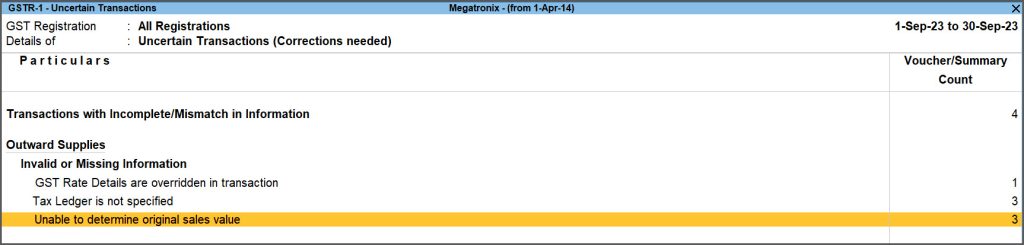

Unable to determine original sales value

Cause

When a Credit Note is passed against an interstate B2C sale, information of original sale value is needed to determine the section to which the Credit Note belongs to (B2C Small Invoices or Credit or Debit Notes (Unregistered)).

If the value of sales is greater than 2.5 lakhs, the corresponding credit note is to be reported in Credit or Debit Notes (Unregistered) – 9B.

If the value of sales is less than or equal to 2.5 lakhs, the corresponding credit note is to be reported in B2C Small Invoices – 7.

Hence, while passing a credit note against interstate B2C sales, it is mandatory to provide the original sales value. You can press Ctrl+I (More Details) for additional details.

However, in case the same is not provided, it is detected as uncertain.

Resolution

- Open the GSTR-1 report > select Uncertain Transactions (Corrections needed)> Unable to determine original sales value and press Enter.

- Select the voucher you wish to determine the original sales value for and press Enter.

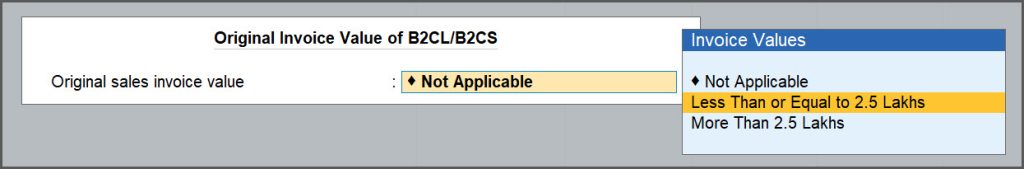

- Set the Original sales invoice value, as per your preference.

- As always, you can press Ctrl A to save.

Now the voucher is listed under Included in Return in GSTR-3B report.

If you select Less Than or Equal to 2.5 Lakhs, then the voucher will be listed under B2C Small Invoices – 7. If you select More than 2.5 Lakhs, then the voucher will be listed under Credit or Debit Notes (Unregistered) – 9B.