Purchase Returns under GST in TallyPrime

In some business scenarios, after you have made a purchase there can be a situation where you return the entire supply or some of the items from the supply to the supplier due to varied reasons such as the quality of supply, surplus supply, late delivery, and so on. If the purchase was recorded with GST, you will have to record the Purchase Returns with GST as well to correctly adjust your expense and taxation in reports. In TallyPrime, you can record Purchase Returns with GST using a Debit Note and also mark the reason for issuing the note. Furthermore, whether the Purchase Returns is made in the same GST return period of the Purchase voucher or the subsequent period, TallyPrime automatically adjusts the taxation in GSTR-3B under Input Tax Credit Reversed and places the entry in the right period.

Record a Debit Note for Purchase Returns

Debit Note is a document issued to a party stating that you are debiting their Account in your Books of Accounts for the stated reason. It is commonly used in the case of Purchase Returns to mark the reduction in expenses, and Input Tax Credit Reversed in GST reports.

![]()

- Press Alt+G (Go To) > Create Voucher > press F10 (Other Vouchers) > type or select Debit Note and press Enter.

Alternatively, Gateway of Tally > Vouchers > press F10 (Other Vouchers) > type or select Debit Note and press Enter.

If you have created multiple registrations in TallyPrime Release 3.0 or later, then to change the registration, press F3 (Company/Tax Registration) > type or select the Registration under which you want to create the voucher and press Enter.

- In Party A/c name, select the party from whom the original purchase was made and press Enter.

The Dispatch Details screen will appear. - Under Original Invoice Details, enter the Original Invoice No. and Date of the original purchase transaction against which you are recording a purchase return.

As per the Purchase voucher, you can enter the Original Invoice Details in the Debit Note as shown in the image below:

- Enter stock item details for debit note and select the tax ledgers.

- Name of Stock Item – Select the stock item that you are returning to the supplier.

- Specify Quantity and Rate.

- Select the required tax ledgers.

For example, shown below is a Debit Note for 10 Bajaj Microwaves with a taxable value of Rs. 80,000/- and with GST of Rs. 14,400/- recorded on 4-Nov-22. The values of GST ledgers here, that is, Rs. 14,400/- will be the Input Tax Credit (ITC) reversed from the original purchase ITC.

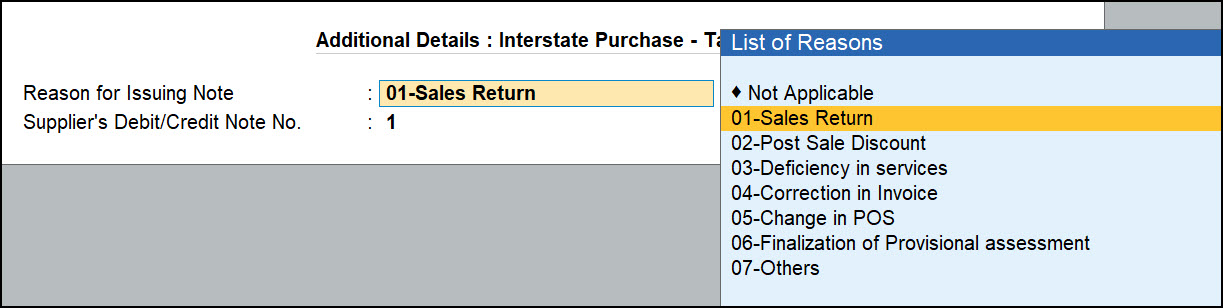

- Set the option Provide GST details to Yes, and select the reason of the purchase return from the List of Reasons.

When the seller has not uploaded the credit note, the buyer has to upload the debit note from the viewpoint of outward supply. Hence, the List of Reasons for Issuing Note is the same in a debit note and a credit note.- 01-Sales Return: When there is a return of goods or services after the purchase.

- 02-Post Sale Discount: When a discount is allowed on goods or services after the purchase.

- 03-Deficiency in services: When there is a deficiency in services (like a quality issue) after purchase.

- 04-Correction in Invoice: When there is a change in the invoice raised that leads to a change in the tax amount.

- 05-Change in POS: When there is a change in place of supply that leads to a change in the tax amount.

- 06-Finalization of Provisional assessment: When there is a change in price or rate after the department issues a notification about the finalized price of the goods or services.

- 07-Others: Any other nature of the return.

- As always, press Ctrl+A to save the Debit Note.

Impact of purchase return if return occurred in the same return period

When you record a Debit Note against a Purchase voucher in the same GST return period of that voucher, then the Input Tax Credit Reversed will be visible in that same GST return period under GSTR-3B.

For example, if you have recorded a Purchase voucher on 25-07-2021 and a Debit Note for that on 28-07-2021, then the Input Tax Credit Reversed for that will be visible under GSTR-3B report for 07/2021.

To learn how to record a debit note, refer to Record a Debit Note for Purchase Returns.

Let us consider a Purchase voucher with Supplier Invoice No. LPG-01 and Date: 1-Nov-22. Taxable value is Rs. 8,00,000/- with GST of Rs. 1,44,000/- recorded on 2-Nov-22. Now, if you had to return a few of the stock items due to reasons like a defect in the product or change in place of supply, you can record a Debit Note.

Shown below is a Debit Note voucher recorded on 4-Nov-22.

You can see the impact of the Debit Note on your Input Tax Credit Reversed, in GSTR-3B for Nov-22.

You can see the impact of the Debit Note on your Input Tax Credit Reversed, in GSTR-3B for Nov-22.

Press Alt+G (Go To) > GSTR-3B > press Enter.

Alternatively, Gateway of Tally > Display More Reports > GST Reports > GSTR-3B > press Enter.

Impact of purchase return if return occurred in the subsequent return period

Purchase returns can also happen after a few weeks or months of purchase, especially after you have filed your returns for the month of purchase. In such cases, you will need to record a Debit Note against the purchase voucher in the subsequent GST return period of that voucher. You can then view the Input Tax Credit Reversed in GSTR-3B of the subsequent GST Return Period.

To learn how to record a debit note, refer to Record a Debit Note for Purchase Returns.

Let us consider a Purchase voucher with Supplier Invoice No. LPG-01 and Date: 1-Nov-22. Taxable value is Rs. 8,00,000/- with GST of Rs. 1,44,000/- recorded on 2-Nov-22. Now, if you had to return a few of the stock items due to any reason like a defect in the product or change in place of supply, you can record a Debit Note. If you record a debit note against this on 01-12-2022, then the Input Tax Credit Reversed for that voucher will be visible in the GSTR-3B report of Dec 2022.

Shown below is a Debit Note voucher recorded on 1-Dec-22.

Shown below is a Debit Note voucher recorded on 1-Dec-22.

You can see the impact of Debit Note under Input Tax Credit Reversed in GSTR-3B for Dec-22.

Press Alt+G (Go To) > GSTR-3B > press Enter.

Alternatively, Gateway of Tally > Display More Reports > GST Reports > GSTR-3B > press Enter.