Invoice Management System (IMS) in TallyPrime

Managing purchase invoices and claiming accurate ITC can be challenging when suppliers delay or make errors in filing. This often leads to mismatches in GSTR-2B and incorrect ITC claims. TallyPrime with the Invoice Management System (IMS) solves this by helping you download and manage supplier-uploaded invoices from the GST portal, right within TallyPrime.

From a single dashboard, you can accept, reject, or mark invoices as pending. Accepted invoices contribute to GSTR-2B ITC, rejected ones move to the ITC Rejected section of GSTR-2B, and pending ones remain for later review. If no action is taken, invoices are auto-accepted in GSTR-2B.

IMS in TallyPrime gives you full control over invoice actions and ITC tracking. With one-click options, you can recompute GSTR-2B, reset IMS Action Statuses, or upload IMS Inward invoices to the GST portal. The IMS Inward Supplies report gives a clear view of the invoice status, while the ITC Summary consolidates ITC data for transparency and control.

With IMS in TallyPrime, you stay compliant, take timely action, and claim only the correct ITC, leading to error-free GST filing.

View IMS Inward Invoices

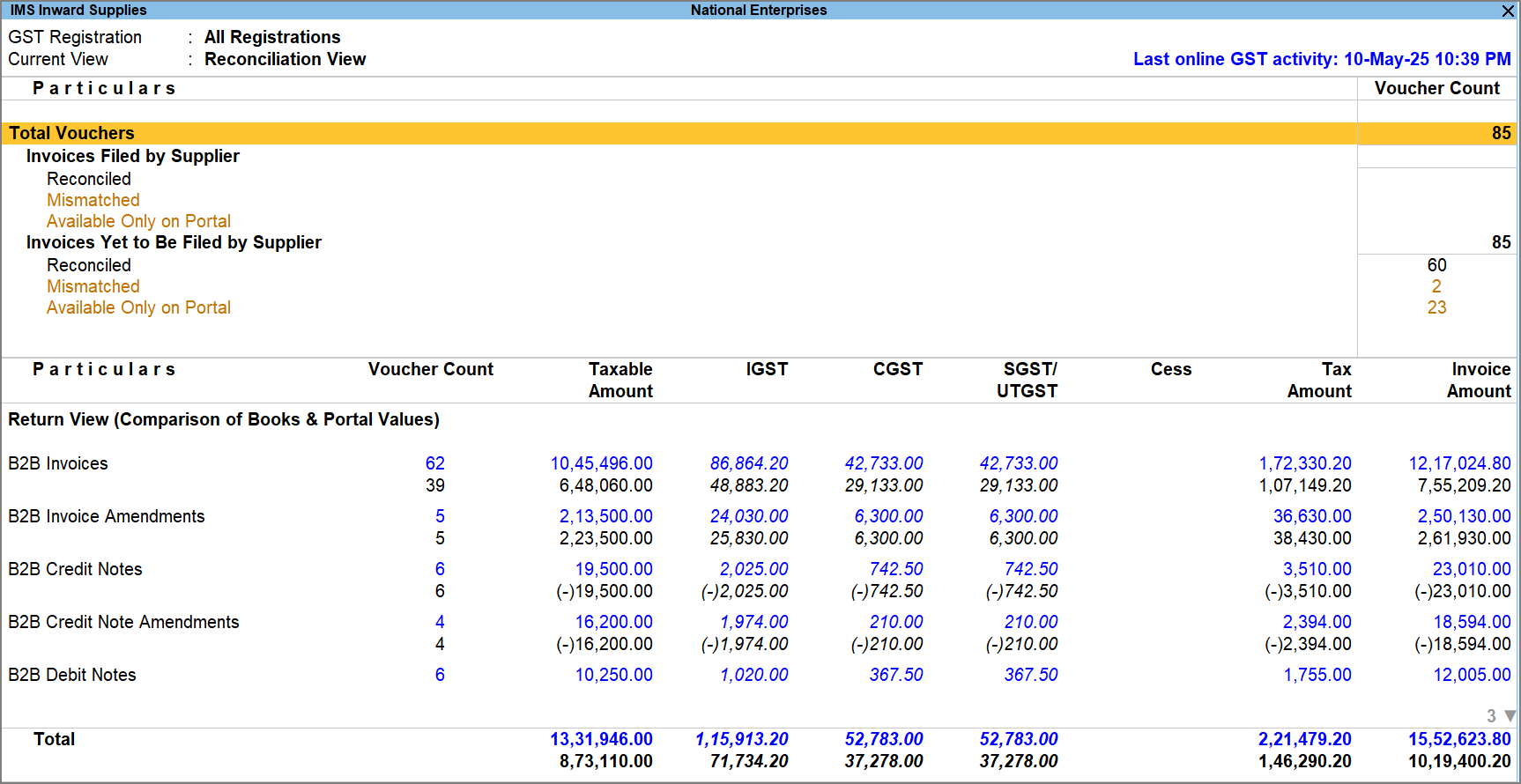

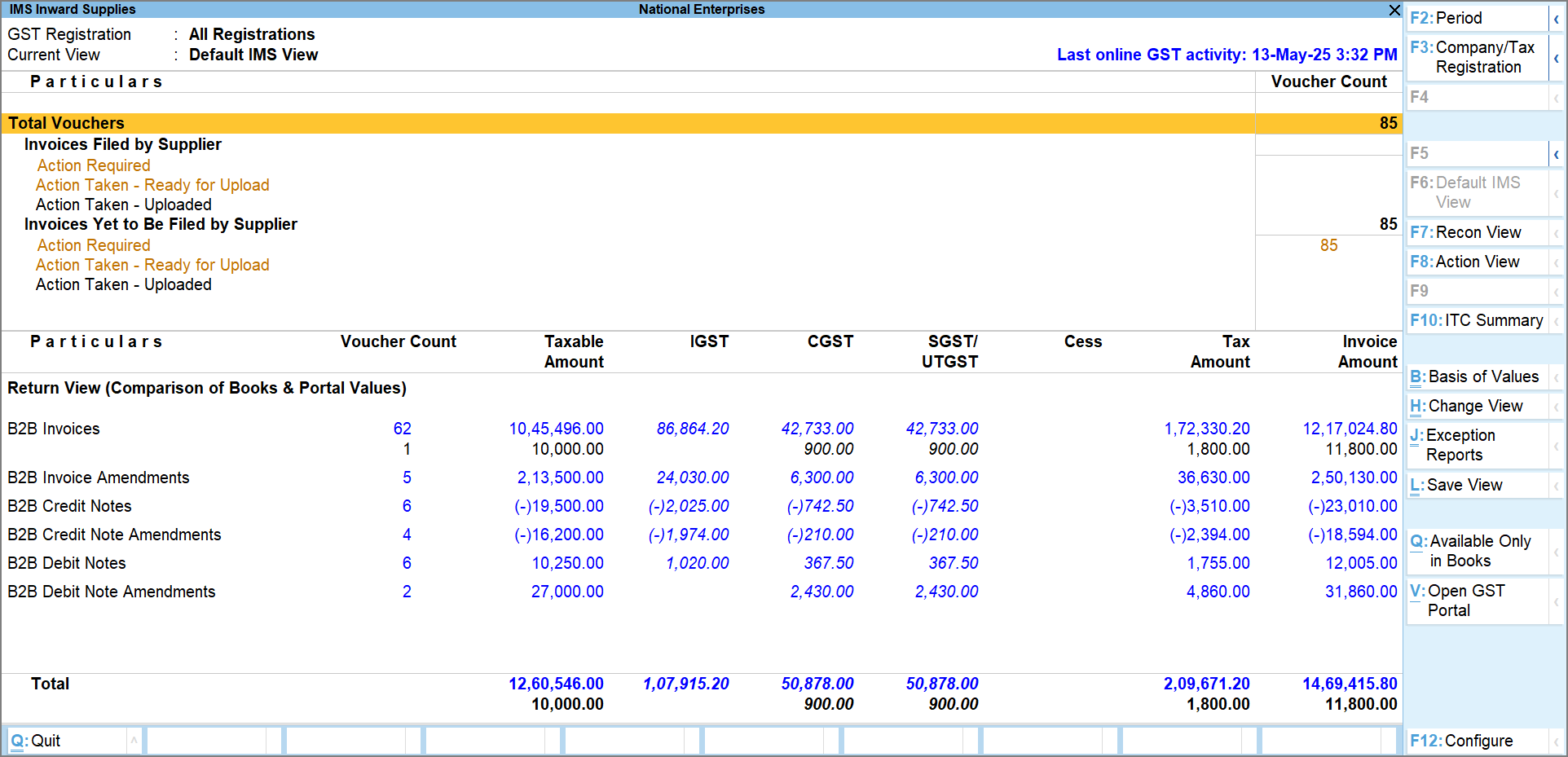

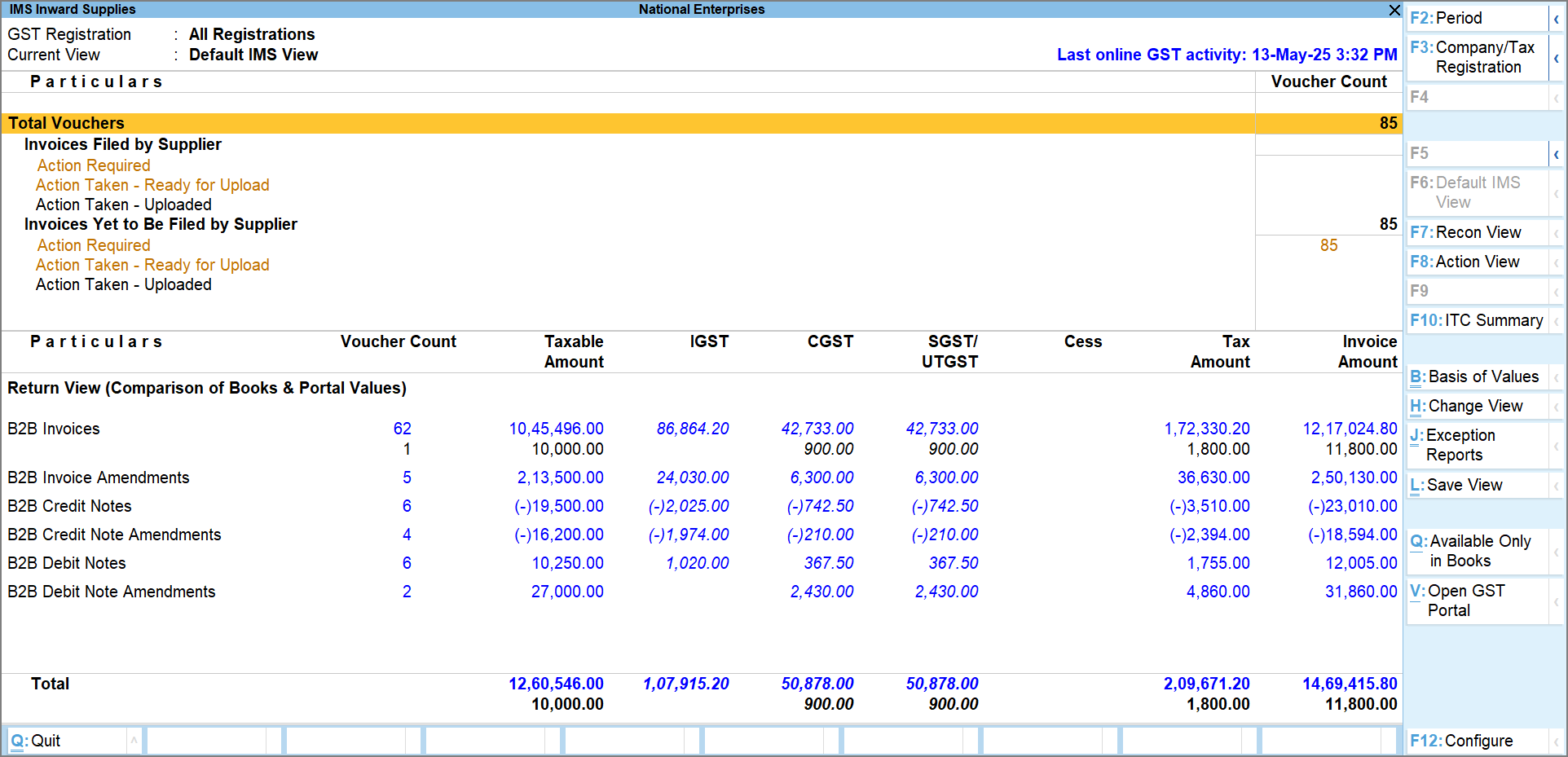

Once you download invoices using the Invoice Management System (IMS), they appear in the IMS Inward Supplies report. The report header displays the active GST registration, and if you manage multiple registrations, you can configure the report accordingly. IMS Inward Supplies offers multiple views – Default View, Reconciliation View, and Action View – to help you analyse invoices from different perspectives. You can also use Basis of Values to filter the report based on criteria such as Filing Status, Reconciliation Status, or Action Status. Sections that require your attention are highlighted in amber, enabling you to quickly identify and act on the pending items.

-

Press Alt+G (Go To) > type or select Invoice Management System, and press Enter.

The IMS Inward Supplies report appears.

By default, the report opens in the IMS Default View. You can switch between views:

-

Press F7 to switch to IMS Reconciliation View.

-

Press F8 to switch to IMS Action View.

Each view highlights the filing status, followed by a relevant classification.

-

Invoices Filed by Supplier: Invoices already filed by your supplier in their GSTR-1. These directly affect your ITC for the current month and should be prioritised for action.

-

Invoices Yet to Be Filed by Supplier: Invoices uploaded to the GST portal but not yet filed by your supplier. These can be reviewed and acted on when appropriate.

In the IMS Inward Supplies report, press Alt+Q (Available Only in Books) to view invoices that are present in your books but missing in the IMS Inward Supplies report and GSTR-2B.

If you want to see the Declared ITC value for invoices in the Return View, press F12 (Configure) and enable the option Show Declared ITC.

IMS Default View

View your invoices based on the action and upload status:

-

Action Required: Downloaded invoices with no action taken.

-

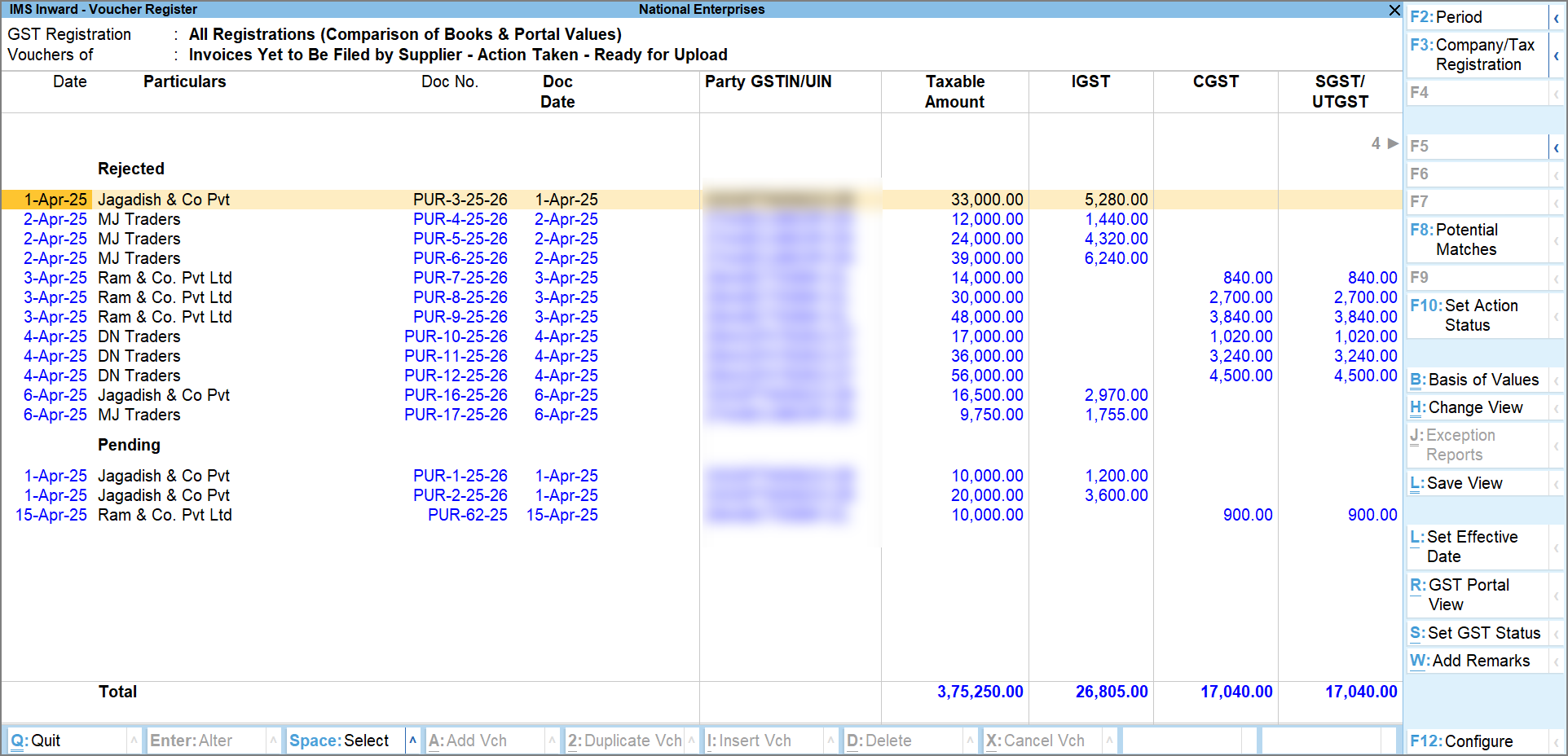

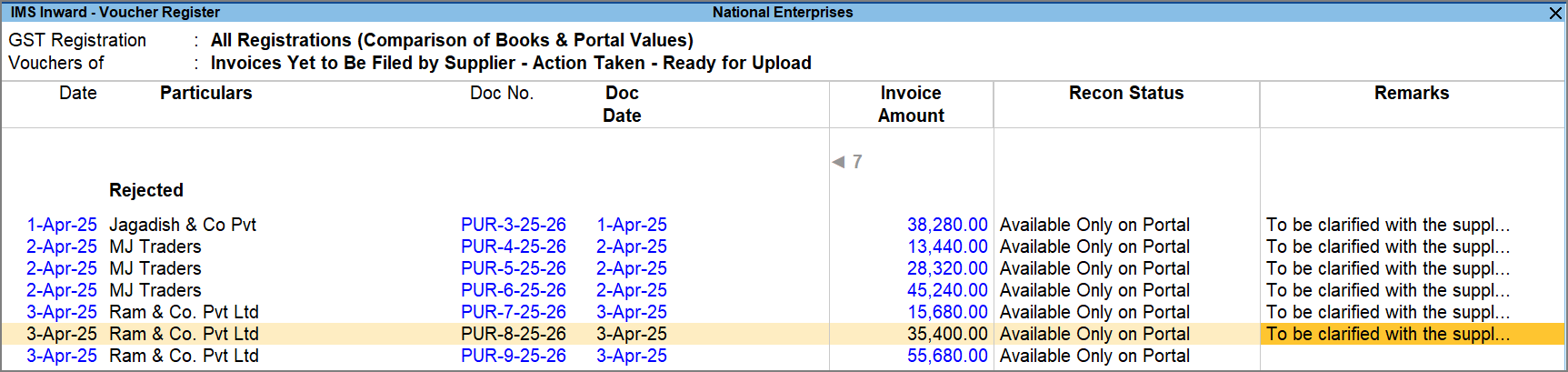

Action Taken – Ready for Upload: Invoices acted upon, but not yet uploaded to the GST portal.

-

Action Taken – Uploaded: Invoices acted upon and uploaded to the portal.

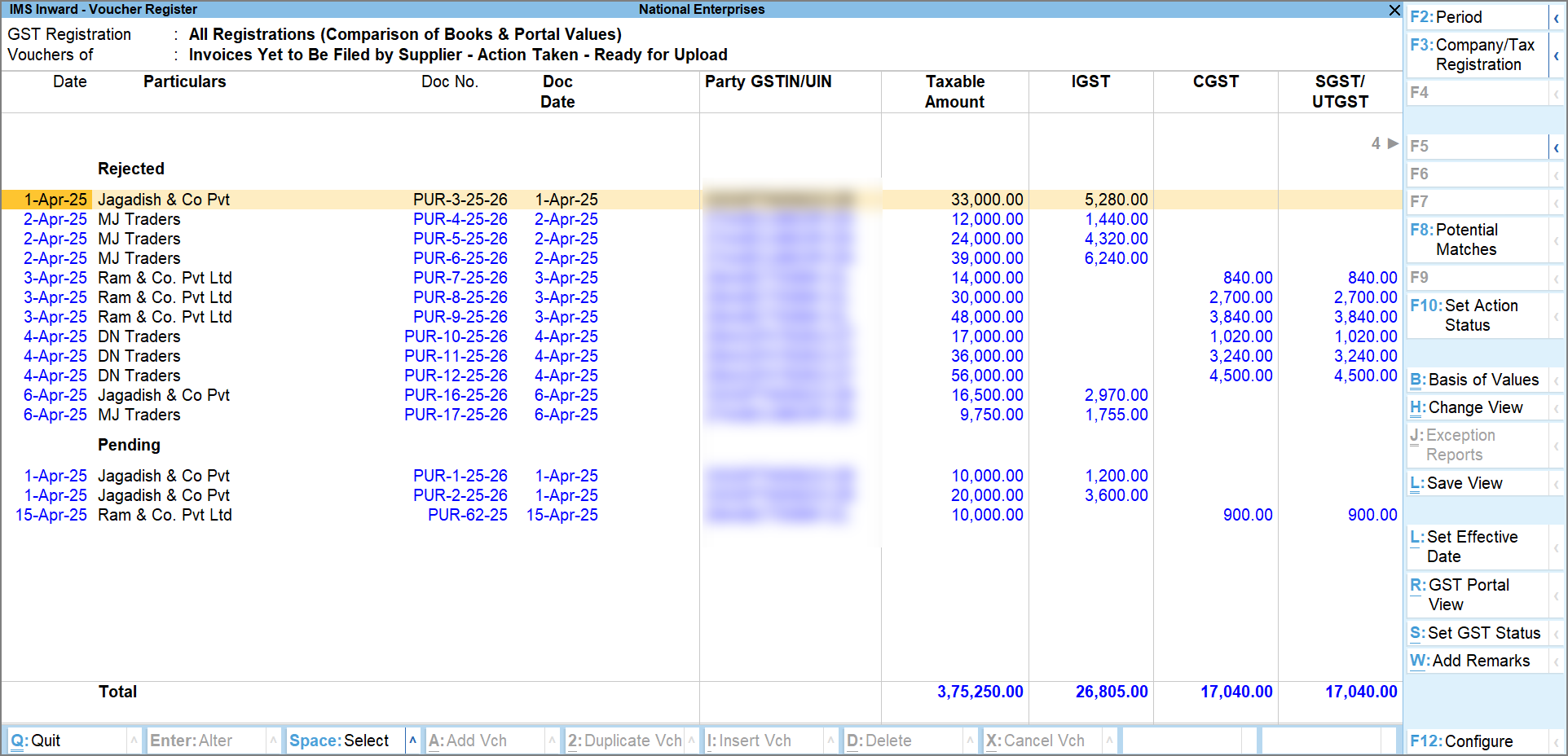

You can drill down from any of these sections to view the respective invoices in the IMS Inward – Voucher Register , and take action accordingly. For example, if you drill down from the Action Required section, the invoices will be grouped according to the reconciliation status, helping you take actions accordingly. Similarly, if you drill down from the Ready for Upload section, the invoices will be grouped as per the Action Status that you have set.

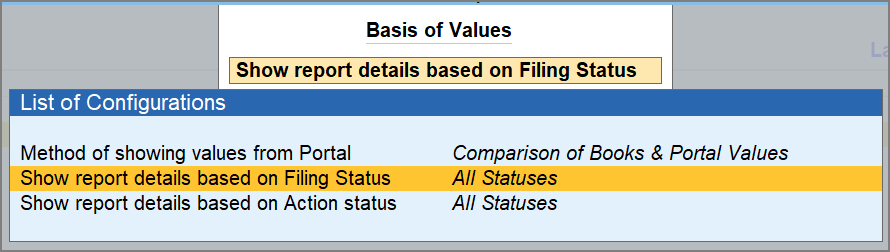

To focus on specific sets of invoices, press Ctrl+H (Basis of Values) to filter by Filing status and Action Status.

IMS Reconciliation View

View your invoices based on the reconciliation results:

-

Reconciled: Invoices that match your book entries.

-

Mismatched: Invoices that differ from your book entries.

-

Available Only on Portal: Invoices present on the portal with no matching entry in your books.

You can drill down from any of these sections to view the respective invoices in the IMS Inward – Voucher Register, and take action accordingly.

To focus on specific sets of invoices, press Ctrl+H (Basis of Values) to filter by Filing status or Reconciliation status.

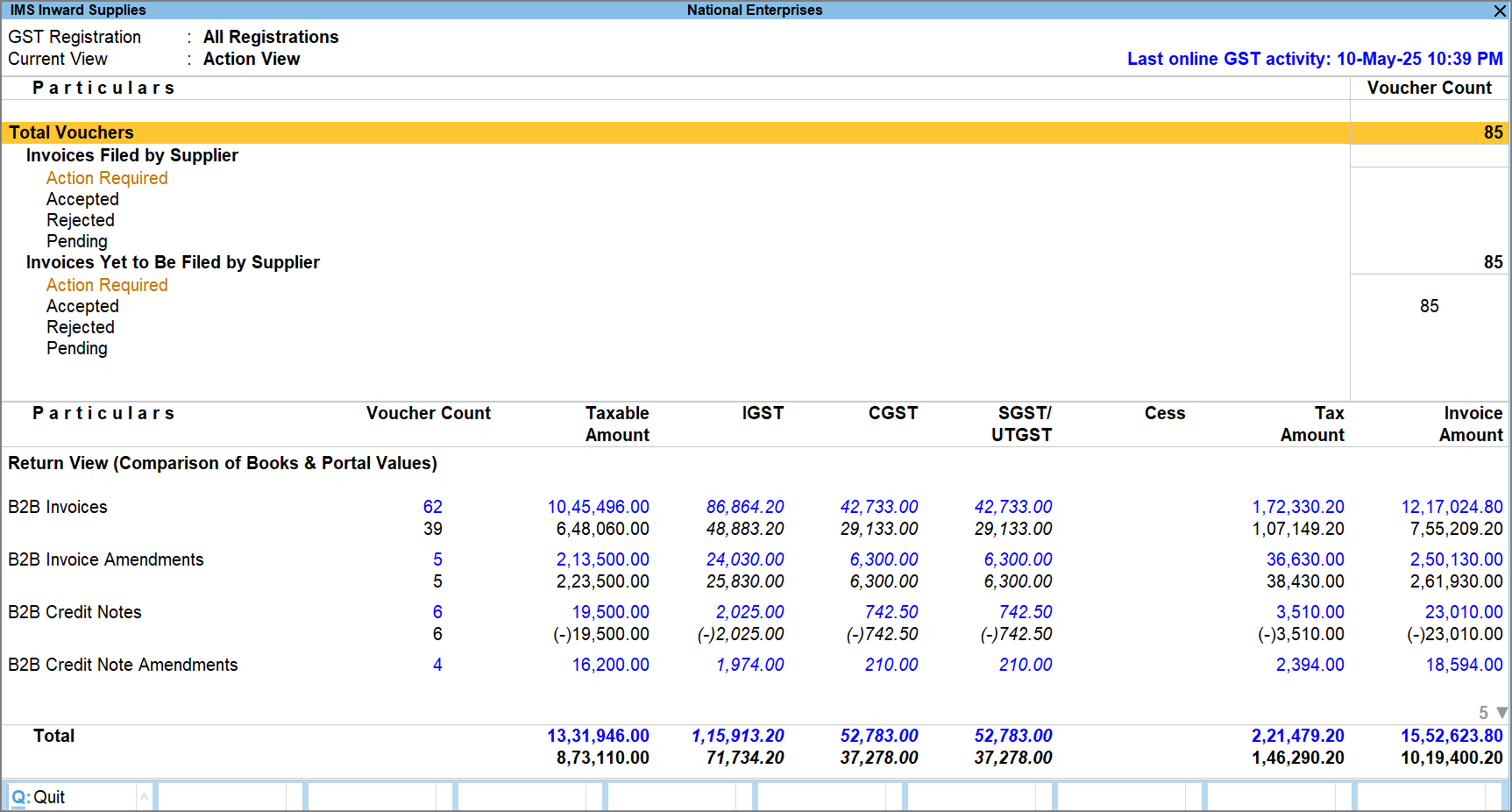

IMS Action View

View your invoices based on the action taken:

-

Action Required: Invoice with no action taken yet.

-

Accepted: Invoices you have accepted.

-

Rejected: Invoices you have rejected.

-

Pending: Invoices you want to keep as pending for future action.

You can drill down from any of these sections to view the respective invoices in the IMS Inward – Voucher Register, and take action accordingly.

To focus on specific sets of invoices, press Ctrl+H (Basis of Values) to filter by Filing status or Action Status.

TallyPrime Release 7.0 onwards, the following new sections have been introduced in the IMS Inward Supplies report: IMPG, IMPGA, IMPGSEZ/strong>, and IMPGSEZA.

Accept, Reject, or Keep ITC Pending | Set IMS Action Status

Once you have downloaded the invoices, you can easily set the IMS Action status from the IMS Inward Supplies report. Depending on the action taken, your ITC will be considered accordingly in GSTR-2B.

You can perform several key actions while managing invoices in IMS:

-

Manage the ITC to be claimed while accepting an invoice.

-

Set the GST Return Effective Date while keeping an invoice pending for the current period.

-

Exclude invoices from GSTR-3B while rejecting them.

-

Add remarks on invoices to note the reason for assigning an action status.

-

Press Alt+G (Go To) > type or select Invoice Management System, and press Enter.

-

Drill down from the required section.

The IMS Inward – Voucher Register screen appears. You can see the vouchers as per the selected section.

-

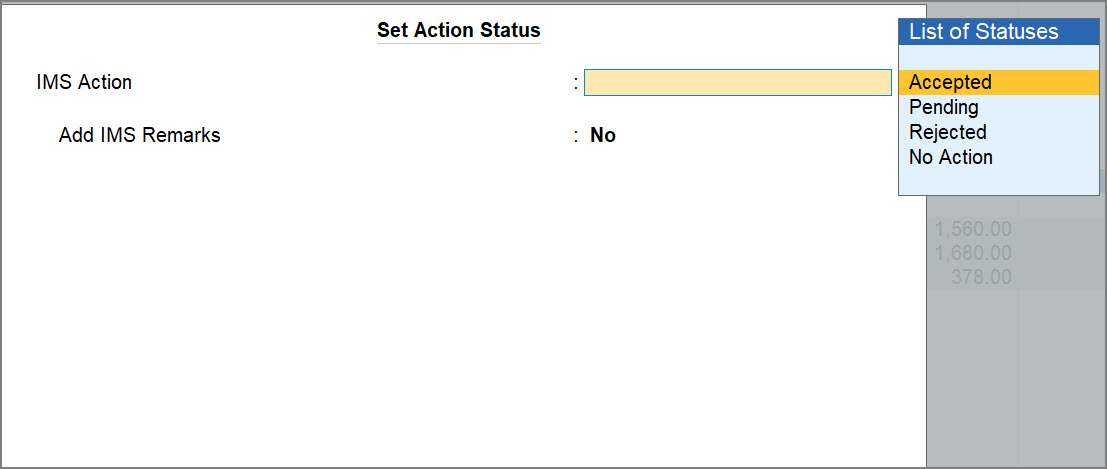

Press Spacebar to select one or more invoices and press F10 (Set Action Status).

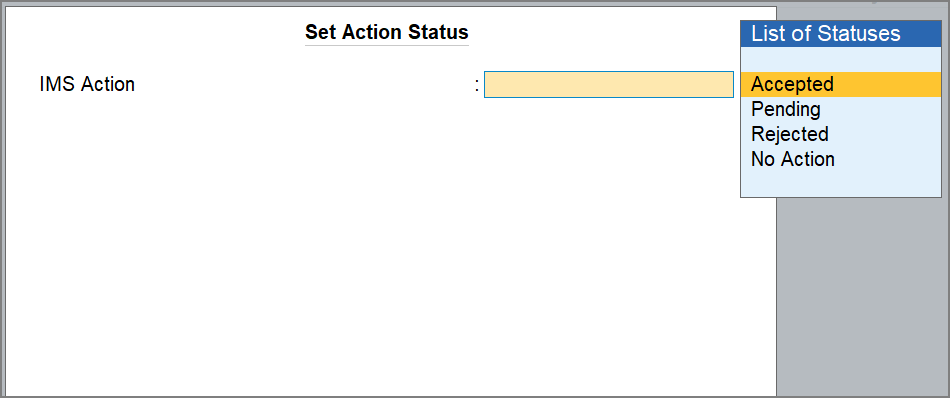

The Set Action Status screen appears:

-

Select the required action from the List of Stauses.

-

Accept: The invoice will be accepted, and ITC will be included in GSTR-2B. Note that you can reduce the ITC while accepting an invoice, if applicable.

-

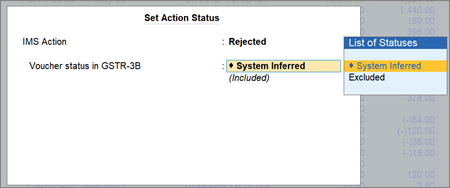

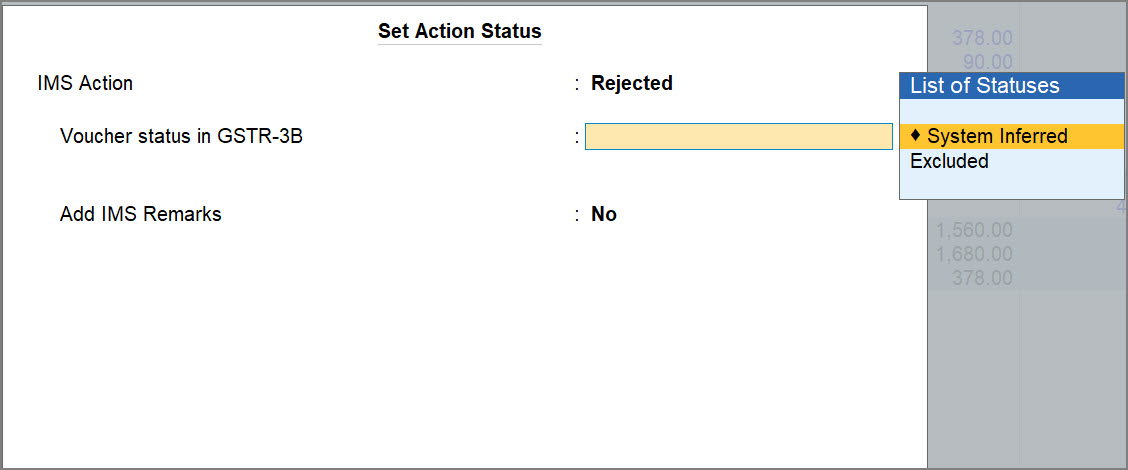

Reject: The invoice will be rejected, and ITC will be excluded from GSTR-2B. It will appear in the ITC Rejected section of GSTR-2B.

Note that while rejecting an invoice, you can exclude it from GSTR-3B of your book data. -

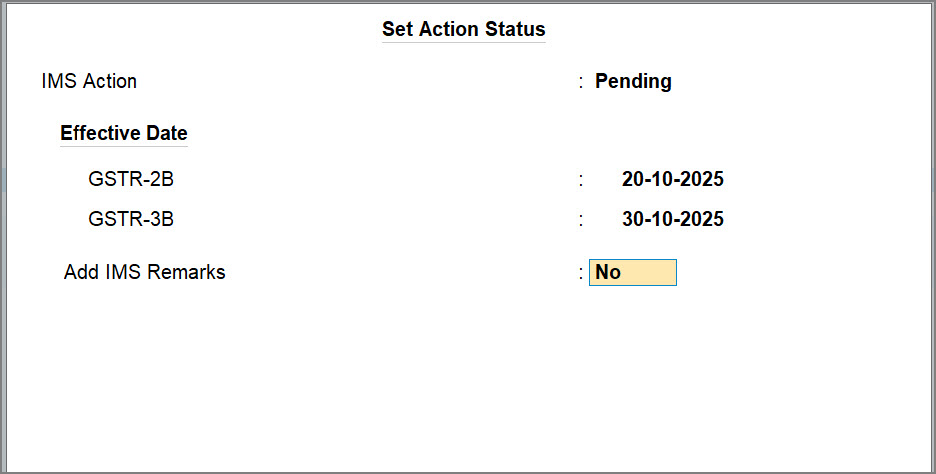

Pending: If you set the Action status as Pending, the invoice will be kept pending for you to review later. It will appear in the Inward Supplies report until you accept or reject it.

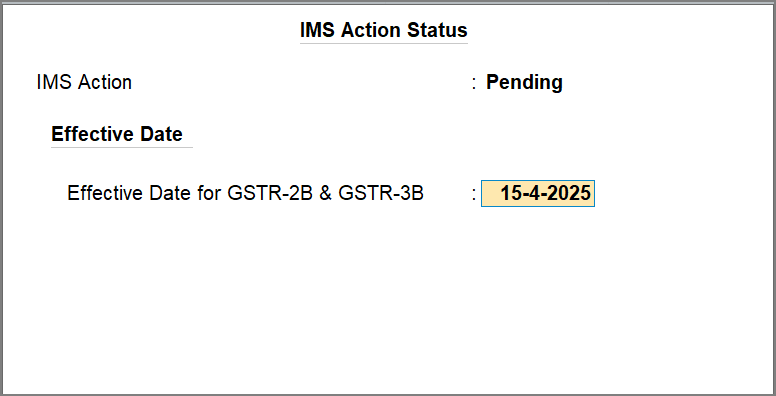

Note that while keeping an invoice as pending, you can set the effective date for GSTR-2B and GSTR-3B of your book data. -

No Action: If you set the Action status as No Action, the invoice will be auto-accepted when GSTR-2B is generated.

-

-

Enable the option Add IMS Remarks, if you want to add a remark on the invoice, and press Ctrl+A to save.

While uploading the IMS Inward invoices, TallyPrime exchange Remarks with the GST portal for invoices with the Action Status as Pending or Rejected across all sections. In addition, for invoices with the Action Status as Accepted, Remarks are exchanged only for specific sections when ITC Reduction is enabled and ITC is partially reduced, or ITC Reduction is set to No. This additional exchange for Accepted invoices is applicable to the following sections: B2BA, B2BCN, B2BCNA, B2BDNA, IMPGA, and IMPGSEZA.

In Release 6.2 and earlier, remarks were exchanged only when the action status was Pending or Rejected.

Change the GSTR Effective Date

While setting the action status as Pending, you can enter the Effective date for GSTR-2B & GSTR-3B.

If you want to enter separate effective dates for GSTR-2B & GSTR-3B, press F12 (Configure) and enable the option Set separate Effective Dates for GSTR-2B & GSTR-3B.

This feature is especially useful when invoices are kept pending for verification and can be accepted after the return for the original period has already been filed. Instead of revising the earlier return, you can simply update the effective date and include the invoice in the current return period. Changing the GSTR effective date allows you to manage delayed acceptances or backdated invoices without disrupting your return cycle.

Exclude Invoices from GSTR-3B

In certain situations, you might want to retain an invoice in your books but prevent it from being included in the GSTR-3B computation. This is helpful when an invoice is being discussed with the party, and not meant for tax calculation in the current return.

For example, if an invoice is rejected due to a price discrepancy or contractual issue, you can choose to exclude it from GSTR-3B.

If you are on TallyPrime Release 6.2, click here.

Once you have downloaded the invoices, you can easily set the IMS Action status from the IMS Inward Supplies report. Depending on the action taken, your ITC will be considered accordingly in GSTR-2B. You can also manage the GST Return Effective date while keeping an invoice pending during the current period, and choose to exclude invoices from GSTR-3B while rejecting them.

Moreover, you can add remarks on invoices to note down the reason for assigning an action status.

-

Press Alt+G (Go To) > type or select Invoice Management System, and press Enter.

-

Drill down from the required section.

The IMS Inward – Voucher Register screen appears. You can see the vouchers as per the selected section.

-

Press Spacebar to select one or more invoices and press F10 (Set Action Status).

The Set Action Status screen appears:

-

Select the required action from the List of Stauses.

-

Accept: The invoice will be accepted, and ITC will be included in GSTR-2B.

-

Reject: The invoice will be rejected, and ITC will be excluded from GSTR-2B. It will appear in the ITC Rejected section of GSTR-2B.

Note that while rejecting an invoice, you can exclude it from GSTR-3B of your book data. -

Pending: If you set the Action status as Pending, the invoice will be kept pending for you to review later. It will appear in the Inward Supplies report until you accept or reject it.

Note that while keeping an invoice as pending, you can set the effective date for GSTR-2B and GSTR-3B of your book data. -

No Action: If you set the Action status as No Action, the invoice will be auto-accepted when GSTR-2B is generated.

-

Once you have acted on the invoices, you can view the IMS – ITC Summary report for a detailed view of the ITC.

Change the GSTR Effective Date

While setting the action status as Pending, you can enter the Effective date for GSTR-2B & GSTR-3B.

If you want to enter separate effective dates for GSTR-2B & GSTR-3B, press F12 (Configure) and enable the option Set separate Effective Dates for GSTR-2B & GSTR-3B.

This feature is especially useful when invoices are kept pending for verification and can be accepted after the return for the original period has already been filed. Instead of revising the earlier return, you can simply update the effective date and include the invoice in the current return period. Changing the GSTR effective date allows you to manage delayed acceptances or backdated invoices without disrupting your return cycle.

Exclude Invoices from GSTR-3B

In certain situations, you might want to retain an invoice in your books but prevent it from being included in the GSTR-3B computation. This is helpful when an invoice is being discussed with the party, and not meant for tax calculation in the current return.

For example, if an invoice is rejected due to a price discrepancy or contractual issue, you can choose to exclude it from GSTR-3B.

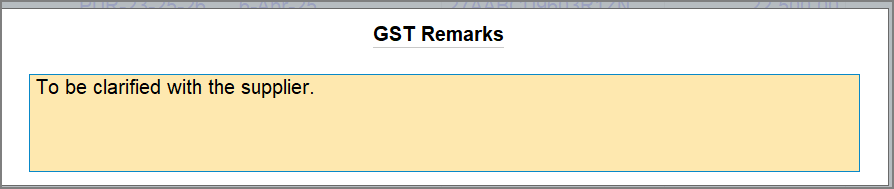

Add Remarks on Invoices

In IMS Inward Supplies, you can add remarks in invoices to record any additional context. This is especially useful for tracking follow-ups, clarifying the reason for marking an invoice as Pending or Rejected, or simply noting important details for audit or review.

-

Press Alt+G (Go To) > type or select Invoice Management System, and press Enter.

-

Drill down from the required section.

The IMS Inward – Voucher Register screen appears. The invoices will be grouped as per the selected section.

-

Select the required invoices by pressing Spacebar, and press Alt+W (Add Remarks).

-

In the GST Remarks field, enter the required notes or comments, and press Ctrl+A to save.

To view the Remarks in IMS Inward – Voucher Register, press F12 (Configure) and enable the option Show Remarks.

Added remarks will appear in the voucher register.