Get Ready to Record Transactions of the New Financial Year in TallyPrime | Moving to the Next Financial Year

Existing users of TallyPrime can start recording the transactions for the new financial year in TallyPrime by changing the current period or by creating a new company. As you are aware, start of a new financial year is the right time for you to restart the voucher numbering.

Start date of the new financial period depends on the accounting guidelines in your country. Certain countries start their financial period from 1st January and end on 31st December. In certain countries the financial period starts from 1st April and ends on 31st March. You can easily manage this in TallyPrime.

When you change the current period. all your ledger balances, pending bills, pending orders, delivery notes, and receipt notes will be available for the continuity of business. If you are creating a new company, you need to set up the masters and voucher numbering.

You can also read this topic in Hindi (हिन्दी)

Change Current Period

In the existing Company data, you can just change the period and you are ready to start bookkeeping for the new financial year in the same Company data that you have been using so far. This also enables you to compare the reports from different financial years.

We recommend starting fresh series of voucher numbering for your New Financial Year by restarting the voucher numbers for all applicable voucher types used in your business. This helps implement a fresh set of numbering for your books in each financial year and manage your outstanding.

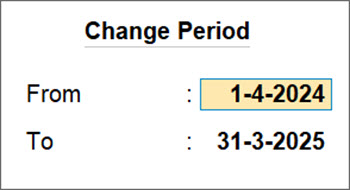

Go to Gateway of Tally > Press Alt+F2 (F2: Period) and enter the dates.

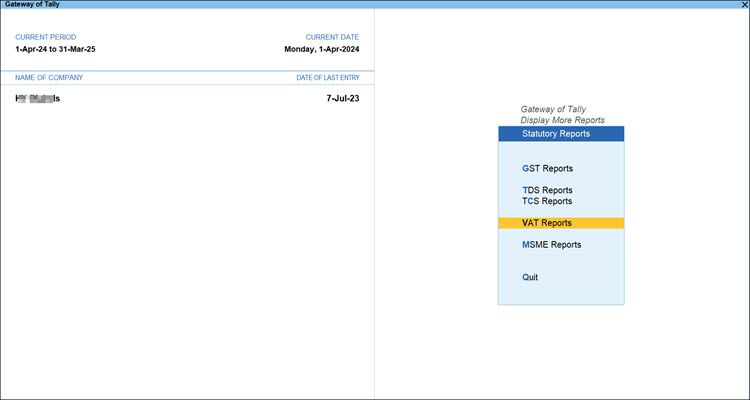

The Current Period and Current Date appear as shown below:

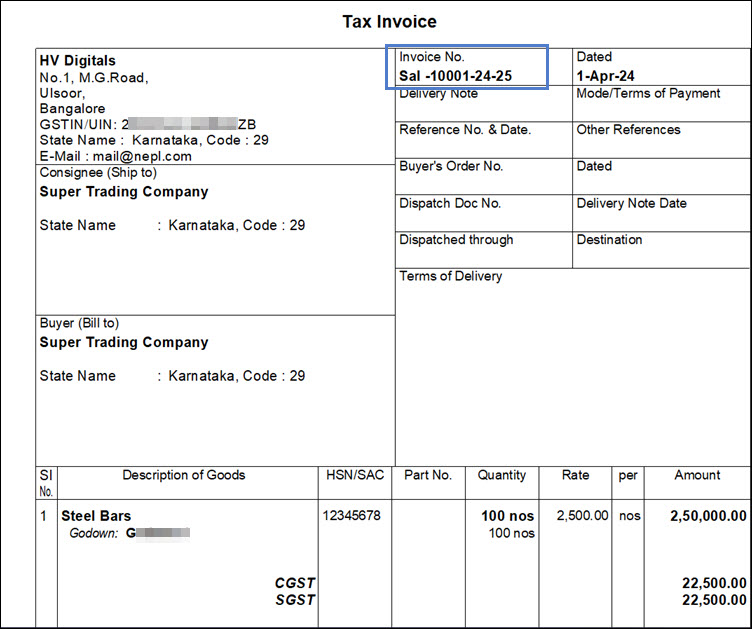

When the Current Period is changed, the balances from the previous financial year are carried forward. The Financial year beginning from and Books beginning from dates in the Company Alteration screen are retained.

Restart Voucher Numbering

To record the transactions from the first day of the new financial year with the new number series, you can restart the voucher numbering with unique voucher numbers for all your voucher types.

You can restart the numbering of your vouchers by entering the date from which you want to restart the voucher numbers.

- Gateway of Tally > Create/Alter > Voucher Type.

Alternatively, Alt+G (Go To) > Create Master/Alter Master > Voucher Type. - If you select the Method of Voucher Numbering as Automatic (Manual Override), a voucher number is generated automatically however you can also manually override the auto-numbering when required.

- Set the option Prevent duplicates to Yes, to ensure unique voucher numbers.

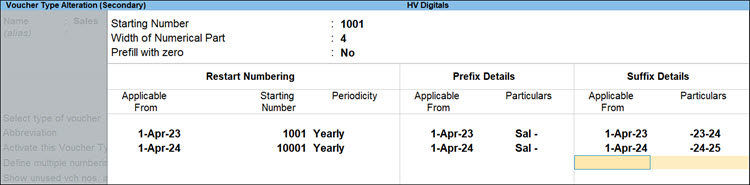

- Set the option Use advanced configuration to Yes, to open the Voucher Type Creation (Secondary) screen.

- In the Starting Number field enter 1, if you want a fresh batch of voucher numbers.

- Enter the Restart Numbering as required.

- Enter the Prefix Details and Suffix Details as required.

Now you can easily record your transactions with a new series of voucher numbers.

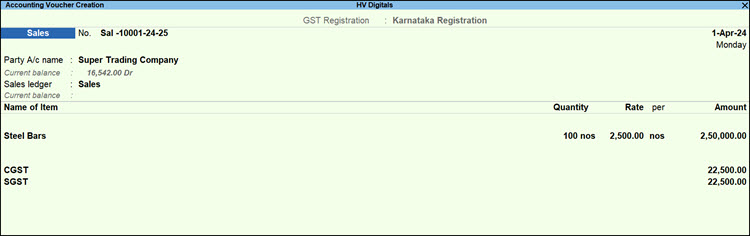

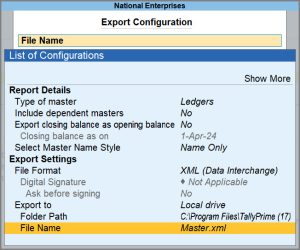

A sample sales voucher with the new series of voucher numbers appears as shown below:

The invoice appears as shown below:

Similarly, voucher numbers for all other voucher types can be configured.

Move to the Next Financial Year by Creating New Books of Accounts

You can create a new company, create masters and start recording the transactions. Instead of creating masters, you can export the masters from your previous year’s company and import them into the new company.

- Go to Gateway of Tally> press Alt+K (K: Company) > Create.

- Enter 1-4-2024 as the Financial year beginning from date. The same date appears in the Books beginning from field.

To know more about company creation refer to the topic Create a Company to Record Business Transactions

After creating the company, you can create the masters, configure voucher numbering and record transactions.

Other Methods of Moving to New Financial Year

You can also do one of the following to move your data to the new financial year:

- Split company data, this will help you to:

- Reduce data size.

- Secure old data and start work in a different folder.

- Maintain separate folders for each financial year.

- Import the opening balances from the old company to a new company.

- Create new books of accounts to start the transactions afresh.

When you move your data from lower releases to the current release in the new financial year:

The VAT rates are migrated and updated in the stock item masters (Release 4.x or 5.x to current release). You need to configure GST rates and map the unit of measure to UQC in the current year.

The GST rates and mapping of unit of measure to UQC are carried forward to the new year (Release 6.0 to current release).

If you split the data, you can update the tax references.

Split Company Data

When you split the data, the original data is retained, and two new companies with unique names and dates are created. You can rename the split company as required, and save the original data in another location.

Before splitting the data:

- Ensure the analysis or audits of the books of the previous financial year are complete.

- Adjust all the unadjusted forex gains/loss displayed on the balance sheet for multi-currency transactions.

- Check the profit and loss account or inventory statements for pending purchase and sales bills, and adjust them to the respective accounts.

To split and move the data to the new financial year:

- Verify the data

- Split the data

- Take a backup of your data

- Update tax references for transactions

- Go to Gateway of Tally > press Alt+Y (Y: Data) > Split > Verify Data.

- Select the required company.

- Press Enter to view the Possible Errors screen.

- Rectify the errors before you proceed to split the data.

- Go to Gateway of Tally > press Alt+Y (Y: Data) > Split > Verify Data

- Select the required company for which the data has to be split.

- Enter or retain the Split from date.

- Press Enter to split the data. Data will split into two periods.

The synchronisation rules are carried forward in the split data, in both the server and client. The new company name is automatically updated in the Client Rule. If you have renamed the split company, update the same in the Client Rule on the server.

If you are splitting data having transactions of two or more years, with taxation transactions of pre-GST regime, the tax references are not carried forward in the split data. You need to record the transactions for the following:

TDS: Fourth quarter TDS payment transaction

Create New Company and Import the Opening Balances

If you have created a new company, export the closing balances of the ledgers and stock items of the old company, and import them as opening balances into the new company. You can also import the audited closing balance of the previous year, as the opening balance into the current year.

To export closing balances from old company

- Go to Gateway of Tally > Chart of Accounts > Ledgers > E: Export > Current.

- Click Configure.

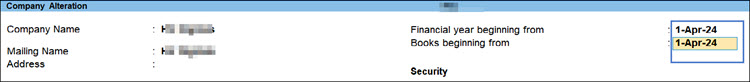

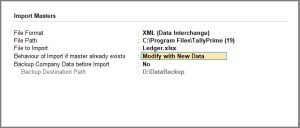

- Select the File Format as XML (Data Interchange) and provide details as shown below:

- Press Esc to close the configuration and return.

- Press Enter to export the data.

To import closing balances as opening balances in new company

- Go to Gateway of Tally > O: Import Data > Masters.

- Enter the location of the file in the File Path field.

- Enter name of the file containing master data in the File to import (XML) field.

- Select the required option for Behaviour of import if master already exists.

- Press Enter to import.

Create New Books of Accounts

You can create a new company and start recording the transactions without any opening balances for the ledgers.

To create new books of accounts

Create the masters and record transactions.

Create the masters and record transactions.