TDS and TCS FVU Tool 9.2 – Errors and Resolutions

This page lists all the workarounds for errors that occur during validation of exported TCS and TDS e-Return files in the FVU 9.2 tool.

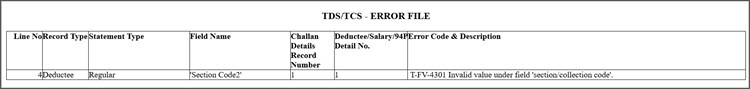

Cause:

This error occurs while validating the exported e-Return TCS 27EQ file in FVU 9.2 tool where the TCS Nature of Goods appears as empty under Collectee Details Record line in field 33. In TallyPrime, if you have created a new TCS Nature of Goods with Section Code 206C and Payment Code as MA, it gets exported as empty in the e-Return TCS 27EQ text file.

The FVU 9.2 tool has been updated as per Notification No. 35 by the Income Tax Department. In this update, certain luxury goods have been added for consideration under Section 206C (1F) for TCS, effective 22-Apr-2025.

Resolution:

You are recommended to open the exported e-return TCS Form 27EQ text file and update the applicable Section Code/Collectee Code in field number 33 of Collectee Detail Record (DD) line as per Annexure 2.

-

In TallyPrime, export e-return TCS Form 27EQ text file.

-

In TCS Form 27EQ report, press Alt+B (Save Return).

-

Press Alt+E (Export) and select E-Return.

-

In the Export screen, configure the Folder Path and select Export.

-

-

Open the exported e-return TCS Form 27EQ and in the Collectee Detail Record (DD) line, it will have a blank/empty value captured in filed number 33. Update the applicable Section Code as MA per the latest Annexure 2.

-

Save the text file.

You can now validate the text file successfully with the latest FVU 9.2 tool and proceed to file TCS returns.

The new Section Code 206C in the TCS Form 27EQ report is applicable only from 22-Apr-2025. If any transaction dated prior to this includes the new Section Code 2, the return will fail validation.

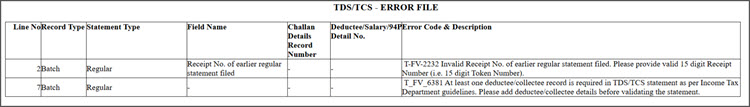

Cause: This error occurs while validating the exported e-Return 26Q file in FVU 9.2 tool, if the previously filled Receipt or Token Number is incorrect/invalid in the exported text file.

Resolution:

Provide a valid 15-digit Receipt Number that starts with 77 and then export the text to ensure successful validation.

-

Download the previously filed TDS Acknowledgement Receipt from the Income Tax Portal.

-

Open Income tax portal and log in.

-

Go to e-File > Income Tax Forms > View Filed Forms.

-

Select the Form Type as 26Q and click Download Acknowledgement to get the Acknowledgement Receipt of Income Tax Forms in PDF.

Note: Ensure the e-Filing Acknowledgement Number and RRR Number are unique. If they appear identical, re-download the Acknowledgement Receipt of Income Tax Forms after 10–20 minutes to generate distinct values.

-

-

Update the Receipt No./Token No. field.

- Press Ctrl+A (save) and then E (export) to export the file.

Now, you can validate the e-TDS return text file using the latest FVU tool. It will be validated successfully without any error.

The above-mentioned resolution is applicable for TDS 26Q & 27Q, TCS 27EQ and Salary TDS 24Q.

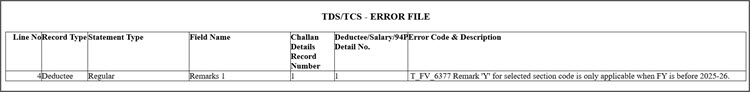

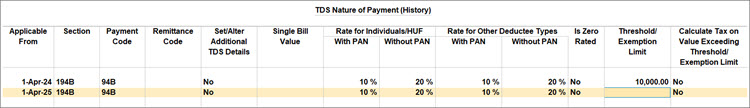

Cause: This error occurs because Remark ‘Y’ is no longer valid for Sections 194B and 194BB in TDS Forms 26Q and 27Q starting from FY 2025–26, as per the latest updates in FVU version 9.2.

This change is due to amendments introduced in the Finance Bill 2025–26. Earlier, the sections 194B – Winnings From Lotteries and Crossword Puzzles and 194BB – Winnings From Horse Race under TDS had an annual limit of Rs 10,000. If exceeded, then TDS was expected to be deducted from Rs 1.

Now, from FY 2025–26 onwards TDS will be deducted only if a single transaction exceeds Rs 10,000.

These changes are updated in latest FVU 9.2 tool version. Therefore, Remark ‘Y’ is no longer valid for the above-mentioned sections.

This error occurs because in TDS Form 26Q and 27Q, Remark ‘Y’ is no longer valid for Section 194B and 194BB from FY 2025–26 onwards, as per FVU 9.2 updates.

Resolution:

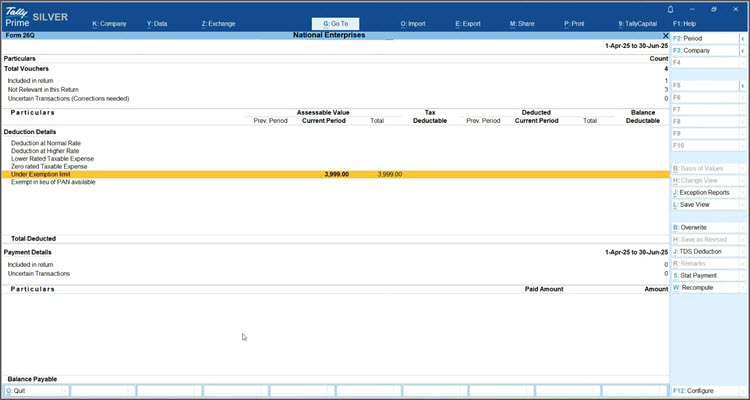

If you have already recorded TDS transaction for Threshold limit below 10000, then in TDS Form 26Q report it participates under Below Exemption Limit section. However, you are now recommended to alter the TDS Nature of Payments and the TDS Nature of Payment (History).

-

Press Alt+G (Go To) > Alter Master > TDS Nature of Payments > and press Enter.

-

In the TDS Nature of Payment Alteration screen, press Ctrl+I (More Details) > TDS Details (History) > and press Enter.

-

In the TDS Nature of Payment (History) screen, create a new history.

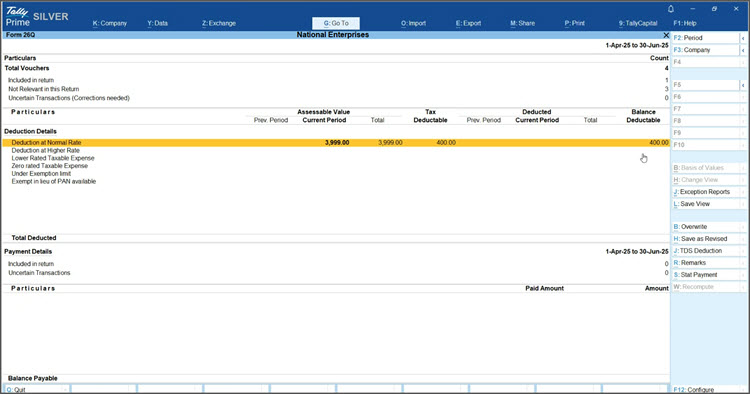

- Recompute TDS Form 26Q report and save as revised.

-

Press Alt+G (Go To) > Form 26Q.

-

Press Alt+W (Recompute) and Alt+H (Save as Revised).

-

Press Yes to continue.

-

-

Reopen Form 26Q to view the transaction appearing against the Deduction at Normal rate section instead of the Under Exemption Limit section.

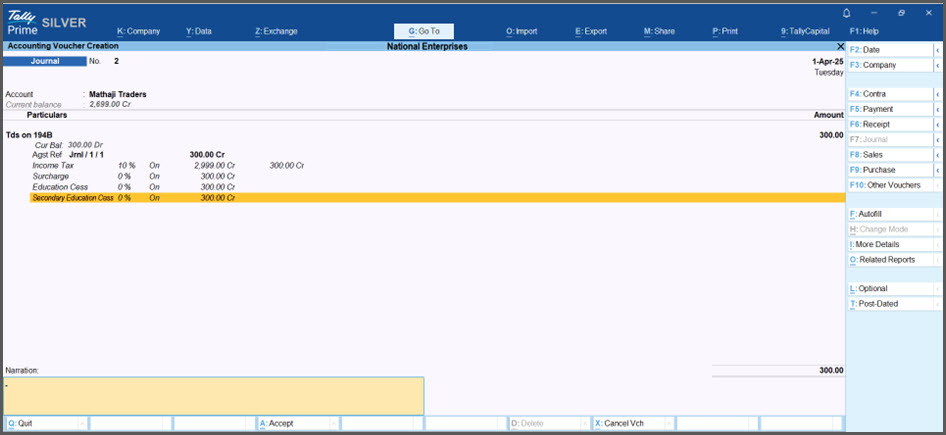

- Pass a Journal Voucher with TDS deduction and save.

- Pass a Payment Voucher against the same TDS Journal Voucher and save.

- Recompute TDS Form 26Q report, save as revised, and export.

- Press Alt+G (Go To) > Form 26Q.

- Press Alt+W (Recompute) and Alt+H (Save as Revised).

-

Re-open TDS Form 26Q report and export.

-

Press Alt+G (Go To) > Form 26Q.

-

Press Alt+E (Export) > E-Return > E (export).

-

Now, you can validate the e-return TDS 26Q Text file using the latest FVU tool. It will be validated successfully without any error.

The above-mentioned resolution is also applicable for Form 27Q, as well.

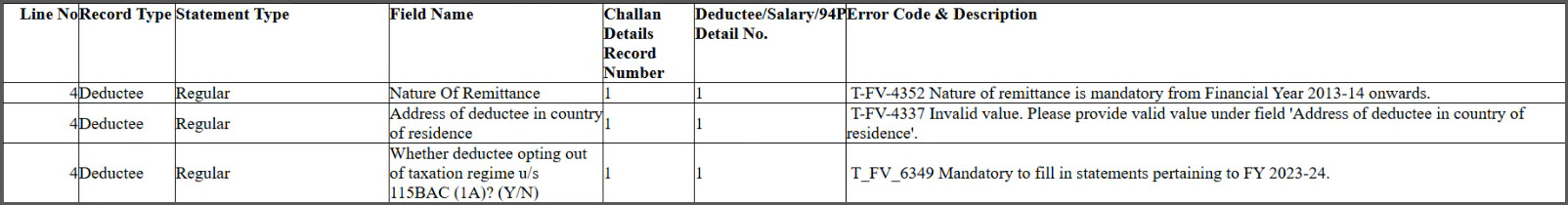

Cause:

This error occurs if the mandatory field Nature Of Remittance is not provided for the transactions below the exemption limit of 20,000.

Resolution:

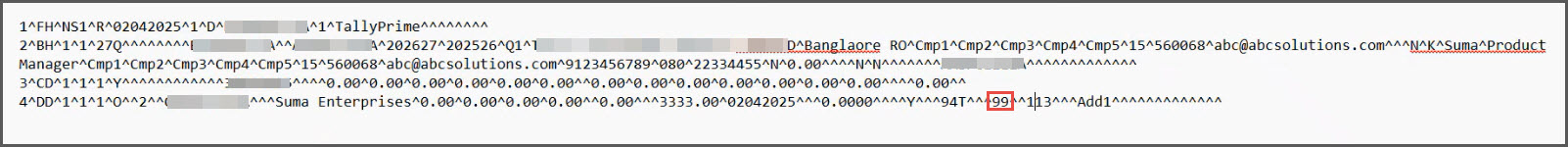

For TDS Section Code 194T-Payments to partners of firms the Payment Code is 94T. This Section is applicable for both Resident (26Q) and Non-Resident (27Q) returns. To report 194T in TDS Form 27Q remittance code is mandatory. However, the new FVU 9.2 tool has not notified any Remittance Code for this section. As per clarification from the Protean/NSDL department, we can use any random code as per Annexure 8 in field number 36 under the DD line of the e-TDS 27Q text file. To avoid the error related to Nature of Remittance, it is recommended that you use 99 as the Remittance Code in that field.

-

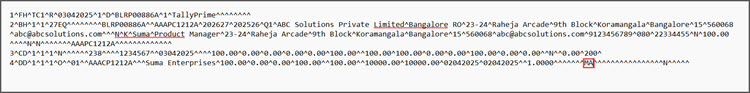

In TallyPrime, export e-return TDS Form 27Q text file.

-

In TDS Form 27Q report, press Alt+B (Save Return).

-

Press Alt+E (Export) and select E-Return.

-

In the Export screen, configure the Folder Path and select Export.

-

-

Open the exported e-return TDS Form 27Q and enter the Remittance code as 99 in the field no. 36 of the Deductee Detail Record (DD) line.

-

Save the text file.

You can now validate the text file successfully with the latest FVU 9.2 tool and proceed to file TDS 27Q returns.

Cause:

This error occurs if an address is present in the Address of deductee in country of residence field for the transactions below the exemption limit of 20,000.

Resolution:

-

In TallyPrime, export e-return TDS Form 27Q text file.

-

In TDS Form 27Q report, press Alt+B (Save Return).

-

Press Alt+E (Export) and select E-Return.

-

In the Export screen, configure the Folder Path and select Export.

-

-

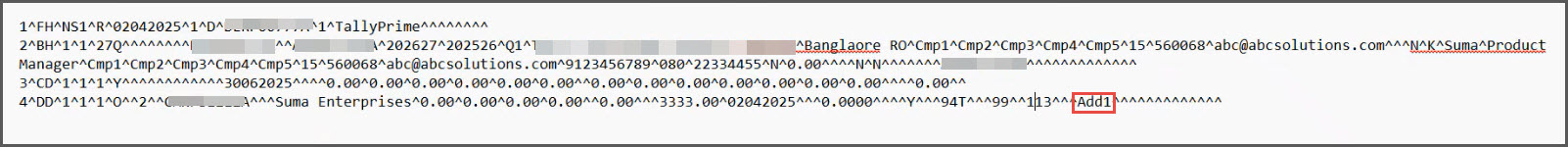

Open the exported e-return TDS Form 27Q and remove the prefilled address in the field no. 41 of the Deductee Detail Record (DD) line.

-

Save the text file.

You can now validate the text file successfully with the latest FVU 9.2 tool and proceed to file TDS 27Q returns.

Cause:

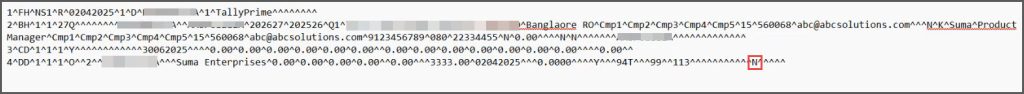

This error occurs if the field Whether deductee opting out of taxation regime u/s 115BAC (1A) ? (Y/N) is blank for the transactions below the exemption limit of 20,000.

Resolution:

-

In TallyPrime, export e-return TDS Form 27Q text file.

-

In TDS Form 27Q report, press Alt+B (Save Return).

-

Press Alt+E (Export) and select E-Return.

-

In the Export screen, configure the Folder Path and select Export.

-

-

Open the exported e-return TDS Form 27Q and enter N in field no. 49 of the Deductee Detail Record (DD) line.

-

Save the text file.

You can now validate the text file successfully with the latest FVU 9.2 tool and proceed to file TDS 27Q returns.