Update e-Way Bill Part B Online in TallyPrime

If Part B details were unavailable at the time of generating an e-Way Bill, you can go for e-Way Bill generation without the part B details. TallyPrime allows you to conveniently update these details later from the e-Way Bill report. As per your preference, you can also opt to update e-Way Bill Part B offline as well.

Before you begin | Prerequisites

Before proceeding with the e-Way Bill Part B update, ensure that, you have

- Created e-Way Bill Profile on the Portal.

- Logged in the e-Way Bill portal.

- Enabled e-Way Bill in TallyPrime.

Update e-Way Bill Part B

- In the e-Way Bill report, drill down from the relevant section in the e-Way Bill report; for example, the For Part B updation section under Pending for Exchange with e-Way Bill System.

- Select the transactions for which you want to update Part B, and press F7 (Update Part B).

In the Part B Updation Details screen:- Select the Mode of transport from the options available.

- Enter the Vehicle Number.

- Select the Vehicle Type.

Now you can send the transaction for Part B updation through the Exchange menu.

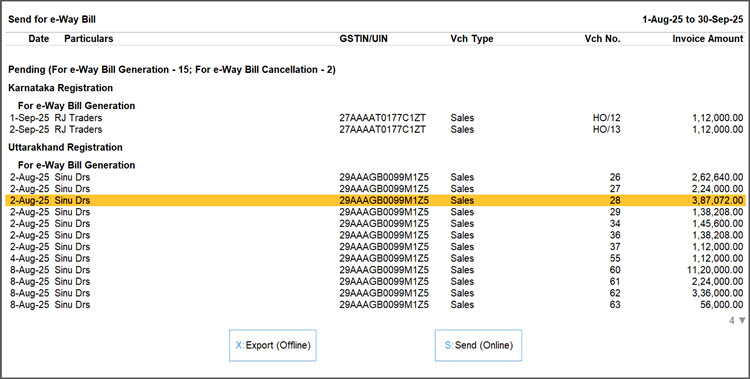

- Press Alt+Z > Send for e-Way Bill.

In the Send for e-Way Bill screen, you can view the transactions that are pending for Part B Updation.

- If you press S without selecting any transaction, then all the transactions will be sent.

The following confirmation screen will appear, with the number of transactions lined up for Part B updation.

- In the e-Way Bill Login screen, enter the login details and press Enter to continue.

You can update Part B of e-Way Bills for Multi-GSTIN as well.

TallyPrime will start exchanging information with the e-Way Bill system. The Exchange Summary will appear after the updation is completed.

After updation, the voucher will move to the e-Way Bill generated With Part B section of the e-Way Bill report.

Update Part B of e-Way Bills for Multi-GSTIN (Release 3.0 & Later)

Click here.

You can update Part B of e-Way Bills even when you have multiple GST registrations.

Questions & Answers

- I have already updated Part B for an e-Way Bill on the portal, but in TallyPrime the status still shows Generate Without Part B. How do I update the status of the transaction in TallyPrime?

A transaction might appear in the Pending For Part B Updation section of the e-Way Bill report, even if you have updated the details on the portal. In such cases, drill down from the Pending For Part B Updation section, select the transaction and press Ctrl+F7 (Mark Part B as Updated). The transaction will move to the Generated With Part B section. - Is Part B a must for an e-Way Bill?

The e-Way Bill cycle completes only the Part B details are updated. Otherwise, the printout of the e-Way Bill would be invalid for the movement of goods. It is necessary to update Part B for an e-Way Bill, except when the consignor and consignee are in the same state, and the distance between their location is less than 50 km. - How many times can I update Part B or Vehicle number for an e-Way Bill?

For an e-Way Bill, you can update Part B and vehicle details as many times as required for the movement of a consignment to its destination. However, you need to update the Part B details within the validity period of the e-Way Bill.

For any further queries, refer to e-Way Bill – FAQ and e-Way Bill Reasons and Rejections.