Reconcile GSTR-2B Data | GSTR-2B Reconciliation Report

GSTR-2B is a reconciliation report that is automatically generated from a seller’s filed return, after the due date. Once your sellers or suppliers file the relevant return, such as GSTR-1, GSTR-5, or GSTR-6, then the details of all your purchases as well as Input Tax Credit (ITC) will appear in GSTR-2B.

Accordingly, TallyPrime comes with the GSTR-2B Reconciliation report using which you can download the transactions from the portal and easily reconcile them with the transactions on your books. Moreover, the GSTR-2B Reconciliation also helps you in identifying the transactions where ITC is available or not available.

Here’s how TallyPrime can make your reconciliation journey easier:

Assured compliance

Form GSTR-2B contains different sections or tables for recording many types of supplies, such as B2B Invoices, Amendment to B2B Invoices, and so on. However, with TallyPrime at your fingertips, you do not have to go to any pains to sort or categorise your GST data separately. The GSTR-2B Reconciliation report is perfectly mapped to the tables of form GSTR-2B, and all the details of your GST inward supplies will be automatically assigned to the relevant tables or sections. Once your details are downloaded, you can rest assured that these details will be seamlessly reflected in the respective sections as well. Refer to the Return View section to know more.

Easy, intuitive design

We understand that GST compliance can become tricky due to the sheer variety of transactions and amendments involved. You might be worried if you will be able to find all the transactions that require your attention. However, the GSTR-2B Reconciliation report neatly covers all the transactions in relevant sections, categories, and summaries, with the necessary detailing.

For example, you can find the details for ITC under two broad categories: Input Tax Credit Available and Input Tax Credit Not Available. Under these categories, you can find further details for purchase vouchers (Part A) and purchase returns (Part B), and the reasons for ITC unavailability.

Further, you can easily track your reconciled and unreconciled transactions. The GSTR-2B Reconciliation report is so flexible that it keeps evolving according to the nature of your transactions. For example, if your imported data contains a few transactions that are present only on the portal, then such transactions will automatically appear in a new section called Available Only on Portal. Refer to the Reconciliation Statistics section to know more.

You also have the option to configure the GST Return Effective Date for a transaction. For some reason, you might not have been able to upload a transaction on the GST portal in the same month, or you might have agreed with your counterparty (or supplier) to upload the transaction in the subsequent month. For such transactions, you can easily update the GST Return Effective Date, as needed. Such transactions will automatically appear under Mismatch in Return Period.

What’s more, all the activities pending for reconciliation will be highlighted in amber colour, while the values from the portal will be presented in blue colour for easy identification.

Unmatched performance

GST transactions are typically filled with so many details, and the more transactions you have, the bulkier your data might get. However, with TallyPrime, you do not have to worry about the size of your data. The GSTR-2B Reconciliation report will always be instantly available, that is, as soon as you import your GSTR-2B file, the return information will be reflected in the reports in real-time. Even when you have thousands of GST transactions, GSTR-2B Reconciliation will load the details in a jiffy. Moreover, you will also be able to move across sub-reports or drill down to the transactions with great ease.

Multi-GSTIN support

If your business consists of multiple GST registrations/GSTINs, then the GSTR-2B Reconciliation report provides you with an amazing view of your combined GST details and activities across registrations. You also have the flexibility to view GSTR-2B Reconciliation for only one registration, from any of your companies. You can view and resolve your uncertain transactions for all GSTINs combined or for one GSTIN at a time, based on your business needs.

Additional flexibilities

What’s more, the GSTR-2B Reconciliation report provides you with a host of other flexibilities. For example, after importing the GSTR-2B data, you can either compare the values in your books and in the portal side-by-side, or you can view the difference between the values, depending on your convenience. You also have other options such as viewing the report for all your transactions, or for specific transactions such as Available only in Books or Excluded, but available on Portal. What’s more, you can also choose to ignore minor differences in values between your company books and portal, which might arise use to factors such as rounding off in the Amount.

Directly Download GSTR-2B from TallyPrime

GSTR-2B reconciliation is now easier than ever. You can now download your GSTR-2B right here from TallyPrime, without the need for visiting the GST portal or carrying out any other manual activity. This will help you in reconciling your returns without any hassles.

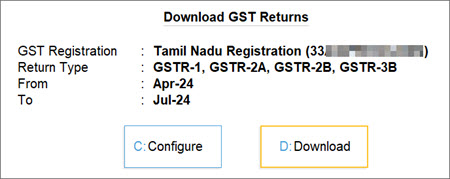

The best part is that you have the flexibility to download returns for multiple GST Registrations, multiple Return Types, and multiple Return Periods, in one go!

You can also set the default return types while downloading GST Returns. Further, TallyPrime automatically identifies the period of the previously filed and downloaded returns. Accordingly, the subsequent period will be prefilled during the next download.

Moreover, you also have the option to redownload any previously downloaded returns. The latest downloads will replace the existing versions.

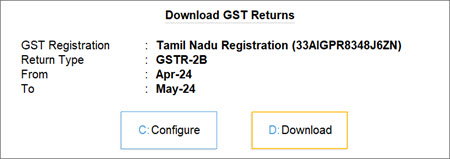

- Press Alt+Z (Exchange) > Download GST Returns.

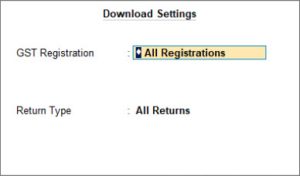

The Download GST Returns screen appears, in which you can see that all the Return Types are selected, by default.

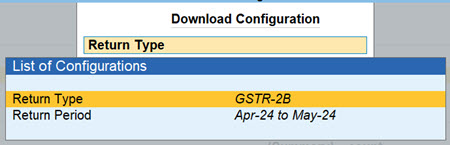

- Press C (Configure) to set the required Return Type, that is GSTR-2B, and the Return Period.

You also have the option to set the default return types for download. - In the Download GST Returns screen, press D (Download).

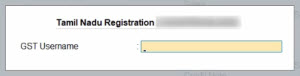

- Log in to your GST profile, if you have not already done so.

- Enter your GST Username.

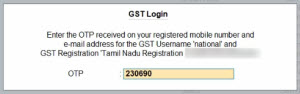

- Enter the OTP received on your registered mobile number, after which your summaries will be exported to the GST portal.

Once you have logged in, the session will be valid for six hours, which will ensure the safety and security of your activities.

- Enter your GST Username.

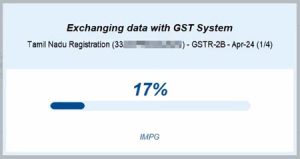

Once GSTR-2B download is initiated, you can easily track the progress.

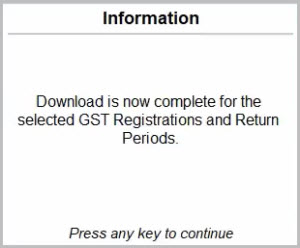

Once the GSTR-2B data is downloaded from the GST portal, you will receive a confirmation.

Now you can view the downloaded details in the GSTR-2B Reconciliation report.

Configure Default Return Types for Download

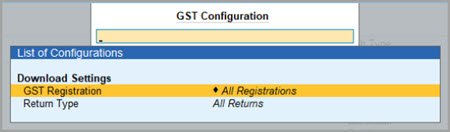

TallyPrime provides you with flexibility to set one or more return types, such as GSTR-2A and GSTR-2B, based on your business preferences.

Subsequently, these return types will be automatically considered as your default returns for download.

- Press Alt+Z (Exchange) > GST.

- Select the required Return Type, such as GSTR-2B.

You also have the flexibility to select multiple Return Types or All Returns.

- Press Ctrl+A to save the configuration.

The selected return types will be considered as the default in subsequent downloads.

Manually Import GSTR-2B Data

This is the first step in an amazingly simple reconciliation process. You only have to import the GSTR-2B file in the GSTR-2B Reconciliation report, after which all the relevant values from the portal will be captured in extensive detail and unparalleled flexibility.

- In the GSTR-2B Reconciliation report, press Alt + O (Import) > GST Returns.

The Import GST Returns screen appears. - Specify the required details such as the GST Registration, Return Type (GSTR-2B), File Path, and the File to Import.

While importing multiple files extracted from a zipped folder, you will be able to view only the files that are required for reconciliation.

- Press Ctrl+A to accept.

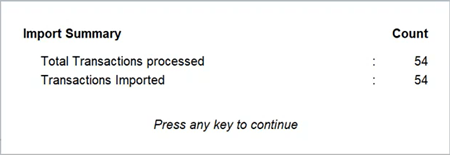

You can see the Import Summary, which will provide you with a clear picture of the number of transactions that were processed, imported, or failed to be imported.

- Press any key to continue.

You can see that the imported details will be captured seamlessly under Reconciled and Unreconciled, as well as in the Return View section, where the respective values from the portal will be highlighted in blue.

Now you can explore and verify the imported details, and make the necessary updates in your GST data.

View GSTR-2B Reconciliation

Header | View Company Information

The header section in GSTR-2B Reconciliation captures some of your key information up front, such as the Company, GST Registration, Period, Status of returns (Signed/Not Signed), and so on. If required, you can change one or more of these necessary details, and the contents of the reports will be updated accordingly.

What’s more, if your business consists of multiple GST registrations/GSTINs, then the GSTR-2B Reconciliation report provides you with an amazing view of your combined GST details and activities across registrations. However, TallyPrime also provides you with the flexibility to view GSTR-2B Reconciliation for only one registration, from any of your companies.

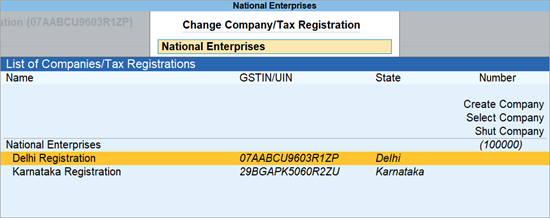

View GSTR-2B Reconciliation for a specific GSTIN

Press F3 (Company/Tax Registration) and select the required company or registration from the list.

The GSTR-2B Reconciliation report will then open for the selected registration.

![]()

Based on your requirements, you can even set a particular registration as the default using the Save View feature, so that GSTR-2B Reconciliation will open the details of your desired registration every time.

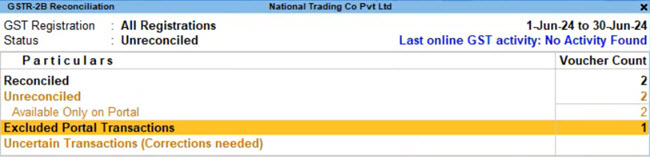

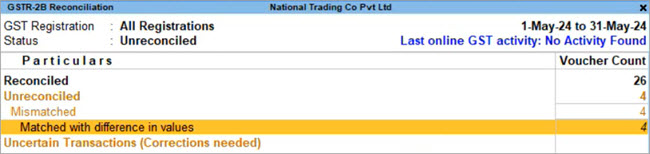

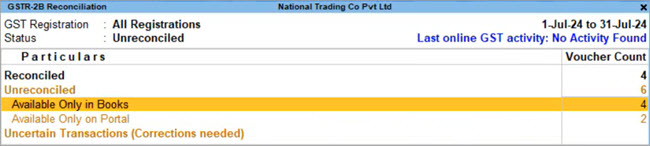

Reconciliation Statistics | View Statistics & Verify Details

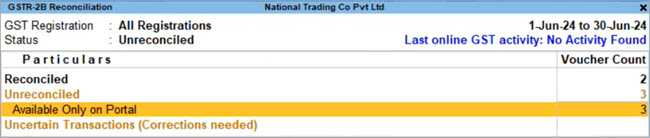

The Reconciliation Statistics section gives you a bird’s eye view of the key numbers and details across your GST transactions. You will get a clear picture of the number of reconciled, unreconciled, and uncertain transactions. You can drill down from each of these sub-sections to take a closer look at the transaction details.

The best part is that the Reconciliation Statistics section evolves according to the nature of your actions. For example, after you import your transactions for GSTR-2B Reconciliation filing, you can find new sections like Available Only on Portal and Mismatch in Return Period, based on the nature of your imported transactions.

What’s more, you can drill down from each section to view the Statistics screen for a detailed breakup of the type of vouchers involved. For example, you can see how many journal vouchers are included in the return, and how many are not relevant or uncertain. The best part is that you can further drill down to see the full list of journal vouchers that have been recorded during the return period.

You can view or hide this section by pressing Ctrl+H (Change View) > Reconciliation Statistics.

The Reconciliation Statistics section will display the following sections, based on your actions and transactions.

- Reconciled

- Unreconciled

- Mismatched

- Available Only in Books

- Available Only on Portal

- Mismatch in Return Period

- Excluded, but available on Portal

- Uncertain Transactions (Corrections needed)

- Invoices Rejected in IMS

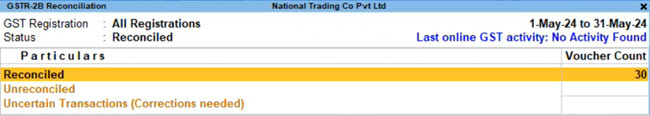

Reconciled

The Reconciled section will provide you with a count of the transactions in GSTR-2B that are already reconciled, and you don’t have to worry about them from a filing perspective.

However, if you want to verify the transactions, you can further drill down to see the full list of reconciled transactions in the selected period.

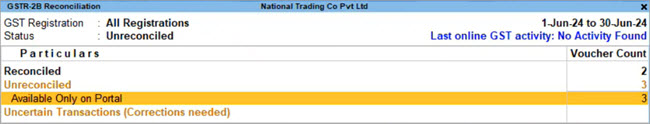

Unreconciled

The Unreconciled section will provide you with a count of the transactions in GSTR-2B that are yet to be reconciled. After you import the GSTR-2B data, you can see that the Unreconciled transactions will be further categorised into Available Only in Books, Available Only on Portal, and Mismatch in Return Period.

You can further drill down to see the full list of unreconciled transactions in the selected period.

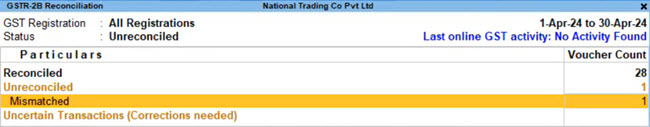

Mismatched

This section will capture the unreconciled transactions in which certain GST details are not matching between your books and the portal.

You can further drill down to see the full list of unreconciled transactions in the selected period.

Available only in Books

This section captures all the transactions that are present only in your books but are yet to listed in your party’s GSTR-2B. You can make a note of such transactions and correspond with your parties, as needed.

You can further drill down to see the full list of transactions available only in your books in the selected period. In TallyPrime Release 5.0, you can drill down from invoices and debit notes without the Supplier Invoice No. and Date, and directly update them to reconcile.

Available only on Portal

This section captures all the transactions that are present exclusively on the portal, and not in your company books. For such transactions, you can easily record a corresponding entry in your books.

You can further drill down to see the full list of transactions available only on the portal in the selected period.

Mismatch in Return Period

This section captures transactions that are present in both your books and on the portal, but in different periods, which leads to issues in reconciliation.

You can further drill down to see the full list of transactions in the selected period.

Excluded, but available on Portal

This section captures transactions that have been excluded from books but are present on the portal.

You can further drill down to see the full list of transactions excluded from the current return period.

Uncertain Transactions (Corrections Needed)

This section captures all the transactions with GST-related errors. You can drill down further from the section to view all such uncertain details and correct them. Even if you have hundreds of transactions, you can easily find and fix a particular error.

Invoices Rejected in IMS

This section captures the transactions that were rejected in the IMS Inward Supplies report. These are the invoices you have chosen to exclude from ITC consideration, so they will not impact your return filing. You can further drill down to see the full list of rejected invoices in the selected period.

Export GSTR-2B to Excel as per the old GSTR-2 format

In TallyPrime Release 5.0 onwards, you can export the GSTR-2B report to Excel as per the old GSTR-2 format.

- Press Alt+E (Export) > Current > F8 (File Format).

- Select Excel (Spreadsheet) as the File Format and set the option As per old format (GSTR-2) to Yes.

The report will be exported in the GSTR-2 format.

Return View | View GST Details as per Form GSTR-2B

The Return View section is your personal map of the GSTN portal. Every section or table in Form GSTR-2B is faithfully represented in this section, so that you can conveniently view and compare the values. After you have imported the GSTR-2B data, you can see that the values from the portal will appear alongside the values in your books, in the relevant sections.

The values from the portal will be highlighted in blue for easy identification, and wherever the books and portal data are reconciled, the values in blue will appear as zero.

Categorisation as per ITC

Return View is broadly divided into two parts, based on ITC availability or unavailability. Accordingly, you can find the respective sum totals (Total Available ITC and Total Unavailable ITC) for easy reference.

Moreover, all of your details for GSTR-2B are conveniently placed under the following categories (or headings) of ITC:

- Input Tax Credit Available – Part A

- Reversal of Available ITC (Purchase Return) – Part B

- Input Tax Credit Unavailable – Part A

- Reversal of Unavailable ITC (Purchase Return) – Part B

You can expand (by pressing Shift+Enter) or drill down (by pressing Enter) from the above categories to view the relevant sub-categories and sections as per the portal.

For example, if you expand the All other ITC from Registered Persons (Excluding Reverse Charge) section, you can see the following sections:

- B2B Invoices

- B2B Debit Notes

- Amended B2B Invoices

- Amended B2B Debit Notes

However, you can also drill down from the above section, if you want to explore further details and options.

The following table details the categories, sub-categories, and sections covered in the Return View of GSTR-2B Reconciliation.

|

Category

|

Sub-Categories & Sections

|

|---|---|

Input Tax Credit Available – Part A |

|

Reversal of Available ITC (Purchase Return) – Part B |

|

Input Tax Credit Unavailable – Part A |

|

Reversal of Unavailable ITC (Purchase Return) – Part B |

|

You can drill down from any of the above sections for a more detailed view of the status of reconciliation for your transactions.

For example, if you drill down from the B2B Invoices section, you can see the transactions grouped under the respective parties.

You can further drill down from a party and view the details of the transactions, including the details of ITC. This will help you immensely in understanding if there are any differences or discrepancies.

For example, you might have recorded certain transactions as ITC Available, whereas on the portal, the corresponding transactions might have been uploaded as ITC Not Available. Accordingly, you can update the details based on the actual status.

You can also view the reconciliation status for your parties under the GST Status column.

Moreover, you can drill down from any of the parties with Unreconciled status and view your transactions in greater detail. You can see that your unreconciled transactions are categorised in different sections, so that you can easily take the necessary actions for resolving any differences in transactions.

The following categories of transactions will be available in the above screen.

- Mismatched

- Mismatch in Return Period

- Available only on Portal

- Reconciled

If required, you can filter the report to view only one of the above categories of transactions, by pressing Ctrl+H (Basis of Values).

Mismatched

In the Mismatched section, you can easily find and resolve any differences between your book and portal values. You can refer to the values under the columns and figure out if there any issues.

What’s more, you can explore F12 (Configure) and view other factors that might lead to mismatch. such as differences in Invoice Type, Reverse Charge details, Declared ITC value, and so on. Once you enable these options, the respective columns will start appearing in the report.

Resolve Mismatched transactions

Let us take the example of a difference in the Tax Amount for a transaction in your books and on the portal. Sometimes, there might be a minor difference in the Tax Amount due to round-off mechanism. However, if you are aware of such differences and you want to ignore them, then you can reconcile the relevant transactions.

For such transactions with minor issues, you can easily update the reconciliation status by pressing Alt+S (Set GST Status), and set the status as Reconciled.

The transaction will now appear in the Reconciled section instead of the Mismatched section.

Mismatch in Return Period

Sometimes, there might be a mismatch in the date of the transaction, due to which it might appear in different return periods for you and your party. This might have happened if you have received the supply in a particular month, while your party has issued an invoice for the same transaction in the previous month.

Sometimes, for a few transactions, there might be a mismatch in the return period between the books and the portal. For example, you might have recorded the transaction in the month of April, while the corresponding invoice might be uploaded in May, due to which there might be a mismatch in the return period.

For such transactions, you can simply update the GST Return Effective Date in your books, by pressing Alt+L (Set Effective Date).

After you update the date and make it consistent with your party, the transaction will move to the Reconciled section.

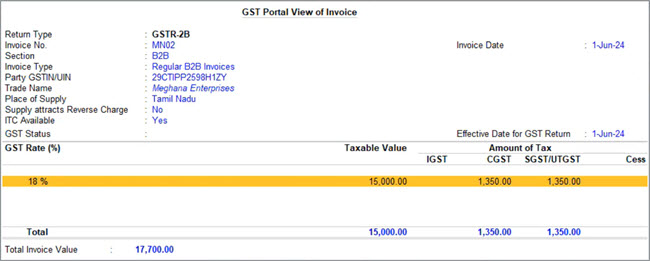

Available only on Portal

This section captures all the transactions that are available in your party’s GSTR-2B on the portal, but not recorded in your books.

If such transactions are indeed valid, then you can easily record a corresponding entry in your books.

You can view the transaction in greater detail by pressing Alt+R (GST Portal View).

Now you can note down all the necessary details, such as Invoice No., Section and Invoice Type, and record the transaction in your books using the same details.

After you record the transaction and make it consistent with your party, the transaction will move to the Reconciled section.

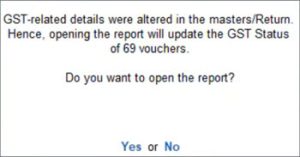

Recompute GSTR-2B

With the introduction of the Invoice Management System by the GST Council, you may need to Recompute GSTR-2B even after it is generated, to ensure that the Input Tax Credit (ITC) is updated accurately in the report. This becomes necessary whenever there are changes in the data that affect ITC availability. Such scenarios may include rejecting or keeping invoices pending in the IMS, reversal of ITC in case of ineligibility, recording or modifying purchase invoices, updating GST details, or changing the GSTR effective date. Due to such scenarios, an error might appear while uploading GSTR-3B, asking you to Recompute GSTR-2B.

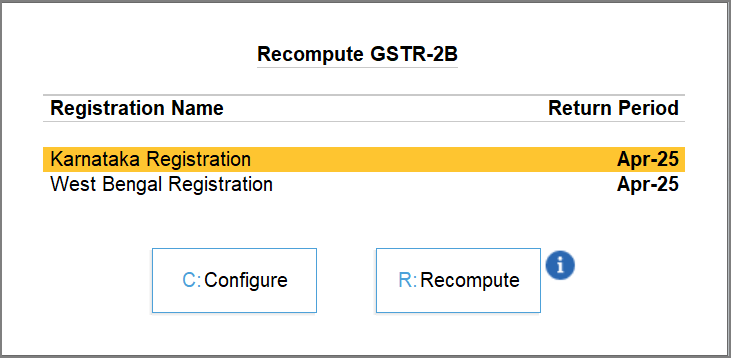

In TallyPrime Release 6.1 and later, you can recompute GSTR-2B in just a few simple steps, so that your ITC is accurate and compliant before filing. The return period for recomputing GSTR-2B will be automatically filled as per the upcoming GSTR-3B filing, assisting you with a hassle-free filing. You can change the return period for recomputing GSTR-2B, if needed.

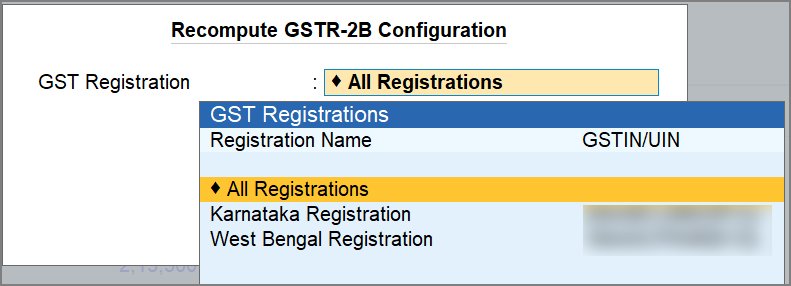

-

Press Alt+Z (Exchange) > All GST Options > Recompute GSTR-2B.

-

In Recompute GSTR-2B Configuration, select the required GST Registration and press Enter.

-

Press C (Configure) to configure the Return Period, if required.

It will be automatically filled as per the upcoming GSTR-3B filing date.

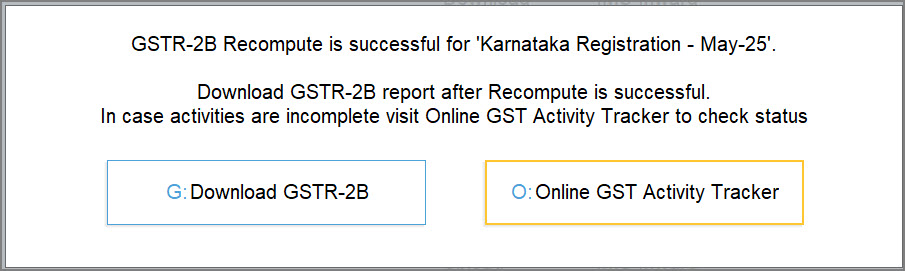

Once the recompute is successful, you will get a confirmation message. You can download the GSTR-2B to view the latest changes in the data after recomputing.

Sometimes, recomputation of GSTR-2B may not happen instantly due to server issues or high traffic on the GST portal. You can refresh the GST status after a few minutes.

For real-time updates of the recompute activity, check the Online GST Activity Tracker report.

View and Resolve Potential Matches in Transactions

Even when you take all precautions while recording your GST details, sometimes your transactions may not be reconciled due to minor differences in details such as Section, GSTIN, or Doc No. However, the GSTR-2A Reconciliation report in TallyPrime possesses the intelligence to identify such transactions, where almost all the key details (such as Taxable Amount and Tax Amount) are matching, apart from minor differences in Section, GSTIN, or Doc No, and so on.

All such potentially matching transactions will be grouped together under specific sections such as Potential matches (Excluding Section), Potential matches (Excluding Party GSTIN/UIN), and Potential matches (Excluding Doc No.). This easy grouping of your potential transactions will help you take the necessary action to reconcile your transactions.

For example, if the details are correct on the portal but incorrect in your books, then you can easily update the relevant details in your books in TallyPrime, after which the transactions will be reconciled. On the other hand, if the details are correct in your books and incorrect on the portal, then you can reach out to your party or customer and request them to update the details. Once the party uploads the corrected details in the subsequent return, you can mark the transactions as reconciled.

To get started with the Potential Match feature, you have to press F12 (Configure) in the GSTR-2B Reconciliation report and enable the option Show potential matches between Books and Portal. Now, based on the nature of corrections required, your potentially matching transactions will be conveniently listed under sections such as Potential matches (Excluding Section), Potential matches (Excluding Party GSTIN/UIN), and Potential matches (Excluding Doc No.).

Potential matches (Excluding Section)

Under this section, you can view the transactions that are similar in all aspects except the Section, which might appear correctly on the portal but not in your books (B2B), and vice versa.

For example, let us take the following transactions recorded for Suraj Enterprises, which appear under Potential matches (Excluding Section).

You can see two transactions, one corresponding to your books and the other (in blue) corresponding to the details on the portal. Both the transactions are similar in all aspects except the Section, which appears correctly on the portal (CDNR) but not in your books (B2B).

This may have happened when you had recorded the original transaction as a regular purchase and later filed for an increase in purchase value, which has to be recorded in a credit note. However, you can easily resolve this difference in Section by opening the transaction in your books and updating the voucher type.

Here is how you can resolve the differences:

- Drill down from the first entry under Potential matches (Excluding Section), which will open the transaction that was recorded in your books.

The transaction will appear as shown below:

- Update the voucher type from Purchase to Credit Note by pressing Alt+F10 (Other Vouchers) > Credit Note. You can see that the correct voucher type is reflected in the transaction.

- Enter the relevant GST details:

- Enable the Provide GST Details option in the transaction screen.

- Specify the Reason for Issuing Note, Supplier’s Debit/Credit Note No., and Date.

- Press Ctrl+A to save the transaction.

Now the details in your books and on the portal will be reconciled, and the transactions appear under the Reconciled section of the GSTR-2B Reconciliation report.

Potential matches (Excluding Party GSTIN/UIN)

Under this section, you can view the transactions that are similar in all aspects except the GSTIN/UIN of the party, which might appear correctly on the portal but not in your books (B2B), and vice versa.

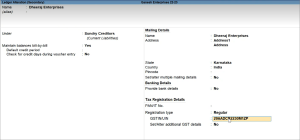

For example, let us take the following transactions recorded for Dheeraj Enterprises, which appear under Potential matches (GSTIN/UIN).

![]()

You can see two transactions, one corresponding to your books and the other (in blue) corresponding to the details on the portal. Both the transactions are similar in all aspects except the GSTIN/UIN, which appears correctly on the portal but not in your books, as the alphabet O has been mistakenly used instead of the number 0. However, you can easily resolve this by updating the correct GSTIN in your transaction and party masters.

Here is how you can resolve the differences:

- Drill down from the first entry under Potential matches (GSTIN/UIN), which will open the transaction that was recorded in your books.

The transaction will appear as shown below:

- Update the GSTIN/UIN in the party master:

- Press Ctrl+Enter from the party, that is, Dheeraj Enterprises.

- Enter the correct GSTIN/UIN.

- Press Ctrl+A to save the details.

- Press Ctrl+Enter from the party, that is, Dheeraj Enterprises.

- Update the GSTIN/UIN in the Party Details of the transaction.

- Press Ctrl+A to save the transaction.

Now the details in your books and on the portal will be reconciled, and the transactions will appear under the Reconciled section of the GSTR-2B Reconciliation report.

Potential matches (Excluding Doc No.)

Under this section, you can view the transactions that are similar in all aspects except the Doc No. (or Vch No.), which might appear correctly on the portal but not in your books (B2B), and vice versa.

For example, let us take the following transactions recorded for Mathaji & Co., which appear under Potential matches (Doc No.).

You can see two transactions, one corresponding to your books and the other (in blue) corresponding to the details on the portal. Both the transactions are similar in all aspects except the Doc No., which appears correctly (MC/2333) on the portal but not in your books (MC/233). However, you can easily resolve this by specifying the correct voucher number in your transaction.

Here is how you can resolve the differences:

- Drill down from the first entry under Potential matches (Doc No.), which will open the transaction that was recorded in your books.

- Update the voucher number, as shown below:

- Press Ctrl+A to save the transaction.

Now the details in your books and on the portal will be reconciled, and the transactions will appear under the Reconciled section of the GSTR-2B Reconciliation report.

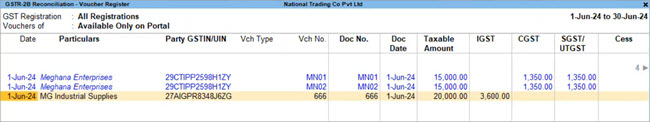

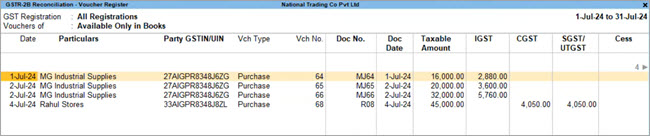

Exclude Transactions Appearing Only on the Portal

In some cases, transactions might appear only on the GST portal and not in your books. For instance, this can happen when a supplier has accidentally entered your GSTIN, instead of the GSTIN of the relevant party, and uploaded the GST invoices.

In GSTR-2A and GSTR-2B, such transactions will appear in the Available Only on Portal section under Unreconciled. If these transactions are not relevant for you, then you can easily exclude such transactions from your books. Whenever needed, you can refer to these transactions by going to the Excluded Portal Transactions section.

- Press Alt+G (Go To) > GSTR-2B Reconciliation.

- Under Unreconciled, drill down from the Available Only on Portal section.

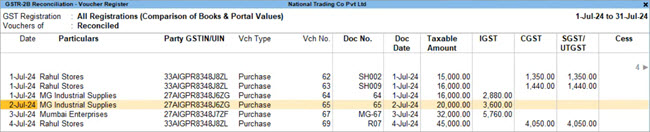

In this example, let us assume that the portal transaction for MG Industrial Supplies is not relevant for you.

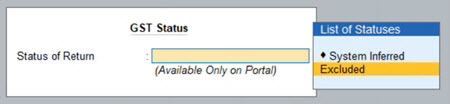

- Press Alt+S (Set GST Status) and set the Status of Return as Excluded.

This will exclude the transaction for MG Industrial Supplies.

You can refer to such transactions anytime by going to the Excluded Portal Transactions section.

Later, if you feel that the transaction is indeed needed in your books, then you can simply update the status to System Inferred. The transaction will be moved back to the Available Only on Portal section.

Reconcile Transactions with Difference in Taxable Amount

In some cases, the taxable value in your transactions might not exactly match the value of the invoice uploaded by your supplier on the GST portal. As a result, these transactions are flagged as Mismatched in your GST Returns. TallyPrime 6.1 has introduced a configuration to reconcile transactions even if there are differences in the taxable amount. Once enabled, the system will ignore differences in taxable value and only consider the tax amount to reconcile vouchers automatically.

- In the GST Details screen, press F12 (Configure) and enable the option Ignore difference in Taxable Amount.

- Open the company and press F11 > Enable Goods and Services Tax (GST) > Yes.

- Press F12 and enable the option Ignore difference in Taxable Amount under Reconciliation Details.

Once you enable this configuration, the system will ignore differences in taxable value between the book data and portal data, and only consider the tax amount to reconcile vouchers automatically.

Reconcile Transactions with Roundoff Amount

In some cases, the values in your transactions might not match the values available on the GST portal, due to a difference in the roundoff value. In such cases, the transactions will appear in the Unreconciled section of GSTR-2A and GSTR-2B. However, you can easily reconcile such transactions by just enabling the relevant configuration in Company GST Registration Details and applying the effective date.

The best part is that you won’t have to repeat this procedure again and again. Once you configure this option, the roundoff amounts will get automatically reconciled in the subsequent transactions as well.

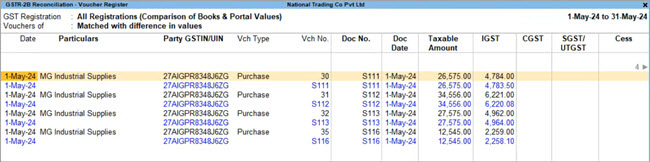

Step 1: Identify transactions with mismatch in roundoff amount

- Press Alt+G (Go To) > GSTR-2B Reconciliation.

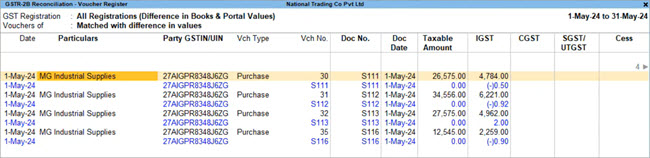

- Under Mismatched, drill down from the Matched with difference in values section.

In this example, for MG Industrial Supplies, you can see that there’s a difference between the values in the books and the values (in blue) fetched from the portal.

- Press Ctrl+B (Basis of Values) and set the Method of showing values from Portal as Difference in Books & Portal Values.

You can see the exact difference between the books and portal values.

Step 2: Enable configuration & reconcile mismatch in roundoff amount

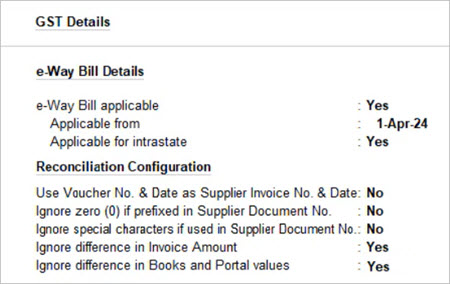

- Press F11 > Enable Goods and Services Tax (GST).

- In GST Details, under Reconciliation Configuration, enable Ignore difference in Books and Portal values.

Ensure that you have first enabled the corresponding configuration from F12 (Configure) > Ignore difference in Books and Portal values.

- Configure further options for round off.

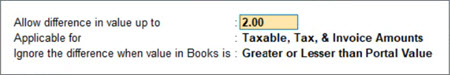

-

Allow difference in value up to: You can set the roundoff limit (for example, Rs 2) as per your business requirements.

-

Applicable for: You can set the roundoff applicability for Taxable, Tax, & Invoice Amounts.

-

Ignore the difference when value in books is: You can set the option for ignoring the roundoff difference as Greater or Lesser than Portal Value.

-

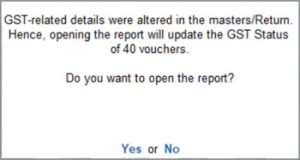

- Enter the Effective Date for the revised GST details.

- Press Enter to open the report.

Now these details will be updated in your transactions, along with the GST Status.

GSTR-2B Reconciliation will open, in which you can see that the transactions are now reconciled.

In this way, this simple configuration will help you in reconciling the differences in the roundoff amount.

Going forward, all your transactions with roundoff will be directly reconciled, without the need for any manual intervention. You won’t have to repeat this procedure again and again.

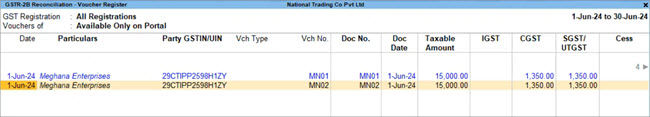

View Trade Names of Parties Appearing Only on the Portal

GSTR-2B now provides you with the flexibility to view a party’s Trade Name, even when the ledger is not available in your Books. In the portal view of the invoice, you can see all the party details that are available in real-time on the GST portal.

In this way, you can easily identify the supplier and create the corresponding ledger and transactions. However, if the transactions are not relevant for you, then you also have the flexibility to exclude them from your books.

- Press Alt+G (Go To) > GSTR-2B Reconciliation.

- Under Unreconciled, drill down from the Available Only on Portal section.

In this example, under Particulars, you can see that MG Industrial Supplies appears in regular font, which indicates that the corresponding party ledger is available in your books.

On the other hand, Meghana Enterprises appears in italics, as the corresponding party ledger is not available in your books.

- Press Alt+R (Portal View) for a better view of the party details available on the portal.

Now you can refer to these details, such as Trade Name and Place of Supply, and create the ledger in your books. Or you can simply create the ledger using the GSTIN/UIN of the party.

Reconcile Purchases with TDS or TCS Amount

In some cases, there might be a difference in the invoice amount when TDS is available for the buyer but not for the supplier. This can happen when TDS was added in the purchases. Such transactions will appear in the Unreconciled section of GSTR-2A and GSTR-2B.

However, you can easily reconcile these transactions by just enabling the relevant configuration in Company GST Details and applying the effective date. The best part is that you won’t have to repeat this procedure again and again. Once you configure this option, the TDS amounts will get automatically reconciled in the subsequent purchases as well.

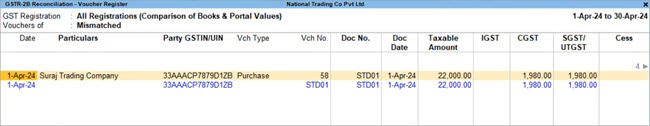

Step 1: Identify transactions with mismatch in TDS amount

- Press Alt+G (Go To) > GSTR-2B Reconciliation.

- Drill down from the Mismatched section.

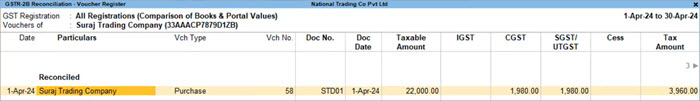

In this example, for Suraj Trading Company, you can see that the transaction in the books is not matching the transaction (in blue) fetched from the portal.

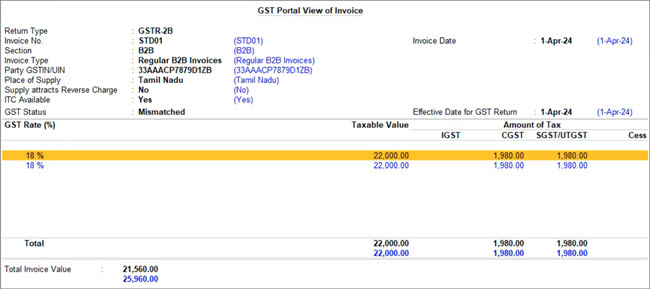

- Press Alt+R (GST Portal View) for a detailed comparison of the transaction details.

In GST Portal View of Invoice, you can see that the Total Invoice Value in your books is not matching the value from the portal.

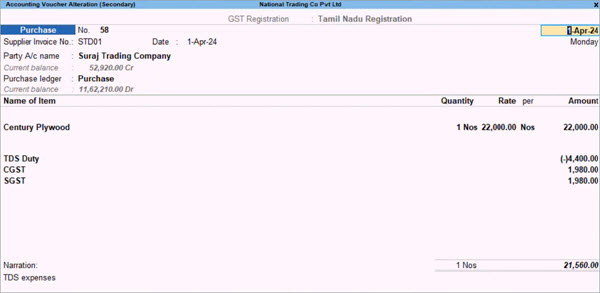

When you open the transaction in your books, you can see that TDS has been applied, which is proving to be the difference in the invoice amount.

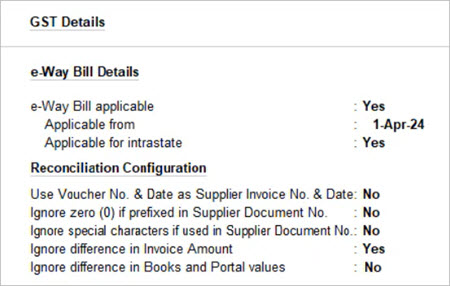

Step 2: Enable configuration & reconcile mismatch in TDS amount

- Press F11 > Enable Goods and Services Tax (GST).

- In GST Details, under Reconciliation Configuration, enable Ignore difference in Invoice Amount.

Ensure that you have first enabled the corresponding configuration from F12 (Configure) > Ignore difference in Invoice Amount.

- Enter the Effective Date for the revised GST details.

- Press Enter to open the report.

Now these details will be updated in your transactions, along with the GST Status.

GSTR-2B Reconciliation will open, in which you can see that the transactions are now reconciled.

In this way, this simple configuration will help you in reconciling any differences in the invoice amount.

Going forward, all your purchases with TDS will be directly reconciled, without the need for any manual intervention. You won’t have to repeat this procedure again and again.

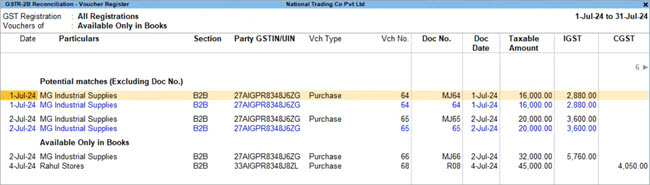

Copy Doc No. from Portal to Books

In GSTR-2A or GSTR-2B, the Doc No. of some of your transactions might not match the Doc No. available on the GST portal. In such cases, the transactions will appear in the Available Only in Books (or Available Only on Portal) section under Unreconciled.

You can easily reconcile such transactions by just copying the relevant information from the portal to your books.

- Press Alt+G (Go To) > GSTR-2B Reconciliation.

- Under Unreconciled, drill down from the Available Only in Books section.

- Press F12 (Configure) and enable the Show potential matches between Books and Portal option.

You can see the potential matches between the transactions in your books and the transactions fetched from the portal.

For MG Industrial Supplies, you can see that the only mismatch between the transactions is the Doc No.

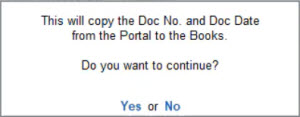

Let us update the transactions with Doc No. 64. - Press Alt+W (Copy Doc No. & Date).

- Press Enter to proceed.

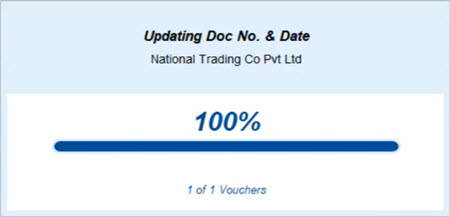

The Doc No. and Doc Date will be updated from the Portal to the Books.

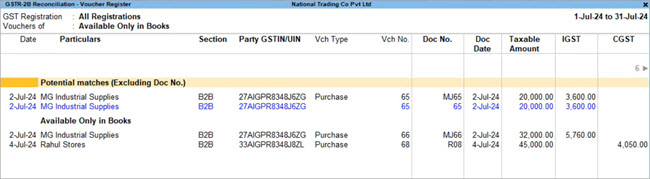

You can see that the transactions with Doc No. 64 are now reconciled.

Similarly, you can select multiple transactions using Spacebar and copy the respective Doc Nos.

The updated transactions will now appear in the Reconciled section.