GST Amendments for Purchases

If there is a change in the invoice after you have purchased a particular set of goods or services, then the supplier of the goods or services will amend the invoice, provided that the return is already signed.

In such a case, you can find the supplier’s transaction in GSTR-2A/GSTR-2B on the portal, and then download and import it to TallyPrime to update your data.

- Mark the voucher as counterparty signed in TallyPrime.

- In GSTR-2A or GSTR-2B, press F2 to open the report for the original period in which the counterparty has signed the return.

- Check if the voucher is signed by the counterparty.

- Drill down to the voucher.

- Press Ctrl+I (More Details) > Counter Party Return Signing Status.

- If the counterparty has signed the return on the portal, but the status is not updated here, then set Return signed by Counter Party to Yes.

- Press Ctrl+A to accept.

- Make the required changes in the invoice.

For instance, you may want to change the amount. - Amend the voucher by providing the Return Effective Date.

- In the voucher, press Ctrl+I (More Details).

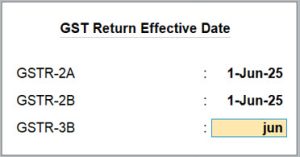

- Under Additional Details, type or select GST Return Effective Date and press Enter.

- Enter the Return Effective Date and press Ctrl+A to save.

If the voucher was originally signed by the counterparty for May-25 and amended in Jun-25, then the Return Effective Date will fall in Jun-25.

- Press Ctrl+A to save the voucher.

Once you amend the voucher, in the subsequent month, you can import the supplier’s invoice to reconcile (GSTR-2A/GSTR-2B) the purchase voucher in TallyPrime. You can learn more about the impact of amendments on returns in the table below.

Resolve Uncertain Transactions about Effective Date

Say, the voucher is marked as signed by the counterparty. If you amend the voucher and do not provide the Return Effective Date, then the voucher will move to the Uncertain Transactions of GSTR-2A/GSTR-2B for the month.

To resolve this, refer to Effective Date of the Amendment is not specified or invalid.

Nature of Amendment and Impact on Returns (Inward Supply)

|

Nature of Amendment

|

Description

|

Original Value

|

Amended Value in Later Month of Amendment

|

|---|---|---|---|

|

Changes in Amount fields |

If the supplier enters a wrong amount in the invoice and modifies it to the actual amount, then there will be an amendment from the supplier’s end. In such a case, you will need to make the necessary changes and amend the purchase voucher to reconcile it with the supplier’s invoice. For example, the invoice value is INR 1,000 in May and is changed to INR 2,000 in June. |

Invoice: INR 10,000 GSTR-2A/GSTR-2B: INR 10,000 |

Invoice: INR 15,000 GSTR-2A/GSTR-2B: INR 15,000 |

|

Changes in Taxability or Tax Rate |

If your supplier enters a different GST rate or incorrect taxability, then there will be an amendment from the supplier’s end. Subsequently, you will need to amend the purchase voucher to reconcile with the supplier’s invoice. |

Invoice: As per 12% GSTR-2A/GSTR-2B: As per 12% |

Invoice: As per 18% GSTR-2A/GSTR-2B: As per 18% |

|

Change in Voucher No. or Voucher Date |

If the supplier has changed the Voucher No. or Voucher Date, then there will be an amendment. You can reconcile the respective purchase voucher by importing the supplier’s revised invoice. For example, the Voucher No. is changed from 123 to 124 or the Voucher Date is changed from 12-May-2025 to 14-Jun-2025. |

Invoice: Voucher No. – 123/ Voucher Date – 12-May-2025 GSTR-2A/GSTR-2B: As per the Voucher No. or Voucher Date |

Invoice: Voucher No. – 124/ Voucher Date – 14-Jun-2025 GSTR-2A/GSTR-2B: As per the revised Voucher No. or Voucher Date |

| Change in Financial Year |

If the new date of invoice falls in the subsequent financial period, then your supplier will amend the invoice. You will need to amend the purchase voucher to reconcile with the supplier’s invoice. For example, the original date of invoice is 24-Mar-2025 and the date is changed to 18-Apr-2025. |

Voucher Date: 24-Mar-2025 GSTR-2A/GSTR-2B: 2 invoices with the invoice date as 24-Mar-2025:

|

Voucher Date: 18-Apr-2025 GSTR-2A/GSTR-2B: 1 Invoice with the revised invoice date 18-Apr-2025 |

| Change in Return Effective Date |

If the return effective date is changed after counterparty signing, then you will need to amend the voucher too. For example, the original return effective date is 15-May-2025 and the new date is 15-Jun-2025, then there will be two invoices in the month of May and one invoice in the month of June. |

Invoice: 15-May-2025 GSTR-2A/GSTR-2B: 2 invoices with return effective date as 15-May-2025:

|

Invoice 15-Jun-2025 GSTR-2A/GSTR-2B: 1 Invoice with return effective date as 15-Jun-2025 |

|

Change in Party GSTIN/UIN |

If the counterparty had recorded the invoice with wrong GSTIN/UIN and signed for returned, then there will be an amendment from their side. In your returns, the current month will show the original invoice and another one against Amend with Zero. In the later month, there will be one invoice with the revised GSTIN/UIN. |

Invoice: With 29ABDXY9601R2JW GSTR-2A/GSTR-2B: 2 invoices with 29ABDXY9601R2JW:

|

Invoice: With 29CEGDFAFACT4XW GSTR-2A/GSTR-2B: 1 Invoice with 29CEGDFAFACT4XW |

|

Change in Tax Unit |

In case of multiple GSTINs, if the GSTIN entered in the sales invoice created by the party and your purchase voucher is wrong, then you will need to amend with the right GSTIN in the future month. For example, the original invoice is recorded for 29ABDXY9601R2JW. You want to amend it with 29CEGDFAFACT4XW. |

GSTR-2A/GSTR-2B: 3 invoices –

|

GSTR-2A/GSTR-2B: 2 Invoices –

|