Upload IMS Inward Invoices

Once you’ve set the Action status in IMS Inward invoices, you can easily upload them back to the GST portal directly from TallyPrime. Once approved, ITC will be reflected in GSTR-2B, based on the set Action status. You also have the flexibility to include or exclude invoices that were previously uploaded during the upload process. In case you find any discrepancy in the action status of invoices, you can also Reset the IMS Inward Action Status for all invoices at once.

-

Press Alt+Z (Exchange) > All GST Options > Upload IMS Inward Invoices.

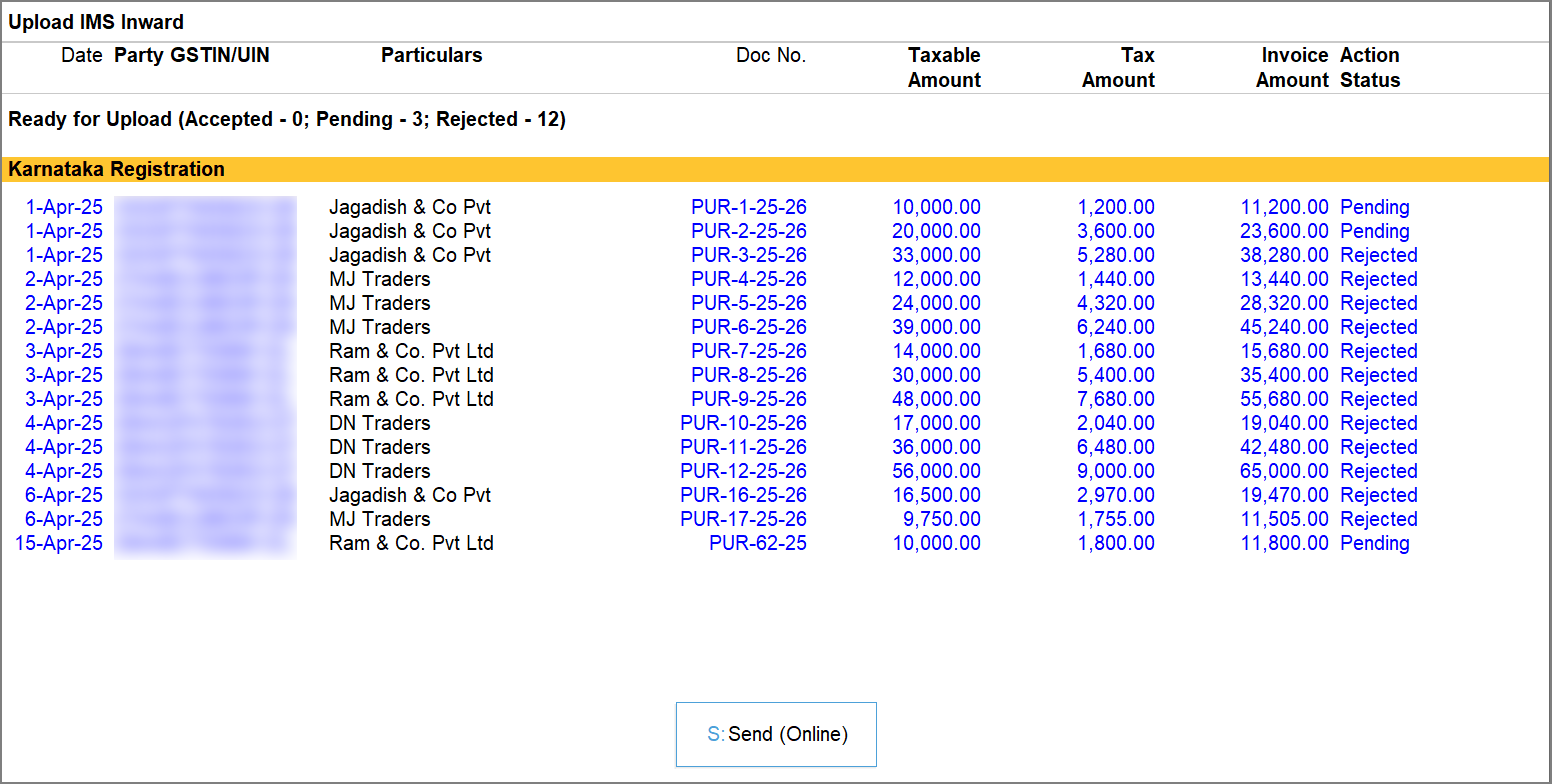

The Upload IMS Inward Invoices screen appears.

-

Press Ctrl+B (Basis of Values) to configure further options, as per your business needs.

-

Include transactions based on Action Status: This option lets you filter invoices based on their Action Status, such as Accepted, Rejected, Pending, or No Action. You can select a specific status or choose All Statuses to view all invoices.Include already uploaded invoices: Enable this option to include invoices that have already been uploaded to the GST portal. This helps you review or reprocess them if required.

-

Include invoices where Upload is in progress: This option allows you to view transactions for which the upload process is currently in progress. It is useful for tracking pending uploads.

-

Include invoices Rejected by GST Portal: Enable this option to include invoices that were rejected by the GST portal during upload. This helps you identify and correct such invoices before re-uploading them.

-

Include IMS Remarks in invoices: Enable this option to include remarks added on the invoices while uploading them to the portal.

TallyPrime exchange Remarks with the GST portal for invoices with the Action Status as Pending or Rejected across all sections. In addition, for invoices with the action status as Accepted, remarks are exchanged only for specific sections when ITC Reduction is enabled and ITC is partially reduced, or ITC Reduction is set to No. This additional exchange for Accepted invoices is applicable to the following sections: B2BA, B2BCN, B2BCNA, B2BDNA, IMPGA, and IMPGSEZA.In Release 6.2 and earlier, remarks were exchanged only when the action status was Pending or Rejected.

-

- Press Spacebar to select the invoices you want to upload.

If you want to upload all the invoices, then you do not have to select any of the invoices. - Press S (Send (Online)) to upload.

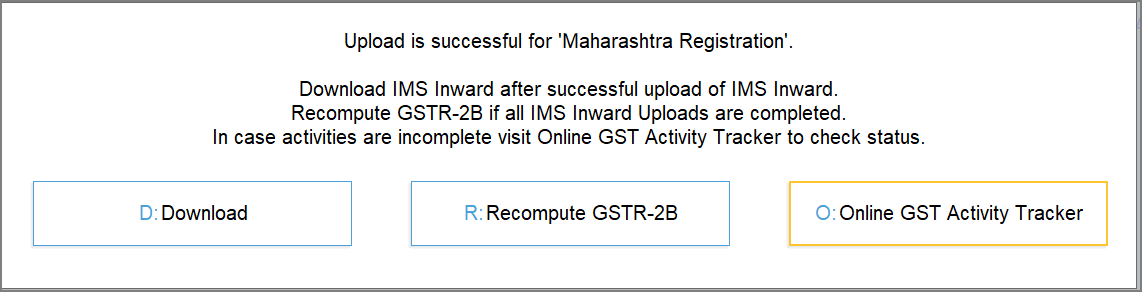

Once the upload is successful, you will get a confirmation message.

Sometimes, invoices may not get uploaded instantly due to server issues or high traffic on the GST portal. You can refresh the GST status after a few minutes.

For real-time updates of the upload activity, check the Online GST Activity Tracker report.

Once you have uploaded the IMS Inward invoices to the GST portal, you can recompute your GSTR-2B to reflect the latest changes in your ITC as per the action taken in the IMS Inward Supplies report.