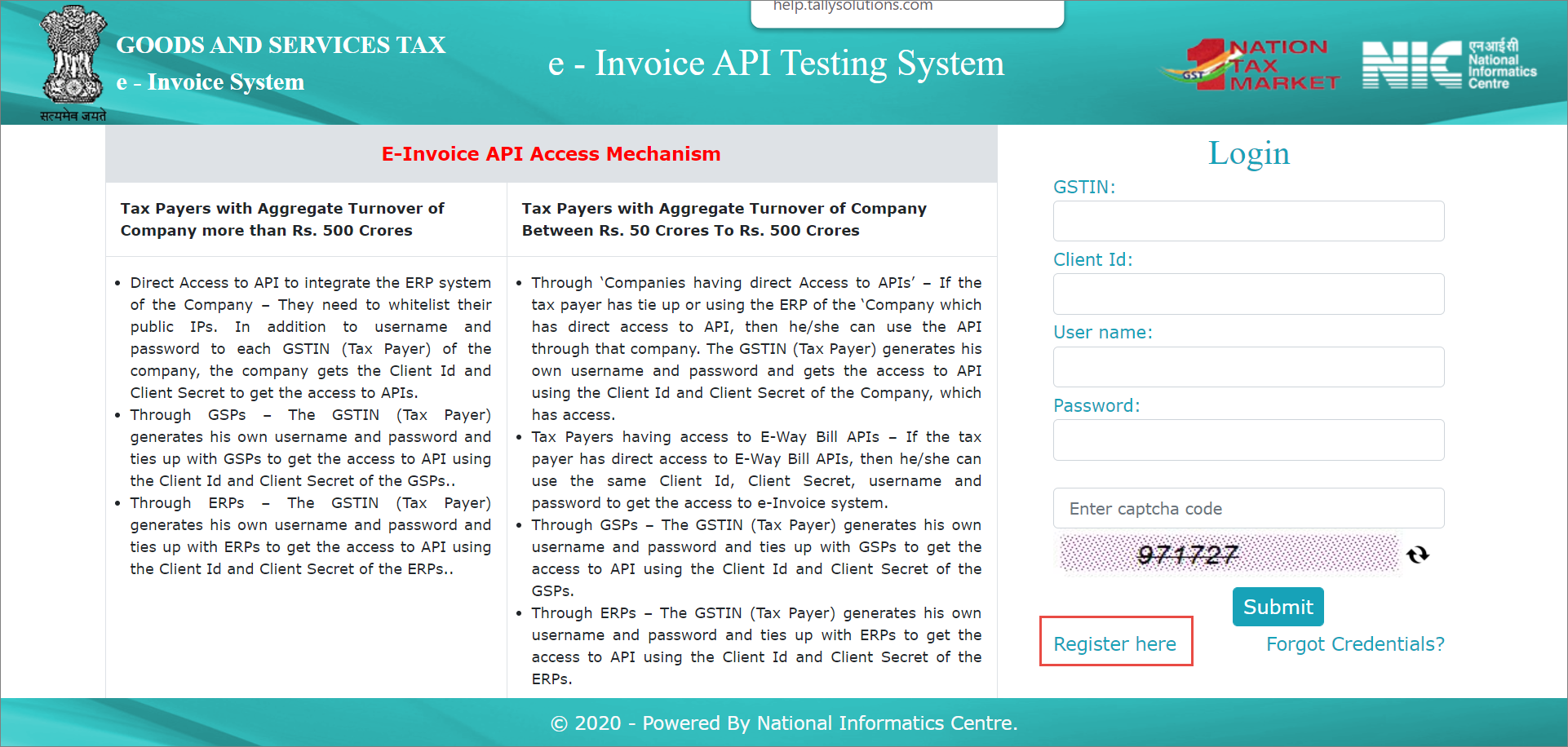

- Open the e-Invoice Sandbox login page on the browser.

The E-way Bill and E-Invoice API Access Mechanism screen appears.

- Click OK.

- Click Register here.

The Registration Form opens.

- Open the e-Invoice Sandbox login page on the browser.

- Provide all the required details in the Registration Form.

- User Type: Select Tax Payer.

- GSTIN: Enter the GSTIN of your business.

The e-Invoice Sandbox portal will determine your eligibility for e-Invoicing through your GSTIN. - Trade Name: Enter the name of your company registered with the department.

- GST Registered Mobile No.: Enter the mobile number that you have registered on the live GST portal.

- GST Registered e-Mail Id: Enter the e-mail ID that you have registered on the GST portal.

- Enter the Captcha.

- Click Send OTP.

You will receive an OTP on the mobile number that you have entered in the form. - Validate through Mobile OTP.

- Click Validate.

- Mobile OTP: Enter the OTP that you have received on your registered mobile number.

If you do not receive the OTP in some time, you may click Click Here to Resend OTP. - Click Submit.

- In the Create Account form, provide all the required details to generate your credentials for the Sandbox portal.

-

- Your GSTIN: Enter the GSTIN of your business.

- Registration through: Select GSP.

- Company: Enter the name of your company.

- Email: Enter your e-mail ID.

- ClientId: Enter AACCT29GSPB5H8G.

- Fill in the details in Enter Username, Enter Password, and Confirm Password, and click Create.

On successful account creation, you can use your credentials – username and password – to log in to the Sandbox portal.

-

Use the e-Invoice Sandbox Feature for e-Invoicing

To experience the e-Invoice Sandbox feature in TallyPrime, it is recommended that you take a copy of your company data or use different data. Using different data or dummy data will ensure that the data that you will be using for e-Invoicing on the live portal (IRP) will remain unaltered.

However, if you use your live data without backup, you will need to cancel the e-Invoices generated on the sandbox before generating it on the live IRP. To avoid this inconvenience, it is important to use a copy of your company data or take a backup before trying this Sandbox feature in TallyPrime.

Enable Sandbox access in TallyPrime

To experience e-Invoicing through Sandbox, you need to enable the Sandbox access in TallyPrime. It is a one-time setup. After loading the company using which you want to try this feature, follow the steps given below.

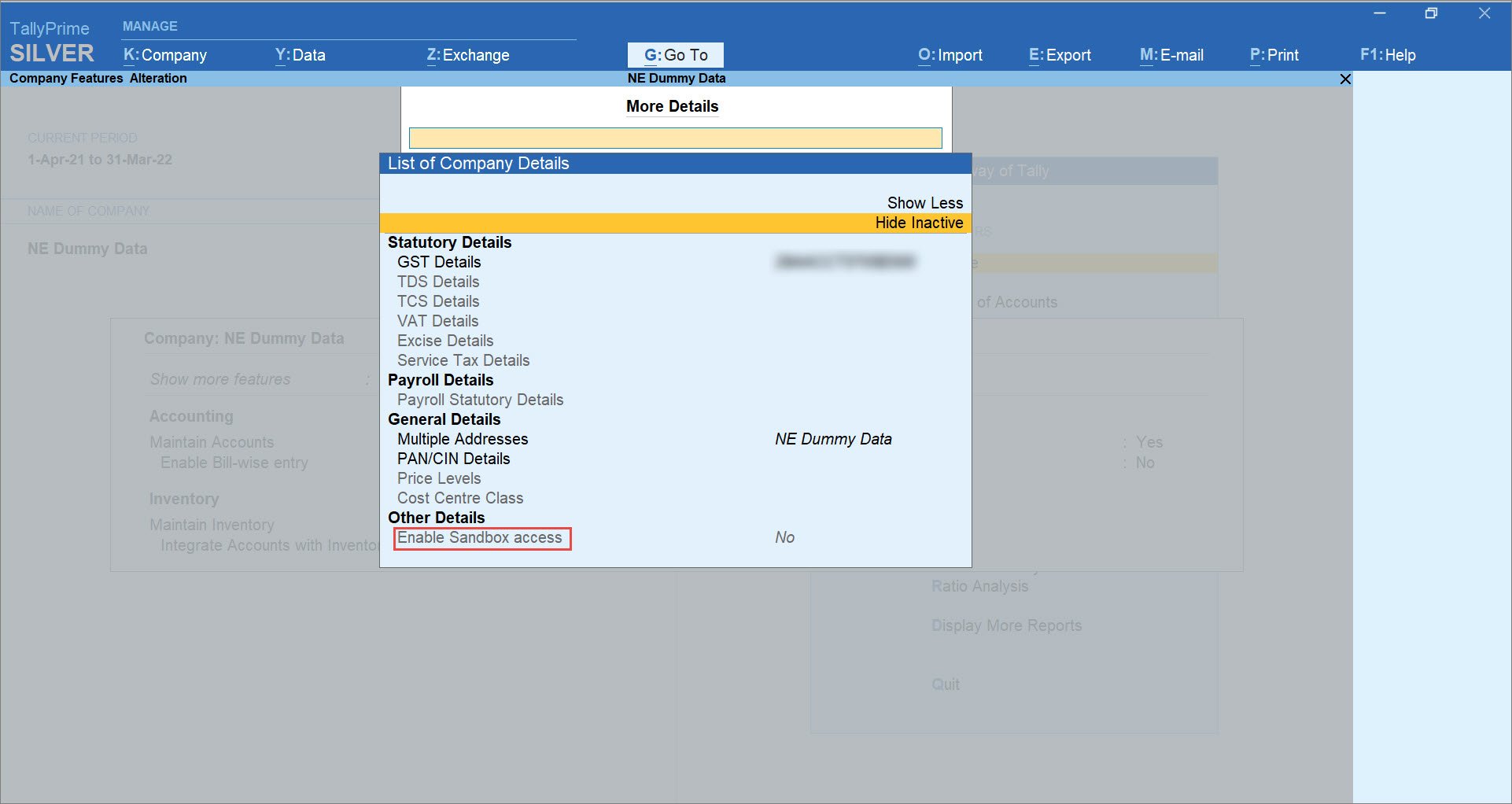

- Press F11 (Features) > press Ctrl+I (More Details) > type or select Enable Sandbox access > press Enter.

If you are using the multiple GST registrations feature of TallyPrime Release 3.0 or later releases, then the GST Registration screen appears. Select the GST Registration for which you want to enable e-Invoicing and press Enter.

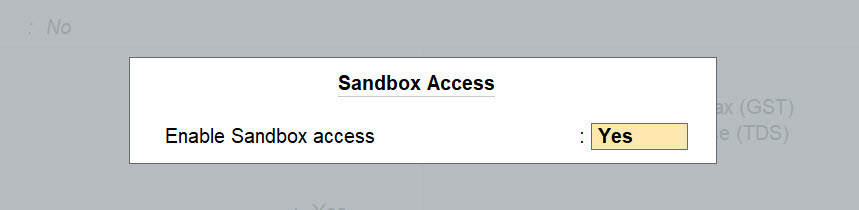

The Sandbox Access screen appears. - Set Enable Sandbox access to Yes.

- As always, press Ctrl+A to save.

If you are using the same company data for generating e-Invoices on the live portal, you will need to disable the feature using the same navigation. The option will be available under More Details without a need to press Enter on Show More and Show Inactive. You can then set Enable Sandbox access to No.

Generate e-Invoices using e-Invoice Sandbox in TallyPrime

Once you have enabled Sandbox access in TallyPrime, you can experience the e-Invoicing process in the e-Invoice Sandbox trial portal.

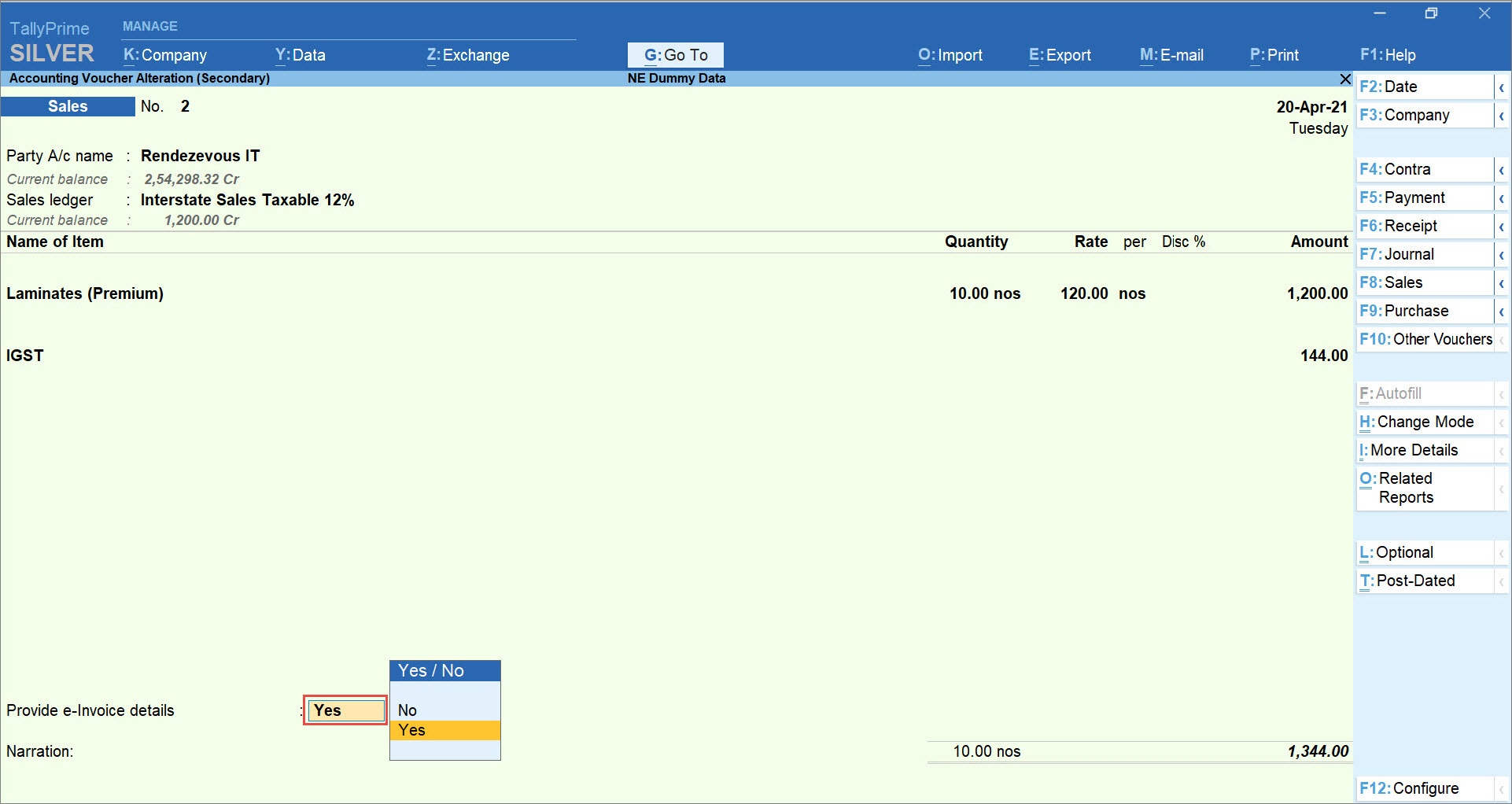

- Record a Sales transaction under GST with e-Invoicing.

To know how to record a sales transaction under GST, click here.

Ensure that Enable Goods and Services Tax (GST) is set to Yes in F11 (Features), and in the GST Details screen, e-Invoicing applicable is set to Yes. - In the Accounting Voucher Creation/Alteration screen, set Provide e-Invoice details to Yes.

- As always, press Ctrl+A to save the transaction.

Send Transactions for e-Invoicing to the e-Invoice Sandbox Portal

After recording transactions applicable for e-Invoicing, you can send them for IRN generation to the e-Invoice Sandbox portal.

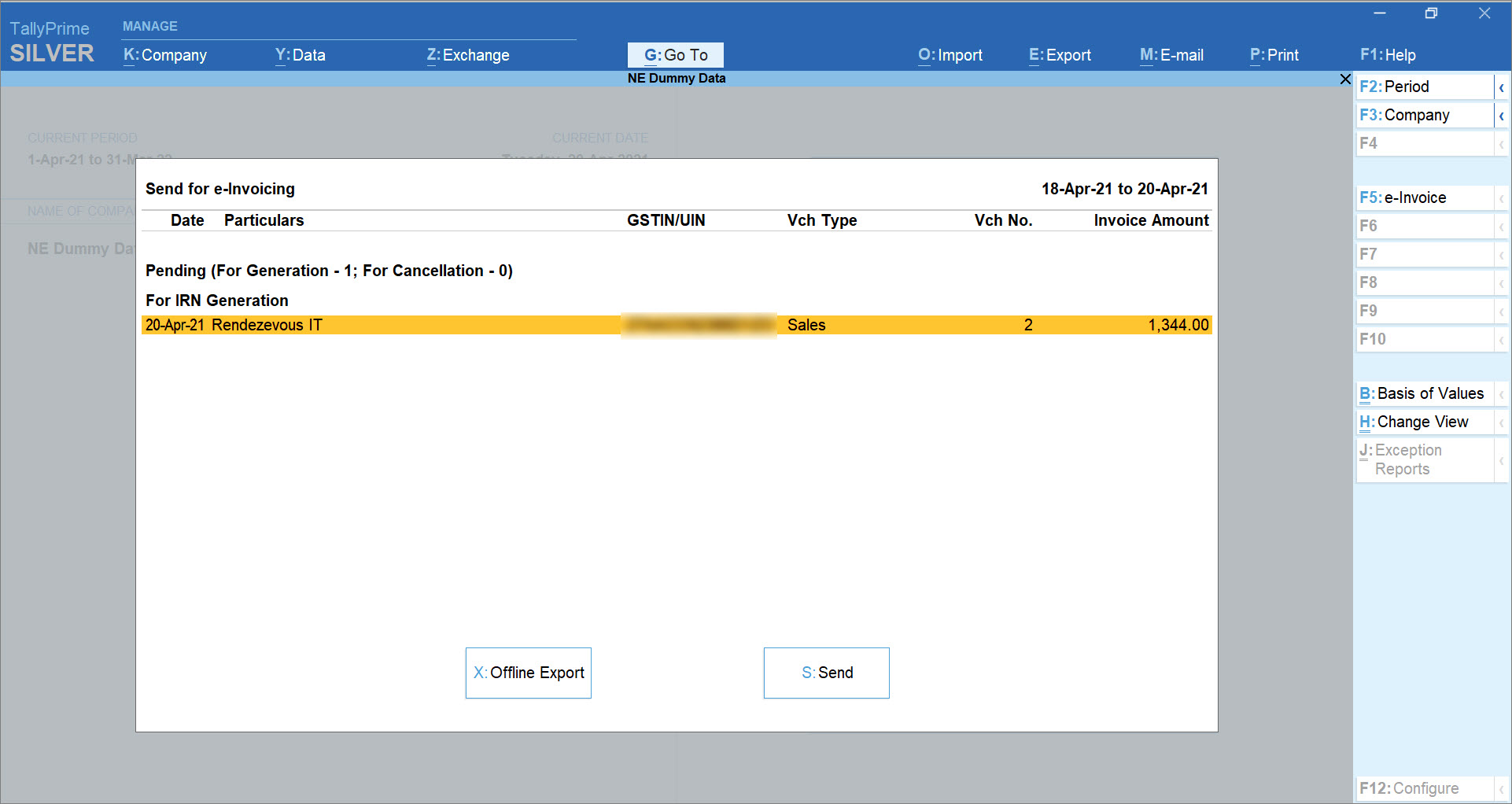

- In TallyPrime, press Alt+Z (Exchange) > Send for e-Invoicing.

The Send for e-Invoicing screen opens.

If you are using the multiple GST registrations feature in TallyPrime Release 3.0 or later releases and e-Invoicing is applicable in more than one GST registration, then the vouchers of those GST registrations that are ready for IRN Generation and Cancellation will be available for selection. - Select the transaction you want to send for IRN generation. Press Spacebar to select.

In a similar way, you can also select multiple transactions for IRN generation or cancellation through e-Invoice Sandbox system. - Press S (Send).

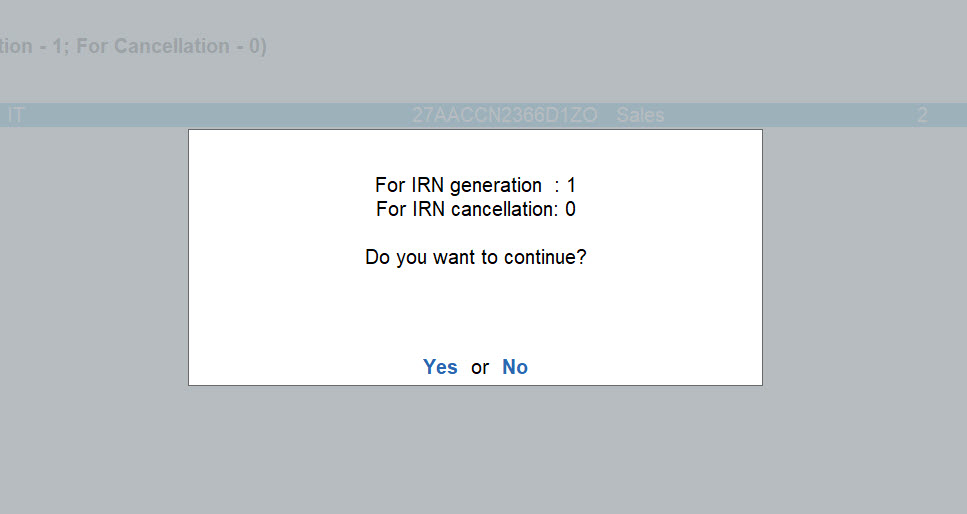

A summary screen appears displaying the number of transactions you are sending for IRN generation and IRN cancellation.

The e-Invoice Sandbox portal does not support offline e-Invoicing on uploading JSON files. So, if you press X (Offline Export), then TallyPrime will display a warning message stating that e-Invoice Sandbox does not allow you to upload JSON.

If you are using the multiple GST registrations feature in TallyPrime Release 3.0 or later releases, then the total number of vouchers for IRN Generation and Cancellation from all GST registrations will be displayed. - Press Y to continue.

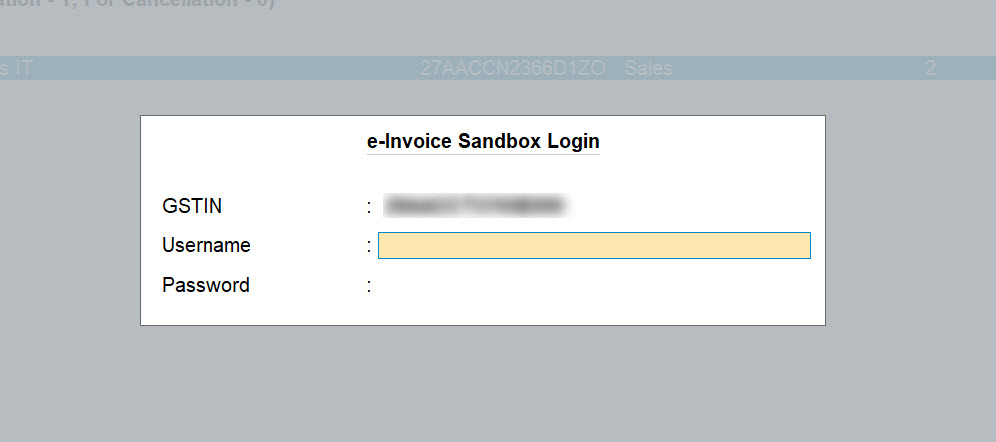

The e-Invoice Sandbox Login screen appears prompting you to enter the login credentials.

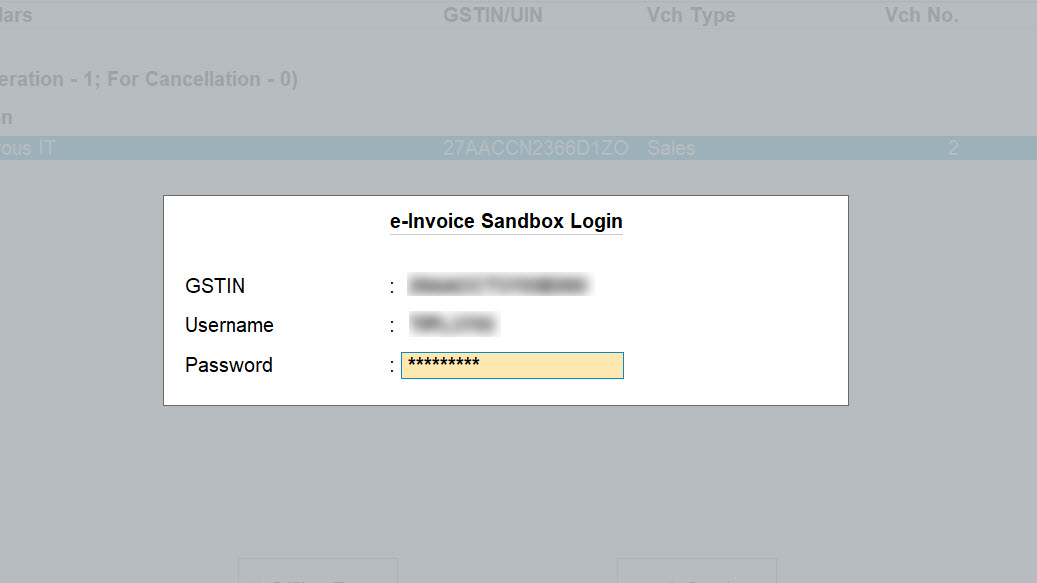

In TallyPrime Release 3.0 or later releases, if you are sending vouchers of multiple GST registrations for IRN generation and cancellation, then the e-Invoice Sandbox Login screen for all the registrations will be displayed one by one. You will need to log in for all the registrations. - Enter your Sandbox credentials that you had created while registering on the Sandbox portal.

- Press Enter to continue.

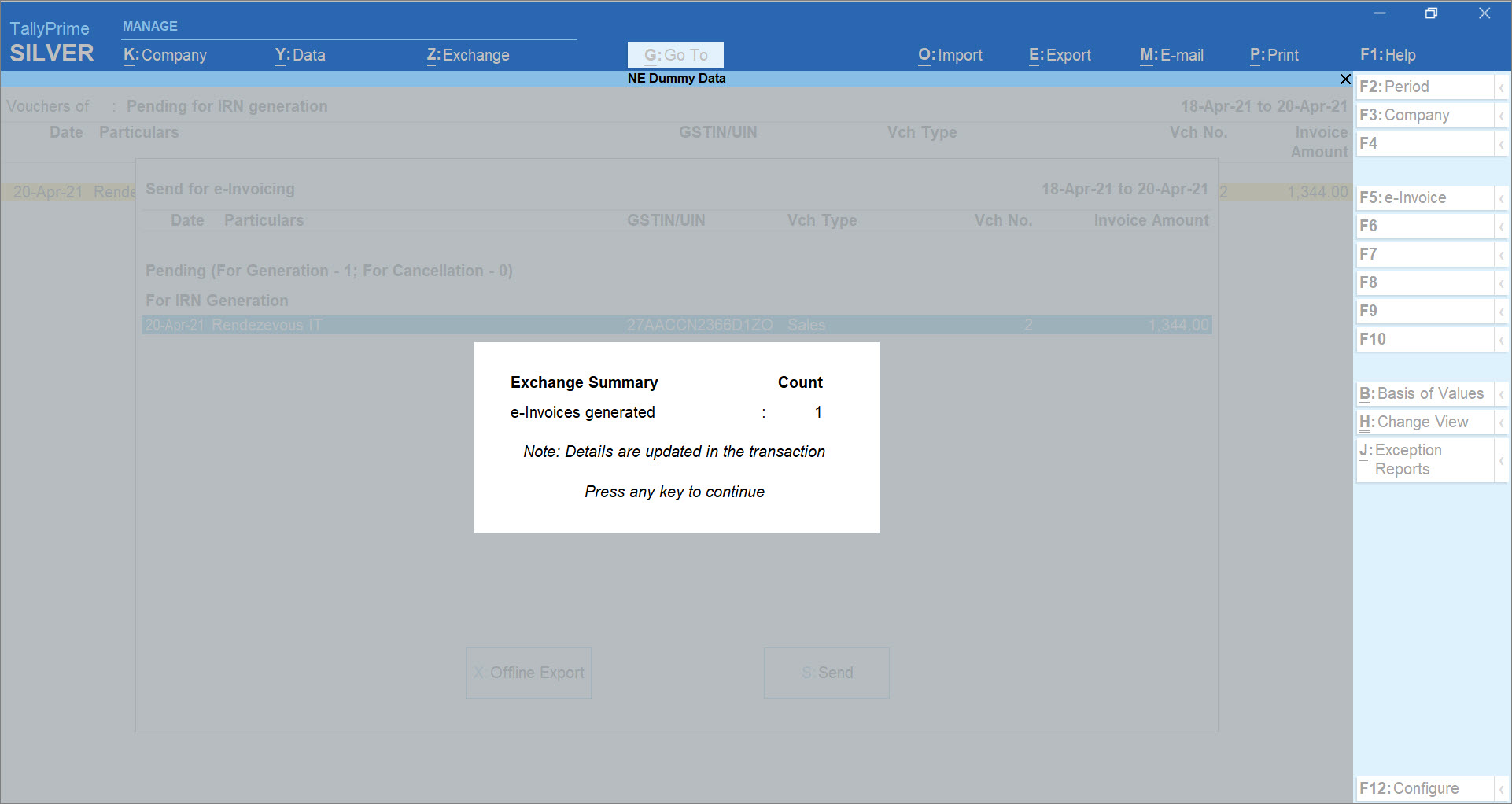

The Exchange Summary screen appears, displaying the status of IRN generation for the transaction or transactions, as applicable.

The IRN details will be downloaded and updated in the transaction.

If one or more login credentials are incorrect, then TallyPrime shows an error message from the portal and you will need to log in again with the correct credentials.

If there is some network issue, or in other such scenarios, then the screen displays Request not sent (Login cancelled).

Moreover, if you are using the multiple GST registrations feature in TallyPrime Release 3.0 or later releases, then the total number of vouchers from all GST registrations that are updated with IRN details and those that are rejected from the portal will be displayed.

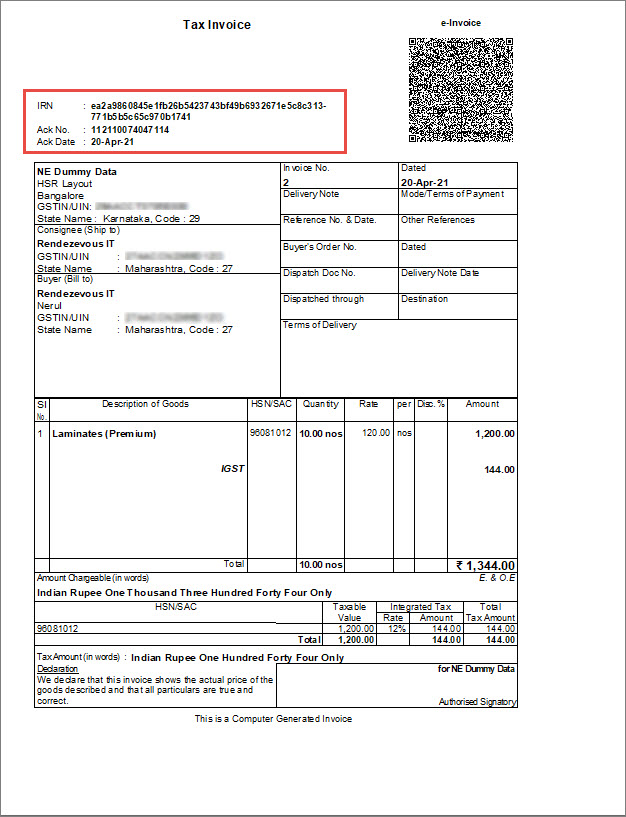

You can print the transaction with e-Invoice details, such as IRN, Ack No., and Ack Date, and the QR Code, as shown below.

Next Step after Experiencing e-Invoicing on the e-Invoice Sandbox Portal

Once you have experienced the complete process of e-Invoice generation through the Sandbox portal, you can generate e-Invoices on the live IRP through TallyPrime.

Refer to the following articles for a smooth experience of generating e-invoices on IRN:

You have to take one of the following actions after experiencing e-Invoicing on the Sandbox system, depending on the status of your TallyPrime license or TSS subscription.

Users without TallyPrime License

If you do not have a TallyPrime license, you can purchase a single user or multi-user license. Once you do that, you can disable Sandbox access in TallyPrime Release 1.1.4 or later, and start using TallyPrime for e-Invoicing on the live IRP.

Users with Invalid Tally Software Services (TSS)

If you do not have a valid TSS, you can renew it on our website. Once you do that, you can disable Sandbox access in TallyPrime Release 1.1.4 or later, and start using TallyPrime for e-Invoicing on the live IRP.

TallyPrime Users with Valid TSS

If you have a valid TSS, then all you need to do is disable Sandbox access in TallyPrime Release 1.1.4 or later, and start using TallyPrime for e-Invoicing on the live IRP.