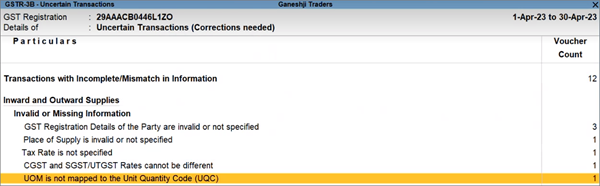

UOM is not mapped to the Unit Quantity Code (UQC)

Release 3.0 & Later

Cause

When the UOM is not mapped to the Unit Quantity Code (UQC).

Resolution

You can resolve this exception using any one of the following methods, as per your convenience.

This is a convenient way for updating all your transactions at once for a particular UOM.

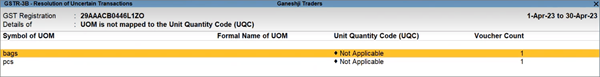

- Drill down from the exception to view the transactions that have to be updated.

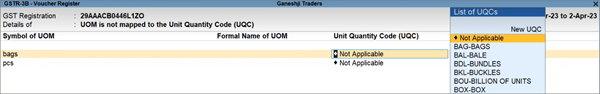

- Press F5 (Update UQC).

The report will appear in the edit mode.

- Map all the UOM to the relevant UQC directly in this screen.

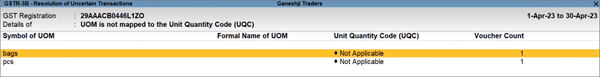

- Press Enter to save the details.

It is recommended that you press Enter here, and not Ctrl+A, to ensure that the proper Effective Date is applied. Refer to the Effective Date section, to know more.

The Effective Date screen appears.

- Specify the Effective Date for revised GST details.

- Press Enter to accept the details.

All the transactions recorded with the UOM will be resolved with the updated details.

You also have the choice to map the UOM to UQC for your transactions one by one, if needed.

- Drill down from the exception to view the transactions that have to be updated.

- Press Enter on the UOM and select the relevant UQC.

- Press Enter to save the details.

It is recommended that you press Enter here, and not Ctrl+A, to ensure that the proper Effective Date is applied. Refer to the Effective Date section, to know more.

The Effective Date screen appears.

- Specify the Effective Date for revised GST details.

- Press Enter to accept the details.

The transaction will be resolved with the updated details. Similarly, you can resolve the other transactions one by one.

Release 2.0 & Earlier

Cause

The Unit of Measurement (UoM) used in the transactions is not mapped to a corresponding Unit Quantity Code (UQC). As a result, the transactions cannot be included in the HSN/SAC Summary.

Resolution

- Select the exception UoM not mapped to Unit Quantity Code (UQC).

- Select the UoM Symbol.

- Exclude from Summary: Press Alt+H (Exclude from Summary) to exclude the transactions involving these unit of measurements from the HSN/SAC Summary report.

These transactions will appear under the Not included in HSN/SAC Summary (UQC not available) section of HSN/SAC Summary report. The transactions will get included in the relevant sections of the GST return. - Mapping with UQC from the report: Press Alt+Q (Update UQC), select the UQC, and press Enter.

- Exclude from Summary: Press Alt+H (Exclude from Summary) to exclude the transactions involving these unit of measurements from the HSN/SAC Summary report.

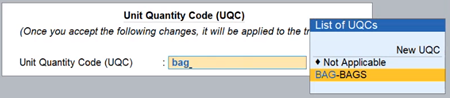

- Selecting UQC in the stock item master: Press Enter on the selected UoM Symbol, and select the Unit Quantity Code (UQC).

- Accept the screen. As always, you can press Ctrl+A to save.