Update GST Rates Using the GST Rate Setup Report in TallyPrime

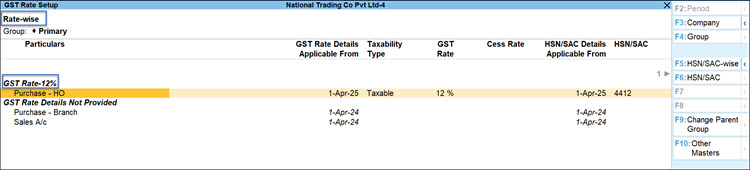

The GST Rate Setup report provides a consolidated view of the GST Rate and HSN/SAC details available in your masters. You can update your existing GST rates to 5%, 18% or 40% as per changes proposed in the GST Council meeting (Sep’25), and modify other details as needed from a single report.

View GST & HSN/SAC Details of Masters

For illustration purpose, let us consider viewing the GST Rate Setup report for Ledgers. You can select Stock Items, Ledger Groups, or Stock Groups as well, as needed.

Open GST Rate Setup Report

- Press Alt+G (Go To) > GST Rate Setup > Ledgers > Enter.

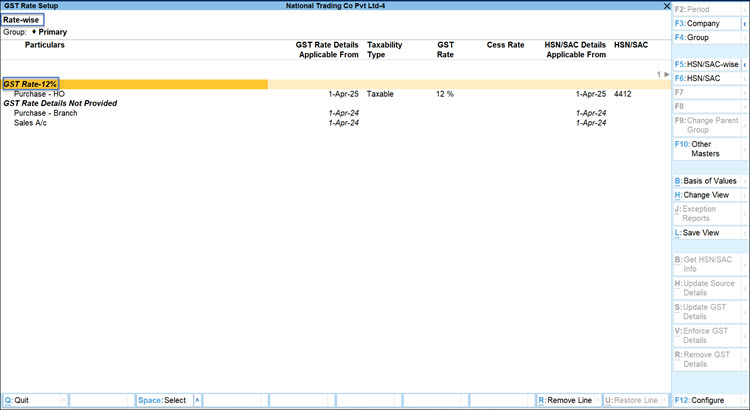

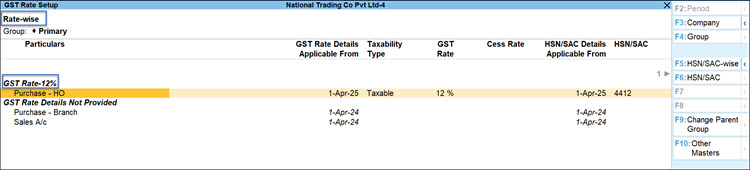

The Rate-wise details appear by default. In case you have not specified any tax rate for one or more masters, such masters are listed under the GST Rate Details Not Specified section.

View GST Rate and HSN/SAC details

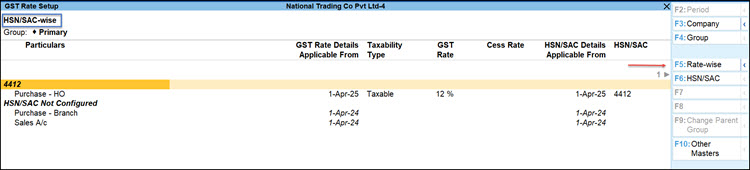

- Details as per HSN/SAC: Press F5 (HSN/SAC-wise).

- Details as per ledger: Press Ctrl+H (Change View) > Ledger-wise.

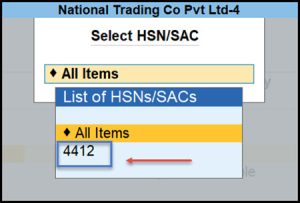

- Details under a specific HSN/SAC: Press F6 (HSN/SAC) > select the required HSN/SAC > press Enter.

- Details for a specific ledger group: Press F4 (Group) > select the relevant ledger group > press Enter.

Configure GST Rate Setup report

Configure the GST Rate Setup report to view additional GST related details. For example:

- Show Source of GST Details & Show Source of HSN/SAC Details: The source from which the GST or HSN/SAC-related details will be considered when you record transactions.

- Show Eligible for ITC: The applicability of input tax credit for the masters.

- Show applicable for reverse charge: The applicability of reverse charge for the masters.

Based on the needs, you can set up or update the GST rate and other related details of multiple masters together from this report. This eliminates the need to open each master separately and update the rate and other details.

Change GST Rates in Masters | Update GST Details

For illustration purpose, let’s consider updating GST rates of Ledgers to 5%, as per the GST Council meeting (Sep’25). The steps below remain the same even for updating the GST rates in Stock Item.

- Press Alt+G (Go To) > GST Rate Setup > Ledgers.

- Select one or more ledgers for which you want to update and press Alt+S (Update GST Details).

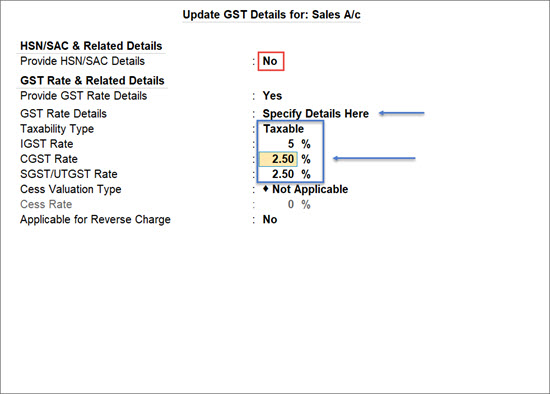

You can select multiple ledgers by pressing Spacebar. - In the Update GST Details screen, set up the GST rates, and update other details, if needed.

- Ensure that the Provide HSN/SAC Details is set to No.

Setting this option to No will keep the HSN/SAC details intact as you had set previously. - Select Specify Details Here to enter the respective tax rates.

You can select GST Classification to select any existing classification master or create a new one configured with the applicable GST rates.

- Ensure that the Provide HSN/SAC Details is set to No.

- Specify the Effective Date for the revised details.

- Press Ctrl+A to save the details in the relevant masters (the ledgers in this case).

Henceforth, the GST Rate Setup report will display the updated details.

If the tax rates have changed in the masters, the GST Status of the related vouchers will get updated. Refer to <link to the relevant topic/section>

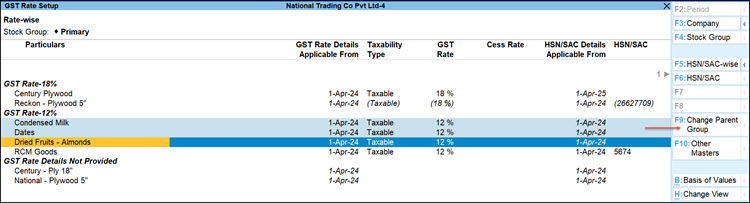

Update GST Rates by Moving Items from One Group to Another | Change Parent Group

Say your stock items taxed at 12% were grouped together. You can easily move them to another group configured with 5% GST rate directly from the GST Rate Setup report.

- Press Alt+G (Go To) > GST Rate Setup > Stock Items.

- Select one or more stock items and press F9 (Change Parent Group).

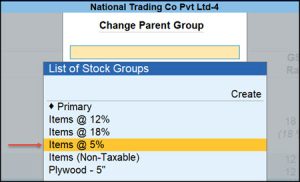

- Select the parent stock group, as needed, and save.

You can create a new stock group on the fly, if needed.

The tax amount for all stock items under the stock group for 5% will now be calculated accordingly in the transactions.