Generate e-Invoices for Export Transactions

Handle export e-Invoicing smoothly in TallyPrime—whether for goods, services to foreign parties, or special domestic cases like transport services. With auto-filled POS codes, correct tax application, and offline JSON generation, TallyPrime helps you stay compliant without extra effort.

e-Invoices for Exports

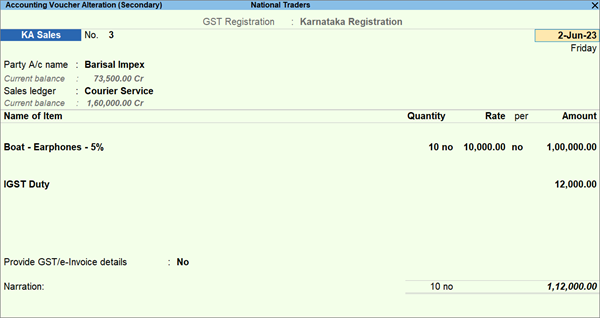

Just like regular sales, you can easily generate e-invoices for exports. The system auto-fills details like POS as 96 and applies IGST, so you don’t need to worry about tax rates or codes.

- Record your sales invoices for exports, as usual, with the necessary setup for e-Invoicing.

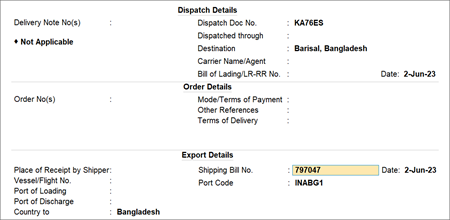

- Press F12 (Configure) > set the option Provide Dispatch, Order, and Export details to Yes and enable Provide Order Details.

- Specify the relevant details under Dispatch Details, Order Details, and Export Details.

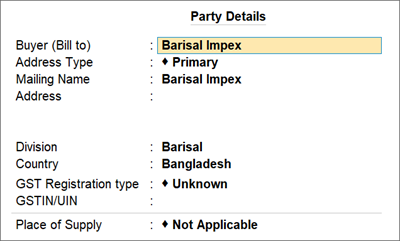

- Specify the relevant Party Details.

Even when the Place of Supply is Not Applicable, the POS value for the transaction will be automatically updated as 96 and IGST will be applied.

- Press Ctrl+A to save the transaction.

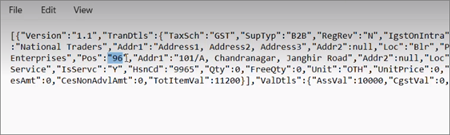

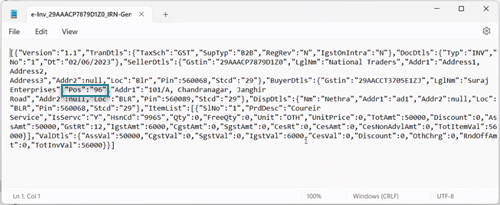

- Go to the folder where the JSON file is saved, and open the JSON file in the Notepad format.

You can see that the POS value is automatically updated as 96.

e-Invoice for service to a foreign party & billing to local or interstate party

According to Notification No. 07/2021 – Central Tax (Rate), export freight will now be taxable under GST from Oct-2022. From 1-Oct-2022, all outbound freight billed to Indian customers with Other Territory as the place of supply will attract IGST, as per Section 12(8) and 7(5) of the IGST Act.

Let’s consider an example, where you are billing a local or interstate party for providing any service (say Airport Transport) to a party located out of India.

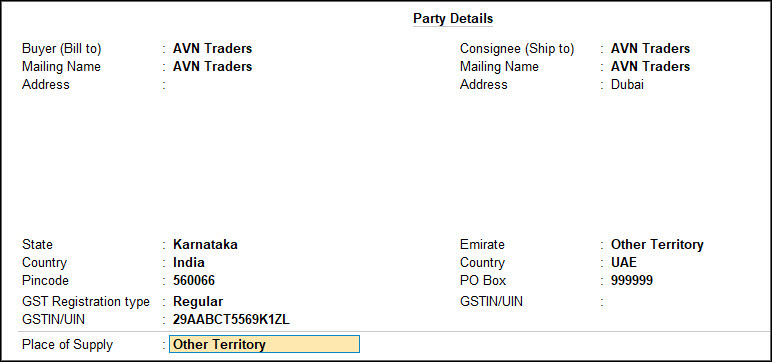

- While recording a sales transaction, fill in the Party Details screen.

- Under Buyer (Bill to), select the ledger created for interstate party or local party who is billed for the service.

- Under Consignee (Ship to), select the ledger created for the foreign party who receives the service.

- Select the Country other than India – for example UAE that the party receiving the service belongs to.

The Emirates option, instead of State, appears for UAE. - Emirates: Select New Emirates > enter Other Territory.

If you are using TallyPrime Release 3.0.1 or later, and the Buyer is from India while the Consignee is from another country, the Emirate will automatically be set as Other Territory and the State Code as 97. - Enter the Pincode as 999999.

If you are using TallyPrime Release 3.0.1 or later, and the Buyer is from India while the Consignee is from another country, then the State or Emirate will be automatically sent as Other Territory, and the Pincode will be sent as 999999.

- Select the Country other than India – for example UAE that the party receiving the service belongs to.

- Place of Supply: Select Other Territory.

For e-invoice generation, the place of supply must be entered as Other Territory; else, TallyPrime will display the following error: The State of the field is required.

- In the sales transaction, select the service ledger (say Airport Transport) and IGST ledger.

- Provide e-Invoice Details: Yes.

- Bill to place: Select the place of the party (local or interstate) who is billed for the service.

- Ship to place: Select the place of the foreign party who receives the service.

- Accept the screen. As always, press Ctrl+A to save.

Ensure that F12 (Configure) > Send e-Invoice Details after saving the Voucher is set to Yes for generating e-invoice for the foreign party.

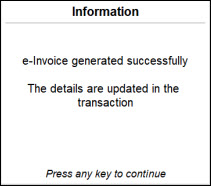

On saving the screen, the e-invoice is generated successfully, displaying the following message:

- Generate the JSON file by pressing Alt+Z (Exchange) > Send for e-Invoicing > Offline Export.

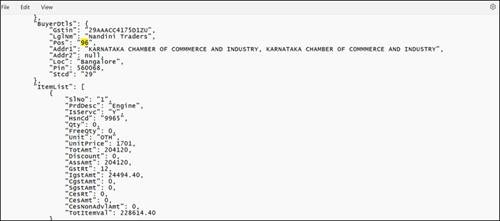

- Go to the folder where the JSON file is saved, and open the JSON file in the Notepad format.

You can see that the POS value is automatically updated as 97.

e-Invoice for Transportation Services (HSN: 9965 & 9968) by Mail/Courier Inside India

If you’re providing mail or courier services within India (HSN 9965/9968), set the Place of Supply’s State Code as 96 (Foreign Country), even for local parties, as per IGST Act updates effective 30-Jan-2023. You can easily update this while recording e-Invoices in TallyPrime.

In TallyPrime Release 3.0 or later versions

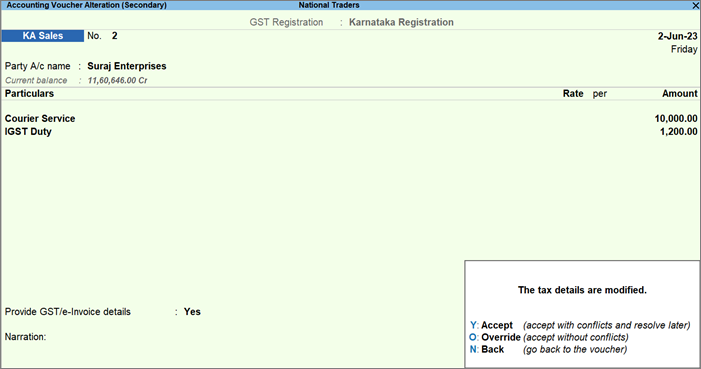

- Record your GST Sales transaction, as usual, with the necessary setup for e-Invoicing.

- Update the following details in the transaction:

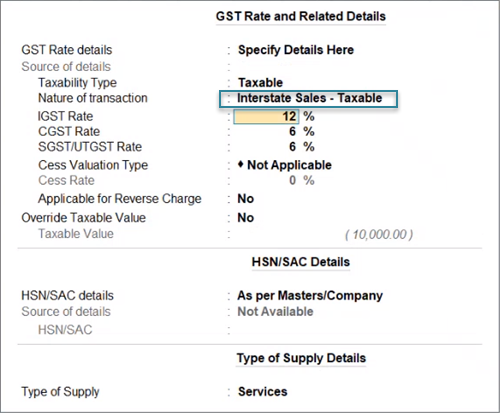

- Nature of transaction as Interstate Sales – Taxable:

The Nature of Transaction has to be overridden as Interstate even when the party is local, so that IGST will be applied in this transaction.

After selecting the transportation ledger, in the GST Rate and Related Details screen specify the Nature of transaction as Interstate Sales – Taxable.

- Nature of supply as IGST:

- In the transaction, set Provide GST/e-Invoice details to Yes.

- In the Additional Details: Interstate Sales Taxable sub-screen, set Supplies under section 7 of IGST Act to Yes.

- Nature of transaction as Interstate Sales – Taxable:

- Save the transaction, as per your requirement:

- Press Y (Accept), if you want to accept the transaction with the conflict in details.

You can resolve this conflict at your convenience by going to Uncertain Transactions in the GSTR-1 or e-Invoice report. After accepting the values, you can directly proceed to generate the JSON. - Press O (Override), if you want to accept the transaction without any conflict in details.

After overriding the values, you can directly proceed to generate the JSON.

- Press Y (Accept), if you want to accept the transaction with the conflict in details.

- Generate the JSON file by pressing Alt+Z (Exchange) > Send for e-Invoicing > Offline Export.

- Go to the folder where the JSON file is saved, and open the JSON file in the Notepad format.

You can see that the POS value is automatically updated as 96.

Now, you can upload the JSON file on the e-Invoice portal at your convenience.

In TallyPrime Release 2.1 or earlier versions

If you are using TallyPrime Release 2.1 or earlier versions, then you have to open the JSON file and manually update the value for POS as 96.

- Record your GST Sales transaction, as usual, with the necessary setup for e-invoicing.

- Generate the JSON file by pressing Alt+Z (Exchange) > Send for e-Invoicing > Offline Export.

- Go to the folder where the JSON file is saved, and open the JSON file in the Notepad format.

- Set the value for PoS as 96, and save the file.

- Ensure that Reverse charge and invoice type IGST on Intra are enabled.

After updating the applicable transactions, you can directly upload them on the e-Invoice portal.

TallyPrime makes exporting e-Invoices and handling special cases, like services to foreign parties or domestic transport services, simple and compliant. With automated POS codes, tax handling, and offline JSON generation, TallyPrime ensures accurate, hassle-free e-invoicing for all your business needs, whether local, interstate, or international.