File GSTR-3B After Uploading Directly from TallyPrime | Download, Reconcile, Upload, and File

For TallyPrime 5.0 & later

With TallyPrime, you can file GSTR-3B after downloading and uploading it directly from TallyPrime, without visiting the GST portal or doing manual work. The GST portal uses GSTR‑1 and GSTR‑2A values for GSTR‑3B, so you must ensure the GSTR‑3B values in TallyPrime match those on the portal. By downloading GSTR‑3B directly in TallyPrime, you can ensure proper reconciliation and a successful upload for filing.

Download GSTR-3B → Reconcile → Upload Online → File on Portal

Before you begin | Prerequisites

- Before downloading or uploading GSTR‑3B in TallyPrime, ensure that you log in to the GST portal from TallyPrime using your credentials.

- For successful reconciliation after downloading GSTR‑3B, ensure that GSTR‑1 and GSTR‑2A are filed on the GST portal.

This ensures that the true values of ITC transactions are reflected on the portal. - For a seamless uploading experience, ensure that you have resolved all exceptions and conflicts.

Download GSTR-3B Right into TallyPrime

Based on GSTR-1, the GST portal updates the ITC values in GSTR-3B. You can download GSTR-3B right from TallyPrime, without any manual activity.

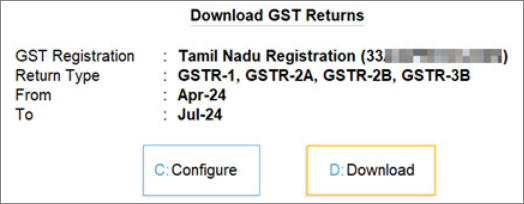

- Press Alt+Z (Exchange) > Download GST Returns.

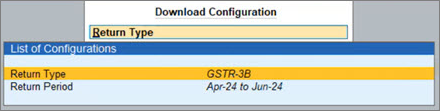

- Press C (Configure) and set the Return details.

- Return Type: GSTR-3B

- Return Period: Enter the relevant return period.

TallyPrime detects the period in which you had filed GSTR-3B previously. It pre-fills the next period during download.

Tip: You can also set default return types for download.

- In the Download GST Returns screen, press D (Download).

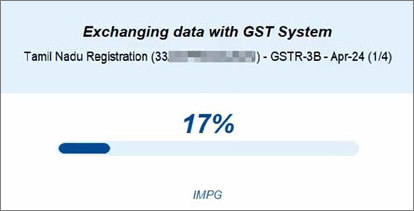

Once GSTR-3B download is initiated, you can easily track the progress.

Once the GSTR-3B data is downloaded from the GST portal, you will receive a confirmation.

Tip: You can also redownload any previously downloaded returns. The latest downloads will replace the existing versions.

Reconcile GSTR-3B

You need to ensure that GSTR-3B is reconciled before you upload it, because TallyPrime ITC values and those on the GST portal must match.

- Press Alt+G (Go To) > type or select GSTR-3B and press Enter.

- Drill down to the required sections in GSTR-3B.

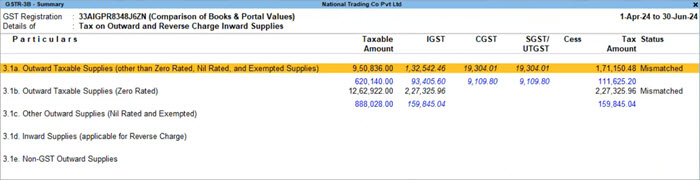

- Compare Books and Portal Values.

- Press Ctrl+B (Basis of Values).

- Press Enter on Method of showing values from the portal.

- Set the option as Comparison of Books and Portal Values.

To view the difference between the details on the portal and the details in your books, set it as Difference in Books and Portal Values.

This will help you in identifying any mismatches. Accordingly, you can make the necessary corrections.

Upload GSTR-3B Right from TallyPrime

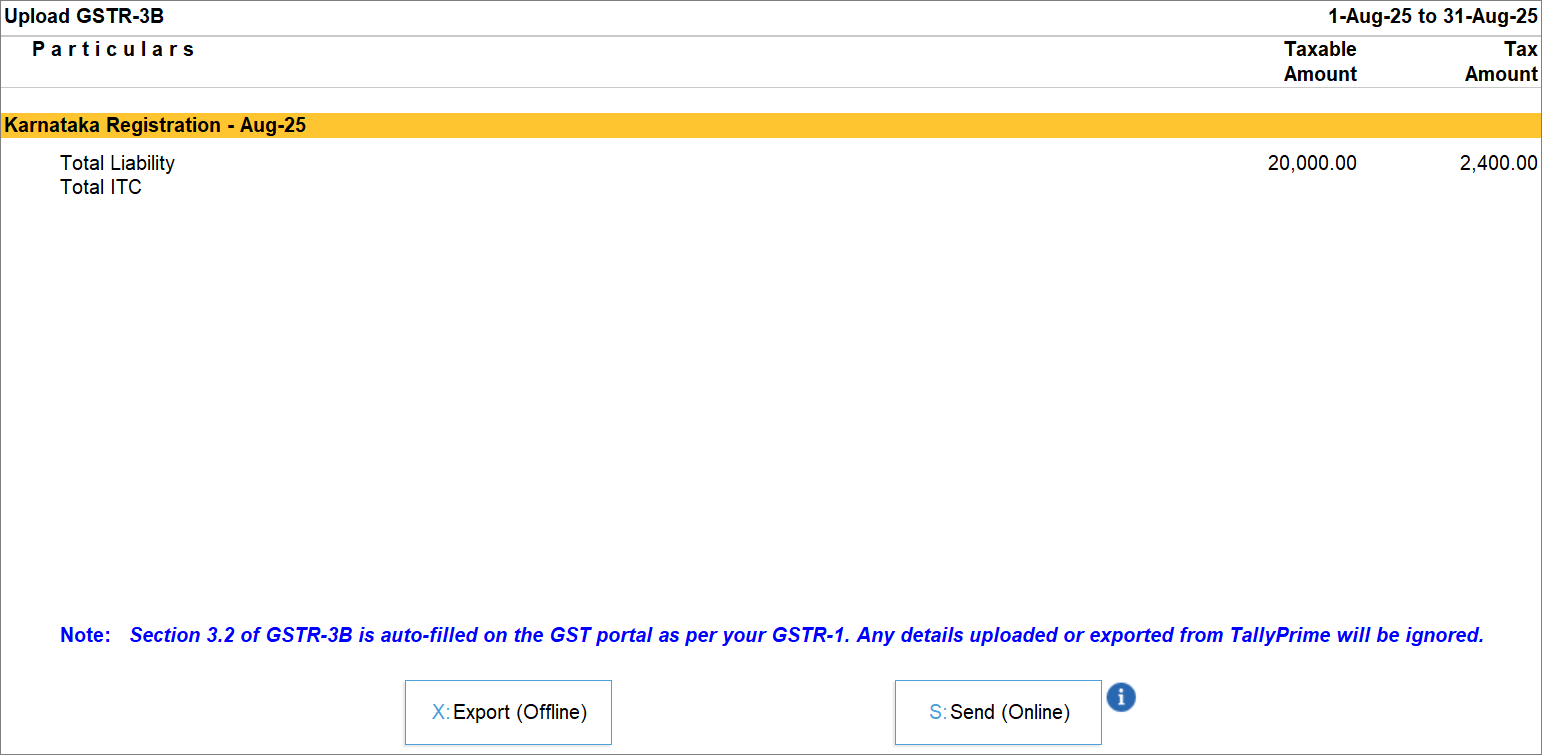

You can upload one or all of your summaries for the required return period.

- Press Alt+Z (Exchange) > All GST Options > Upload GST Returns > GSTR-3B.

- In the Upload GST Returns screen, press Spacebar to select the summaries you want to upload.

If you want to upload all the summaries, then you do not have to select any entry.

If you are using TallyPrime Release 2.0 to TallyPrime Release 6.2, then the details of Interstate Supplies in Section 3.2 of GSTR-3B will not get auto-filled from GSTR-1.

If you have multiple GST registrations, then you can press F3 (Company/Tax Registration), and select the relevant GST registration to upload GSTR-3B.

- Press S (Send (Online)) to upload.

You will receive the confirmation once the upload is complete.

The uploaded summaries will appear in the No Action Required section.

File GSTR-3B on the GST Portal

Once GSTR-3B is uploaded to the GST portal, you can log in to the GST portal and file GSTR-3B by preparing online.

Tip: Based on your recent activities, you can always see your last online GST activity in the top right corner of the report.

Questions & Answers

- Does uploading GSTR-3B online from TallyPrime complete the filing process?

No. Uploading GSTR‑3B online directly from TallyPrime helps you avoid the hassle of a JSON upload and manual work. By uploading GSTR‑3B, you can ensure that the correct and reconciled values are updated online. This is a step toward filing it on the GST portal. Once you upload GSTR‑3B from TallyPrime, you need to prepare it online on the GST portal and then proceed to make the payment.

To know more, refer to Upload GSTR-3B from TallyPrime.

- Can I prepare GSTR-3B online on the GST portal and make the payment later? If yes, then how do I do it?

Yes. You can retain the draft for 15 days and then make the payment. It is important to note that the GSTR-3B gets filed only after a successful payment of your net liability, if applicable.